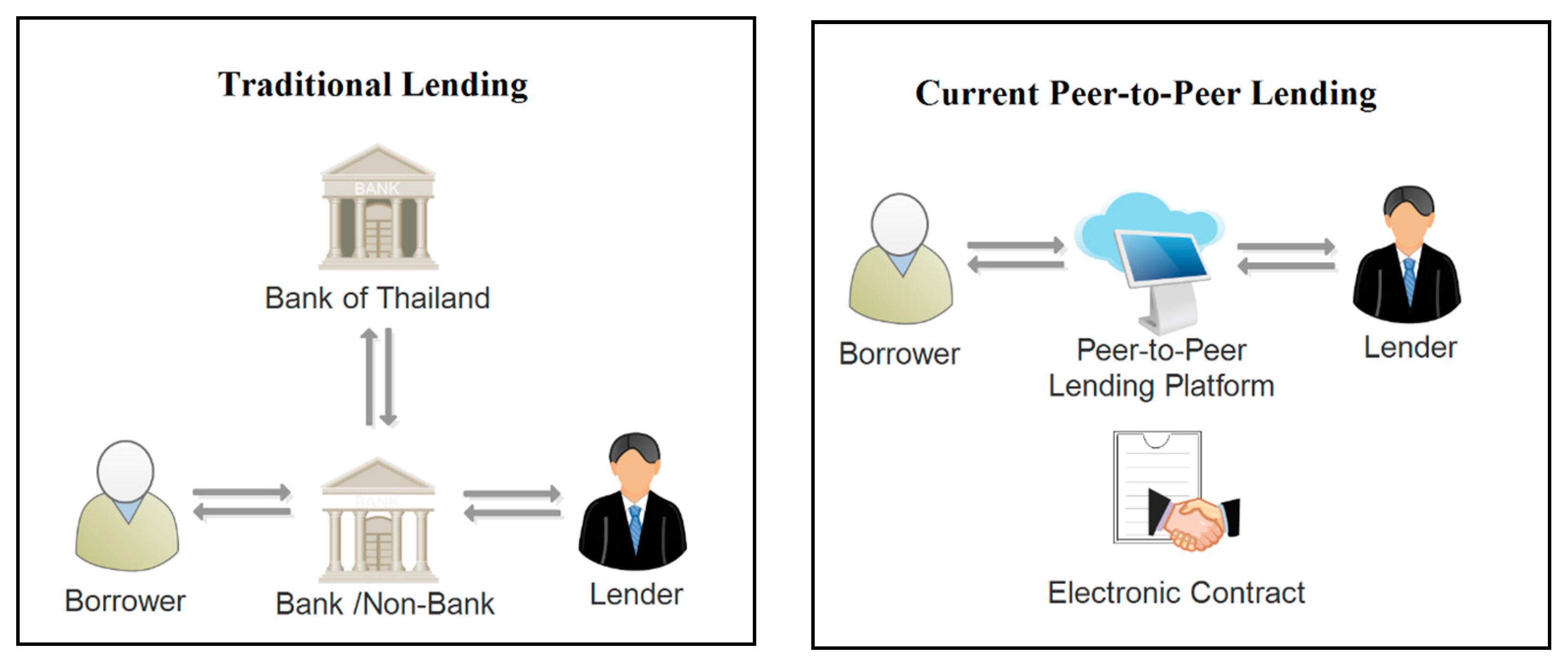

Key takeaways Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms. Make sure you know about the potential risks of P2P lending before you decide to become a P2P borrower or lender.

P2P lending might have looser eligibility requirements for borrowers than loans from a traditional financial institution do. But P2P loans might have higher fees, have higher interest rates and offer less support to people struggling with loan payments. Submit an official P2P loan application.

Keep in mind that credit applications might trigger a hard inquiry on your credit report. And hard inquiries can impact your credit. Find out if your application is approved.

If your application is approved, different investors review your loan to decide whether to fund it. Once your loan is fully funded, you get an electronic transfer of funds for the loan amount.

You make your loan payments. But P2P lending platforms have to follow state and federal laws—just like any other lender. Safety tips for P2P lending Here are a few ways you can help keep your money safe when taking out a P2P loan: Do your research and make sure the P2P lending platform is reputable.

