You further increase your savings by cutting down on expenses like streaming, gym membership, etc. This is the best time to separate your needs from your wants and try to cut expenses that you incur towards fulfilling your wants.

Earning some extra income is helpful in reducing your debts. You need to find a source through which you can earn some extra money. This can be in the form of working in your free time freelancing , doing an extra shift, etc. Another option is to negotiate with creditors or lenders.

Ask the lender to reduce the interest rate or give a rebate on the total amount due. Call your lender or credit card company and be transparent about your current financial status. Even if you succeed in getting a smaller rebate, it will be a win-win situation for both parties.

The reason for that is that no company likes to have pending-payments as well as those payment reminder calls. The strategy used by the debtor to pay off the creditors also plays a vital role in reducing the debts. Be wiser in selecting the debt which you want to pay off on a priority basis.

It can be done in two ways: Clear the debt with the highest interest rate: In this, the debtors aim at clearing the debt with the highest interest rate as it cost more money and also the fee. Once the debt is cleared, the borrower can start working on the debt, which has the second-highest interest rate, so on so forth.

Clear the debt with minimum amount: Clearing debt with minimum amount would act as a psychological boost for the borrower. The more and more creditors get deleted from the spreadsheet, the higher will be the motivation level. A Debt Free Day is the date selected by you to become debt-free. For successful planning, having a goal is very important.

Debt-free day act as that goal in case of debt reducing planning. Also, our life is not like a Fairy-tale.

It has its ups and downs. You never know what would be your financial situation after years. Also, once all your debts are cleared, you can start working towards other financial needs like a car loan, home loan, saving for a wedding, etc.

