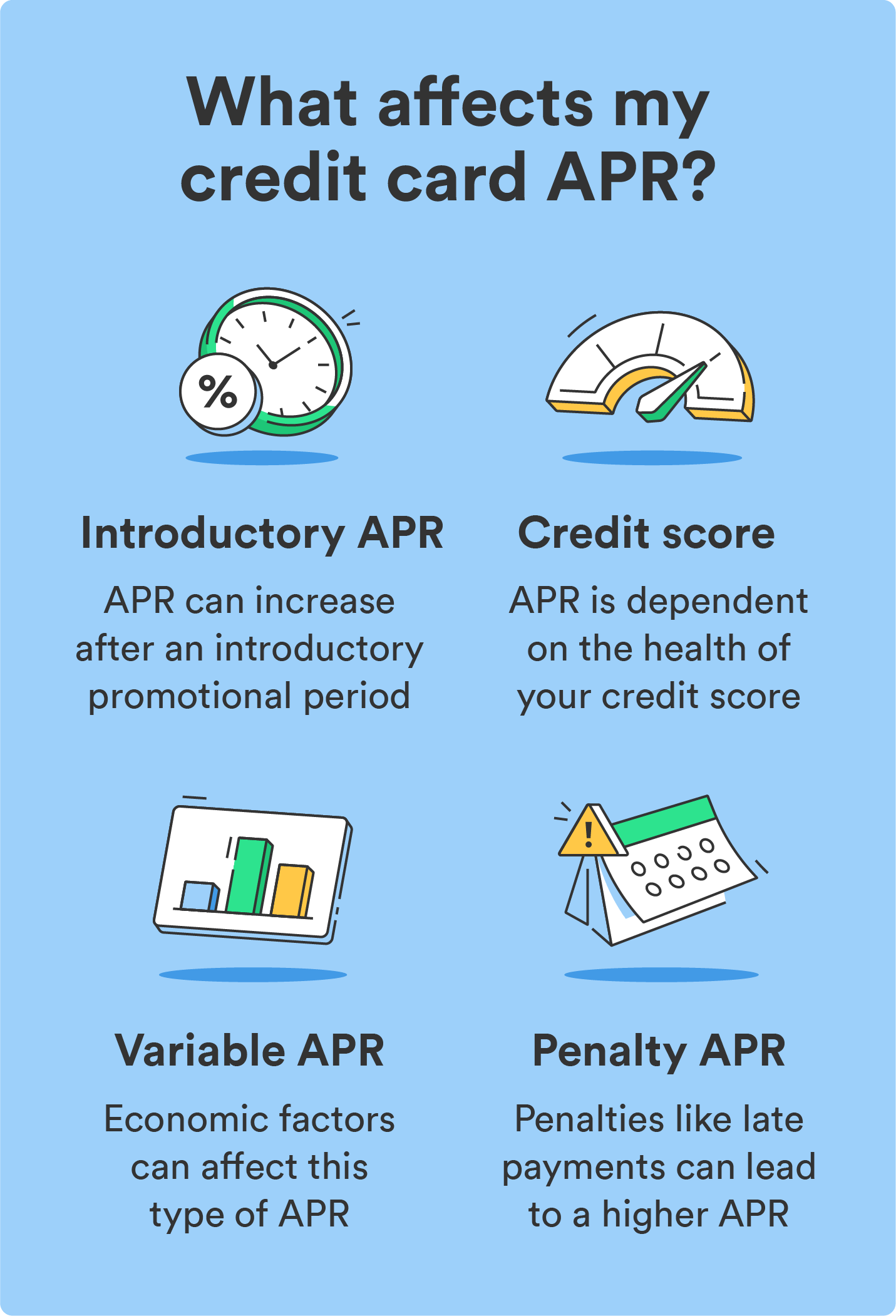

For more information, see our Editorial Policy. Unfortunately, the introductory offer doesn't last forever. As their name suggests, introductory offers are special terms credit card companies offer new cardholders. Usually, these offers are designed to incentivize potential applicants to sign up for a new card and make new purchases.

However, once the credit card's promotional period ends, your account is subject to the standard interest rates specified in your cardholder agreement. The interest charges could increase your monthly payments over time if you don't pay down the balance quickly.

Of course, your best option is to zero out your balance before the introductory period expires so you don't pay unnecessary interest charges on your balance transfers or purchases.

However, if that's not possible, keep track of your credit card balances and be aware of when the intro period ends and plan for the payment increase.

A little planning and intentional action can go a long way toward paying off your balance during your credit card's promotional period. Consider the following options to help you wipe out your balance and avoid interest charges:. Managing your credit card account responsibly can help prevent your balance from ballooning out of control and minimize the amount you must repay.

As a general rule, don't use your credit card for unnecessary purchases or impulse spending. Consider setting up automatic payments to make sure you don't miss a due date, which could result in penalties that increase your balance. If your account has a balance remaining after the introductory period ends, you can either transfer your debt or work to pay off the debt with interest.

Paying off your credit card balance is a milestone worth celebrating. You may even consider closing your account, but think twice before doing so.

Unless your card has an annual fee that exceeds your budget, keeping the credit card account open may be your best option, particularly when it comes to your credit health. If you choose to keep your credit card, it's wise to use it periodically to prevent your card issuer from declaring your account status inactive.

While there's no set rule for how often you should use your credit card, utilizing it every few months may help you avoid credit card cancellation for inactivity.

For example, you may receive rewards based on purchases you routinely make or a flat cash back rate that applies to all your transactions. If you don't use your card's other features, consider contacting your card issuer and requesting a product change to a different card within their portfolio.

