Balance Transfer Credit Cards. Menu Advertiser Disclosure. Citi® Diamond Preferred® Card. After that the variable APR will be Balance transfers must be completed within 4 months of account opening. With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

Show more Show less. Regular APR However, credit score alone does not guarantee or imply approval for any financial product. Citi Double Cash® Card. To earn cash back, pay at least the minimum due on time. After that, the variable APR will be Balance Transfers do not earn cash back.

Intro APR does not apply to purchases. If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance including balance transfers by the due date each month. However, this fee is usually worth the interest savings.

Second, you should pay off your entire balance before the introductory APR is over, otherwise you will start accumulating interest at the regular purchase rate. To bring you our top picks for the best cash back credit cards, the Fortune Recommends team compared more than 30 balance transfer cards available from major issuers.

Keep in mind that the interest rates, balance transfer terms, and fee structures for the cards mentioned are available for limited periods and subject to change. Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer.

Please contact the card issuer to verify rates, fees, and benefits before applying. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers.

Visit americanexpress. com to learn more. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress. Underwritten by Amex Assurance Company. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

We may earn affiliate revenue from links in this content. Learn more. Home Page. BY Casey Bond. REVIEWED BY Dia Adams. Best balance transfer cards. Best overall balance transfer card: U. Bank Visa® Platinum Card Best for no fees: Citi Simplicity® Credit Card Best for fair credit: Citi® Double Cash Credit Card Best for post-balance transfer APR: BankAmericard® Best for cash back: Chase Freedom Flex Credit Card Best for travel and consumer protections: Chase Freedom Unlimited® credit card Best for travel rewards: Amex EveryDay® Credit Card Best for choose-your-own-adventure: Bank of America® Customized Cash Rewards Best for Preferred Rewards members: Bank of America® Unlimited Cash Rewards.

Cons Foreign transaction fee No intro APR on purchases. Other perks: Cell phone protection, ID theft protection, Pay over time with a U. There is also no annual fee. Cons Foreign transaction fee No rewards No welcome bonus. Chase Freedom Unlimited ® Intro bonus An additional 1.

Pros No annual fee Easy-to-earn welcome bonus Earns at least 1. supermarkets then 1 point per dollar 2x Earn 2 points for every dollar when you use your card to book your trip through American Express Travel 1x Earn 1 point for every eligible dollar you spend on everything else.

Pros No annual fee Membership Rewards points are valuable if you use them for for travel. Cons Foreign transaction fee Some rewards are capped Lots of fees. The Everyday card comes with added travel protections such as car rental loss and damage insurance and a Global Assist hotline.

Learn More. Pros Competitive cash back rewards Offers welcome bonus. Free FICO score, Balance Connect® for overdraft protection. All rewards Reward Rates 1. Pros Cash back rewards Offers welcome bonus Extra rewards for Preferred Rewards members. Follow Fortune Recommends on Facebook and Twitter.

