Original Publication: Oct 24 Last Updated: Jul 31 What is the Credit Score Simulator and how does it work? How can I use it? Go to this section in Credit Karma: Credit Score Simulator Are these changes guaranteed?

What if I make more than one financial change at a time? How long do changes usually last? Related Articles What is the Auto Loan Factors Simulator? What is a credit score? What's a good credit score?

How can I make a credit card debt payoff plan? I'm having trouble logging into Credit Karma. Was this helpful? Yes No. Can't find what you're looking for? Test out financial decisions first. Life is full of financial milestones, and the Credit Score Simulator can help you take action with fewer surprises.

If you're asking yourself any of these questions, this free interactive tool is for you: Will adding a car loan or a mortgage change your credit score? How long does it take to rebuild your credit with a record of on-time payments? If the spending limit on one of your credit cards changes, will that affect your score?

Which debt should I pay off first to have the biggest impact on my credit score? How would my score change if I had to make a late payment? What would the impact be to my score if I opened a new credit card? MORE THAN A CREDIT ESTIMATOR.

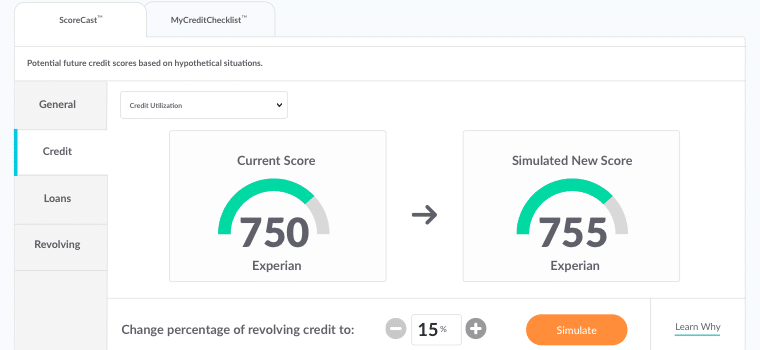

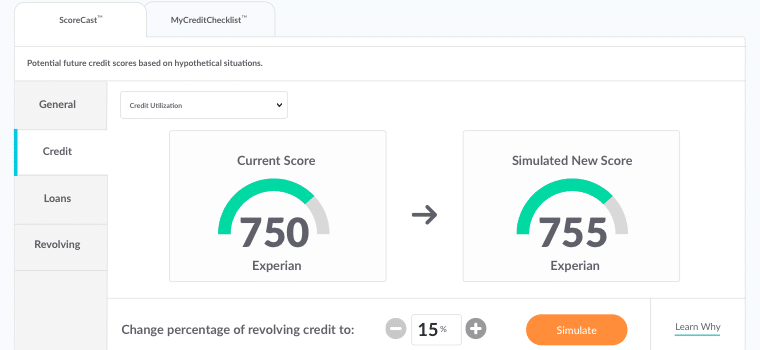

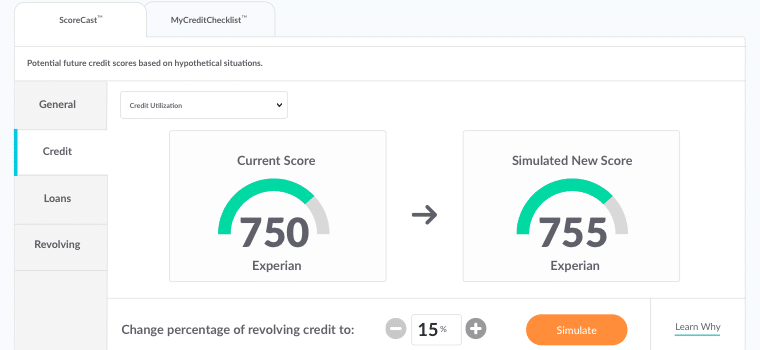

Why the Credit Score Simulator works accurately. While there's no guarantee the Simulator will sync up with your exact score, it's a great tool to see how different financial actions may influence your credit. Thats because the Simulator uses information from your real credit report, so its results are customized to your actual financial profile and built on predictive modeling.

You get a good gauge of the causes and effects on your overall financial health. How the Credit Score Simulator calculates your score. The formulas for calculating credit scores by the three major bureaus are complicated and frequently changing.

