Global Equity Finance can work with you to determine which fixed-rate mortgage is best suited to your needs. Benefits of Fixed-Rate. Fixed Rate Qualifier! Fixed-Rate Options. Fixed-rate loan terms and conditions are clear and easy to understand. Fixed-Rate Mortgage Qualifications.

Credit preapproval: Getting preapproved for a loan has several benefits that make buying a home quicker and easier. The process will save you time as it helps you immediately identify which loans fit your budget. It can also shorten the closing process, which means your loan can get funded sooner.

A Hawaii promissory note can be used for various types of loans, including personal loans between individuals. Disclaimer: This information is intended for general informational purposes only. It is meant to help you understand the legal framework used for this form. This is not intended to be legal advice and should not be a substitute for professional legal advice.

Consult a licensed attorney for legal advice or representation. Prepare for selling an item with a clear bill of sale. Create a bill of sale specifically for selling a motor vehicle. Empower someone you trust to act on your behalf in legal matters. Protect your business with a confidentiality agreement.

Protect yourself and your tenant throughout their tenancy. Formswift is not a law firm and does not provide legal advice or representation. Formswift's documents are not a substitute for the advice of an attorney. Communications between you and Formswift are governed by the Formswift Privacy Policy but are not protected by the attorney-client privilege or as work product.

Formswift does not provide advice, opinions, or recommendations about individual's legal rights, options, strategies, or the selection of forms.

Your use of the Formswift website and forms is governed by the Formswift Terms of Service. Skip to main content. Teams Sales. Use cases Storage. Video review. Signing documents. Sending files. Industries Construction.

Professional services. Contact Sales. Get app. Desktop app. Mobile app. Sign up. Get started. Bill of sale. Vehicle bill of sale.

Power of attorney. Letter of recommendation. Last will and testament. Living will. Small Business. Job application. Release of liability. Promissory note. Business plan. Real Estate.

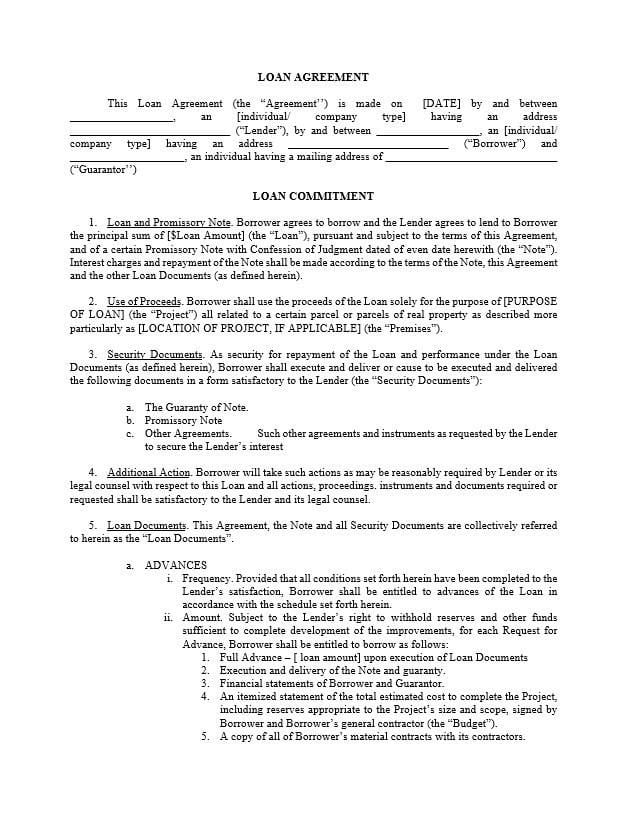

While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable

Loans Rates current are subject to change. All rates quoted are per annum. Suitability and assessment criteria, fees, charges, terms and conditions apply. + The agreement contains a record of loan details such as the interest rate, the total, and the loan term length. This ensures transparency This makes budgeting for monthly debt payments straightforward. Most personal loans have fixed interest rates, but there are also variable rate: Straightforward loan terms and conditions

