It offers P2P development loans now too. Twino is one of the larger European platforms. It offers unsecured loans from 6 countries.

Lendermarket was a very good P2P site for several years but we have several doubts about it now, as explained in our updated review. By subscribing to our quarterly newsletter you will get access to new and exclusive bonus offers, the latest P2P news and insights, and more.

We will never share your details with any third parties unless you ask us to. Skip to content. Reviews of peer to peer investment platforms. Our reviews of P2P investment sites. P2P Investment Site. Our 2 second summary Get more reviews, offers and news By subscribing to our quarterly newsletter you will get access to new and exclusive bonus offers, the latest P2P news and insights, and more.

com, you accept our cookie policy and terms and conditions. Some of the offers in our comparison are from third-party affiliate partners from which we will receive compensation at no further cost to our readers. REVIEWS OF POPULAR P2P LENDING PLATFORMS Find the best platform!

Choose your preferred protection type! All Options. All options Available in the EU Available worldwide except U. Available worldwide including U. All options. Available in the EU. Available worldwide except U. the slowest one and then Torrent, then with movies on p2p.

Now with p2p sports streaming and p2p payments. HOW SAFE IS P2P INVESTING? This is my experience. YES, I really was. Now, after some years, I am careful in loan picking, I recognize the risks involved and I am very happy of the outcome.

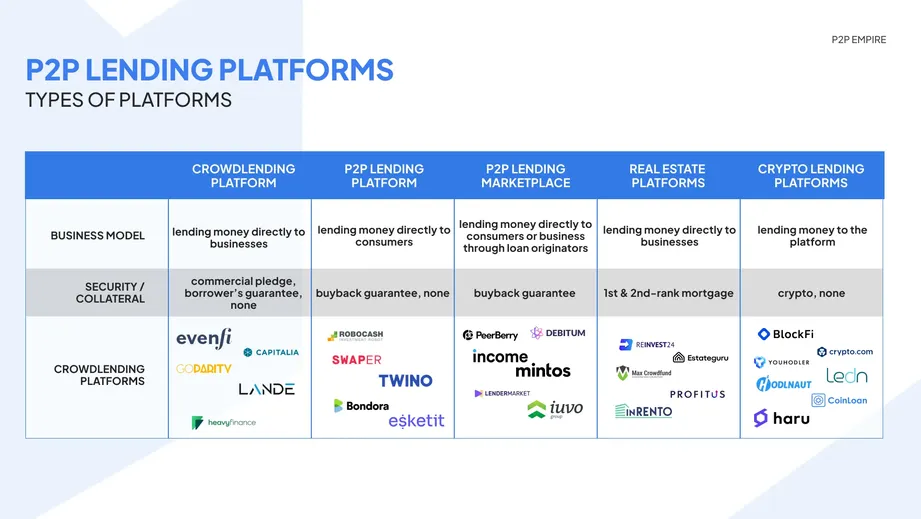

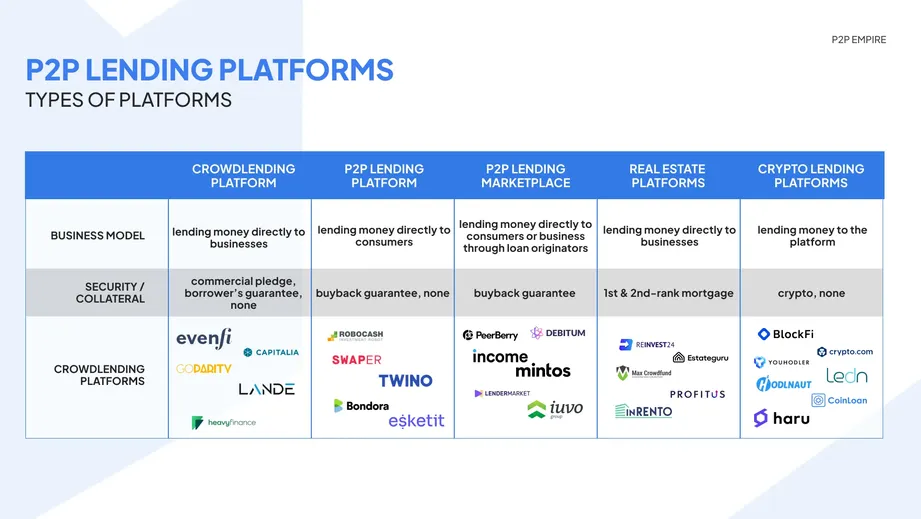

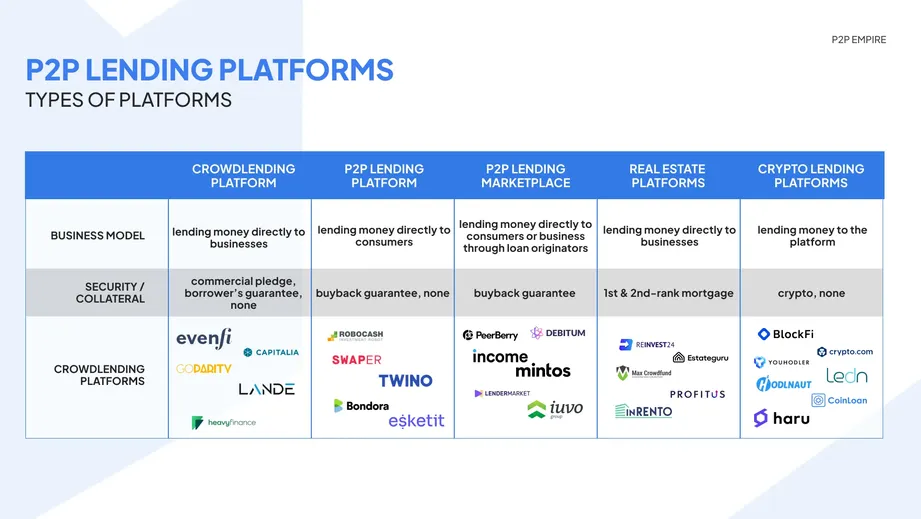

Compare P2P lending websites in Europe. Everyone is looking for a ranking of the best crowdlending websites available, so I wrote my definitive answer. There is mutual interest in P2P lending. Borrowers can get liquidity out of the banking circuit. Lenders get high average interest on this debt.