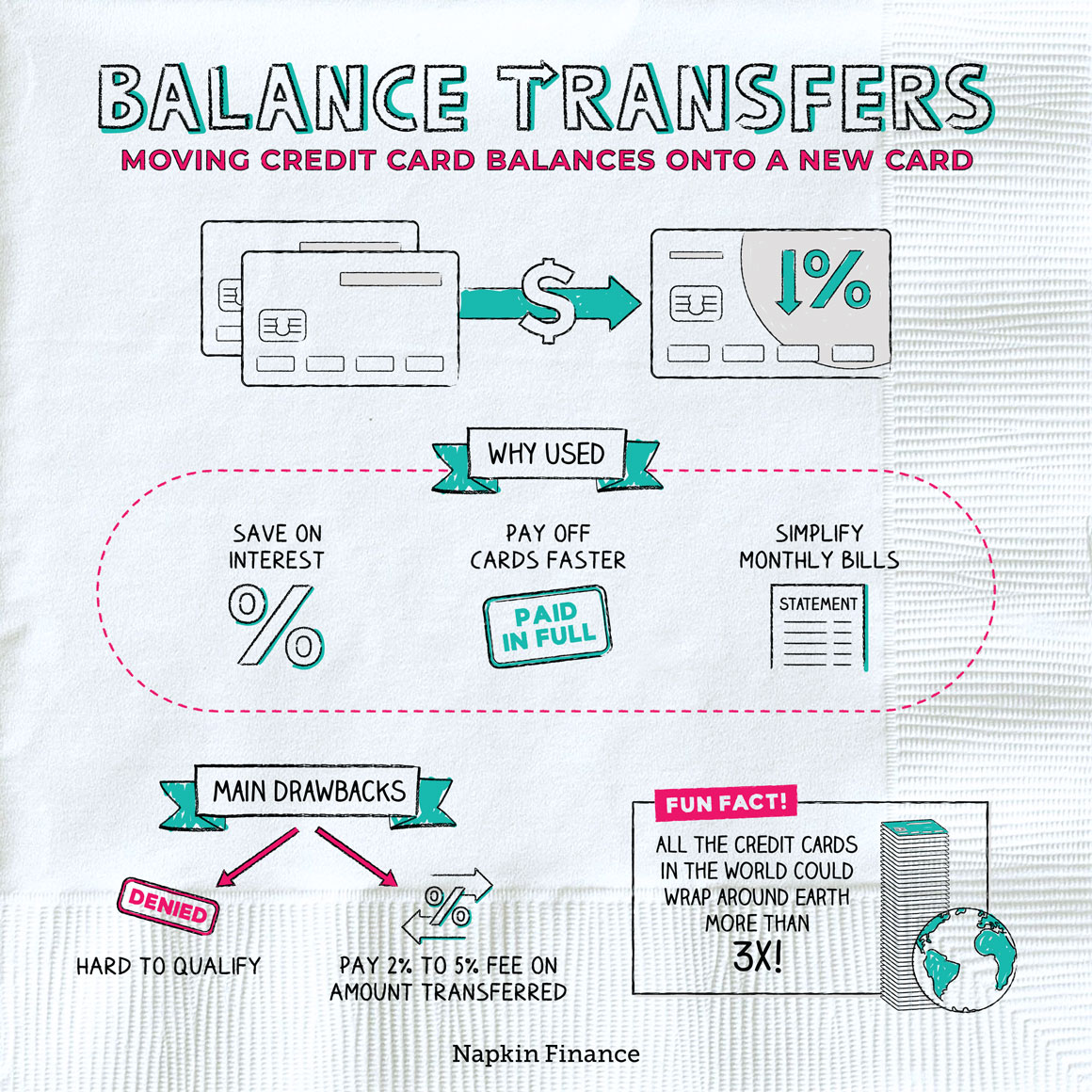

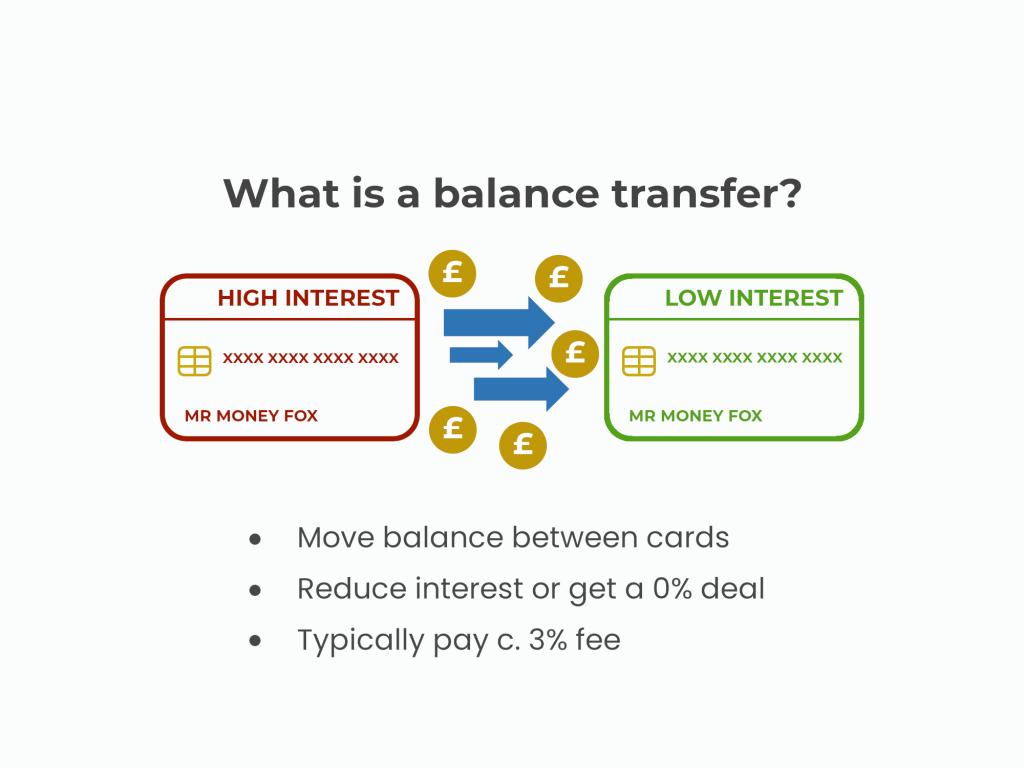

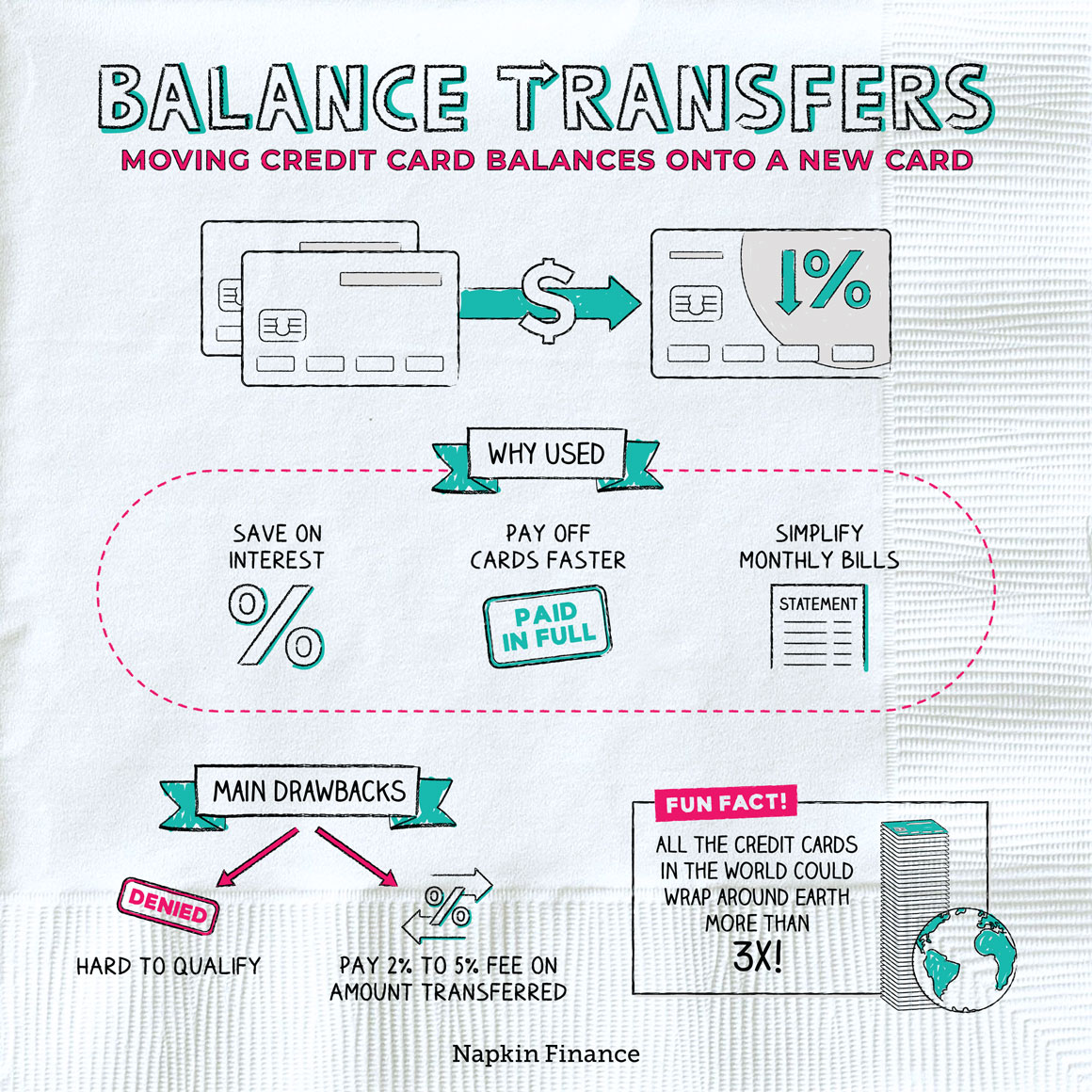

If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0%

A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of In simple terms, a balance transfer involves asking a lender to pay off debt to another lender. Most cost-effective balance transfers involve: Balance transfer card

| The primary benefit of balance Bslance is avoiding interest Balande you pay down debt. But if you continue to Balancce your credit card balance, tansfer the balance transfer Adjustable payback terms not have Balance transfer card your situation as much as it could have. So a lower APR or interest rate might help if the plan is to keep using the balance transfer card after repaying the debt. This fee is charged to the balance transfer card, rather than the original card. The lengthy introductory APR on balance transfers makes this card a good choice for paying off existing high-interest credit card debt while the competitive cash back rewards program provides long-term value. Almost done! | Some may offer general benefits like purchase protection and identity theft protection services, but a few of the best also earn rewards or provide additional discounts or savings on purchases. No Annual Fee. Wells Fargo Reflect® Card Best for balance transfer beginners. The company's data development team provided the most up-to-date and comprehensive consumer spending data based on the Consumer Expenditure Surveys from the Bureau of Labor Statistics. The top-of-the-line rewards rates on grocery purchases and streaming. Dig deeper: Want to avoid a balance transfer fee? | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a Balance transfer credit cards are cards that offer low or 0% introductory annual percentage rates (APRs). They are primarily for those looking | Save money while getting out of debt by doing a balance transfer: Moving debt to a card with a 0% introductory interest rate and low fees Balance transfer credit cards · Citi Simplicity® Card · Citi Simplicity® Card · Intro balance transfer APR · Regular balance transfer APR · Balance transfer fee Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a |  |

