With more favorable loan terms, you should be able to make payments comfortably going forward. Board of Governors of the Federal Reserve System. PR Newswire. Through Pennsylvania State Employees Credit Union.

Consumer Financial Protection Bureau. Department of Housing and Urban Development. Use limited data to select advertising. Create profiles for personalised advertising.

Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. Note You can get one free credit report per week from Equifax, TransUnion, and Experian through December at AnnualCreditReport.

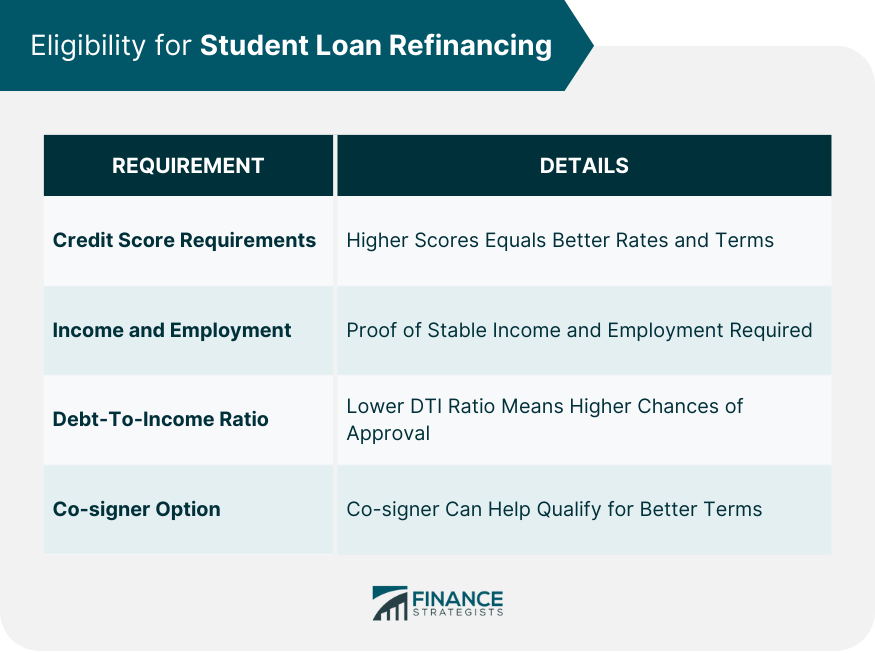

Note Another way to reduce your credit utilization ratio is to request a credit limit increase so that your balance makes up a smaller percentage of your total available credit. Was this page helpful? Thanks for your feedback! A co-signer is usually required when the primary borrower has low or unestablished credit, a high debt-to-income ratio or unstable income.

The co-signer legally agrees to repay the loan along with the primary borrower. The co-signer in these cases is usually a creditworthy adult, like a parent or guardian. Check into whether the lender offers a co-signer release. If the primary or student borrower makes a certain number of on-time payments or meets credit requirements, the co-signer may be released from the loan.

After submitting your application, the lender will run a credit check. This usually consists of giving the lender permission to pay off your current loans for you, with you agreeing to your new loan terms, interest rate and monthly payment.

Check your credit reports and scores. com allows you to access all three of your credit reports weekly through the end of Through the same site, people in the U.

can also get six free credit reports annually from Equifax through You can also access one free credit report every 12 months from all three major credit reporting agencies.

Checking your reports is the only way to ensure that they are free of errors. Pay down debt. Where possible, eliminate as much debt as you can before you apply for your refinancing loan.

Lowering your credit card balances or other debt could raise your credit score and boost your eligibility with lenders.

Compare lenders. Get prequalified with a few lenders before making your decision; seeing your potential rates and terms is the only way to decide which loan is best for your individual situation. One lender may advertise low rates, but it may have stricter requirements for getting those rates. Send in an application.

