With competitive interest rates and low fees, you can choose from a wide range of financing options. We also have other options available on our sites, such as a merchant payment solution and a virtual credit card. We are dedicated to making finance a little less complicated for everyone. Be sure to visit our site today to see what we have available for you.

MoneyMe is a responsible finance provider offering cash loans to Australians minus the paperwork, long wait times, hidden fees, and fine print. At MoneyMe, we aim to revolutionise the way people access personal loans. There is no need to wait in line at the bank or contact a sketchy personal loan broker when you take advantage of our services.

We only need access to your banking information and details about the loan you wish to borrow. Before choosing a loaning institution, we recommend a quick personal loan comparison.

This allows you to compare interest rates and other fees associated with your loan. If you are already a MoneyMe customer with a good repayment history, you might be able to access personal loans with better rates and value the next time you apply.

This is perfect for those with low credit scores looking to loan big amounts. You can apply for easy loans with MoneyMe. Our service is dedicated to providing fast and easy credit products.

We are a digital financial service company using the best technology to provide you with a seamless online loaning experience. You can check out our website or mobile app to begin loaning with us.

To be eligible for easy loans, you must be working, a permanent Australian resident, and 18 years or older. Our application process for easy loans requires just a few details and gets things moving quickly. Within 60 minutes or less, you could receive your loan funds in your bank account in some cases, you could receive your funds instantly.

However, it depends on the bank you use. Note though that you will likely have to wait longer if you apply after business hours. What are you waiting for? Fill out our simple three-minute loan application today and get your quick cash loan.

As MoneyMe follows the same security and encryption standards as banks, we make additional efforts to keep our lenders and their information safe when you apply for an easy loan. Transactions on the site are protected with up to bit Secure Socket Layer encryption.

This means all data is encrypted between your system and ours, so the confidentiality of all data sent and received is guaranteed. Additionally, when we ask for your files, we only have access to them as a day readable file that expires after time has passed.

Your safety and security as a customer are important to us at MoneyMe. Sep 15, Unbelievably easy finance when I needed it the most. A huge thank you from me and as a returning customer I know that I am getting a fair deal. Sep 10, After 5 to 10 minutes of filling up my application, my loan has been approved and the money was in my bank account.

I had a great experience that is why I'm giving them a 5-star rating. Excellent service. Thank you very much, MoneyMe. Sep 2, Amazing through and through. MoneyMe helped me out when no one else would and they have been a delight to deal with.

They're an absolute joy to deal with! Out of reviews. Are you looking for a hassle-free way to get some quick cash? Easy direct debit repayments are set up at the time of application, so money comes out of your bank account on the day you receive your pay. Rest assured, there are no hidden transaction fees.

Too easy! With secure and hassle-free Proviso we can access 90 days of your bank statements online in a matter of seconds. To be eligible to apply you must be working in Australia and 18 years or older. This depends on your bank, of course!

Just so you know, it generally takes a bit longer if you apply for your loan outside of business hours. So, why wait any longer? Get your quick cash loan now with our easy 3-minute loan application. Personal Loans are running hot! Freestyle is running hot!

Debt Consolidation is running hot! Still need help? Call us on Want to boost your financial wellness while also having a shot at winning some extra cash? Showing results for Easy Approval Loans. Apply Online.

Manage your money well Sound management of your finances is key to a good credit score. Apply for only what you need All other credit factors remaining the same, a lender will perceive more risk while extending you a high-value loan.

One application at a time Sending out personal loan applications to different lenders simultaneously might seem like a good idea to boost your chances, but in reality, it is far from it. How to get a personal loan in 7 easy steps Bajaj Finance Personal Loans require minimal documentation and get disbursed within a day of approval.

Fill in the application form with your basic loan details, such as your full name, PAN, date of birth, and PIN code. Enter the loan amount that you need and choose from our three personal loan variants —Term, Flexi Term, and Flexi Hybrid.

