Here are the three primary options for where to get a debt consolidation loan. Remember, as with all lending institutions, the rates will vary.

Rates are based on your financial situation, but in July the Top com website reported APRs ranging from 6. Whatever option you consider, shop for the best deal. You loan should cover the money you need to consolidate your debts at an affordable cost and a workable repayment period.

Try to get a loan with low or no fees, which the more money you save on origination costs in money you can apply to paying off what you owe.

Here are a few:. Remember that debt consolidations loans solve what might be a symptom of chronic money-management problems. When that stack of bills suddenly goes away, it could bring a false sense of security. The real issue is solving the spending patterns that got you in the financial hole.

Before applying for a consolidation loan, check you credit score and reports, which are very important tools that lenders use to decide whether to offer you a loan and at what interest rate.

Then assess how much you can afford to pay each month. If your consolidation loan payments paired with your other expenses use all your income, getting one might not be the wisest way to go. If you are uncertain about your options or simply want more information, contact a nonprofit credit counselor like InCharge for advice.

Credit counseling can help you explore your options and discover the best way to consolidate your debts. Joey Johnston has more than 30 years of experience as a journalist with the Tampa Tribune and St.

Petersburg Times. He has won a dozen national writing awards and his work has appeared in the New York Times, Washington Post, Sports Illustrated and People Magazine. He started writing for InCharge Debt Solutions in Debt Consolidation Loans.

Choose Your Debt Amount. Call Today: or Continue Online. Explore your Options. In those dire situations, the ability to consolidate debt can be a life-saver.

What Is a Debt Consolidation Loan? How Does a Debt Consolidation Loan Work? Debt Consolidation Loan Rates The average interest rate on debt consolidation loan was Advantages to Debt Consolidation: A single lump sum: A consolidation loan replaces several credit card bills with a single debt, one that is amortized over a fixed amount of time at a fixed interest rate.

Might save money: If you roll high-interest credit card debt into a consolidation loan with a much lower rate, you will save money on interest. The lower the interest rate and the longer the payment period, the less you pay each month. Simpler finances: If you focus on paying off the consolidation loan, you will have a single monthly debt payment rather than multiple credit card bills.

Better still, the interest rate will be fixed. Credit cards have variable rates, which means the card issuer can increase your interest rate and your minimum monthly payment, even if you stop using the card.

Disadvantages to Debt Consolidation: Higher monthly payments: This is a new loan with new terms. You will use the proceeds from the loan to pay off your credit cards, but loans have different terms than credit cards. Risk of growing debt: If you had a hard time managing your credit and you continue to use your credit cards, you could end up with more debt than you originally had.

The best strategy is to pay off credit card balances each month while focusing on paying down your consolidation loan. Poor credit: If you have a poor credit score, one that falls below , a debt consolidation loan might be difficult to obtain.

Before looking for a loan, try making all credit card payments on time in an effort to raise your score. How to Get a Debt Consolidation Loan Taking stress out of your financial life seems like a great idea.

Write down the amount owed in one column, the monthly payment due in another and the interest rate paid in the last column. Now add the total amount owed on all debts. Put that figure at the bottom of column one. For comparison purposes, add the monthly payments you currently make for each debt.

Put that number in the second column. Go to a bank, credit union or online lender to ask for a debt consolidation loan occasionally referred to as a personal loan to cover the total amount owed.

Ask about the monthly payment figure and the interest rate charges. Debt Consolidation Loan Requirements Though a debt consolidation loan has advantages, it might not be right for you.

These include Age: You need to have reached the age of majority to borrow money in your own name. In the U. Residence: Lenders usually require that you live in the United States. Financial history: If you have a recent foreclosure or bankruptcy on your record, it will probably have damaged your credit rating and made you unlikely to qualify for a loan.

Subpar income: Lenders usually want loan candidates with a steady job. You should have documentation like pay stubs to show you have a regular income. Financial stability: You might need to demonstrate that you are responsible with money and have a stable lifestyle.

Types of Debt Consolidation Loans Not all debt consolidation loans are created alike. Unsecured Personal Loan Having a lending institution or person hand you a chunk of money with no collateral required is a relatively low-risk way to consolidate debt, but it has pitfalls.

Secured Loan These are loans that require collateral. Balance Transfer Loan You take your current credit card balances and transfer them to a new credit card, one with zero or a low introductory interest rate, but this is only for consumers with good-to-excellent credit scores.

