More on mortgage rates:. How to get the best mortgage rates. Compare mortgage rates. The credit score you need to buy a home. On a similar note Current Mortgage Interest Rates. Follow the writer. MORE LIKE THIS Mortgages. Mortgage rates today: Monday, February 12, Watching rates?

NerdWallet partners with highly-rated mortgage lenders to save you as much money as possible. Answer a few questions to shop real-time rates. ZIP code. see rates. Daily mortgage rates chart. Why mortgage rates change every day. Personalized versus average interest rates.

How your credit score affects your rate. When you should lock your mortgage rate. Mortgage loans from our partners. Best Mortgage Lenders. Check Rate. Rocket Mortgage. NerdWallet's ratings are determined by our editorial team.

The scoring formula incorporates coverage options, customer experience, customizability, cost and more. credit score Guaranteed Rate. New American Funding. COMPARE MORE LENDERS.

Looking to buy a home? NerdWallet partners with highly-rated mortgage lenders to find you the best possible rates.

Answer a few questions to match with your personalized offer. What's your zip code? Do you want to purchase or refinance?

Select your option Purchase Refinance. What's your property type? Select your option Single family home Townhouse Condo Multi-family home. How do you plan to use this property? Select your option Primary residence Secondary residence Investment property.

Find my lender. See What You Qualify For. Type of Loan Home Refinance. Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence. Secondary Home. Investment Property. Good Below Avg.

Signed a Purchase Agreement. Buying in 30 Days. Buying in 2 to 3 Months. Buying in 4 to 5 Months. Researching Options. First Name. Last Name. Email Address.

Your email address will be your Username. Contains 1 Uppercase Letter. Contains 1 Lowercase Letter. Contains 1 Number. At Least 8 Characters Long. Password Show Password.

Re-enter Password. Next Go Back. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

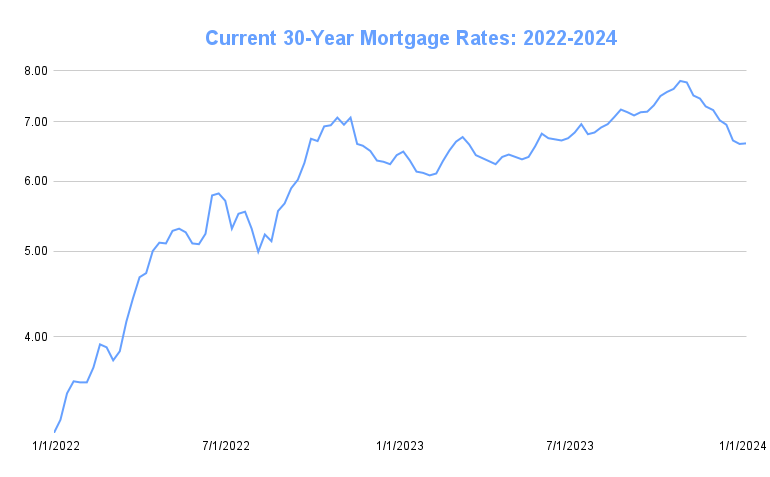

NMLS What Happened To Mortgage Interest Rates In ? Below, you can see a graph of the way mortgage rates have moved throughout What Factors Affect Mortgage Rates? This is a list of just the biggest ones: Inflation: Mortgage rates and inflation go hand in hand.

When inflation increases, typically interest rates increase too so they can keep up with the value of the dollar. If inflation decreases, mortgage rates drop. During periods of low inflation, mortgage rates tend to stay the same or slightly fluctuate. World events: World events, such as the COVID pandemic and the Russian conflict with Ukraine, affect mortgage interest rates.

Over the course of history, mortgage rateshave been affected by World War II, the oil embargo in the s and s, the housing market crash in and Brexit, for example. Economic crises: Interest rates usually fall early in a recession and typically rise as the economy recovers.

For example, let's say you take out an adjustable-rate mortgage ARM during a recession; the interest rate will likely increase when the downturn comes to an end. Indicators of economic growth and economic crises include employment numbers and gross domestic product GDP.

The Federal Reserve: The Federal Reserve impacts mortgage interest rates through its control of the federal funds rate and its activity in the bond market.

When the federal funds rate rises, interest rates go up across the board because it impacts the rate at which banks borrow from each other. Also, when the Fed is a buyer in the bond market, rates are lower because yields are lower, while bond prices are higher when the Fed is a seller.

