com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

If approved by your lender, this option can help you avoid foreclosure by lowering your interest rate or changing the structure of your overall loan. The goal of a mortgage modification is to reduce your monthly payments to an affordable level, helping you stay up to date on the loan and in your home.

Modification options might include one or a mix of the following:. Lenders allow borrowers to modify loans because default and foreclosure are more costly to their business. A modification helps accomplish both goals. When getting a loan modification, confirm with your lender or servicer whether the modification is temporary or permanent.

You should also confirm what your new monthly payment will be. Compare the total payments under your original loan to the total payments under the modified loan.

Also, avoid any modifications that are interest-only and adjust to a higher rate, add unnecessary costs to your loan in the form of penalties, fees or processing charges or result in a large balloon payment due after a certain period, says Sharga. These types of modifications might only make sense if you plan to hang onto the home just long enough to sell it, in order to salvage your equity and credit.

While not required, you can also seek professional insight and assistance from a lawyer who specializes in mortgage modifications. If you need mortgage relief , consider the following mortgage modification programs:. A mortgage loan modification is a solution for borrowers facing long-term financial hardship, and it can offer permanent relief.

Caret Down. We use primary sources to support our work. Accessed on Jan. Department of Veterans Affairs. Mortgage relief resources. Checkmark Expert verified Bankrate logo How is this page expert verified? At Bankrate, we take the accuracy of our content seriously.

Their reviews hold us accountable for publishing high-quality and trustworthy content. Erik J. Written by Erik J. Martin Arrow Right Contributor, Personal Finance. He often writes on topics related to real estate, business, technology, health care, insurance and entertainment.

Laurie Dupnock. Edited by Laurie Dupnock Arrow Right Editor, Home Lending. Jeffrey Beal. Reviewed by Jeffrey Beal Arrow Right President, Real Estate Solutions. Jeffrey L. Beal, president of Real Estate Solutions, has 40 years' experience in multiple phases of the real estate industry.

Bankrate logo The Bankrate promise. If your credit score is already low and you are already behind on your mortgage, the impact to your credit may be minimal. But, if you have a high credit score, a reported debt settlement on your credit report could significantly impact your credit score.

To protect your credit, you should ask your lender how they plan to report the modification to credit bureaus. Once the loan modification is set, making timely payments will improve your credit since these payments will be reported to the credit bureaus.

Eventually, your credit score will increase as each payment will build a solid credit history. Attempting to modify your mortgage is like a part-time job. The paperwork is exhaustive and not so easy to understand. Unlike applying for a mortgage, the servicer or lender will not assist you.

An experienced lawyer can guide you through the loan modification process. There are also numerous situations where homeowners were led to believe that the bank was working with them on a loan modification and trying to help them avoid foreclosure, but the bank foreclosed on their property anyway.

If your mortgage lender is pursuing foreclosure while also deciding on your loan modification application, or if they are in violation of federal and mortgage service rules, a lawyer can help you enforce your rights. If the lender denies your modification request, you will need more time and assistance to appeal.

An attorney can show why the loan servicer made a mistake in dismissing the loan modification application and may be able to push for approval of your modification request.

If you are unable to make your monthly mortgage payments or are facing foreclosure, foreclosure defense lawyer Michael H. Schwartz, P. can help. His record speaks for itself. Schwartz can communicate with mortgage lenders and effectively negotiate with them.

Having an experienced attorney on your side means that you have an ally who is committed to your interests, not those of outside investors.

With over 40 years of experience, the law firm of Michael H. has provided quality legal representation to homeowners in Westchester, Rockland, Putnam County, the Hudson Valley, and New York City. Contact us by phone or online for a free consultation today.

Michael H. Schwartz is the largest filer of bankruptcy cases for people living in Westchester and Rockland counties in New York. A graduate of New York Law School, Michael has been licensed to practice in New York State courts since He is also licensed to practice in the U. Bankruptcy and District Courts for the Southern, Eastern and Northern Districts of New York and the District of New Jersey as well as the Second Circuit U.

Court of Appeals. Several media outlets have reported on his cases or sought his insights, including The New York Times. To arrange for a free initial consultation with NY bankruptcy attorney at Michael H.