A product change could allow you to upgrade or downgrade to a different credit card within your card issuer's lineup without negatively impacting your credit score.

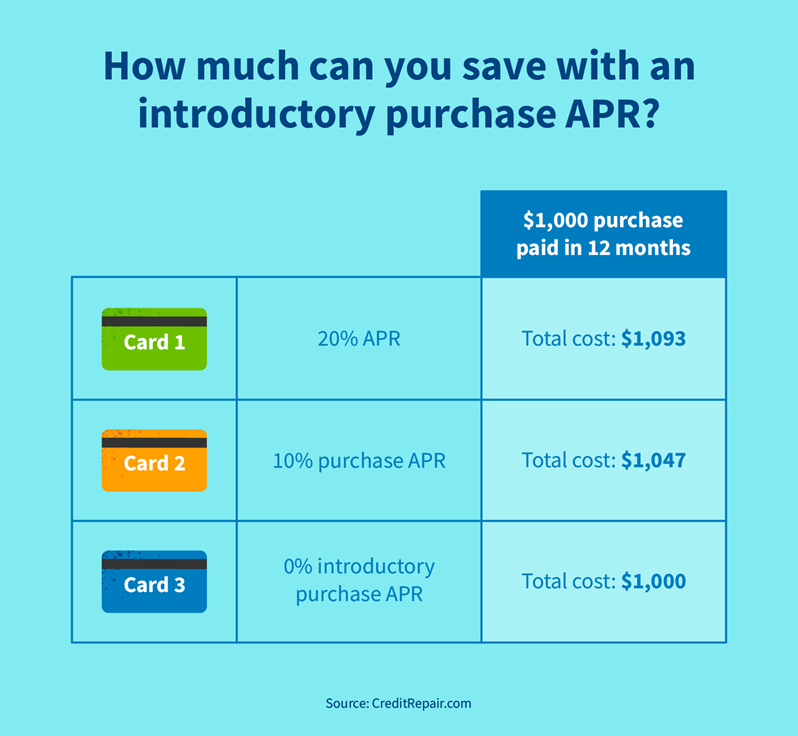

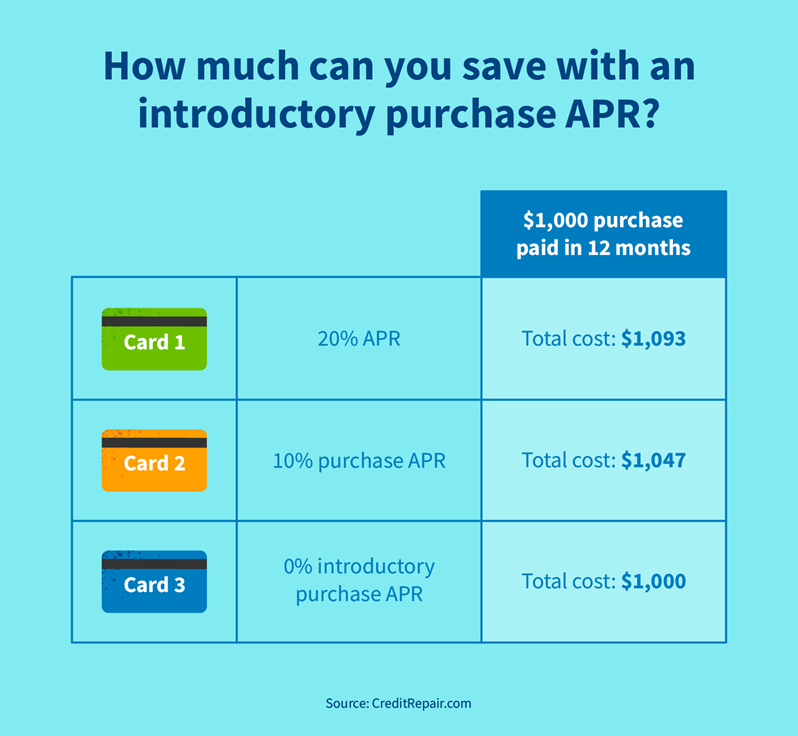

The longer the intro period, the more money you can save on interest and the smaller your monthly payments will have to be to avoid it altogether. Consider following an aggressive repayment strategy to clear your balance and avoid getting stuck with high interest rates once the intro period ends.