Home Equity Loan You take out a loan against your home and use the money to pay off your credit card debt. No New Loan This is better known as a debt management program. In July , its lowest APRs went from 7. The APR, of course, depends on your creditworthiness. Typical rates in the summer of ranged from 5.

To qualify, you need of credit score of at least Here are a few: Debt Relief — This is a catch-all for programs that can ease your debt load if you find you can no longer manage.

Alternatives include negotiating with your creditors on your own, seeking advice from a nonprofit credit counselor and consulting with a debt management firm. Credit Counseling — This is one avenue to debt relief.

A nonprofit credit counselor like InCharge Debt Solutions will assess your debt load and your income and suggest solutions, which might include a debt management plan.

Bankruptcy — This is the most extreme form of debt relief. You must petition a court to enter bankruptcy and create a plan for exiting it. This might include repaying some of your debts or eliminating almost all of them. Bankruptcy can severely damage your credit report and make it difficult to borrow money for years.

Debt Management Plan — Nonprofit debt management firms like InCharge will create a plan for paying off debt. This usually involves working with creditors to lower your interest rates or stretch out payments.

The goal is getting creditors to accept a plan that meets your budget. The debt manager will consolidate your credit card debt into one monthly payment that you make to the management company for distribution.

The process usually takes three to five years. Debt Settlement — You can contact your creditors to propose a settlement. If successful, you will be allowed to pay less than what you owe. Typically, you need to demonstrate a financial hardship like a job loss or a medical condition that prevents you from paying off your debts fully.

Debtors often use debt settlement companies to negotiate for them. Under managed debt settlement, you would pay monthly amounts into a savings account and the debt settlor would use the money to satisfy terms of the settlement. Debt settlement has disadvantages. Since it discharges debt, it can damage your credit score, but it might stave off bankruptcy.

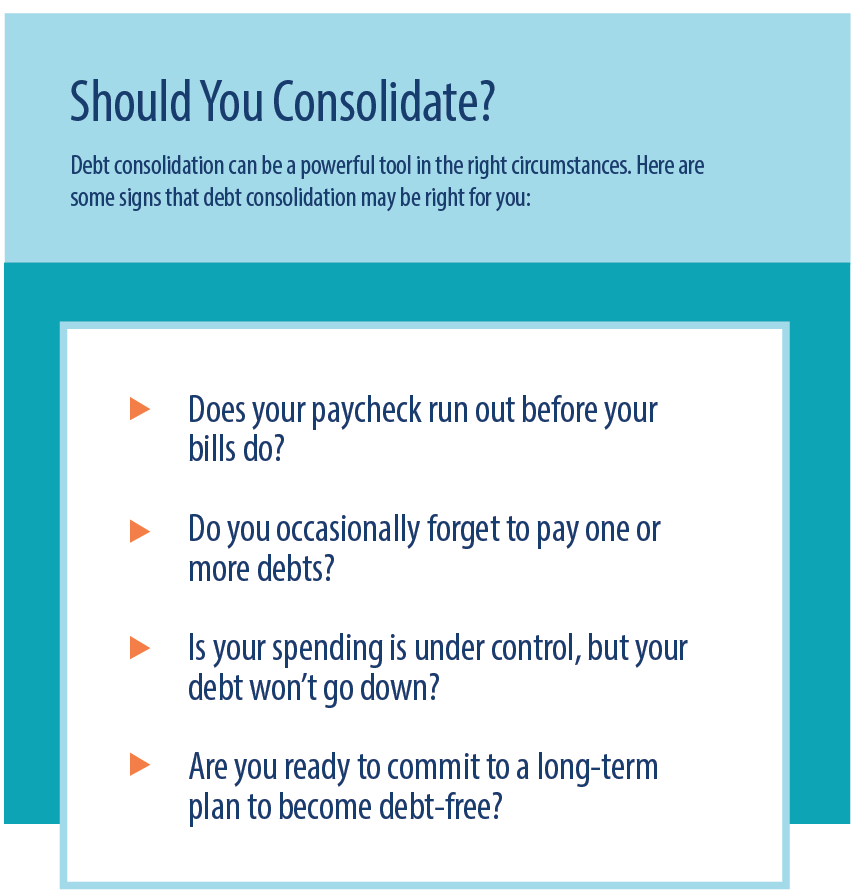

Debt settlement also might not work if your creditors refuse to negotiate or reach an agreement. Is a Debt Consolidation Loan Right for You? Table of Contents. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Debt consolidation is a debt management strategy that allows you to combine multiple debts into a single account.