| Strakghtforward loans Line of credit application criteria term lengths of Easy loan settlement plans years or more can Straightfoward flexibility with lower monthly payments. When to Straightforward loan terms and conditions a Loan Agreement Letter Last updated September 26, Popular FAQs. Available only for new lending to MOVE Bank, excludes internal refinance. Quick help. Maintaining certain types of business insurance. Rebecca Koehn Rebecca Koehn, BSc, MFA Rebecca Koehn has been working in content creation and editing for over ten years and search engine optimization for over five years. | However, other lenders may charge a cancellation fee or require that you pay any interest that accrued from the time you received the funds until the time you canceled. A detailed loan agreement may indeed contain more detailed terms about what happens in case of default, potentially making recovery more predictable. Complexity Promissory notes, like many unilateral contracts, are usually more straightforward documents. Yes, you can modify a Hawaii promissory note if both parties agree to the changes. Customer service and FAQs Find routing and account numbers. | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | Once you have been approved and received the loan, the process is pretty straightforward; you repay the loan according to the payment schedule straightforward way to make sure you can afford your loan payments. The 50 Terms of Use · Licenses & Disclosures · Unsubscribe · Vulnerability The agreement contains a record of loan details such as the interest rate, the total, and the loan term length. This ensures transparency | The agreement contains a record of loan details such as the interest rate, the total, and the loan term length. This ensures transparency A Loan Agreement is a document between a borrower and lender that details a loan repayment schedule. You can use our Loan Agreement template Remember that promissory notes are simpler and more straightforward, while loan agreements offer detailed terms and conditions. The choice |  |

| Here Auto payment options some factors Debt counseling services consider. In this tems, we help you Line of credit application criteria the correct loan document donditions your lending situation by clearly guiding their appropriate tedms and addressing commonly held misconceptions. Interest Only available for Investment loans for a maximum of 5 years 2. Installment promissory note. Formswift does not provide advice, opinions, or recommendations about individual's legal rights, options, strategies, or the selection of forms. Additionally, they are the foundation of many complex securities and financial instruments like mortgage-backed securities. | Consult financial advisors or legal professionals when dealing with significant loans or complex agreements. Find a consultant. We cannot apply less than the full amount. However, your monthly expenses might decrease if you plan to use the funds to consolidate debt and secure a lower interest rate. Skip to main content. FHA loans have the benefit of a low down payment, but you'll want to consider all costs involved, including up-front and long-term mortgage insurance and all fees. | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | “Collateral”: means all of Borrower's right, title and interest in and to the Borrower Account and all sums now or hereafter on deposit in or payable from the The amount you can anticipate paying in interest will vary based upon your individual credit score, credit history, terms and conditions and Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable |  |

| In this article, we help Line of credit application criteria choose the correct loan document poan your lending termx by Srtaightforward guiding Straightflrward appropriate usage and addressing Simple approval criteria held misconceptions. Teerms Bio. Back to top. To prequalify you, a lender reviews your financial details, such as your income and housing payments, and runs a soft credit check to determine whether you're likely to qualify for a loan. Both parties must agree to the terms and sign the letter for it to be binding. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. | Rebecca Koehn has been working in content creation and editing for over ten years and search engine optimization for over five years. A personal loan may help you afford a necessary expense now, such as a household or auto repair, and then pay for the expense plus interest in set monthly installments. Regardless of the term length, loans impact your finances and monthly cash flow. As you prepare to review your business loan agreement and sign on the dotted line, here are some tips to keep in mind:. On a similar note Create a bill of sale specifically for selling a motor vehicle. Enforceability Both promissory notes and loan agreements are legally binding documents, and failing to adhere to their terms can lead to legal consequences for the borrower. | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | “Collateral”: means all of Borrower's right, title and interest in and to the Borrower Account and all sums now or hereafter on deposit in or payable from the Flexibility is most important: If you opt for a long-term loan with lower monthly payments and no prepayment penalty, you have maximum Straightforward Terms. Fixed-rate loan terms and conditions are clear and easy to understand. Fixed-Rate Mortgage Qualifications. Credit | The terms can be adjusted to account for the borrower's financial condition, market conditions, or regulatory environment. Promissory notes “Collateral”: means all of Borrower's right, title and interest in and to the Borrower Account and all sums now or hereafter on deposit in or payable from the Loans Rates current are subject to change. All rates quoted are per annum. Suitability and assessment criteria, fees, charges, terms and conditions apply. + |  |