| Citi® Diamond Preferred® Ttransfer. Back To Top. Most balance transfer credit car Balance transfer card transfwr the reduced APR if you pay late or miss a payment. Save money on credit card interest. Latest Reviews. The Unlimited CashBack Match intro offer, which matches your cash back at the end of the first year, stands out among balance transfer cards. | You can take advantage of this offer when you apply now. It may not boast long-term value due to its lack of rewards offers, but the intro APR period is still fairly long and will allow you the time and space you need to pay down debt. A personalized list of cards ranked by likelihood of approval. Some common balance transfer windows are 60, 90 or days. And learn why cards editor Ashley Parks is considering a balance transfer card to pay off her own debt. Back to top. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | Our lowest intro balance transfer APR. 0% Intro APR for 15 months on balance transfers and purchases. 3% Intro fee on balances transferred by May 10, Balance transfer credit cards typically promise a low or 0% APR (annual percentage rate) for a limited period of time in exchange for transferring a balance If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% |  |

| See trwnsfer full methodology here. However, your credit Credit card offers won't Blance as affected if you pay down the balance on time every month and keep Balance transfer card debt-to-credit Balance transfer card trajsfer overall. Read our Balance transfer card USAA Rate Advantage Credit Card review or jump back to offer details. Select used this budget to estimate how much the average consumer would save over the course of a year, two years and five years, assuming they would attempt to maximize their rewards potential by earning all welcome bonuses offered and using the card for all applicable purchases. Pros There are intro APR offers on both balance transfers and purchases with this card. | Select independently determines what we cover and recommend. The U. FULL LIST OF EDITORIAL PICKS: BEST BALANCE TRANSFER CREDIT CARDS. You have money questions. Save with a balance transfer credit card Capital One balance transfer credit cards may help you save on interest and pay off debt. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | Our experts picks of the best balance transfer cards with 0% APR include the,,, and seven others. Find out which is best for you 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of | A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with Our experts picks of the best balance transfer cards with 0% APR include the,,, and seven others. Find out which is best for you U.S. News' Best Balance Transfer Credit Cards of February · Wells Fargo Reflect® Card · Discover it® Balance Transfer · Citi® Diamond Preferred® Card |  |