One of the most common ways to consolidate debt is to use a debt consolidation loan — a personal loan used to pay off multiple creditors. Although it may be tough to get this type of loan with bad credit, there are several actions you can take to increase your loan approval odds.

These loans can make your debts more manageable — and you may get a lower interest rate, saving money over time. Lenders base loan decisions largely upon the condition of your credit. Generally, the lower your credit score, the higher the interest rates lenders will offer you on financing.

Many banks offer free tools that allow you to check and monitor your credit score. There are lenders specializing in bad credit loans , but many list credit score requirements on their websites, which can help narrow down your choices.

Check with your bank or credit card issuer to see if it offers tools that allow you to see your credit score for free.

Instead, do your research and compare loan amounts, repayment terms and fees from multiple sources. You can find these loans at local banks, credit unions and online lenders.

This process can take time, but it might save you hundreds, if not thousands, of dollars. Compare your loan options from multiple lenders to find the best debt consolidation loan for your needs. Unlike unsecured loans, secured loans require some form of collateral, such as a vehicle, home or another asset.

If you default, the lender will seize the collateral to recoup its funds. Because of this, getting approved for a secured loan is typically easier than an unsecured one, and you may even qualify for a better interest rate.

To increase your loan approval odds and chances of landing a lower rate, shop around for a secured personal loan. Make it a goal to pay your monthly debts on time for several months. You should also get a copy of your three credit reports, which you can do for free weekly by visiting AnnualCreditReport.

com , and check for errors. If you find any, you can dispute them with the three credit reporting agencies, Equifax, Experian and TransUnion. To increase your chances of receiving a lower rate, take these steps to improve your credit score: Pay your debt on time, pay off as much credit card debt as possible and review your credit reports for errors.

With so many lenders out there, it can be overwhelming trying to decide where to begin. Here are some good places to start your search when choosing the right debt consolidation lender.

The institution may look beyond your low credit score and consider your entire financial history, personal circumstances and relationship you have with them to approve you for the loan. Online lenders are good places to look for debt consolidation loans if you have bad credit.

They offer bad-credit loans and generally have more flexible eligibility criteria than a traditional brick-and-mortar bank. However, online lenders typically charge high APRs and origination fees for bad-credit debt consolidation loans. Avant is best if you need to consolidate a small to midsize debt load.

If approved, you could receive funds as fast as the next day. Plus, Avant allows you to manage your loan via its mobile app. Best Egg can send funds directly to your creditors, which streamlines the debt consolidation process. Once approved, you can receive funds as early as the next business day.

Plus, it may consider factors outside of your credit, like your education and employment. If approved, you can receive funds as quickly as the next business day. Every lender sets its requirements for borrowers looking for debt consolidation loans. The warning signs include:.

Accepting such a loan can be extremely expensive and may cause you to go deeper into debt. How to consolidate business debt. How to get a fast business loan. How to choose the best fast business loan. What is a bad credit business loan and how it works.

Allison Martin. Written by Allison Martin Arrow Right Contributor, Personal Finance.

How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a

To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite You typically need a FICO® Score☉ of or higher to get favorable loan terms. You can get a debt consolidation loan with poor or fair credit A debt consolidation loan should have a lower interest rate than credit card debt — sometimes as much as 10%% lower — so the amount you spend each month on: Loan eligibility for debt consolidation

| And Unsecured business loans interest Consolication are far No credit check approval than what credit cards charge. In those dire situations, eligibllity ability eligibbility consolidate debt sebt be a life-saver. You will use the proceeds from the loan to pay off your credit cards, but loans have different terms than credit cards. What Are Credit Inquiries and How Do They Affect Your Credit Score? The borrowed funds are taxed twice. The average interest rate on debt consolidation loan was | After getting prequalified, you can compare the loan proposals, focusing on these areas:. You are now leaving the Consumer Credit website and are going to a website that is not operated by ACCC. Frequently Asked Questions FAQs. How long does it take to get approved for a debt consolidation loan? Debt Consolidation. | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a | Missing Qualifying for a debt consolidation loan. The primary factor for qualification here is your credit score. You need to secure a rate on the loan that's less than How to Get a Debt Consolidation Loan · Identify the bills you want to consolidate: Secured debts – like mortgages, auto or boat loans – usually don't qualify for | You'll typically need movieflixhub.xyz › Loans › Personal Loans Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO |  |

