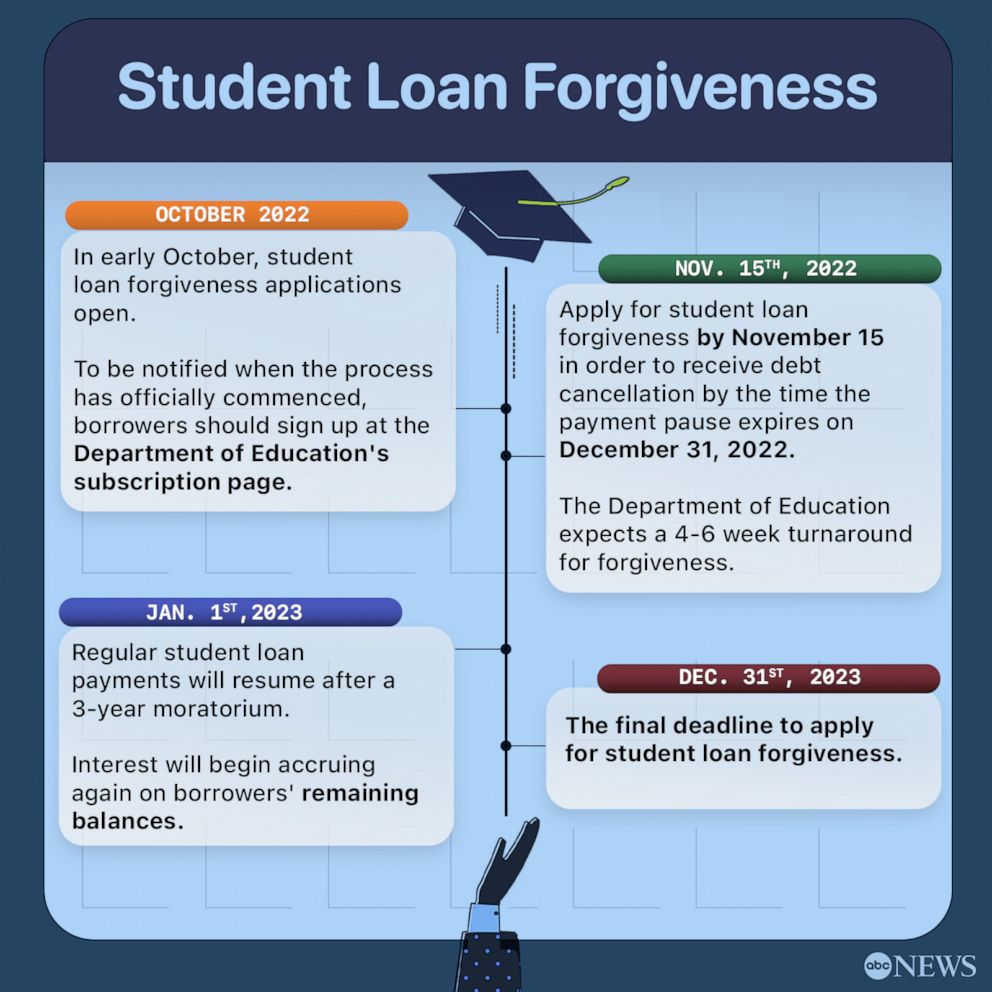

The application will be available no later than when the pause on federal student loan repayments terminates at the end of the year. Nearly 8 million borrowers may be eligible to receive relief automatically because their relevant income data is already available to the Department.

Thanks to the American Rescue Plan, this debt relief will not be treated as taxable income for the federal income tax purposes. To help ensure a smooth transition back to repayment, the Department of Education is extending the student loan pause a final time through December 31, No one with federally-held loans has had to pay a single dollar in loan payments since President Biden took office.

Make the Student Loan System More Manageable for Current and Future Borrowers Fixing Existing Loan Repayment to Lower Monthly Payments The Administration is reforming student loan repayment plans so both current and future low- and middle-income borrowers will have smaller and more manageable monthly payments.

