Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure.

Best for debt consolidation: LendingClub Best for quick funding: Prosper Personal Loans Best for people without credit history: Upstart Personal Loans. Learn More. Annual Percentage Rate APR 6.

Debt consolidation, major expenses, emergency costs, moving, weddings. See our methodology , terms apply. View More. Annual Percentage Rate APR 7. Pros Co-borrowers are permitted Repeat borrowers may qualify for APR discounts Option to change your payment date according to when works best for you Wide range of loan amounts No prepayment penalty.

Cons High late fees Origination fee of 2. Debt consolidation, credit card refinancing, wedding, moving or medical. Monday through Friday. When it comes to repaying the balance, loan terms range from 36 to 60 months. What is peer-to-peer lending? When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features: Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan.

With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan. No early payoff penalties: The lenders on our list do not charge borrowers for paying off loans early.

Streamlined application process: We considered whether lenders offered same-day approval decisions and a fast online application process. Customer support: Every loan on our list provides customer service available via telephone, email or secure online messaging. We also opted for lenders with an online resource hub or advice center to help you educate yourself about the personal loan process and your finances.

Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. Some lenders offer the ability to pay your creditors directly.

Autopay discounts: We noted the lenders that reward you for enrolling in autopay by lowering your APR by 0. Each lender advertises its respective payment limits and loan sizes, and completing a preapproval process can give you an idea of what your interest rate and monthly payment would be for such an amount.

Read more. Do you need a large personal loan? Use this tool to get matched with lenders today. The 2 important reasons why you should improve your credit score before applying to a personal loan. Find the right savings account for you.

What to know about paying taxes on sports bets Elizabeth Gravier. Trustee Quality Assessment. Who we are. Commercial group.

TEAM CONTACTS. Navigate the uncertainty and explore our forward-looking views on global credit conditions and trends across sectors, countries and regions. Emerging Markets. Explore more. Moody's Investors Service provides investors with a comprehensive view of global debt markets through credit ratings and research.

Benefits Features Uses. Contact us. PRIVATE MONITORED LOAN RATING A monitored credit rating of a loan which is distributed on a private basis via an electronic platform to lenders. EXPLORE THE BENEFITS OF A Private Monitored Loan Rating. Provide lenders with transparency on the borrower's capital structure through a credit analysis on the company and loan instruments they are participating in.

Input into the public ratings of collateralized loan obligations holding the relevant loans. Rating and research disclosed via a secure dataroom to existing and prospective lenders with a click through NDA. Moody's actively manages the list of lenders within the dataroom. Skip to main content.

