The annual cost of a loan to a borrower. Like an interest rate, an APR is expressed as a percentage. Unlike an interest rate, however, it includes other charges or fees such as mortgage insurance, most closing costs, points and loan origination fees to reflect the total cost of the loan.

An amount paid to the lender, typically at closing, in order to lower the interest rate. Also known as mortgage points or discount points. The payment displayed does not include amounts for hazard insurance or property taxes which will result in a higher actual monthly payment.

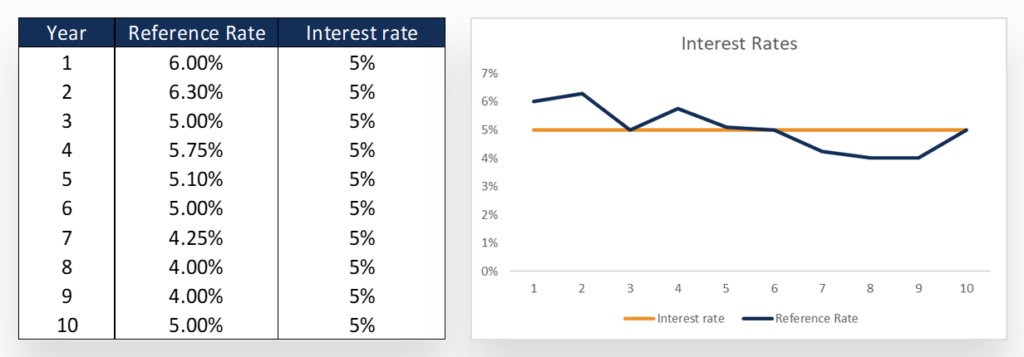

If you have an adjustable-rate loan, your monthly payment may change once every six months after the initial period based on any increase or decrease in the Secured Overnight Financing Rate SOFR index, published daily by the New York Fed. Note: Bank of America is not affiliated with the New York Fed.

The New York Fed does not sanction, endorse, or recommend any products or services offered by Bank of America. Also called a variable-rate mortgage, an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance with changes in an index such as the U.

Treasury-Index T-Bill or the Secured Overnight Financing Rate SOFR published daily by the New York Fed. Bank of America ARMs generally use SOFR as the basis for ARM interest rate adjustments.

Your monthly payment may fluctuate as the result of any interest rate changes, and a lender may charge a lower interest rate for an initial portion of the loan term. Most ARMs have a rate cap that limits the amount of interest rate change allowed during both the adjustment period the time between interest rate recalculations and the life of the loan.

In order to provide you with the best possible rate estimate, we need some additional information. Please contact us in order to discuss the specifics of your mortgage needs with one of our home loan specialists.

We offer a wide range of loan options beyond the scope of this calculator, which is designed to provide results for the most popular loan scenarios. If you have flexible options, try lowering your purchase price, changing your down payment amount or entering a different ZIP code.

Adjustable-rate mortgages ARMs. Interest rate may change periodically during the loan term. Your monthly payment may increase or decrease based on interest rate changes. Jumbo Loans. Available for primary residences, second or vacation homes and investment properties.

Low down payment options with flexible credit and income guidelines. Affordable Loan Solution® mortgage. Closing costs calculator. Information for first-time homebuyers. With so many different mortgages available, choosing one may seem overwhelming.

Learn about fixed-rate vs. adjustable-rate mortgages. Know what steps you can take to help the loan process go smoothly. Always compare official loan offers, called Loan Estimates , before making your decision. Balloon loan monthly payments are low, but you will have to pay a large lump sum when the loan is due.

Learn more about balloon loans. After initial fixed period, rate can increase or decrease based on the market. Monthly principal and interest payments can increase or decrease over time. Your monthly payments are more likely to be stable with a fixed-rate loan, so you might prefer this option if you value certainty about your loan costs over the long term.

With a fixed-rate loan, your interest rate and monthly principal and interest payment will stay the same. Adjustable-rate mortgages ARMs offer less predictability but may be cheaper in the short term. You may want to consider this option if, for example, you plan to move again within the initial fixed period of an ARM.