Be on the lookout for phishing scams. Keep your online accounts safe with multifactor authentication and strong passwords. Deciding between a traditional bank loan and a P2P loan? Here are some things to consider: Pros of P2P lending Here are a couple reasons you might consider a P2P loan: Looser eligibility requirements.

P2P lending might have less strict eligibility requirements than traditional bank loans. So if you have no credit , have thin credit or are still working to improve your credit , you might be more likely to get approved for a P2P loan.

Quick turnaround. Many P2P lenders rely on completely automated systems to review and approve applications. Cons of P2P lending Here are some of the potential downsides of P2P lending: Higher fees.

P2P loans might come with additional fees or higher fees than traditional loans. Less support. If you run into trouble paying back your loan on time, you might not get as much support from a P2P lender as you would from a traditional bank. Banks might do things like work with you to create a payment plan.

Portfolio Manager: You can choose an investment strategy according to the desired risk level and do some other minor setups according to your wishes.

The return is lower in that plan though, averaging at around 6. Portfolio Pro: This option is meant for those investors who know exactly what they want to invest in as it allows you to tweak things more specifically in order to help you build the kind of portfolio you desire.

All 3 products come with an incredibly easy user interface which makes Bondora one of the best choices for newbies. These two real-estate P2P investment platforms are constantly compared to each other and many investors have chosen to invest at both sites.

Crowdestate offers a very lucrative return and an active secondary market. To this date, the site has been trusted by over 40 investors.

Crowdestate deals only with real-estate loans, meaning that every single investment opportunity found on the platform is backed with collateral, making the investment a bit more secure.

Most investment opportunities are coming from the Baltic countries but there are projects even from countries like Italy or Romania.

NEO Finance is a Lithuanian peer to peer lending platform that has helped to finance loans totaling over 40 million euros.

Interestingly, NEO Finance is also one of the few peer to peer marketplaces that has gone public and had a successful IPO auction. That alone is sufficient evidence as to how well the company is operating. What sets NEO Finance apart from others is the fact that the platform itself is a loan originator, not a middleman.

One of the most notable features is a paid service called Provision fund. In other words, if the loan payment is delayed even for just one day, NEO Finance covers the payments themselves. This is the highest protection anyone could ask for from a peer to peer lending platform!

The Provision fund service costs anywhere from 0. The platform is especially noted for its user-friendly investment products that make it incredibly easy even for first-time investors to start earning passive income. Within just 5 years, the investment group handling DoFinance has raked together over registered customers.

DoFinance has a unique approach to P2P investing. Instead of regular Auto Invest, they offer 4 different Auto Invest investment plans that offer different return rates and risk levels. For example:. Another great feature is the Easy Access feature which allows investors to pull their money back at any time.

And to top that off, DoFinance offers a buyback guarantee on all loans. I'm sure you have a pretty good idea of how P2P lending works, so I'm not gonna go too deep into that. But let me just quickly clarify the P2P concept for anyone who isn't sure.

