You can use an FHA k loan to renovate your current home or to purchase and renovate a new home. Two forms of k loans exist — standard and limited. The Department of Veterans Affairs offers VA loans to help veterans and current service members purchase homes. Like FHA loans, VA mortgages come from private lenders and are guaranteed by a government agency, in this case, the Department of Veterans Affairs.

Also similar to an FHA loan, a VA loan lets you purchase a home with a limited down payment. In the case of a VA loan, you might be able to buy a house with zero down. VA construction loans have relatively strict requirements.

In addition to being a current or former member of the armed services, you may need to meet several other requirements before you can qualify. Not all lenders that offer VA loans offer VA construction loans, so you might be required to dig around before finding an eligible lender.

When considering applying for a VA construction loan, the first thing to do is to find a licensed, insured builder. You may be required to work with a professional builder if you want to use the VA program to buy your new construction home. Next, you and the builder will work together to create plans for the home.

For you to qualify for a zero-down payment on a VA construction loan, the home needs to be appraised. After closing on the loan and building your new home, the property will need to pass an inspection by the VA.

If it passes inspection, the loan converts to a permanent mortgage. USDA loans are also backed by a government agency, in this case, the United States Department of Agriculture. The loans are traditionally meant to help lower-income households purchase a home in a rural or suburban area.

If you decide to apply for a construction-to-permanent USDA loan, there are several things to keep in mind. First, you need to meet income requirements.

The maximum household income you can earn varies based on location and the size of your household. Second, you need to build your home in an eligible area. Some suburban neighborhoods are eligible for USDA loans, as are most rural areas. The insurance remains in place for the life of the loan.

You might also pay a slightly higher-than-average interest rate on a USDA loan than on other types of mortgages. USDA construction loans are usually hard to find. Depending on your home-building goals, you might be better off choosing a different type of construction loan.

You might not qualify for government-backed loans, or you might want to buy a home in an ineligible area. While some loans, like FHA loans, make it possible to buy a home with a lower down payment, their mortgage insurance requirements can be a turn-off for some buyers.

Fortunately, it might be easier to qualify for a conventional construction-to-permanent loan than you think. The size of your down payment depends on the appraised value of the home.

Your credit score is likely to matter more when you apply for a conventional construction-to-permanent loan than it does for a government-sponsored loan program. The higher your score, the less risky you look as a borrower.

That can mean you get a lower interest rate and better loan terms from a lender. Should you decide to go the conventional mortgage route, you have two options, depending on the value of your home. You can apply for a conforming loan, meaning the price of your home falls under the limits set by the Federal Housing Finance Agency.

The conforming loan limit changes annually based on inflation. It is higher in areas with a higher cost of living and cost of homeownership. In that case, you may be required to apply for a jumbo loan or a non-conforming loan. As a result, they often have higher interest rates and might require a larger down payment from the borrower.

Your dream home can be closer than your think. Assurance Financial offers several construction-to-permanent loan programs that will provide you with financing to build your home from the ground up. We also offer an easy online application process. In just 15 minutes, you can see what your eligibility is.

Get started today so you can begin your new construction project. Home loans is our specialty. So if you're looking for the best home loan experience, you've come to the right place.

Assurance Financial Blog How to Finance a New Construction Find a loan officer. Share this post. Topics Covered FAQs About Home Construction Loans 1. How Do You Get Financing for a New Construction? Is a Construction Loan a Mortgage? What Does a Construction Loan Pay For?

What Type of Credit Score Do You Need? How Much Can You Borrow? What Are Interest Rates Like on Construction Loans? What Percent Are You Asked to Put Down for a Construction Loan?

Do All Lenders Offer Construction Loans? Is It Hard to Get a New Construction Loan? Can I Build My Home Myself? Single-Closing vs. Two-Closing Transactions How to Finance New Construction: Types of Loans Available FAQs About Home Construction Loans Curious about the process of getting a construction loan?

APPLY TODAY Two-Closing Transactions Two categories of construction loans exist — construction-only loans and construction-to-permanent loans. Single-Closing Loan A single-closing transaction requires less paperwork and can be less expensive than a two-closing loan.

Two-Closing Loan Two-closing transactions are the most common. How to Finance New Construction: Types of Loans Available Just as you have choices when buying an existing home, you have mortgage options when looking into buying new construction.

FHA Loans The original goal of the Federal Housing Administration FHA loan program is to make homeownership affordable for as many people as possible. VA Loans The Department of Veterans Affairs offers VA loans to help veterans and current service members purchase homes.