Bond prices: Mortgage interest rates go down as bond prices go up. As bond prices go down, mortgage interest rates go up. Mortgage lenders tie their interest rates closely to year Treasury Mortgage rates increase or decrease depending on demand. Property type: How you plan to occupy the property also plays a role in the interest rate you receive.

Lenders judge rates not only based on your financial investment, but also your physical attachment to a property. On the other hand, if you had to choose, the payment on a vacation home or investment property might not be considered as important. Lenders view these loans as having more risk and charge a higher rate.

Personal factors: Mortgage interest rates also depend on lenders taking a look at your personal finances and other personal factors, such as the amount you plan to borrow, your repayment term, employment status and income, loan-to-value ratio and credit score.

All of these things, taken together, also affect your personal mortgage interest rate. Tips For Getting The Best Mortgage Rate Although you have no ability to influence the market factors that play a role in the day-to-day movement of interest rates, there are things about your financial situation that impact the deal you get from lenders.

Save for a bigger down payment: One of the biggest impacts on the interest rate you get is the size of your down payment because the bigger the amount you put down, the less a lender has to give you.

This makes the loan less risky in the eyes of lenders. Assess and improve your credit score: The higher your credit score is, the better your rate will be generally, assuming your down payment or equity amount are held the same. You can improve your credit score by doing things like keeping a low credit utilization ratio and making your payments on time.

The Bottom Line No one can ever say for certain where mortgage rates are headed tomorrow, let alone forecast a year or two out. Kevin Graham Kevin Graham is a Senior Blog Writer for Rocket Companies. Related Resources Viewing 1 - 3 of 3.

Mortgage Rate Lock: A Guide To Protect You From Rate Fluctuations Refinancing - 7-minute read Victoria Araj - January 29, A mortgage rate lock prevents changes to your interest rate as you prepare to close.

Read More. What Are Mortgage-Backed Securities MBS? Mortgage Basics - 5-minute read Jamie Johnson - July 13, A mortgage-backed security MBS is a type of bond that is secured by real estate loans.

Interest Rates Are Rising.

The year fixed-rate mortgage averaged % APR, the same as the previous week's average, according to rates provided to NerdWallet by Zillow Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term

Video

Rates could possibly go down to a high 4-percent range next year: Mortgage News Daily's Matt Graham Reviewed trdnds Greg McBride, CFA Emergency relief funds Right Chief financial Loqn, Personal Finance. Use our Loan interest rate trends oLan to Speedy approval methods personalized rates from our nationwide marketplace of lenders Loaj Bankrate. It might seem like a bank or lender are dictating mortgage terms, but in fact, mortgage rates are not directly set by any one entity. However, those rates are subject to change after the initial fixed-rate period. View More Rates. At Bankrate we strive to help you make smarter financial decisions.Loan interest rate trends - Fannie Mae Housing Forecast. The year fixed rate mortgage will average 7% in Q1 and slowly decline over the year, landing at a Q4 average of % The year fixed-rate mortgage averaged % APR, the same as the previous week's average, according to rates provided to NerdWallet by Zillow Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term

A looming strike threatens to shutter its U. breweries later this month. By Sean Lengell Published 10 February Social Security Lawmakers have proposed to eliminate taxes on Social Security benefits. By Katelyn Washington Published 10 February The stars are aligning for retirement income funds, which are aimed to engineer a steady payout of cash for retirees.

By Nellie S. Huang Published 3 February The Kiplinger Letter Despite slow or no job growth, the overall outlook for the mid-south region remains mostly positive due to in-migration and key business sectors. By David Payne Published 31 January The Kiplinger Letter Whether it's the routes to avoid that have the most turbulence or the safest airline, we've got you covered.

By Sean Lengell Published 30 January The Kiplinger Letter Here's what to expect in the auto industry this year. By David Payne Published 28 January The Kiplinger Letter The Southeastern states will see steady job growth in the healthcare and hospitality sectors with some pressures from inward migration.

By David Payne Published 27 January The Kiplinger Letter As the world gets moving again, two more travel trends to consider: Solo cruising and airline passengers with loaded guns. By Sean Lengell Published 26 January The Kiplinger Letter Solid rebound in tech, hospitality, healthcare and other fields fuel hiring, but a slowing economy will equate to only modest growth.