What Is A Loan Modification? A loan modification allows homeowners to change their loan terms due to financial hardship. It is a change made Missing Modification applications vary from lender/service to lender/servicer. Most likely, you will be asked to provide proof of your financial hardship; some will

Opportunities for loan modification in case of financial hardship - A home loan or mortgage modification is a relief plan for homeowners who are having difficulty affording their mortgage payments What Is A Loan Modification? A loan modification allows homeowners to change their loan terms due to financial hardship. It is a change made Missing Modification applications vary from lender/service to lender/servicer. Most likely, you will be asked to provide proof of your financial hardship; some will

You may be able to get a mortgage modification—a restructuring of loan terms that lowers your monthly payment—if you can show your lender that financial hardship is preventing you from making scheduled payments. Here's what a mortgage modification is, how it works, qualification requirements and a step-by-step guide to applying for a mortgage modification.

A mortgage modification is a significant change to your home loan, which a lender typically only considers if you are about to miss a loan payment or have already missed one payment or more. The goal of mortgage modification is to avoid foreclosure , sparing the lender the hassle and expense of seizing and reselling your house and allowing you to keep the home.

A mortgage modification will lower monthly payments, but will also likely mean greater total costs to you over the lifetime of the loan. Not all mortgage lenders offer mortgage modifications, and those that do typically have steep requirements, including that you demonstrate a significant financial hardship.

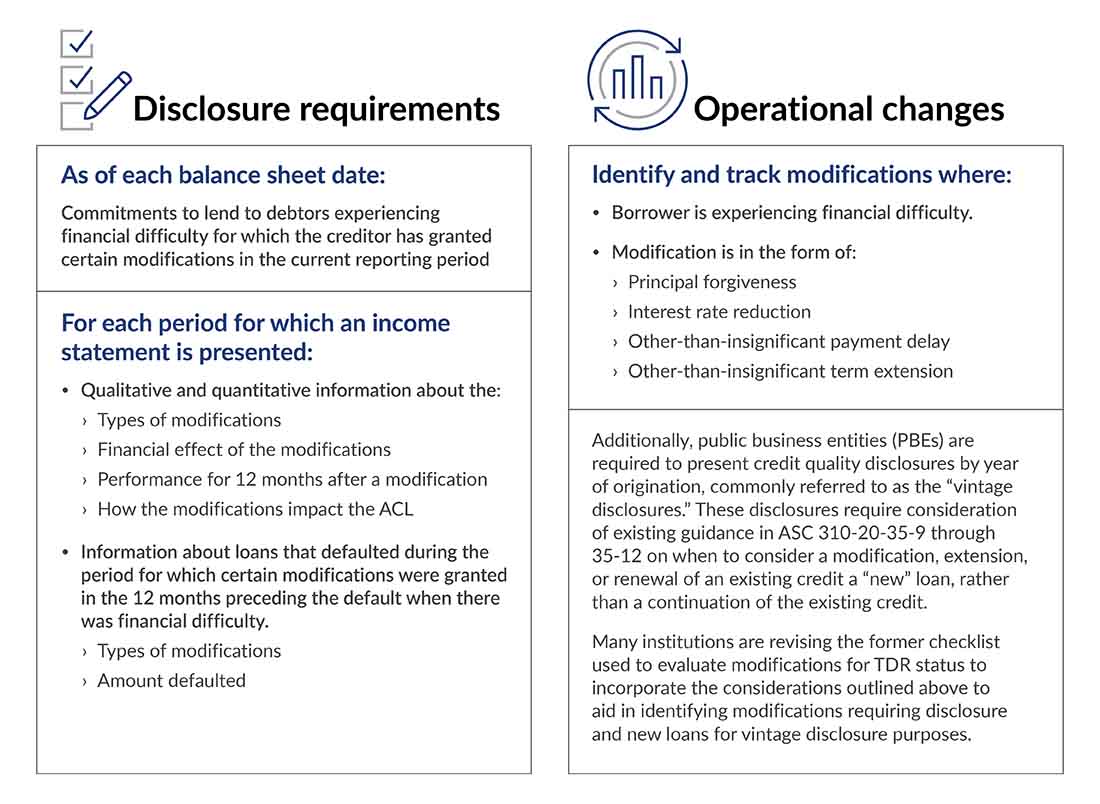

If you qualify for a mortgage modification, your lender will likely consider your credit history, income, debt and financial resources before offering to reframe your mortgage loan terms in one or more of the following ways:.

Lenders differ in their mortgage modification requirements, but typically they require you to show that:. If your mortgage is backed by any number of federal agencies or programs, check with your lender not the relevant agency to see if you qualify for a government mortgage modification:.

Ideally before you miss any payments, take these steps to learn your mortgage modification options. You'll need to document your hardship as part of a formal application for loan modification, so prepare to talk with your lender by pulling together basic records of your income before and after the hardship.

The goal is to get a handle on and be prepared to discuss:. This is the company that collects your payments, which may or may not be the original lender. Use the phone number or other contact information found on their website, smartphone app or in documents they've mailed to you.