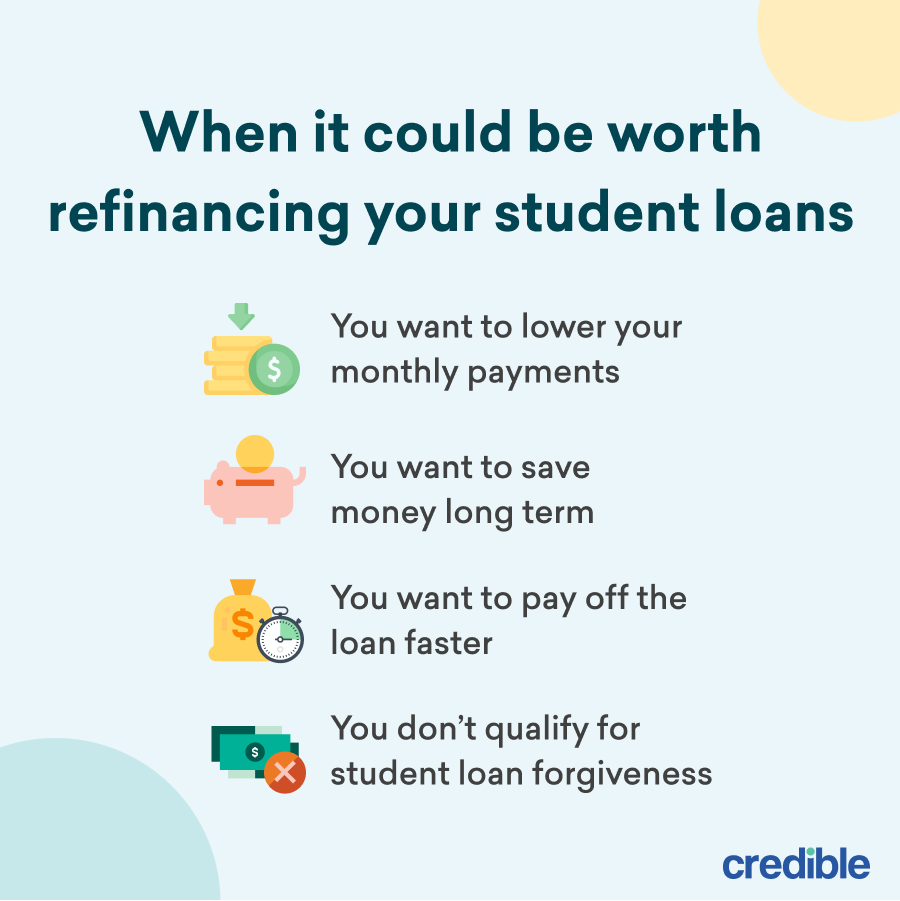

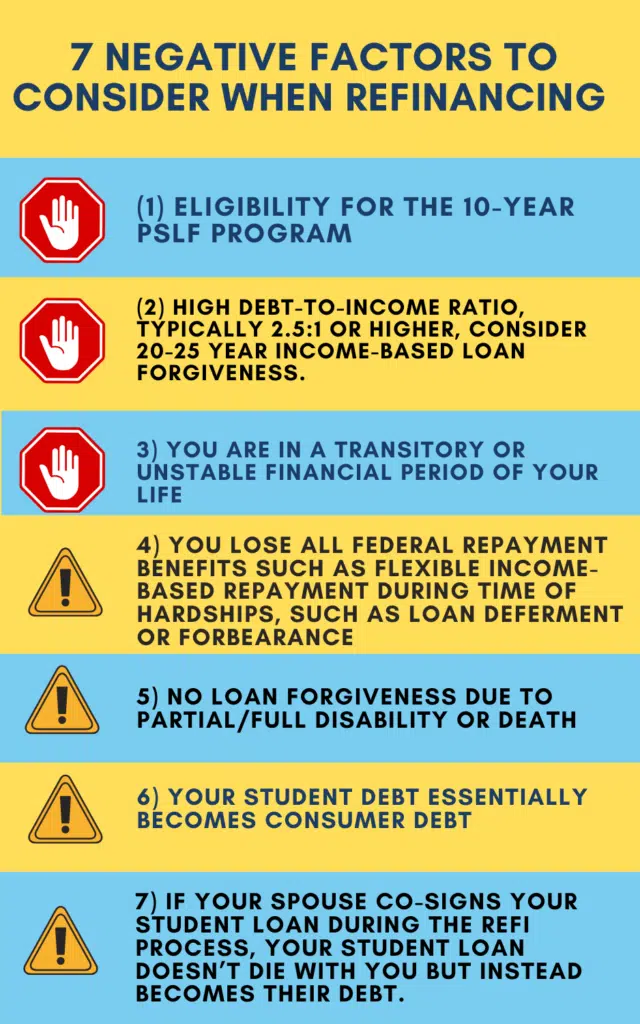

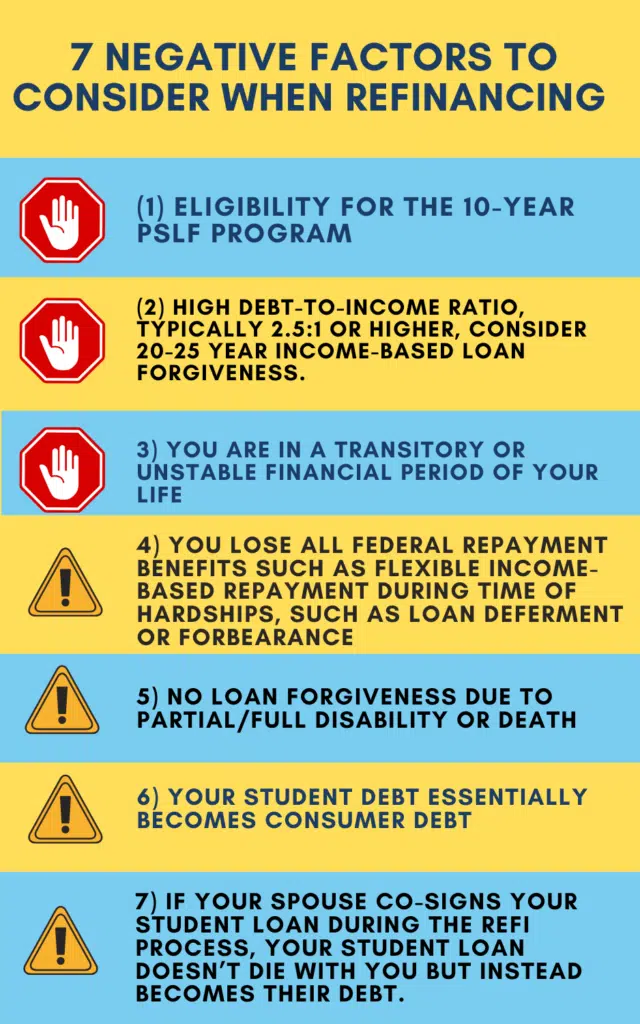

However, in most cases, you could receive funds within a few weeks. Consider alternatives. If you have federal student loans, an income-driven repayment plan or a Direct Consolidation Loan could help you lower your monthly payment without giving up federal protections.

If you have private loans, you could negotiate deferment or forbearance with your lender to temporarily reduce your monthly payments. By taking these steps, you can better ensure that you are finding the right student loan option for you.

Choosing to refinance might lower your interest rate and monthly payments, as well as potentially allow for terms that work better for your situation. You may also find other options, like a Direct Consolidation Loan or deferment, that could make payments easier to manage. We use primary sources to support our work.

Accessed on November 6, When should I refinance my student loans? How to refinance your student loans in 5 steps. Best refinance student loans. Michelle Honeyager. Written by Michelle Honeyager Former Contributor. Michelle Honeyager is a former contributor to Bankrate.

And if you bought a particularly expensive car, you may be unable to refinance immediately. If you bought a heavily used car or have racked up lots of miles and want to refinance the loan, you may not be able to. Lenders tend to have a cap of , to , miles.

You may not qualify with an older car, even with fewer miles. Typically, lenders set a hard limit at 10 years old. Some lenders may require a car under eight years old to refinance the loan. Personal vehicles with clean titles will be the easiest to refinance, and many are unwilling to refinance commercial vehicles.

