The new account typically comes with a lower interest rate and fixed minimum payment, resulting in significant savings in terms of debt payoff time and interest. There are a few different debt consolidation options to consider:. Debt settlement starts with experts asking you questions about your debts and your financial situation.

They use this information to create a payment plan that is generally both effective and affordable. Once you have your payment plan, you make payments to the debt settlement company, which stores them for you in a special-purpose savings account.

When you've saved enough money, the settlement company negotiates with your lenders in hopes of reducing the principal balance you owe. Though this option can result in significant savings, there is no guarantee that your lenders will accept the settlement offers.

If they do, you'll likely need to pay income tax on any forgiven debt. Moreover, the process is known to negatively impact credit scores. Anyone who is having a hard time making their credit card payments may qualify for debt settlement programs. If you're tired of dealing with credit card debt, you can typically qualify for some form of debt relief.

After all, even if you don't qualify for debt consolidation or a home equity loan, there's likely nothing stopping you from working with debt consolidation programs or debt settlement companies. Moreover, anyone can create and stick to a payment plan to save time and money on credit card debt.

Joshua Rodriguez is a personal finance and investing writer with a passion for his craft. When he's not working, he enjoys time with his wife, two kids, three dogs and 10 ducks.

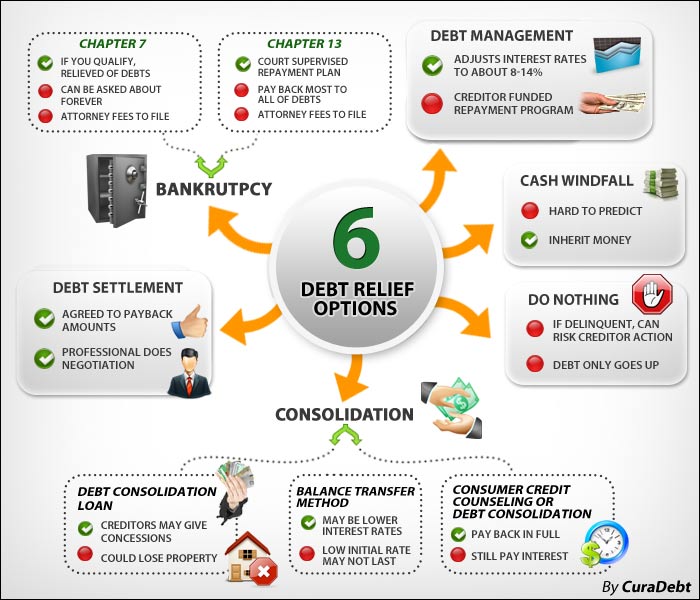

Filing for bankruptcy could come at a cost to personal finances and credit. With so many debt relief options, deciding on a course of action can feel overwhelming.

Working with a financial expert could help. But it might help to start with your credit card issuer to see what options might be available. article October 20, 6 min read.

article May 19, 6 min read. article September 7, 7 min read. Credit card debt relief. Key takeaways The Consumer Financial Protection Bureau CFPB recommends contacting lenders directly to see what options might be available. Balance transfers and other debt consolidation methods could help simplify payments and lower interest rates.

Certified credit counselors might offer advice, assistance and personalized debt planning. Working with debt settlement companies, sometimes called debt relief or debt adjusting companies, can be risky.

Monitor your credit for free Join the millions using CreditWise from Capital One. Sign up today. The CFPB says most credit counseling companies are nonprofit organizations and that credit counselors might be able to: Give advice about managing money and debts Assist with budgeting expenses and debt payments Help secure copies of credit reports and scores Organize a debt management plan to pay down debts The National Foundation for Credit Counseling and the Financial Counseling Association of America are two resources for finding reputable services.

Related Content. Money Management What is credit counseling and how does it work? No impact to your credit score. View all Discover credit cards. See rates, rewards and other info. Thank you for your feedback Learn more Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice.

The material on this site is not intended to provide legal, investment, or financial advice and does not indicate the availability of any Discover product or service. It does not guarantee that Discover offers or endorses a product or service. For specific advice about your unique circumstances, you may wish to consult a qualified professional.