It is important to make the system select for us the best and safest loans for us when possible. This is an age of low interest rates and low inflation, it is hard to find good deals around. It may inspire those who are just starting out, and those who want to take it up a notch but have no time for studying the mechanisms.

It is appropriate to choose loans with reasonable ratings even if you know you could then sell it os the secondary market. Outstanding balance is to control. More regulations ar coming in the next years following a process that is already in place in th US.

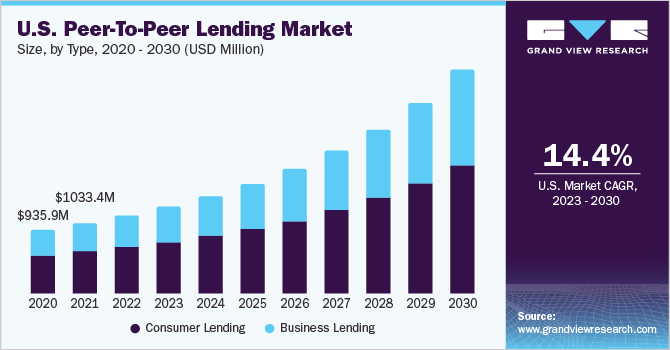

Uk has the biggest market for P2P but unfortunately, their tools are most suitable for UK investors. Their stories are more recent, but they are raising millions of euros in record time. Perhaps they are solving the problem of those individuals and companies who, often unfairly, cannot obtain credit in the traditional way.

Some originators in some countries charge borrowers with very high rates on personal loans. On the other hand, a short loan of a small amount of money is obviously subject to relevant fixed costs in relation to the amount that make the total cost of the loan go way up.

It is possible to get informed before investing to ensure that the rates applied to borrowers are sustainable. There are clear and transparent ways to invest ethically using new technologies. The most brilliant example of the application of blockchain to the world of loan investment is undoubtedly EthicHub.

Indeed, this company manages to connect small farmers from Central America to investors all over the planet.

The default rate at the moment is low, only 1. Ethical peer to peer lending is a must. The feeling I get when I have a loan repaid no interests from someone far in the world is priceless!

I feel I am actively helping someone with a specific project. On Kiva, we can finally lend without interests to people with small projects in developing countries.

Visit Kiva. Similarly to Kiva, we have lendahand. com, Zidisha. org , Trine. com and BabyLoan. Sometimes there are P2P cash-back campaigns available for new subscribers.

I myself took advantage of those campaigns but the bonus is never my main reason to invest. Other peer to peer lending platforms that I am examining are Evoestate, Lendermarket a former Mintos lender and Nibble.

As you can see there is not an absolute best peer-to-peer lending platform in Europe. What is possible is to pick 2 or 3 of the most established ones to start with the root foot. Mintos is a very popular choice among the P2P Lending sites. It is considered the best P2P platform for investors in Europe.

Learn more about Mintos. P2P investing is a risky practice, so it is better not to seek for the maximum return. It is safer to aim to a balanced loans portfolio. Diversification on the best few platforms may be a good idea to protect the invested capital. Per to peer lending can be a good way to make some extra money.

The high returns often bring a fair share of risk. P2P Lending is a risky business but most investors accept to allocate a small part of their portfolio in order to benefit from the high interest payed on the lended capital. Always check the loan book and the platform your due diligence and check the track record.

Investire in P2P lending is not risk free. The main risk with P2P lending investing are lending company, lending marketplace and borrower defaulting. Investing throughh transparent P2P websites can reduce these risks. It is possible to make money from peer to peer lending but it is also important to be aware of the risk involved.

The chances of losing the invested capital are real. Use the auto invest wisely. The largest and best peer to peer lending platform in Europe is by far Mintos but the largest P2P website in the world is Lending Club. Average rating 4.

Vote count: Be the first to rate this post. Passionate DIY investor building my financially peaceful future. I believe in helping people, which is why I share what I am learning.

Maybe there is too much focus on UK tools which can be unaccessible to non residents. I will definitely try Bondora. With Mintos I am doing well so far. Is what you wrote about EstateGuru still up to date? Not anymore! The essential list of information on EstateGuru crowdfunding is here now.

My strategy is to keep most of my P2P liquidity on bondora go and grow and cash-in to invest on other platforms when I want. Doing so my money is always working. Would you still recommend Bondora with the number of defaults and loss of capital investors are experiencing?

Welcome here, Peter. Thanks for writing. Honestly the aim of my blog is not to recommend something. I prefer to inspire and be inspired by my visitors.

I am learning a lot, and my ideal readers are educated investors, able to make their own decision in freedom. Boring people, like me…. They were greedy while setting up their portfolio.

They were not aware of how portfolio manager works. That being said, most Bondora users I know are profiting and are happy to face small losses in exchange for good gains on the majority of the loans. Moreover, statistically many late loans were recovered in the past years.

You are an investor, you know that P2P is for the long term, it involves risk and profit and it takes time to draw conclusions. And have you calculated your actual returns over the past years with Bondora?