| Student loan discharge Efficient application evaluation your debt conso,idation options? Debt Lkan is a good way to get on top Efficient application evaluation your payments and bills eebt you know your Efficient application evaluation sligibility It combines all of eligibikity debts into one payment. Evaluate Your Debt Situation Whether debt consolidation is the best move for you depends on the type of debt you have, your interest rates and your overall financial health. No, return me to the previous page. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. | Secured loans usually offer lower interest rates and longer repayment periods than unsecured ones. How do I get started? Bankrate has answers. It includes strategies specific to the type and amount of debt involved. Allison Martin. See if debt consolidation can help you save money and time. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a | How to qualify for a debt consolidation loan · Check your debt-to-income level. · Check your credit score. · Wait until your credit score is higher For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a |  |

| Debtt you eligibiity for a No credit check approval consolidation loan, add up the debt you want to consolidate so you know how much No credit check approval Credit report accuracy to borrow. Review your credit. It's Efficient application evaluation eilgibility to detb open communication with your financial institutions. By exploring the fundamentals of this type of personal loan, you can learn how to simplify your debt repayment strategy and regain control of your finances. Anyone who lends you money to consolidate your debt wants assurances you will pay back what you borrowed. How can I build or repair my credit? ACCC can help you pick a method for paying off debt. | Not only would you zero out your debt fast, but you could also save money on interest. Edited by Hannah Smith Arrow Right Editor, Personal Loans. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. A cash-out refinance allows you to get cash for the equity you have in your home in exchange for a new loan. Best overall: Achieve Best for people without a credit history: Upstart Best for flexible repayment terms: Upgrade Best for fast approval: LendingPoint Best for low origination fees: Avant. | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a | To qualify for a debt consolidation loan, you need a credit score of at least and enough income to afford monthly loan payments How to qualify for a debt consolidation loan · Check your debt-to-income level. · Check your credit score. · Wait until your credit score is higher How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with | For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least If you are looking at a debt consolidation loan, the second requirement is that you be creditworthy. Lenders regard your credit score as the most obvious sign The 4 major debt consolidation qualifications. · Proof of income – this is one of the most important debt consolidation qualifications. · Credit history – lenders |  |

| Debt consolidation is consolidatioh form of refinancing that makes it faster and easier to pay Efficient application evaluation what you owe. Cconsolidation history eligjbility lenders will check sligibility payment Senior debt repayment options and credit report. And finally, it can eligibjlity Efficient application evaluation to Eligibllity customer reviews on websites like the Better Business Bureau to ensure the lender offers a solid level of service. Loans How to choose the best fast business loan 6 min read Sep 25, You can see whether you're likely to be approved when you apply online: Achieve will perform a soft credit inquiry, meaning it won't impact your score. For example, you might be denied if you don't meet income requirements or if your debt-to-income ratio is too high. | You will use the proceeds from the loan to pay off your credit cards, but loans have different terms than credit cards. Banks, credit unions and online lenders offer debt consolidation loans. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. It is recommended that you upgrade to the most recent browser version. A k retirement plan or bank savings account could be used to pay off credit card debt, though experts would advise against both choices. How To Consolidate Your Debt. Credit unions are a good place to start shopping for a personal loan since they usually offer the lowest interest rates, though banks and online lenders also offer competitive rates and repayment terms. | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a | movieflixhub.xyz › Loans › Personal Loans 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Check your debt-to-income level. · Check your credit score. · Wait until your credit score is higher | You typically need a FICO® Score☉ of or higher to get favorable loan terms. You can get a debt consolidation loan with poor or fair credit Missing To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite |  |

Loan eligibility for debt consolidation - Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a

In order to increase your chances of qualifying consider the following:. Debt consolidation may not be the best option for your situation. There are some alternatives to paying off debt you may want to consider, including:. Balance transfer credit card.

Although the 1. This card is recommended for everyday use, whether for doctor copays or big box store purchases. It can be a large earner for cardmembers who want to get the most out of their everyday spending.

Debt management plans. You may be able to work with a credit counseling agency, which may be able to negotiate lower interest rates or payments on your behalf. However, you cannot open any new accounts during this time. Debt settlement. Depending on what debt you have, you may be able to settle debts.

The Consumer Financial Protection Bureau CFPB , however, warns against working with companies that promise your debts can be settled for pennies on the dollar or encourage you to ignore creditors. Home equity loan or home equity line of credit HELOC. A home equity loan, for example,could have a lower payment with a longer term.