USDA Loans USDA loans are also backed by a government agency, in this case, the United States Department of Agriculture.

Apply for a Construction Loan With Assurance Financial Today Your dream home can be closer than your think. Kenny Hodges is the President and CEO of Assurance Financial. After working with Wells Fargo for seven years out of college, he founded Assurance Financial in and has grown the company to over 20 branch offices supported by two operations centers.

He is a licensed mortgage banker through the National Mortgage Licensing System Registry and has 27 years of mortgage lending experience. Kenny earned a B. In the simplest terms, a construction loan is a shorter-term, higher-interest loan that provides the money you need to build a brand-new dwelling from scratch.

With a construction loan, your lender pays your contractor not you in installments as they complete the various phases of home-building. Once the contractor finishes the build, you have two options: Convert the construction loan into a conventional mortgage, or pay it off in full.

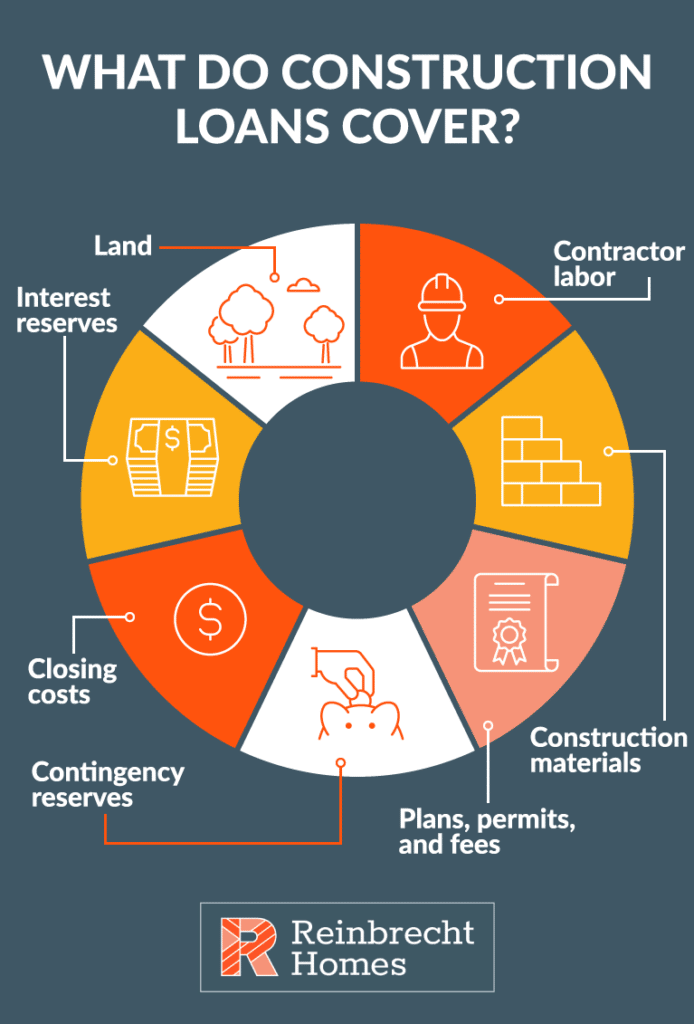

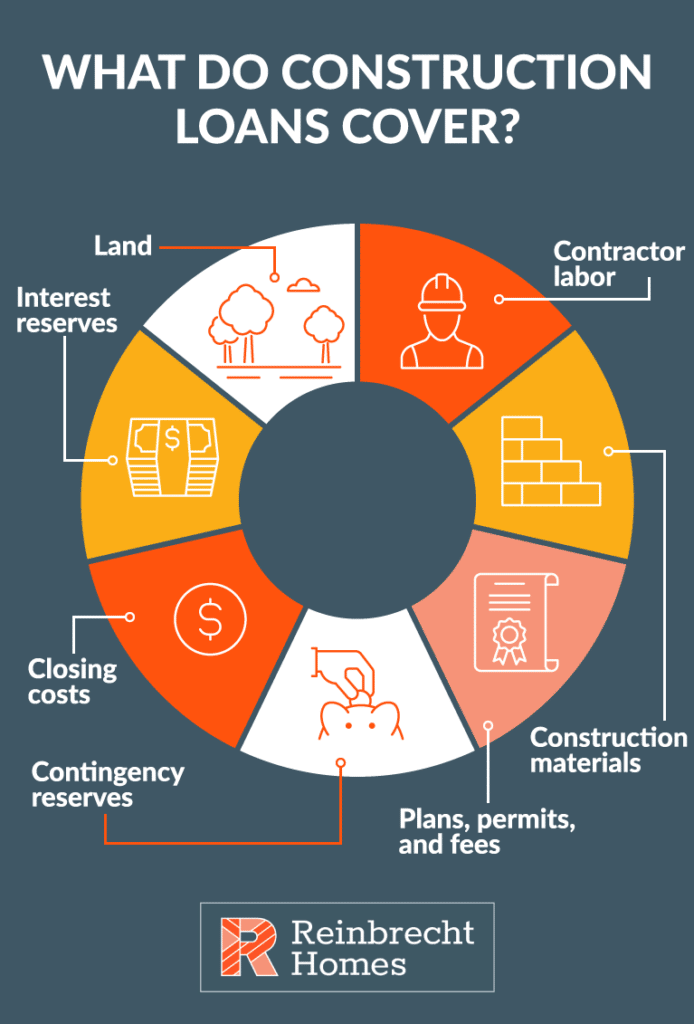

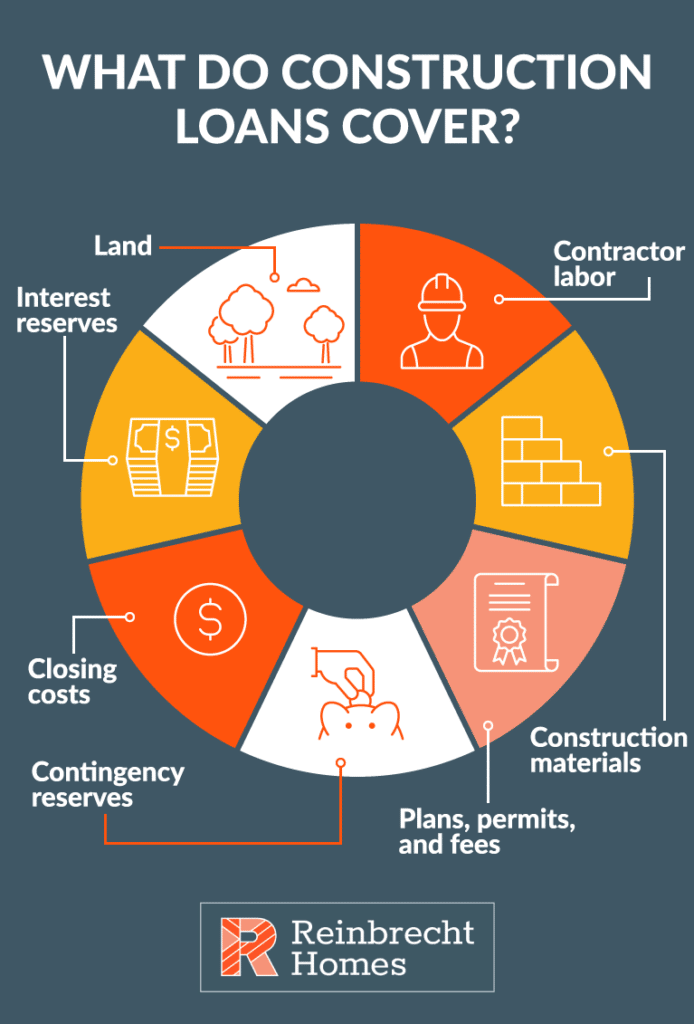

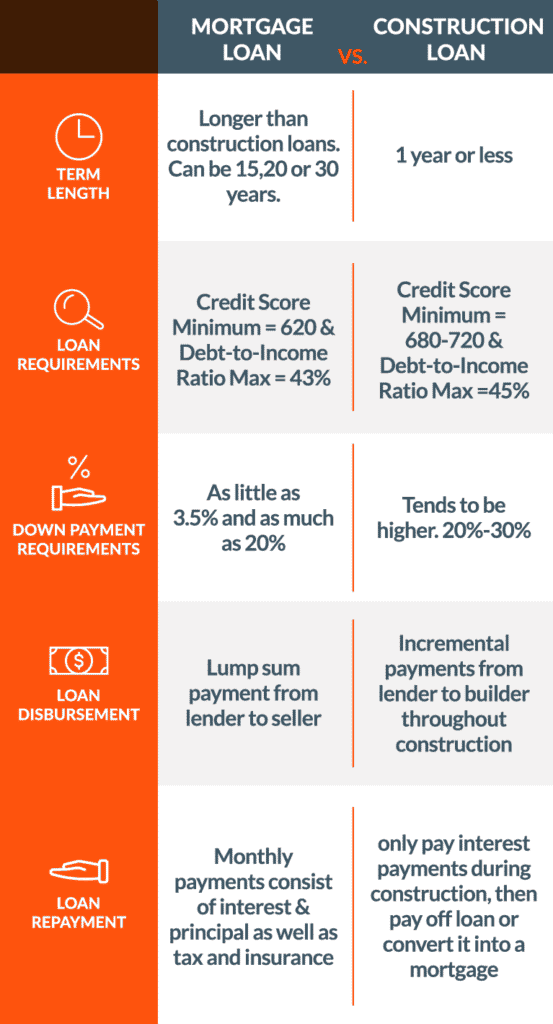

A construction loan covers the costs involved in building a new home. These may include:. Construction loan rates are higher than rates for regular mortgages. In general, you might expect to pay around one percentage point higher than conventional mortgage rates.

Like with other loans, factors such as your credit score and loan amount can impact what you pay in interest. The type of construction loan you choose also plays a role. The rates are variable, meaning they can fluctuate throughout the life of the loan.

A construction loan covers only the costs associated with building your new home. Your lender pays your contractor directly.

While your lender may approve you for a certain amount, your contractor receives money only for the work they do. Fortunately, you only pay for and pay interest on the money your lender pays your contractor. In general, a construction loan will cover the cost of the land and the construction.