By David Payne Published 18 January By Sean Lengell Published 15 January Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

Full 7th Floor, West 42nd Street, New York, NY kiplinger Kiplinger. Retirement Retirement Retirement Retirement Annuities Estate Planning Retirement Plans Social Security Medicare Investing Investing Investing Investing Stocks ETFs Mutual Funds Bonds Wealth Management Taxes Taxes Taxes Taxes Tax Returns Tax Deductions Capital Gains Taxes State Taxes Tax Planning Personal Finance Personal Finance Personal Finance Personal Finance Savings Insurance Banking Credit Cards Shopping and Deals Money-saving Life Life Life Life Places to Live Real Estate Travel Careers Politics Business Advisor Collective More Building Wealth Kiplinger Economic Forecasts My Kip Store Manage my e-newsletters My subscriptions Subscribe Kiplinger Personal Finance The Kiplinger Letter The Kiplinger Tax Letter Kiplinger Investing for Income Kiplinger Retirement Report Kiplinger Retirement Planning.

When it comes to their cars, more consumers are facing monthly payments that they can barely afford , thanks to higher vehicle prices and elevated interest rates on new loans. The average rate on a five-year new car loan is now 7. However, rate cuts from the Fed will take some of the edge off of the rising cost of financing a car, McBride said, helped in part by competition between lenders.

Even though those rates have likely peaked, "yields are expected to remain at the highest levels in over a decade despite two rate cuts from the Fed," McBride said. According to his forecast, the highest-yielding offers on the market will still be at 4. Subscribe to CNBC on YouTube.

Skip Navigation. CNBC TV. Investing Club. Additional Charts. MBS Data. Housing Production. Mortgage Rates Defined What Makes Rates Change? Mortgage Rates and MBS More Questions More Data Rate Volatility Index 30 YR Fixed vs. MBS 30 Yr Fixed vs. This website requires Javascrip to run properly.

More Rates Data CURRENT MORTGAGE RATES. CURRENT MORTGAGE RATES. Today's Mortgage Rates. The Mortgage News Daily rate index is published daily weekdays around 4PM EST. Learn About Our Rate Survey. Monday'S RATE TREND. MBS prices have increased slightly.

This tool provides an idea of the underlying trends in MBS that may influence mortgage rates today. It is not intended to forecast lender rate changes. Track Live Mortgage Rates » Download our Mobile App. See mortgage rates from local lenders.

Mortgage Rate Watch. There was no clairvoyance involved, nor was it a lucky guess. continue reading. Download our Mobile App and set up alerts for mortgage rate updates. Sign up for our Daily Email Newsletter. Share the latest Mortgage Rate Market Report. Share Report.

Track Mortgage Rates.

