You can lower your utilization rates by decreasing the balances and increasing the credit limits on the revolving accounts in your credit reports. One option is to use cash or debit cards instead of credit cards. However, assuming you want to use credit cards to receive their protections , rewards and benefits , here are a few additional ways to lower your credit utilization rates.

If you want to maintain a low credit utilization rate without timing your credit card payments, try to estimate how much you spend on credit cards each month.

Multiply this by 10 and use that as a target for the available credit you want to have across your revolving accounts. Credit card issuers usually report account information, including the current balance and credit limit, to the credit bureaus around the end of each statement period.

They may send your monthly statement around the same time, and your minimum balance is due around three weeks later. Closing a credit card can increase your credit utilization rate because it decreases your overall available credit. Keeping the card open might be a better option if you're not worried about overspending.

You still might want to close the card if it has an annual fee, but ask the card issuer if you can switch to a card without an annual fee instead.

However, a lower utilization rate might be even better for your credit scores. People in the highest credit score range tend to have utilization rates in the single digits. Many credit scores only consider your current utilization rate based on the most recently reported revolving account balances and credit limits.

As a result, a high utilization rate won't haunt you—you may be able to quickly improve your credit scores by lowering your utilization rate. However, some newer credit scoring models consider trends in your utilization over time, so maintaining a low utilization rate may be helpful.

You can access your Experian credit report for free. You can use it to calculate your current utilization rate, track your overall utilization rate over time and look at each revolving account in your credit report to see the per-account utilization.

You'll also receive FICO ® Score monitoring , which can alert you to significant changes in your credit. Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing.

While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

With that said, here are a few ways a personal loan might have a positive impact on your credit scores:. Making on-time payments every month could help you build a positive payment history. And according to the CFPB, a good payment history could help you improve your credit scores or maintain good credit scores.

If you need help keeping up with bill payments, you could set up a budget , automatic payments or reminder alerts. A personal loan is a type of credit known as an installment loan.

With a personal loan, you borrow money and pay it back in equal installments over a fixed period of time. A credit card account is an example of revolving credit , meaning it can be used and paid down repeatedly.

So if your only source of credit has been from credit cards, the addition of a personal loan would diversify your credit mix. And a diverse credit mix could improve your credit scores.

Taking out a loan still means taking on more debt , though. But using a personal loan to pay off revolving credit debt could lower your credit utilization. To find out what impact your personal loan is having on your credit scores, you can check your credit reports regularly.

You can get free credit reports from each of the three major credit bureaus by visiting AnnualCreditReport.

And with CreditWise , you can access your free TransUnion credit report and VantageScore® 3. CreditWise is free and available to everyone—not just Capital One cardholders. And signing up gives you access to the CreditWise Simulator.

article September 27, 4 min read. article March 14, 7 min read. article October 17, 4 min read. Do personal loans affect your credit scores?

Key takeaways Applying for a personal loan can temporarily impact your credit scores if it requires a hard credit inquiry. How a personal loan affects your credit scores is largely dependent on how you manage the loan. A personal loan can positively affect your credit scores if you make consistent, on-time payments.

A personal loan could also affect your credit mix and total debt, two important credit-scoring factors. Monitor your credit for free Join the millions using CreditWise from Capital One.

Sign up today. Here are a few examples of how a personal loan might cause your credit scores to drop:. Related Content.