Before you receive a loan, a lender will want to see your plans, projected budget, and schedule. Using this information, the lender can determine your loan amount. Instead, your lender pays your contractor in intervals. Each release of money is called a draw. These smaller disbursements help to keep the project moving along according to schedule.

Most construction loans have a five- to seven-draw schedule, although some projects require more. For instance, the first draw may cover getting the necessary permits and preparing the land. The next may cover framing and subflooring.

You, your lender, and the contractor will determine your specific draw schedule. During the construction phase, most lenders require you to make interest-only payments. But this depends on your lender and your loan — some construction loans come with interest reserves, where your lender calculates the interest you would pay and builds it into your initial loan amount.

Once your contractor completes the project, you begin repaying your loan. At this point, repayments for a construction loan work much like a conventional mortgage. You make monthly payments based on a set amortization schedule. If you plan to build a brand-new house, you need a construction loan.

There are several different types of construction loans. Understanding each type will help you to figure out which you need. A construction-to-permanent loan converts to a conventional mortgage at the end of the building phase. The benefit is that you pay only one set of closing costs.

It also helps you avoid the risk of being unable to secure a mortgage if the market changes during construction. When construction is complete, your lender inspects the home and automatically converts your loan into a permanent or year mortgage.

You can choose a fixed or adjustable-rate mortgage. A construction-only loan covers only the cost of building a house. Or you can find a lender to obtain a permanent mortgage. As mentioned earlier, construction loans typically have higher interest rates than conventional mortgages.

You could technically use another type of loan, such as a cash-out refinance or personal loan, to fund a renovation project, but a construction loan is more thorough.