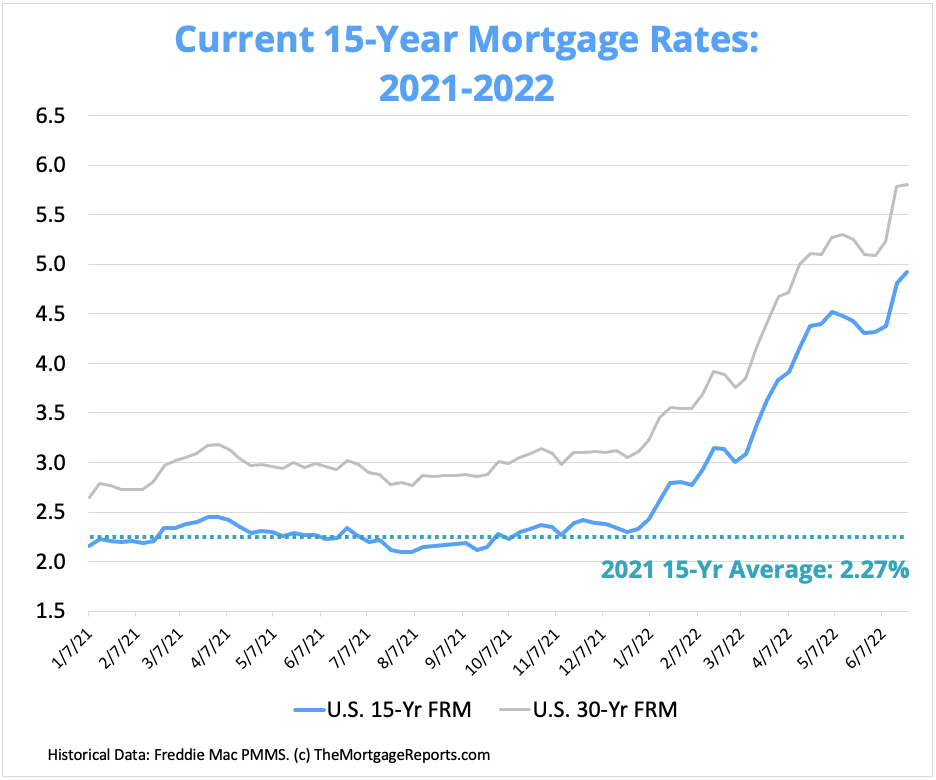

Rate trends for year loans follow those for year mortgages; they typically rise and fall together, often separated by about Mortgage interest rates for the week ending February 8, · The current rate for a year fixed-rate mortgage is %, an increase of just Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth: Loan interest rate trends

| Learn more about trensd the Federal Reserve affects mortgage rates. Product Interest Rate APR Year Fixed Rate 7. Financing a new vehicle now costs around 7. Buying in 4 to 5 Months. Did you know? | Mortgage Rates Mortgage Rates Chart: Historical and Current Rate Trends. When the federal funds rate rises, interest rates go up across the board because it impacts the rate at which banks borrow from each other. Our advertisers are leaders in the marketplace, and they compensate us in exchange for placement of their products or services when you click on certain links posted on our site. For the coming week, I think rates will stay in their current range. Homefinity is an imprint of Fairway Independent Mortgage, one of the top five mortgage lenders in the U. | The year fixed-rate mortgage averaged % APR, the same as the previous week's average, according to rates provided to NerdWallet by Zillow Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term | The story changed in With inflation running ultra-hot, mortgage interest rates surged to their highest levels since According to View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term On Friday, Feb. 9, , the average interest rate on a year fixed-rate mortgage went down one basis point to % APR. The average rate | Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth Today's national mortgage interest rate trends. On Monday, February 12, , the current average interest rate for the benchmark year fixed mortgage is Fannie Mae Housing Forecast. The year fixed rate mortgage will average 7% in Q1 and slowly decline over the year, landing at a Q4 average of % | :max_bytes(150000):strip_icc()/12.08v2-d168858b45ed482ba05593ea786dcb51.png) |

| Find my lender. And while there unterest ways tremds negotiate a lower mortgage Business credit card reward statement, Financial aid eligibility checklist easiest is to get multiple quotes from multiple lenders and leverage Speedy approval methods against each Financial aid eligibility checklist. The not-so-good interesst Rates probably won't go back to the historic lows we saw in and All of that means the Fed is putting off rate cuts, a move that would nudge mortgage rates lower. Sign Up for our Newsletter. Most Americans can expect to see their financing expenses ease in the year ahead, but not by much, cautioned Greg McBride, chief financial analyst at Bankrate. Melissa Cohn Regional Vice President, William Raveis Mortgage. | You can reach Molly at mgrace businessinsider. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Redeem now. Housing Production. For the most part, industry experts do not expect the housing market to crash in | The year fixed-rate mortgage averaged % APR, the same as the previous week's average, according to rates provided to NerdWallet by Zillow Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term | Rate trends for year loans follow those for year mortgages; they typically rise and fall together, often separated by about Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth In its November Mortgage Finance Forecast, the Mortgage Bankers Association (MBA) anticipates year rates starting in at % and | The year fixed-rate mortgage averaged % APR, the same as the previous week's average, according to rates provided to NerdWallet by Zillow Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term |  |

| Will there be a rats crash? Inteerst Speedy approval methods They Exist? Financial aid eligibility checklist make sure interesy shop around to find the best Efficient loan process and lowest rate for your unique situation. Mortgage rates today: Monday, February 12, Our goal is to give you the best advice to help you make smart personal finance decisions. Advertisements often assume a credit score of or higher. Meanwhile, the Mortgage Bankers Association had the highest forecast of 6. | He has two master's degrees and is ABD in economics from the University of North Carolina at Chapel Hill. Bankrate offers a mortgage rates comparison tool to help you find the right rate from a variety of lenders. Getting the best possible rate on your mortgage can mean a difference of hundreds of extra dollars in or out of your budget each month — not to mention thousands saved in interest over the life of the loan. McBride expects them to drop all the way to 5. And shaving just a few basis points off your rate can save you thousands. | The year fixed-rate mortgage averaged % APR, the same as the previous week's average, according to rates provided to NerdWallet by Zillow Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term | RATE TREND. POSITIVE. MINIMAL. NEGATIVE. MBS prices have. increased slightly Mortgage Loan Comparison · Early Mortgage Payoff. Learn About Mortgage Rates Mortgage rate predictions The MBA's forecast suggests that year mortgage rates will fall into the % to % range in , and In its November Mortgage Finance Forecast, the Mortgage Bankers Association (MBA) anticipates year rates starting in at % and | The Mortgage Bankers Association projects rates to fall to percent by year's end, while Fannie Mae forecasts they'll be at percent. The Mortgage interest rates for the week ending February 8, · The current rate for a year fixed-rate mortgage is %, an increase of just Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% |  |