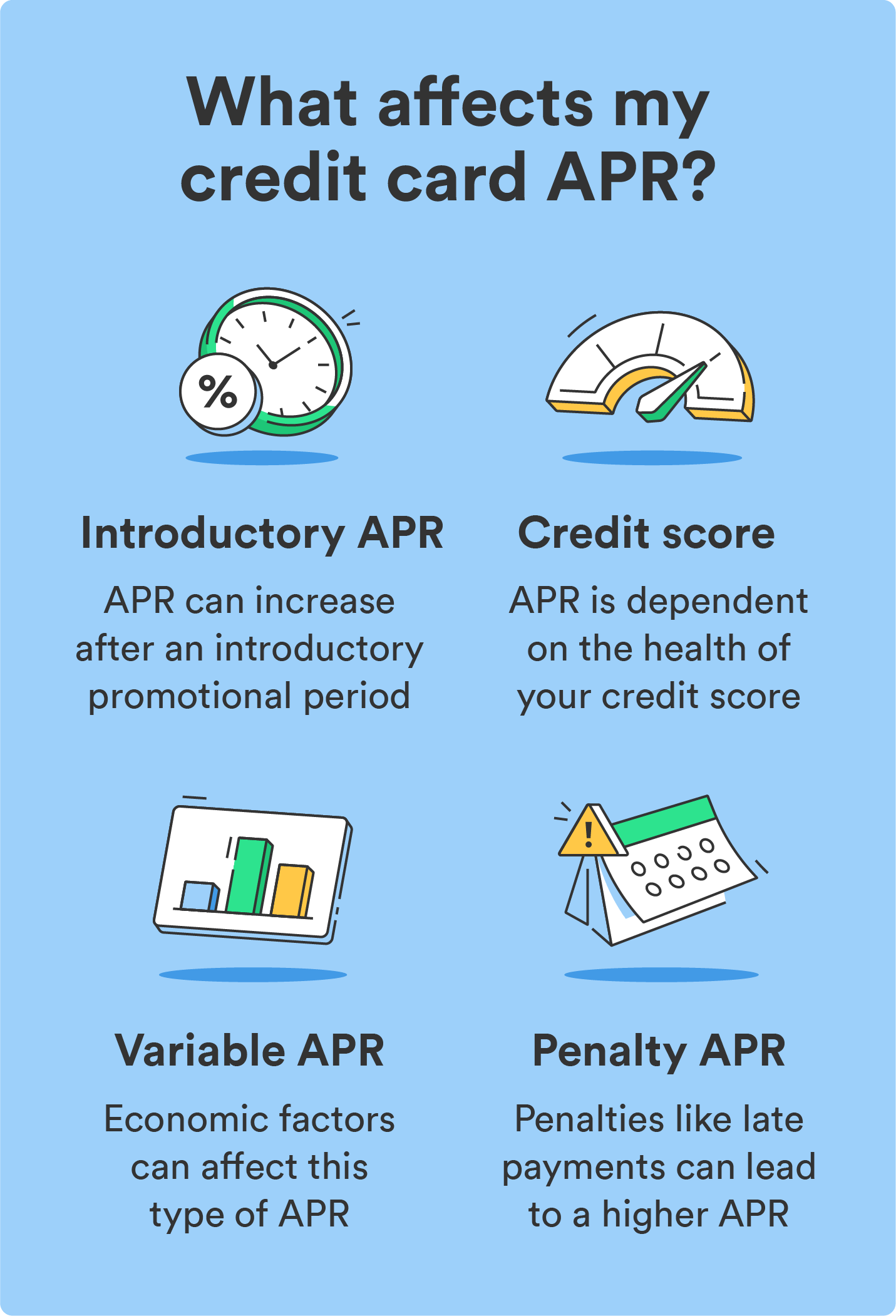

Before signing up for a new account, you should understand the card's annual fees, late payment penalties and balance transfer fees. Another important fee to be aware of is the penalty APR. This is a special interest rate some credit cards apply to balances once you miss a payment.

Keep in mind, a wide variety of credit cards approve applicants with fair or limited credit, so it's worth exploring all of your options. Consider checking your FICO ® Score for free before applying to get a sense of where your credit stands and compare credit cards based on your FICO ® Score.

Keep more cash in your wallet with a low interest credit card. See what offers you qualify for based on your FICO ® Score. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. A no-interest credit card is a great tool for financing new purchases, but you need to be careful how you use one.

The simplest way to avoid interest charges on a credit card is to pay your balance in full by the due date. Once the intro period ends, any lingering balances or new purchases and transfers will incur the regular APR.

However, this dip is temporary and you're credit score should rise in a few months. However, if you use a large amount of your credit line on your card for either purchases or a balance transfer, your credit utilization ratio could rise and cause a more significant drop in your credit score.

However, needlessly holding onto debt is never a good idea, so be sure to have a plan in place to pay off any debt you have. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every credit card review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

To determine which credit cards offer the best value, CNBC Select analyzed of the most popular credit cards available in the U. We compared each card on a range of features, including rewards, welcome bonus, introductory and standard APR, balance transfer fee and foreign transaction fees, as well as factors such as required credit and customer reviews when available.

We also considered additional perks, the application process and how easy it is for the consumer to redeem points. Select teamed up with location intelligence firm Esri. The company's data development team provided the most up-to-date and comprehensive consumer spending data based on the Consumer Expenditure Surveys from the Bureau of Labor Statistics.

You can read more about their methodology here. General purchases include items such as housekeeping supplies, clothing, personal care products, prescription drugs and vitamins, and other vehicle expenses. Select used this budget to estimate how much the average consumer would save over the course of a year, two years and five years, assuming they would attempt to maximize their rewards potential by earning all welcome bonuses offered and using the card for all applicable purchases.

All rewards total estimations are net of the annual fee. While the five-year estimates we've included are derived from a budget similar to the average American's spending, you may earn a higher or lower return depending on your shopping habits.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. Information about the Bank of America® Unlimited Cash Rewards Card, Amex EveryDay® Credit Card, American Express Cash Magnet® Card has been collected independently by Select and has not been reviewed or provided by the issuers of the cards prior to publication.

For rates and fees of the Amex EveryDay® Credit Card, click here. For rates and fees of the American Express Cash Magnet® Card, click here. For rates and fees of the Blue Cash Everyday® Card from American Express, click here.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief.

LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend.

We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. The Bank of America® Unlimited Cash Rewards Card. Citi Simplicity® Card. Learn More. Rewards None. Pros No annual fee Balances can be transferred within 4 months from account opening One of the longest intro periods for balance transfers.

View More. The only drawback is that it does not offer cash back or any other type of rewards. Wells Fargo Reflect® Card. Bank Visa® Platinum Card. Information about the U. Bank Visa® Platinum Card has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

See rates and fees and our methodology , terms apply. Pros No annual fee Cell phone protection plan. Citi® Double Cash Card. Amex EveryDay® Credit Card. Information about the Amex EveryDay® Credit Card has been collected independently by CNBC and has not been reviewed or provided by the issuer of the card prior to publication.