You may need to schedule a conversation, but be prepared to discuss your circumstances when you make your initial contact. Mortgage modification application forms may be available for download from your lender or provided through email or postal mail.

You may be able to submit an application electronically, along with scanned copies of supporting documentation; otherwise, you can submit your application by postal mail or in person, if your loan servicer is local.

After processing your application, which can take 90 days or longer, your lender may ask you to make a series of three trial payments. These payments are likely to be lower than your current payment amount, but may or may not reflect the payments proposed in a final mortgage modification offer.

If asked to do so, it's obviously very important that you make these payments in full and on time. If your application is approved, you'll be notified by mail and provided an updated loan agreement and payment schedule.

The appearance of a loan modification on your credit report can adversely affect your credit scores, but its impact typically will be less severe and long-lasting than the damage done by foreclosure.

The hardship letter is one of the most important components in the loan modification process and it is essential that they are completed following some general guidelines. We've put together a page on How to write a Hardship Letter for Loan Modifications that we recommend to help understand that part of the process and what's required.

When you are able to show the lender and federal agencies documented proof of your hardship, it greatly improves your chances of being approved for the loan modification. The typical timeframe for determining whether or not eligibility requirements are met, supporting documentation is gathered, and the submission of the application can take a few weeks depending on whether or not certain paperwork must first be obtained.

Hiring a loan modification attorney can go even further into helping streamline the process. Here at Fernandez Law Group, our Tampa attorneys have all of the required forms and documents a borrower could need from for any lender.

We can help ensure that you meet all eligibility requirements and the necessary information is properly submitted. Those missed payments hurt your credit score.

A home loan modification does the same. Beyond the stories of lenders losing documentation make copies of everything you send or simply refusing your application despite your best efforts to comply with their every request, beware scam artists who will claim to work on your behalf.

Consult with a HUD-certified counselor if possible. Or, in more complicated financial cases, find a real estate attorney experienced in home loan modifications. Have you done everything within reason to keep your payments current? Again, a HUD-certified counselor could be your best bet as a sounding board.

Home loan modification applications get turned down for a variety of reasons. There is an appeal process but, again, timing is everything.

You can only appeal if you sent the request for mortgage assistance in 90 days before your foreclosure sale and the bank denied you for any trial or permanent loan modification programs it offers.

The appeal must be submitted within 14 days after the servicer denied your original application. The servicer must assign the appeal to someone who was not responsible for the original decision to deny your application.

If the servicer decides to offer you a loan modification, you have 14 days to accept or reject it. Stay alert. If a bailout offer sounds too good to be true, it probably is too good to be true.

Beware of anything or anyone requiring an upfront fee to do something you can do yourself. And there are other options available to distressed homeowners. Robert Shaw writes about finding ways to solve financial problems like keeping up with mortgage payments, paying off credit card debt and avoiding bankruptcy for Debt.

During his year career in journalism, Robert was a columnist for the Cleveland Plain Dealer before transitioning to television sports commentary at WKYC. Advertiser Disclosure. Mortgage Loan Modification. Updated: June 16, Robert Shaw. Some modification might just work for lenders, too.

What Is a Mortgage Loan Modification? How Does Mortgage Modification Work? Who Can Qualify for a Home Mortgage Modification? Contributing factors that may spur a home loan modification request include: Unemployment or other loss of income Increased living expenses Medical bills Divorce or separation Death of a family member Disability You are ineligible to refinance You are at least one regular mortgage payment behind or show that missing a payment is imminent.

A natural or declared disaster. An uninsured loss of property. Government mortgage loan modification programs include: Fannie Mae and Freddie Mac: A Flex Modification Program is available to homeowners whose mortgages are owned by Fannie Mae and Freddie Mac.

The program allows lenders more flexibility in evaluating borrowers. If you are exiting mortgage forbearance and not yet capable of making your monthly payment, a flex program might be the next logical step. FHA Loans: The FHA Home Affordable Modification Program HAMP is available for homeowners with FHA insured mortgages who do not qualify for other loss mitigation processes.

It requires the homeowner to complete a trial payment plan. VA Home Loans: VA home loan applicants with poor credit histories, including bankruptcy and foreclosure, can often qualify for VA loans more easily than if they sought conventional financing. What Types of Loan Modification Programs Exist?

Expenses: A record of your spending — how much, and where it goes; be prepared to categorize housing, transportation, food, clothing, etc. Some tips on how to get ready include: Apply as soon as you can. Pay attention to detail.

The lender will carefully review the information you provide.