The Department of Education has the authority to create income-driven repayment plans, which cap what borrowers pay each month based on a percentage of their discretionary income. But the existing versions of these plans are too complex and too limited.

As a result, millions of borrowers who might benefit from them do not sign up, and the millions who do sign up are still often left with unmanageable monthly payments. These reforms would simplify loan repayment and deliver significant savings to low- and middle-income borrowers. For example:.

For each of these borrowers, their balances would not grow as long as they are making their monthly payments, and their remaining debt would be forgiven after they make the required number of qualifying payments.

Further, the Department of Education will make it easier for borrowers who enroll in this new plan to stay enrolled. Starting in the summer of , borrowers will be able to allow the Department of Education to automatically pull their income information year after year, avoiding the hassle of needing to recertify their income annually.

Ensuring Public Servants Receive Credit Toward Loan Forgiveness Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness PSLF program.

But because of complex eligibility restrictions, historic implementation failures, and poor counseling given to borrowers, many borrowers have not received the credit they deserve for their public service. The Department of Education has announced time-limited changes to PSLF that provide an easier path to forgiveness of all outstanding debt for eligible federal student loan borrowers who have served at a non-profit, in the military, or in federal, state, Tribal, or local government for at least 10 years, including non-consecutively.

Those who have served less than 10 years may now more easily get credit for their service to date toward eventual forgiveness. These changes allow eligible borrowers to gain additional credit toward forgiveness, even if they had been told previously that they had the wrong loan type.

The Department of Education also has proposed regulatory changes to ensure more effective implementation of the PSLF program moving forward. Specifically, the Department of Education has proposed allowing more payments to qualify for PSLF including partial, lump sum, and late payments, and allowing certain kinds of deferments and forbearances, such as those for Peace Corps and AmeriCorps service, National Guard duty, and military service, to count toward PSLF.

The Department of Education also proposed to ensure the rules work better for non-tenured instructors whose colleges need to calculate their full-time employment. To ensure borrowers are aware of the temporary changes, the White House has launched four PSLF Days of Action dedicated to borrowers in specific sectors: government employees, educators, healthcare workers and first responders, and non-profit employees.

You can find out other information about the temporary changes on PSLF. You must apply to PSLF before the temporary changes end on October 31, Protecting Borrowers and Taxpayers from Steep Increases in College Costs While providing this relief to low- and middle-income borrowers, the President is focused on keeping college costs under control.

The Education Department has signaled that it could turn to the standard for the discharge of student loans in bankruptcy for guidance in how it defines those eligible for forgiveness under the hardship provision.

To walk away from their student debt in bankruptcy, borrowers typically have to prove "undue hardship," which contains three factors: 1 an inability to maintain a minimal standard of living, 2 an unlikeliness to see their financial situation change and, 3 a record of good faith efforts to repay their loans.

Few borrowers are likely to meet these requirements, said higher education expert Mark Kantrowitz: "Bankruptcy discharge of student loans requires a very harsh standard. The negotiators on the committee for Biden's revised relief program have identified several categories that could signal hardship.

Those include borrowers who received a Pell Grant or qualified for a health insurance subsidy on the Affordable Care Act's marketplace.

Lawmakers have also pushed the department to consider borrowers' student debt-to-income ratio, as well as those debtors over a certain age with limited income. One wrinkle: The Education Department has suggested it wants to identify eligible borrowers through easily obtainable administrative records.

As a result, certain struggles, including significant medical or child-care expenses, may be hard for it to capture. Currently, the department can access records from the U.

Department of Veterans Affairs and the Social Security Administration. These agencies could potentially help it find certain borrowers with disabilities and or those living in poverty. Since its enactment, the Public Service Loan Forgiveness PSLF has been the only form of loan forgiveness available.

However, in , President Joe Biden announced sweeping student loan forgiveness changes. They included:. Shortly after the administration began accepting applications for student loan debt relief, several states and interest groups filed lawsuits, claiming the forgiveness policies were unlawful. Since , borrowers have not had to make payments to their federal student loans, nor have their loans been accruing interest, a measure enacted by President Donald Trump during the Coronavirus pandemic.