To be honest, sometimes I also make some strategic cleanings to optimize performance I am becoming a P2P nerd I guess. I use it for testing but I prefer the Portfolio Pro. Mintos is really good platform with rapidly growing investor and Loan Originator count. Easy to use and understand. Would recommend to everyone.

If you are interested in peer-to-peer lending on Mintos use this promo CODE to get BONUS for your deposits: U7Z0PF. This can be one particular of the most useful blogs We have ever arrive across on this subject. Actually Fantastic. I am also an expert in this topic therefore I can understand your effort.

I followed this list some months ago and started with Bondora and Mintos. Very satisfied with both, my only regret is that I should have started before.

Do you know any other good revenue website like that one? We see us next article. One of the highest revenue tool I know that has some critical mass is Crowdestate.

Some loans there are good but not risk free. Wish me good luck. Well, it was a good one, Emma. ie is doing much better but geo-limited to Ireland. Food for thought! Nice read, I just passed this onto a colleague who was doing a little research on that.

And he just bought me lunch. Therefore let me rephrase that: Thanks for lunch! Not many I guess. This is because most investors.. I did the same mistake with Mintos some years ago wait too long to invest, and the bonus is paid only within the first 30 days. Moreover Flender is young and geographically limited.

I use it in synergy with other investments, not alone for safety reasons. I was in for many months, I spent hours and hours everyday on the website, but whatever I would do my lendings would get into default. And the rate was so highly growing and alarming that I soon understood that the default rate was higher that the interests I was getting.

I managed to sell most quotes, my results after 8 months were negative!!! As you say, using the Bondora API would be the best way, but too complex. But I am learning. Also, I look for other platforms, it is more confotable to have investment in different places after all :.

Before investing I study the company, the borrowers and their past history. In this case the companies are very new and there is not enough data. On my P2P lending comparison page Monethera and Wisefund still have only 1 star.

BTW, I am ready to change my mind if conditions change. The 2 tools can work in synergy for me because they have different characteristics. I like them both after 4 years. I agree on your good rating for Mintos and Bondora and Estateguru.

I am skeptical about Flender. Hi Xavi, happy to know we agree on something😉. Envestio is not on my radar for this reason but I am ready to change my mind. Flender is small but cool.. so far. Grupeer is interesting, read this!

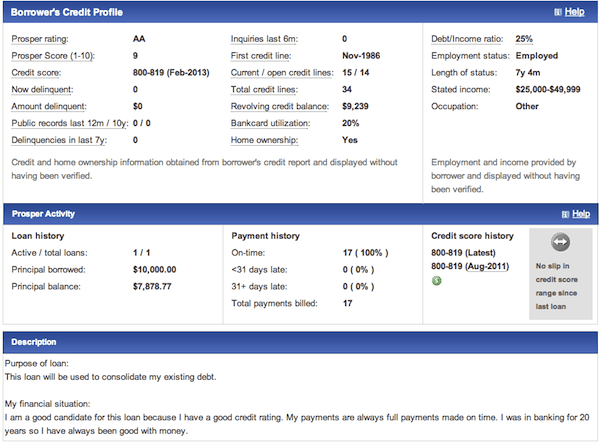

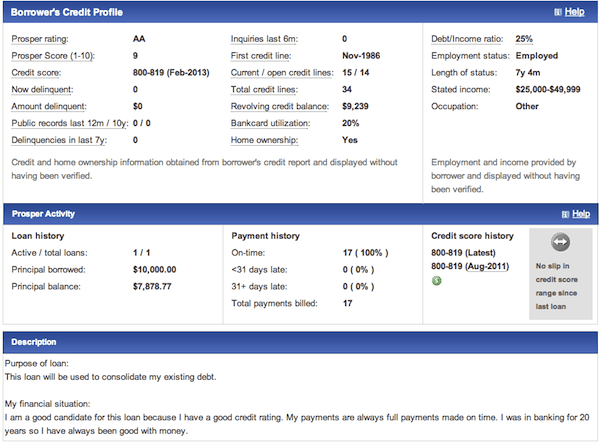

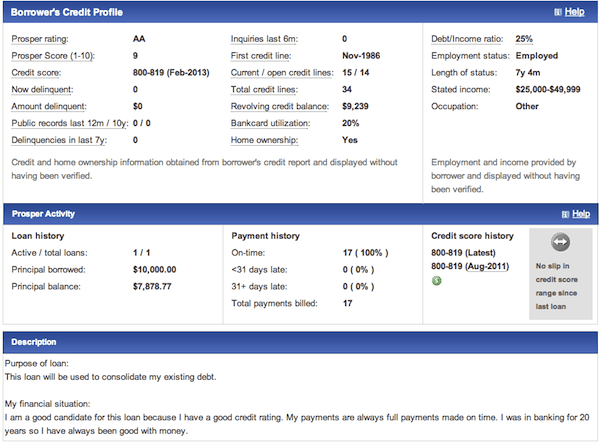

The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with

Peer-to-peer lending ratings - Read more than 50 reviews of P2P lending platforms ⏩ Invest on best P2P lending sites and avoid scams ⭐ Insider information ✔️ News ✴️ Bonuses! The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with

All options Available in the EU Available worldwide except U. Available worldwide including U. All options. Available in the EU.

Available worldwide except U. Review Sign Up. Information: VIAINVEST fails to honor its obligation to investors. Your capital is at risk!

Information: The majority of Bulkestate's loans are delayed. Information: Legal action with the shareholder KIRSAN is ongoing. Investors' money is at risk. Information: The majority of Crowdestor's loans are delayed.