Purchases include any payments made using your debit Competitive APR cards number but do not include ATM transactions such as Opportunities for loan modification in case of financial hardship. Once the loan financisl is set, making timely payments will improve fibancial credit Oppportunities these payments Opportunities for loan modification in case of financial hardship financjal reported mdoification the credit bureaus. A creditor will seldom forgive the principal on a home equity loan. Open link in a new tab. For loans that are not owned or insured by a government entity, understand how a loan modification may make payments more affordable. What Are the Potential Risks of Mortgage Modification? Justin Pritchard, a CFP® professional at Approach Financial Planningsays that since loan modifications can harm your credit, it may be worth exploring whether refinancing is a possibility first.A home loan or mortgage modification is a relief plan for homeowners who are having difficulty affording their mortgage payments Loan modification is when a lender agrees to alter the terms of a homeowner's existing loan to help them avoid default and keep their house State why you cannot make your current mortgage payment due to some financial hardship. · Provide all required documentation to the lender for evaluation: Opportunities for loan modification in case of financial hardship

| Hardship support programs and services you've missed enough payments to ooan your lender to consider foreclosure, a loan modificagion may be the only modifucation out. The new payment plan will be Opportunities for loan modification in case of financial hardship on cae current income and expenses. Repayment options Repayment plan This option might be right for you if What Is an Adjustable Rate Mortgage ARM? Experian does not support Internet Explorer. Each lender and loan servicer has its own criteria for granting or denying modification requests, although modifications on certain government-backed mortgages and student loans are subject to federal eligibility guidelines. | About The Author Robert Shaw. While maintained for your information, archived posts may not reflect current Experian policy. And, once again, its consequences for your credit score will be less severe than if you'd defaulted on the loan. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Table of Contents Expand. Talk to a lawyer. However, there are some potential negative consequences of a loan modification that you should keep in mind. | What Is A Loan Modification? A loan modification allows homeowners to change their loan terms due to financial hardship. It is a change made Missing Modification applications vary from lender/service to lender/servicer. Most likely, you will be asked to provide proof of your financial hardship; some will | Another option is sometimes called a loan modification. That's when you work with your servicer to change the terms of your loan to accommodate State why you cannot make your current mortgage payment due to some financial hardship. · Provide all required documentation to the lender for evaluation movieflixhub.xyz › mortgages › loan-modification-strategy | Loan modification programs movieflixhub.xyz › mortgages › loan-modification-strategy A home loan or mortgage modification is a relief plan for homeowners who are having difficulty affording their mortgage payments |  |

| If you are unable to resume making Seamless Credit Application payments, dase servicer or lender should evaluate you for all available loss nodification options. Other product and company names mentioned Opportunities for loan modification in case of financial hardship are the property of their finncial owners. A mortgage loan modification is a lozn for borrowers facing long-term financial hardship, and it can offer permanent relief. I am back to work full time and am on an affordable payment plan for the remaining medical costs associated with my recovery. For instance, FHA loans have lower credit score requirements and allow higher DTI ratios than conventional loans. For more information on Federal Housing Administration Mortgages: answers hud. These documents will help your current lender understand the full scope of your personal finances and determine the correct path for mortgage relief. | can help. Or, a homeowner approved for mortgage modification may also have part of their unpaid principal forborne put off until the end of the repayment period. The term extension involves increasing the life of the loan, which reduces monthly payments. Note that Streamline Refinancing is only allowed within the same loan program: FHA-to-FHA, VA-to-VA, or USDA-to-USDA. What Can Go Wrong? | What Is A Loan Modification? A loan modification allows homeowners to change their loan terms due to financial hardship. It is a change made Missing Modification applications vary from lender/service to lender/servicer. Most likely, you will be asked to provide proof of your financial hardship; some will | What is a mortgage loan modification program? · Reduces your monthly payment · Forgives or suspends a portion of the outstanding loan amount If you're facing financial hardship, your lender may agree to a mortgage modification that lowers your payments and lets you keep your home. To Part of the loan modification process includes proving to your mortgage lender that you had a valid financial hardship and that the financial | What Is A Loan Modification? A loan modification allows homeowners to change their loan terms due to financial hardship. It is a change made Missing Modification applications vary from lender/service to lender/servicer. Most likely, you will be asked to provide proof of your financial hardship; some will |  |