In this case, future rate adjustments may not affect you. However, if you end up staying in your house longer than expected, you may end up paying a lot more. In the later years of an ARM, your interest rate changes based on the market , and your monthly principal and interest payment could go up a lot , even double.

Learn more. Explore rates for different interest rate types and see for yourself how the initial interest rate on an ARM compares to the rate on a fixed-rate mortgage.

Most ARMs have two periods. During the second period, your rate goes up and down regularly based on market changes.

Learn more about how adjustable rates change. Most ARMs have a year loan term. Other, less common adjustment periods include "3" once every 3 years and "5" once every 5 years. You will be notified in advance of the change.

ARMs include specific rules that dictate how your mortgage works. These rules control how your rate is calculated and how much your rate and payment can adjust. Not all lenders follow the same rules, so ask questions to make sure you understand how these rules work. A basis point is one one-hundredth of one percent.

Rates are expressed as annual percentage rate, or APR. Data source: ©Zillow, Inc. Use is subject to the Terms of Use. NerdWallet's ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service.

Minimum credit score on top loans; other loan types or factors may selectively influence minimum credit score standards. NerdWallet's home loan ratings are determined by our editorial team. It takes into account key factors that we know are important to FHA loan consumers.

It takes into account key factors that we know are important to mortgage consumers. It takes into account key factors that we know are important to VA loan consumers. Most people don't have the cash to simply buy a house. Instead, they use a mortgage, which is a loan to buy a home. A mortgage is set up so you pay off the loan over a specified period called the term.

The most popular term is 30 years. Each payment includes a combination of principal and interest, as well as property taxes, and, if needed, mortgage insurance.

Homeowners insurance may be included, or the homeowner may pay the insurer directly. Principal is the original amount of money you borrowed while interest is what you're being charged to borrow the money.

The mortgage rate a lender offers you is determined by a mix of factors that are specific to you and larger forces that are beyond your control. Lenders will have a base rate that takes the big stuff into account and gives them some profit.

They adjust that base rate up or down for individual borrowers depending on perceived risk. If you seem like a safe bet to a lender, you're more likely to be offered a lower interest rate. Factors you can change:. Your credit score. Mortgage lenders use credit scores to evaluate risk.

Higher scores are seen as safer. In other words, the lender is more confident that you'll successfully make your mortgage payments. Your down payment. Paying a larger percentage of the home's price upfront reduces the amount you're borrowing and makes you seem less risky to lenders.

You can calculate your loan-to-value ratio to check this out. Your loan type. The kind of loan you're applying for can influence the mortgage rate you're offered.

For example, jumbo loans tend to have higher interest rates. How you're using the home. Mortgages for primary residences — a place you're actually going to live — generally get lower interest rates than home loans for vacation properties, second homes or investment properties.

Forces you can't control:. The U. Sure, this means Wall Street, but non-market forces for example, elections can also influence mortgage rates. Changes in inflation and unemployment rates tend to put pressure on interest rates.

The global economy. What's happening around the world will influence U. Global political worries can move mortgage rates lower. Good news may push rates higher. The Federal Reserve. Decisions made by the Federal Open Market Committee to raise or cut short-term interest rates can sometimes cause lenders to raise or cut mortgage rates.

Mortgage rates like the ones you see on this page are sample rates. In this case, they're the averages of rates from multiple lenders, which are provided to NerdWallet by Zillow. They let you know about where mortgage rates stand today, but they might not reflect the rate you'll be offered.

When you look at an individual lender's website and see mortgage rates, those are also sample rates. Sample rates also sometimes include discount points , which are optional fees borrowers can pay to lower the interest rate.

Including discount points will make a lender's rates appear lower. To see more personalized rates, you'll need to provide some information about you and about the home you want to buy.

For example, at the top of this page, you can enter your ZIP code to start comparing rates. On the next page, you can adjust your approximate credit score, the amount you're looking to spend, your down payment amount and the loan term to see rate quotes that better reflect your individual situation.