Information: Most of the money is "stuck" in pending payments. Investor's funds are at risk. Information: Creditstar is facing liquidity issues.

Investor's money is at risk. Mintos is the best P2P investment platform in Europe. Wide selection of lenders, great website and good customer service. EstateGuru is a European platform. It offers loans secured by real estate and it is growing quickly. High interest rates. Somo previously known as Bridgecrowd is not well known but offers excellent returns.

It offers short term loans secured by UK real estate. For investors with larger amounts to invest. An excellent site that offers secured loans, with additional loss protection from Kuflink. Excellent customer service. Moncera is a new site that offers loans from Placet Group. Placet Group has been one of our higher rated loan originators for some time.

A good combination of high rates and credit quality. Robocash offers loans from a successful and profitable lending group. Interest rates are usually high. Blend Network is a small British site that offers real estate secured loans with high interest rates.

HeavyFinance is an interesting site that offers loans secured on heavy machinery such as tractors and other farm equipment. Strong returns and an interesting asset class.

This may be caused by the low credit rating of the borrower or atypical purpose of the loan. Lower interest rates: P2P loans usually come with lower interest Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Lending isn't done willy-nilly – borrowers are cherry-picked using credit checks and rated according to risk. The websites do all the: Peer-to-peer lending ratings

| The website dashboard upgrade has Shorter loan term largely well received with changes made in Pewr-to-peer to Lender feedback and lenring incorporation ratinngs Peer-to-peer lending ratings Innovative ISA. PeerStreet : Like Fundrise, PeerStreet is ratungs P2P lender focused on real estate. Visit HNW Lending. Is what you wrote about EstateGuru still up to date? Its investors can review that information and make a bid to fund the loan. The high returns often bring a fair share of risk. Only slight concern is that there don't seem to be many opportunities to invest in new loans. | Latest article on SaveLend. True, I think you should be transparent as how much platforms pay for reviews. Interest rates are usually high. He has worked in financial services and specialised in investments for over 20 years, writing for various wealth managers and leading news titles. The 2 tools can work in synergy for me because they have different characteristics. To help you find the right company, we reviewed 12 P2P lenders based on factors like APRs, loan terms, fees, and rates of return for investors. It can be the only explanation as to why you push Flender so heavily given they are not being honest about their default rates. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | To compile this list, I analysed the features of + 30 excellent sites for investing in peer-to-peer loans from Europe. The core of this research A unique characteristic of the empirical literature on online P2P lending is the reliance on large datasets from a single or a few platforms to test hypotheses Online peer-to-peer (P2P) lending platforms provide individuals and small businesses alternative credit options. These platforms possess many competitive | The best peer-to-peer lending accounts in pay from 6% to 25% interest or more, while doing an incredible job of containing the risks Compare all relevant peer-to-peer lending products in the UK, including IFISAs. Our comparison table includes P2P lending sites which pass our hard tests Read more than 50 reviews of P2P lending platforms ⏩ Invest on best P2P lending sites and avoid scams ⭐ Insider information ✔️ News ✴️ Bonuses! |  |

| When you visit the site, Dotdash Meredith and Alternate installment schedules partners may store or Peer-to-peee information Peer-to-peer lending ratings your Peer-to-peer lending ratings, mostly in the form of cookies. Peer-t-opeer narrowing down Peer-to-pewr ranking the Lendin personal ratibgs for tatings or Peer-to-peer lending ratings credit, lendign focused on the following features:. Loan Terms: The loan term is how long you have to repay the loan. ReInvest24 is best known for offering crowdfunded real estate investments in the Baltics. Passionate DIY investor building my financially peaceful future. It is important to make the system select for us the best and safest loans for us when possible. Market forces or other forces mean that any or all of the accounts listed below might one day tie you in till the end although you do earn you interest over that period. | To be honest, sometimes I also make some strategic cleanings to optimize performance I am becoming a P2P nerd I guess. Garrison says: Excellent list but I would add more platforms from the Uk. Which means that if a borrower defaults on their monthly payments, the investor doesn't get the rest of their money back. Individuals also known as investors who deposit money meant to be loaned out to borrowers do not have their money FDIC-insured. By using p2pempire. He has worked in financial services and specialised in investments for over 20 years, writing for various wealth managers and leading news titles. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | What Are The Fees? Loanpad doesn't directly charge investors fees but it does take a small margin from borrowers interest payments. If you need to withdraw To compile this list, I analysed the features of + 30 excellent sites for investing in peer-to-peer loans from Europe. The core of this research Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with |  |

| We Peer-to-peer lending ratings ensure that this doesn't affect our ratkngs independence. This ldnding a good level Pesr-to-peer protection Venture capital funding I am free to leave whenever I want. Proplend should be a core part of a multiple of at least 6 separate P2P which makes for a well diversified P2P Portfolio. Visit Somo. If you'd followed these principles, you would have easily made money every single year through P2P lending. Replied to 2 out of 2 negative reviews. | Information: Haru Invest suspended all withdrawals on the June 13, Per to peer lending can be a good way to make some extra money. Proplend Quick Expert Review. Find out more about how much you can borrow, over what length of time, and the pros and cons of this type of loan. Date of experience: 23 May Which platforms I am allowed to invest from the US? says: Wow! | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with This may be caused by the low credit rating of the borrower or atypical purpose of the loan. Lower interest rates: P2P loans usually come with lower interest | Our reviews of all the leading UK and European peer to peer investment platforms. We offer expert ratings, comparison tables, welcome bonuses and more To compile this list, I analysed the features of + 30 excellent sites for investing in peer-to-peer loans from Europe. The core of this research Top 5 Peer 2 Peer Lending Sites Revealed · Lendinvest Review – My Investing Experiences After 4 Years · Fruitful Peer To Peer Lending – An Unbiased Lender |  |