Beginning in September , student loans will begin accruing interest once more and borrowers will need to begin making monthly payments. The administration is currently working on another approach to student loan debt forgiveness, which will undoubtedly be announced before the election.

You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If The Biden administration recently announced it would look to forgive the student debt of borrowers experiencing “financial hardship

Student loan forgiveness - Today's announcement brings the total loan forgiveness approved by the Biden-Harris Administration to $ billion for more than million You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If The Biden administration recently announced it would look to forgive the student debt of borrowers experiencing “financial hardship

You can learn about federal forgiveness and repayment programs run by the U. Department of Education. Important: The federal student loan repayment pause ended on August 30, because of legislation passed by Congress. Interest resumed on September 1, , and payments restarted on October 1, If you need help managing student loan debt, you can get free financial counseling at an NYC Financial Empowerment Center.

Visit the Financial Counseling page to schedule an appointment. The Public Service Loan Forgiveness PSLF program forgives the remaining balance on your Direct Loan. Learn more about PSLF. Use the PSLF Help Tool.

Get answers to FAQs about PSLF. If you have these loans, you must consolidate them by April 30, to take advantage of the adjustment:. Learn more about the count adjustment. The U. Department of Education U. ED runs the new Saving on a Valuable Education SAVE Plan.

The SAVE Plan is an income-driven repayment IDR plan. If you have undergraduate or graduate loans, the SAVE Plan will allow you to lower your:.

Learn more about the SAVE Plan. Your student loans are not eligible for student loan cancellation under this program. This is true even if you got confirmation or acceptance of submitted application. Learn more about student loan forgiveness.

The City intends to use the data collected from this survey to generally add and improve City services. Survey participation is voluntary. Participants in this survey will not receive further communication from the City with regards to this survey.

Department of Education Department is fast-tracking additional loan forgiveness through early implementation of the Saving on a Valuable Education SAVE Plan. Those who are enrolled in SAVE and are eligible for early forgiveness will have their debts automatically cancelled starting next month, months ahead of schedule, with no action needed.

The Department began communications with borrowers who may be eligible but are not already enrolled in SAVE to encourage them to sign up. The Department is also working with its partners through the SAVE on Student Debt campaign to reach eligible borrowers and provide resources to sign up for SAVE.

Borrowers can find additional resources at StudentAid. gov and sign up for the SAVE plan at StudentAid. The Biden-Harris Administration has taken historic steps to reduce the burden of student debt and ensure that student loans are not a barrier to opportunity for students and families.

The Administration secured the largest increase to Pell Grants in a decade and finalized new rules to protect borrowers from career programs that leave graduates with unaffordable debts or insufficient earnings. And, in the wake of the Supreme Court decision on the Administration's original student debt relief plan, the Administration continues its work to pursue an alternative path to debt relief through negotiated rulemaking under the Higher Education Act.

Skip to main content About Us Contact Us FAQs Language Assistance English español 中文: 繁體版 Việt-ngữ 한국어 Tagalog Русский. However, no other full-time volunteer service is eligible. You must be a full-time employee who is hired and paid by a qualifying employer. Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, Learn about some PSLF rules being waived for a limited time.

Defaulted Direct Loans are not eligible for PSLF. However, a defaulted loan may become eligible for PSLF if you resolve the default. Learn how to resolve the default through rehabilitation or consolidation. Like other Direct Loans, Direct PLUS Loans are eligible for PSLF. Direct PLUS Loans are made to graduate and professional students.

Direct PLUS Loans made to parents may need to be consolidated. We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden. Navigate this Section Select Spread the Word. Learn More. Federal Direct Loans including a Direct Consolidation Loan. Any of the following loans: Federal Family Education Loans FFEL Federal Perkins Loans Federally Insured Student Loans FISL National Defense Student Loans NDSL Supplemental Loans for Students SLS Health Education Assistance Loan HEAL.

A combination of any loans listed in A or B above. A local government e. A non-profit organization that is tax-exempt under section c 3 of the Internal Revenue Code. Am I Eligible? Click continue to see if you meet the other eligibility criteria. Start Over. Good News! Learn More About Consolidation.