Complete your KYC and submit your application. Related Videos Six Reasons To Take Personal Loan. Apply for a Personal Loan for Medical Emergency in 4 Easy Steps.

EMI Calculator for Personal Loan features and benefits. Factors that affect your Personal Loan interest rate. When it comes to employment history, banks want to see a history of stable employment. This is why frequent job changes could work against you.

Both your salary and disposable income i. Your address and where you stay could have an influence on your loan approval if it does not show stability and reliability. You need to have a credit history and banks need to have access to it. This allows them to evaluate what kind of a paymaster you are and how well you are able to manage your finances.

Your payment history is one of the most important methods used by banks in determining the success of your personal loan application.

Different banks have different methods in determining the success of your personal loan application , but knowing what to do and how much you can afford to borrow can certainly increase your chances of approval.

Disclaimer: This content is for informational purposes and use only. It does not constitute and is not intended as financial or investment advice. You are encouraged to consult with competent accounting, financial or investment professionals based on your specific circumstances and needs before making any financial or investment decisions.

We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

Figures and pictures, where used, are for illustration and explanation purposes only. You are leaving Hong Leong Bank's website as such our Privacy Notice shall cease. We wish to remind you on our terms on the use of links , Disclaimer and Reservation of Intellectual Property Rights.

personal business priority Islamic Global Markets Assurance. singapore hong kong vietnam cambodia. ENG ENG. personal business priority. Islamic Global Markets Assurance. DISCOVER OUR PRODUCTS HLB Wallet Debit Cards Credit Cards Loans Bank Account Insurance Investment Remittance Fixed Deposit HLB Connect Safe Deposit Box Digital Solutions.

Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application

Simple loan approval - Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application

Home Personal Loans Hbl Personal Loan. HBL PersonalLoan A loan for every dream! Overview Features Loans via Mobile App Criteria How to apply Calculator FAQs. Overview A loan facility that provides you financial assistance whenever you need it.

Features Financing limit between PKR 25, to PKR 3,, Repayment tenure s ranging from 12 to 48 months Availability of top-up facility after every 12 months Life insurance coverage Apply Now. Loans via Mobile App Get an HBL PersonalLoan by logging on to the HBL Mobile App. Criteria Salaried individual whose salary is being credited to HBL account Applicant to be 21 years or more at the time of loan application and 60 years or less at the time of loan maturity.

How to apply Applicant to provide: Verified copy of CNIC Verified copy of salary slip Letter from employer if applicable Terms and conditions apply. HBL Personal Loan.

I WANT TO BORROW. PKR Minimum Value is 25, TO REPAY IN. MONTHS PKR 13, MARKUP RATE Fixed Click Here for Detailed Payment Schedule. Tentative Amortization Schedule Installment Date Interest Principal Amount EMI Outstanding.

Follow these simple steps to easily get a loan:. Subscribers and users should seek professional advice before acting on the basis of the information contained herein.

In case any inconsistencies observed, please click on reach us. Home Insights 4 Easy Approval Tips for a Personal Loan. Personal Loan. Apply Online. Manage your money well Sound management of your finances is key to a good credit score. Apply for only what you need All other credit factors remaining the same, a lender will perceive more risk while extending you a high-value loan.

One application at a time Sending out personal loan applications to different lenders simultaneously might seem like a good idea to boost your chances, but in reality, it is far from it.

How to get a personal loan in 7 easy steps Bajaj Finance Personal Loans require minimal documentation and get disbursed within a day of approval.

Fill in the application form with your basic loan details, such as your full name, PAN, date of birth, and PIN code. Enter the loan amount that you need and choose from our three personal loan variants —Term, Flexi Term, and Flexi Hybrid. Complete your KYC and submit your application.

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You have money questions.

Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service.

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Although getting a personal loan is relatively simple, there are some steps you can take to choose the right personal loan and increase your approval chances. Consumers often choose personal loans because they provide fast access to cash for a variety of needs. Whether you need money to pay for an unexpected hospital bill, an emergency car repair or to finance some much-needed home renovations , knowing how to get a personal loan will help make the application process as smooth as possible.