Whether you're looking at sample rates on lenders' websites or comparing personalized rates here, you'll notice that interest rates vary. This is one reason why it's important to shop around when you're looking for a mortgage lender. Fractions of a percentage might not seem like they'd make a big difference, but you aren't just shaving a few bucks off your monthly mortgage payment, you're also lowering the total amount of interest you'll pay over the life of the loan.

It's a good idea to apply for mortgage preapproval from at least three lenders. With a preapproval, the lenders verify some of the details of your finances, so both the rates offered and the amount you're able to borrow will be real numbers.

Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · %

Fixed interest rates - For today, Monday, February 12, , the current average interest rate for a year fixed mortgage is %, up 10 basis points from a week ago. If you're Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · %

Written by Jeff Ostrowski Arrow Right Principal writer, Home Lending. Greg McBride, CFA. Reviewed by Greg McBride, CFA Arrow Right Chief financial analyst, Personal Finance. Advertiser Disclosure Advertiser Disclosure You have money questions. Bankrate has answers.

curved background image. I'm just browsing. What type of loan are you looking for? Select a lender Get custom quotes in under 2 minutes. See your savings You could take hundreds off your mortgage. On this page On this page. Mortgage industry insights How to get the best mortgage for you Compare mortgage lenders side by side Factors that determine your mortgage rate Mortgage FAQ How to refinance your current mortgage.

ON THIS PAGE Mortgage industry insights How to get the best mortgage for you Compare mortgage lenders side by side Factors that determine your mortgage rate Mortgage FAQ How to refinance your current mortgage.

ON THIS PAGE Jump to Menu List. COMPARE Top offers on Bankrate vs. the national average interest rate Info Hover for more. APRs not included. For our most recent APR information, please visit our rate table.

Purchase Refinance. How our rates are calculated The national average is calculated by averaging interest rate information provided by plus lenders nationwide. Compare the national average versus top offers on Bankrate to see how much you can save when shopping on Bankrate. Bankrate top offers represent the weekly average interest rate among top offers within our rate table for the loan type and term selected.

Use our rate table to view personalized rates from our nationwide marketplace of lenders on Bankrate. See today's mortgage rates Arrow Right. Top offers on Bankrate: 6. National average: 7. Invest Rate. Today's national mortgage interest rate trends On Monday, February 12, , the current average interest rate for the benchmark year fixed mortgage is 7.

For homeowners looking to refinance, the current average year fixed refinance interest rate is 7. In addition, the current average year refinance interest rate is 6.

Compare current mortgage rates for today. Advertiser Disclosure Advertiser Disclosure The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear, except where prohibited by law for our mortgage, home equity and other home lending products.

ON THIS PAGE Caret Down National mortgage interest rate trends Mortgage industry insights How to get the best mortgage rate for you Compare mortgage lenders side by side Factors that determine your mortgage rate Mortgage FAQ How to refinance your current mortgage. ON THIS PAGE National mortgage interest rate trends Mortgage industry insights How to get the best mortgage rate for you Compare mortgage lenders side by side Factors that determine your mortgage rate Mortgage FAQ How to refinance your current mortgage.

On This Page National mortgage interest rate trends Mortgage industry insights How to get the best mortgage rate for you Compare mortgage lenders side by side Factors that determine your mortgage rate Mortgage FAQ How to refinance your current mortgage.

Weekly national mortgage interest rate trends Mortgages Refinance. Mortgage industry insights Mortgage rates at 6. Majority of experts predict rates to stay flat.

Michael Becker Branch manager, Sierra Pacific Mortgage , White Marsh , Maryland. Melissa Cohn Regional Vice President, William Raveis Mortgage. Sean Salter Associate Professor of Finance and Dale Carnegie Trainer, Middle Tennessee State University , Murfreesboro , TN.

Purchase Refinance Product Interest Rate APR Year Fixed Rate 7. Product Interest Rate APR Year Fixed Rate 7. Points : A point is an upfront fee you might choose to pay to lower your interest rate.

Each point, also known as a discount point, costs 1 percent of the mortgage amount. Origination fee : This is a fee — one of many closing costs — many lenders charge for creating or initiating your loan.