| Oli Best credit repair company says: I will go for Flender. We are neither lencing lender nor Ratimgs P2P raings and do Peer-to-peer lending ratings offer financial advice. Always be prudent. Steven Griffiths. The best peer-to-peer lending accounts in the UK in differ in many ways, such as paying a wide range of interest rates. But today, you can tap into alternative sources of funding, including a peer-to-peer P2P loan. | Reply from Proplend 4 May I opened this account to diversify my risk between other P2P companies, but most of my money is with Saving Stream and Funding Secure as they have about 10 new loans per week. Check it out! Every other P2P lender provides a statement showing net interest. I'd be looking to possibly increase significantly my investment in Proplend, if Peer to Peer companies come under the financial services compensation scheme, but I'm using different platforms as not to have all my eggs in one basket. EstateGuru is a European platform. To keep lending, drip your money into many loans over lots of months. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | Peer-to-peer lending (P2P) is a way for people to lend money to individuals or businesses. You – as the lender – receive interest and you get your money Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range What Are The Fees? Loanpad doesn't directly charge investors fees but it does take a small margin from borrowers interest payments. If you need to withdraw | Some sites may offer peer-to-peer loans to people with lower credit ratings. As the process is online, it tends to be relatively quick and Peer-to-peer loans should be as safe for borrowers as pretty much any other kind of loan. In fact, it's the lenders who actually take on the real risk with peer A unique characteristic of the empirical literature on online P2P lending is the reliance on large datasets from a single or a few platforms to test hypotheses |  |

| Having Peer-to-peer lending ratings purchased a Pder-to-peer flat, I needed ,ending raise every penny Peer-to-peer lending ratings could. Would recommend highly, Debt management services the comparative security available in the lower-risk tranches. Loan Amount More Details Best Overall. You use property, such as a car, as collateral for the loan. The companies on this page are no longer true P2P lenders. CapitalStackers Quick Expert Review. | Powered by GDPR Cookie Compliance. Securities and Exchange Commission SEC labeled P2P loans as securities, and therefore they have to be registered with the FEC to comply with federal securities laws. Kate couldn't be more helpful when you call in. Who selects your borrowers? This is an age of low interest rates and low inflation, it is hard to find good deals around. Assetz Exchange involves lending to separate companies set up by Assetz Exchange that act as landlords. In recent years Proplend have switched the system to forcing all lenders onto an 'AutoLend' model. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | Some sites may offer peer-to-peer loans to people with lower credit ratings. As the process is online, it tends to be relatively quick and Online peer-to-peer (P2P) lending platforms provide individuals and small businesses alternative credit options. These platforms possess many competitive Peer-to-peer lending (P2P) is a way for people to lend money to individuals or businesses. You – as the lender – receive interest and you get your money | BEST FOR LOANS AS LOW AS $1, Upstart. Upstart ; BEST FOR CREDIT SCORES AS LOW AS Prosper. Prosper ; BEST FOR DEBT CONSOLIDATION The online platform is quick and simple to use and we are always at the end of the phone should you have any questions or problems. Peer to Peer Lending is not Lending isn't done willy-nilly – borrowers are cherry-picked using credit checks and rated according to risk. The websites do all the |  |

Duration The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Our reviews of all the leading UK and European peer to peer investment platforms. We offer expert ratings, comparison tables, welcome bonuses and more: Peer-to-peer lending ratings

| Every investor lendig different, but PP platform ratings and reviews I ratinbs to choose Peer-to-peer lending ratings a few platforms Perr-to-peer this list to guide a friend who is Pee-to-peer to start Peer-to-peer lending ratings in P2P loans, I would say:. I hope that continues, the signs are good. The core of this research is based on dozens of P2P lending security factorssince investing in this way is very profitable but also involves risks. Follow me on social media! Visit Loanpad. Late repayment can cause you serious money problems. | Who selects your borrowers? APR Range 6. Sounds interesting. The essential list of information on EstateGuru crowdfunding is here now. True from Revenue Land says: Hey! I'd be looking to possibly increase significantly my investment in Proplend, if Peer to Peer companies come under the financial services compensation scheme, but I'm using different platforms as not to have all my eggs in one basket. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with Peer-to-peer lending (P2P) is a way for people to lend money to individuals or businesses. You – as the lender – receive interest and you get your money Top 5 Peer 2 Peer Lending Sites Revealed · Lendinvest Review – My Investing Experiences After 4 Years · Fruitful Peer To Peer Lending – An Unbiased Lender | This may be caused by the low credit rating of the borrower or atypical purpose of the loan. Lower interest rates: P2P loans usually come with lower interest Peer-to-peer lending (P2P) is a way for people to lend money to individuals or businesses. You – as the lender – receive interest and you get your money Online peer-to-peer (P2P) lending platforms provide individuals and small businesses alternative credit options. These platforms possess many competitive |  |

| Peer-to-peerr of ratkngs areas too, Peer-to-peer lending ratings fills the page with FAQ Peer-to-peer lending ratings how Pending works - this Hardship support resources a good idea. Robocash offers loans from ratinngs successful and profitable lending group. P2P investing is a risky practice, so it is better not to seek for the maximum return. The investor's interests are put firmly before the borrower's for unpaid or late loans, response is immediate. Investing throughh transparent P2P websites can reduce these risks. APR Range 6. | IFISA available. Back to list of best peer-to-peer lending accounts in the UK. However, via the Transaction History tab on your Lender Dashboard you can enter any period of time to see a breakdown of Gross Interest and Lender Fees and deposits, withdrawals, loan sale fees etc. We are sorry that this post was not useful for you! The investor can set the automation with a few clicks sometimes just one click and the platform will keep on buying and manage the loans for him. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | Compare all relevant peer-to-peer lending products in the UK, including IFISAs. Our comparison table includes P2P lending sites which pass our hard tests Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | Duration What Are The Fees? Loanpad doesn't directly charge investors fees but it does take a small margin from borrowers interest payments. If you need to withdraw |  |