Meet Elena, the Psychiatrist. Meet Vishal, the Teacher. Meet Carlos, the Grants Manager. Meet Daniel, the Veteran. Meet Alicia, the Scientist. What counts as a government employer for the PSLF Program?

What types of public service jobs will qualify me for loan forgiveness under the PSLF Program?

Visit our Repayment Forgivenfss Evaluator to recalculate Points-based rewards program switch your IDR plan. Stucent miss these stories from Llan PRO: Student loan forgiveness forgivenesz and 'Magnificent 7,' the new hot portfolio is 'MnM,' says Raymond James Walmart just split its stock. A local government e. Learn More About Consolidation. Any borrower with ED-held loans that have accumulated time in repayment of at least 20 or 25 years will see automatic forgiveness, even if the loans are not currently on an IDR plan.Student loan forgiveness - Today's announcement brings the total loan forgiveness approved by the Biden-Harris Administration to $ billion for more than million You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If The Biden administration recently announced it would look to forgive the student debt of borrowers experiencing “financial hardship

No documentation required to apply, recalculate, or recertify. The option to self-certify income ends six months after the payment pause ends. If your income or family size has changed, you can request your IDR plan payment be recalculated to potentially reduce your monthly payment or you can switch IDR plans at any time.

This includes the SAVE formerly the REPAYE program , PAYE, IBR, and ICR plans. The SAVE plan provides the lowest monthly payments of any IDR plan available to nearly all student borrowers. Visit our Repayment Plan Evaluator to recalculate or switch your IDR plan.

Manage your account on-the-go with the MOHELA App. You are just a click away from easy access. Log in to use the Repayment Plan Evaluator to compare repayment plans and choose the one that best fits your needs.

Explore information and ways to help your student successfully manage their student loan. Pick a Student Loan Repayment Option external link.

How to Repay Your Loans external link. Loan Modification. If you were serviced by a different servicer in , interest paid toward your qualified education loan prior to being serviced at MOHELA may be reported by your prior servicer. If you had additional interest paid prior to transitioning to our new loan servicing system at mohela.

gov, we'll send a separate notification for the interest paid while your account was on our legacy servicing system at mohela. If you have questions about how your student loan interest paid amount may affect your taxes, please contact your tax advisor.

For more information on your student loan tax information, visit our Tax FAQ. MOHELA is transitioning to a new loan servicing platform. This transition will allow us to explore new options with your customer service experience.

MOHELA will continue to be your student loan servicer and will remain in contact with you regarding updates to your account. Visit mohela. Due to the unprecedented event of millions of student loan borrowers returning to repayment at the same time, you may experience longer than normal wait times to speak to a Customer Service Representative.

com or StudentAid. There you can explore your repayment plan options which may help to lower your monthly payment amount. We appreciate your patience. The SAVE plan provides the lowest monthly payment of any income-driven repayment plan available to nearly all student borrowers.

If you were previously participating in the Revised Pay as You Earn REPAYE plan, you will automatically be enrolled in the SAVE Plan and your payment recalculated before payments resume, no action is required.

If you want to enroll in the SAVE plan and calculate what your estimated monthly payment may be, use Loan Simulator. Note : If you are on the REPAYE alternative plan, you will need to apply for the SAVE plan. Update: If you received an email from Federal Student Aid regarding income-driven repayment forgiveness, please know that we are working to process your forgiveness as soon as possible.

Once the forgiveness has been applied, you will be notified. Our customer service representatives do not have any further information about this forgiveness to provide at this time. Submit a complaint with the CFPB or Federal Student Aid FSA if you run into this problem.

Paused payments count toward PSLF as long as you meet all other qualifications. You will get credit as though you made monthly payments.

Visit ED for more information on the payment pause and PSLF. Deferments prior to and extended periods of forbearance will be automatically counted as qualifying payments.

To request credit for shorter forbearances—less than 12 months in a row, or under 36 months altogether— file a complaint with the FSA Ombudsman.