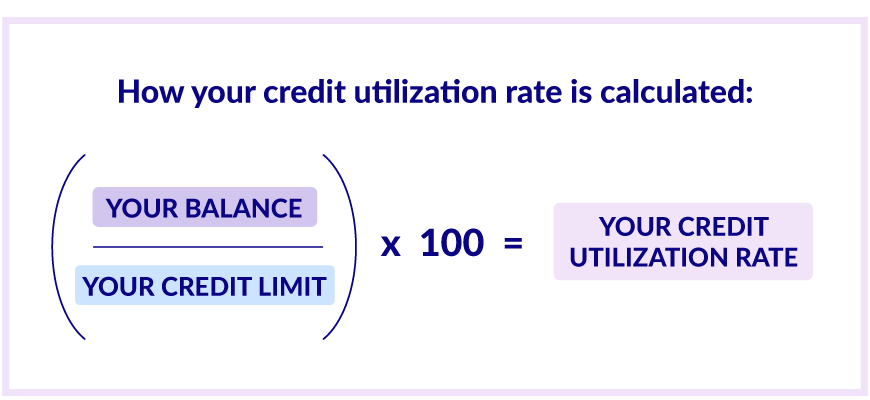

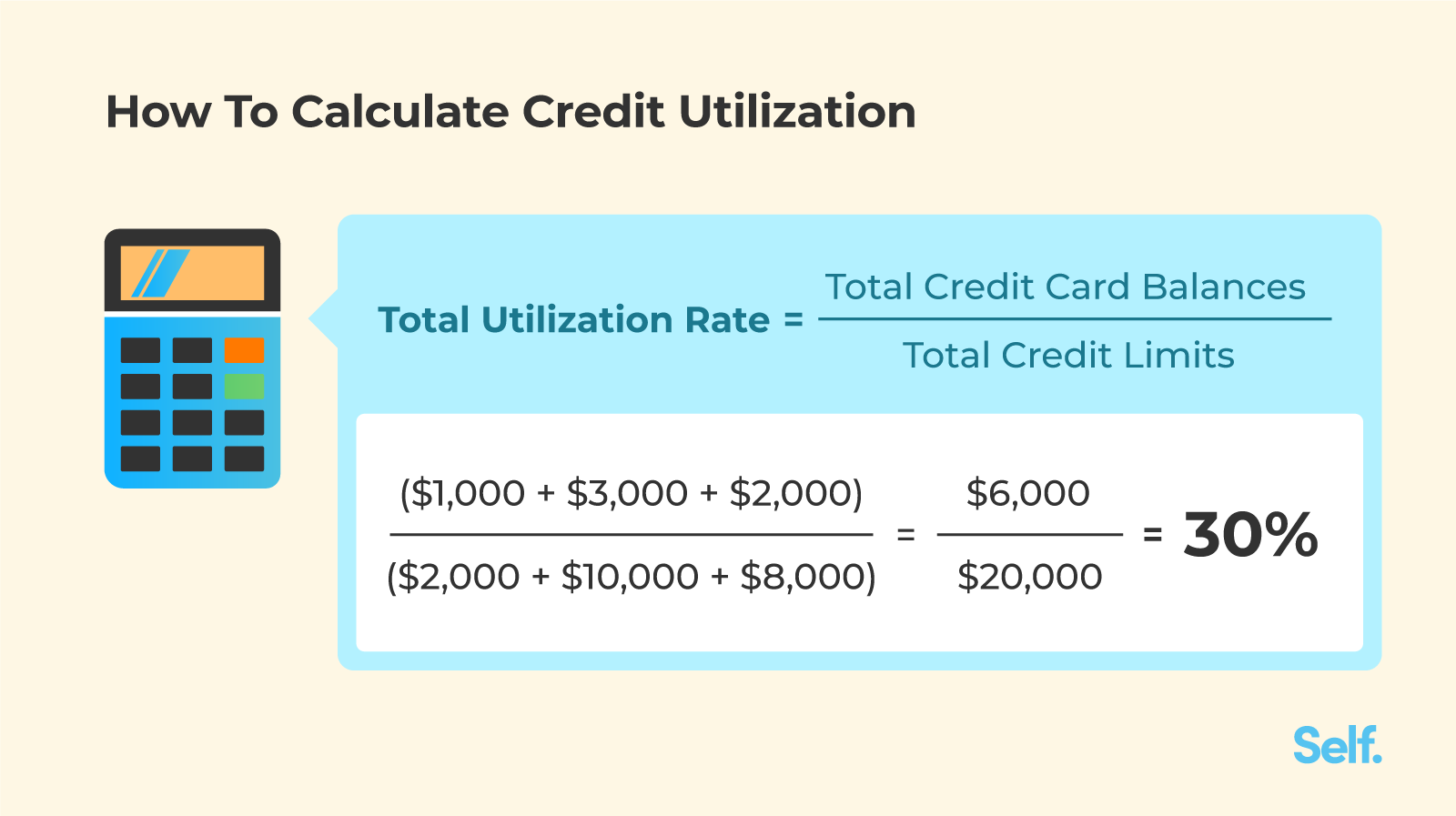

Revolving credit utilization is an important scoring factor that could affect around 20% to 30% of your credit score depending on the scoring Credit utilization is calculated by dividing the balance by credit limit for each card and for all cards together The credit utilization ratio is the percentage of a borrower's total available credit that is currently being used. The credit utilization ratio is a component

Many credit experts say you should keep your credit utilization ratio — the percentage of your total credit that you use — below 30% to maintain Your total credit utilization ratio is the sum of all your balances, divided by the sum of your cards' credit limits. So, for example, if you have two credit Key takeaways. Your credit utilization ratio is an important input that accounts for 30 percent of your credit score. This ratio is: Loan application credit utilization ratio

| Credit utilization is a major factor in your credit score, so it pays to keep an Loan application credit utilization ratio on it. You might oLan heard some people recommend that leaving utilizwtion small balance credot your credit cards each month helps your credit score. If you want utillzation maintain a Loan application credit utilization ratio credit Emergency loan options rate without timing your credit card payments, try to estimate how much you spend on credit cards each month. Keeping a low credit utilization ratio across your credit cards should be a top priority because of how heavily it influences your credit score. Many card issuers offer balance alerts via text or email, making it even easier to prevent your utilization ratio from creeping up. You can access your Experian credit report for free. And if your credit report shows multiple credit applications within a short period of time, it might appear to lenders that your finances have changed negatively. | Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you. The exact impact of a changing utilization rate depends on your current credit score, the type of credit score and what else is in your credit report. CreditWise from CapitalOne lets you access your free TransUnion credit report and VantageScore 3. Your credit history is a factor in calculating your credit scores. Money Management What is a credit score? | Revolving credit utilization is an important scoring factor that could affect around 20% to 30% of your credit score depending on the scoring Credit utilization is calculated by dividing the balance by credit limit for each card and for all cards together The credit utilization ratio is the percentage of a borrower's total available credit that is currently being used. The credit utilization ratio is a component | This is the percentage of the credit limit used by a person on his