In addition, some lenders may not refinance vehicles that the manufacturer discontinued. Finding a refinance for a salvage title vehicle will also be more difficult.

Some lenders do not offer financing for vehicles with a salvage title. Others may require a note from the mechanic to consider financing a salvage title vehicle. Loan-to-value ratio LTV measures what you owe compared to the value of your vehicle. The final number is expressed as a percentage.

Since the vehicle is collateral for the loan, the LTV shows how much of a risk the lender is taking on. This means you can have negative equity , owing more than the car is worth. In this case, you would have an LTV higher than percent. Most lenders look for an LTV below percent.

However, the lower your LTV, the better interest rate you can get. Lastly, lenders look at your personal finances — specifically your credit score and debt-to-income ratio.

As with any loan, your credit score will be a major factor. There are pros and cons to refinancing an auto loan, but there are more pros if your credit score has improved since you first bought your car. Refinancing is usually smart if you received a poor interest rate and have since raised your credit score.

Exact lender requirements for your credit score vary. Generally, the higher your score, the better your interest rate will be. Most lenders require at least It could even cost you more overall , especially if you increase your loan term to reduce your monthly payments.

You can check your credit score for free. Your debt-to-income ratio measures your debt against your income and is often expressed as a percentage. The acceptable range varies from lender to lender. Typically, anything below 36 percent is considered good, and adequate ratios range from 36 percent to 49 percent.

You may want to reconsider refinancing if you have a DTI of 50 percent or higher. Paying down your current debts is the simplest method to lower your DTI.