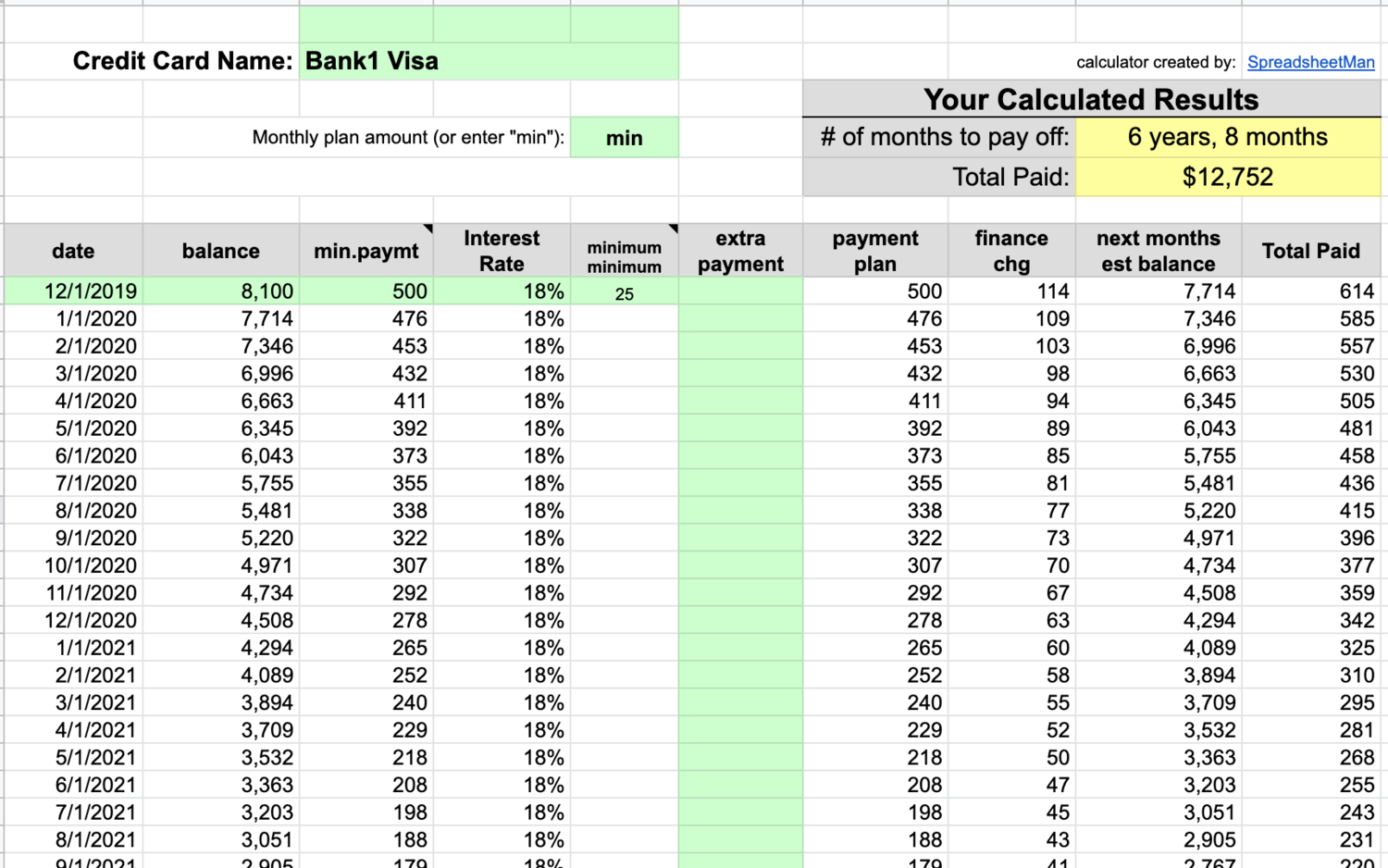

Irrespective of the method selected by you to pay off your debts, just make sure you stick your debt settlement plan. After clearing one debt, move forward and start working toward paying off the next creditor on your Debt Reduction spreadsheet. If you are planning to plan your debt settlement program, a debt reduction spreadsheet can be very helpful.

By this, you can find out whether the strategies planned by you would give you a fruitful result or not. This is how you use debt reduction spreadsheets to get out of debt and monitor your expenses wisely. Bank statements are more than just records of financial transactions; they are a window into the Navigating the complex world of finance requires breaking down important ideas into simpler terms In the world of finance, understanding the concepts of accounts payable and receivable is crucial Finance processes.

Valentine Schelstraete. Debt is something that you might not be proud of. This is why clearing debts is very important. Many debtors prefer taking guidance from the professionals for settling their debts.

Depending on the financial situation of the borrower, credit counseling agencies often suggest the debtor undergo a debt management program. These programs generally last for years. Credit counseling agencies A good credit counseling company not only helps the debtor in clearing off the debt but also help them in controlling expenses and managing their finances.

Use a debt reduction spreadsheet Besides being easy to use, these debt reduction spreadsheets are available for free. Two of its most popular versions are: 1. Debt Reduction Spreadsheet This version is highly advanced. This includes: Name of creditors Balance amount Interest rate charged Required monthly payment This helps you identify the creditor with maximum debt, minimum debt, highest interest rate, etc.

Debt reduction Spreadsheet Original This version of debt reduction is quite simple to use. And before you know it, debt freedom will be yours. While more people have success with the debt snowball method, the avalanche payoff approach is the best option mathematically.

Using this method, you pay off the debt with the highest interest rate first, regardless of how much you owe. In the example able, you would pay off your credit card debt first, because it has the highest interest rate.

A spreadsheet is one of the most helpful tools for planning the best debt payoff strategy for your situation. So here are some of the best free debt snowball spreadsheets for Google Sheets and Excel.

Note that some of these help you evaluate the avalanche method as well. The Tiller Community Debt Snowball Spreadsheet allows you to calculate estimated payoff dates and track your progress toward debt freedom.

Graphs will help you compare the two strategies side by side. The spreadsheet can be used for any type of debt.

Tiller automatically updates Google Sheets and Excel with your daily finances, including all your spending, account balances, and current debts and liabilities. Use the Debt Payoff Calculator for Google Sheets to plan the best debt payment strategy for the fastest payoff based on your current financial situation.