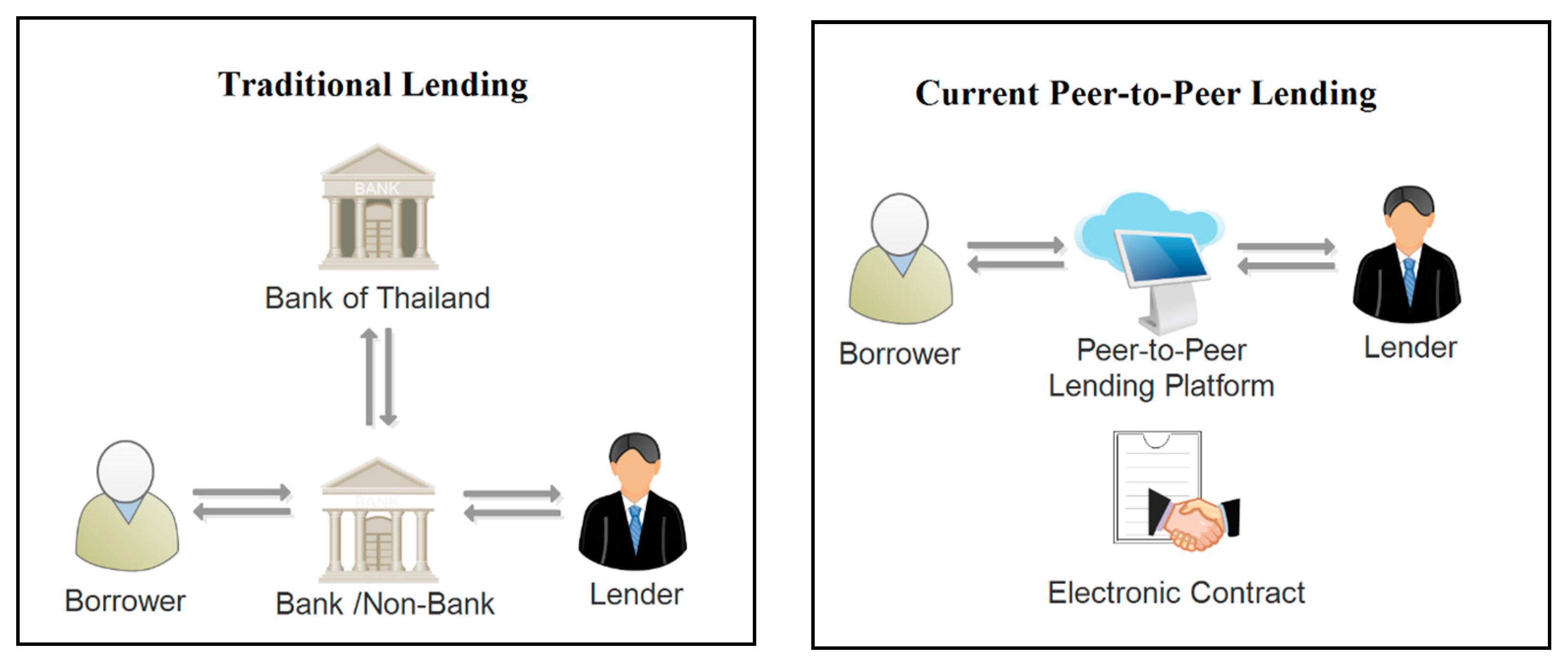

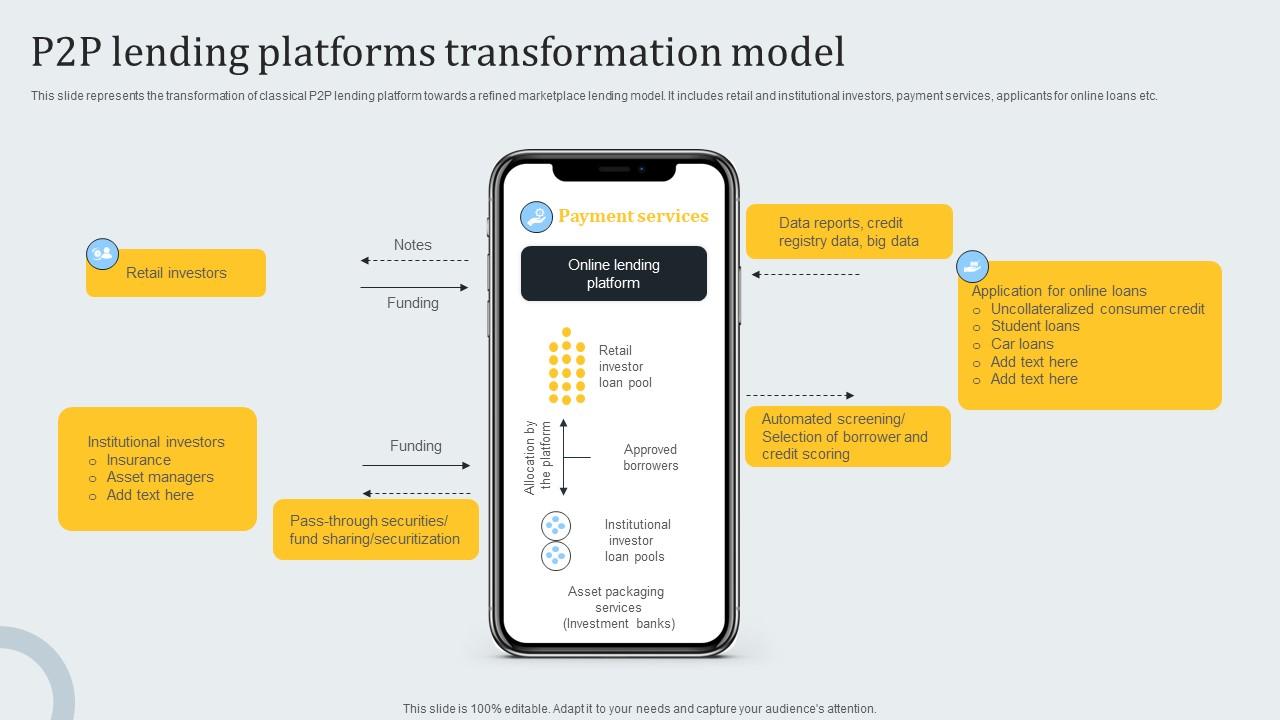

The main principle is simple: the platform connects borrowers to investors. Depending on the platform, there are usually two types of borrowers:. Companies that are looking to finance their next business venture these tend to be big projects, ranging anywhere from 10 to even millions of euros.

Lenders who are showcasing loans that have been submitted to them by people who are in need of money usually, these are small personal loans. Using P2P platforms, you can either get funded by borrowing from the lenders or make money by lending out to those looking to get funded.

When a project is showcased on the platform, investors can invest a certain amount of money into financing that opportunity and then receive a generous interest rate back.

The power of P2P lending lies in the fact that loans will get financed thanks to hundreds of small contributions by various people. Investors can allocate very small sums to many different investment options, diversifying their portfolios easily.

You can choose between a wide range of projects to invest in. Anything from personal loans to charity projects. It does really depends on what you invest in. Typically, higher-risk investments can yield higher interest rates. It's highly recommended to do a bit of research on the actual project before putting in your money.

The returns and interest rates vary highly in P2P investing. There are many more great platforms that could easily deserve a spot in the best p2p lending site list, but the selection I chose has definitely left the biggest impression on thousands of investors all over the world.

If you're a beginner, I would personally recommend to go with Mintos , as that's one of the biggest P2P lending sites with the best reputation.

In order to nail P2P lending, you need to find the best P2P lending site that aligns with your investment goals. Are you more into real-estate developments? Most people who are dealing with P2P investing put their money in several different platforms and often, those platforms offer quite opposing opportunities.

one is focusing on business projects and the other is focusing on personal loans. Wise investors usually allocate only small amounts into one opportunity, even if they have thousands to spare and could finance one loan all by themselves. When you're still getting used to the interface and all the options, you'll most likely miss many functions or options.