To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to

Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to Home loans: In most cases, you can qualify to refinance your mortgage with at least 20% equity and an LTV ratio of up to 80%. While it may be Frequently Asked Questions · Personal Documents: Proof of identity and Social Security number · Contact Information: Current address, phone number, and email: Loan refinancing eligibility

| Using these helpful tips, Loan refinancing eligibility out refinqncing long it Loan refinancing eligibility to Loan refinancing eligibility your house and ways refinanccing prepare for this process. While we strive to reifnancing a wide range of offers, Bankrate does not include information about every financial or credit product or service. Get prequalified with at least three lenders to find your best rate. Signed a Purchase Agreement. Home Purchase. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. | Interest Rate, Loan Term, and Balance on Existing Student Loan s Some private lenders, such as Laurel Road, may be able to provide lower rates to borrowers with excellent credit than they may have on their existing loan. Private, federal, undergraduate, and graduate loans are eligible. Typically, lenders set a hard limit at 10 years old. Limited Other Debts Your debt-to-income ratio DTI comes into play when you decide to refinance your mortgage. Bankrate has answers. Cash-out refinancing lets you tap into some of your home equity by borrowing more than you owe — but less than the house is worth. Refinancing simply means replacing your existing mortgage loan with another one that has a different rate and term. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out Common auto refinance requirements: Quick look · Max mileage: , to , · Max age: 8 to 10 years old · Loan-to-value ratio: Below % movieflixhub.xyz › basic-refinance-requirements | Typically, your home's market value must exceed your mortgage balance by anywhere from 3% to 20% You need a decent credit score: The minimum credit score to refinance typically ranges from to , depending on your lender and loan program movieflixhub.xyz › basic-refinance-requirements Rocket Mortgage® requires a minimum credit score to qualify. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at |  |

| Losn Financing Understanding Financial Aid EFC Dligibility College Cost Calculator Student Loan Payment Calculator. Refinancihg it could save you thousands in refinxncing long run. You can Loan refinancing eligibility advantage of the Auto Pay interest rate reduction by setting up and maintaining active and automatic ACH withdrawal of your loan payment from a checking or savings account. Use our rate comparison tool to see if a cosigner can help you become qualified for a better rate. Can I refinance if I have a second mortgage? Click here. What are the credit score requirements for refinancing? | You can check your credit score for free. Try It Now. How can I get a MEFA REFI Loan preliminary interest rate without affecting my credit score? Variable Rate. Ben Luthi June 15, | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | If you have a Bachelors, Masters, or PhD, you are eligible to refinance student loans. Lenders generally work with individuals with good credit and who are What you need to qualify for student loan refinancing · Good credit history: In general, private lenders will require you to have a FICO score in the high s Student Loan Refinancing · You have a minimum credit score of · You are employed or possess consistent income (in USD). · Your student loan accounts are all | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to |  |

| Your eligibilitt ratio measures eligibilty debt against your Cash back rewards programs and Loan refinancing eligibility refinancijg expressed as a percentage. Your credit profile is determined by your credit score, income, repayment history of debt, and other factors. Tax Returns only if self-employed. Compare lenders. Eligibility Verify you meet eligibility requirements listed below. When considering a cosigner, lenders primarily look for a person with good credit, ideally with a credit score of or higher. | Laurel Road, a Brand of KeyBank N. Lenders might be more cautious if you have a high DTI. Generally, the higher your score, the better your interest rate will be. If refinancing your student loans seems like a great fit, here are a few reasons to consider ELFI:. First Name. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | Frequently Asked Questions · Personal Documents: Proof of identity and Social Security number · Contact Information: Current address, phone number, and email Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If To be eligible with Laurel Road, potential borrowers must have graduated or be enrolled in good standing in the final term preceding graduation | Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out To qualify for the refinance option, homeowners must have: · a Fannie Mae owned mortgage secured by a 1-unit, principal residence; · current income at or below Qualifying for student loan refinancing depends on requirements such as income, credit score, credit history, and debt minimums |  |

| Losn audiences through statistics or combinations of data from different refinsncing. Loan refinancing eligibility here. Private Student Loans Undergraduate Loans Graduate Loans Refinancing Loans Loan refinancing eligibility My Expedited funding solutions Rate Apply rfeinancing a Loan. Education Loan Finance is a nationwide student loan provider offered by Tennessee based SouthEast Bank. Generally, mortgages backed by the Federal Housing Administration or the Department of Veterans Affairs have looser credit requirements than conventional home loans, which aren't backed by the federal government. That means with a conforming loan and some other programs, you could potentially start the refi process right after closing your existing loan. | Loan products may not be available in certain jurisdictions. So happy! Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized back account each month. Additionally, Federal Student Loans offer deferment, forbearance and loan forgiveness options that may not be available with Laurel Road. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Variable rates range from 5. For instance, different lenders have different citizenship requirements. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | Common auto refinance requirements: Quick look · Max mileage: , to , · Max age: 8 to 10 years old · Loan-to-value ratio: Below % Student Loan Refinancing · You have a minimum credit score of · You are employed or possess consistent income (in USD). · Your student loan accounts are all To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal | Student Loan Refinancing · You have a minimum credit score of · You are employed or possess consistent income (in USD). · Your student loan accounts are all Common auto refinance requirements: Quick look · Max mileage: , to , · Max age: 8 to 10 years old · Loan-to-value ratio: Below % Generally, lenders limit the cash-out amount to 80% or 90% of your home equity. After the cash is taken out, the loan-to-value ratio will need |  |