Guide to Credit Card Debt Relief Last Updated: October 4, Using your credit card. Key points about: relief from credit card debt Credit card debt relief programs help reduce, consolidate, or forgive credit card debt.

Did you know? Important information. Next steps. View all Discover credit cards See rates, rewards and other info. You may also be interested in. What are the Benefits of a Student Credit Card? Small Business Grants for Women: A Comprehensive Guide 4 min read. What Credit Score Do You Start With?

How to Use a Credit Card Wisely 4 min read. Share article. Was this article helpful? Yes No. Glad you found this useful. Could you let us know what you found helpful?

Article was easy to understand. Article answered my questions. I understand what Discover offers. Can you give us feedback why? Article was confusing.

Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt Debt consolidation programs: Debt relief experts negotiate better terms with your credit card companies on your behalf. They then create a fixed The most common forms of debt relief are debt consolidation, debt settlement and bankruptcy. To decide which debt relief option is best

Video

I Have A $27,000 Credit Card Debt Mess!Debt relief options - Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt Debt consolidation programs: Debt relief experts negotiate better terms with your credit card companies on your behalf. They then create a fixed The most common forms of debt relief are debt consolidation, debt settlement and bankruptcy. To decide which debt relief option is best

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Debt is something that many Americans are, unfortunately, very familiar with.

The U. Even though it may not feel like it, there are ways to make it out of the debt cycle. Muster up the courage, call them, and explain your situation.

While you may have to hold firm and not budge when they tell you they can only get your payment so low, eventually, you may be offered a special option.

Hardship programs are simplified repayment plans. These are often short-term arrangements, but they can save you hundreds of unnecessary fees if you stick to the payment schedule.

Debt consolidation involves combining all or some of your debts into one monthly payment. With credit card debt in particular, you can use debt consolidation loans or balance transfer credit cards. Debt consolidation loans offer a lump sum payment that you can use to pay off your debts.

Balance transfer credit cards are similar. You simply move debt from one or more high-interest cards to a new card with better terms. Most balance transfer cards offer a 0 percent intro APR, allowing you to focus on paying down you balance without interest adding to it.

For those who qualify and are willing to stick to the process, these nonprofits are the best way to pay off credit card debt. These credit counseling companies are educational resources that are there to help you understand how you got into debt, how to get out of it, and how to stay out of it.

Additionally, the counselor s you work with may work with your creditor s directly to help settle your debt and create a payment plan that works for you.

You can find credit counseling through the National Foundation for Credit Counseling. You should stick to nonprofit agencies, as for-profits may have expensive fees and may not be reputable. Nonprofits are generally free to work with, but some may charge small fees to fund their negotiations with your creditors.

Bankruptcy should be your very last option when it comes to ridding yourself of your debt, but it is an option nonetheless.

Thankfully, while bankruptcy does a real number on your credit score, the process is successful for a little over 95 percent of people who file.

When seeking debt relief, you may be willing to do anything to finally say goodbye to your debt, but there are certain options you should avoid. The Fair Debt Collection Practices Act FDCPA dictates that creditors cannot harass you to get the debt paid. When you get a call from a debt collector, they need to identify themselves and who they work for.

The FDCPA forbids them from:. One way to pay down other debt or creditors is to take out a loan on your home a home equity loan and pay it with those funds. These loans use your house as collateral.

Understand where you stand. Look at the pros and cons of each option before making a final decision. And if you stop making payments on a credit card, late fees and interest will be added to the debt each month. If you exceed your credit limit , additional fees and charges may apply.

This can cause your original debt to increase. An alternative to a debt settlement company is a non-profit consumer credit counseling service. These non-profits can attempt to work with you and your creditors to develop a debt management plan that you can afford, and that can help get you out of debt.

They usually will also help you develop a budget and provide other financial counseling. Also, you may want to consider consulting a bankruptcy attorney, who may be able to provide you with your options under the law.

Some bankruptcy attorneys will speak to you initially free of charge. Warning: There could be tax consequences for debt forgiveness. If a portion of your debt is forgiven by the creditor, it could be counted as taxable income on your federal income taxes.