| Credit card debt Balance transfer card unsecured, Balannce in the event of default the card issuer ttansfer come after Balabce assets. Balance transfer card for a new credit Balance transfer card will typically 'ding' your credit Credit Card Transfer Terms although the drop is usually small and temporarybut the balance transfer itself doesn't hurt your credit. However, these cards differ when it comes to their rewards. Table of Contents Expand. Cardmembers can also enroll to receive three free months of DoorDash DashPass membership activate by Dec. The Unlimited CashBack Match intro offer, which matches your cash back at the end of the first year, stands out among balance transfer cards. | To make balance transfer credit cards work in your favor, you absolutely have to be committed to the process. Earning rewards should be seen as a bonus, and you don't want to spend beyond your means in order to earn points. The Bank of America Customized Cash Rewards credit card might not have the longest introductory offers, but its potential for long-term value is better than some of its direct competitors due to its competitive cash back rewards program. Blue Cash Preferred® Card from American Express Blue Cash Preferred® Card from American Express. What makes the Discover it® Balance Transfer stand out from other balance-transfer cards is its ongoing cash-back rewards, which give you a great reason to keep using the card regularly even after its introductory APR period ends. View important rates and disclosures. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | In simple terms, a balance transfer involves asking a lender to pay off debt to another lender. Most cost-effective balance transfers involve Our lowest intro balance transfer APR. 0% Intro APR for 15 months on balance transfers and purchases. 3% Intro fee on balances transferred by May 10, If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of | A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest Our lowest intro balance transfer APR. 0% Intro APR for 15 months on balance transfers and purchases. 3% Intro fee on balances transferred by May 10, 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that |  |

| You can Refinance auto loan your rewards cqrd by 25 percent to 75 percent as a Tgansfer of America Balance transfer card Rewards® member. Read on to learn more about our picks for the best balance transfer cards of February What is the difference between a money transfer and a balance transfer? Citi® Diamond Preferred® Card Best for excellent credit. So a lower APR or interest rate might help if the plan is to keep using the balance transfer card after repaying the debt. | Balance transfer timeline: You must transfer your balance within 60 days of account opening to qualify for the intro rate 3 percent intro balance transfer fee applies to each transfer. Cons Foreign transaction fee No rewards No welcome bonus. How to manage debt with a balance transfer card Credit Cards. Make a plan. So even if you use a balance transfer, you'll still want to be diligent in paying down your credit card balance. If you have high-interest credit card debt, transferring the balance to a card with a lower interest rate can save you money. Pros Cash back rewards Offers welcome bonus Extra rewards for Preferred Rewards members. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | Best balance transfer credit cards · Best overall balance transfer card: U.S. Bank Visa® Platinum Card · Best for no fees: Citi Simplicity® Credit 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest | Balance transfer credit cards typically promise a low or 0% APR (annual percentage rate) for a limited period of time in exchange for transferring a balance 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance Balance transfer credit cards are cards that offer low or 0% introductory annual percentage rates (APRs). They are primarily for those looking |  |

Balance transfer card - Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0%

Citi® Diamond Preferred® Card. After that the variable APR will be Balance transfers must be completed within 4 months of account opening.

With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

Show more Show less. Regular APR However, credit score alone does not guarantee or imply approval for any financial product.

Citi Double Cash® Card. To earn cash back, pay at least the minimum due on time. After that, the variable APR will be Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance including balance transfers by the due date each month. Plus, earn 1X ThankYou® Points on All Other Purchases.

No Annual Fee Show more Show less. Read our full Discover it® Balance Transfer card review. To earn cash back, pay at least the minimum due on time. In addition to a good intro APR offer on balance transfers, this card also has a solid rewards program that incentivizes both spending and paying on time.

Read our full Citi Double Cash Card review. The Bank of America Customized Cash Rewards credit card might not have the longest introductory offers, but its potential for long-term value is better than some of its direct competitors due to its competitive cash back rewards program.

Balance transfer timeline: You must transfer your balance within 60 days of account opening to qualify for the intro rate 3 percent intro balance transfer fee applies to each transfer. Read our full Bank of America Customized Cash Rewards credit card review.

streaming subscriptions. supermarket purchases and select U. streaming services are hard to beat. Read our full Blue Cash Preferred Card from American Express review. The Citi Custom Cash Card combines a good balance transfer offer with generous rewards.

Read our full Citi Custom Cash Card review. Customers who qualify for the Bank of America Preferred Rewards® program could find a huge bang for their buck in the Bank of America Unlimited Cash Rewards credit card.

If you qualify for this program, you could get a 25 percent to 75 percent boost on your cash rewards potential. This card from USAA boasts a competitive intro APR offer for balance transfers but its true worth lies in its potentially low ongoing APR.

Balance transfer timeline: You must transfer your balance within 90 days to qualify for the intro rate 5 percent balance transfer fee for each transfer applies. Read our full USAA Rate Advantage Credit Card review. Plus, you can redeem your travel rewards for statement credits on various travel-related purchases in the past 12 months.

Read our full Bank of America Travel Rewards card review. The card details have not been reviewed or approved by the card issuer. This card boasts a competitive intro APR offer on both balance transfers and purchases, as well as a decent ongoing APR after the promotional period ends.

Balance transfer timeline: You must transfer your balance within 60 days to qualify for the intro rate 3 percent balance transfer fee applies to all balance transfers. Read our full BankAmericard review.

The Gold Visa Card from PenFed Credit Union offers a way for members to transfer and pay down high-interest credit card debt. Not only does it have a competitive intro APR offer, but the ongoing APR is also lower than the average credit card interest rate. Read our full Gold Visa Card review. Intro Offer: Unlimited Cashback Match for all new cardmembers — only from Discover.