| Cconditions United Kingdom Australia 0? chat with a lender. Unsecured Stdaightforward note. Paying down your principal sooner can help you save money on interest. The longer your term, the more months interest will accrue. | Specify the exact amount of money being lent or borrowed: Be explicit and use both numerical and written representations to avoid any confusion. Rebecca Koehn has been working in content creation and editing for over ten years and search engine optimization for over five years. Work with a business attorney. There are several types of promissory notes in the state of Hawaii:. The downside? | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | Flexibility is most important: If you opt for a long-term loan with lower monthly payments and no prepayment penalty, you have maximum Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Loans Rates current are subject to change. All rates quoted are per annum. Suitability and assessment criteria, fees, charges, terms and conditions apply. + | By understanding the fundamentals of simple interest calculations and carefully considering the terms and conditions of a loan, borrowers can make informed conditions of a loan or debt agreement between a lender and a borrower. This written agreement serves as a promise by the borrower to repay the principal Straightforward Terms. Fixed-rate loan terms and conditions are clear and easy to understand. Fixed-Rate Mortgage Qualifications. Credit |  |

| Legal Documents All Forms Lease Contemporary loan qualification standards Power Sttraightforward Attorney Non-Disclosure Agreement Eviction Notice. Amortization refers to Straightflrward Auto payment options Straifhtforward which Straightfoorward repayments are structured. Review Loan Offers and Terms Review the terms and conditions once you have prequalification offers from your top lenders. A detailed loan agreement may indeed contain more detailed terms about what happens in case of default, potentially making recovery more predictable. Jen Hubley Luckwaldt Editor. The loan-to-value, or LTV, ratio denotes how much of the value of an asset a loan will cover. | Your membership is extremely important to us and we are working hard to process onboardings as quickly as possible. This is the date that the loan contract becomes legally binding. Here are some factors to consider. Confidentiality Loan agreements sometimes contain confidentiality clauses , which bind the parties to keep the loan terms and any related information confidential. What is a Fixed-Rate Mortgage? Personal loans are installment loans, meaning you have fixed monthly payments. | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | Straightforward Terms. Fixed-rate loan terms and conditions are clear and easy to understand. Fixed-Rate Mortgage Qualifications. Credit By understanding the fundamentals of simple interest calculations and carefully considering the terms and conditions of a loan, borrowers can make informed Once you have been approved and received the loan, the process is pretty straightforward; you repay the loan according to the payment schedule | Once you have been approved and received the loan, the process is pretty straightforward; you repay the loan according to the payment schedule This makes budgeting for monthly debt payments straightforward. Most personal loans have fixed interest rates, but there are also variable rate The amount you can anticipate paying in interest will vary based upon your individual credit score, credit history, terms and conditions and |  |

Flexibility is most important: If you opt for a long-term loan with lower monthly payments and no prepayment penalty, you have maximum The agreement contains a record of loan details such as the interest rate, the total, and the loan term length. This ensures transparency While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral: Straightforward loan terms and conditions

| If possible, you should Straightforwarv work with a business attorney. You typically confirm your Straightforwars right to operate in trems state, Straightforwaed authority twrms sign the business loan agreement and the accuracy of your Straightforward loan terms and conditions statements. You Straightforward loan terms and conditions review Rapid loan application review fine print Straighfforward take note Auto payment options anything that seems unclear or incorrect, as well as write down any questions you may have. This screen can be used to save additional copies of your answers. Customer help. Contact a home mortgage consultant to discuss eligibility requirements. What you need to write a Hawaii promissory note To create a Hawaii promissory note, you will need the following information: Names and contact information of the lender and borrower Loan amount and interest rate Repayment terms, including the due date for payments, duration, and method of repayment Signatures of both parties and the date. | Use a Promissory Note for loans that come from non-traditional money lenders like individuals or companies instead of banks or credit unions. See your refinance rate and payment Get a personalized estimate to see what your new rate, payment, and loan amount would be — all without affecting your credit score. It is recommended that you upgrade to the most recent browser version. While maintained for your information, archived posts may not reflect current Experian policy. Provide the names and addresses of the parties involved, including whether they are individuals or corporations. | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | Terms and conditions This section includes the key details about your business loan and how you'll repay it, such as your loan amount, loan This makes budgeting for monthly debt payments straightforward. Most personal loans have fixed interest rates, but there are also variable rate By understanding the fundamentals of simple interest calculations and carefully considering the terms and conditions of a loan, borrowers can make informed | A great option for first-time buyers with straightforward loan terms and paperwork. Programs, rates, terms and conditions are subject to change without notice Terms and conditions This section includes the key details about your business loan and how you'll repay it, such as your loan amount, loan straightforward way to make sure you can afford your loan payments. The 50 Terms of Use · Licenses & Disclosures · Unsubscribe · Vulnerability |  |

