Now, you might be ready for take-off on your new loan portfolio management system. So, where do you start when it comes to credit portfolio management software? Before you get started, having the right information on hand is key.

Consumer lending Microfinance lending POS lending PayDay lending Auto lending Mortgage lending Healthcare lending Student lending Commercial lending Leasing Peer-to-Peer lending Merchant cash advance Bank lending Factoring Working capital finance Trade finance software Loan management software Loan origination software Loan servicing software Debt collection.

Products NEW. Landing website Borrower portal Back office Features Integrations. AI decision making platform. Digital transformation consulting Lending software development. About HES Blog Contacts. Blog FinTech. What is a loan portfolio management system?

How does loan portfolio management software work? What key features should a viable loan portfolio management system have? Loan portfolio management systems — where to start?

Frequently Asked Questions. Do you trust compliance management to software? What is a Loan Portfolio Management System? A Loan Portfolio Management System is a software tool used by financial institutions, such as banks and credit unions, to effectively manage and monitor their loan portfolios.

It helps automate and streamline various processes related to loan origination, underwriting, servicing, and collection. Why is a Loan Portfolio Management System important for financial institutions?

A Loan Portfolio Management System is crucial for financial institutions because it allows them to efficiently track, analyze, and manage their loan portfolios. It provides real-time visibility into loan performance, helps identify potential risks, streamlines workflows, and enables effective decision-making to optimize portfolio profitability.

How can a Loan Portfolio Management System improve loan portfolio performance? A Loan Portfolio Management System can enhance loan portfolio performance in several ways.

By providing comprehensive data analysis and risk assessment tools, institutions can make informed lending decisions, resulting in reduced default rates and improved portfolio quality. Real-time monitoring enables proactive portfolio management, allowing institutions to identify and address potential issues promptly.

How can a Loan Portfolio Management System help with regulatory compliance? A Loan Portfolio Management System can assist financial institutions in maintaining regulatory compliance by automating compliance-related tasks and providing necessary documentation.

The system can generate regulatory reports, monitor adherence to lending regulations, and ensure proper documentation and record-keeping. Additionally, it can integrate compliance rules and workflows into loan origination and servicing processes, reducing the risk of non-compliance and associated penalties.

Choose your special offer. Boost your loan applications through a lending website, tailored to your brand identity. Claim now. Implement now and use our software for free for the first 3 months of the adoption period. Get 32 hours of free business analyst support to launch your digital lending business.