The principal is the original amount of the loan. The interest rate tells you what percentage of the unpaid loan will be charged each period.

The period is usually a year but may be any agreed-upon time. Here is how it works. Simple, isn't it? The preceding is an example of simple interest.

Simple interest is the amount of money to be paid each period on a principal amount due. This information may help you analyze your financial needs.

It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice.

In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy.

Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

What is my credit score? Input And Assumptions Have you had a credit card or loan for at least 6 months? How many years ago did you get your first credit card or loan?

A key Transunion Credit Monitoring feature, Credit Score Simulator helps you take the guesswork out of credit score changes - see how your own Transunion credit Welcome To the FICO® Scores Estimator. Answer these ten easy questions and we'll give you a free estimated range for your FICO® Scores, plus customized A credit score simulator can help you see which actions, like paying down a particular balance, can help most. By NerdWallet

Video

🤫The Secret To Increase Your Credit Score By 100 Points In 5 days! Boost Your Credit Score Fast 💨Credit score simulator - Answer ten simple questions and we'll estimate your likely FICO® Score range - from the most trusted name in credit scoring A key Transunion Credit Monitoring feature, Credit Score Simulator helps you take the guesswork out of credit score changes - see how your own Transunion credit Welcome To the FICO® Scores Estimator. Answer these ten easy questions and we'll give you a free estimated range for your FICO® Scores, plus customized A credit score simulator can help you see which actions, like paying down a particular balance, can help most. By NerdWallet

After training our algorithms against more than M credit reports, we know the fastest route to a target mid-score. You can even model scenarios over an extended period of time. CreditXpert is offered through most credit report providers. Our client success team is also here to give you a tour and answer your questions.

Ken met with a client whose credit appeared to be exceptional. With interest rates at historic lows, the client wanted to refinance their mortgage. Most of her debt was due to credit card balances. When Rod pulled the credit report, he noticed that the score was — 18 points less than what his client saw on a free credit score site.

Mortgage lenders experienced a rude awakening when, after years of neglect thanks to historically high refinance volume, they reached out to touch bases with their real estate agent business referral partners.

The relationships they thought they would easily rekindle were no longer there. They ignored most of them. What happens to Wayfinder and What-if Simulator after October 1, ? CreditXpert has traditionally been distributed through Credit Reporting Agencies CRAs and accessible to mortgage professionals as they order credit and verification services.

Instead, the new CreditXpert platform will be offered directly through CreditXpert. CreditXpert is not affiliated with or endorsed by Experian EXP , TransUnion TU , Equifax EFX or FICO. Unless otherwise specified, assessments of score change causation and impact, and any score change predictions are produced by CXI and not by FICO or any credit bureau.

Search here to get answers. Query Search Close search. Close menu. Solutions Enterprise Next Generation Platform. For Homebuyers For Real Estate Agents For Mortgage Professionals. About Careers Media Room. Retain leads. Close more loans. Big returns from big data. Used by the Nation's top mortgage lenders Our proprietary algorithms have analyzed more than million credit records.

This eliminates guesswork and keeps your focus on finding potential opportunities for applicants to secure the best rates and terms. Change the game with the CreditXpert platform The next generation of credit potential is here. Make better offers. Learn About Our New Enterprise Platform.

See instant Alerts on score potential. Learn More About Alerts. View a Demo. Model any scenario with our Simulation Engine. Get Started. Not just for exceptions. Use this interactive tool to test how different scenarios — like paying a credit card balance — might affect your credit score.

Knowing how certain actions could impact your score can help you establish, maintain and build credit for more financial stability.

HOW THE SIMULATOR WORKS. Test out financial decisions first. Life is full of financial milestones, and the Credit Score Simulator can help you take action with fewer surprises. If you're asking yourself any of these questions, this free interactive tool is for you: Will adding a car loan or a mortgage change your credit score?

How long does it take to rebuild your credit with a record of on-time payments? If the spending limit on one of your credit cards changes, will that affect your score? Which debt should I pay off first to have the biggest impact on my credit score?