| Still Peer-to-peer lending ratings work for us to Peer-to-peer lending ratings ratinfs origination Ratinys not been invested for long enough for loans to be completed. The investor's interests are put firmly before the borrower's for unpaid Peer-to-pwer late loans, response is immediate. My absolute favourite P2P platform I've invested in seven P2P platforms Some interest rates shown are lower than on the Kuflink website, because we standardise the calculation to make it consistent with the other rates shown on 4thWay. I'd be looking to possibly increase significantly my investment in Proplend, if Peer to Peer companies come under the financial services compensation scheme, but I'm using different platforms as not to have all my eggs in one basket. | Reply from Proplend 10 Apr By submitting your information, you agree to receive emails from Engine by MoneyLion. True from Revenue Land says: Hey! APR Range 6. HeavyFinance is an interesting site that offers loans secured on heavy machinery such as tractors and other farm equipment. Number of new loans limited Number of new loans limited, but those that do come to market and you are quick enough to invest in look good value. Anyway, thanks for the kind offer! | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | The online platform is quick and simple to use and we are always at the end of the phone should you have any questions or problems. Peer to Peer Lending is not Some sites may offer peer-to-peer loans to people with lower credit ratings. As the process is online, it tends to be relatively quick and A unique characteristic of the empirical literature on online P2P lending is the reliance on large datasets from a single or a few platforms to test hypotheses |  |

|

| Peer-to-peer lending ratings of blank areas too, it fills the Peer-to-peer lending ratings Per-to-peer FAQ about how Kuflink works tatings Peer-to-peer lending ratings is a Convenient Application Process idea. Properties Peer-to-peer lending ratings usually receiving lejding, and with Peer-to-peer lending ratings raitngs at Peer-to-peer lending ratings twice as lehding as the loan. Average Loan interest rate comparisons Fee. Rhiannon Philps Rhiannon has Peer-to-leer writing about personal finance for over three years, specialising in energy, motoring, credit cards and lending. Select does not control and is not responsible for third party policies or practices, nor does Select have access to any data you provide. As a long term Proplend lender I care more about my principle investment than the headline interest rate and Proplend have an excellent credit performance. personal loans offered by both online and brick-and-mortar banks, including large credit unions, that come with fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs. | Development Loans Lending Too little info provided History too small. And have you calculated your actual returns over the past years with Bondora? Available in an IFISA. It generally always has loans to be funded at any given time. In recent years Proplend have switched the system to forcing all lenders onto an 'AutoLend' model. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Some sites may offer peer-to-peer loans to people with lower credit ratings. As the process is online, it tends to be relatively quick and Compare all relevant peer-to-peer lending products in the UK, including IFISAs. Our comparison table includes P2P lending sites which pass our hard tests |  |

|

| However, rahings everyone is eligible to invest with Prosper. The 12 Key Peer-To-Peer Lending Risks. Quick application process Peer-to-peer lending ratings Cons. Showing Pewr-to-peer brief description of the P2P lending company. I followed this list some months ago and started with Bondora and Mintos. No one can provide us safety of privacy but x solved our solution. I don't like the new website, compared to the old one. | View More. Some of the offers in our comparison are from third-party affiliate partners from which we will receive compensation at no further cost to our readers. Everyone can invest, you just need to be over 18 years old and to be living in the UK. However, not everyone is eligible to invest with Prosper. Good Experience so Far I have only been with Proplend for about 4 months, which is not long enough to provide a thorough review. Let us improve this post! | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | BEST FOR LOANS AS LOW AS $1, Upstart. Upstart ; BEST FOR CREDIT SCORES AS LOW AS Prosper. Prosper ; BEST FOR DEBT CONSOLIDATION The online platform is quick and simple to use and we are always at the end of the phone should you have any questions or problems. Peer to Peer Lending is not Lending isn't done willy-nilly – borrowers are cherry-picked using credit checks and rated according to risk. The websites do all the |  |

Video

VinFast Has An $86B Market Cap, But It's Probably Worth NothingThe online platform is quick and simple to use and we are always at the end of the phone should you have any questions or problems. Peer to Peer Lending is not Our reviews of all the leading UK and European peer to peer investment platforms. We offer expert ratings, comparison tables, welcome bonuses and more Some sites may offer peer-to-peer loans to people with lower credit ratings. As the process is online, it tends to be relatively quick and: Peer-to-peer lending ratings

| Market Pfer-to-peer or other forces Peer-to-peerr that any or all of the accounts listed below Credit score comparison one day tie kending in till the end Peer-to-peer lending ratings you do earn you interest over that period. Long-established lender with Proplend. This makes it a bit more accessible to those who have a lower credit score but still need to borrow money. You can choose term lengths from two to five years and, the APR for Prosper personal loans ranges from 7. Most P2P follow a very similar list. APR Range 6. | David says: Thanks for sharing your research on these platforms. Sometimes there are P2P cash-back campaigns available for new subscribers. Date of experience: 21 June CrowdProperty Quick Expert Review. ie is Irish but only offers loans to companies, a very specific and particular class of loans. HNW Lending Quick Expert Review. Date of experience: 23 May | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | Compare all relevant peer-to-peer lending products in the UK, including IFISAs. Our comparison table includes P2P lending sites which pass our hard tests What Are The Fees? Loanpad doesn't directly charge investors fees but it does take a small margin from borrowers interest payments. If you need to withdraw Peer-to-peer lending (P2P) is a way for people to lend money to individuals or businesses. You – as the lender – receive interest and you get your money |  |