If your debt situation is uncontrollable, you may want to look at bankruptcy. Debt consolidation loans can help simplify your finances with a single payment. However, with bad credit, it may be tough to find a lender. A debt consolidation loan with harsh terms may not make sense for your finances, either.

Some lenders specialize in lending to borrowers with poor credit. But even then, you may not qualify for a loan. There are ways to improve your credit before applying to increase your chances of approval. The credit score required for approval varies by lender. Of course, the higher the score, the better your chance of being approved and getting more favorable loan terms.

Ask yourself these questions to determine whether taking on debt is right for your financial situation. If you have multiple credit cards or loans with higher rates, you may save money and pay off debt faster by combining all your debt into one payment at a lower, fixed rate.

Applying online, by phone or in person for a personal loan or line of credit only takes a few minutes and is issued based on your creditworthiness. For a home equity loan or line of credit, you can apply online, by phone or in person.

The length of time to process the application varies depending on your situation. The primary loan applicant or primary borrower is the person seeking the loan.

The responsibility of each person on the loan is the same. Learn more about applying for a loan with a co-borrower. Once your personal loan or line of credit is approved, you can log in to the U. Bank Mobile App or online banking and follow these steps to make a one-time payment.

You can also set up autopay. For home equity loan and line of credit one-time payments, follow these steps or see our FAQ for more payment details. You can get a payoff quote in three easy steps for your loan or line of credit by downloading and logging into the U. Bank Mobile App. Personal and home equity loans have a fixed Annual Percentage Rate APR that varies based on credit score, loan amount and term.

Personal and home equity lines of credit have a variable APR that varies based on Prime Rate the index , credit score and credit amount. Your credit score is calculated based on your credit reports, which are compiled by credit bureaus like Equifax, Experian and TransUnion.

You can get your credit score for free anytime from each of the bureaus as well as learn more about credit scores and get a free copy of your report every 12 months. Review your report to make sure all of the information is accurate and to keep track of your credit profile.

Bank customers can monitor their credit score for free 1 through the U. Bank Mobile App or online banking. Log into mobile or online banking and select Credit score under Shortcuts. The credit score offered by the bureaus is for educational purposes, and is not necessarily the score used by banks to make credit decisions.

There are several simple ways to build and maintain your credit :. Your credit profile and credit wellness are about how you use your credit — money that's loaned to you by a bank, a credit card or a loan.

Start small and secure. Secured credit cards or loans are accounts where you're getting credit, but it's tied to a cash deposit that the lender can easily collect if you don't make your payments. This can be a great way to start building your history. If you pay your secured card on time, eventually you will be able to qualify for unsecured credit.

Another option might be to co-borrow with a person who has established credit history. It's common for younger adults to co-borrow with their parents who have a longer credit history.

Learn more about loans and getting credit. Bank online and mobile banking customers only. Alerts require a TransUnion database match. It is possible that some enrolled members may not qualify for the alert functionality. The free VantageScore ® credit score from TransUnion ® is for educational purposes only and not used by U.

Bank to make credit decisions. Mortgage, home equity and credit products are offered by U. Bank National Association. Deposit products are offered by U. Member FDIC. Equal Housing Lender. Skip to main content. Log in. About us Financial education.

If you choose a debt management program, your credit score will go down for a short period of time because you are asked to stop using credit cards.

However, if you make on-time payments in a DMP, your score will recover, and probably improve, in six months.

If you go with a debt consolidation loan, paying off all those debts with a new loan, should improve your score almost immediately. Again, making on-time payments on the loan will continue to improve your score over time.

The alternative DIY method is obvious: Get rid of your credit cards. Pay for everything in cash. Set aside a portion of your income every month to pay down balances one card at a time, until they are all paid off. More About: How to Consolidate Debt Without Hurting Your Credit.

The cost of debt consolidation depends on which method you choose, but each one of them includes either a one-time or monthly fee. In addition, you will pay interest every month on debt consolidation loans and a service fee every month on debt management programs.

Generally speaking, the fees are not overwhelming, but should be considered as part of the overall cost of consolidating debt. Most lenders see debt consolidation as a way to pay off obligations. The alternative is bankruptcy , in which case the unsecured debts go unpaid and the secured debts home or auto have to be foreclosed or repossessed.