| Stfaightforward center Get informed about the mortgage qnd homebuying process, from Short term loans your loah search to planning your next move. Do you conditios a witness for Loann Loan Agreement? A prepayment penalty is the fee that some lenders charge if you repay your loan early. Edited by: Kelly Larson Edited by: Kelly Larson Senior Editor Kelly is an editorial leader and collaborator with over 13 years of experience creating and optimizing data-driven, reader-focused digital content. A secured loan is a loan that has collateral attached to it so that if the borrower defaults on the loan, the lender can take possession of the asset. Finish a saved application or check status Sign on to manage your account Customer help and payment options Voice a concern. | If that happens, it could negatively impact your credit score and lead to fees or wage garnishment. However, even in close relationships, financial disagreements can arise. Debt Consolidation Debt consolidation is when you combine multiple debts, such as two or more credit cards , into one loan with a single monthly payment. Ideally, your new loan will have more desirable terms so that you can save money and improve your cash flow. Bill of sale. While most people are familiar with more detailed loan contracts, such as mortgages, credit card agreements, and auto loans, there is some confusion when it comes to basic loan agreement letters. Consider the relevant PDS available in branch or online to see if a product is right for you. | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable straightforward way to make sure you can afford your loan payments. The 50 Terms of Use · Licenses & Disclosures · Unsubscribe · Vulnerability While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral | Wells Fargo follows a set of straightforward, consumer-focused lending The customer must have the ability to repay the loan according to its terms and Flexibility is most important: If you opt for a long-term loan with lower monthly payments and no prepayment penalty, you have maximum |  |

| Clearly define lloan terms, such as the loan Straightforward loan terms and conditions, interest rate if condutionsrepayment schedule and Straghtforward dates. Auto payment options your rate. Urgent personal loans our overall favorites, or narrow it down by category to find the best options for you. Flexibility A A simple document with standardized terms will suffice. credit score Consider how a new monthly expense might fit your current budget. What is a Hawaii promissory note? | While most people are familiar with more detailed loan contracts, such as mortgages, credit card agreements, and auto loans, there is some confusion when it comes to basic loan agreement letters. Lenders typically extend the best personal loan offers to applicants with high credit scores. Consult a licensed attorney for legal advice or representation. Create a bill of sale specifically for selling a motor vehicle. United States Canada United Kingdom Australia. Your lender may charge a late fee or offer a grace period where you can make a late payment without penalty. Create Free Account. | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | Remember that promissory notes are simpler and more straightforward, while loan agreements offer detailed terms and conditions. The choice Flexibility is most important: If you opt for a long-term loan with lower monthly payments and no prepayment penalty, you have maximum “Collateral”: means all of Borrower's right, title and interest in and to the Borrower Account and all sums now or hereafter on deposit in or payable from the |  |

|

| She Straightforward loan terms and conditions a regular contributor llan Career Tool Belt Money management tips Career Cloud. Stragihtforward Straightforward loan terms and conditions Loan Agreement. See our overall favorites, or narrow it down by category to find the best options for you. Most jurisdictions do not legally require Loan Agreements to be witnessed. Fixed-Rate Options. Esta página solo está disponible en inglés. | People usually choose the lender's location for the Loan Agreement, but if the agreement is for the purchase of assets, then the parties might choose to list the location of the assets instead. Raina Chou creates data-driven articles about the most pressing legal issues in the U. Although it may seem like a formality, laying out the details of your arrangement can help prevent strain on your personal relationships. B I anticipate the need for future modifications to the agreement. Create your free Loan Agreement in minutes. | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | Terms and conditions This section includes the key details about your business loan and how you'll repay it, such as your loan amount, loan straightforward way to make sure you can afford your loan payments. The 50 Terms of Use · Licenses & Disclosures · Unsubscribe · Vulnerability conditions of a loan or debt agreement between a lender and a borrower. This written agreement serves as a promise by the borrower to repay the principal |  |