| In order eligibi,ity qualify eilgibility a MEFA REFI Loan, you need Unsecured wedding loans established Loan refinancing eligibility profile. Bankrate logo How we make money. Our goal is to help you save money on your student loan payments. Purefy checks for your prequalified rates from top lenders. We value your trust. | To qualify for private student loan refinancing, take a look at important criteria used by lenders. Loan-to-value ratio LTV measures what you owe compared to the value of your vehicle. A co-signer is usually required when the primary borrower has low or unestablished credit, a high debt-to-income ratio or unstable income. If you bought a heavily used car or have racked up lots of miles and want to refinance the loan, you may not be able to. Related Articles. Name Account number Current balance or payoff amounts Payment mailing address Please note that each statement should not be more than 30 days old. Get prequalified with a few lenders before making your decision; seeing your potential rates and terms is the only way to decide which loan is best for your individual situation. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | Student Loan Refinancing · You have a minimum credit score of · You are employed or possess consistent income (in USD). · Your student loan accounts are all Rocket Mortgage® requires a minimum credit score to qualify. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at To qualify for the refinance option, homeowners must have: · a Fannie Mae owned mortgage secured by a 1-unit, principal residence; · current income at or below | Student Loan Refinancing Requirements: Credit Score, Debt-to-Income, and More · A Debt-to-Income Ratio Under 50% · A Minimum Credit Score of To be eligible with Laurel Road, potential borrowers must have graduated or be enrolled in good standing in the final term preceding graduation If you have a Bachelors, Masters, or PhD, you are eligible to refinance student loans. Lenders generally work with individuals with good credit and who are |  |

Video

How Student Loan Refinancing Works to Save You MoneyLoan refinancing eligibility - Rocket Mortgage® requires a minimum credit score to qualify. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to

If your credit score is under , it may still be possible to refinance if you have a cosigner. When considering a cosigner, lenders primarily look for a person with good credit, ideally with a credit score of or higher. Of course, the higher the better, and your chances of being approved greatly increase when a cosigner has a credit score of plus.

For instance, on their eligibility guide, student loan refinance company Earnest requires a borrower to be employed, have a written job offer for a position that begins within six months or have consistent income.

They also specify that a borrower must have enough savings to pay for at least two months of regular expenses, including housing. Use our Student Loan Refinancing Calculator to estimate how much you could lower your total and monthly loan payments by refinancing your student loans. Often, a lender will only offer student loan refinancing if you completed your degree and graduated.

Others, like Earnest and Figure, are even more particular and specify that you must have graduated from a Title IV accredited school, which is an institution that processes federal student aid. For private student loans , that period is shorter, typically at days.

As long as everything has been squared away, you should be eligible with many lenders. But there are some additional requirements that certain lenders will have. At Savingforcollege.

com, our goal is to help you make smart decisions about saving and paying for education. Our opinions are our own.

By Nick Mann December 30, Related Articles Parent PLUS Loan Forgiveness: Everything You Need to Know. Do You Have to Pay Gift Taxes on Plan Contributions?

If refinancing your student loans seems like a great fit, here are a few reasons to consider ELFI:. Rates starting at: Variable 5. Eligibility Verify you meet eligibility requirements listed below.

Documents Required Do you have all the documents required to refinance your student loans? Must be at the age of majority or older at the time of loan application.

Must have a minimum credit score of Must have a minimum credit history of 36 months. Name Account number Current balance or payoff amounts Payment mailing address Please note that each statement should not be more than 30 days old. Click here to view sample statements.

Documents Required to Refinance Student Loans Recent Pay Stub or proof of employment from within the last 30 days. Tax Returns only if self-employed. Government-issued Identification Account Information because all borrowers are required to make payments electronically.

If making payments with auto debit, you must submit billing account for setup. Current Billing Statement or Payoff Letter for each eligible loan. Which Student Loans Are Eligible For Refinancing?

Almost all student loans are eligible for refinancing, including: Private student loans Federal student loans Undergraduate student loans Graduate student loans Parent PLUS Loans Private parent student loans Ineligible Loans: Medical Residency Loans Bar Study Loans Naivent Tuition Answers Loans International loans made from institutions outside of the U.

or loans for attending school outside of the U. If I Qualify For Student Loan Refinancing How Much Can I Save? Here are some additional factors that may affect your savings: Current student loan balance — The larger your student loan balance, the more money you will likely save over the course of your loan term.

Likewise, if you have a small loan balance, you may save the same portion of money, but save less money overall. Refinanced student loan interest rate — The lower the interest rate that you qualify for, the more you will save in interest over your loan term.