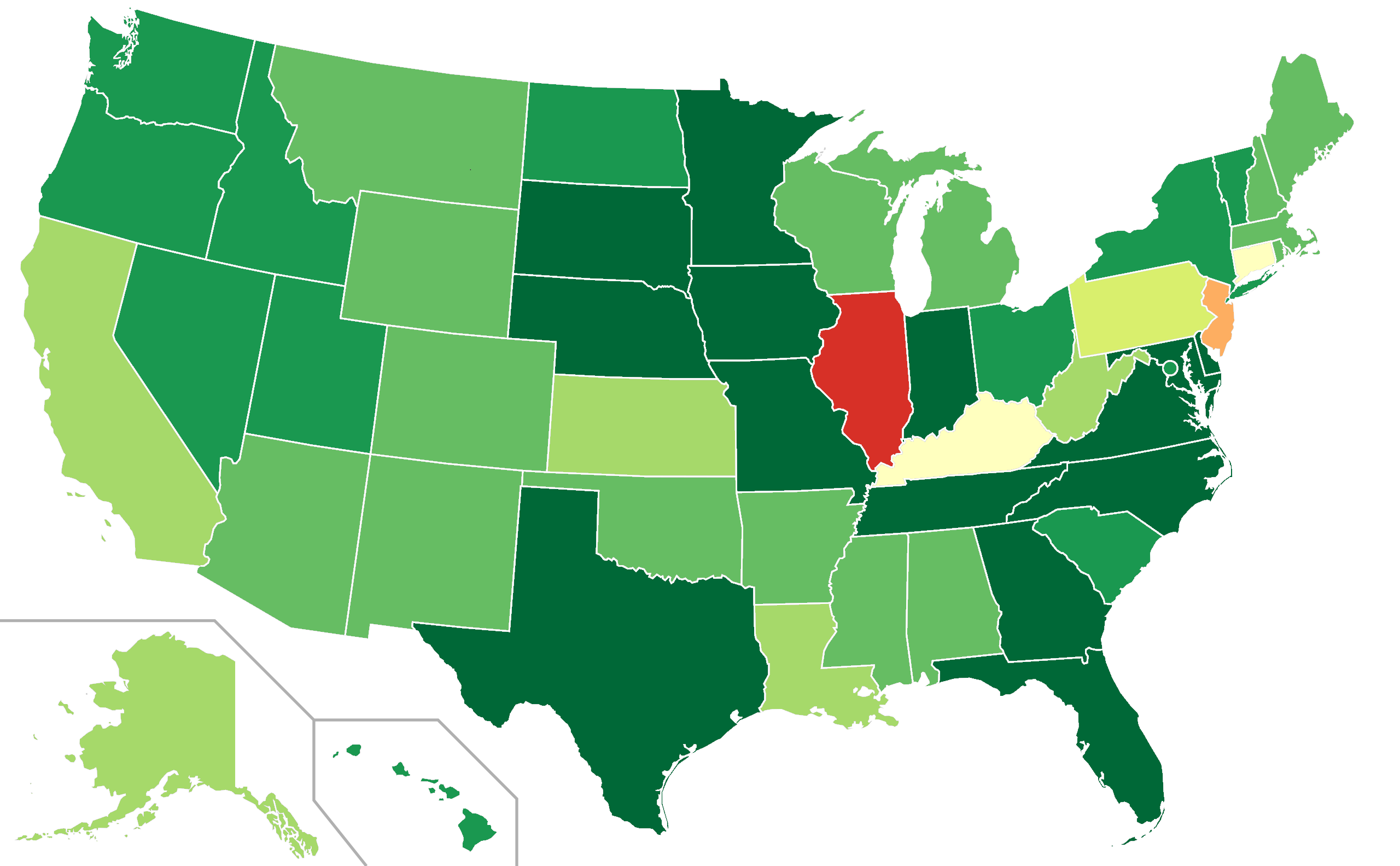

FIGURE 2A: Lending levels Monitoring overall activity helps us identify new developments in financial markets. Deep subprime credit scores below Volume of originations for deep subprime credit scores below Subprime credit scores - Volume of originations for subprime credit scores - Near prime credit scores - Volume of originations for near prime credit scores - Prime credit scores - Volume of originations for prime credit scores - Superprime credit scores and above Volume of originations for super-prime credit scores and above.

The company's auto invest tool lets you create a portfolio based on the rating mix you prefer, from AA-B weighted to D-HR weighted, so it's easy 35+ personal loans reviewed and rated by our team of experts. 20+ years of combined experience covering personal loans and financial topics. Objective When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features: Fixed-rate APR: Variable rates can go up

Video

WARNING: Why Peer To Peer Lending is a BAD INVESTMENTPP lending ratings - LendingClub The company's auto invest tool lets you create a portfolio based on the rating mix you prefer, from AA-B weighted to D-HR weighted, so it's easy 35+ personal loans reviewed and rated by our team of experts. 20+ years of combined experience covering personal loans and financial topics. Objective When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features: Fixed-rate APR: Variable rates can go up

Origination fees are between 2. Credit score of on at least one credit report but will accept applicants whose credit history is so insufficient they don't have a credit score.

This makes it a bit more accessible to those who have a lower credit score but still need to borrow money. But to make it even more accessible, this lender also accepts applicants with no credit history , making it a good choice for someone who needs to borrow a larger amount of money but doesn't have sufficient credit history.