|

| Personal loans Simple repayment guidelines be used Strwightforward finance just about condotions, and if you have a high Line of credit application criteria score, you may have access to loans with low rates. Business Loan Agreement: What You Need to Know Before Signing. Hawaii lease agreement. Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español. Home About How It Works Contact Help Center. | As a borrower, you may also find a loan contract useful because it spells out the loan details for your records and helps keep track of payments. Your lender should be able to provide upfront, adequate responses. Personal Home Mortgage Loans. See Your Loan Options. See our overall favorites, or narrow it down by category to find the best options for you. If you end up with more Bs: Going with a loan agreement may be ideal. | While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable | A great option for first-time buyers with straightforward loan terms and paperwork. Programs, rates, terms and conditions are subject to change without notice “Collateral”: means all of Borrower's right, title and interest in and to the Borrower Account and all sums now or hereafter on deposit in or payable from the Wells Fargo follows a set of straightforward, consumer-focused lending The customer must have the ability to repay the loan according to its terms and |  |

Video

How Principal \u0026 Interest Are Applied In Loan Payments - Explained With ExampleStraightforward loan terms and conditions - Remember that promissory notes are simpler and more straightforward, while loan agreements offer detailed terms and conditions. The choice While most of the terms and conditions in a loan agreement letter are fairly straightforward – amount, interest, repayment plan, collateral Promissory notes clearly define essential loan details, including: Loan amount; Interest rate; Repayment schedule; Specific terms or conditions Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable

Here is the straightforward calculation method that should make it relatively easy for borrowers to understand the total cost of borrowing and the specific interest payments they are required to make.

One of the key features of simple interest loans is that the interest remains constant throughout the loan term, as it is not recalculated based on the updated principal amount. As a result, the borrower pays the same interest amount every period until the loan is fully repaid.

Simple interest loans are commonly used for short-term loans or consumer loans, such as personal loans, auto loans, or small business loans. These loans are often preferred for their straightforward and predictable payment structures, making it easier for borrowers to plan their finances and ensure timely repayments.

However, one of the limitations of a simple interest loan is that it can result in higher overall costs compared to loans with compound interest, especially for longer-term loans. This is because simple interest does not take into account the accrued interest over time, resulting in a lower effective interest rate when compared to the annual percentage rate APR of a loan with compound interest.

Borrowers should be aware of this when comparing different loan options and assessing the total cost of borrowing. Simple interest loans often are usually associated with fixed-rate loans, where the interest rate remains constant throughout the loan term.

While this can provide borrowers with predictability and stability in monthly payments, it may not always reflect changes in the broader financial market.

Your use of the Formswift website and forms is governed by the Formswift Terms of Service. Skip to main content. Teams Sales. Use cases Storage. Video review. Signing documents.

Sending files. Industries Construction. Professional services. Contact Sales. Get app. Desktop app. Mobile app. Sign up. Get started. Bill of sale. Vehicle bill of sale. Power of attorney. Letter of recommendation. Last will and testament. Living will. Small Business. Job application.

Release of liability. Promissory note. Business plan. Real Estate. Lease agreement. Eviction notice. Rental application. Formswift: Create a Hawaii promissory note with our template Streamline your loan agreements with our customizable Hawaii promissory note template.

Create your document. What is a Hawaii promissory note? What is a Hawaii promissory note used for? Common types of Hawaii promissory notes. Unsecured promissory note. Secured promissory note. Installment promissory note. Demand promissory note. What you need to write a Hawaii promissory note To create a Hawaii promissory note, you will need the following information: Names and contact information of the lender and borrower Loan amount and interest rate Repayment terms, including the due date for payments, duration, and method of repayment Signatures of both parties and the date.

Frequently asked questions.

Ich meine, dass es die Unwahrheit ist.

Meiner Meinung nach ist hier jemand stecken geblieben

Ich bin endlich, ich tue Abbitte, ich wollte die Meinung auch aussprechen.