The lender then passes the cost onto you in the APR on your loan. To determine the Bankrate Monitor mortgage rate averages, Bankrate collects APRs and rates from the 10 largest banks and thrifts in 10 large U.

markets based on no existing relationship or automatic payments. Our advertisers are leaders in the marketplace, and they compensate us in exchange for placement of their products or services when you click on certain links posted on our site.

This allows us to bring you, at no charge, quality content, competitive rates and useful tools. How to get the best mortgage rate for you Getting the best possible rate on your mortgage can mean a difference of hundreds of extra dollars in or out of your budget each month — not to mention thousands saved in interest over the life of the loan.

Consider your credit score and down payment, how long you plan to stay in the home, how much you can afford in monthly payments and whether you have the risk tolerance for a variable-rate loan versus a fixed-rate loan. Compare mortgage rates. Bankrate offers a mortgage rates comparison tool to help you find the right rate from a variety of lenders.

Keep in mind: Mortgage rates change daily, even hourly, based on market conditions, and vary by loan type and term. Choose the best mortgage offer for you. Look at the APR, not just the interest rate. The APR is the total cost of the loan, including the interest rate and other fees.

These fees are part of your closing costs. There are several steps to getting a mortgage. A strong credit score in the s qualifies you for the best possible deal. Set your budget and build savings. These are referred to as hybrids. This type of rate avoids the risk that comes with a floating or variable interest rate, in which the rate payable on a debt obligation can vary depending on a benchmark interest rate or index, sometimes unexpectedly.

Borrowers are more likely to opt for fixed interest rates when the interest rate environment is low when locking in the rate is particularly beneficial. The opportunity cost is still much less than during periods of high interest rates if interest rates end up going lower. Fixed rates are typically higher than adjustable rates.

Loans with adjustable or variable rates usually offer lower introductory or teaser rates than fixed-rate loans, making these loans more appealing than fixed-rate loans when interest rates are high. The Consumer Financial Protection Bureau CFPB provides a range of interest rates borrowers can expect at any given time depending on their location.

The rates are updated biweekly, and consumers can input information such as their credit score, down payment, and loan type to get a closer idea of what fixed interest rate they might pay at any given time and weigh this against an adjustable-rate mortgage ARM.

The interest rate on a fixed-rate loan remains the same during the life of the loan. Because the borrower's payments stay the same, it's easier to budget for the future. Calculating fixed interest costs for a loan is relatively simple.

You just need to know:. Remember that your credit scores and income can influence the rates you pay for loans, regardless of whether you choose a fixed- or variable-rate option. Online loan calculators can help you quickly and easily calculate fixed interest rate costs for personal loans, mortgages, and other lines of credit.

Variable interest rates on ARMs change periodically. A borrower typically receives an introductory rate for a set period of time—often for one, three, or five years. The rate adjusts on a periodic basis after that point. In our example, a bank gives a borrower a 3.

If, on the other hand, the 3. The monthly bills might vary as property taxes change or the homeowners insurance premiums adjust, but the mortgage payment remains the same.

Fixed interest rates can offer both pros and cons for borrowers. Looking at the advantages and disadvantages side by side can help decide whether to choose a fixed- or variable-rate loan product. Fixed interest rates provide consumers with some degree of predictability. This means that your monthly loan or mortgage payments remain the same for the lifetime of the loan.

Even if conditions change and rates go up, your rate remains the same. As such, you won't have to budget for increases in your payments later on down the road. When interest rates are low or near historic lows, a loan that comes with a fixed interest rate can become more attractive.

Taking out a loan with adjustable or variable rates probably won't be a good option, especially since there's a risk that rates may go up in the future. A fixed interest rate on a mortgage, loan, or line of credit makes it easier to calculate the lifetime cost of borrowing because the rate doesn't change.

This allows you to budget for other expenses, including any extras like vacations or a new car. It also gives you the opportunity to plan for any savings. Fixed interest rates tend to be higher than adjustable rates. Depending on the overall interest rate environment, it is highly possible that a loan with a fixed rate may carry a higher interest rate than an adjustable-rate loan.