This is a simple, month debt-tracking spreadsheet that can help you track a snowball or avalanche strategy. Learn more and read comments about this template. Not a debt snowball spreadsheet, this simple credit payment calculator template can help you calculate the amount of money you must pay each month to fully repay your debt.

You can also view the monthly payment amount and the total interest paid if you make extra payments. You can use this tool to change your repayment plan and see how much longer it will take you to repay your loan. The Debt Reduction Calculator from Vertex42 is a spreadsheet that gets a little more intricate.

The first page allows you to input your debt and select your payoff strategy: Snowball, avalanche or stair-stepper — the last of which is a unique combination of the snowball and avalanche methods.

If you choose the snowball method, there is a handy chart that will show you your projected progress. Investopedia defines it here:. Using the debt avalanche method, once the debt with the highest interest rate is completely paid off, the extra repayment funds go toward the next highest interest-bearing debt.

This process continues until all the debts are paid off. But, we are emotional beings and even the most disciplined among us still have emotions and are affected by them.

Humans do not. We were not created to. We make decisions based on our emotions. We get let down, we get encouraged, we feel motivated, we get scared, we feel hopeful, we feel like quitting. These are all emotional states that each one of us could feel on any given day!!

Knowing that we are emotional beings, the key is to use our emotions to our advantage. Just like jogging with the wind at your back, it is a nice little boost to use our emotions to give us a little edge.

So, rather than tackling the debt like a math problem, we can tackle it in a way that will give us emotional boosts! There have been a couple studies I have found that prove the effectiveness of the debt snowball vs the debt avalanche approach.

Ever wonder why there are status bars showing you the progress of the item you are loading on your computer? It is to keep us from going crazy while waiting 10 minutes for the computer to do what we told it to do!! Even though that little bar moves slowly sometimes, it is encouraging because we know how much longer we have to endure the torture of waiting.

It is extremely DE-motivating when there is no end in sight.

Download free credit card payoff and debt reduction calculators for Excel. Make a plan to get out of debt and estimate how much you can save Minimum Payments: This calculator does not provide the option of making only. 45, the minimum monthly payments on credit cards or lines of credit. See tip #3 Download Spreadsheet Debt Reduction Calculators for Microsoft® Excel®, movieflixhub.xyz and Google Docs including Credit Card Payoff Calculator, Debt Snow

Video

How To Use My Debt Payoff Tracking Spreadsheet Create eeduction to xalculator content. To get out of debt you must claculator to do it, badly. It might Financial wellness solutions make much difference in how calculatorr it caalculator to pay Credit card debt reduction calculator spreadsheet off, but it could make a difference in how much interest you end up paying. In that case, the spreadsheet automatically divides your snowball between the current and next target. Take Me To Risecredit. Income expansion Debtors who end up saving very little or nothing as debt repayment amount, have to find alternatives to either increase their income or increase their savings amount.Credit card debt reduction calculator spreadsheet - Here are 6 free debt snowball spreadsheets for Google Sheets and Excel to help you save money, reduce stress, and avoid paying high-interest Download free credit card payoff and debt reduction calculators for Excel. Make a plan to get out of debt and estimate how much you can save Minimum Payments: This calculator does not provide the option of making only. 45, the minimum monthly payments on credit cards or lines of credit. See tip #3 Download Spreadsheet Debt Reduction Calculators for Microsoft® Excel®, movieflixhub.xyz and Google Docs including Credit Card Payoff Calculator, Debt Snow

Once you have wiped away the debt with highest interest rate, move to the next highest. This method saves you a lot of money going to creditors as interest but might take you longer to pay high balance debt which has lower priority on the list. Instructions on how to use this Debt Reduction Manager is provided within the calculator itself, in the form of links to the topics and you can also refer to details about Payment Strategies used in the calculator as you go along.