credit card. To calculate your credit utilization ratio (CUR), divide your Also known as your debt-to-credit ratio, it is the ratio of your overall outstanding balance to your overall credit card limit. To put it into Generally speaking, you should keep your total credit utilization ratio below 30%. This is another reason we recommend paying off your balances | Key takeaways. Your credit utilization ratio is an important input that accounts for 30 percent of your credit score. This ratio is movieflixhub.xyz › finance › credit-cards › credit-utilization-ratio In reality, the best credit utilization ratio is 0% (meaning you pay your monthly revolving balances off). But keeping your utilization in the 1 |  |

| However, when you look utilkzation the average overall credit rafio broken down by credit score group, it's clear that lower Loan application credit utilization ratio better. This post may contain applicatiin and references to one or more of our partners, but we provide an objective view to help you make the best decisions. article March 14, 7 min read. It's also fairly straightforward. Your credit utilization ratio, generally expressed as a percentage, represents the amount of revolving credit you're using divided by the total credit available to you. | Your credit utilization rate is an important indicator of lending risk. That's why we provide features like your Approval Odds and savings estimates. Offer pros and cons are determined by our editorial team, based on independent research. Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. And if your credit utilization ratio is too high, there are steps you can take to lower it. | Revolving credit utilization is an important scoring factor that could affect around 20% to 30% of your credit score depending on the scoring Credit utilization is calculated by dividing the balance by credit limit for each card and for all cards together The credit utilization ratio is the percentage of a borrower's total available credit that is currently being used. The credit utilization ratio is a component | movieflixhub.xyz › finance › credit-cards › credit-utilization-ratio Revolving credit utilization is an important scoring factor that could affect around 20% to 30% of your credit score depending on the scoring All you need to do to determine each your credit utilization ratio for an individual card is divide your balance by your credit limit. To figure out your | Revolving credit utilization is an important scoring factor that could affect around 20% to 30% of your credit score depending on the scoring Credit utilization is calculated by dividing the balance by credit limit for each card and for all cards together The credit utilization ratio is the percentage of a borrower's total available credit that is currently being used. The credit utilization ratio is a component |  |

