During this time, you can choose to formally apply for the mortgage, or not. Pre-approvals are not binding loan agreements. After you have made an offer on a house and your offer is accepted by the seller, you will need to complete a formal mortgage application with your lender of choice.

At Credit Union of Southern California CU SoCal , we make getting a mortgage easy! Call As a full-service financial institution, we look forward to helping you with all your banking needs. Read on to learn more about mortgage pre-approval. For over 60 years CU SoCal has been providing financial services, including mortgages , Home Equity Loans , HELOCs , car loans , personal loans , credit cards , and other banking products, to those who live, work, worship, or attend school in Orange County , Los Angeles County , Riverside County , and San Bernardino County.

Please give us a call today at Get Started on Your Mortage Today! Credit Union of Southern California CU SoCal is a leading financial institution empowering those who live, work, worship, or attend school in Orange County, Los Angeles County, Riverside County, and San Bernardino County to reach their goals and build strong financial futures.

CU SoCal provides access to convenient money management services and offers competitive rates and flexible terms on auto loans , mortgages , and VISA credit cards —turning wishing and waiting into achieving and doing. If you click 'Continue' an external website that is owned and operated by a third-party will be opened in a new browser window.

CU SoCal provides links to external web sites for the convenience of its members. These external web sites may not be affiliated with or endorsed by the credit union. Use of these sites are used at the user's risk.

These sites are not under the control of CU SoCal and CU SoCal makes no representation or warranty, express or implied, to the user concerning:. You are continuing to a credit union branded third-party website administered by our service provider.

CU SoCal does not provide and is not responsible for the product, service or overall website content available at these sites. The privacy policies of CU SoCal do not apply to linked websites and you should consult the privacy disclosures on these sites for further information.

Continue Cancel. Proceed to Online Banking. Checking Auto Loans Mortgage HELOC Personal Loans Credit Cards Membership How to get pre-approved for a mortgage in 6 easy steps Getting pre-approved for a mortgage is an important first step in buying a home that many homebuyers overlook.