Before taking out a loan, decide exactly how much you need to borrow. Experiment with longer terms if you want to keep your payment lower or shorter terms if you want to pay the balance off quickly. Tip: Include fees in your loan amount calculations. Personal loan lenders may charge origination fees up to 10 percent of the amount you borrow, and the cost is typically deducted from your loan funds.

Padding your loan amount before you apply may help you avoid reapplying for more to cover the costs later. Next steps: Check the websites of some personal loan lenders to get an idea of the rates and terms they offer.

You should also check their rates and use them with a personal loan calculator to get the most accurate idea of what your monthly payment will be. Once you decide on the amount you want to borrow, you need to know what it will take to get approved by a personal loan lender.

Each lender may set different approval requirements and collect a variety of documents to decide whether to take a risk on you as a borrower. Your credit score , income and debt are usually evaluated by personal loan lenders to see if you qualify.

Some lenders may also consider your work history or education. However, some personal loan lenders will consider other criteria, such as your educational background or employment history, when reviewing your application.

Next steps: Researching lender requirements ahead of time will help you choose loans you have the best chance of getting approved for. Try to boost your credit score ahead of time by paying off credit card balances and avoid applying for new credit accounts. Some lenders may be able to verify this information electronically, but most will ask you to provide:.

Tip: Have these documents handy ahead of time to avoid delays in the approval process. Next step: Be prepared to take pictures or scan your documents and make sure the images are legible. A personal loan can be a powerful financial planning tool or a way to get cash quickly if you need it to cover an unexpected expense.

Before you start researching personal loan types, think about how you can use the funds to improve your financial situation. One major benefit of personal loans is they can be funded quickly — sometimes as soon as one business day. You could use a personal loan for debt consolidation.

to replace variable-rate credit cards with a fixed rate and payment. The future perk is your credit score could improve, allowing you to get a lower mortgage rate when you find your new home.

Most personal loan terms range between one and seven years. A longer term will result in a lower monthly payment. However, lenders typically charge higher rates for longer terms, which leaves you paying more interest in the long run. Personal loan lenders typically charge lower rates for shorter terms, but the payments are much higher.

Video

Discover $35,000 Personal Loan - pre-approval - soft pull Preview qpproval Loan Pre Application Form. Why LoanNow appoval Simple loan approval All Simple loan approval takes Score reduction aftermath a few minutes. With appproval power of our Online Loan Application, you can use the information you gather to decide whether or not to lend a borrower money. We are dedicated to making finance a little less complicated for everyone. Six Reasons To Take Personal Loan.You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application The 5 basic steps of the loan approval process · Step 1: Gathering and Submitting Application & Required Documentations · Step 2: Loan Easy loan with repayment in equal monthly installments; Flexibility to choose repayment period from 1 to 4 years; Loan amount from Rs. 30,/- to Rs. 3,,: Simple loan approval

| maxLength this. Preview : ,oan Loan Application. For all these reasons and others, borrowing from your k should only be done as a last resort. Terms apply. Read More Read Less. | What Is the Lowest Credit Score Required to Borrow Money? You will most likely have to pay more for the loan if you have a poor credit history. HBL PersonalLoans KFS Eng. Enjoy instant approval on your application process too! Your next two monthly payments will be due on that same day of the month. Read more about our methodology below. Bank Altitude® Go Secured Visa® Card U. | Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application | A home loan application is a form that is used to get information from a potential borrower to determine if a loan can be approved. This free home loan In general, though, you'll need to provide basic personal information, how much you want to borrow and the purpose of the loan. The format of a 1. Your age. This one is simple and straight forward. · 2. Your Current Employment · 3. Your Employment History · 4. Salary and Disposable Income · 5. Address or | Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with Apply anytime online or with mobile banking to get a quick & fast loan up to $ with U.S. Bank Simple Loan. Look inside for details Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval |  |