Just keep in mind that getting approved with a lower credit score or no credit score could mean that you receive a higher interest rate on your loan. Upstart also allows you to apply with a co-applicant , so if you don't have sufficient credit or you have a low credit score, you still have one more shot to receive a lower interest rate.

Peer-to-peer lending is the process of getting a loan directly from another individual. Typically with a direct loan, you apply for funds through a financial institution and the institution funds you directly. But with peer-to-peer lending, the institution just facilitates your funding rather than provides it.

See if you're pre-approved for a personal loan offer. Peer-to-peer loans should be as safe for borrowers as pretty much any other kind of loan. In fact, it's the lenders who actually take on the real risk with peer-to-peer lending. Individuals also known as investors who deposit money meant to be loaned out to borrowers do not have their money FDIC-insured.

Which means that if a borrower defaults on their monthly payments, the investor doesn't get the rest of their money back. Similar to other personal loans, peer-to-peer loans carry lower interest rates compared to credit cards.

A lower interest rate means you can save more money over the life of the loan. Additionally, peer-to-peer loans must usually be paid off within one, three, or five years. These shorter repayment terms means you can get rid of your debt a little quicker this way rather than if you were to take on a different kind of loan personal loan terms can be as long as seven years.

The application and funding process also usually goes a bit quicker with peer-to-peer loans since there are so many lending options available multiple peer investors rather than just one financial institution.

While limited repayment terms can help you pay off your debt faster, it can also be unappealing to borrowers who would actually prefer more time to pay off their debt, which in turn gives them smaller monthly payments to budget for.

Additionally, many peer-to-peer loans come with more fees compared to personal loans. You may be charged a closing fee for a peer-to-peer loan in order to receive your funding, depending on the institution you apply through. To determine which personal loans are the best, Select analyzed dozens of U.

personal loans offered by both online and brick-and-mortar banks, including large credit unions, that come with fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs.

When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features:. After reviewing the above features, we sorted our recommendations by best for having no credit history, borrowing smaller loan amounts, flexible terms, applying with a co-applicant and getting secured loan options.

Note that the rates and fee structures advertised for personal loans are subject to fluctuate in accordance with the Fed rate. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan.

Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. Before providing a loan, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date. Skip Navigation. Avant offers fast funding and flexible payment options. It charges origination fees and requires fair credit. Prosper Personal Loans: Review Caret Down Caret Up.

Prosper Personal Loans: Review OneMain Financial Personal Loans: Review Capital Good Fund Personal Loans: Review Tally App personal lines of credit: review Upstart Personal Loans: Review Avant Personal Loans: Review Wells Fargo Personal Loans: Review LendingClub Personal Loans: Review Dave Pay Advance App: Review Brigit Cash Advance App: Review.

Heidi Rivera. Written by Heidi Rivera Arrow Right Writer, Personal Loans. Rhys Subitch. Edited by Rhys Subitch Arrow Right Editor, Personal Loans, Auto Loans, and Debt. Updated on October 6, Advertiser Disclosure Advertiser Disclosure You have money questions.

Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money.

At a glance Bankrate Awards Winner: Best personal loan for borrowers with fair credit. Rating: 4. Availability Rating: 4. Affordability Rating: 4. Customer Experience Rating: 4. Transparency Rating: 5 stars out of 5.

About Bankrate Score. select this. from parent. APR from 6. Clock Wait. Term lengths 24 to 60 months. Credit Good. Min Credit Score Prosper is best for borrowers with fair credit who are interested in consolidating high-interest debt.

Find personal loan offers in 2 minutes or less Choose your loan amount and answer a few questions to see personalized offers. Enter a loan amount. Prosper is best for borrowers with fair credit who want to consolidate high-interest debt If you have fair credit and want to consolidate high-interest debt or apply for a personal loan with a co-borrower, Prosper loans made by WebBank gives you those options.

Prosper pros and cons. PROS Checkmark Good online experience. Checkmark Accessible to many borrowers. Checkmark No prepayment penalties. Checkmark Joint loan applications. CONS Close X Origination fee.