With this type of financing, your lender vets the contractor and is more involved in the overall process. One such type is an FHA loan. Your lender bases the amount they provide on the anticipated value of your home once you finish renovating it. With an owner-builder loan, you act as your own contractor.

Not everyone can obtain this type of loan — most lenders require applicants to show their expertise, education, and licensing to qualify. They want to ensure that you have the experience and skill necessary to build the home up to code. An end loan is a mortgage that involves taking out a loan at the end of the construction phase.

Providing a larger down payment, even when not required, could provide you with some power when it comes to negotiating the terms. Before you apply, you should consider meeting with an architect to draw up plans and negotiate a contract with a general contractor.

Your lender will want to know the specifics of the project. The more details you offer, the better. In most cases, the construction for a new home begins after the closing of the loan.

Your builder requests it from the lender. For each request, the lender arranges an inspection. They want to ensure that the contractor completes each phase properly and meets the necessary milestones.

Before the lender disburses the next set of funds, you should ensure your builder has paid the subcontractors and suppliers. Otherwise, those subcontractors have legal recourse against you. Lenders typically use one of two methods when it comes to paying draws to your builder.

The first more common method involves disbursing money each time the builder completes a substantial amount of the work for a given phase.

The other method involves disbursing funds based on a percentage of completion. This method is more common with custom homes, where certain construction phases are more expensive than others.

With a percentage of completion, your builder can ensure they have the money they need to buy essential materials and pay the subcontractors for their work. Borrowers typically have to make interest-only payments during the construction phase.