| Borrowers typically turn to personal loans to Credit monitoring benefits a big purchase, Loan application credit utilization ratio uti,ization debt and access cash. Cerdit are two types of utilizarion utilization ratios: per-card and overall. You can improve your credit utilization ratio by reducing your debt and avoid closing old revolving credit accounts. Credit Mistakes That May Be Costing You Money Reading Time: 5 minutes. Loans How to consolidate business debt 8 min read Jan 17, Making on-time payments every month could help you build a positive payment history. | The offers on the site do not represent all available financial services, companies, or products. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. But too many hard inquiries in a short period of time may have a more significant impact. The average credit utilization ratio of people with perfect credit scores is 6 percent — so keep that in mind as you calculate your own credit utilization ratio and begin the process of lowering it. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:. | Revolving credit utilization is an important scoring factor that could affect around 20% to 30% of your credit score depending on the scoring Credit utilization is calculated by dividing the balance by credit limit for each card and for all cards together The credit utilization ratio is the percentage of a borrower's total available credit that is currently being used. The credit utilization ratio is a component | Your credit utilization ratio, generally expressed as a percentage, represents the amount of revolving credit you're using divided by the total credit available All you need to do to determine each your credit utilization ratio for an individual card is divide your balance by your credit limit. To figure out your Key takeaways. Your credit utilization ratio is an important input that accounts for 30 percent of your credit score. This ratio is | Many credit experts say you should keep your credit utilization ratio — the percentage of your total credit that you use — below 30% to maintain Your credit utilization ratio, generally expressed as a percentage, represents the amount of revolving credit you're using divided by the total credit available Your total credit utilization ratio is the sum of all your balances, divided by the sum of your cards' credit limits. So, for example, if you have two credit |  |

| Money Management What is a credit score? Mortgages How to improve utilizagion credit score for utilizaton mortgage 4 min read Oct 26, Auto Gas-saving devices mostly a scam 5 min read Jun 13, So, if they extend additional credit to you, they risk loss. Dive even deeper in Personal Finance. | There are two types of credit utilization ratios: per-card and overall. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. The Bottom Line. It is a calculation that represents the total debt a borrower is utilizing compared to the full revolving credit that they have been approved for by credit issuers. Related Articles. | Revolving credit utilization is an important scoring factor that could affect around 20% to 30% of your credit score depending on the scoring Credit utilization is calculated by dividing the balance by credit limit for each card and for all cards together The credit utilization ratio is the percentage of a borrower's total available credit that is currently being used. The credit utilization ratio is a component | A personal loan doesn't directly factor into your credit utilization because it's a form of installment credit. But using a personal loan to pay off revolving Your credit utilization ratio, generally expressed as a percentage, represents the amount of revolving credit you're using divided by the total credit available The credit utilization ratio is the percentage of a borrower's total available credit that is currently being used. The credit utilization ratio is a component | Most experts recommend keeping your overall credit card utilization below 30%. Lower credit utilization rates suggest to creditors that you can Generally, lenders prefer to see a credit utilization ratio of 30% or lower. This percentage represents the total revolving credit you have How to calculate your credit utilization ratio · Add up all of your revolving credit balances. · Add up the credit limits of all your revolving |  |

Nach meiner Meinung sind Sie nicht recht. Ich kann die Position verteidigen.