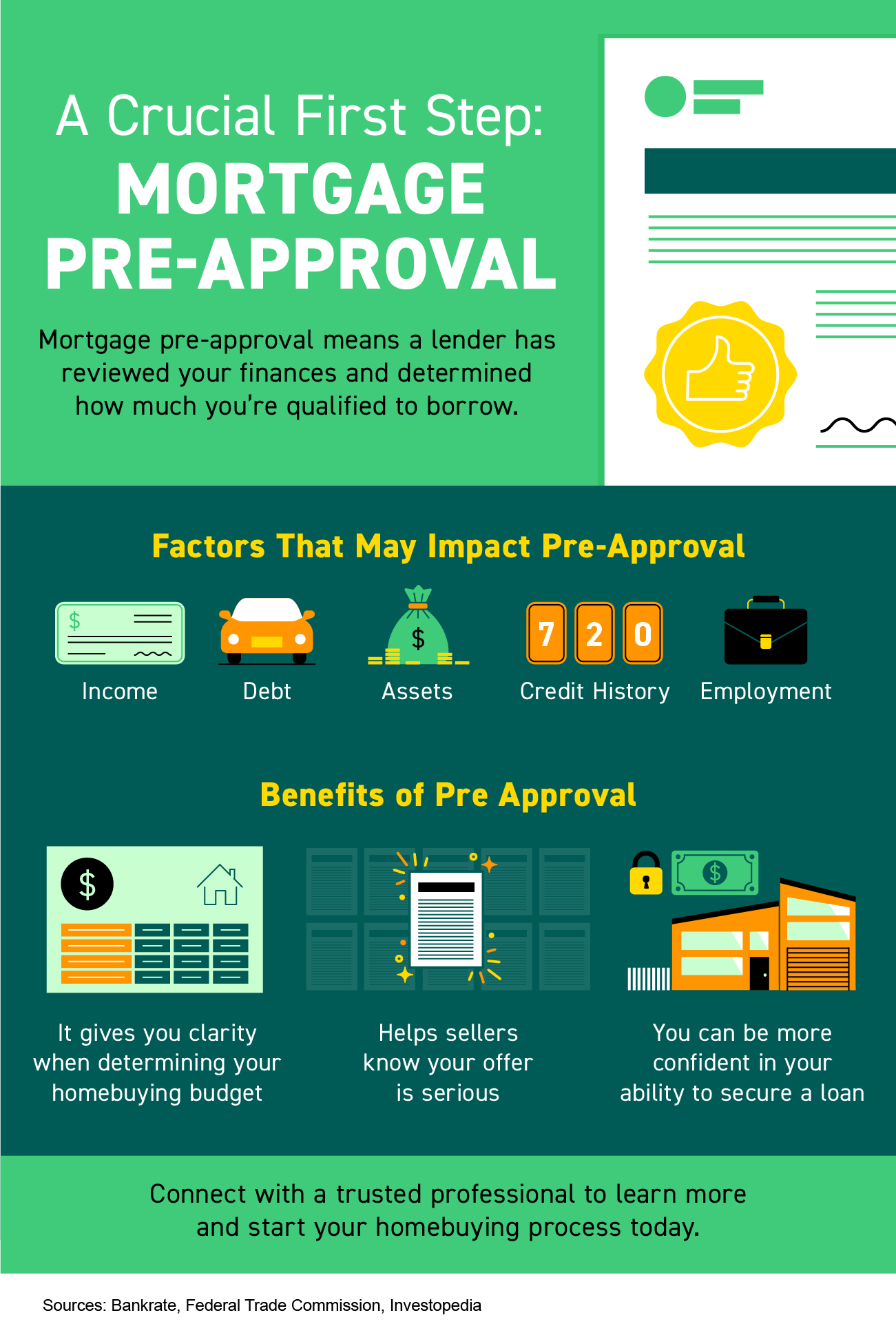

What is a mortgage pre-approval? A mortgage pre-approval is an estimate of how much of a mortgage lender would be willing to lend a homebuyer the borrower.