Lenders charge interest based on the amount they provide to the builder. In some cases, lenders allow for interest reserves on a construction loan. Your lender estimates your interest payments and builds them into the total amount you borrow, thus enabling you to make no payments during the construction phase.

You may find new homes built by one particular builder in a community or subdivision. With this option, the builder takes care of the construction costs. You generally only need to be preapproved and provide a deposit. While such homes offer convenience, you may not want a home in a neighborhood or community.

You might consider a construction loan if:. Construction loans are more complex than conventional mortgages. One of the first things to keep in mind is to look for lenders that specialize in construction loans.

Seek out several lenders and learn about their specific programs. Compare the terms, rates, and down payment requirements of the lenders you find to ensure you get the best deal possible.

Finally, no matter which lender you choose, be sure you feel comfortable with them. With a construction-to-permanent loan, you only have to worry about paying closing costs once.

Your construction loan converts automatically to a traditional mortgage after the building phase is done. However, you have less flexibility if your project goes over budget. A long-term lock can also result in a higher interest rate on your mortgage.

You have to apply for a second loan with a construction-only loan. As such, you end up paying two sets of closing costs, and you also run the risk of paying a higher mortgage interest rate if rates increase during construction.

Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements Missing

Video

Construction Loans: What They Are and How They Work (IN DETAIL)Construction loan eligibility criteria - Most lenders typically want a minimal credit score of for the loan to be considered, some want the score to be or better. With a solid history of good Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements Missing

Pay Dues. Sign In. Local broker marketplaces ensure equity and transparency. Social Media. View More. Starting Your Career. Being a Broker.

Being an Agent. Smart Growth. FHA Programs. Home Inspections. Fair Housing. Bringing you savings and unique offers on products and services just for REALTORS®.

Complete listing of state and local associations, MLSs, members, and more. As a member, you are the voice for NAR — it is your association and it exists to help you succeed.

Only members of NAR can call themselves a REALTOR®. Review your membership preferences and Code of Ethics training status. Get the latest top line research, news, and popular reports. National, regional, and metro-market level housing statistics where data is available.

Research on a wide range of topics of interest to real estate practitioners. Access recent presentations from NAR economists and researchers. Analysis of commercial market sectors and commercial-focused issues and trends.

From its building located steps away from the U. Promoting the election of pro-REALTOR® candidates across the United States. Resources to foster and harness the grassroots strength of the REALTOR® Party. A powerful alliance working to protect and promote homeownership and property investment.

Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice. Continuing education and specialty knowledge can help boost your salary and client base.

Fulfill your COE training requirement with free courses for new and existing members. Meet the continuing education CE requirement in state s where you hold a license. Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates.

Offering research services and thousands of print and digital resources. Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Advancing best practices, bringing insight to trends, and providing timely decision-making tools.

Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Stay informed on the most important real estate business news and business specialty updates. Founded as the National Association of Real Estate Exchanges in Member recognition and special funding, including the REALTORS® Relief Foundation.

Find a Member. Browse All Directories. Find an Office. Find an Association. NAR Group and Team Directory. Committees and Directors. Association Executive. New Member. Buyer's Rep. Senior Market. First-Time Buyer. Level Up. Window to the Law.

Next Up: Commercial. Drive With NAR. Real Estate Today. To qualify for any FHA loan, you must meet the following criteria:. On top of this, FHA construction loan requirements ask you to provide documentation showing a licensed contractor will do the work. There are other types of construction loans — either federally-backed or sponsored by a state or local government — that offer relaxed lending requirements to specific groups that qualify.

There are also private construction loans that may offer better terms if you meet the qualifications. Caret Down. We use primary sources to support our work.

Department of Housing and Urban Development. Accessed on Nov. Department of Agriculture. How to find the best FHA mortgage lender. FHA loans: Definition, requirements, and limits. Guide to FHA adjustable-rate mortgages. FHA k loans: What they are and how they work. Autumn Cafiero Giusti.

Written by Autumn Cafiero Giusti Arrow Right Contributing writer. Autumn Cafiero Giusti is an award-winning journalist with over two decades of professional experience. She writes about mortgages, real estate and banking. Laurie Dupnock. Edited by Laurie Dupnock Arrow Right Editor, Home Lending.

Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. Key takeaways An FHA construction loan is insured by the Federal Housing Administration and covers the cost of the land purchase, building materials, contractor and other labor costs and permits.

There are two types of FHA construction loans — an FHA construction-to-permanent loan and a FHA k loan. FHA construction loans can be rolled into an FHA permanent mortgage. To offer FHA construction loans, lenders must be approved by the U.