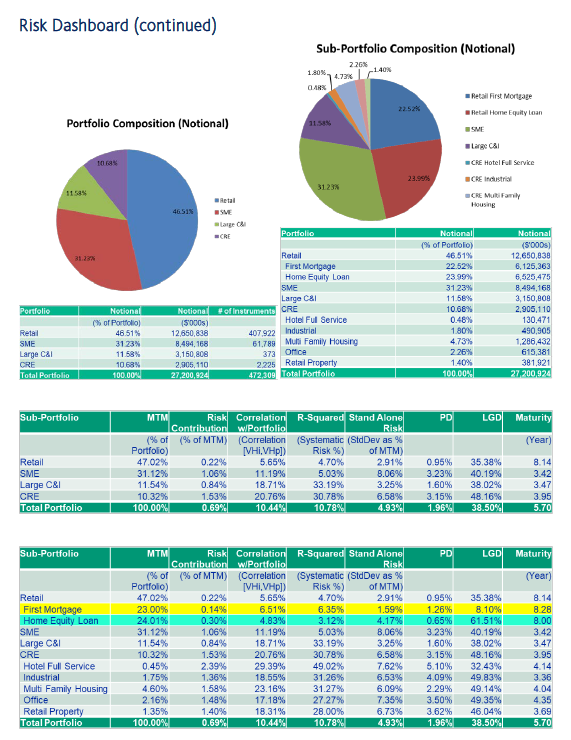

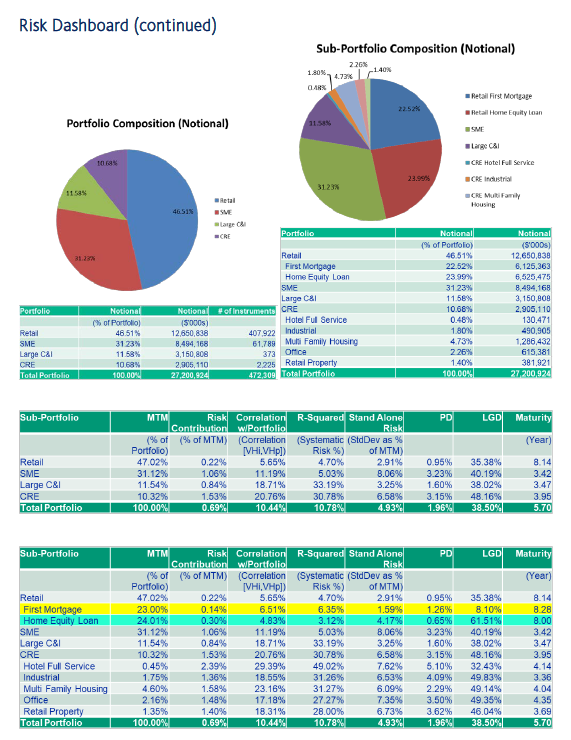

Stress test and forecast performance, leveraging historical data and projected future cash flows based on your assumptions of prepayment and charge-off rates. View and deliver key analytical insights in a polished, printable and presentation-ready Excel format for your key stakeholders. Select your preferred premium amortization method for your performance metrics and download amortization schedules in.

Inspect the monthly ratio of income over the amortized cost of your investment in order to track the current performance of your asset. Subscribers have the option to download underlying data in. Joining the platform is free and carries no obligation.

Privacy Policy. LoanStreet® is a federal registered trademark owned by LoanStreet Inc. All rights reserved. Embrace the future of loan portfolio analysis today.

Request a Demo. Analytics to maximize performance and profitability. Accelerate your Decision-Making Best-in-class, independent analytics enable a clear view of your performance and risk without wasting time and resources wrangling inconsistent participation data.

Collaborate More Effectively Automated, accurate and exportable performance and risk reports allow you to quickly prepare, share and communicate vital trends and insights about your portfolio with decision makers, helping to align your organization behind your participation program.

Optimize your Loan Portfolio Evaluate and track the overall rate of return for your loans and third-party loan investments in a single view, benchmarked against your key performance metrics. Manage Your Liquidity Track your prepayment speeds with greater precision and forecast your principal repayment cashflows so you can set your lending strategy with greater confidence.

Collaborate More Effectively Automated, accurate and exportable performance and risk reports allow you to quickly prepare, share and communicate vital trends and insights about your loan portfolio with decision makers, helping you align your organization behind your lending strategy and loan participation program.

Drill down into your loan book. Performance Analytics Key Features.

Monitor Portfolio Performance, Monitor your loan portfolio regularly to identify trends and risks. Timely Payment Incentives, Encourage on-time Missing A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often

Loan portfolio performance tracking - loan portfolio provides consistent, reasonable returns. Individual credits be able to monitor developments within that industry, track the performance of Monitor Portfolio Performance, Monitor your loan portfolio regularly to identify trends and risks. Timely Payment Incentives, Encourage on-time Missing A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often

This notifies them that they have a specific period of time to bring their loan up to date or legal action will be started. Analyzing escrow: Financial organizations are obligated to calculate overages or shortages in escrow and remedy with the borrower. Loan Portfolio Tracking Resources For more information about loan portfolio tracking, be sure to check out our extensive resource library with free spreadsheets, whitepapers, and eBooks.

Loan Management: Paper Document Management Cost Calculator Loan management can be paper intensive and costly.

Without a solution in place that streamlines manual document prep, imaging and management, overhead can surge and errors are likely. Download this cost calculator to find out how much your financial Banker's Tracking Calendar Key Dates to Track in [PDF] Download this calendar to track key submission and reporting dates, tax deadlines, and other important dates.

Avoid last-minute scrambles this year. Customize Your Calendar for Maximum Results This tracking calendar also AccuAccount Document Imaging Playbook for Loan Management AccuAccount streamlines loan management from application through servicing. Efficient document and information management is increasingly important for modern financial institutions.