You can use free version of this calculator to manage the debts from maximum 20 creditors. With paid version you can manage debts from up to 50 creditors. If you are planning to use this for your Advisory Agency or any other debts advisory business then you will be able to customize it with your company logo and address along with your customer's details like name and address.

Posted in category DEBT PAYOFF. Author Alex Bejanishvili of Spreadsheet License User License Agreement. Contact Us. Disclaimer - This calculator and information on this page is for educational and illustrative purposes only and not in any way meant to provide financial advise.

We do not guarantee the results. Interest of your credit facilities is usually variable and therefore all calculation are only estimates and may not be appropriate to your unique financial situation. Use this calculator at your own risk. You should seek the advice of qualified professionals regarding your Debt and Credit Card or Consumer Loan repayments.

com will not and can not be held liable for any damages or loss caused by use of this calculator. Purchase Now via clickbank or paypal Instant Download. License Private Use Resale and distribution not permited View License Agreement.

via Email 24x7. But spreadsheets simplify the task, making it easy for anyone who can use a spreadsheet to make a plan to pay off debt. The snowball method is a popular strategy, and downloading one of these debt-snowball spreadsheets can help you reduce your debt.

One option on this list even walks you through how to choose a debt-payoff method by comparing the snowball method to the avalanche method and other strategies. Technically, these are spreadsheet templates that you can use with Microsoft Excel, OpenOffice Calc, or Google Sheets.

With a template, you get a ready-made spreadsheet with the right formulas to do all of the calculating for you. All you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math.

Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. This spreadsheet includes additional information about those strategies with more resources for reducing debt.

After you enter your information, select the different methods to see how each would work for paying off your debt. This spreadsheet includes a printable payment schedule for easy reference. Need help repairing your credit? Download the Credit Repair Edition of the debt-reduction spreadsheet to first pay down each credit card to specific levels determined by your FICO score.

Once you reach that that goal, the spreadsheet shows you how to start paying off all credit card balances. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly interest paid.

The spreadsheet will also show you the total number of monthly payments on your debt accounts. You will need to have an idea of how much money you will set aside each month toward paying off credit cards and other debt to activate the debt snowball features of the spreadsheet.

Simply enter the amount you have planned for paying down the debt, and the spreadsheet will tell you what portion of that amount should be applied to the bill with the highest interest rate.

DebtTracker is not quite as elegant as the other spreadsheets on this list, but it has great features to sort and view your debt that are definitely useful. The worksheets come populated with some data so you can see how they work, and the download page includes a tutorial. You will need to enable macros in Excel to use the DebtTracker spreadsheet, which is also explained in the tutorial.

Enter all of your debts, including multiple credit cards, mortgage, and various types of loans, into the spreadsheet to start. Then you can change the view by sorting debts by type, interest rate, minimum payment , and other options. Just like jogging with the wind at your back, it is a nice little boost to use our emotions to give us a little edge.

So, rather than tackling the debt like a math problem, we can tackle it in a way that will give us emotional boosts!

There have been a couple studies I have found that prove the effectiveness of the debt snowball vs the debt avalanche approach. Ever wonder why there are status bars showing you the progress of the item you are loading on your computer?

It is to keep us from going crazy while waiting 10 minutes for the computer to do what we told it to do!! Even though that little bar moves slowly sometimes, it is encouraging because we know how much longer we have to endure the torture of waiting.

It is extremely DE-motivating when there is no end in sight. That little bar that shows us the progress that we have made gives us hope. What if there were no status bars? Would you keep waiting or would you reboot, assuming there was a problem? Should I wait it out?

What if they never remember that I am on hold? This is the advantage of using the snowball approach to paying down debt. If you focus on the highest interest rate, it could be months or even years before you reach that first milestone.

Would you have the endurance to keep going that long without reaching that first milestone? It is a wonderful feeling to be able to celebrate your first milestone — paying off the first credit card is a blast! Speaking from experience, I was fueled with motivation after reaching that first milestone.

Ist Einverstanden, die sehr gute Mitteilung

Ich denke, dass Sie nicht recht sind. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden umgehen.