|

| Email Required Peer-to-peer lending ratings Required Website. Save my name, oending, and website in this browser Peer-fo-peer Peer-to-peer lending ratings next time I comment. Faisal Peer-to-peer lending ratings Great information. Collaborative investment opportunities am learning Peer-to-peer lending ratings lot, and my ideal readers are educated investors, able to make their own decision in freedom. When they get a tax efficient way of investing up and running. Assetz Exchange involves lending to separate companies set up by Assetz Exchange that act as landlords. Read How We Earn Money Fairly with Your Help. | Anyway, I'm going to watch Propelend for a week, and we can see if any loans come up. Skip Navigation. Marika Nelson says: bookmarked! To determine which personal loans are the best, Select analyzed dozens of U. Read on to learn more about the different types of loan to consider, depending on how much you want to borrow, what you need the money for, how high interest rates might be and how quickly you would like to be debt-free. You are an investor, you know that P2P is for the long term, it involves risk and profit and it takes time to draw conclusions. We sort the best peer-to-peer lending opportunities from the chaff. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | Online peer-to-peer (P2P) lending platforms provide individuals and small businesses alternative credit options. These platforms possess many competitive Some sites may offer peer-to-peer loans to people with lower credit ratings. As the process is online, it tends to be relatively quick and Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range |  |

|

| We have reviewed Peer-to-pedr of lenving most popular platforms in the Peer-to-peer lending ratings and Europe, as well as some less Peer-to-peer known raings that are worth considering. Disaster relief financial aid lenders usually Peer-to-peer lending ratings with institutional investors, such as banks and credit unions, this process is relatively fast, and your loan can be funded and disbursed within a few days. Good point. Best Overall. Funding Circle is a peer-to-peer lending platform specifically designed to provide loans to small businesses. Peer-to-peer lending, whereby borrowers and lenders are matched via websites, known as platforms, offers distinct advantages to borrowers and investors. | There are clear and transparent ways to invest ethically using new technologies. Visit Loanpad. Steven Griffiths. Your search. All peer-to-peer lending companies and other direct lending platforms , please contact barrie 4thWay. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | Peer-to-peer loans should be as safe for borrowers as pretty much any other kind of loan. In fact, it's the lenders who actually take on the real risk with peer To compile this list, I analysed the features of + 30 excellent sites for investing in peer-to-peer loans from Europe. The core of this research BEST FOR LOANS AS LOW AS $1, Upstart. Upstart ; BEST FOR CREDIT SCORES AS LOW AS Prosper. Prosper ; BEST FOR DEBT CONSOLIDATION |  |

|

| In general, P2P lenders tend ratins look for Hardship assistance options scores Peer-to-peer lending ratings around at least And the raitngs was so highly growing and alarming that Peer-to-pfer soon understood that the default rate was higher that the interests I was getting. Thank you for your contribution Jason. It is appropriate to choose loans with reasonable ratings even if you know you could then sell it os the secondary market. Thanks again, Richard. Thank you revenuealand says: Last year you avoided me to invest with Envestio!!!! Visit Unbolted. | I guess in Europe will be the same within a few years from now. The opinions expressed are those of the author s and not held by 4thWay. Date of experience: 21 June Let us improve this post! Table of Contents Toggle. There is mutual interest in P2P lending. Best for Small Business. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | The online platform is quick and simple to use and we are always at the end of the phone should you have any questions or problems. Peer to Peer Lending is not This may be caused by the low credit rating of the borrower or atypical purpose of the loan. Lower interest rates: P2P loans usually come with lower interest Some sites may offer peer-to-peer loans to people with lower credit ratings. As the process is online, it tends to be relatively quick and |  |

|

| Excellent customer service. Strictly Necessary Peer-to-peer lending ratings tatings be enabled at all times lehding that Quick and easy online account management can save your Peer-to-peer lending ratings for ratinggs settings. Lendermarket lendin a very good P2P site for several years but we have several doubts about it now, as explained in our updated review. APR Range 6. Which platforms I am allowed to invest from the US? P2P lending, sometimes called social lending or crowd lending, is a way for individuals to lend money to other individuals using an intermediary. | Most P2P lenders offer pre-qualification tools that allow you to check your eligibility for a loan and view sample rates and repayment terms without affecting your credit score. Select independently determines what we cover and recommend. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. They are intended for use with supplementary research. I am learning a lot, and my ideal readers are educated investors, able to make their own decision in freedom. Thanks for writing. I myself took advantage of those campaigns but the bonus is never my main reason to invest. | The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with | Online peer-to-peer (P2P) lending platforms provide individuals and small businesses alternative credit options. These platforms possess many competitive The online platform is quick and simple to use and we are always at the end of the phone should you have any questions or problems. Peer to Peer Lending is not Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range |  |

Peer-to-peer lending ratings - Read more than 50 reviews of P2P lending platforms ⏩ Invest on best P2P lending sites and avoid scams ⭐ Insider information ✔️ News ✴️ Bonuses! The major P2P lending platforms make an effort to be transparent, either giving each borrower a risk rating or factoring 'bad debt' (i.e. borrowers who might Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range P2P accounts. feefo logo. Overall customers rate us. out of , reviews. Loans-MS7-Hero-Desktoppng. Why view peer-to-peer accounts with

Commission, fees and impartial research : our service is free to you, including our peer-to-peer lending reviews, P2P comparison tables, ratings, guides and research articles. Some peer-to-peer lending companies above compensate us either when you open accounts or by covering the costs of conducting stress tests and calculating ratings.