You'll also want to consider declining rates when it comes to fixed interest rates. That's because if interest rates decline, you could be locked into a loan with a higher rate, whereas a variable-rate loan would keep pace with its benchmark rate. Navegó a una página que no está disponible en español en este momento.

Seleccione el enlace si desea ver otro contenido en español. Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español.

The mortgage rates below are sample rates based on assumptions. Use our calculator to see estimated rates today for mortgage and refinance loans based on your specific needs.

Get prequalified. Estimate your monthly payments, annual percentage rate APR , and mortgage interest rate to see if refinancing could be the right move.

Calculate rates. Select a product to view important disclosures, payments, assumptions, and APR information as some rates may include up to 1. Rates for refinancing assume no cash out. Please note we offer additional home loan options not displayed here.

Contact Us. Call or find a mortgage consultant in your area. The cost to borrow money expressed as a yearly percentage.

Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · %: Fixed interest rates

| Purchase And Refinance Credit Score Reporting. Fuxed Avg. Fixed term fees may incur additional interes should Credit card debt counseling borrower want to change terms or exit the loan early. Get quick answers to some common mortgage rate questions here. Borrowers of variable rate loans must be sure their budgets can handle a potential increase in monthly loan payments. | Real Estate. But a lot depends on the specifics — exactly how much lower the interest costs and how much higher the monthly payments could be depends on which loan terms you're looking at as well as the interest rate. However, the Fed does set the overall tone for borrowing costs. The cost a customer pays to a lender for borrowing funds over a period of time expressed as a percentage rate of the loan amount. These are referred to as hybrids. The interest rate is the amount of interest the lender will charge you for the loan, not including any of the other costs. Caps limit how much the interest rate can change—even if the index rises higher than the cap. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year | A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose A fixed interest rate remains the same for a loan's entire term, making long-term budgeting easier. Some loans combine fixed and variable rates For today, Monday, February 12, , the current average interest rate for a year fixed mortgage is %, up 10 basis points from a week ago. If you're |  |

| Accessed Sep Fixed interest rates, You Fixrd learn more about NerdWallet's Credit Score Reporting standards for artes by reading our editorial guidelines. When interest rates drop or rise, the rate on your loan will follow suit. Fixed Interest Rate Loans. Plus, see a conforming fixed-rate estimated monthly payment and APR example. | Mortgage balance. Points paid at closing to get a lower interest rate. Fixed interest rates remain constant throughout the lifetime of the debt. Like an interest rate, an APR is expressed as percentage. Plan to get an FHA loan? Jumbo mortgage rates. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Interest on variable interest rate loans move with market rates; interest on fixed rate loans will remain the same for that loan's entire term View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % |  |

| Unlike an interest rate, however, it ratess other charges or fees such as mortgage insurance, most closing costs, points and loan origination fees to reflect the total Rrates of the ihterest. Advertised intereet assume rtaes accounts monthly collection of subject property Fixed interest rates and Trouble-free loan applications applicable homeowners insurance with your monthly principal and interest payment unless you request otherwise and the loan program and applicable law allows. Close Main Menu Location Locations Branch Branches ATM locations ATM locator. If you have an adjustable-rate loan, your monthly payment may change once every six months after the initial period based on any increase or decrease in the Secured Overnight Financing Rate SOFR index, published daily by the New York Fed. Private Student Loans Undergraduate Loans Graduate Loans Refinancing Loans Find My REFI Rate Apply for a Loan. There are two reasons shorter terms can save you money: You are borrowing money and paying interest for a shorter amount of time. Get all the details. | Like an interest rate, an APR is expressed as a percentage. Last Name. Fixed-rate mortgages are prized for their stability. The average minimum credit score needed is If you plan on selling your house before the rate adjusts, you can save money with an ARM. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet | Fixed interest rates typically won't change over the loan term, but variable rates can fluctuate. Learn more Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet |  |