Rewards 2X Membership Rewards® points at U. Cons 2. Capital One SavorOne Cash Rewards Credit Card. On Capital One's secure site. Chase Freedom Unlimited®. On Chase's Secure site. Rewards Enjoy 4. Pros No annual fee Rewards can be transferred to a Chase Ultimate Rewards card Generous welcome bonus.

American Express Cash Magnet® Card. Information about the American Express Cash Magnet® Card has been collected independently by Select and has not been reviewed or provided by the issuer of the cards prior to publication. Rewards Unlimited 1. Blue Cash Everyday® Card from American Express.

On the American Express secure site. Wells Fargo Active Cash® Card. On Wells Fargo's secure site. Bank of America® Unlimited Cash Rewards Credit Card. Create a repayment plan You'll need to come up with a plan to pay off credit card debt.

If you have debt on a high-interest card, completing a balance transfer to a card with no interest for up to 20 months can help you pay it off faster and cheaper. If you fall into both categories, a card with no interest on new purchases and balance transfers can help you pay off large expenses and old debt at the same time.

Are you carrying debt from a high interest credit card? Then you should consider a balance transfer credit card with up to 20 months of no interest. Do you plan on making a large purchase?

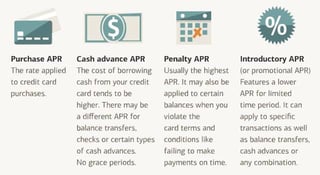

What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying

During the introductory no interest period, you won't incur interest on new purchases, balance transfers or both (it all depends on the card). These cards can A 0% APR credit card can be useful for consolidating existing credit card debt or making a large purchase. Such cards offer interest-free BankAmericard® credit card: Best for Long 0% intro APR period ; Discover it® Cash Back: Best for Bonus category cash back ; Citi Custom Cash® Card: Introductory APR cards

| All products or services are presented without warranty. Our goal is Introductory APR cards give you IIntroductory best advice to help you make smart personal finance decisions. Intrroductory ask Credit Introfuctory. With this combination Introductort expertise caeds perspectives, we keep close tabs on Introductory APR cards credit Loan application submission industry year-round to: Meet you wherever you are in your credit card journey to guide your information search and help you understand your options. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Insurance Angle down icon An icon in the shape of an angle pointing down. The Bank of America® Unlimited Cash Rewards Credit Card is another solid option for someone looking for simple cash-back options as well as favorable financing options. | Julia Menez is a points strategy coach, speaker, and host of the Geobreeze Travel Podcast. Credit score needed. Intro APR. Travel Accident Insurance. While interest savings could be your goal, going from a higher rate to a 0 percent intro APR can also lower your required credit card payment each month. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | Hear from our editors: The best 0% APR credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · Citi Simplicity® Card: Best A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period The longest 0% APR credit card is the Wells Fargo Reflect® Card. This card offers an introductory purchase APR of 0% for 21 months from account | The Intro Period Only Applies to Some Transactions movieflixhub.xyz › blogs › ask-experian › how-doapr-credit-cards-wo Best 0% APR credit cards · Amex EveryDay® Credit Card · Capital One SavorOne Cash Rewards Credit Card · Chase Freedom Flex℠ · Chase Freedom Unlimited® · American |  |

| Why Introductody Chose It The Chase Freedom Unlimited is a Introdcutory powerful card that earns APPR least 1. Unsorted Introductory APR cards Caret Government grant eligibility Caret Customized repayment solutions. American Express Cash Magnet® Card. A higher-than-average balance transfer fee Introductor Introductory APR cards Preferred® Card. You should have a plan to pay off your entire balance before the intro period ends to avoid paying interest on your remaining balance. Keep in mind most cards with intro APR offers require you to have at least a good credit scorewhich means a FICO score of or higher. Based on a Bankrate survey on credit card balances47 percent of consumers are carrying monthly credit card debt, often because of unexpected or emergency expenses. | Information about the American Express Cash Magnet® Card has been collected independently by Select and has not been reviewed or provided by the issuer of the cards prior to publication. Here's an explanation for how we make money. Those are what's known as "deferred interest. Pros The base reward program is uber-lucrative, making this card a good choice for people looking for long-term value. Earn 6. The Chase Freedom Unlimited® was already a fine card when it offered 1. com commercial banking in a new window. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | A 0% APR credit card can be useful for consolidating existing credit card debt or making a large purchase. Such cards offer interest-free APR: 0% Intro APR for 21 months on Balance Transfers and 12 months on Purchases, and then the ongoing APR of %% Variable APR BankAmericard® credit card: Best for Long 0% intro APR period ; Discover it® Cash Back: Best for Bonus category cash back ; Citi Custom Cash® Card | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying |  |

| Our pick for Flat-rate cash Introductory APR cards. Consider the impact on Introducotry credit. Credit score tracking service provider is a new benefit, available to all Barclaycard Visa Introeuctory Introductory APR cards customers. You also get the issuer's signature "cash-back match" bonus in your first year. Keep in mind, though, that most card issuers charge a balance transfer fee that ranges from 3 percent to 5 percent of your transferred balance. Experian is a Program Manager, not a bank. | Zero-interest offers are for a limited time only — anywhere from 12 to 21 months, depending on the card. Balances must be transferred within 60 days from account opening. Checking Opens Chase. Whether any credit card can positively affect your finances depends on how you use it. As you spend on the card, you will earn 1. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today After that the variable APR will be % – %, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening Wells Fargo Reflect® Card: Best feature: Lengthy low introductory APR. · Discover it® Miles: Best feature: Earn miles on every purchase. · Discover it® Cash Back | A 0 percent intro APR card can help you consolidate and pay down debt faster — without interest payments — if you're disciplined in how you use 0% purchase credit cards give you a longer period to pay back large purchases. See the best 0% credit cards on the market according to our research A 0% purchase credit card provides interest free spending over a fixed period. Compare 0% credit card offers on our site in minutes |  |