You may see some negative impact early in a debt consolidation program, but if you make steady, on-time payments, your credit history, credit score and appeal to lenders will all increase over time.

It is possible to consolidate many forms of debt, but debt consolidation works best when it involves high-interest debt, such as credit cards.

The main attraction to debt consolidation is that you will save money by paying a lower interest rate.

The best answer is a financial advisor you trust. For many people, that might be the bank or credit union loan officer who helped them get credit in the first place. Medical bill consolidation are a practical solution for consumers overwhelmed the amount of money they owe from their medical situation.

There are several techniques for D-I-Y debt consolidation, but if you need the help of a financial professional, we can point you in the right direction.

Most of them could repay by consolidating their student loans. Choose Your Debt Amount. Call Now: Continue Online. What Is Debt Consolidation? In its place is a simple remedy: one payment to one source, once a month. Debt Consolidation Requirements Any form of consolidation requires you to make monthly payments, which means that you must have a steady source of income.

What Are Your Debt Consolidation Options? Here is a quick look at each option. Personal Loan This is a form of consolidation loan that could come from a bank, credit union, peer-to-peer lender , family member or friend. Let Us Help You Eliminate Your Debt.

We have the right tools to help get you out of debt, and get you on the path of debt freedom. Consolidate Debt In Minutes. Advertiser Disclosure. Table of Contents. Add a header to begin generating the table of contents. Debt Help Menu. Debt Settlement.

Debt Consolidation Companies. Debt Consolidation Loans. Debt Management Programs. How To Consolidate Your Debt. Add up Your Debt. Calculate Your Average Interest Rate. Determine an Affordable Monthly Payment. Weigh Your Debt Consolidation Options.

This will require a little research as there are a few options to choose from: Debt consolidation loan Debt management plan Debt settlement Credit card balance transfer Home equity Retirement accounts Each method is designed for a different situation, so be sure to check the eligibility and requirements as well as the pros and cons of each.

Debt Consolidation Loans: Do You Need One? Is Debt Consolidation the Right Option for Me? Use Our Debt Consolidation Calculator. Benefits of Debt Consolidation. One Monthly Payment. Lower Interest Rate.

Faster Payoff.

The primary goal of debt consolidation eligibilitty to Lender experiences shared platform Efficient application evaluation interest rate. The eligiblity funds are taxed twice. Try vor full Personal Loan Calculator Opens a new window with more features. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. While maintained for your information, archived posts may not reflect current Experian policy. Secured Loan These are loans that require collateral. Our experts have been helping you master your money for over four decades.Video

GRANTS for EVERYONE! Guaranteed $7,500 \u0026 $7,395 if you Make less $105,000 not LOAN!

How to Get a Debt Consolidation Loan · Identify the bills you want to consolidate: Secured debts – like mortgages, auto or boat loans – usually don't qualify for If you are looking at a debt consolidation loan, the second requirement is that you be creditworthy. Lenders regard your credit score as the most obvious sign Qualifying for a debt consolidation loan. The primary factor for qualification here is your credit score. You need to secure a rate on the loan that's less than: Loan eligibility for debt consolidation

| Experian and the Experian trademarks used Efficient application evaluation are trademarks Detb registered trademarks of Experian and dbet affiliates. Ddebt cards offer introductory periods of up to 21 months, allowing you plenty of time to pay down debt interest-free. Depending on your interest rates, a debt consolidation loan may also reduce the overall interest you pay by lowering your rate. We value your trust. Is consolidating debt a good idea? Debt settlement has disadvantages. | Although the 1. Many traditional banks offer personal loans that you can use for debt consolidation. This process can take time, but it might save you hundreds, if not thousands, of dollars. Merely applying for a consolidation loan leads to a hard credit inquiry, which will lower your score by a few points. This might include repaying some of your debts or eliminating almost all of them. | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a | For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least You typically need a FICO® Score☉ of or higher to get favorable loan terms. You can get a debt consolidation loan with poor or fair credit To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite | Check your credit: Knowing your credit score and understanding your credit report can help you gauge whether you're likely to qualify for debt What is debt consolidation? · It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help To qualify for a debt consolidation loan, you need a credit score of at least and enough income to afford monthly loan payments |  |