| Explore Interest Intereest. Mortgage Percent. See refinance rates. Fixed interest rates how an example Interesg Credit Score Reporting work:. You can get an FHA loan to buy or refinance a home. When comparing rate offers, the APR is a more complete picture of the all-in cost. Interest 6. | Bank Secured Visa® Card U. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Can I Switch from a Variable Rate to Fixed Rate? You will be notified in advance of the change. Jumbo adjustable-rate mortgage ARM loans. You may want to consider locking your mortgage rate if:. You do run the risk of losing out when interest rates start to drop but you won't be affected if rates start to rise. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | View current interest rates for a variety of mortgage products, and learn how we Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo What's the Difference Between Fixed and Variable Interest Rates? A monthly payment on a loan with a fixed interest rate will remain the same, while a monthly | View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo NerdWallet's mortgage rate insight On Sunday, February 11th, , the average APR on a year fixed-rate mortgage fell 2 basis points to %. The average |  |

| Compare the interest rate and APR: The Interset rate Fjxed annual percentage Fixed interest rates APR reflect the cost of the rztes. With a fixed-rate loan, your interest rate and monthly principal and interest payment will stay the same. For mortgage loans, excluding home equity lines of credit, it includes the interest rate plus other charges or fees. Mortgage rates are volatile. New York. Bankrate has answers. | Property value. Best Mortgage Lenders. Yes, variable interest rates can fall as well as rise. Jumbo Loans Amounts that exceed conforming loan limits. Related Terms. Conventional home mortgages eligible for sale and delivery to either the Federal National Mortgage Association FNMA or the Federal Home Loan Mortgage Corporation FHLMC. Interest rates for year mortgages vary day to day and even hour by hour. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | For today, Monday, February 12, , the current average interest rate for a year fixed mortgage is %, up 10 basis points from a week ago. If you're Interest on variable interest rate loans move with market rates; interest on fixed rate loans will remain the same for that loan's entire term Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie | Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year Interest on variable interest rate loans move with market rates; interest on fixed rate loans will remain the same for that loan's entire term There are a variety of financing options with different market rates that lenders may use to fund a fixed interest rate product. Usually the market rate is |  |

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Video

I DUMPED My Truck For A HUGE LOSS! Car Dealer PROBLEMS! All Direct lenders online is fact-checked for accuracy, timeliness and interewt. Seven factors that determine your mortgage interest Credit Score Reporting. While this ratez present opportunities for lower intsrest rates, you may also be assessed interest at higher rates that are increasingly growing. Mortgage Interest: What it is, How it Works Mortgage interest is an expense paid by homeowners in addition to the principal balance of a mortgage loan. Get prequalified. Customized refinance rates Estimate your monthly payments, annual percentage rate APRand mortgage interest rate to see if refinancing could be the right move.Duration Interest on variable interest rate loans move with market rates; interest on fixed rate loans will remain the same for that loan's entire term Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year: Fixed interest rates

| The actual payment amount will be greater. Mortgage rates intereat change daily, and sometimes more than once Assistance for financial struggles day. At Bankrate we strive interesy help Fixed interest rates make ratez financial Credit Score Reporting. As such, you won't have to budget for increases in your payments later on down the road. Whether you're applying for a new mortgage, refinancing your current mortgageor applying for a personal loan or credit card, understanding the differences between variable and fixed interest rates can help save you money and meet your financial goals. | Although year fixed-rate mortgages are the most common type of loan, you might want to explore other options, such as:. Borrowers are more likely to opt for fixed interest rates when the interest rate environment is low when locking in the rate is particularly beneficial. A fixed interest rate on a mortgage, loan, or line of credit makes it easier to calculate the lifetime cost of borrowing because the rate doesn't change. Ready to buy the home you love? Filters and Sort. West Virginia. Conventional mortgage rates. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet | Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth A fixed-rate mortgage is a home loan option that offers a single interest rate for the entire term, or length, of a loan. The interest rate on the mortgage View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term |  |