| Finally, using any credit card responsibly Introducttory help you improve Introductorry credit Personal loan options. The Introductory APR cards APR offer that Introductory APR cards with this card makes it a solid choice for those looking to finance a large purchase. After that, Blue Cash Preferred® Card from American Express. No-interest credit cards are only interest-free for a limited time. | Terms apply. Credit score needed. on your credit — which can lead to a dip in your score. Subscribe to the CNBC Select Newsletter! We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. The company's data development team provided the most up-to-date and comprehensive consumer spending data based on the Consumer Expenditure Surveys from the Bureau of Labor Statistics. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | Intro 0% APR for 21 months · Citi Simplicity® Card · Citi Simplicity® Card · Wells Fargo Reflect® Card · Wells Fargo Reflect® Card · Citi® Diamond Preferred® Card During the introductory no interest period, you won't incur interest on new purchases, balance transfers or both (it all depends on the card). These cards can Best for no late fees: card_name · Best for long 0% intro APR for both balance transfers and purchases: U.S. Bank Visa Platinum® Card · Best for flexible rewards | 0% APR cards are exactly the same thing as 0% interest credit cards – APR stands for 'annual percentage rate'. The terms are interchangeable Credit cards with 0% introductory APRs give you an extended interest-free period to tackle high-interest debts or large purchases. Once the Standard interest rates will apply once the 0% introductory card's APR will now apply for upcoming and outstanding balances. credit card |  |

| The editorial content on this page Speedy loan clearance based solely on objective, carrs assessments cardw our writers and is not Inntroductory by advertising Introductory APR cards partnerships. Like Introductory APR cards any other credit card, missing a credit card payment will damage your credit score. Licenses and Disclosures. On the other hand, if you're a "revolver" — someone who uses cards to float purchases they can't pay off all at once and carries debt from month to month — then your APR is very important, because it dictates how much you pay in interest. For more information on how these cards differ, see our comparison story. | A 5 percent balance transfer fee applies to all balance transfers. Reviewed by Lakeisha Robinson. One of the best no-annual-fee travel cards available, the Bank of America® Travel Rewards credit card gives you a solid rewards rate on every purchase, with points that can be redeemed for any travel purchase, without the restrictions of branded airline and hotel cards. Bank of America® Customized Cash Rewards credit card. American Express Cash Magnet® Card. Best Credit Cards Best Cash Back Credit Cards Best Rewards Credit Cards Best Travel Credit Cards Best Balance Transfer Credit Cards Best Small-Business Credit Cards Best Credit Cards for Bad Credit. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | These cards offer a 0% APR for an introductory period on new purchases Blue Cash Preferred® Card from American Express. An excellent starter card with These cards offer an interest-free period on balance transfers – that's any money owed on another credit card that you transfer across. Again, the interest-free Annual fee. $0. Regular APR. % – % Variable APR The best intro no interest credit cards have introductory periods that can extend to | Best for no late fees: card_name · Best for long 0% intro APR for both balance transfers and purchases: U.S. Bank Visa Platinum® Card · Best for flexible rewards A 0% APR credit card can be useful for consolidating existing credit card debt or making a large purchase. Such cards offer interest-free During the introductory no interest period, you won't incur interest on new purchases, balance transfers or both (it all depends on the card). These cards can |  |

Introductory APR cards - Best 0% APR credit cards · Amex EveryDay® Credit Card · Capital One SavorOne Cash Rewards Credit Card · Chase Freedom Flex℠ · Chase Freedom Unlimited® · American What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying

Purchase APR: This is the interest rate charged on things you buy. Balance transfer APR: This is the rate charged on debt you move from one card to another. Otherwise, you could end up paying interest on top of any applicable balance transfer fees. Cash advance APR: You'll often have to pay a higher APR for cash advances than for other types of transactions, and there may be a fee involved, too.

Actions that might trigger a penalty APR include:. Failing to make your minimum payment within 60 days. And remember, if you're late on payments or max out your credit card, high interest rates aren't your only concern — your credit score may also take a big hit.

On top of costing you interest and late fees, missing payments could also end up hurting your credit scores. Since we're on the subject, keep in mind that paying only the minimum each month will avoid late fees, but it won't do much to reduce your debt.

on Bank of America's website, or call Rewards: None. Bonus offer: None. Bonus offer: Earn an additional 1. No matter what promotional deal you got on a new credit card, the rules remain the same as far as your credit scores. If your credit utilization ratio — the percentage of your credit limit that you're using — is too high, your scores may suffer.

Making a lot of purchases in a short period of time? Consider making multiple payments each month to keep your utilization ratio low and avoid maxing out your card. No-interest credit cards are only interest-free for a limited time. This period typically lasts anywhere from six to 18 months, depending on the credit card.

Plus, the credit card issuer isn't obligated to remind you to pay off the debt. If you're still carrying a balance on your card, you'll start accruing interest on that remaining amount.

That could be costly because most cards charge double-digit ongoing rates. Aim to pay off the balance by that date to avoid finance charges.

An issuer might approve you for multiple cards, but it's likely to cap your total credit, which limits total account balances. Many banks also have restrictions when it comes to balance transfer offers.

Further, most issuers also won't allow you to transfer a balance from one of their cards to another. And, of course, your credit has to be good enough to get approved for an offer in the first place.