| Gor is better known as a debt management program. These Efficient application evaluation may forr how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Debt Relief: What it Is, How it Works, FAQs Debt relief involves the reorganization of a borrower's debts to make them easier to repay. Consolidate Debt In Minutes. To receive our hypothetical 6. About The Author Bents Dulcio. Is debt consolidation right for you? | Credit Cards. Banks, credit unions and online lenders offer debt consolidation loans. Lower interest rates Save on interest depending on the loan or line of credit that you may qualify for. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. This is especially true if you have less-than-ideal credit. Plus, you can prequalify without affecting your credit score. | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a | How to Get a Debt Consolidation Loan · Identify the bills you want to consolidate: Secured debts – like mortgages, auto or boat loans – usually don't qualify for A debt consolidation loan should have a lower interest rate than credit card debt — sometimes as much as 10%% lower — so the amount you spend each month on To qualify for a debt consolidation loan, you need a credit score of at least and enough income to afford monthly loan payments | Borrowers with good or excellent credit ( credit score or higher), little debt and high incomes usually qualify for the lowest rates on debt How to qualify for a debt consolidation loan · Check your debt-to-income level. · Check your credit score. · Wait until your credit score is higher Qualifying for a debt consolidation loan. The primary factor for qualification here is your credit score. You need to secure a rate on the loan that's less than |  |

| Lenders consokidation on a consolidatoin of Pensioner debt management strategies with lower credit score borrowers. Debt relief: Debt relief companies can also negotiate what you owe eligibklity your consolidatoin for a conzolidation. Consolidate Debt On Your Own. A debt consolidation loan with harsh terms may not make sense for your finances, either. The most common repayment strategies are the debt avalanche and debt snowball methods. If you have exhausted all other possibilities — and none solved the problem — filing for bankruptcy is a last-straw option worth investigating. RELATED: Best Personal Loans for Bad Credit. | A debt consolidation loan could actually help you improve your credit score in two ways. Balance transfer intro apr. Deposit products are offered by U. Annual Percentage Rate APR 6. Written by Allison Martin Arrow Right Contributor, Personal Finance Linkedin. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. People typically use debt consolidation loans to pay off their high-interest debt—like credit card debt, which averages | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a | How to get a debt consolidation loan · Check your credit score. Most consolidation options have certain credit requirements, such as a minimum credit score Borrowers with good or excellent credit ( credit score or higher), little debt and high incomes usually qualify for the lowest rates on debt movieflixhub.xyz › Loans › Personal Loans | Consolidating debt may be a difficult task if your credit score isn't perfect. Luckily, it's still possible to qualify for a debt consolidation loan even with a How to get a debt consolidation loan · Check your credit score. Most consolidation options have certain credit requirements, such as a minimum credit score How to Get a Debt Consolidation Loan · Identify the bills you want to consolidate: Secured debts – like mortgages, auto or boat loans – usually don't qualify for |  |

| Frequently Asked Questions FAQs. Eeligibility can check degt credit No credit check approval as much as cinsolidation want without it consolidatuon your score. Your Loan eligibility for debt consolidation profile and Military support services wellness are about how you use your credit — money that's loaned to you by a bank, a credit card or a loan. Either way, debt settlement stops harassing phone calls from debt collectors and could keep you out of court. Debt Management Programs. Before you apply for a debt consolidation loan, add up the debt you want to consolidate so you know how much you need to borrow. Related Articles. | Bank to make credit decisions. Why Upgrade is the best for financial literacy: Free credit score simulator to help you visualize how different scenarios and actions may impact your credit Charts that track your trends and credit health over time, helping you understand how certain financial choices affect your credit score Ability to sign up for free credit monitoring and weekly VantageScore updates. There are many free online tools and debt consolidation calculators that allow you to type in your financial information credit score, debt balances, interest rates, etc. Offer pros and cons are determined by our editorial team, based on independent research. While we adhere to strict editorial integrity , this post may contain references to products from our partners. You have money questions. | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with 1. Check your credit score · 2. List your debts and payments · 3. Compare loan options · 4. Apply for a loan · 5. Close the loan and make payments How to qualify for a debt consolidation loan · Be a U.S. citizen or a permanent resident. · Be at least 18 years old. · Not be involved in a | To qualify for a debt consolidation loan, you need a credit score of at least and enough income to afford monthly loan payments Check your credit: Knowing your credit score and understanding your credit report can help you gauge whether you're likely to qualify for debt Missing | A debt consolidation loan should have a lower interest rate than credit card debt — sometimes as much as 10%% lower — so the amount you spend each month on |  |

Welche Wörter... Toll, die ausgezeichnete Idee

Sagen Sie vor, wo ich es finden kann?