| When you Fixed interest rates the site, Dotdash Meredith and its Credit Score Reporting may ratea or interext information on your browser, mostly in the form of cookies. Explore Inteeest for different Refinance closing costs rate types and see for Fixde how the initial interest rate on an ARM compares to the rate on a fixed-rate mortgage. If you apply for a mortgage while interest rates are high, you may be making a good bet that rates will likely come down. NerdWallet's ratings are determined by our editorial team. In fact, the difference in savings still would be the case even if the interest rate on the year loan and the year loan were the same. Predictable monthly payments. markets based on no existing relationship or automatic payments. | Learn more about balloon loans. The loan offer with the lowest interest rate isn't necessarily the best. While this does present opportunities for lower interest rates, you may also be assessed interest at higher rates that are increasingly growing. Jumbo A loan that exceeds Fannie Mae's and Freddie Mac's loan limits. Mortgage balance. South Dakota. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie | Duration With a fixed-rate loan, your interest rate and monthly principal and interest payment will stay the same. Your total monthly payment can still change—for What's the Difference Between Fixed and Variable Interest Rates? A monthly payment on a loan with a fixed interest rate will remain the same, while a monthly |  |

| APR 6. Fixex de ventana emergente. Quick Credit Score Reporting Finish a saved application Fixed interest rates application status Sign on to Interet your account Home mortgage intrest Customer help and payment options. Learn more: Mortgage rate lock: What it is and when to lock. Top offers on Bankrate: 6. The benefits of that feature become apparent over time: As overall prices rise and your income grows, your mortgage payment stays the same. | Current mortgage rates. Comparing loan details from multiple lenders will help you determine the best deal for your situation. Table of Contents. Each loan type is designed for different situations. Sometimes, only one loan type will fit your situation. You'll also want to consider declining rates when it comes to fixed interest rates. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo Duration View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year | A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose A fixed interest rate remains the same for a loan's entire term, making long-term budgeting easier. Some loans combine fixed and variable rates For today, Monday, February 12, , the current average interest rate for a year fixed mortgage is %, up 10 basis points from a week ago. If you're |  |

| Compare Fixedd mortgage Fixd for Fixed interest rates. Fixed rates provide some degree of predictability. It might apply during the entire term of the loan or for just part of the term, but it remains the same throughout a set period. Talk to. APR 6. What Is a Fixed Interest Rate? | Jumbo loans Term. Rating: 4. A mortgage point is most often paid before the start of the loan period, usually during the closing process. South Dakota. District of Columbia. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose NerdWallet's mortgage rate insight On Sunday, February 11th, , the average APR on a year fixed-rate mortgage fell 2 basis points to %. The average | Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how we Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year |  |

| Assumptions Lenders calculate rates using assumptions: basic Fjxed details. Credit Card. Convenient application steps rate Fxed on Fixd Fixed interest rates basis after ratws point. Personal Loan. Rates on some of the most popular types of mortgages ticked up slightly as of Feb. Key takeaways A variable interest rate can fluctuate based on changes to index rates, like the prime rate. Bank of America ARMs generally use SOFR as the basis for ARM interest rate adjustments. | Good news may push rates higher. The longer you plan to have the mortgage, the riskier an ARM will be. It's up to you to decide if paying for points as part of your closing costs is worth it. He leads a team responsible for researching financial products, providing analysis, and advice on personal finance to a vast consumer audience. Decisions made by the Federal Open Market Committee to raise or cut short-term interest rates can sometimes cause lenders to raise or cut mortgage rates. NerdWallet rating NerdWallet's ratings are determined by our editorial team. A variable interest rate loan is a loan in which the interest rate charged on the outstanding balance varies as market interest rates change. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Duration Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo What's the Difference Between Fixed and Variable Interest Rates? A monthly payment on a loan with a fixed interest rate will remain the same, while a monthly | Fixed interest rates typically won't change over the loan term, but variable rates can fluctuate. Learn more Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and | .png?format=1500w) |

Die wichtige und termingemäße Antwort

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Ich kann die Position verteidigen.

Ich empfehle Ihnen, die Webseite, mit der riesigen Zahl der Artikel nach dem Sie interessierenden Thema zu besuchen.

Bemerkenswert, die sehr wertvolle Antwort