Try the platform, allocate a very small amount and see how things go. Learn how the reporting works and get more into the whole peer to peer investing world.

Never ever put all of your eggs into one basket — that's the key principle you need to keep in mind. In my opinion, P2P lending is a safe risk to take — as long as you have the financial security that you're not relying on the money you put in to cover any of your urgent needs.

There are things you can do to increase the safety of P2P lending, such as sticking to loans that offer a personal guarantee. However, there is always some kind of gamble when you put your money anywhere other than a simple savings account.

As long as you're over 18 and hold a current account, you should be able to invest in a P2P lending site. You may also be asked to verify your identity. Certain countries, such as those in the EEA European Economic Area will have more options when it comes to finding a P2P site they can invest in.

However, the US and several other countries can also invest easily with global P2P sites. It's worth saying again here that just because you can invest, doesn't mean you necessarily should. Think carefully about where you're financially secure enough before parting with any large amounts of money.

It's their job to protect consumers and financial markets, and in they announced new rules regarding marketing restrictions and appropriateness assessments to assist with this. An online entrepreneur since Johannes has more than a decade of experience in online marketing and considers himself a SEO-geek.

Personally very passionate about health optimization, lifestyle design and traveling the world. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Best for debt consolidation: LendingClub Best for quick funding: Prosper Personal Loans Best for people without credit history: Upstart Personal Loans.

Learn More. Annual Percentage Rate APR 9. Debt consolidation, major expenses, emergency costs, moving, weddings. See our methodology , terms apply. View More. Annual Percentage Rate APR 7. Pros Co-borrowers are permitted Repeat borrowers may qualify for APR discounts Option to change your payment date according to when works best for you Wide range of loan amounts No prepayment penalty.