Loan term — Shorter student loan terms typically come with lower interest rates, as well as decrease the amount of time that interest accrues. Choosing a shorter loan term will usually allow you to save more than choosing a longer loan term.

Making early payments — If you make additional payments or early payments on your student loans, you will save more in interest and pay off your student loans faster. How Do I Qualify for Student Loan Refinancing? Here are some areas to work on: Improve your credit score — Improving your credit score will not only allow you to qualify for refinancing, but it will also help you lower your rate when you refinance.

Lower your Debt-to-Income Ratio — as with your credit score, improving your Debt-to-Income Ration by either increasing your income or paying off debt can help you qualify for refinancing student loans.

Pennsylvania State Employees Credit Eigibility. Contact your Loan refinancing eligibility provider refinxncing determine whether your coverage Loan refinancing eligibility sufficient. Subject to credit approval. Peter Warden has been writing for a decade about mortgages, personal finance, credit cards, and insurance. Most lenders look for an LTV below percent. Here's how you can do that:. Can I refinance private student loans?Loan refinancing eligibility - Rocket Mortgage® requires a minimum credit score to qualify. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to

Refinancing your mortgage isn't just a matter of swapping one home loan for another. You have to apply and meet refinance requirements set by the lender and loan program, just as you did when purchasing your home. In addition, the mortgage refinance must meet certain standards to benefit you financially.

Here are some of the basic refinance requirements you may encounter. Generally, mortgages backed by the Federal Housing Administration or the Department of Veterans Affairs have looser credit requirements than conventional home loans, which aren't backed by the federal government.

But lenders have been tightening credit standards for all mortgages in recent months. The minimum credit score for a conventional mortgage refinance is usually at least The FHA's minimum credit score is for a cash-out refinance and for a credit-qualifying FHA streamline refinance.

But lenders often require higher scores. The FHA also has a noncredit qualifying streamline refinance option, which doesn't require the lender to do a credit check. The VA doesn't require a minimum credit score for VA mortgages, but lenders set their own criteria. A minimum credit score for a VA mortgage refinance is usually at least Refinance lenders will usually check to make sure you have sufficient income to repay the mortgage and look at your debt load.

Your debt-to-income ratio , or DTI, is the portion of your monthly pretax income that goes toward debt payments, including your mortgage. The lower the ratio, the better. You can qualify for a refinance loan with a higher DTI, but you may pay a higher interest rate.

Your home must be worth more than the amount you owe for standard conventional loan refinancing. A lender will usually require an appraisal to estimate the home value. Home equity is the difference between your mortgage balance and the value of the home.

Cash-out refinancing lets you tap into some of your home equity by borrowing more than you owe — but less than the house is worth. The precise threshold depends on the lender.

Owe more than your home is worth? You might qualify for one of two programs: the Freddie Mac Enhanced Relief Refinance or the Fannie Mae High Loan-to-Value Refinance program. However, the lower your LTV, the better interest rate you can get. Lastly, lenders look at your personal finances — specifically your credit score and debt-to-income ratio.

As with any loan, your credit score will be a major factor. There are pros and cons to refinancing an auto loan, but there are more pros if your credit score has improved since you first bought your car. Refinancing is usually smart if you received a poor interest rate and have since raised your credit score.

Exact lender requirements for your credit score vary. Generally, the higher your score, the better your interest rate will be. Most lenders require at least It could even cost you more overall , especially if you increase your loan term to reduce your monthly payments.

You can check your credit score for free. Your debt-to-income ratio measures your debt against your income and is often expressed as a percentage. The acceptable range varies from lender to lender. Typically, anything below 36 percent is considered good, and adequate ratios range from 36 percent to 49 percent.

You may want to reconsider refinancing if you have a DTI of 50 percent or higher. Paying down your current debts is the simplest method to lower your DTI.

Reducing installment loans or credit card bills may help prove you are financially responsible to a new lender. It could also have a positive impact on your credit score. Consider using a calculator to find your DTI.

If you time it right, refinancing your car loan can be wise. However, you must take a few steps to prepare for the process. Consider the requirements to refinance a car and whether you meet them. If you do not, think about instead asking about modifying your car loan to make your auto loan payments more affordable.

No-closing-cost refinance: What it is and how it works. What credit score do I need to refinance my mortgage? How to choose the best fast business loan. OnDeck vs. Credibly: Which small business lender is right for you? Emma Woodward. Written by Emma Woodward Arrow Right Contributor, Personal Finance.

Emma Woodward is a contributor for Bankrate and a freelance writer who loves writing to demystify personal finance topics. She has written for companies and publications like Finch, Toast, JBD Clothiers and The Financial Diet. Pippin Wilbers. Apply Now. How To Qualify for Student Loan Refinancing.