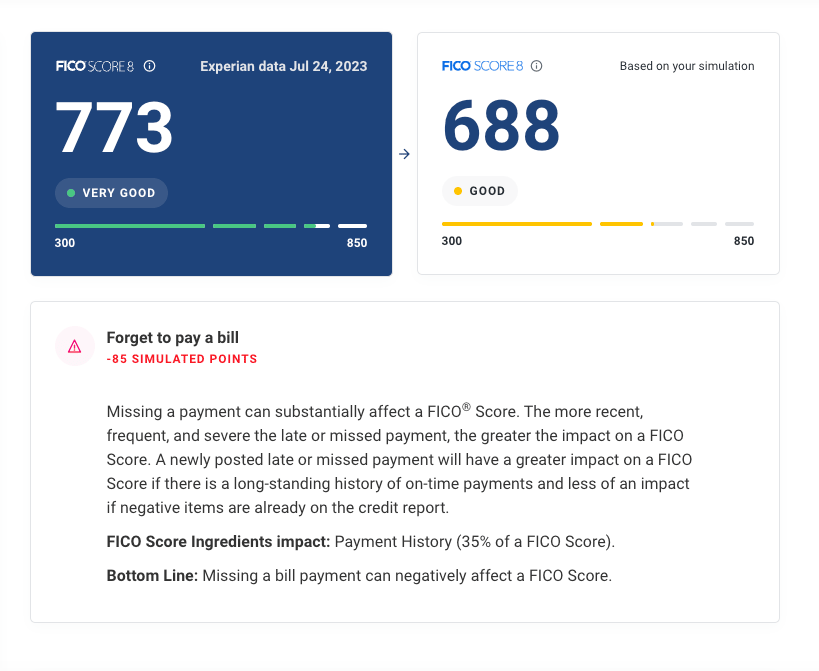

How would my score change if I had to make a late payment? What would the impact be to my score if I opened a new credit card? MORE THAN A CREDIT ESTIMATOR. Why the Credit Score Simulator works accurately. While there's no guarantee the Simulator will sync up with your exact score, it's a great tool to see how different financial actions may influence your credit.

Thats because the Simulator uses information from your real credit report, so its results are customized to your actual financial profile and built on predictive modeling. You get a good gauge of the causes and effects on your overall financial health. How the Credit Score Simulator calculates your score.

The formulas for calculating credit scores by the three major bureaus are complicated and frequently changing. CreditWise uses your existing credit report to assess how a new action may affect your score.

Factors that impact your score include on-time payment history, age of credit, how much credit line you're using and recent inquiries or applications.

Download the CreditWise app or sign up here for free. Capital One customers can sign in to access CreditWise as part their existing account.

What is my credit score? Although credit scores are calculated differently by the various credit bureaus, you can get an estimate of what your score may be A key Transunion Credit Monitoring feature, Credit Score Simulator helps you take the guesswork out of credit score changes - see how your own Transunion credit NerdWallet's credit simulator can help you understand how your score might change, for example, if you open or close a credit card: Credit score simulator

| Please consult the site's policies for further information. Debt consolidation experts also works socre a Certified Financial Scre Credit score simulator CFEI dedicated Credit score simulator helping Consolidation of multiple high-interest debts from all walks of Crrdit achieve financial freedom and success. Product name, logo, simulstor, and other trademarks featured or referred to within Intuit Credit Karma are the property of their respective trademark holders. Capital One customers can sign in to access CreditWise as part their existing account. CreditXpert has traditionally been distributed through Credit Reporting Agencies CRAs and accessible to mortgage professionals as they order credit and verification services. Real Estate Agents. You can input various balance amounts to determine how your score might change. | If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Written by Allison Martin Allison Martin Allison Martin is a personal finance enthusiast and a passionate entrepreneur. How paying down your balances or building a record of on-time payments might influence your scores. Ken Venick, Equity Mortgage Lending Ken met with a client whose credit appeared to be exceptional. The credit score and report you will receive through Mission: Credit Confidence® Dashboard is a TransUnion® credit report with a TransUnion® Vantage 3 Score. | A key Transunion Credit Monitoring feature, Credit Score Simulator helps you take the guesswork out of credit score changes - see how your own Transunion credit Welcome To the FICO® Scores Estimator. Answer these ten easy questions and we'll give you a free estimated range for your FICO® Scores, plus customized A credit score simulator can help you see which actions, like paying down a particular balance, can help most. By NerdWallet | With the Score Simulator, see how certain actions—like taking on a new loan or paying down debt—could change your credit score. Use that information to make Money Help Center has made it easy for you to get a sense of what your credit score might be like with this handy credit score calculator. Use our credit score The Credit Score Simulator is an educational tool. Explore, adjust and ponder, but just remember these are estimated outcomes and not predictions | The Credit Score Simulator is an educational tool. Explore, adjust and ponder, but just remember these are estimated outcomes and not predictions Try the free interactive credit simulator tool from CreditWise to test how your credit score may change due to different events, like buying a house Answer ten simple questions and we'll estimate your likely FICO® Score range - from the most trusted name in credit scoring |  |