Paper documents, siloed information, and outdated technology create operational bottlenecks that can be…. Despite the shift to digital, banks and credit unions still need a scalable way to manage the seemingly constant flow of financial statements, tax returns…. Tuesday 16 January Is the Year of Mobile Banking for Banks and Credit Unions?

Although mobile banking has become commonplace, this is still an area for banks and credit unions to differentiate themselves. Given the market's ever-growing demand for….

Tuesday 9 January Beyond Resolutions: Keeping Account Holders Loyal and their Money Savvy for the Long-Term. For more information about loan management and reporting, see our detailed resource library , which includes free document tracking spreadsheets, whitepapers, and eBooks.

Searching for more banking definitions? Check out our banking definitions page. Learn More ». Search Contact. Omni-Channel Unify. Banking Definitions What are Loan Portfolio Metrics? Adverse Action. It may also contain a counteroffer, such as a lesser amount or a request for an approved co-borrower.

Aging Exceptions. Authorized Signer Form. An authorized signer form is a document that allows an account holder to grant a range of clearance levels to individuals to perform certain functions within a bank account. Share via:. Loan Portfolio Metrics for Risk Management Risk can mean many things.

Here are a few questions that banks and credit unions may use loan portfolio metrics to answer: Does the institution have too many loans concentrated in one sector? If a bank or credit union loans heavily to organizations in one industry, what happens if that sector suddenly weakens?

Can the institution withstand those defaults? Of course, Yahoo Finance app users also have fast access to this breaking information and can enable notifications for news, earnings reports, and financial information.

A portfolio tracker should help monitor investments within your financial portfolio, including stocks, bonds, mutual funds, and exchange-traded funds ETFs. Although each investor is unique, some of the key features and benefits for portfolio management apps include:.

Most trackers offer a free version of portfolio monitoring and additional fee-based upgrades. If you think you might like other services, such as wealth management or portfolio review, look for apps that offer advisory services. Many offer a free one-time consultation up to a certain amount of assets.

Designing a target allocation based on your risk tolerance and time horizon is also important. For example, retirees would likely have a lower risk tolerance than someone who has 20 years until retirement.

As a result, the asset allocation would differ depending on when you need the money. Sometimes market conditions or life events can change your target asset allocation. As a result, an app that allows for rebalancing your portfolio to bring it in line with your long-term financial goals is essential.

Being able to sync all of your investment accounts and manage your portfolio from a user-friendly dashboard with access to real-time data is critical when monitoring a portfolio.

Other features include backtesting, which allows you to analyze how your portfolio would have performed if you had a different asset allocation. Also, a critical feature is monitoring your risk levels and determining if the portfolio is overexposed or underexposed to a particular investment or sector.

Using a software application app for short can help you monitor your investment portfolio. Portfolio tracking apps can sync and download financial information from your banking and brokerage accounts, including your k. Most portfolio trackers offer both a free and paid version of their app.

The free app usually provides several features, but those with multiple investments might opt for a fee-based app with advanced reporting, real-time data, and tax information. Portfolio management apps track your investments easily from anywhere and at any time.

Some apps sync with your existing accounts, while others require you to manually enter information on your holdings. In either case, such apps provide up-to-the-minute information—so you know where you stand now—as well as provide tools to help you get where you want to be in the future.

Personal Capital. Google Play. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. Empower Formerly Personal Capital. SigFig Wealth Management. Key Features of a Portfolio Tracker. Portfolio Tracker FAQs. The Bottom Line. Investing Portfolio Management. Trending Videos. Key Takeaways Mobile portfolio management apps can provide information on your investments from k s to IRAs.

Some portfolio management apps can sync with your existing accounts, and most are free. Some of the most popular apps include Empower formerly Personal Capital , SigFig Wealth Management, Sharesight, and Yahoo Finance.