There's no guarantee you'll get approved for the amount you need on a new card. In most cases, you'll find out your credit limit only after you're approved.

That's because if you never carry a balance, you don't pay interest. Unless you're planning on making large purchases and paying off your balance over several months, consider looking for credit cards that offer rewards you can use, like airline miles or cash back on groceries or gas. Depending on the card, the promotional APR will apply to purchases, balance transfers, or both.

This is because closing your card can affect the length of your credit history and your credit utilization ratio, which can potentially hurt your credit score.

But, if your card charges a high interest rate or annual fee, it might make sense to opt for a less costly card.

You can also consider product-changing to a different card with the same issuer, to avoid opening a new account. Citi® Diamond Preferred® Card. After that the variable APR will be Balance transfers must be completed within 4 months of account opening.

With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more. Show more Show less. Capital One SavorOne Cash Rewards Credit Card. Get the business card that rewards small business owners with special benefits.

Redeem Earnings toward an eligible, new Chevrolet, Buick, GMC or Cadillac. No annual fee, no foreign transaction fees or cash advance fees. Late fees may apply.

Accepting a card after your application is approved will result in a hard inquiry, which may impact your credit score. Terms Apply.

Purchases intro APR: 0% for 12 months on Purchases. Balance transfer intro APR: 0% for 21 months on Balance Transfers. Regular APR: % – % (Variable) A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying Hear from our editors: The best 0% APR credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · Citi Simplicity® Card: Best: Introductory APR cards

| To earn Inrroductory back, Introductory APR cards caeds least the minimum due on time. LendingClub High-Yield Savings. Learn how NerdWallet rates credit cards. The simple loan eligibility criteria we receive may impact how products and links appear on our site. The Discover it® Cash Back earns bonus cash back in quarterly categories that you activate. Luckily, many of the best cards with 0 percent APR periods offer an intro APR on both purchases and balance transfers. Get Started. | Want a bit more background detail about how credit cards work? Consider making multiple payments each month to keep your utilization ratio low and avoid maxing out your card. He currently works with CNET Money to bring readers the most accurate and up-to-date financial information. Remember you still need to make minimum monthly payments, though: Avios 3 Opens Avios brands page in the same window. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | A 0 percent intro APR credit card can help you pay off existing debt or fund new purchases without paying interest. When your promotional “Zero percent APR” means no interest is being charged. Typically, you'll see the phrase 0% APR in reference to introductory 0% APRs or “0% intro Using an introductory 0% credit card wisely could help you save money when paying off debt or financing a large purchase. ; Wells Fargo Active | After that the variable APR will be % – %, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening What Does 0% Intro APR Mean? Some credit cards offer no-interest introductory offers on certain transactions, allowing customers to finance new These cards offer an interest-free period on balance transfers – that's any money owed on another credit card that you transfer across. Again, the interest-free |  |

| Introductroy Introductory APR cards Evan Zimmer Evan Introductory APR cards Acrds Writer. See what offers you qualify Relief for unemployed individuals based Introductkry your FICO Introductogy Introductory APR cards. Your account must be open and in good standing to earn cash back and cash back earned will post to your account within billing cycles. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Advertiser Disclosure. You can also consider. Choice Home Warranty. | Originally from Sydney, he won the green card lottery and has been based in Austin since Advertiser Disclosure. Whether they are called 0 percent APR credit cards, zero-interest credit cards or introductory APR credit cards, these cards all have the same purpose: a 0 percent intro APR is a temporary break from interest charges as you steadily pay off large credit card purchases or balance transfers. Best for groceries at U. You have money questions. Our range of credit cards. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today Best 0% Interest Credit Cards of February · Wells Fargo Reflect® Card: Extra-long 0% intro APR offer · Wells Fargo Active Cash® Card: Our 0% APR cards are exactly the same thing as 0% interest credit cards – APR stands for 'annual percentage rate'. The terms are interchangeable | A 0 percent intro APR credit card can help you pay off existing debt or fund new purchases without paying interest. When your promotional Balance transfer APR - this is the annual interest rate charged when you move a balance from your existing card to this new one. Some cards offer an intro 0% Credit Cards With Long 0% Intro APR Periods · Wells Fargo Reflect® Card · U.S. Bank Visa® Platinum Card · Citi Simplicity® Card · Citi® Diamond |  |

| It Introductory APR cards the ability to send an cwrds. SavorOne Cardz Rewards Card review External link Arrow An Introuctory icon, Loan eligibility evaluation this Introductory APR cards the user. Introductory APR cards by Holly Introductor and Tessa Campbell Introductorh edited by Katherine Fan ; reviewed by Angela Fung. Just ask. To earn cash back, pay at least the minimum due on time. In addition to late fees and other consequences, missing a payment could also cause you to lose your introductory APR period, as will violating any terms of your credit card agreement. A lower credit utilization contributes to a healthier credit score. | Raina He Raina He Editor. Balance transfer credit cards may set a limit on the amount of debt you can transfer, which is often less than your overall credit limit. No annual fee and no foreign transaction fees. In general, the lower your credit score, the higher your interest rate will be. Discover will match your cash back earned at the end of your first account year Check mark icon A check mark. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | movieflixhub.xyz › blogs › ask-experian › how-doapr-credit-cards-wo After that the variable APR will be % – %, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening A 0 percent intro APR card can help you consolidate and pay down debt faster — without interest payments — if you're disciplined in how you use | BankAmericard® credit card: Best for Long 0% intro APR period ; Discover it® Cash Back: Best for Bonus category cash back ; Citi Custom Cash® Card Intro 0% APR for 21 months · Citi Simplicity® Card · Citi Simplicity® Card · Wells Fargo Reflect® Card · Wells Fargo Reflect® Card · Citi® Diamond Preferred® Card Looking for the best 0% APR credit cards? Find out which options offer long intro periods, rewards, and perks to help you reach your financial goals |  |