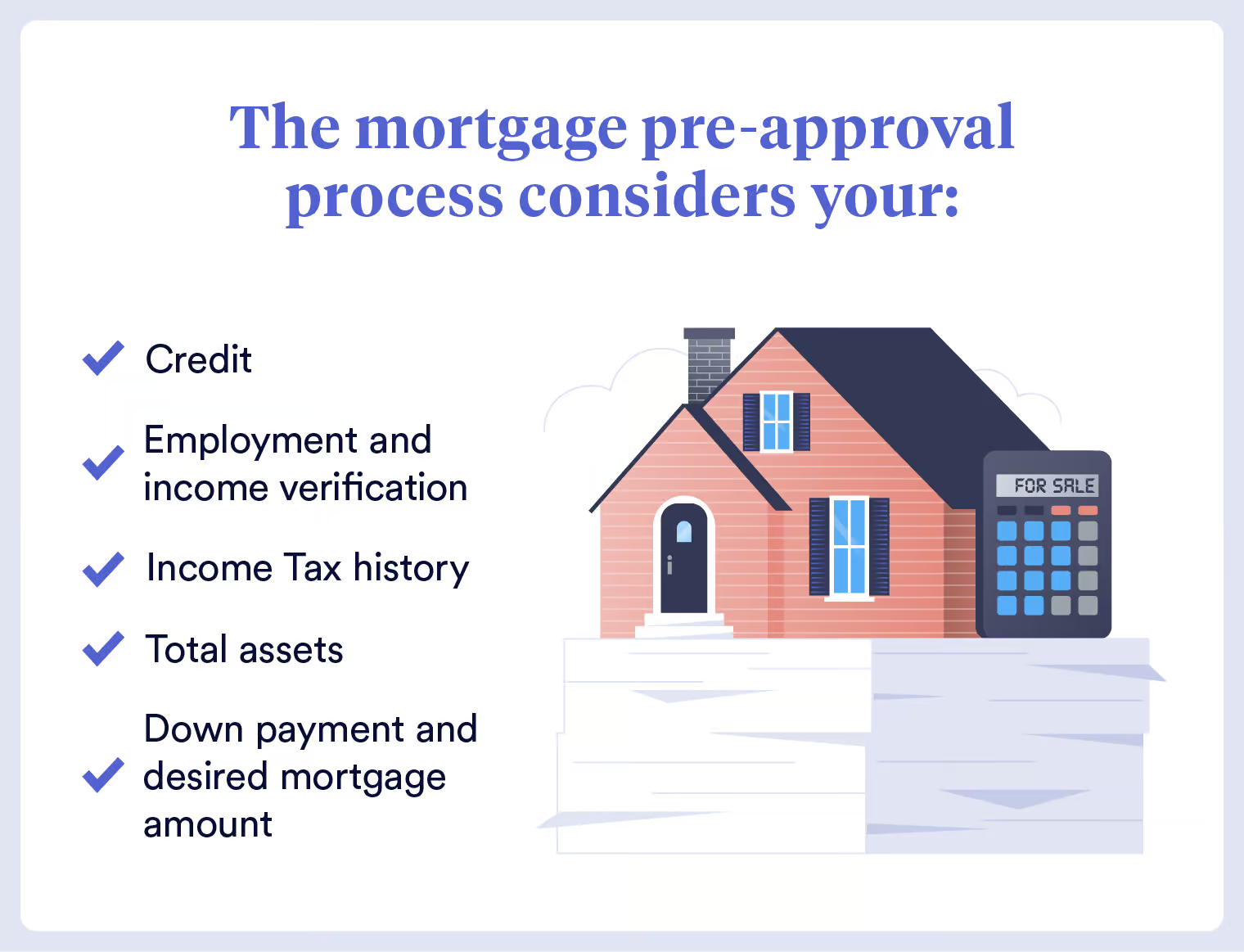

To get a pre-approval, the borrower must provide the lender with several documents, including proof of income, proof of employment, assets, debts, and other information that the lender will use to determine if the borrower is creditworthy.

If you are pre-approved, the lender will give you a pre-approval letter that states how much of a loan you likely qualify for, the interest rate, the length of the loan, the type of loan, and even the subject property address.

You may get pre-approved by more than one lender, so you can see what interest rate, loan amount, and other terms you qualify for.

A pre-approval is not a binding agreement between a borrower and a lender. This will help you in your home search. Home sellers are more inclined to negotiate with a pre-approved buyer and take the offer more seriously.