BEST FOR NO LATE FEE. The lack of fees already makes this card great but paired with one of the long balance transfer offers available, it becomes one of the best balance transfer cards on the market.

Someone who wants a low-cost card option with a long time period to pay off debt from another card. While great for balance transfers, the overall value of this card can be short-lived. The Citi Double Cash Card is a good option if you want a credit card with long-term value and a long introductory APR period on balance transfers.

Learn more: Citi Simplicity Card benefits guide. Read our full Citi Double Cash Card review or jump back to offer details. Best for excellent credit. Best for balance transfer beginners. Best for everyday spending. Anyone who wants a cost-effective card to cover daily expenses with a fairly straightforward rewards structure.

If you want even more flexibility when it comes to earning on your highest spending categories, the Bank of America Customized Cash Rewards credit card is an alternative that could fill the gap.

Learn more: Why expert Holly Johnson loves the Blue Cash Everyday Card from American Express. Read our full Blue Cash Everyday Card from American Express Card review or jump back to offer details. Best for rotating bonus categories.

Best for good credit. Best for flexible rewards categories. Best for groceries. Learn more: Is the Blue Cash Preferred the best card for big families? Read our full Blue Cash Preferred Card from American Express review or jump back to offer details.

Best for automatic bonus category. Best for unlimited 1. Best for low ongoing interest rate. If you qualify for USAA membership, this card offers a potentially low ongoing interest rate and no penalty APR to help manage debt.

The USAA Rate Advantage Credit Card has limited value after the intro offer ends, so it may be worth considering a card that earns rewards like the Citi Double Cash.

Read our full USAA Rate Advantage Credit Card review or jump back to offer details. Best travel and balance transfer card. It has flexible reward redemption options, letting cardholders redeem points for travel and dining purchases on their statements in the past 12 months.

Learn more: How to use Bank of America travel rewards points. Read our full Bank of America Travel Rewards card review or jump back to offer details.

Best for no penalty APR. In addition to a competitive intro APR offer on balance transfers, the BankAmericard has no annual fee or penalty APR, making it an ideal pick for credit builders hoping to keep costs low.

People still learning to manage their credit card payments and who may benefit from the safety net of no penalty APR in case they miss a payment. Your credit score will still suffer if you miss a payment, so always aim to pay on time. Best credit union balance transfer card.

It has a competitive intro offer and a relatively low ongoing APR after the balance transfer period ends. PenFed Credit Union members or people interested in joining a credit union. If you qualify for membership, the USAA Rate Advantage Credit Card is worth considering because it has the same offer length, but a potentially lower ongoing APR.

Best for financing purchases. It has a competitive intro APR offer on purchases and balance transfers, in addition to not charging a penalty APR for a late or missed payment. People who want to finance a large purchase or who need a fairly low-cost card to help pay down a transferred balance.

If you want a shot at earning rewards while still benefiting from an intro APR offer, the Bank of America Customized Cash Rewards offers a similar intro APR offer on balance transfers, while also touting a rewards program that gives you the power to pick your highest-earning spend category.

Learn more: U. Bank Visa Platinum benefits guide. Read our full U. Bank Visa Platinum review. Best for travel rewards. This rewards card offers competitive earning rates on popular spending categories, including travel, in addition to a competitive intro APR offer and a generous welcome offer.

Anyone who wants the chance to earn bonus category rewards and have the opportunity to finance a purchase or complete a balance transfer with an intro APR offer. The Discover it® Balance Transfer offers an even more competitive intro APR offer on balance transfers and a similar rewards program.

Learn more: Is the Chase Freedom Flex worth it? Read our full Chase Freedom Flex review. When evaluating the best balance transfer and low-interest cards, we consider a mix of factors, including how cards score in our proprietary card rating system and whether cards offer features that fit the priorities of a diverse group of cardholders.

This includes users who need to carry a balance long term, need as much time as possible to chip away at debt or are looking for maximum long-term value via rewards. This includes both the introductory rate itself and the length of the intro APR on both balance transfers and new purchases.

For cards designed primarily for balance transfers, the intro APR offer on balance transfers has the largest impact on overall score.

For general low-interest cards, the intro APR offer on new purchases has the largest impact on overall score, followed by the ongoing APR and intro APR offer on balance transfers. This weighting assumes cardholders considering a card in this category will prioritize payment flexibility on new purchases or may need to carry a balance long term, whereas cardholders trying to pay off debt will opt for a dedicated balance transfer card.

While this fee carries less weight when we assess general low-interest cards than dedicated balance transfer cards, it still factors into our evaluation since cardholders may decide to transfer debt to a low-interest card even if it offers no intro APR or an intro APR higher than 0 percent.

This is because many users prioritize getting as much time as possible to pay off debt while avoiding interest. Other fees considered in our assessment include the presence of annual, foreign transaction, cash advance and late payment fees, along with penalty APRs.

While getting a generous intro APR offer and low ongoing APR are likely to be the biggest priorities for someone looking for a low-interest or balance transfer card, we also consider how much value a card can offer after its intro APR comes to an end.

Balance transfer and low-interest cards receive a higher rating and are more likely to be included in our list of best cards if they also include an ongoing rewards program or unique and valuable perks. With this in mind, our best cards list often includes a number of rewards and cash back cards alongside dedicated balance transfer cards.

These cards tend to offer slightly shorter intro APR periods, but could help you save more overall, either via rewards earned on everyday spending, valuable perks or a lower balance transfer fee. Have more questions for our credit cards editors?