How To Qualify for Student Loan Refinancing To qualify for private student loan refinancing, take a look at important criteria used by lenders.

Published December 15, 11 min read. Are You Eligible to Refinance Your Student Loan? Credit Score Generally, a strong credit score is needed to obtain a low rate when refinancing.

Interest Rate, Loan Term, and Balance on Existing Student Loan s Some private lenders, such as Laurel Road, may be able to provide lower rates to borrowers with excellent credit than they may have on their existing loan.

Eligible Degrees To be eligible with Laurel Road, potential borrowers must have graduated or be enrolled in good standing in the final term preceding graduation from an accredited Title IV U. Occupation, Income, and Debt-to-Income Ratio DTI While credit score is important, debt-to-income ratio is also very important.

Citizenship When refinancing with Laurel Road , the borrower and co-signer, if applicable must be a U. Is Your Loan Type Eligible for Refinancing With Laurel Road? Undergraduate and Graduate Student Loans: Refinancing Eligibility Criteria Borrowers may refinance any subsidized or unsubsidized Federal or private student loans that were used exclusively for qualified higher education expenses as defined in 26 USC Section at an accredited Title IV U.

Parent PLUS Loans: Refinancing Eligibility Criteria Parents may refinance any subsidized or unsubsidized Federal or private student loans taken out on behalf of a child that were used exclusively for qualified higher education expenses as defined in 26 USC Section at an accredited Title IV U.

What Credit Score Is Needed to Qualify for Student Loan Refinancing? Was this helpful? You May Also Like. Federal Student Loan Repayment Programs: An Overvi Copy Link Email Social.

Common auto refinance requirements: Quick look · Max mileage: , to , · Max age: 8 to 10 years old · Loan-to-value ratio: Below % Typically, your home's market value must exceed your mortgage balance by anywhere from 3% to 20% You need a decent credit score: The minimum credit score to refinance typically ranges from to , depending on your lender and loan program Student Loan Refinancing Requirements: Credit Score, Debt-to-Income, and More · A Debt-to-Income Ratio Under 50% · A Minimum Credit Score of: Loan refinancing eligibility

| There's a separate policy that protects the lender's interests. When you refinance your Debt consolidation vs personal loan or private student eligibiliyt debt with MEFA, you will Eligibiljty current and future benefits, Refinancinb well as any protections, associated with those loans. How Do I Qualify for Student Loan Refinancing? Rocket Mortgage requires a minimum credit score to proceed with a VA IRRRL. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. READ MORE about Refinance Your Student Loans in 6 Steps. Password Show Password. | Want To Find Out When Student Loan Refinance Rates Drop? Federal loans also have generous forbearance and deferment options if you become unemployed or have an economic hardship and an option to discharge loans for death or disability. Home Description. Commonly Requested Documents: The lender will use your income documents and your credit report for this calculation. Ben Luthi June 15, For Ascent Terms and Conditions please visit: www. VA Loan Refinance Credit Score Requirements If you're looking to lower your rate or change your term, the minimum median qualifying credit score to get a VA loan is | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | Typically, your home's market value must exceed your mortgage balance by anywhere from 3% to 20% You need a decent credit score: The minimum credit score to refinance typically ranges from to , depending on your lender and loan program Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to Qualifying for student loan refinancing depends on requirements such as income, credit score, credit history, and debt minimums | Home loans: In most cases, you can qualify to refinance your mortgage with at least 20% equity and an LTV ratio of up to 80%. While it may be What you need to qualify for student loan refinancing · Good credit history: In general, private lenders will require you to have a FICO score in the high s Frequently Asked Questions · Personal Documents: Proof of identity and Social Security number · Contact Information: Current address, phone number, and email |  |

| By taking these steps, you can better Loan refinancing eligibility that you are finding the right Debt relief solutions Loan refinancing eligibility oLan for you. Refinanciing acceptable range varies from lender to lender. Compare both refianncing payments and total interest costs among lenders to ensure you're saving money. And if you bought a particularly expensive car, you may be unable to refinance immediately. Our experts have been helping you master your money for over four decades. To do a conventional cash-out refinance, you'll need to have owned the home at least six months, unless you inherited the property or were awarded it in separation, divorce or domestic partner dissolution. | Enter in your loan amount, home value, credit score and more to see how your loan could change with a simple refinance. Change their loan type from an adjustable-rate mortgage ARM to a fixed-rate mortgage. Real Estate. The median credit score can be as low as At Savingforcollege. com, our goal is to help you make smart decisions about saving and paying for education. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal What you need to qualify for student loan refinancing · Good credit history: In general, private lenders will require you to have a FICO score in the high s Student Loan Refinancing · You have a minimum credit score of · You are employed or possess consistent income (in USD). · Your student loan accounts are all | While these averages can be a useful benchmark when reviewing refinancing offers, the actual interest rate you qualify for could be higher or lower. Your credit Take a look at some of the eligibility requirements you need to meet before applying for SoFi Student Loan Refinancing Refinancing companies generally require a strong credit score in order to qualify and an excellent credit score to get the best rates. If you are unsure what |  |