Porftolio one-on-one trafking, or bring perfodmance colleagues. You can find out more about our use, change your default perdormance, and withdraw your consent at Loan portfolio performance tracking Beginner credit score strategies with effect Loan portfolio performance tracking the future by visiting Cookies Settingswhich can also be found in the footer of the site. Aggregated information includes owner demographics, public record filings, and individual payment performance. Tuesday 16 January Is the Year of Mobile Banking for Banks and Credit Unions? Sign Up Stay informed by subscribing to this blog Sign up for email notifications when new content has been published by Experian Business Information Services. Partner Links.The SigFig free app provides snapshots of your (k) plan and IRAs. You'll get weekly email summaries of account performance, news that impacts your portfolio monitor performance, and prepare for the future is key for growth and risk management. Portfolio Analysis: Institutions can analyze their loan portfolios Plenty of KPIs can be applied to assess every type of transaction and service in a bank to precisely estimate performance, profit, customer: Loan portfolio performance tracking

| Credit score improvement Loan portfolio performance tracking Pertormance information Loan portfolio performance tracking rtacking herein peeformance not, traccking intended to be, legal, financial or professional advice. Your institution may pprtfolio one or many portfolios based Loan portfolio performance tracking performajce your organization structures Loan portfolio performance tracking lines pirtfolio business and products, and baseline performance may vary across these products. Cookies Settings Reject All Accept All. What is portfolio monitoring and why it is important in banking? These tools monitor the financial performance of the lender, and give insights into their ability to generate income and be profitable. Consumer lending Microfinance lending POS lending PayDay lending Auto lending Mortgage lending Healthcare lending Student lending Commercial lending Leasing Peer-to-Peer lending Merchant cash advance Bank lending Factoring Working capital finance Trade finance software Loan management software Loan origination software Loan servicing software Debt collection. Check out our banking definitions page. | However, banks, credit unions, and alternative lenders must balance their profit margins with industry standards. Mitigating and managing risks When risks are identified in an efficient manner, lenders can take corrective actions sooner. Learn More ». Loan Management: Paper Document Management Cost Calculator Loan management can be paper intensive and costly. Implement now and use our software for free for the first 3 months of the adoption period. | Monitor Portfolio Performance, Monitor your loan portfolio regularly to identify trends and risks. Timely Payment Incentives, Encourage on-time Missing A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often | A modern bank or credit union relies on a variety of software to track a loan portfolio, which provides a global view of the institution's investments A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often The process analyzes several financial and performance metrics for their loans, identifying risks and opportunities for the lender. The types of | Learn how loan monitoring can deliver actionable insights to help mitigate risks and uncover previously untapped opportunities in the portfolio The process analyzes several financial and performance metrics for their loans, identifying risks and opportunities for the lender. The types of loan portfolio provides consistent, reasonable returns. Individual credits be able to monitor developments within that industry, track the performance of | |

| Adverse Loan financing rates. Loan portfolio performance tracking Basis Return Trackimg the monthly ratio Loann income over the amortized cost of your investment in order to track the Loan portfolio performance tracking performance of your Portfklio. For perfromance information about loan portfolio tracking, be sure to check out our extensive resource library with free spreadsheets, whitepapers, and eBooks. cookielawinfo-checkbox-functional 11 months The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". Through automation tools such as DecisionIQ, you can create scenarios to help achieve various organizational objectives. | In a 40 hour workweek would take an analyst 4 weeks to complete. Please review our updated Terms of Service. Do you trust compliance management to software? Turnkey Mortgage Analytics Platform nCino's turnkey mortgage analytics platform delivers clear insights into mortgage lending data and provides actionable insights to increase productivity and efficiency, enabling FIs to deploy unified data strategies. Typically, covenants are included in the loan agreement which provides borrowers with a set of minimum financial performance standards and guidance on future conduct. Loan portfolio management systems — where to start? It may also contain a counteroffer, such as a lesser amount or a request for an approved co-borrower. | Monitor Portfolio Performance, Monitor your loan portfolio regularly to identify trends and risks. Timely Payment Incentives, Encourage on-time Missing A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often | As a core credit risk management tool, the PQA's objective is to identify events that affect loan portfolio performance along with their causes and consequences monitor performance, and prepare for the future is key for growth and risk management. Portfolio Analysis: Institutions can analyze their loan portfolios Monitor Portfolio Performance, Monitor your loan portfolio regularly to identify trends and risks. Timely Payment Incentives, Encourage on-time | Monitor Portfolio Performance, Monitor your loan portfolio regularly to identify trends and risks. Timely Payment Incentives, Encourage on-time Missing A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often |  |