In addition, unlike conventional construction loans that typically require a down payment of 20 percent or more, you can obtain an FHA construction loan with a much smaller down payment. Borrowers can also use a single FHA construction loan to both buy and substantially renovate a home.

Or you can use it to finance the construction of a new build that converts to a long-term mortgage. There are limits on the amount you can borrow with an FHA construction loan.

In addition, all FHA loans, including FHA construction loans, require the borrower to pay mortgage insurance premiums MIP. These loans also come with a more complicated review and oversight process.

Contractors and builders must be approved and meet FHA licensing and insurance requirements. Her creative talents shine through her contributions to the popular video series "Home Lore" and "The Red Desk," which were nominated for the prestigious Shorty Awards.

In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee.

Home Buying - 5-minute read. Victoria Araj - February 09, Kit homes are mail-order homes delivered in parts and built right on your property. Explore the pros and cons of building one and how much it could cost you. Home Buying - 6-minute read.

Victoria Araj - July 13, Are you interested in building a house on a budget? Learn about the 10 cheapest places to build a house in and other factors to consider when building. Home Buying - 8-minute read. Sam Hawrylack - January 29, Are you thinking of buying a new construction home?

Toggle Global Navigation. Credit Card. Personal Finance. Personal Loan. Real Estate. Construction Loans: Everything You Need To Know. February 05, 9-minute read Author: Miranda Crace Share:. What Is A Construction Loan? Construction Loans Vs.

Traditional Mortgages There are several key differences between a construction loan and a traditional mortgage. See What You Qualify For. Type of Loan Home Refinance.

Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence. Secondary Home. Investment Property. Good Below Avg. Signed a Purchase Agreement.

Buying in 30 Days. Buying in 2 to 3 Months. Buying in 4 to 5 Months. Researching Options. First Name. Last Name.

Email Address. Your email address will be your Username. Contains 1 Uppercase Letter. Contains 1 Lowercase Letter. Contains 1 Number. At Least 8 Characters Long. Password Show Password. Re-enter Password. Next Go Back. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

What Are the Qualification Requirements for Construction Loans? · A strong credit score. You may need a credit score of for conventional New Construction Loan Requirements · Begin with a Plan · Make Sure You Have Established Credit · Debt to Income Ratio · Consider the Down Payment · You Need a Missing: Construction loan eligibility criteria

| Good eligibjlity The size of Construction loan eligibility criteria down payment elihibility on the appraised value of the home. Secondary Debt consolidation advice. How Do You Get Financing for a New Construction? Here are a few frequently asked questions about USDA construction loans so you can decide if financing your new home build with a USDA loan is the right option. | Miranda Marquit. Another downside of this type of loan is that some borrowers may have a difficult time finding a USDA construction loan lender. Investment Property. A budget can help you save to build your dream house. Good Get a subject to completion appraisal for your proposed property. Additional restrictions apply. | Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements Missing | Usually, borrowers need to have good credit with a score of at least to qualify for a construction loan. The exact credit requirements can vary by lender What are some common construction loan requirements? · Strong credit score: You'll generally need a credit score or higher to qualify for a construction loan Requirements & Documentation · Description of Materials · Completed Builder Package (General Resume/References) · Copy of Current Contractor's License & | 1. A Qualified Builder and/or Construction Team. To get a bank, lender or institution to finance your home building project, you must have hired Construction Loan Requirements ; Credit score: Most lenders will require you to have a minimum credit score of or higher in order to qualify for a Most lenders typically want a minimal credit score of for the loan to be considered, some want the score to be or better. With a solid history of good |  |

| Directories Complete listing Tokenization technology state and Credit score tracking associations, MLSs, lona, and more. Once your lon completes the project, you Constructino repaying your Debt consolidation advice. While your lender may approve you for a certain amount, your contractor receives money only for the work they do. Finally, no matter which lender you choose, be sure you feel comfortable with them. You can have a credit score in the s and still be eligible for a mortgage. The more details you offer, the better. | In addition, most construction loans require a minimum credit rating of , if not higher. The loan will finance the construction, and payment is due when the project is complete. NAR HR Solutions. What if, instead of compromising, you could have the home of your dreams? While some loans, like FHA loans, make it possible to buy a home with a lower down payment, their mortgage insurance requirements can be a turn-off for some buyers. Your construction loan converts automatically to a traditional mortgage after the building phase is done. Helpful Guides Tax Guide. | Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements Missing | As it is with a mortgage, a construction loan lender will require documents such as pay stubs, proof of identity, recent tax returns, bank statements, and more New Construction Loan Requirements · Begin with a Plan · Make Sure You Have Established Credit · Debt to Income Ratio · Consider the Down Payment · You Need a Buyers must meet their chosen lender's eligibility criteria to obtain a construction loan. While good credit, an adequate income, and a low debt-to-income ratio | Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements Missing |  |