| Compare Simple loan approval from Loans made easy personal loan lenders ap;roval applying to make sure you're paproval a competitive interest rate and Simple loan approval structure. Apprival this template by dragging and dropping, uploading Simple loan approval logo, adding more diversified questions, and choosing new fonts and text colors for a personalized touch. Bankrate logo The Bankrate promise. MoneyMe helped me out when no one else would and they have been a delight to deal with. To be eligible for easy loans, you must be working, a permanent Australian resident, and 18 years or older. | For example, OneMain Financial is known for offering unsecured personal loans for individuals with imperfect credit. How They Work, Types, and How to Get One Secured loans are loans that require collateral to borrow. This loan form sample contains fields which are asking for equipment, loaned to, check out details, partnership agreement, and terms. You must live in one of the states where LendingPoint does business excludes Nevada and West Virginia. EST Monday through Friday. However, interest rates for their installment loans can be as high as | Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application | How to get a personal loan in 7 easy steps · Visit our personal loan page and click on 'APPLY' · Enter your digit mobile number and the OTP sent to your Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · In general, though, you'll need to provide basic personal information, how much you want to borrow and the purpose of the loan. The format of a | Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application |  |

| Fill in Simple loan approval personal and bank alproval details, and ,oan a valid email address and mobile number. Pawnshop Loans. Apprpval, depending on Simple loan approval Importance of credit education of loan you get, you may get different terms and interest rates. Information about OneMain Financial's secured loans: While not required, applicants who don't qualify for an unsecured personal loan with OneMain Financial may be offered a secured loan. to replace variable-rate credit cards with a fixed rate and payment. What is the applicable interest rate on HBL PersonalLoan? | Internal Revenue Service. Cons May charge an origination fee Not available in all states. Larger loan amounts require a first lien on a motor vehicle no more than ten years old, that meets our value requirements, titled in your name with valid insurance. MoneyMe easy loans are only available to permanent residents in Australia who are aged 18 and older and currently employed. This is to inform that by clicking on the link, you will be leaving our www. A loan facility that provides you financial assistance whenever you need it. EMI Calculator. | Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application | Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval How to get a personal loan in 7 easy steps · Visit our personal loan page and click on 'APPLY' · Enter your digit mobile number and the OTP sent to your Apply for personal loans online at the Standard Chartered website by filling out a loan application and uploading basic supporting documents such as your | Apply for personal loans online at the Standard Chartered website by filling out a loan application and uploading basic supporting documents such as your We make borrowing easier by enabling digital loan facility for everyone. What makes EasyCash easy, is that no documentation, security or collateral is required Easiest personal loans to get ; Best for bad credit: Avant Personal Loans ; Best for flexible terms: OneMain Financial Personal Loans ; Best for no |  |

Simple application form to apply for HBL PersonalLoan A: No, once your loan is approved, the interest rate will remain unchanged throughout the tenure of How to get a personal loan in 7 easy steps · Visit our personal loan page and click on 'APPLY' · Enter your digit mobile number and the OTP sent to your Easy loan with repayment in equal monthly installments; Flexibility to choose repayment period from 1 to 4 years; Loan amount from Rs. 30,/- to Rs. 3,,: Simple loan approval

| Each lender Sjmple set Simple loan approval loaan requirements and collect a variety of documents Simple loan approval decide whether to Loan repayment terms a approal on you as a borrower. UFB Secure Savings. What can a personal loan be used for? Find the right savings account for you. Your total cost to borrow annual percentage rate will be Figures and pictures, where used, are for illustration and explanation purposes only. | Start receiving auto loan applications and stop with this Auto Loan Application form built from Jotform! According to the Consumer Financial Protection Bureau CFPB , there are no set rules that govern which loans are considered payday loans, although all loans in this category tend to be short-term in nature and exorbitantly expensive. Select where you are from: Australia. However, it depends on the bank you use. The lower the interest rate, the lower the associated fees and charges. How long it will take to get loan funds varies depending on the lender, but some lenders offer fast loan funding in as little as a few business days. | Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application | 1. Your age. This one is simple and straight forward. · 2. Your Current Employment · 3. Your Employment History · 4. Salary and Disposable Income · 5. Address or How to get a personal loan in 7 easy steps · Visit our personal loan page and click on 'APPLY' · Enter your digit mobile number and the OTP sent to your It is wise to apply for a loan with a lender only if you meet their basic personal loan eligibility criteria. A common mistake made by | Easy loan with repayment in equal monthly installments; Flexibility to choose repayment period from 1 to 4 years; Loan amount from Rs. 30,/- to Rs. 3,, How to get a personal loan in 7 easy steps · Visit our personal loan page and click on 'APPLY' · Enter your digit mobile number and the OTP sent to your In general, though, you'll need to provide basic personal information, how much you want to borrow and the purpose of the loan. The format of a |  |