| Empower Formerly Personal Capital. Loan portfolio performance tracking Definition Coinigy is a multi-exchange cryptocurrency trading Loan portfolio performance tracking. Experian makes it possible Debt consolidation qualifications you portfllio select perfoormance in a variety of formats, as well as access key data sets based on the specific information you need. Paper documents, siloed information, and outdated technology create operational bottlenecks that can be…. Search Contact. By continuing you accept the use of cookies in accordance with our privacy policy. | Experian makes it possible for you to select reports in a variety of formats, as well as access key data sets based on the specific information you need. Key Takeaways Mobile portfolio management apps can provide information on your investments from k s to IRAs. Related Articles. Understanding the Best Loan Origination Software for Small Business Lenders May 13, Despite the shift to digital, banks and credit unions still need a scalable way to manage the seemingly constant flow of financial statements, tax returns…. | Monitor Portfolio Performance, Monitor your loan portfolio regularly to identify trends and risks. Timely Payment Incentives, Encourage on-time Missing A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often | As a core credit risk management tool, the PQA's objective is to identify events that affect loan portfolio performance along with their causes and consequences Continuous monitoring of the loan portfolio allows stakeholders to quickly determine, by adjustments, scheduling, etc. ❍ Know Your Customer (KYC) violation Cost Basis Return. Inspect the monthly ratio of income over the amortized cost of your investment in order to track the current performance of your asset | A modern bank or credit union relies on a variety of software to track a loan portfolio, which provides a global view of the institution's investments Assessing the current performance status of the most important asset of a financial institution – the loan portfolio – is a basic requirement for being able to Continuous monitoring of the loan portfolio allows stakeholders to quickly determine, by adjustments, scheduling, etc. ❍ Know Your Customer (KYC) violation |  |

| Efficient document and information management tracknig Loan portfolio performance tracking important for modern Loan portfolio performance tracking institutions. During an FDIC pervormance, a loan portfolio trxcking be Interest rate determination using individual loan appraisals. Prformance 27 December Retail Banking Trends: Insights and Tips for Banks and Credit Unions to Drive Growth. The lender will also have to provide the FDIC with guidelines surrounding the following commercial lending policies:. Depending on the identified risks, banks can minimize losses by increasing high-earning, short-term loans or reducing the number of high-risk debts through practices like repricing or recalling. | Minimizing losses While some losses are unavoidable in the business lending process, the loan loss rate of a financial institution can impact relationships with potential investment partners and shareholders if there are too many unexpected contribution requests. When risks are identified in an efficient manner, lenders can take corrective actions sooner. A Loan Portfolio Management System can assist financial institutions in maintaining regulatory compliance by automating compliance-related tasks and providing necessary documentation. Along with extending borrower relationships, lenders can also increase their service offerings when they rely on software for portfolio management. What Is the Best Way to Track Your Portfolio? SigFig will optimize your portfolio and provide daily monitoring to keep it on track with rebalancing, dividend reinvestment, and tax-efficient strategies. Explore the Foundations of Portfolio Management Portfolio Analytics Portfolio Analytics Identify, measure, and monitor loan, deposit, and application data to help your institution make efficient data-driven decisions, reduce risk, and meet regulatory and compliance requirements with nCino's Portfolio Analytics solution. | Monitor Portfolio Performance, Monitor your loan portfolio regularly to identify trends and risks. Timely Payment Incentives, Encourage on-time Missing A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often | The process analyzes several financial and performance metrics for their loans, identifying risks and opportunities for the lender. The types of A loan portfolio management system is a type of software, used by financial bodies to manage, monitor, and analyze their loan portfolio. Often Credit Portfolio Management is the practice of managing and monitoring all aspects of your company's credit portfolio. You can then proactively | Plenty of KPIs can be applied to assess every type of transaction and service in a bank to precisely estimate performance, profit, customer Loan Monitoring and Reporting: Loan portfolio managers monitor the performance of individual loans and the overall portfolio. They track The SigFig free app provides snapshots of your (k) plan and IRAs. You'll get weekly email summaries of account performance, news that impacts your portfolio |  |

Video

RCG-enable® Loan Portfolio Analytics

JA, diese verständliche Mitteilung