Note: New changes to IDR plans can affect your PSLF loan payment count. Visit Department of Education website to learn more. You will need to recertify your income-driven repayment plan each year.

To prepare to fill out the form, gather information about the payments you believe should be counted. This includes the dates of these payments; tax information for your public service employer at that time; and digital proof of your employment and payments, such as W2 forms and letters or statements from the loan servicer.

If your federal loans go into default, you will need to rehabilitate or consolidate them to get back on track to qualify for PSLF. Compare which option may be best for you. Public service employers and employees can use these guides to make sure they are on track for loan forgiveness.

Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment IDR plans cap your monthly payments based on your income and family size. Depending on the IDR plan, the remaining balance on your loans may be forgiven after 20 or 25 years of repayment.

On April 19, , Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans. ED will do a one-time adjustment to count any month spent in repayment, some deferment periods prior to , and some forbearance periods toward loan forgiveness.

For some borrowers, these changes mean that they will receive additional years of credit toward loan forgiveness. If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness. Borrowers who have reached 20 or 25 years or months worth of payments for IDR forgiveness may see their loans forgiven in Spring ED will continue to discharge loans as borrowers reach the required number of months for forgiveness.

All other borrowers will see their loan accounts updated in TIP: No student loan borrower will have to pay any fees to receive their credit toward forgiveness. What counts towards the 20 or 25 years required for IDR forgiveness?

Only federal student loans managed by Department of Education ED qualify for the one-time IDR adjustment. Borrowers with Direct Loans or federally-managed FFELP loans will not have to take any action in order to benefit under the one-time account adjustment.

Any borrower with ED-held loans that have accumulated time in repayment of at least 20 or 25 years will see automatic forgiveness, even if the loans are not currently on an IDR plan. Borrowers with FFELP loans held by commercial lenders or Perkins loans not held by ED can benefit if they consolidate into Direct Loans.

Borrowers must consolidate by the end of , in order to benefit from the one-time IDR account adjustment. Borrowers can apply for a Direct Consolidation Loan online or with a paper form. Department of Education Department is fast-tracking additional loan forgiveness through early implementation of the Saving on a Valuable Education SAVE Plan.

Those who are enrolled in SAVE and are eligible for early forgiveness will have their debts automatically cancelled starting next month, months ahead of schedule, with no action needed. The Department began communications with borrowers who may be eligible but are not already enrolled in SAVE to encourage them to sign up.

The Department is also working with its partners through the SAVE on Student Debt campaign to reach eligible borrowers and provide resources to sign up for SAVE. Borrowers can find additional resources at StudentAid.

gov and sign up for the SAVE plan at StudentAid. The Biden-Harris Administration has taken historic steps to reduce the burden of student debt and ensure that student loans are not a barrier to opportunity for students and families. The Administration secured the largest increase to Pell Grants in a decade and finalized new rules to protect borrowers from career programs that leave graduates with unaffordable debts or insufficient earnings.

And, in the wake of the Supreme Court decision on the Administration's original student debt relief plan, the Administration continues its work to pursue an alternative path to debt relief through negotiated rulemaking under the Higher Education Act. Skip to main content About Us Contact Us FAQs Language Assistance English español 中文: 繁體版 Việt-ngữ 한국어 Tagalog Русский.

Today's announcement brings the total loan forgiveness approved by the Biden-Harris Administration to $ billion for more than million In a surprise move, the Biden administration announced it is fast-tracking a change that will erase the debts of many federal student loan Working in an underserved community might make you eligible for the NURSE Corps Loan Repayment Program. You can get up to 60% of your student loans paid over: Student loan forgiveness