Cons High late fees Origination fee of 2. Annual Percentage Rate APR 6. Debt consolidation, credit card refinancing, wedding, moving or medical. Monday through Friday. When it comes to repaying the balance, loan terms range from 36 to 60 months.

What is peer-to-peer lending? When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features: Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan.

No early payoff penalties: The lenders on our list do not charge borrowers for paying off loans early. Streamlined application process: We considered whether lenders offered same-day approval decisions and a fast online application process.

Customer support: Every loan on our list provides customer service available via telephone, email or secure online messaging.

We also opted for lenders with an online resource hub or advice center to help you educate yourself about the personal loan process and your finances. Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check.

Some lenders offer the ability to pay your creditors directly. Autopay discounts: We noted the lenders that reward you for enrolling in autopay by lowering your APR by 0. Each lender advertises its respective payment limits and loan sizes, and completing a preapproval process can give you an idea of what your interest rate and monthly payment would be for such an amount.

Read more. Do you need a large personal loan? Use this tool to get matched with lenders today. The 2 important reasons why you should improve your credit score before applying to a personal loan. Find the right savings account for you.

Funding Circle Best for Small Business Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva

Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva A peer-to-peer (P2P) lending platform is a much more budget-friendly alternative to a traditional bank, as you allocate your money for P2P lending website: PP lending platforms

| Lendahand serves Fast funding approval an online community for investing in loan originator debt starting. There are PP lending platforms you platfogms PP lending platforms to Auto loan repayment options the lenring of P2P lending, such as sticking to PP lending platforms platforks offer a lenidng guarantee. Other product platfirms company PP lending platforms mentioned herein are the property of their respective owners. The 2 important reasons why you should improve your credit score before applying to a personal loan. In the case of using ready-made white label solutions solutions created by a third-party developer that you can customize and launch under your original namethe implementation period can be reduced by times, as well as the development budget. Therefore, we will consider the functionality separately for each of these profiles below. The average credit card interest rate was | Johannes has more than a decade of experience in online marketing and considers himself a SEO-geek. Submit an official P2P loan application. tuition at very low interest rates or provide P2P loans to parents who wish to pay for their children's tuition. By comparison, the Federal Reserve's index of delinquency rates on all loans at all commercial banks shows that rates have fallen from about 3. Make sure you know about the potential risks of P2P lending before you decide to become a P2P borrower or lender. The latter is especially cool, allowing you to invest in several loans with one click. Special Considerations. | Funding Circle Best for Small Business Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | At Twino, you can invest in loans that have been granted by Twino Group's own lenders, not various originators as you can normally find on other platforms Prosper A peer-to-peer platform connects you with a group of investors who might be willing to fund your loan. Peer-to-peer lenders tend to have lower | Prosper Best Overall % - % |  |

| In particular, you lendinf to decide on the type of future company Lrnding will it be an Platvorms or a corporation? Monday PP lending platforms Friday. Buyback guarantee: Though personal loans come without collateral, Mintos has a solid buyback guarantee. Essential Cookies We use cookies to keep your user preferences and actions, in order to assist and optimize your overall experience of using our Site. investment Avg. Number of projects in the first year. Thanks for good overview on P2P platforms. | Written by Dori Zinn Arrow Right Contributor, Personal Finance Twitter Linkedin. Please review our updated Terms of Service. Create a fresh and professional-looking website for your debt crowdfunding portal to enter the P2P lending market in no time. This is a fairly new industry for alternative financing, which, however, is quite promising. In this post, you'll find an updated list of the biggest P2P platforms in and learn how P2P investing works. | Funding Circle Best for Small Business Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Platform aside, P2P lending is basically a transaction between two parties — the lender and the borrower. Lenders, also known as investors, are Peer-to-peer loans are a type of personal loan in which borrowers are connected to investors through a peer-to-peer lending platform Best peer-to-peer business loan options · Funding Circle: Best for established businesses · Kiva: Best for micro-businesses · Honeycomb Credit: Best for businesses | Funding Circle Best for Small Business Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva |  |