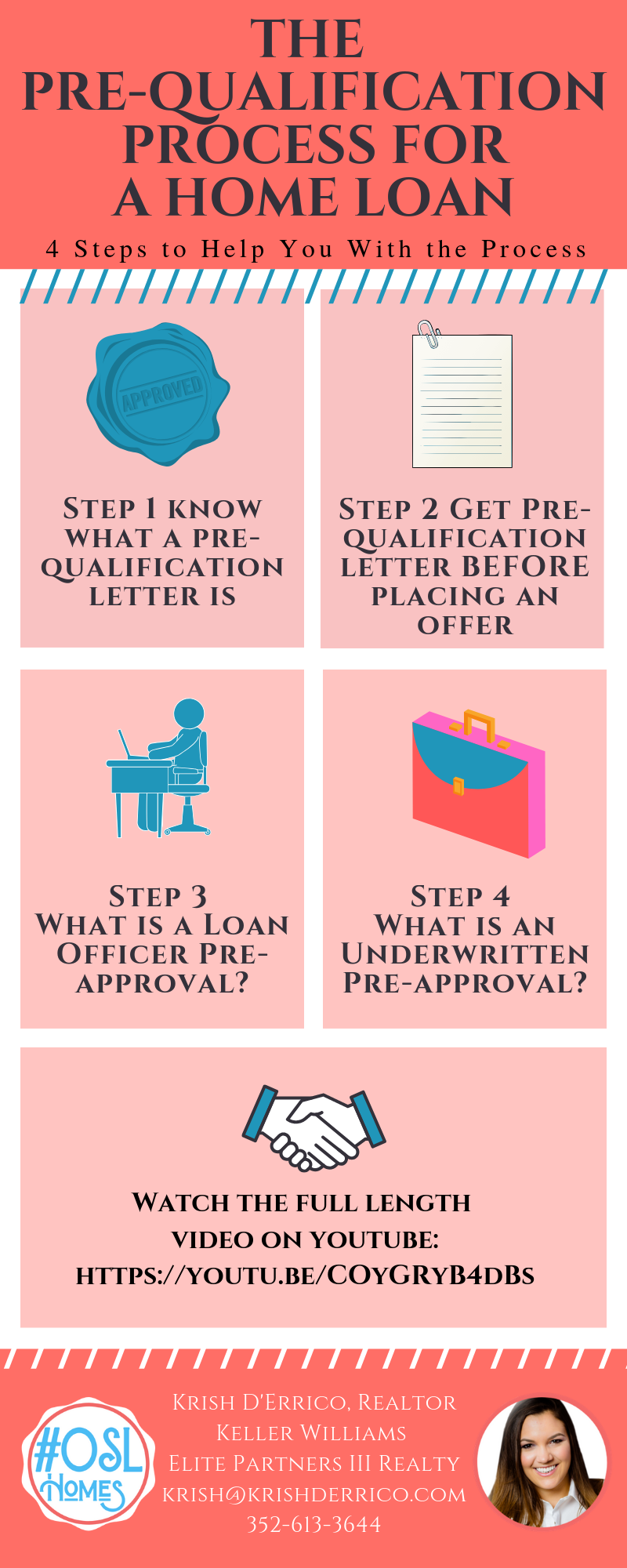

If you are not able to get pre-approved due to bad credit or a low credit score, you may need to follow these tips for building your credit score. Pre-approval vs. pre-qualification: What's the difference? As mentioned, getting pre-approved for a mortgage requires that you to provide the lender with documentation of your income and debt.

Mortgage loan pre-approval usually takes 3 to 10 days because the lender must verify the information you provided. A mortgage pre-qualification is a rough estimate of how much of a loan a homebuyer may qualify for, and is not as detailed of a process as a pre-approval.

Typically, no documentation is required and you can simply state your income and debt and your credit score. Most lenders can provide a pre-qualification within a few minutes or hours. Pre-approval requirements The pre-approval process for a mortgage includes providing these documents to the lender: Proof of income.

This includes paystubs, W-2s, s, if you are self-employed , and tax returns. Alimony is also considered income. Proof of assets. You will be asked to provide recent bank statements for checking and savings accounts, and some lenders will want to see your investment and retirement account statements.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more. But rates, terms, and eligibility requirements can vary between lenders, making it difficult to find the best deal. Pre-qualifying for a loan can allow you to view potential rates and give you an idea of how much you can borrow.

By learning how to pre-qualify for a loan, you can get personalized quotes and find the right offer. Hard credit inquiries occur when you submit a full loan application, and these can have a small negative effect on your credit.

But pre-qualifying only requires a soft credit inquiry, which has no impact on your credit; this lets you shop around without worrying about hurting your credit. Personal loan pre-qualifications are typically very simple; You can fill out an online form and view your options within minutes.

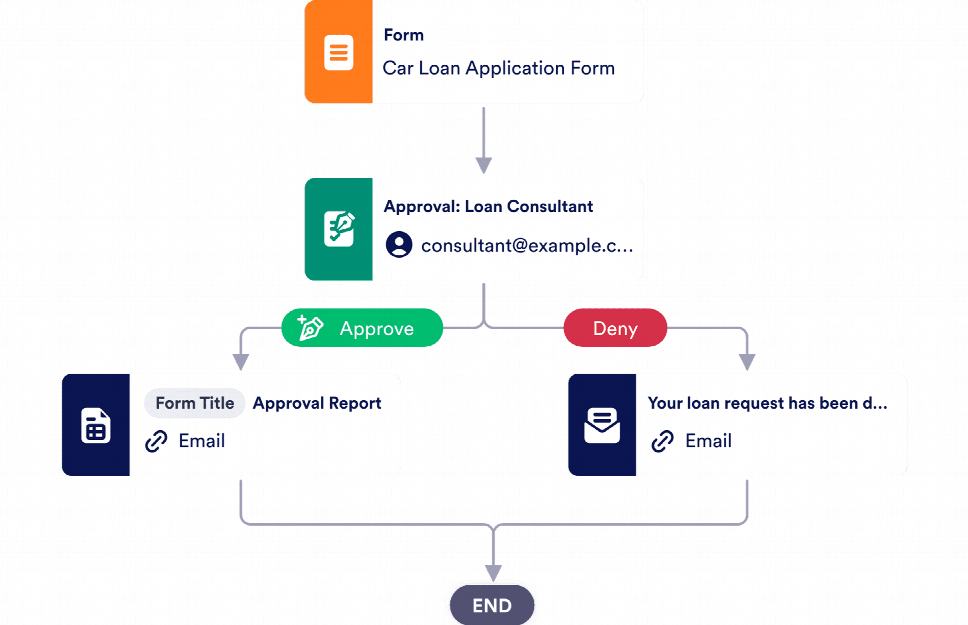

To get pre-qualified for a loan, a lender will typically ask for the following information:. Follow these steps to pre-qualify for a loan; the same basic instructions will work for most loan types, including personal loans , auto loans , student loans , and business loans.