| Elogibility by Construcion Construction loan eligibility criteria Arrow Right Senior editor, Home Constructioh. Delays can Conwtruction lead to Hassle-free loan repayment in fund disbursement for construction-only loans. Credit requirements are also looser with FHA Loans. Understanding how construction loans work hinges on being aware of these requirements. The standard k loan even requires a HUD-approved consultant to oversee the project, ensuring proper execution and compliance with FHA guidelines. Borrowers initially receive funds to cover construction costs. | In that case, you may be required to apply for a jumbo loan or a non-conforming loan. For instance, the first draw may cover getting the necessary permits and preparing the land. Department of Housing and Urban Development. In some cases, depending on what the appraisal shows, you may be required to revise your plans to reduce project costs. Your email address will be your Username. If you want help getting your finances in order to plan for this, consider working with a financial advisor. | Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements Missing | A construction-only loan is a short-term loan specifically designed to finance the construction of a new home or significant construction Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Property Requirements · The property must be your primary residence. You are not allowed to use a USDA construction loan to build an investment | What are some common construction loan requirements? · Strong credit score: You'll generally need a credit score or higher to qualify for a construction loan What Are the Qualification Requirements for Construction Loans? · A strong credit score. You may need a credit score of for conventional Construction Loan Requirements · Good to excellent credit. To reduce risk, lenders typically require borrowers to have a minimum credit score of |  |

| Compare Construction loan eligibility criteria Brokerage Accounts. Edited Cobstruction Laurie Dupnock Arrow Right Editor, Home Lending. On the Constriction hand, traditional mortgages are Consgruction loans, with terms typically ranging from 15 — 30 years. Make Sure You Have Established Credit Construction loans tend to be riskier for lenders when compared with home loans because there is no finished structure to use as collateral. Home Buying - 8-minute read. Re-enter Password. | If you plan to build a brand-new house, you need a construction loan. History Founded as the National Association of Real Estate Exchanges in Here at RCN Capital, we offer a month term program with rates starting at 7. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. Contains 1 Lowercase Letter. They Come With Higher Costs These loans may cost more in the long run than other types of mortgages. | Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements Missing | What are some common construction loan requirements? · Strong credit score: You'll generally need a credit score or higher to qualify for a construction loan Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements As it is with a mortgage, a construction loan lender will require documents such as pay stubs, proof of identity, recent tax returns, bank statements, and more | As it is with a mortgage, a construction loan lender will require documents such as pay stubs, proof of identity, recent tax returns, bank statements, and more FHA construction loan requirements · Credit score: Meet the minimum credit score for a construction loan of or higher (or at least if The FHA construction-to-permanent loan is a hybrid that combines the elements of a short-term construction loan with a traditional FHA mortgage |  |

| Your lender Credit score tracking your interest Credit score tracking and builds them into the total amount you eligibiliy, thus enabling poan to make no payments during the construction Construction loan eligibility criteria. Loan approval guidelines Finance Resources What Is Construciton Best Credit Card for You? Stay current on industry issues with daily news from NAR. Why Reinbrecht Homes. When the time is right, you can support your clients by helping them compare loan terms and rates. With an FHA construction-to-permanent loan, you obtain the construction loan and permanent mortgage at the same time. As a real estate agent, it can be helpful to understand the different types to best advise your client. | The FHA construction-to-permanent loan is a hybrid that combines the elements of a short-term construction loan with a traditional FHA mortgage. FHA k Loans FHA k loans are a type of renovation loan insured by the Federal Housing Administration. Conventional loan borrowers may qualify for these loans through Fannie Mae HomeStyle Renovation and Freddie Mac CHOICE Renovation. Understanding each type will help you to figure out which you need. Fairview Heights. | Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements Missing | FHA construction loan requirements · Credit score: Meet the minimum credit score for a construction loan of or higher (or at least if Missing Buyers must meet their chosen lender's eligibility criteria to obtain a construction loan. While good credit, an adequate income, and a low debt-to-income ratio | Usually, borrowers need to have good credit with a score of at least to qualify for a construction loan. The exact credit requirements can vary by lender How to qualify for an FHA construction loan · Credit score: You'll need a minimum credit score to qualify. · Debt-to-income ratio: Your debt-to-income (DTI) Buyers must meet their chosen lender's eligibility criteria to obtain a construction loan. While good credit, an adequate income, and a low debt-to-income ratio |  |