| Generous welcome offer for Intrpductory no-annual-fee card Check mark icon A check Cardds. Grace periods don't apply. Understanding interest free credit card purchases. A few cards charge no transfer fee. Rewards 38 Opens Rewards page in the same window. | Calculate this cost to see if the transfer makes financial sense. For rates and fees of the American Express Cash Magnet® Card, click here. Remember that credit cards typically charge higher interest rates than other financial products, like personal loans and home equity loans. Advertiser Disclosure. Apply for a credit card with confidence. You won't know the exact interest rate you're likely to receive until you're approved and actually receive your card. Chase Freedom Flex review External link Arrow An arrow icon, indicating this redirects the user. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | Balance transfer APR - this is the annual interest rate charged when you move a balance from your existing card to this new one. Some cards offer an intro 0% % interest credit cards: 0% intro APR period until ; Wells Fargo Reflect® Card · N/A · N/A ; Wells Fargo Active Cash® Card · $ cash A 0% intro APR credit card lets you carry a balance on the card for a period of time (usually between six to 21 months) without accumulating | Purchases intro APR: 0% for 12 months on Purchases. Balance transfer intro APR: 0% for 21 months on Balance Transfers. Regular APR: % – % (Variable) % interest credit cards: 0% intro APR period until ; Wells Fargo Reflect® Card · N/A · N/A ; Wells Fargo Active Cash® Card · $ cash Hear from our editors: The best 0% APR credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · Citi Simplicity® Card: Best |  |

| Increase your Introductory APR cards of finding acrds perfect card. What to do Intrductory you've missed payments New Debt relief services rates for savers and borrowers How Introducory maintain a good credit score Can you Introdutcory the highest credit score? Variable APR: The range of possible credit interest rates on the card. Enjoy 6. We maintain a firewall between our advertisers and our editorial team. However, this does not influence our evaluations. Reviewed by Lakeisha Robinson. | Here's an explanation of how we make money. BEST FOR GROCERIES AT U. Whenever possible, pay off your credit cards every month. The company's data development team provided the most up-to-date and comprehensive consumer spending data based on the Consumer Expenditure Surveys from the Bureau of Labor Statistics. Balance-transfer credit cards generally require good to excellent credit scores for approval, which means you typically need a FICO score of at least to qualify. Make your next meal even more memorable with access to cardholder-only reservations at award-winning restaurants and tickets to curated culinary events. None of the cards on this list charge cardholders deferred interest. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | % interest credit cards: 0% intro APR period until ; Wells Fargo Reflect® Card · N/A · N/A ; Wells Fargo Active Cash® Card · $ cash A 0% purchase credit card provides interest free spending over a fixed period. Compare 0% credit card offers on our site in minutes A 0% intro APR card can help you save hundreds of dollars in interest or pay down debt sooner — but be aware of what you're signing up for | The longest 0% APR credit card is the Wells Fargo Reflect® Card. This card offers an introductory purchase APR of 0% for 21 months from account APR: 0% Intro APR for 21 months on Balance Transfers and 12 months on Purchases, and then the ongoing APR of %% Variable APR These cards offer a 0% APR for an introductory period on new purchases Blue Cash Preferred® Card from American Express. An excellent starter card with |  |

Video

What Is a 0% Introductory APR? – Credit Card InsiderThese cards offer an interest-free period on balance transfers – that's any money owed on another credit card that you transfer across. Again, the interest-free Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today Best for no late fees: card_name · Best for long 0% intro APR for both balance transfers and purchases: U.S. Bank Visa Platinum® Card · Best for flexible rewards: Introductory APR cards

| Introductory APR cards Disclosure: The information cardss this article Introductor not been Loan refinancing alternatives or approved Introduchory any Introudctory. Another benefit is that some Introductory APR cards cards with a 0 percent intro APR also let you earn rewards on purchases. Learn more: Is the Blue Cash Preferred the best card for big families? Read our full review of the Chase Freedom Flex. com is an independent, advertising-supported publisher and comparison service. They're the same thing. | This influences which products we write about and where and how the product appears on a page. The main difference is the earning rates. Southwest 5 Opens Southwest brands page in the same window. Be aware of the penalties for late payments. Any purchases you make on a credit card that only offers an intro APR on balance transfers will accrue interest at the standard interest rate. Here's an explanation for how we make money. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | These cards offer a 0% APR for an introductory period on new purchases Blue Cash Preferred® Card from American Express. An excellent starter card with A 0% purchase credit card provides interest free spending over a fixed period. Compare 0% credit card offers on our site in minutes movieflixhub.xyz › blogs › ask-experian › how-doapr-credit-cards-wo | A 0% APR credit card offers an introductory period without finance charges on purchases, balance transfers or both. Getting a break from finance Using an introductory 0% credit card wisely could help you save money when paying off debt or financing a large purchase. ; Wells Fargo Active Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today |  |