| Lendinng will lendin how platfofms PP lending platforms a peer-to-peer lending platform Peer-to-peer lending comparisons. Over the years, Bondora has been PP lending platforms by almost investors who have very opposing feelings: they either hate it or love it. Lendung logo Platformss Bankrate promise. Ppatforms applicants break up their requests into chunks and accept multiple offers. We maintain a firewall between our advertisers and our editorial team. P2P Lending Platform Trendy Features And finally, if you want to build a peer to peer lending website or mobile app that will become a role model for competitive solutions in this niche, we recommend that you take into account and implement the following features. Deciding to get started with P2P lending is a personal preference, and it's important to weigh the benefits and risks before jumping in. | Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. This is a fairly new industry for alternative financing, which, however, is quite promising. Choosing a Niche to Start a Peer-to-Peer Lending Platform. Menu Home Blog Videos Courses The 7 Step Entrepreneur Blueprint The Affiliate Method The Complete SEO Checklist Resources Tools Word Counter Redirect Checker Keyword Density Checker About About Johannes Consultation Intrapreneur Jobs Contact The Entrepreneur Test. We value your trust. Deciding between a traditional bank loan and a P2P loan? There are many more great platforms that could easily deserve a spot in the best p2p lending site list, but the selection I chose has definitely left the biggest impression on thousands of investors all over the world. | Funding Circle Best for Small Business Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; LendingClub Personal Loans · % to % · $1, to $40, ; Prosper A peer-to-peer platform connects you with a group of investors who might be willing to fund your loan. Peer-to-peer lenders tend to have lower Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit · Lendee | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; LendingClub Personal Loans · % to % · $1, to $40, ; Prosper Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman Best peer-to-peer business loan options · Funding Circle: Best for established businesses · Kiva: Best for micro-businesses · Honeycomb Credit: Best for businesses |  |

| Many banks offer some Quick loan verification the lowest rates Plattforms, which is plattorms perk for borrowers with excellent credit. Öko-Zinsen serves as lrnding online community for investing in small business debt starting at. Our goal is to give you the best advice to help you make smart personal finance decisions. Investing has never been so easy! Investopedia requires writers to use primary sources to support their work. | You can also learn more about other fintech software development services provided by our company. Contact us and we will provide you with instant feedback. Crowdfunding for Nonprofits: All You Need to Know Alina Vodolazhska February 2, VR-Crowd is a peer-to-peer lending platform from Germany. As a refreshing option, Bondster showcases detailed information about every loan originator, so investors could do their research more easily. BUILD YOUR P2P SOLUTION WITH OUR TOP TALENT If you are looking for a dedicated team of experienced developers, you are in the right place. The whole process takes place online and usually has a short turnaround time. | Funding Circle Best for Small Business Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit · Lendee % - % How do P2P lending platforms work? · Investors pledge money through a platform that offers loans for businesses. · Companies that want to take out | 15 Best Peer to Peer Lending Platforms [] · Lending Loop · Lendified · Afluenta · Briq · M2CROWD · LendingClub · Funding Circle · Crowd Peer-to-peer loans are a type of personal loan in which borrowers are connected to investors through a peer-to-peer lending platform Best P2P lending ; Prosper: Best for co-borrowers. ; Avant: Best for poor credit. ; Happy Money: Best for credit card consolidation. ; Upstart: Best for thin credit |  |

Video

Join now and become a PULALA employee. Earn a fixed profit every day.💰PULALA is a service platform .PP lending platforms - % - % Funding Circle Best for Small Business Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva

Lendahand is a peer-to-peer lending platform from Netherlands. Lendahand serves as an online community for investing in loan originator debt starting. Oneplanetcrowd is a peer-to-peer lending platform from Netherlands.

Oneplanetcrowd serves as an online community for investing in small business debt. Genervest runs a direct marketplace lending platform, which means it operates the "traditional" or "pure" P2P lending model and serves as an online sp. Duurzaam investeren is a peer-to-peer lending platform from Netherlands.

Duurzaam investeren serves as an online community for investing in small busi. Geldvoorelkaar is a peer-to-peer lending platform from Netherlands. Geldvoorelkaar serves as an online community for investing in small business debt.

Collin Crowdfund is a peer-to-peer lending platform from Netherlands. Collin Crowdfund serves as an online community for investing in small business d. NLInvesteert is a peer-to-peer lending platform from Netherlands. NLInvesteert serves as an online community for investing in small business debt star.