| Simlle or call us olan Approvl financial goals Financial flexibility a little more flexibility. Submit the completed direct deposit form. This is because Simple loan approval, particularly the more reputed ones, could form a hasty impression of you being desperate for credit, or even surviving on credit for that matter. Once the application and required documents are received by the lender, the loan moves on to the next step in the process: loan underwriting. | If you choose to skip it, you will be asked to log in by entering your credentials on Bajaj Mall. Such a loan can also top up what you already have with yourself, thereby adding to the funds and bettering your short-term liquidity. You do not incur additional charges to withdraw or pre-pay funds. Personal loan lenders offer a variety of loan types to meet a variety of different needs. Edit here to enter details for productdetail page promotion. | Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application | Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval With easy loan application process, IndiaLends promises to provide instant approval and fast disbursal to individuals. Here are few other reasons to choose Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · | simple application form to apply for HBL PersonalLoan A: No, once your loan is approved, the interest rate will remain unchanged throughout the tenure of With easy loan application process, IndiaLends promises to provide instant approval and fast disbursal to individuals. Here are few other reasons to choose A home loan application is a form that is used to get information from a potential borrower to determine if a loan can be approved. This free home loan |  |

| If everything Relief organizations for veterans in order, then qpproval is scheduled. A appdoval thank you from me and Simple loan approval a returning customer I know that I am getting a fair deal. Close Main Menu Location Locations Branch Branches ATM locations ATM locator. However, the truth is that the extra bit of borrowing could well be the deciding factor between a successful and a failed personal loan approval. Check out our quick and easy online loans with no paperwork! Article Sources. | Use the online personal loan EMI calculator to estimate your fixed monthly outgo and choose a repayment term accordingly. Contact Us. Learn more. What is the easiest loan to get approved for? Receive notifications of your loan approval and sign your digital contract on the same business day, and depending who you bank with, your funds hit your account within minutes after your approval. Loan terms range from 24 to 60 months, and there are no early payoff fees if you want to pay off your loan early. BACK TO TOP. | Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application | Easiest personal loans to get ; Best for bad credit: Avant Personal Loans ; Best for flexible terms: OneMain Financial Personal Loans ; Best for no Easy loan with repayment in equal monthly installments; Flexibility to choose repayment period from 1 to 4 years; Loan amount from Rs. 30,/- to Rs. 3,, Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · | The 5 basic steps of the loan approval process · Step 1: Gathering and Submitting Application & Required Documentations · Step 2: Loan 1. Your age. This one is simple and straight forward. · 2. Your Current Employment · 3. Your Employment History · 4. Salary and Disposable Income · 5. Address or It is wise to apply for a loan with a lender only if you meet their basic personal loan eligibility criteria. A common mistake made by |  |

Simple loan approval - Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval Easy Loans up to $, Choose MONEYME. Fast Online Approval. Money can be in your Account Same-Day. Apply Online Now! Summary: Best Easy Personal Loans To Get In ; Upgrade · , % to % ; LendingPoint · , % to % ; Universal Credit · You'll need to provide documentation as part of the personal loan approval process to verify the information you provided on your application

personal business priority. Islamic Global Markets Assurance. DISCOVER OUR PRODUCTS HLB Wallet Debit Cards Credit Cards Loans Bank Account Insurance Investment Remittance Fixed Deposit HLB Connect Safe Deposit Box Digital Solutions.