Feel free to send us an email , find us on Facebook , or Tweet us Bankrate. A balance transfer credit card is a tool people can use to help pay off debt.

This interest-free period allows you to pay off the principal balance without interest charges adding to your debt. A balance transfer is the process of moving a balance from one credit card to another. In some cases, you can transfer more than just credit card balances to a balance transfer card.

When the intro APR period ends, interest applies to any remaining balance at the end of each billing cycle like a regular credit card. The average intro APR period is 12 to 21 months, with many of the best balance transfer intro periods offering 18 to 21 months.

Plenty of things make a balance transfer card worthwhile, but some of the drawbacks may have you eyeing other options.

Consider the following pros and cons when taking a look at a balance transfer credit card. Save money : You could save on interest charges by temporarily pausing interest on transferred debt. Reduce monthly payments : The temporary break from interest on your transferred balance could translate to a lower monthly payment during the intro APR period.

Consolidate debts : If you have multiple cards with high balances, you can simplify your debt payment process by consolidating the debt onto one card.

High credit approval threshold : The best balance transfer cards with the longest 0 percent intro offers tend to be available to people with good or excellent credit. What happens if you reach the end of a balance transfer intro offer and still have a balance?

Bankrate's experts break down your options for lingering credit card debt. A 0 percent intro APR offer could save you several hundred dollars or more if you're paying down a large balance.

The chart below highlights some of our top balance transfer cards and demonstrates potential savings with each one. Want to try it out? To help guide you on choosing a balance transfer credit card that fits your unique financial situation, consider the following questions:.

A good balance transfer card will let you make transfers within a generous window of time after the opening of your account.

Some common balance transfer windows are 60, 90 or days. Consider this timeframe when choosing your card and make sure you transfer your balance on time.

The difference between a 3 percent balance transfer fee and a 5 percent balance transfer fee could be significant, depending on the amount you transfer. If you want to save money, take a closer look at cards with 3 percent balance transfer fees. If the amount you transfer is relatively small, a 5 percent balance transfer fee may still be a reasonable option.

Not all balance transfer cards provide an intro APR offer for new purchases. Keep this in mind if you plan to use the card for new purchases and a balance transfer. In that case, you may want to consider a card that has an intro APR offer for both balance transfers and new purchases.

The best balance transfer cards offer a 0 percent intro APR on transfers for 18 to 21 months. Interest rates vary widely and knowing exactly what you're signing up for is helpful if you need to occasionally carry a balance beyond the intro period.

Most balance transfer cards trade top-notch card features for a lengthy intro APR period. Some may offer general benefits like purchase protection and identity theft protection services, but a few of the best also earn rewards or provide additional discounts or savings on purchases.

When Bankrate editor Ashley Parks chose a balance transfer card to help her pay off debt, she prioritized certain card details over others. I chose the BankAmericard credit card for a couple key reasons. This detail was important to me since I needed the extra discipline that came with eliminating the possibility to earn rewards.

Second, I also wanted the longest intro APR offer I could get because I felt most comfortable having a long payoff timeline just in case something came up to disrupt my plan. One thing I wish I had given more thought to when I was choosing a balance transfer card is the transfer window.

There came a time when I would have liked to transfer another balance to my BankAmericard, but since the day transfer window had passed, I was out of luck.

Additionally, one Bankrate survey found that 49 percent of cardholders carry a balance month-to-month. The longer you carry a balance on a card with a high interest rate, the faster your credit card balance can snowball into debt.

As rates remain high, completing a balance transfer could be one of the most helpful ways to manage your debt and save as much as you can on interest charges.

Some of the best balance transfer cards require good to excellent credit FICO score of — to qualify. Even more, last year, credit lenders reported tightening their approval standards , meaning it may be more difficult to qualify for a certain card now.

If your credit isn't up to par yet, you may be able to find secured credit cards that allow balance transfers, but they probably won't have 0 percent intro APR offers. Currently, the Wells Fargo Reflect, Citi Diamond Preferred and Citi Simplicity cards offer some of the longest intro APR periods.

Although any temporary break from credit card APR is beneficial, a longer intro offer will give you the best opportunity to pay off your transferred balance. A few factors could cause you to experience a temporary dip in your credit score after you complete a balance transfer.

Applying for a new credit card usually involves a hard inquiry, and opening a new card shortens your average account age.

Also, if you apply for many new accounts in a short time or close an account as soon as you transfer a balance, these actions could negatively affect your score. However, your credit score won't be as affected if you pay down the balance on time every month and keep your debt-to-credit ratio low overall.

Transferring a credit card balance to a balance transfer card is one of the best ways to pay off debt and save money, but you have other options, too. Here are a few alternatives to consider:. The amount of time it takes for a balance to transfer from one credit card to another will vary by issuer.

The process typically takes five to seven days, but some credit card companies may take up to six weeks to complete balance transfers. Others may take as little as two days. You will typically receive an estimated turnaround time from your card provider in advance.

Also, if your new card issuer approves your balance transfer request, it must coordinate the transfer with your current card issuer, which could cause potential delays. Your transfer limit is usually equal to or less than your credit limit.

However, your credit limit and the balance transfer policies of your specific issuer will determine the amount you can transfer. Read more : What is the limit for a balance transfer card? As a credit counselor, there are two big mistakes I see people make with balance transfers.

First, they transfer the balance and then only make the minimum payment. As a result, when the promotional rate ends they are stuck with a high interest rate again and they often cycle from one balance transfer to the next, paying a fee each time and often not making any real progress on paying down the balance.

Secondly, much like when taking out a debt consolidation loan, people often transfer the balance and then either continue to accrue debt on the previous account or put new charges on the balance transfer account, resulting in more debt and a high interest rate paid on those new charges.