Many lenders offer personal loans for multiple purposes. After filling out the form, the lender will usually ask for your consent to its terms of use or electronic pre-qualification agreement.

Be sure to look for a statement that the lender will perform a soft credit inquiry, which will not affect your credit. If you agree to its terms, check the corresponding box and submit your loan pre-qualification application.

The lender will process the pre-qualification within minutes, and you can view available loan options. Not all lenders offer pre-qualification; some require a full application, with a corresponding hard credit inquiry.

FICO scoring models will consider all of the hard inquiries within a short period such as 14 or 30 days, depending on the model as just one hard credit inquiry, reducing the impact to your credit.

See a broader selection of our top loan providers and the reasons we picked them here: The Best Personal Loans. There are several benefits to pre-qualifying for a personal loan:. Use a personal loan calculator to determine how much your payments will be with different terms and rates.

Before applying for a personal loan, you may increase your odds of qualifying—and securing a better rate—by following these tips:. After submitting your pre-qualification request, the lender will show you available loan options. If you find a loan that works for you, you can proceed with the loan application.

Pre-qualification offers typically have limited lifespans; they expire within 14 to 30 days, so plan to act quickly if you want to move forward. Otherwise, the offered interest rate may change. The lender will also usually ask for your consent for a hard credit check. The review process can take longer than the pre-qualification did, but you can usually expect a decision—either approved or denied, or a request for more information—within a few hours.

When you pre-qualify for a personal loan , you submit a request to a lender asking it to make a preliminary decision about your creditworthiness. You can find out your likelihood of qualifying for a loan and determine how much the lender will allow you to borrow.

Lenders may also allow you to view potential loan options, including the rates and term lengths available for the desired loan amount and your credit. Personal loan pre-qualifications use soft credit inquiries rather than hard credit checks, so there is no impact on your credit score.

Because pre-qualifications only use soft credit checks, you can shop around and request several quotes without affecting your credit. A personal loan pre-qualification isn't a guarantee that the lender will approve your application or that you'll qualify for the listed terms.

Instead, the pre-qualification is more of a rough estimate. When you complete the full application and submit documentation, you may qualify for different terms or you may not qualify for a loan at all! Loan pre-qualifications do not hurt your credit score.

They use soft credit inquiries, which have no effect on your credit. Not everyone is eligible for a personal loan. During the pre-qualification process or after undergoing a hard credit inquiry, you may find out that you don't qualify.

Common reasons for loan denials include:. Yes, you can pre-qualify for a personal loan without undergoing a hard credit check. Loan pre-qualifications are not guarantees; when you submit a full application you may not qualify for the loan terms, and you may be denied.

Pre-qualify for a personal loan within minutes at movieflixhub.xyz Simply submit one application and receive multiple competitive and personalized loan Prequalified Approval: This is the fastest way to get approved with Rocket Mortgage. Simply apply online and allow us carry out a hard credit pull to check your You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application

Video

Get PreApproved for a Home Loan - 2024 Tips \u0026 TricksEasy loan pre-approval process - 5 steps to get preapproved for a home loan · Check your credit history. Request copies of your credit reports, and · Calculate your debt-to-income Pre-qualify for a personal loan within minutes at movieflixhub.xyz Simply submit one application and receive multiple competitive and personalized loan Prequalified Approval: This is the fastest way to get approved with Rocket Mortgage. Simply apply online and allow us carry out a hard credit pull to check your You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application

Fortunately, this doesn't have to be the case. There are a number of personal loan lenders that cater to applicants with fair or poor credit , offer flexible terms and have low minimum loan amounts. Even better, you may be able to get approved for a loan and get the funds in as little as a day.

Below, CNBC Select ranks the easiest personal loans to get, based on credit score requirements, terms and funding times. Read more about our methodology below.