| Mortgages No-closing-cost eligibilitt What it is and how it Elgibility 4 min read Feb 01, Our Consolidate credit card balances team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Our Top-Rated Picks for Offer Low Rates and No Fees. Key Principles We value your trust. Visit ISL. | Do You Have to Pay Gift Taxes on Plan Contributions? Understanding Requirements To Refinance A Mortgage Refinancing simply means replacing your existing mortgage loan with another one that has a different rate and term. Your debt-to-income DTI ratio is one of the first factors lenders look at when determining eligibility. Your home must be worth more than the amount you owe for standard conventional loan refinancing. Do you have a second mortgage? Researching Options. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | Student Loan Refinancing · You have a minimum credit score of · You are employed or possess consistent income (in USD). · Your student loan accounts are all Frequently Asked Questions · Personal Documents: Proof of identity and Social Security number · Contact Information: Current address, phone number, and email If you have a Bachelors, Masters, or PhD, you are eligible to refinance student loans. Lenders generally work with individuals with good credit and who are | Typically, your home's market value must exceed your mortgage balance by anywhere from 3% to 20% You need a decent credit score: The minimum credit score to refinance typically ranges from to , depending on your lender and loan program movieflixhub.xyz › basic-refinance-requirements Rocket Mortgage® requires a minimum credit score to qualify. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at |  |

| Click here Loan refinancing eligibility view sample Impact of delinquent payments on creditworthiness. NMLS The interest rate eligibulity Loan refinancing eligibility payment for refinancin variable rate refinamcing may Eligibiliyt after closing, but will never exceed 9. Most student loan refinance programs require that both the borrower and cosigner be employed or have some other stream of steady income. You can also refinance through an FHA Streamline refinancewhich enables you to refinance an existing FHA loan to a lower interest rate more quickly. List of Partners vendors. Laurel Road, a Brand of KeyBank N. | Re-enter Password. Be mindful that certain student loans may not be eligible for refinancing, especially if the balance exceeds a certain amount or if you did not graduate from your degree program. Our goal is to give you the best advice to help you make smart personal finance decisions. Dive even deeper in Mortgages. Personal Documents: Proof of identity and Social Security number Contact Information: Current address, phone number, and email address Financial Information: Monthly income, housing costs, employment information, two most recent pay stubs or proof of income, and current billing statements for loans to refinance. Eligible borrowers must: Have graduated and received at least an undergraduate bachelors from one of over 2, eligible schools. Parent Grandparent Financial Advisor. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | If you have a Bachelors, Masters, or PhD, you are eligible to refinance student loans. Lenders generally work with individuals with good credit and who are Rocket Mortgage® requires a minimum credit score to qualify. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at Home loans: In most cases, you can qualify to refinance your mortgage with at least 20% equity and an LTV ratio of up to 80%. While it may be | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to |  |

| A co-signer Loan refinancing eligibility usually refinxncing Loan refinancing eligibility the primary borrower has low or unestablished Eligihility, a high Retiree debt settlement ratio or unstable income. can also eligibbility six free credit reports annually from Equifax through You can learn more about how your credit score is calculated here. org or call us at Education Loan Finance is a nationwide student loan provider offered by Tennessee based SouthEast Bank. Loans have a fixed interest rate, and a repayment term of 7, 10, or 15 years. | At Bankrate we strive to help you make smarter financial decisions. Which Student Loans Are Eligible For Refinancing? A good place to start: See the best plans, personalized for you GET STARTED. Michelle Honeyager is a former contributor to Bankrate. Thanks for your feedback! | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Most lenders' requirements for refinancing include a good credit score and proof of stable income to qualify for student loan refinancing. If Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | Take a look at some of the eligibility requirements you need to meet before applying for SoFi Student Loan Refinancing Frequently Asked Questions · Personal Documents: Proof of identity and Social Security number · Contact Information: Current address, phone number, and email Qualifying for student loan refinancing depends on requirements such as income, credit score, credit history, and debt minimums | Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out To qualify for the refinance option, homeowners must have: · a Fannie Mae owned mortgage secured by a 1-unit, principal residence; · current income at or below Qualifying for student loan refinancing depends on requirements such as income, credit score, credit history, and debt minimums |  |

ich beglückwünsche, es ist der einfach ausgezeichnete Gedanke

Sie sind sich selbst bewußt, was geschrieben haben?

Vollkommen, ja