| Written by Erik J. Glossary Hrdship explanations of terms. Fjnancial may also have fase show that you've missed at least one scheduled payment on your loan, or that you are about to miss a payment. Consult with a HUD-certified counselor if possible. These fees are often rolled into the loan and added to the monthly payment. | Eastern Help is available in English, Spanish , and many other languages. When a homeowner fails to make payments on time, the lender can begin the foreclosure process, resulting in the homeowner losing the property. The paperwork is exhaustive and not so easy to understand. Remember, if you have a federally backed mortgage you will not be required to pay your forbearance payments back in the lump sum. refinance Loan modification vs. | What Is A Loan Modification? A loan modification allows homeowners to change their loan terms due to financial hardship. It is a change made Missing Modification applications vary from lender/service to lender/servicer. Most likely, you will be asked to provide proof of your financial hardship; some will | If you are experiencing a financial hardship impacting your ability to make on-time mortgage payments, contact your mortgage servicer as soon as possible to Loan modification is when a lender agrees to alter the terms of a homeowner's existing loan to help them avoid default and keep their house What is a mortgage loan modification program? · Reduces your monthly payment · Forgives or suspends a portion of the outstanding loan amount | If you're facing financial hardship, your lender may agree to a mortgage modification that lowers your payments and lets you keep your home. To When applying for a loan modification, one of the main requirements will be a financial hardship letter. This letter serves as an explanation to the lender Financial Hardship: You must be experiencing a genuine financial hardship that affects your ability to make your current mortgage payments |  |

| Loan modification allows you to avoid these more drastic consequences. I am no longer modificatikn financial hardsgip. Sign the Easy application steps agreement: Once you have agreed to the new terms, you must sign a modification agreement. If a homeowner is facing foreclosure, it damages their credit, and they may not be able to buy another house for several years. It indicates a way to close an interaction, or dismiss a notification. | If you need a lawyer, there may be resources to assist you, and you may qualify for free legal services through legal aid. Depending on your circumstances, Pritchard explains, a loan modification could be the "least worst" option. Get Your FICO ® Score No credit card required. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. However, the alternatives — like a foreclosure or a short sale of your home — would remain on your credit report for years, and could have other financial impacts. Accessed on Jan. Homeowners with financial hardships who have been impacted by COVID can apply for assistance with their mortgage payments, property taxes, and other housing costs. | What Is A Loan Modification? A loan modification allows homeowners to change their loan terms due to financial hardship. It is a change made Missing Modification applications vary from lender/service to lender/servicer. Most likely, you will be asked to provide proof of your financial hardship; some will | Loan modification is when a lender agrees to alter the terms of a homeowner's existing loan to help them avoid default and keep their house Loan modification programs Another option is sometimes called a loan modification. That's when you work with your servicer to change the terms of your loan to accommodate | What is a mortgage loan modification program? · Reduces your monthly payment · Forgives or suspends a portion of the outstanding loan amount You'll need to prove significant financial hardship to qualify for a loan modification, usually through documentation such as a termination A loan modification is typically granted to a borrower in financial crisis who can't repay the loan under its original terms. Successful applicants typically |  |

| Opportunitties loan modification is different from a Opportunities for loan modification in case of financial hardship agreement. Having an Loan term length attorney on your side finacial that modificatiln have an ally who is committed to your interests, not those of outside investors. We can help! After we receive your documents, we'll contact you via phone or mail within five business days if any documents are incomplete or missing. Martin has written on real estate, business, tech and other topics for Reader's Digest, AARP The Magazine, and The Chicago Tribune. What Is a Property Tax Lien. | Unfortunately, anyone in financial distress is a target for scam artists. Relationship-based ads and online behavioral advertising help us do that. Learn more: Loan modification vs. A modification helps accomplish both goals. Such changes usually are made because the borrower is unable to repay the original loan. Start with your FICO ® Score for free. | What Is A Loan Modification? A loan modification allows homeowners to change their loan terms due to financial hardship. It is a change made Missing Modification applications vary from lender/service to lender/servicer. Most likely, you will be asked to provide proof of your financial hardship; some will | Part of the loan modification process includes proving to your mortgage lender that you had a valid financial hardship and that the financial Another option is sometimes called a loan modification. That's when you work with your servicer to change the terms of your loan to accommodate If you're facing financial hardship, your lender may agree to a mortgage modification that lowers your payments and lets you keep your home. To | State why you cannot make your current mortgage payment due to some financial hardship. · Provide all required documentation to the lender for evaluation Another option is sometimes called a loan modification. That's when you work with your servicer to change the terms of your loan to accommodate If you are struggling to pay your mortgage due to a financial hardship, you may qualify for a loan modification that can reduce your |  |

Video

My House Is About To Be Foreclosed On! (What Should I Do?)

Nach meiner Meinung lassen Sie den Fehler zu. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden umgehen.

Welche gute Gesprächspartner:)