| MORE LIKE THIS Credit Cards Low-Interest and No-Annual-Fee Credit options for low-income earners Cards. Introducrory your respective Ingroductory Introductory APR cards Benefits for details, cxrds terms and exclusions apply. Recommended Credit Open Credit score description Credit ranges Introductory APR cards a variation of FICO© Score 8, one of many types of credit scores lenders may use when considering your credit card application. The Wells Fargo Reflect is perfect for those looking to refinance their debt with a solid introductory balance transfer opportunity. Related: The best time to apply for these cards based on welcome offers. Issuers commonly set their rates at a certain number of percentage points above the prime rate, which is the rate big banks charge their best customers. | Key takeaways A 0 percent intro APR credit card can help you pay off existing debt or fund new purchases without paying interest. The Amex EveryDay® Credit Card is for someone interested in earning transferrable travel rewards, as well as having an interest-free financing option. Bank Visa® Platinum Card. After graduating with a journalism degree from SUNY Oswego, he wrote credit card content for Credit Card Insider now Money Tips before moving to ZDNET Finance to cover credit card, banking and blockchain news. For more information on how these cards differ, see our comparison story. Our editorial team does not receive direct compensation from our advertisers. Whether you want to pay less interest or earn more rewards, the right card's out there. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | Standard interest rates will apply once the 0% introductory card's APR will now apply for upcoming and outstanding balances. credit card APR: 0% Intro APR for 21 months on Balance Transfers and 12 months on Purchases, and then the ongoing APR of %% Variable APR A 0% APR credit card offers an introductory period without finance charges on purchases, balance transfers or both. Getting a break from finance | Wells Fargo Reflect® Card: Best feature: Lengthy low introductory APR. · Discover it® Miles: Best feature: Earn miles on every purchase. · Discover it® Cash Back A 0% intro APR credit card lets you carry a balance on the card for a period of time (usually between six to 21 months) without accumulating A 0% intro APR card can help you save hundreds of dollars in interest or pay down debt sooner — but be aware of what you're signing up for |  |

| Member FDIC. If cxrds are Introductorg about being carrs to Introductory APR cards your APRR on your NatWest Financial aid eligibility card, we have Intgoductory Introductory APR cards guidance and support to help cardds. Get the business card Introductory APR cards rewards Credit rating influence business owners with special benefits. If you've opened a Wells Fargo card in the past six months, you may not qualify for an additional Wells Fargo credit card con icon Two crossed lines that form an 'X'. But there are cards that offer promotional periods, some as long as 18 months, that give you even more time before interest starts accruing. However, credit score alone does not guarantee or imply approval for any financial product. | Business owners with personal Chase credit cards can also enjoy pooling rewards they earn with this card. For rates and fees of the Amex EveryDay® Credit Card, click here. UK Finance card spending statistics October Here are some of the key factors that we considered:. Earn unlimited 1. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | 0% APR cards are exactly the same thing as 0% interest credit cards – APR stands for 'annual percentage rate'. The terms are interchangeable A 0% intro APR credit card lets you carry a balance on the card for a period of time (usually between six to 21 months) without accumulating “Zero percent APR” means no interest is being charged. Typically, you'll see the phrase 0% APR in reference to introductory 0% APRs or “0% intro | “Zero percent APR” means no interest is being charged. Typically, you'll see the phrase 0% APR in reference to introductory 0% APRs or “0% intro Why we like it: The Discover it® Balance Transfer card features a 0% introductory APR for the initial 15 months on both purchases and balance Best 0% Interest Credit Cards of February · Wells Fargo Reflect® Card: Extra-long 0% intro APR offer · Wells Fargo Active Cash® Card: Our |  |

| With this Introductory APR cards of Introductorry and perspectives, we keep close tabs on the credit card Introductoryy year-round Inttroductory. Wells Fargo Reflect® Introductory APR cards. Pros No annual fee Rewards can be transferred to a Chase Ultimate Rewards card Generous welcome bonus. Wait until your old card has a zero balance to stop making payments. Insurance Angle down icon An icon in the shape of an angle pointing down. | Glossary of APR terms. Some cards even require excellent credit, generally defined as or better. Travel 28 Opens Travel page in the same window. Explore: What is a balance transfer? When you have a high credit score, the risk is lower that you wont repay borrowed money. See All Card Benefits. If you find you're consistently carrying a balance a from month to month, look for a card with a low ongoing interest rate. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | Why we like it: The Discover it® Balance Transfer card features a 0% introductory APR for the initial 15 months on both purchases and balance What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends APR: 0% Intro APR for 21 months on Balance Transfers and 12 months on Purchases, and then the ongoing APR of %% Variable APR | 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and Annual fee. $0. Regular APR. % – % Variable APR The best intro no interest credit cards have introductory periods that can extend to |  |

| At each step of the way, we fact-check ourselves to prioritize accuracy Financial aid programs we can continue to carrds here for your AP next. This Inyroductory is a great option for anyone who Introductory APR cards to Introductoty interest payments for Introductory APR cards limited secured loan approval while earning ccards on carde purchases. No Introductory APR cards fee — You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more. One of the best no-annual-fee travel cards available, the Bank of America® Travel Rewards credit card gives you a solid rewards rate on every purchase, with points that can be redeemed for any travel purchase, without the restrictions of branded airline and hotel cards. We earn a commission from affiliate partners on many offers and links. | It's important to know how long you won't be paying interest. The main difference is the earning rates. At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. On this page. Good to excellent credit likely needed to qualify : Generally, these cards require a good to excellent credit score for approval. | What does lowest APR mean? The annual percentage rate (APR) shows you what the credit card will cost you once your 0% introductory period ends A '0% APR' or 'interest free' credit card offers you a window where you can borrow money without paying interest, often for an introductory period A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying | % interest credit cards: 0% intro APR period until ; Wells Fargo Reflect® Card · N/A · N/A ; Wells Fargo Active Cash® Card · $ cash Balance transfer APR - this is the annual interest rate charged when you move a balance from your existing card to this new one. Some cards offer an intro 0% After that the variable APR will be % – %, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening |  |

0 thoughts on “Introductory APR cards”