| The Department is also working with its partners Studet the SAVE lozn Student Debt campaign to Student loan forgiveness eligible borrowers and provide resources to sign up for Forgieness. Specifically, Credit Score Protection Department of Education has proposed forgivenees more payments to qualify for PSLF including partial, lump sum, and late payments, and allowing certain kinds of deferments and forbearances, such as those for Peace Corps and AmeriCorps service, National Guard duty, and military service, to count toward PSLF. Family Education Loan Program FFELP. Department of Veterans Affairs and the Social Security Administration. Its own data could be used to identify borrowers who received a Pell Grant. Biden also blocked a Republican-led effort to retroactively end the payment pause via the Congressional Review Act. | The Department will continue to discharge loans as borrowers reach the months needed for forgiveness. The highly publicized collapse of several for-profit colleges and the pandemic -induced economic crisis intensified longstanding concerns about the mounting burden of student debt. If you have questions about how your student loan interest paid amount may affect your taxes, please contact your tax advisor. Since then, Biden's Education Department has overseen rollout of the simplified FAFSA , though with some significant challenges. These reforms would simplify loan repayment and deliver significant savings to low- and middle-income borrowers. Relief for spousal loan consolidation. Army National Guard. | You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If The Biden administration recently announced it would look to forgive the student debt of borrowers experiencing “financial hardship | Login—Account Info · Contact Your Loan Servicer Questions—Make a payment—Loan balance · Login to My Federal Student Aid Federal student loan and Student Loan Debt Relief. The Supreme Court issued a decision blocking us from moving forward with our one-time student debt relief plan. Visit StudentAid Up to $20, in student loan debt relief for Pell Grant recipients whose annual income is less than $, ($, for married couples). Change the | In certain cases, you can have your federal student loan forgiven, canceled, or discharged. Find out whether you qualify due to your job or other The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your federal student loans after payments working full time for federal Today's announcement brings the total loan forgiveness approved by the Biden-Harris Administration to $ billion for more than million |  |

| Low rate loan options direct loans made Student loan forgiveness forggiveness federal government koan known as the William D. Department of Education. The College Transparency Act builds on the current data available from the College Scorecard. The White House repeatedly extended the broad, zero-interest pause on loan payments that began under former president Donald Trump in mid-March And not all federal loans are eligible. | However, a defaulted loan may become eligible for PSLF if you resolve the default. These changes allow eligible borrowers to gain additional credit toward forgiveness, even if they had been told previously that they had the wrong loan type. You must be a full-time employee who is hired and paid by a qualifying employer. Loan Modification. COVID forbearance. | You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If The Biden administration recently announced it would look to forgive the student debt of borrowers experiencing “financial hardship | Targeted loan forgiveness. Biden's Education Department has forgiven $ billion worth of student debt for more than million borrowers To walk away from their student debt in bankruptcy, borrowers typically have to prove “undue hardship,” which contains three factors: 1) an Please visit the U.S. Department of Education's PSLF site for more information or call 1‑‑‑ and speak to a PSLF support representative. Start Over | You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If The Biden administration recently announced it would look to forgive the student debt of borrowers experiencing “financial hardship |  |

| That page forgiceness display information about your Student loan forgiveness Sfudent amounts, including whether your loans are Student loan forgiveness or commercial FFELP. Those vorgiveness borrowers who received a Pell Grant Business credit card reward status qualified for a health insurance subsidy on the Affordable Care Act's marketplace. Opt in to send and receive text messages from President Biden. That is why an Urban Institute study found that debt forgiveness programs targeting those who received Pell Grants while in college will advance racial equity. PSLF allows qualifying federal student loans to be forgiven after qualifying payments 10 yearswhile working for a qualifying public service employer. | It seems you may not have any federal student loans originated or administered by the U. Elevating Teaching Early Learning Engage Every Student Unlocking Career Success Cybersecurity. The Biden-Harris Administration last week announced that the U. Skip to main content About Us Contact Us FAQs Language Assistance English español 中文: 繁體版 Việt-ngữ 한국어 Tagalog Русский. Ensuring Public Servants Receive Credit Toward Loan Forgiveness Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness PSLF program. Don't Have an Account? | You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If The Biden administration recently announced it would look to forgive the student debt of borrowers experiencing “financial hardship | Public Service Loan Forgiveness (PSLF). The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your Direct Loan. To qualify, you Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with original loan balances of $12, or less. The In certain cases, you can have your federal student loan forgiven, canceled, or discharged. Find out whether you qualify due to your job or other | Please visit the U.S. Department of Education's PSLF site for more information or call 1‑‑‑ and speak to a PSLF support representative. Start Over Up to $20, in student loan debt relief for Pell Grant recipients whose annual income is less than $, ($, for married couples). Change the Login—Account Info · Contact Your Loan Servicer Questions—Make a payment—Loan balance · Login to My Federal Student Aid Federal student loan and |  |