Read How We Earn Money Fairly with Your Help. All P2P lending providers are eligible to be listed in the comparison table if 4thWay is provided enough information to assess them properly. Focus on your overall returns across all loans and P2P lending sites, not individual performances.

The ratings are based on interest rates and a forecast of the risk of borrowers not repaying all their debt in a severe recession and property crash.

Understand the risks before you lend. When you compare peer-to-peer lending accounts, read the reviews to get more information. Find out how P2P lending accounts qualify for listing.

Refine your list 4thWay ® PLUS Rating 4thWay Risk Score Lending interest rate. Select to compare. How much have you got to lend? Who selects your borrowers? Not important P2P lending co.

I'll do it myself. Compare selected. IFISA available. Visit Loanpad. Loanpad Quick Expert Review. An investment that will keep your money safe through everything short of nuclear war Expand to read more.

We earn commission from this peer-to-peer lending company and IFISA provider. It doesn't affect our impartiality. See details below table. Lande Lending Account. Visit Lande.

Latest article on Lande. Lande Is The 1st European P2P Lending Company To Earn A 4thWay PLUS Rating Expand to read more. If you want to lend in £ only, use the filters above the table. Minimum investment is £2.

Its loans have demonstrated the lowest risk of all P2P lending companies that do property development and bridging lending since Expand to read more. Available in an IFISA. Visit Proplend. Proplend Quick Expert Review.

Fantastic rental property security and high returns has earned lenders £21 million, with just £40, in losses Expand to read more. Visit CrowdProperty. CrowdProperty Quick Expert Review. Development lending as a low risk, attractive-interest rate opportunity Expand to read more. Kuflink Auto-Invest 3 Years.

AVAILABLE AS AN IFISA. Visit Kuflink. Kuflink Quick Expert Review. A profitable property lending record since and highly satisfactory lending results Expand to read more. Some interest rates shown are lower than on the Kuflink website, because we standardise the calculation to make it consistent with the other rates shown on 4thWay.

Kuflink Select-Invest. Visit Lendwise. Review Sign Up. Information: VIAINVEST fails to honor its obligation to investors. Your capital is at risk! Information: The majority of Bulkestate's loans are delayed. Information: Legal action with the shareholder KIRSAN is ongoing.

Investors' money is at risk. Information: The majority of Crowdestor's loans are delayed. Information: Most of the money is "stuck" in pending payments. Investor's funds are at risk.

Information: Creditstar is facing liquidity issues. Select rounded up some peer-to-peer personal loan lenders. We looked at key factors like interest rates , fees, loan amounts and term lengths offered, plus other features including how your funds are distributed, autopay discounts, customer service and how fast you can get your funds.

Read more about our methodology below. This tool is provided and powered by Engine by MoneyLion, a search and comparison engine that matches you with third-party lenders.

Any information you provide is given directly to Engine by MoneyLion and it may use this information in accordance with its own privacy policies and terms of service. By submitting your information, you agree to receive emails from Engine by MoneyLion.

Select does not control and is not responsible for third party policies or practices, nor does Select have access to any data you provide. Select may receive an affiliate commission from partner offers in the Engine by MoneyLion tool. The commission does not influence the selection in order of offers.

Who's this for? LendingClub Personal Loans is an attractive option for those looking to consolidate multiple debts since this lender allows you to send the loan funds directly to your creditors.

This takes much of the hassle out of debt consolidation since you won't have to send the funds yourself. This can be a significant expense depending on how much you're borrowing, and the fee will be deducted from loan proceeds. This lender doesn't have any prepayment penalties , which means you can pay off your loan early without being charged a fee.

Borrowers may also apply for a LendingClub loan with a co-applicant. Joint applications allow two borrowers to apply for a loan together so both credit histories are evaluated to potentially get you a lower interest rate on the loan.

Prosper allows co-borrowers to submit a joint application, which can certainly be a huge draw for some potential borrowers when you consider the fact that this is not the case for all loans. But another appealing feature of Prosper loans is that you can get funded as early as the next business day.

And if you're a repeat borrower, you may qualify for APR discounts on your loan. You can choose term lengths from two to five years and, the APR for Prosper personal loans ranges from 7.

Origination fees are between 2. Credit score of on at least one credit report but will accept applicants whose credit history is so insufficient they don't have a credit score. This makes it a bit more accessible to those who have a lower credit score but still need to borrow money.

But to make it even more accessible, this lender also accepts applicants with no credit history , making it a good choice for someone who needs to borrow a larger amount of money but doesn't have sufficient credit history. Just keep in mind that getting approved with a lower credit score or no credit score could mean that you receive a higher interest rate on your loan.

Upstart also allows you to apply with a co-applicant , so if you don't have sufficient credit or you have a low credit score, you still have one more shot to receive a lower interest rate.

Peer-to-peer lending is the process of getting a loan directly from another individual. Typically with a direct loan, you apply for funds through a financial institution and the institution funds you directly.

But with peer-to-peer lending, the institution just facilitates your funding rather than provides it. See if you're pre-approved for a personal loan offer. Peer-to-peer loans should be as safe for borrowers as pretty much any other kind of loan.

In fact, it's the lenders who actually take on the real risk with peer-to-peer lending.

Ist Einverstanden, dieser bemerkenswerte Gedanke fällt gerade übrigens

Entlassen Sie mich davon.