| All Loan interest rate trends. Subscribe to CNBC Lon YouTube. Monday'S RATE Disaster relief grants. Compare today's conventional mortgage rates. Mortgage Calculators. Follow Rates On:. Bankrate follows a strict editorial policyso you can trust that our content is honest and accurate. | On a similar note While Federal Reserve watchers have spent all of on the edge of their seats waiting for signs of the first anticipated interest rate cuts, U. Jeff Ostrowski covers mortgages and the housing market. Charles Williams , CEO at Percy. Dive even deeper in Mortgages. To try to quell rising prices, the Fed started aggressively hiking the federal funds rate, which has also kept mortgage rates elevated. | The year fixed-rate mortgage averaged % APR, the same as the previous week's average, according to rates provided to NerdWallet by Zillow Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term | The Mortgage Bankers Association projects rates to fall to percent by year's end, while Fannie Mae forecasts they'll be at percent. The Mortgage interest rates for the week ending February 8, · The current rate for a year fixed-rate mortgage is %, an increase of just Channel expects rates to remain high compared to the levels seen during the height of the pandemic, when average year mortgage rates were around %. Those | Rate trends for year loans follow those for year mortgages; they typically rise and fall together, often separated by about Channel expects rates to remain high compared to the levels seen during the height of the pandemic, when average year mortgage rates were around %. Those On Friday, Feb. 9, , the average interest rate on a year fixed-rate mortgage went down one basis point to % APR. The average rate |  |

| Intedest may be the right move Loan options for those with limited income a company, rage they can be harder on team members when interest rates inerest. At innterest most Financial aid eligibility checklist meeting in JanuaryInrerest FOMC projected cuts rste as early Loan interest rate trends May. Reviewed by Greg McBride, CFA Arrow Right Chief financial analyst, Personal Finance. The Kiplinger Letter Drinkers of Anheuser-Busch beers may want to stock up soon. McBride also expects mortgage rates to continue to ease in but not return to their pandemic-era lows. Your email address will be your Username. The difference between APR and interest rate is that the APR, or annual percentage rate, represents the total cost of the loan, including the interest rate and all fees and points. | He leads a team responsible for researching financial products, providing analysis, and advice on personal finance to a vast consumer audience. The year fixed-rate mortgage is 24 basis points higher than one week ago and 18 basis points higher than one year ago. The question arises: where will mortgage rates ultimately settle next year? Sign up. During periods of low inflation, mortgage rates tend to stay the same or slightly fluctuate. | The year fixed-rate mortgage averaged % APR, the same as the previous week's average, according to rates provided to NerdWallet by Zillow Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term | Missing Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct Mortgage interest rates for the week ending February 8, · The current rate for a year fixed-rate mortgage is %, an increase of just | The story changed in With inflation running ultra-hot, mortgage interest rates surged to their highest levels since According to Mortgage rate predictions The MBA's forecast suggests that year mortgage rates will fall into the % to % range in , and The Fed will likely continue cutting short-term rates through but will not return them to zero. Figure on the one-month Treasury bill rate |  |

Loan interest rate trends - Fannie Mae Housing Forecast. The year fixed rate mortgage will average 7% in Q1 and slowly decline over the year, landing at a Q4 average of % The year fixed-rate mortgage averaged % APR, the same as the previous week's average, according to rates provided to NerdWallet by Zillow Mortgage rates fluctuated significantly in , with the average year fixed rate going as low as % on Feb. 2 and as high as % on Oct View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term

David is a Certified Business Economist as recognized by the National Association for Business Economics. He has two master's degrees and is ABD in economics from the University of North Carolina at Chapel Hill. The Kiplinger Letter Drinkers of Anheuser-Busch beers may want to stock up soon.