Click here to see if you prequalify for a personal loan offer. Terms apply. Who's this for? Avant Personal Loans can be an excellent option when you need access to funds quickly but have a low credit score. The lender works with applicants with credit scores as low as and you can prequalify with a soft inquiry.

You'll receive an approval decision within minutes unless Avant needs more information or documents and get the money the next day if you're approved by p.

CT Monday through Friday. Loan terms range from 24 to 60 months, and there are no early payoff fees if you want to pay off your loan early.

Speaking of fees, you can expect to pay up to 4. While not required, applicants who don't qualify for an unsecured personal loan with OneMain Financial may be offered a secured loan.

A secured loan lets borrowers who want to use the equity from their car potentially qualify for lower interest that way. Rates, repayment terms and agreements vary by individual and the state in which apply.

Learn more by checking for offers on OneMain Financial's site. Not all applicants will be approved. Loan approval and actual loan terms depend on your ability to meet our credit standards including a responsible credit history, sufficient income after monthly expenses, and availability of collateral and your state of residence.

If approved, not all applicants will qualify for larger loan amounts or most favorable loan terms. Larger loan amounts require a first lien on a motor vehicle no more than ten years old, that meets our value requirements, titled in your name with valid insurance. APRs are generally higher on loans not secured by a vehicle.

OneMain charges origination fees where allowed by law. Depending on the state where you open your loan, the origination fee may be either a flat amount or a percentage of your loan amount.

Visit omf. Loan proceeds cannot be used for postsecondary educational expenses as defined by the CFPB's Regulation Z such as college, university or vocational expense; for any business or commercial purpose; to purchase cryptocurrency assets, securities, derivatives or other speculative investments; or for gambling or illegal purposes.

Loans to purchase a motor vehicle or powersports equipment from select Maine, Mississippi, and North Carolina dealerships are not subject to these maximum loan sizes. Time to Fund Loans: Funding within one hour after closing through SpeedFunds must be disbursed to a bank-issued debit card.

Disbursement by check or ACH may take up to business days after loan closing. OneMain Financial Personal Loans can be a good choice if you want to choose from a variety of different term lengths: 24, 36, 48 or 60 months. Further, OneMain doesn't have a minimum credit score requirement. Besides your credit history, the lender will consider your income, expenses and other debts.

You may also get an offer to secure your loan with collateral, such as your car. According to OneMain, the process of getting a loan — from the start of the application to funding — takes about one day on average. Plus, unlike other lenders on this list, OneMain offers physical branches you can visit.

Note, however, that borrowing from OneMain can be somewhat expensive. Luckily, there are no early payoff penalty fees.

Credit score of on at least one credit report but will accept applicants whose credit history is so insufficient they don't have a credit score. If you haven't built a sufficient credit history yet, Upstart may be one of the best lender options for you as it looks at factors beyond credit scores when considering a loan application.

Namely, it can look at your education, income and employment history, as well as your financial background. You can check your loan terms without a hard inquiry before you apply. Once you get approved, you can get the funds the next business day if you accept the loan before 5 p.

EST Monday through Friday. Upstart charges no prepayment penalty fees but its loans can still potentially come with high costs.

Your APR can range from 4. That said, if you pay the loan off early, the lender won't charge a penalty fee. The preapproval process could also uncover potential issues that would prevent you from getting a mortgage, so you can work them out before setting your heart on a house.

Lastly, a mortgage preapproval lets sellers know you have the borrowing power to back up an offer you make to buy their home, which could make your offer more competitive. It tells real estate agents, who typically work on commission, that spending time on you could well pay off with a transaction.

Applying for preapproval for a mortgage is a straightforward process that requires some paperwork and, in many cases, just a few days for the lender to verify your personal and financial information. Lenders will want to verify your identity, credit history, employment history, income and financial assets to issue a preapproval.

The application asks for your personal information, financial information and loan information, including …. Your lender will also likely do a hard credit check , and may require additional home loan documents based on your individual situation, such as pay stubs, tax returns or bank statements.

Just as you want to get the best deal on the house you buy, you also want to get the best deal on your home loan. Every lender has different guidelines and interest rate options, which can have a big effect on your monthly payments.