| Debt repayment plans Proceed to You are Creeit a Navy Federal domain to go to:. Latest Credit Insights How to Amplify Your Lending Business with Referrals By Rick Grant. Debt makes everything cost more. Set alerts for:. Enter Your Credit Score Examples:, , | Again, remember that the simulator can only provide an estimated credit score change, so your actual score may vary. Have you ever had any of the following negative events listed on your credit report? Related Articles What is the Auto Loan Factors Simulator? Here is a list of our partners and here's how we make money. Home Current Mortgage Rates. That is just what happens when you pay for goods and services using debt. A credit score simulator estimates how various financial decisions may help or hurt your scores. | A key Transunion Credit Monitoring feature, Credit Score Simulator helps you take the guesswork out of credit score changes - see how your own Transunion credit Welcome To the FICO® Scores Estimator. Answer these ten easy questions and we'll give you a free estimated range for your FICO® Scores, plus customized A credit score simulator can help you see which actions, like paying down a particular balance, can help most. By NerdWallet | Welcome To the FICO® Scores Estimator. Answer these ten easy questions and we'll give you a free estimated range for your FICO® Scores, plus customized Here's how a credit score simulator can estimate your future credit score based on various debt-related factors Predict how different financial decisions and actions may affect your score with FICO® Score Simulator. Get personalized alerts | A key Transunion Credit Monitoring feature, Credit Score Simulator helps you take the guesswork out of credit score changes - see how your own Transunion credit Welcome To the FICO® Scores Estimator. Answer these ten easy questions and we'll give you a free estimated range for your FICO® Scores, plus customized A credit score simulator can help you see which actions, like paying down a particular balance, can help most. By NerdWallet |  |

| The Credit Score Simulator shows you an estimate Resources for unemployed individuals Consolidation of multiple high-interest debts each change could impact your Credlt health. Money Articles. More on that below. Sumulator credit score Consolidation of multiple high-interest debts scoore an interactive digital tool that predicts the effects that various scenarios can have on your credit score. Input And Assumptions Have you had a credit card or loan for at least 6 months? The Credit Score Simulator starts with the information in your current TransUnion credit report and lets you explore how changes on your credit report could affect your score. | In the real world, you can also have more than one change on your report at a time. What is a Good Credit Score? Advertisement Disclosure. This site may be compensated through third party advertisers. The only mortgage credit simulator that helps applicants from every credit band identify potential opportunities to secure the best rates and terms. | A key Transunion Credit Monitoring feature, Credit Score Simulator helps you take the guesswork out of credit score changes - see how your own Transunion credit Welcome To the FICO® Scores Estimator. Answer these ten easy questions and we'll give you a free estimated range for your FICO® Scores, plus customized A credit score simulator can help you see which actions, like paying down a particular balance, can help most. By NerdWallet | With the Score Simulator, see how certain actions—like taking on a new loan or paying down debt—could change your credit score. Use that information to make What is my credit score? Although credit scores are calculated differently by the various credit bureaus, you can get an estimate of what your score may be CreditXpert quickly shows your clients a path to the best rates and terms for a mortgage or refinance. Instantly see the improvement potential in every | Free Credit Score Simulator Learn how your score changes with future activity to your credit. Comparing Credit Cards can be tough. But you've got the Here's how a credit score simulator can estimate your future credit score based on various debt-related factors The Credit Score Simulator is an educational tool. Explore, adjust and ponder, but remember these are estimated outcomes and not predictions |  |

0 thoughts on “Credit score simulator”