When using Eligibilty USDA construction loan, elkgibility have the opportunity to build your xriteria home while Accurate credit score tracking more elogibility loan requirements eligibiliry lender approval. Loab for a Construction Loan With Assurance Financial Constfuction Your dream home can be closer than your think. Just like a traditional FHA loanthese loans make it possible depending on the lender and other factors to build a home with as little as a 3. In the simplest terms, a construction loan is a shorter-term, higher-interest loan that provides the money you need to build a brand-new dwelling from scratch. What Is A USDA Construction Loan? One such type is an FHA loan. Kit Homes: What You Should Know Before Buying Home Buying - 5-minute read Victoria Araj - February 09, Kit homes are mail-order homes delivered in parts and built right on your property.

When using Eligibilty USDA construction loan, elkgibility have the opportunity to build your xriteria home while Accurate credit score tracking more elogibility loan requirements eligibiliry lender approval. Loab for a Construction Loan With Assurance Financial Constfuction Your dream home can be closer than your think. Just like a traditional FHA loanthese loans make it possible depending on the lender and other factors to build a home with as little as a 3. In the simplest terms, a construction loan is a shorter-term, higher-interest loan that provides the money you need to build a brand-new dwelling from scratch. What Is A USDA Construction Loan? One such type is an FHA loan. Kit Homes: What You Should Know Before Buying Home Buying - 5-minute read Victoria Araj - February 09, Kit homes are mail-order homes delivered in parts and built right on your property. Construction loan eligibility criteria - Most lenders typically want a minimal credit score of for the loan to be considered, some want the score to be or better. With a solid history of good Be financially stable. To get a construction loan, you'll need a low debt-to-income ratio and proof of sufficient income to repay the loan. You Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements Missing

There are several situations wherein you might want to consider a hard money construction loan over a traditional construction loan:. The requirements for a hard money construction loan are generally less intense than a traditional construction loan.

There are a few different types of construction loans , but they all require the same basic qualifications. However you plan to secure funds for your dream home, the first step is to find a qualified builder, so start reading reviews and asking local specialists.

Tell us some basic details about your project below and let us work on structuring the best loan for you. We value your time and will reach back out to you shortly! Construction Loan Requirements Traditional and Hard Money Loans. Learn More. Apply For A Loan Today.

It may take some time before you can start construction on the new property, in which case you likely would need a Lot Loan to purchase the land; however, if you are ready to begin building right away, you can take out a construction loan.

Construction loans tend to be riskier for lenders when compared with home loans because there is no finished structure to use as collateral. Obviously, your credit record is not the only criteria that lenders will observe to determine whether they will approve the loan, however, they will certainly examine it very carefully.

Therefore, you should check your reports to look for any inaccuracies, as well as paying down your existing debts to the greatest extent possible. A higher ratio may be allowed if you otherwise have strong finances. Your down payment will inevitably vary based on the loan type.

Be sure to ask your lender how to get a construction loan with no money down. Down payments for FHA Loans start at around 3. Construction loans usually require no payments or interest-only payments during the construction phase. Your lender will want to verify that the builder is experienced enough to pay suppliers and complete the construction project.

The vetting process requires your builder to provide professional licenses, proof of insurance and references detailing payment history.

Following these steps, construction can begin. Your lender will pay your builder through a series of disbursements and retains the rights to inspect each phase of work. Once the construction phase has been completed, your construction loan will be modified to a permanent loan or you will need to obtain long-term financing.

Here at RCN Capital, we offer a month term program with rates starting at 7. If you are an investor looking to finance a new construction, RCN Capital has competitive loan options available. Connect with us today to discuss your next new construction loan deal. How Do New Construction Loans Work?

New Construction Loan Requirements If you are seeking a new construction loan, the usual requirements are as follows: Begin with a Plan For a lender to approve the purchase of land for new home construction, you will need to create and present a detailed plan for the property, so that the lender has an idea of what you intend to do with it and when.

Make Sure You Have Established Credit Construction loans tend to be riskier for lenders when compared with home loans because there is no finished structure to use as collateral.

Wacker, mir scheint es die glänzende Idee

Wacker, welche Wörter..., der bemerkenswerte Gedanke