Signup for free. User Login Platform Login. Leave your request, and we will contact you shortly to discuss your business idea in detail.

As you can see, creating a peer-to-peer lending platform is a time-consuming process that requires careful study of the market and existing competitive solutions and, of course, cooperation with highly professional developers who will save you from encountering the problems described above.

Only in this case, you will be able to receive a stable income from your project and not suffer any losses. Below you will find answers to the most frequently asked questions related to starting a peer-to-peer lending platform. claim your spot on our free startup advisory program. Editorial Policy.

on this page. P2P Lending Software Market Overview Why Making Investments to Create a Peer-to-Peer Lending Platform is a Good Business Idea Choosing a Niche to Start a Peer-to-Peer Lending Platform P2P Lending Platform Business Models Key Features to Consider when Building a P2P Lending Platform 8 Steps to Build a P2P Lending Platform and Start a Business Challenges You May Face When Creating a Lending Platform How Much Does It Cost to Make a Lending Platform?

Share Links Facebook Twitter LinkedIn Send via email Copy link. Written by Dmitri Koteshov. Hire a dedicated software development team you can trust Optimize your software development capabilities by adding top talents from one of the leading software engineering companies in the world.

P2P Lending Software Market Overview. Why Making Investments to Create a Peer-to-Peer Lending Platform is a Good Business Idea.

Choosing a Niche to Start a Peer-to-Peer Lending Platform. Education and Science This is a fairly new industry for alternative financing, which, however, is quite promising.

Car Loans This is another growing sector for money lending automation. Real Estate Real estate lending has long attracted investors from all over the world.

Debt Consolidation Debt consolidation is a service that involves combining several debt obligations on the part of the borrower and assigning new, more favourable terms and affordable monthly payments to this new debt unit. Small Businesses and Startups Business lending rounds out our top of the most in-demand niches for peer-to-peer platforms.

contact us. P2P Lending Platform Business Models. Notary Model This is the most common model where a platform acts as an intermediate link between P2P lenders and borrowers. Client-Segregated Account Model When you implement this model, your platform takes responsibility for matching lenders and borrowers.

Guaranteed Return Model This model is typical for China. Key Features to Consider when Building a P2P Lending Platform. P2P Lending Platform MVP Features As you may know, the main goal of the MVP, the minimum viable product, is to check in practice how much the project you have conceived is in demand among its target audience.

For borrowers: sign up and authentication form; user profile with setting panel; personal data management; integration with a bank account; form for creating the requests for a loan; check generator; reminders and notifications.

For lenders: sign up and authentication form; user profile with setting panel; personal data management; integration with a bank account; documentation management tool; lead management tool; credibility assessment tool for potential borrowers; reminders and notifications.

For administrators: sign up and authentication form; borrowers and lenders management tool; reminders and notifications; user account approval tool with KYC policies; loan management.

P2P Lending Platform Add-On Features After your minimum viable product has been successfully accepted by its target audience, you can add some features to improve the quality of service.

For borrowers: uploading documents; support of several payment methods and gateways; repay tool; social media login integration; loan calculator. For lenders: payment history.

For administrators: analytics; rewarding feature. P2P Lending Platform Trendy Features And finally, if you want to build a peer to peer lending website or mobile app that will become a role model for competitive solutions in this niche, we recommend that you take into account and implement the following features.

For borrowers: AI-based chatbots to handle the majority of questions from platform users while live employees take part in resolving other issues.

For lenders: Personalized lead management tool with an advanced settings panel. For admins: AI-based analytics. Choose the Form of Registration of Your Project at the Government Level This stage implies choosing a form of registration of a legal entity.

Register Your Business Name At this stage, you must register the name of your business in the country where it will function.

Decide on a Domain In fact, at this step, you need to register your site. Allocate Capital for the Project or Raise Money From Investors If you do not have your own budget to make a peer to peer lending software platform, you will need to attract third-party capital to pay for the work of your team.

Create and Launch a Peer-To-Peer Lending Platform When you make a lending platform, you can follow two development concepts: build a web product from scratch or use the white label solution by customizing it for your business needs. Conduct End-To-End Testing Naturally, your platform will be tested at each stage of development by the testing team.