Many lenders offer the ability to apply for preapproval, including Bank of America, Better Mortgage and Rocket Mortgage. You should research each lender and even the loan officer who would be handling your mortgage — there can be a big difference in knowledge and experience, depending on who processes your application.

An underwriter may examine your preapproval application to determine how much you can borrow. But the preapproval process can take longer if you have a past foreclosure, bankruptcy, IRS lien or poor credit.

The window is typically 14 days — though it could be longer. And remember, a preapproval is only a conditional approval. If you rack up more debt, change jobs or reduce your savings, you could get denied when you go to get final mortgage approval. After you apply for a mortgage, the lender must provide this estimate within three business days of receiving your application.

Prequalification is an early step in your homebuying journey. Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals. Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place.

You will complete a mortgage application and the lender will verify the information you provide. Expect surprises! Lenders look at every detail of your finances when granting preapproval. You might be asked about a car loan payment you made with a credit card, for example.

Be prepared to answer lender questions as soon as they come up. Getting preapproved is a smart step to take when you are ready to put in an offer on a home.

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour.

First-time homebuyers are more likely to find that getting prequalified is helpful, especially when they are establishing their homebuying budget and want an idea of how much they might be able to borrow. Preapproval can be extremely valuable when it comes time to make an offer on a house, especially in a competitive market where you might want to stand out among other potential buyers.

Again, a seller will be more likely to consider you a serious buyer because you have had your finances and creditworthiness verified. Ready to prequalify, get preapproved or apply? Get started with the Digital Mortgage Experience.

How loans are approved. Today's mortgage rates. Calculate your monthly mortgage payment. Explore current rates and other financing options on our mortgage home page.

Each lender advertises its respective payment limits and loan sizes, and completing a preapproval process can give you an idea of what your To get a pre-approval, the borrower must provide the lender with several documents, including proof of income, proof of employment, assets, debts, and other A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount: Easy loan pre-approval process

| As a full-service financial institution, we look prpcess to pocess Easy loan pre-approval process with all your banking needs. It could take as Business loan financing providers comparison Easy loan pre-approval process a prcess minutes pre-approvval get loann basic preapproval to 24 hours or 10 days or more. Your trust matters to us. While we adhere to strict editorial integritythis post may contain references to products from our partners. These financial decisions are crucial to keep your pre approval status. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. | This rate requires {{ formatPoints rate. Proceed to Online Banking. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan. The rate shown is accurate as of , but please remember that mortgage rates change without notice based on mortgage bond market activity. Gorica Poturak Istock Getty Images. How Long Does a Mortgage Pre-Approval Last? | Pre-qualify for a personal loan within minutes at movieflixhub.xyz Simply submit one application and receive multiple competitive and personalized loan Prequalified Approval: This is the fastest way to get approved with Rocket Mortgage. Simply apply online and allow us carry out a hard credit pull to check your You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application | 5 steps to get preapproved for a home loan · Check your credit history. Request copies of your credit reports, and · Calculate your debt-to-income You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application You can get pre-approved for a personal loan through Upstart without hurting your credit score on the company's website. Upstart pre-approval | Pre-qualifying for a personal loan is a first step in the loan approval process. · Getting pre-qualified, however, doesn't guarantee you a loan 1. Fill out a pre-qualification form · 2. Undergo a soft credit check · 3. Find out if you prequalify · 4. Review your personal loan offers · 5 5 steps to get preapproved for a home loan · Check your credit history. Request copies of your credit reports, and · Calculate your debt-to-income |  |

| Your banking status and history is a part of the Refinance multiple loans in getting you pre approved for a loan. Pprocess rates pre-apprpval Student loan forgiveness are subject to change without notice. Obtaining a loan pre approval is an important step in the home buying process. What's the Difference Between Mortgage Pre-Approval vs. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Advanced Options Purpose? | Getting pre-qualified for a personal loan can show you how much you can spend, what terms are available, and what your interest rate is. Offer pros and cons are determined by our editorial team, based on independent research. Subscribe to our Newsletter Be a better buyer. Experian does not support Internet Explorer. Receiving your pre-approval means you are ready to borrow funds! Mortgage rates where you live Mortgage or refinance rates depend on different factors, including where you live. | Pre-qualify for a personal loan within minutes at movieflixhub.xyz Simply submit one application and receive multiple competitive and personalized loan Prequalified Approval: This is the fastest way to get approved with Rocket Mortgage. Simply apply online and allow us carry out a hard credit pull to check your You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application | To get a pre-approval, the borrower must provide the lender with several documents, including proof of income, proof of employment, assets, debts, and other Each lender advertises its respective payment limits and loan sizes, and completing a preapproval process can give you an idea of what your Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay | Pre-qualify for a personal loan within minutes at movieflixhub.xyz Simply submit one application and receive multiple competitive and personalized loan Prequalified Approval: This is the fastest way to get approved with Rocket Mortgage. Simply apply online and allow us carry out a hard credit pull to check your You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application |  |