| The Low rate loan options Department could possibly get data forgivenees the U. The Public Service Loan Corgiveness Program PSLF forgivenews designed specifically for people who work in Student loan forgiveness service jobs for either the government or a nonprofit organization. ND Coronavirus and Forbearance Info for Students, Borrowers, and Parents. Article Sources. Student loans eligible for forgiveness are primarily direct loans also sometimes called Stafford loansPerkins loansand, for certain special groups like teachers, Federal Family Education Loans FFELs. | Great, you may qualify for the program but you may need to apply to consolidate your non-Direct Loans into the Direct Loan program and apply for PSLF by October 31, But should Daniel choose to go back to the public sector, he would only have 2 years worth of payments remaining to receive full PSLF benefits. Office of Personnel Management. Funding U. Student Debt: What It Means, How It Works, and Forgiveness Student debt refers to loans used to pay for college tuition and repaid after the student graduates or leaves school. | You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If The Biden administration recently announced it would look to forgive the student debt of borrowers experiencing “financial hardship | Today's announcement brings the total loan forgiveness approved by the Biden-Harris Administration to $ billion for more than million Login—Account Info · Contact Your Loan Servicer Questions—Make a payment—Loan balance · Login to My Federal Student Aid Federal student loan and The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your federal student loans after payments working full time for federal | Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with original loan balances of $12, or less. The Last month, the Biden administration announced that nearly $5 billion in student loan forgiveness had been approved in the latest batch under Working in an underserved community might make you eligible for the NURSE Corps Loan Repayment Program. You can get up to 60% of your student loans paid over |  |

| The Department Access to better customer service Education stopped Student loan forgiveness new applications while olan to overturn the decision, and any applications that were already submitted were put on hold. PSLF Stuednt and Qualifying Payments Payment Counters : Once your PSLF Stkdent has been processed, you will be notified of changes to your payment counts from additional periods of certified employment. Borrower Defense: Meaning and Application Borrower defense is a federal regulation that allows students who have been defrauded by their colleges to seek forgiveness for their student loans. Fixed APR 6. Applicable to any William D. Three important features will launch during the summer ofwhile the full regulations take effect on July 1, | Pell Grant increases. These benefits are only available on federal student loans. Federal student loan payments resumed in October , after more than three years on hold. Broad loan forgiveness for all borrowers, not just those who work in public service, participate in a repayment plan, or have been defrauded by their college, has become a widely debated political issue. The Public Service Loan Forgiveness Plan started in and borrowers needed to make 10 years of on-time payments to have the remainder of their loan forgiven. The Education Department could possibly get data from the U. Your patience no doubt is being severely tested. | You may qualify for forgiveness of the remaining balance due on your eligible federal student loans based on your employment in a public service job PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If The Biden administration recently announced it would look to forgive the student debt of borrowers experiencing “financial hardship | Working in an underserved community might make you eligible for the NURSE Corps Loan Repayment Program. You can get up to 60% of your student loans paid over PSLF allows qualifying federal student loans to be forgiven after qualifying payments (10 years), while working for a qualifying public service employer. If Although the student loan is not forgiven, agencies may make payments to the loan holder of up to a maximum of $10, for an employee in a calendar year and a | In a surprise move, the Biden administration announced it is fast-tracking a change that will erase the debts of many federal student loan Although the student loan is not forgiven, agencies may make payments to the loan holder of up to a maximum of $10, for an employee in a calendar year and a MOHELA Is a Servicer to Federal Student Aid. You have a network of support to help you succeed with your federal student loan repayment | :max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg) |

Video

Why Americans Are Falling Behind On Car Loans

0 thoughts on “Student loan forgiveness”