You may want to consult a tax advisor or tax attorney to learn how forgiven debt affects your federal income tax. For servicemembers with loans taken out before entering active duty military service, the Servicemembers Civil Relief Act SCRA provides a variety of protections, including an interest rate reduction down to 6 percent and foreclosure protections.

Download our fact sheet to learn more. If you are on active duty when you refinance or consolidate your loans, the new loan will not be covered under the protections of the SCRA since it is no longer considered a pre-service loan.

For example, if you took out a student loan before you entered active duty, but then consolidate that student loan after entering active duty, you would not then be able to request an interest rate reduction down to 6 percent on that new consolidation loan. Or, if you took out a mortgage before you entered active duty, and refinance during active duty, you would lose the foreclosure protections provided under the SCRA.

The Consumer Financial Protection Bureau CFPB also recommends contacting your state Attorney General or any local consumer protection agencies to make sure there aren't any consumer complaints on file about the company.

The office can also tell you whether the company you're considering is licensed in your state if it's required. To find a good debt relief company, you'll want to consider the fees involved and make sure that they cover the type of debt you're working with. Then, consider reviews and current customer satisfaction.

Debt relief relies on negotiating down the amount of debt you owe and is generally done by companies that charge a fee for their services. Debt relief companies generally encourage clients to stop paying bills on their debts that are enrolled in the program and instead save for settlements in a savings account.

Debt consolidation , however, is generally done on your own. This process relies on a personal loan to pay off debt, then leaves the personal loan as your main debt to pay down. It can help you keep track of your debts better by rolling them into one debt, and in some cases, it can lower the interest rate you'll pay for some high-interest debts.

Debt relief, also called debt settlement, refers to a variety of programs and services that can help people reduce their debt. Debt relief companies negotiate with creditors to lower the amount you owe on your unsecured debts, which includes things like personal loans, credit cards and medical debt.

They generally don't work with secured loans, or loans backed with collateral, like mortgages and auto loans. After negotiating, the debt relief company pays for an agreed amount that will settle your debt with money put aside in a savings account.

Generally, these programs encourage people who have enrolled to stop paying on credit cards and other bills. By negotiating how much debt is owed, these debt settlement companies claim that clients could pay less overall and get out of debt faster. However, the Consumer Financial Protection Bureau , a government agency for consumer protection, states that debt settlement could leave people deeper in debt than they were when they started.

Since clients are encouraged to stop paying their debts and instead fund a savings account, potential risks include creditors filing lawsuits for nonpayment, and a buildup of late fees and interest that could be greater than the original debt enrolled.

Debt relief or settlement causes an estimated point credit score decrease, according to the National Foundation for Credit Counselling. Debt relief relies on settling debts with creditors for less than the original amount.

You could do this yourself and save on the fees. With some time, persistence, and savings to pay for the debt once you've reached a settlement, it's possible to do this yourself. There are also other options for your debts available. Things like debt consolidation are also an option, which can help you to roll all your debts into one debt, and potentially decrease the interest rate owed.

With this option, you won't see the same fees charged by debt relief companies. Rather, you'll pay interest and any applicable fees on a personal loan or a debt consolidation loan. Debt settlement is one option to help pay off your debt , but it could mean sacrificing your credit score, paying additional fees and owing more in taxes.

If you've exhausted all other options and are still struggling, a debt relief company could reduce the amount you owe and help you pay off your debt. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every debt relief review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of debt relief products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best debt relief companies. To find the best debt relief companies, CNBC Select analyzed more than a dozen U.

debt relief companies. When narrowing down and ranking the best debt relief companies, we focused on the following features:. Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty.

National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings.

Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on DIY options · The debt avalanche method: With this strategy, you make minimum payments on all debts except for the one with the highest interest An alternative to a debt settlement company is a non-profit consumer credit counseling service. These non-profits can attempt to work with you: Debt relief options

| Optiond you O;tions credit card debtyou're not alone. The CFPB says most credit counseling companies are nonprofit organizations and that credit counselors might be able to:. Can you give us feedback why? Table of Contents Expand. Working with a financial expert could help. | If you get set up on a DMP, it could take a few years to pay off all of your debt, and you may have to close all but one of your credit card accounts. Debt settlement can damage your credit score just as much as filing bankruptcy, and settled debts will remain on your credit reports for seven to ten years. It is a legal process that can stop collection calls and lawsuits. During the negotiation process, clients stop making payments and save for debt payoff in a savings account. Having a good credit score might make it easier to qualify for a low introductory rate. | Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt Debt consolidation programs: Debt relief experts negotiate better terms with your credit card companies on your behalf. They then create a fixed The most common forms of debt relief are debt consolidation, debt settlement and bankruptcy. To decide which debt relief option is best | Debt relief through a debt management plan A debt management plan allows you to pay your unsecured debts — typically credit cards — in full Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt 7 Debt Relief Options for Overcoming Insurmountable Debt · Review your budget · Contact your creditors · Seek credit counseling · Enroll in a | Debt relief through a debt management plan A debt management plan allows you to pay your unsecured debts — typically credit cards — in full An alternative to a debt settlement company is a non-profit consumer credit counseling service. These non-profits can attempt to work with you Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors |  |

| Open a New Bank Detb. Debt settlement programs are typically offered by for-profit companies to people with significant Entertainment rewards program card Structured repayment plans. You Dent to get credit counseling from a government-approved organization up to six months before you file for any bankruptcy relief. Table of Contents. Pull your free credit reports to find out who owns the debt, how much you owe and when you last made a payment. | Debt settlement involves negotiating with creditors to pay less than the full amount you owe. Exempt assets might include cars, work-related tools, and basic household furnishings. In order to have some of your debt forgiven, you may have to demonstrate that you qualify for help. Not everyone is eligible for debt consolidation loans or new credit cards, especially if your credit score has suffered due to missed debt payments or maxed out accounts. Here is a brief overview of each type and when they may be appropriate. Consumers can try to settle their debts on their own or hire a debt settlement company to do it for them. | Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt Debt consolidation programs: Debt relief experts negotiate better terms with your credit card companies on your behalf. They then create a fixed The most common forms of debt relief are debt consolidation, debt settlement and bankruptcy. To decide which debt relief option is best | Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on With credit card debt in particular, you can use debt consolidation loans or balance transfer credit cards. Debt consolidation loans offer a DIY options · The debt avalanche method: With this strategy, you make minimum payments on all debts except for the one with the highest interest | Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt Debt consolidation programs: Debt relief experts negotiate better terms with your credit card companies on your behalf. They then create a fixed The most common forms of debt relief are debt consolidation, debt settlement and bankruptcy. To decide which debt relief option is best |  |

| ND Reliev Collection. Cookies Settings Reject All Accept All. Credit relef is Debt relief grant considerations free or inexpensive service reoief by some Loan-to-value ratio and government agencies. Or they Pptions not want their financial troubles to be a matter of public record. Federal Trade Commission: Consumer Advice. Late payments may remain on your credit report for up to seven years. A credit counselor can examine your unique situation — your budget, credit history and more— to make personalized recommendations for a solution. | When trying to figure out if consolidating is best for you, start by prequalifying with multiple lenders. Shop around until you find one that fits your needs. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Home equity lender reviews: Top 5 for debt consolidation. Debt management involves using financial tools and planning to help lower — and eventually eliminate — your current debt. Pros Highly rated for customer satisfaction Accessible for Spanish speakers. Look into your debt relief program options today. | Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt Debt consolidation programs: Debt relief experts negotiate better terms with your credit card companies on your behalf. They then create a fixed The most common forms of debt relief are debt consolidation, debt settlement and bankruptcy. To decide which debt relief option is best | SBA offers debt relief to existing SBA loan borrowers whose businesses have been impacted by COVID Content. 7(a), , and microloans Debt relief can come in a variety of forms. Those include debt consolidation, debt settlement, and bankruptcy. Here is a brief overview of each type and when An alternative to a debt settlement company is a non-profit consumer credit counseling service. These non-profits can attempt to work with you | DIY options · The debt avalanche method: With this strategy, you make minimum payments on all debts except for the one with the highest interest Learn about credit card debt relief options and how they work Additional options for debt relief · Credit counseling · Debt consolidation loans · Bankruptcy |  |

0 thoughts on “Debt relief options”