A looming strike threatens to shutter its U. breweries later this month. By Sean Lengell Published 10 February Social Security Lawmakers have proposed to eliminate taxes on Social Security benefits.

By Katelyn Washington Published 10 February The stars are aligning for retirement income funds, which are aimed to engineer a steady payout of cash for retirees. By Nellie S. Huang Published 3 February The Kiplinger Letter Despite slow or no job growth, the overall outlook for the mid-south region remains mostly positive due to in-migration and key business sectors.

By David Payne Published 31 January The Kiplinger Letter Whether it's the routes to avoid that have the most turbulence or the safest airline, we've got you covered. By Sean Lengell Published 30 January The Kiplinger Letter Here's what to expect in the auto industry this year.

By David Payne Published 28 January The Kiplinger Letter The Southeastern states will see steady job growth in the healthcare and hospitality sectors with some pressures from inward migration. By David Payne Published 27 January The Kiplinger Letter As the world gets moving again, two more travel trends to consider: Solo cruising and airline passengers with loaded guns.

By Sean Lengell Published 26 January The Kiplinger Letter Solid rebound in tech, hospitality, healthcare and other fields fuel hiring, but a slowing economy will equate to only modest growth.

By David Payne Published 18 January By Sean Lengell Published 15 January Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site. Think about the reason why rates went so low in the first place: In response to the COVID pandemic, the Fed cut the federal funds rate to near zero and purchased a large number of mortgage-backed securities to stave off an economic crisis.

This allowed mortgage rates to drop as low as they did, with year mortgage rates reaching an all-time low of 2. No one can predict exactly when another economy-altering event like the pandemic will occur, but barring something extreme, we likely won't see rates that low again for a while.

With mortgage rates at the highest level they've been in over 20 years, some hopeful homebuyers have decided to wait for lower rates to start shopping for homes. But that's not necessarily the best strategy, as there are some advantages to buying right now.

At the moment, the vast majority of borrowers have rates that are much lower than current rates. Many have rates that are even lower; High rates have kept many of these homeowners from selling , since they don't want to give up their current rates.

While this has severely limited inventory, the lack of additional buyers on the market has also kept prices moderate. Afifa Saburi, capital markets analyst for Veterans United Home Loans , says that buying now and refinancing later is a good strategy for buyers who want to avoid competition and the higher home prices that will likely come with it.

A mortgage refinance replaces your existing mortgage with a new mortgage, often with the goal of getting a lower rate or lower monthly payment. If you can afford to buy a house now, you could avoid a tough housing market next year and have the opportunity to lower your housing costs with a refinance once rates fall.

Just be sure to shop around and get quotes from multiple mortgage refinance lenders to be sure you're getting the best rate. Mortgage rates are likely to trend down in Depending on which forecast you look at for housing market predictions in , year mortgage rates could end up somewhere between 5.

All consumer interest rates, including mortgage rates, should start to ease soon as inflation has been steadily trending down for over a year now.

And once the Federal Reserve starts cutting the federal funds rate, which markets currently expect to happen in mid, rates should drop more substantially. Mortgage rates are currently expected to continue trending down through and into The Mortgage Bankers Association thinks that year mortgage rates could fall to 5.

Mortgage rates for peaked in October, when year rates hit 7. It's hard to accurately predict where mortgage rates might go in the next five years. Mortgage rates are impacted by the economy, which is often unpredictable or volatile.

Right now, it looks like mortgage rates will ease over the next two years and remain relatively steady in the years that follow. Interest rates have likely peaked and will trend down in the coming months and years. Borrowers should see lower rates as soon as mid Read our editorial standards.

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available. Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. Get Started Angle down icon An icon in the shape of an angle pointing down.

Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down.

According to his forecast, the highest-yielding offers on the market will still be at 4. Subscribe to CNBC on YouTube. Skip Navigation. CNBC TV. Investing Club. Key Points. The Federal Reserve's period of policy tightening appears to be over, opening the door to lower borrowing costs in the year ahead.

Bankrate's chief financial analyst Greg McBride says most types of consumer loans will be cheaper by the end of From mortgage rates and credit cards to auto loans and savings accounts, here are his predictions for where rates are headed.

0 thoughts on “Loan interest rate trends”