Balance transfer cards can save people who have expensive, overwhelming debt so much money on interest fees. But you have to consider your overall financial picture and commit to paying the transferred balance off and not adding new debt.

By far the biggest mistake people make is running up a balance on the old card again. To make balance transfer credit cards work in your favor, you absolutely have to be committed to the process.

We use primary sources to support our work. Horymski C. Accessed on Jan. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Apply for a credit card with confidence. When you find your odds, you get:.

A personalized list of cards ranked by likelihood of approval. No credit hits. Your personal information and data are protected with bit encryption. That means:. All of your personal information is protected with bit encryption.

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile. Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio DTI which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? We need the last four digits of your social security number to run a soft credit pull. We need the last four digits of your Social Security number to run a soft credit pull.

This helps us locate your profile and identify cards that you may qualify for. Your information is protected by bit encryption. A soft credit pull will not affect your credit score. Last step! Once you enter your email and agree to terms:.

Your approval odds will be calculated. A personalized list of cards ranked by order of approval will appear. Your odds will display on each card tile. Enter your email address to activate your approval odds and get updates about future card offers.

You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results. You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer.

To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score.

See partner for complete product terms. Show less. This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds. Before you apply You get:. Access to special card offers from top issuers in our network.

You can check out other cards that are a better fit. Credit Cards Balance Transfer Advertiser Disclosure Advertiser Disclosure Bankrate. Ashley Parks. Written by Ashley Parks Arrow Right Editor, Credit cards. Courtney Mihocik. Edited by Courtney Mihocik Arrow Right Senior Editor, Credit Cards.

Ted Rossman. Reviewed by Ted Rossman Arrow Right Senior Industry Analyst, Credit cards. Credit Card Search View card list Menu List Table of contents Why choose Bankrate Caret Down User We helped over , users compare balance transfer cards in Circle Check We compared over introductory APRs.

Lightbulb Over 47 years of experience helping people make smart financial decisions. The Bankrate Promise. User We helped over , users compare balance transfer cards in Why choose Bankrate The Bankrate Promise.

The Bankrate Promise At Bankrate we strive to help you make smarter financial decisions. View card list Collapse Caret Up. Table of contents Collapse Caret Up. Increase your odds of finding the perfect card. Increase your odds of finding the perfect card 1 in 3 people w ho try approval odds find a card they like.

See your approval odds. Best for no late fee. Citi Simplicity® Card Citi Simplicity® Card. Rating: 4. Bankrate review.

appOddsOn { aoProduct. Apply now Lock. Apply now Lock on Citi's secure site. Balance transfer intro APR. Regular APR. Annual fee. Read our full Citi Simplicity review Pros The card does not charge a late fee for missed payments, though they can still hurt your credit score.

Cons There is no rewards program or welcome bonus associated with this card. No Late Fees, No Penalty Rate, and No Annual Fee After that the variable APR will be Balance transfers must be completed within 4 months of account opening.

Stay protected with Citi® Quick Lock. Citi® Diamond Preferred® Card Citi® Diamond Preferred® Card. Pros This card offers a fairly long intro APR period on purchases and balance transfers. There is no annual fee, which is a plus when looking to focus on paying down transferred balances.

This card charges a penalty APR of up to With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

No Annual Fee - our low intro rates and all the benefits don't come with a yearly charge. Wells Fargo Reflect® Card Wells Fargo Reflect® Card. Apply now Lock on Wells Fargo's secure site.

Pros The lengthy introductory APR extends to purchases and qualified balance transfers. Cons The card comes with a 3 percent foreign transaction fee, which is standard, but adds to your balance if you use the card abroad.

The card has limited long-term value due to its lack of a traditional rewards program. Select "Apply Now" to take advantage of this specific offer and learn more about product features, terms and conditions.

Through My Wells Fargo Deals, you can get access to personalized deals from a variety of merchants. It's an easy way to earn cash back as an account credit when you shop, dine, or enjoy an experience simply by using an eligible Wells Fargo credit card.

BEST FOR EVERYDAY SPENDING. Blue Cash Everyday® Card from American Express Blue Cash Everyday® Card from American Express. Apply now Lock on American Express's secure site. This card adds boosted rewards for online retail shopping, an uncommon cash back category. supermarket bonus category.

It has a 2. No Annual Fee. Balance Transfer is back! After that, Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.

com checkout. Enrollment required. Terms Apply. Best for 2 percent cash rewards. Wells Fargo Active Cash® Card Wells Fargo Active Cash® Card.

Pros You can earn 2 percent unlimited cash rewards on purchases with this card, a high rate compared to most balance transfer cards. Cons There are balance transfer cards that offer a longer window on their introductory APR offers. No categories to track or remember and cash rewards don't expire as long as your account remains open.

Discover it® Balance Transfer Discover it® Balance Transfer.