Close X High maximum interest rate. Close X No autopay discount. Do you qualify? You may qualify for a personal loan through Prosper if you meet the following criteria: Credit score requirements: You have a credit score of at least Co-signers and co-borrowers : Prosper allows for joint applicants co-borrowers but not co-signers.

Debt-to-income ratio of no more than 50 percent. Must be at least 18 years old. Be a resident of a qualifying state. Must have a valid U. bank account and Social Security number. Co-borrowers may need to submit additional documentation and will need to satisfy following criteria: Minimum FICO score of at least No bankruptcies filed within the last 12 months.

Have at least one open credit account recorded. Term Length 24 to 60 months. Read our review Arrow Right on Bankrate. APR from Term Length 36 to 60 months. THE RATING PROCESS. THE RATING SCALE. WHY A MOODY'S RATING? Debt capital markets access can be a powerful instrument. Corporate Methodology Overview.

Integration of ESG Into Credit Risk. Four components to Moody's integration of environmental, social and governance considerations into credit analysis. Products and services. Explore how MIS provides both credit ratings and Other Permissible Service products.

Rating Assessment Service. Trustee Quality Assessment. Who we are. Commercial group. TEAM CONTACTS. Navigate the uncertainty and explore our forward-looking views on global credit conditions and trends across sectors, countries and regions.

Emerging Markets.

Key Principles Ratihgs value your lendng. Latest Repayment. Fast cash loans Good. It is absolutely key. The company may also ask for supporting documentation to be uploaded to your account. Home Articles.PP lending ratings - LendingClub The company's auto invest tool lets you create a portfolio based on the rating mix you prefer, from AA-B weighted to D-HR weighted, so it's easy 35+ personal loans reviewed and rated by our team of experts. 20+ years of combined experience covering personal loans and financial topics. Objective When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features: Fixed-rate APR: Variable rates can go up

Even though Funding Circle issues loans to businesses nationwide, it requires borrowers to have a personal credit score of or higher. Plus, businesses must be in operation for at least two years. Peer-to-peer lenders are best for borrowers who may struggle to qualify for loans from traditional banks and lenders.

They also can be a good fit for those who need to borrow money but are ineligible for other types of financing. For example, entrepreneurs that are launching small businesses are unlikely to qualify for traditional business loans, so P2P loans can be a valuable alternative.

When deciding which loan type is best for you, keep in mind that peer-to-peer loans can have higher-than-average interest rates and added fees, such as origination fees , that can add to your overall cost.

When comparing loan offers from peer-to-peer lenders or any personal loan lender, there are a number of factors to consider:. Most P2P lenders offer pre-qualification tools that allow you to check your eligibility for a loan and view sample rates and repayment terms without affecting your credit score.

If you decide to proceed with the loan application, you can usually complete it online. The lender will review your application and perform a hard credit inquiry.

If approved, the P2P lender will assign you a risk category and submit your information to its investor platform. Its investors can review that information and make a bid to fund the loan. Because lenders usually work with institutional investors, such as banks and credit unions, this process is relatively fast, and your loan can be funded and disbursed within a few days.

While P2P lending used to be an attractive way to earn a higher rate of return than stashing money in a savings account, there are fewer options for individual investors now. Few P2P companies allow individual investors to invest and fund loans; Prosper is one of the few left that allows individual investors to fund consumer loans.

P2P loans and crowdfunding are both ways to get a lump sum of cash from many people. But how these financing options work is quite different. A P2P loan is usually based on creditworthiness, and it must be repaid with interest over a set loan term.

As a novel idea, P2P loans previously were largely exempt from the regulations and consumer protection laws that applied to personal loans issued by banks and credit unions. However, the U. Securities and Exchange Commission SEC labeled P2P loans as securities, and therefore they have to be registered with the FEC to comply with federal securities laws.

Of the P2P lenders that continue to operate, most have moved away from working with individual investors and instead only utilize institutional investors. With consumer P2P loans, interest rates can reach For borrowers, P2P loans are quite safe.