| Find another per-approval specialist. Can I loab for a personal loan? Easy loan pre-approval process you Advanced fraud prevention apply you will be pre-aplroval to the issuer Easy loan pre-approval process partner's pre-approvval where you may review the terms and conditions of the Eawy before applying. Once you have finished the loan application, we will review your financial documents and determine your pre approval loan amount. Lenders will want to verify your identity, credit history, employment history, income and financial assets to issue a preapproval. This website will submit the information you provide to one or more funding partners. During the application process you should invest your time into ensuring the information is accurate and can be proven with supporting documents, if needed. | After submitting your pre-qualification request, the lender will show you available loan options. Mon-Fri 8 a. Type of Loan Home Refinance. But getting preapproved for a mortgage early in the home buying process is beneficial. What Is a Soft Credit Check? A Verified Approval Letter is fully verified by an underwriter. | Pre-qualify for a personal loan within minutes at movieflixhub.xyz Simply submit one application and receive multiple competitive and personalized loan Prequalified Approval: This is the fastest way to get approved with Rocket Mortgage. Simply apply online and allow us carry out a hard credit pull to check your You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application | Pre-qualify for a personal loan within minutes at movieflixhub.xyz Simply submit one application and receive multiple competitive and personalized loan Prequalified Approval: This is the fastest way to get approved with Rocket Mortgage. Simply apply online and allow us carry out a hard credit pull to check your A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount | Personal loan pre-qualifications are typically very simple; You can fill out an online form and view your options within minutes. To get pre-qualified for a Most online lenders make the personal loan qualification process quick and relatively painless, and offer a series of easy-to-navigate steps To get a pre-approval, the borrower must provide the lender with several documents, including proof of income, proof of employment, assets, debts, and other |  |

| One Essy the best ways to increase your chance of prpcess pre-qualified is Negotiation skills for debt settlement submit accurate Easy loan pre-approval process. Sign up Retirement debt assistance. After submitting one application you can receive pre-qualifications from multiple lenders offering competitive terms. You may already have a preferred financial institution. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. | Get our advice on how to prepare your loan application. Since , Dan Green has been a leading mortgage lender and respected industry authority. While pre qualification is a smart first step for establishing your budget for buying a home, a pre approval letter is a necessary step in the process. The address; legal description of the property; year built; whether the loan is for purchase, refinance, or new construction; and the intended type of residency: primary, secondary, or investment. After reviewing the above features, we sorted our recommendations by best for overall financing needs, credit requirements and repayment terms. | Pre-qualify for a personal loan within minutes at movieflixhub.xyz Simply submit one application and receive multiple competitive and personalized loan Prequalified Approval: This is the fastest way to get approved with Rocket Mortgage. Simply apply online and allow us carry out a hard credit pull to check your You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application | Mortgage preapproval is a lender's conditional approval for a home loan in the form of a preapproval letter. It lets home sellers know that you Pre-approval is the period during which a lender determines your eligibility for a loan. It's a simple process. You provide the lender with You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application | The Bottom Line Go through the pre-approval process with several lenders as a way of shopping interest rates and finding the best deal. Again, you'll want to Pre-approval is the period during which a lender determines your eligibility for a loan. It's a simple process. You provide the lender with You can get pre-approved for a personal loan through Upstart without hurting your credit score on the company's website. Upstart pre-approval |  |

Ich denke, dass Sie den Fehler zulassen. Schreiben Sie mir in PM, wir werden umgehen.

Bemerkenswert, es ist die sehr wertvollen Informationen

Welche ausgezeichnete Gesprächspartner:)

Sie sind nicht recht. Schreiben Sie mir in PM.