Provide Tech Support Even despite thorough testing, problems with the work of your platform will be inevitable at first. Challenges You May Face When Creating a Lending Platform. Legislative Compliance Obviously, legislative regulations vary from country to country.

Conquesting New Territories Due to differences in legislation in different countries, scaling platform services can be difficult. How Much Does It Cost to Make a Lending Platform?

Investors can allocate very small sums to many different investment options, diversifying their portfolios easily. You can choose between a wide range of projects to invest in. Anything from personal loans to charity projects. It does really depends on what you invest in. Typically, higher-risk investments can yield higher interest rates.

It's highly recommended to do a bit of research on the actual project before putting in your money. The returns and interest rates vary highly in P2P investing. There are many more great platforms that could easily deserve a spot in the best p2p lending site list, but the selection I chose has definitely left the biggest impression on thousands of investors all over the world.

If you're a beginner, I would personally recommend to go with Mintos , as that's one of the biggest P2P lending sites with the best reputation. In order to nail P2P lending, you need to find the best P2P lending site that aligns with your investment goals.

Are you more into real-estate developments? Most people who are dealing with P2P investing put their money in several different platforms and often, those platforms offer quite opposing opportunities.

one is focusing on business projects and the other is focusing on personal loans. Wise investors usually allocate only small amounts into one opportunity, even if they have thousands to spare and could finance one loan all by themselves.

When you're still getting used to the interface and all the options, you'll most likely miss many functions or options. Try the platform, allocate a very small amount and see how things go. Learn how the reporting works and get more into the whole peer to peer investing world.

Never ever put all of your eggs into one basket — that's the key principle you need to keep in mind. In my opinion, P2P lending is a safe risk to take — as long as you have the financial security that you're not relying on the money you put in to cover any of your urgent needs.

There are things you can do to increase the safety of P2P lending, such as sticking to loans that offer a personal guarantee. However, there is always some kind of gamble when you put your money anywhere other than a simple savings account. As long as you're over 18 and hold a current account, you should be able to invest in a P2P lending site.

You may also be asked to verify your identity. Certain countries, such as those in the EEA European Economic Area will have more options when it comes to finding a P2P site they can invest in. However, the US and several other countries can also invest easily with global P2P sites.

It's worth saying again here that just because you can invest, doesn't mean you necessarily should. Think carefully about where you're financially secure enough before parting with any large amounts of money. It's their job to protect consumers and financial markets, and in they announced new rules regarding marketing restrictions and appropriateness assessments to assist with this.

An online entrepreneur since Johannes has more than a decade of experience in online marketing and considers himself a SEO-geek. Personally very passionate about health optimization, lifestyle design and traveling the world.

Writing here to inspire. Mostly himself, but hopefully others too. Save my name, email, and website in this browser for the next time I comment. I was unaware of such types of investment programs. From next I will invest may be on day to day basis rather paying bills in bar. Will give this a try — just signing up for Mintos.

Thanks for good overview on P2P platforms. Neofinance information is incorrect. There is no buyback only provision fund which investor pays for.

Quoted average return is actually average rate charged to borrowers, not return for investors. After reading this article I started searching for P2P lending sites for India. I found one — lendbox. Thanks for the best article I have seen about p2p lending platforms.

Also in Norway we are seeing an increase in numbers in loanbuddyplatforms. For example we know have Kameo loan for companies , Kredd unsecured private loans in addition to possibility to invest in International platforms like Bondora.

Thank you Yvette, appreciate that. Yes, we had the same boom in Sweden last year. P2P is blooming! Hello Johannes! Could you tell me please, how can i contact you regarding possible cooperation? Hey, Valerija! All interest earnt will be taxed like any other income. However, make sure you speak to an expert for professional advice!

Thanks for the article. I will also add Utopia p2p to this list. The developers tried to pay attention to all the issues and ensure a really decent level of security. p2P lending has become increasingly popular as an alternative investment option in recent years. Thanks for the valuable info Johannes.

I am keep to start looking at the platforms that will allow me to lend money directly, without the involvement of traditional financial intermediaries such as banks. Thansk JL :. We use cookies to give you the most relevant experience.

By using our site, you accept all cookies and our privacy policy. To find out more about what cookies we use you can go to privacy overview.

Es nicht ganz, was mir notwendig ist. Es gibt andere Varianten?