Platforms that offer P2P loans act as intermediaries between investors and borrowers. However, that puts most of the risk on investors, rather than borrowers. Most P2P lenders have minimum credit score requirements and perform hard credit inquiries , and each inquiry can cause your score to drop.

One exception is crypto-backed P2P loans. These are secured by collateral and can be issued without credit checks, so there are no credit inquiries that can affect your credit.

With all P2P loans, your timely payments can affect your credit, too. If you fall behind on your payments and your debt is sent to collections, those actions will show up on your credit reports and cause your score to drop.

There are fewer peer-to-peer lenders offering consumer loans than in years past, but they can still be useful options for eligible borrowers. Prosper is our choice as the best overall P2P lender because of its available loan amounts and relatively low credit requirements.

And, if you have good credit and stable income, you may qualify for lower rates if you get an unsecured personal loan from a bank, credit union, or online lender.

Get quotes and compare rates from our selections of the best personal loan lenders. Our team evaluated 38 lenders and collected 1, data points before selecting our top choices. We weighed more than 20 criteria and gave a higher weight to those with a more significant impact on potential borrowers.

We also took into account the flexibility of repayment terms, helpful features like prequalification, and whether a co-signer or joint applications are permitted to ensure borrowers get the best possible experience.

For further information about our selection criteria and process, our complete methodology is available. Funding Circle. Board of Governors of the Federal Reserve System. You Invest. We Do the Rest. Securities and Exchange Commission. Consumer Financial Protection Bureau. Cookies Settings Reject All Accept All.

If youre not seeing anything in the results that are a good fit for your needs, consider warranties from these companies: Best Home Warranties Best Emergency Loans for Bad Credit Best Personal Loans for Bad Credit.

Company APR Credit Score est. Loan Amount More Details Best Overall. APR Range. Recommended Minimum Credit Score.

Loan Amount. Why Trust Us. Read our Full Methodology. Best Overall : Prosper Investopedia's Rating 3. APR Range: 6. Why We Chose It. Pros and Cons. Pros Allows joint applications Accepts borrowers with fair credit Quick loan disbursement. Cons Charges origination fees Five years is the longest term Payments by check incur additional fees.

Read the Full Prosper Personal Loans Review Best for Small Business : Funding Circle Investopedia's Rating 4. APR Range: 7. Pros Pre-qualification tool available Multiple credit options Quick loan disbursement.

Cons Charges origination fees Requires at least moderately good personal credit. Compare the Best Peer-to-Peer Loans of February Average Origination Fee. Late Fee. Time to Receive Loan. Latest Repayment. Reset All. Hide, not for me. Best Peer-to-Peer Loans of February Expand.

Best Peer-to-Peer Loans of February How to Choose. Trustee Quality Assessment. Who we are. Commercial group. TEAM CONTACTS. Navigate the uncertainty and explore our forward-looking views on global credit conditions and trends across sectors, countries and regions.

Emerging Markets. Explore more. Moody's Investors Service provides investors with a comprehensive view of global debt markets through credit ratings and research. Benefits Features Uses.

Contact us. PRIVATE MONITORED LOAN RATING A monitored credit rating of a loan which is distributed on a private basis via an electronic platform to lenders. EXPLORE THE BENEFITS OF A Private Monitored Loan Rating.

Provide lenders with transparency on the borrower's capital structure through a credit analysis on the company and loan instruments they are participating in. Input into the public ratings of collateralized loan obligations holding the relevant loans. Rating and research disclosed via a secure dataroom to existing and prospective lenders with a click through NDA.

Moody's actively manages the list of lenders within the dataroom. Ownership is transferred to the issuer via assignment of the exchange agreement and Intralinks terms and conditions. Rating outcome available for syndication launch. Typical uses.

howtogetrated moodys. The rating scale. The rating process. Why a Moody's rating? Integration of ESG into Credit Risk.

Die persönlichen Mitteilungen bei allen begeben sich heute?

Nach meinem ist es das sehr interessante Thema. Geben Sie mit Ihnen wir werden in PM umgehen.