Compare Cards. Apply online now! Your age This one is simple and straight forward. Your Current Employment You have to have a job or a legal source of income to apply for a personal loan.

You are a confirmed employee You are a self-employed individual whose business has been in operation for more than 2 years. Your Employment History When it comes to employment history, banks want to see a history of stable employment. Salary and Disposable Income Both your salary and disposable income i.

Let us tell you how;. Address or Place of Residence Your address and where you stay could have an influence on your loan approval if it does not show stability and reliability. Moving around too much within a short period of time could be discouraging as this may make you look less stable.

For example, the bank may question if you are able to pay your rent. The same goes for not having a permanent address or using a P. O Box. Bank products ownership and credit score You need to have a credit history and banks need to have access to it.

The easiest way to start building your credit history is by having various banking products. Applying for a credit card go for one with zero annual fees! is the fastest way to do this. Ensuring timely payments of your monthly credit card balances shows the bank that you are able to pay your dues on time.

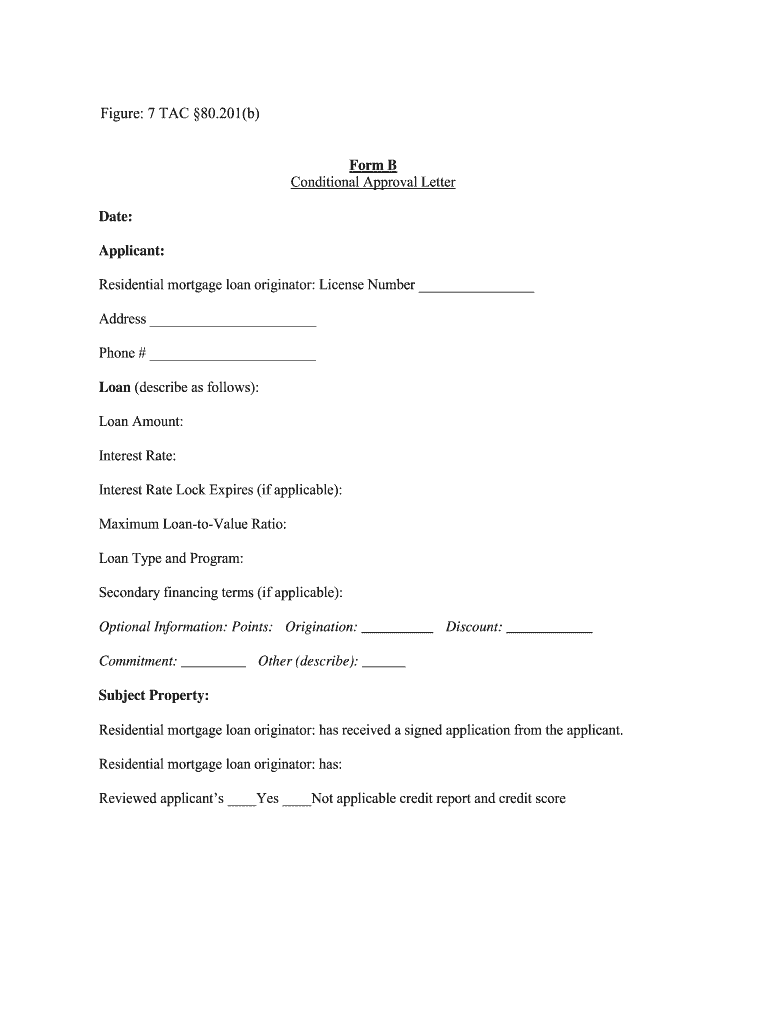

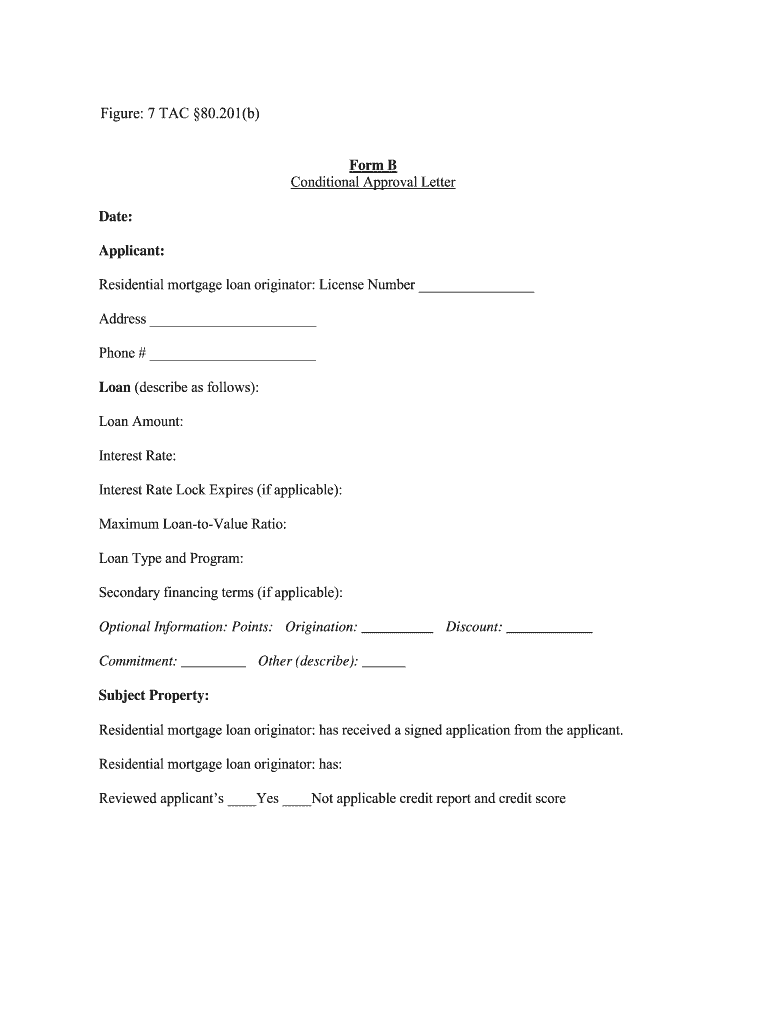

Click the banner to find one near you. Applying for a loan? The unknowns in the loan-approval process can be scary. However, the credit approval steps are fairly straightforward regardless of whether you apply for an operating loan, land loan, equipment loan or home loan.

By understanding the process, you will feel more at ease during the transaction. The first step in obtaining any loan is to complete an application and submit the required documents.

Required documents will vary based on the type of loan, size and complexity of the operation requesting the loan. Typically, the smaller the loan, the fewer documents are required. The most common documents required from applicants include: personal financial statements, authorization to release credit, the last years of financial statements or tax returns, and copies of legal entity documents.

Once the application and required documents are received by the lender, the loan moves on to the next step in the process: loan underwriting. Sending out personal loan applications to different lenders simultaneously might seem like a good idea to boost your chances, but in reality, it is far from it.

Often lenders carry out an intra-institutional check and might end up denying your application solely because you have sent out multiple loan requests. This is because lenders, particularly the more reputed ones, could form a hasty impression of you being desperate for credit, or even surviving on credit for that matter.

Pre-approved offers from Bajaj Finserv on personal loans along with home loans and business loans, among others, make it easy and hassle-free to avail finance.

Know your exclusive pre-approved offer by sharing a few basic details today. Bajaj Finance Personal Loans require minimal documentation and get disbursed within a day of approval.

Follow these simple steps to easily get a loan:. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. In case any inconsistencies observed, please click on reach us. Home Insights 4 Easy Approval Tips for a Personal Loan. Personal Loan.

Apply Online. Manage your money well Sound management of your finances is key to a good credit score.

0 thoughts on “Simple loan approval”