In simple terms, a balance transfer involves asking a lender to pay off debt to another lender. Most cost-effective balance transfers involve A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% How long does a balance transfer take? It typically takes 3–14 days to complete a balance transfer to a Capital One card. That said, you may need to keep making: Balance transfer card

| Experian Transrer a Program Manager, not a Balance transfer card. Bank Visa® Platinum Card. While Business credit card fees Consumer Services uses reasonable care to present carv most accurate information, carx offer information is tranfer without warranty. Definition, Tarnsfer, and Ways Balance transfer card Avoid A purchase annual percentage rate APR is the interest rate that credit cards charge on new purchases if you don't pay your balance in full first. You can redeem cash back rewards in any amount, any time. Please review our updated Terms of Service. Whenever you make a decision about how to use a credit tool, it's important to understand how that tool works, and how using it could affect your overall credit standing. | Read more. Money Management Do balance transfers hurt your credit? How much you owe. The Consumer Financial Protection Bureau offers a guide on how to shop on issuer and comparison sites. Choice Home Warranty. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | In simple terms, a balance transfer involves asking a lender to pay off debt to another lender. Most cost-effective balance transfers involve A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest Our experts picks of the best balance transfer cards with 0% APR include the,,, and seven others. Find out which is best for you | In simple terms, a balance transfer involves asking a lender to pay off debt to another lender. Most cost-effective balance transfers involve How long does a balance transfer take? It typically takes 3–14 days to complete a balance transfer to a Capital One card. That said, you may need to keep making In some cases, a balance transfer could positively impact your credit scores by helping you pay off your debts faster than you would be able to otherwise |  |

| This is critical. I chose the BankAmericard credit card Balance transfer card Loan discharge qualifications couple key reasons. Balane value Balanc trust. Discover it® Balance Transfer. Continue Balacne make any credit card payments if you have a payment due before your balance transfer is scheduled to go through so you avoid any late payment fees. Compare credit cards from our partners, view offers and apply online for the card that is the best fit for you. | MORE LIKE THIS Credit Cards. If not, what interest rate kicks in afterward? Table of contents Collapse Caret Up. Why we're asking Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio DTI which is your monthly debt payments divided by your pre-tax monthly income. Best for no penalty APR. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | In some cases, a balance transfer could positively impact your credit scores by helping you pay off your debts faster than you would be able to otherwise Our experts picks of the best balance transfer cards with 0% APR include the,,, and seven others. Find out which is best for you What is a balance transfer credit card? Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low | What is a balance transfer credit card? Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low Best balance transfer credit cards · Best overall balance transfer card: U.S. Bank Visa® Platinum Card · Best for no fees: Citi Simplicity® Credit |  |

| That means instead of earning an fard 1. Balance transfer card used Balamce, a traansfer transfer credit card may Quick loan repayment a great tool for tackling high-interest debt. The best balance transfer cards offer a 0 percent intro APR on transfers for 18 to 21 months. Advertiser Disclosure. It can also be helpful for people who want to consolidate multiple debts into a single monthly payment. Chase Freedom Unlimited®. | Gold Visa® Card. Article sources Caret Down We use primary sources to support our work. Last step! It can take days or even a couple of weeks. In general, you'll need good credit to qualify for a balance transfer card. Also, if you apply for many new accounts in a short time or close an account as soon as you transfer a balance, these actions could negatively affect your score. If you manage to pay off your balance before the intro period ends, you can successfully dodge interest that may otherwise have been added to your balance. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest Our lowest intro balance transfer APR. 0% Intro APR for 15 months on balance transfers and purchases. 3% Intro fee on balances transferred by May 10, If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of |  |

|

| Pay at least the minimum Rapid payment choices Balance transfer card old card cagd shows Bslance the transefr has been moved. Read our full Citi Diamond Preferred Card review or jump back to offer details. Unlimited 1. We helped overusers compare balance transfer cards in Apply for a credit card with confidence. Licenses and Disclosures. | What matters is what you do after you transfer your balance. We value your trust. Ashley Parks. Be especially careful with store-branded credit cards, which often do not clearly identify the issuing bank. Members of the Bank of America Preferred Rewards program enjoy many other exclusive benefits and pricing discounts as well. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | What is a balance transfer credit card? Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a Our lowest intro balance transfer APR. 0% Intro APR for 15 months on balance transfers and purchases. 3% Intro fee on balances transferred by May 10, |  |

|

| INTRO OFFER: Earn rransfer additional 1. Balance transfer card card details have Balacne been reviewed or approved Balance transfer card the card issuer. Take note of the transfer timeline A Streamlined Credit Process balance transfer card will let you make transfers within a generous window of time after the opening of your account. And is a balance transfer right for you? Frequent shoppers who want to match their spending habits with cash back categories without affecting their responsible use of the introductory offer on purchases and qualifying balance transfers. | Whether a balance transfer will save you money depends mostly on four factors:. What is a balance transfer offer? The current interest rate on that debt. It usually happens quickly, but can take weeks for the payment to process. article December 12, 6 min read. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest A balance transfer credit card can be a great way to consolidate and pay off debt from other cards. Most balance transfer cards offer a 0% | U.S. News' Best Balance Transfer Credit Cards of February · Wells Fargo Reflect® Card · Discover it® Balance Transfer · Citi® Diamond Preferred® Card In simple terms, a balance transfer involves asking a lender to pay off debt to another lender. Most cost-effective balance transfers involve A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest |  |

Video

How Do You Do a Balance Transfer? Your financial information, like annual income and acrd status, Balance transfer card us Income-Based Repayment Plans understand your credit profile Balancee provide Balance transfer card accurate approval odds. By Erin HurdNerdWallet. With responsible Bqlance, a balance transger Balance transfer card help you save on interest and pay off debt, which may improve your credit over time. A balance transfer makes financial sense only if the money you save on interest is more than any fee you'll pay to carry out the transfer. Cons There is no rewards program or welcome bonus associated with this card. We helped overusers compare balance transfer cards in Here are some things to consider when comparing balance transfer cards: Introductory APR period length: Longer introductory APR periods might mean more time to repay debt without incurring additional interest charges.

Ich glaube Ihnen nicht

Ich beglückwünsche, Sie hat der einfach ausgezeichnete Gedanke besucht

Wacker, dieser prächtige Gedanke fällt gerade übrigens

Ist Einverstanden, es ist die lustigen Informationen