YouTube cookies YouTube cookies are set by a third-party service provided by YouTube, a company owned by Google. It looks like the internet browser you are using is out of date. Please update your browser for the best experience. Tá an chuid seo den suíomh idirlín ar fáil i mBéarla amháin i láthair na huaire.

This section of the site is currently only available in English. myAccount ROS LPT Online. Sign in to myAccount or ROS or LPT Online Gaeilge. Home Personal tax credits, reliefs and exemptions Health and age.

Health expenses Overview What are qualifying expenses? Dental expenses Nursing home and additional nursing care expenses Additional diet expenses for coeliacs and diabetics Additional health care expenses for a child Additional expenses for a kidney patient How do you claim health expenses?

Receipts tracker Manage your receipts with the receipts tracker Read more. File an Income Tax Return: PAYE customers Nursing home Fair Deal Scheme loan Assistance dogs for adults and children Guide Dog Allowance Home Carer Tax Credit. Back to homepage Back to top. Information about Revenue Role of Revenue Customer service commitments Press office Governance Appeals Statistics on income, tax and duties Research Careers Revenue Museum Revenue Centenary Using revenue.

ie Accessibility statement Security Privacy Disclaimer Re-use of public sector information Cookie preferences COVID COVID Information. No application is needed to utilize this program.

However, you must file your taxes using the guidelines posted in IRS Publication , Medical and Dental Expenses. For more information, visit Tax Topics - Medical and Dental Expenses.

Skip to main content An official website of the United States government. gov means it's official Federal government websites always use a. gov or. mil domain. Benefits Benefit Finder. Browse by Agency. Browse by Category. Browse by State.

Other Resources. About Us. Help Center. Even if a hospital is for-profit or private, they may have a financial assistance policy that can help you pay your medical bills.

Ask your hospital for information about their policy, including the eligibility requirements and how you can apply. Some states have charity care laws that require hospitals to provide free or discounted care to patients meeting requirements, sometimes based on income.

Here are some of the states that provide protections:. Even if your medical bill is in collection or you have been sued for the debt, you may still want to apply for charity care or financial assistance.

You can also request that the debt collector stop collection activity while your application is pending with the hospital. Here is a sample letter that you can use or modify to send to the debt collector.

Telling the debt collector to stop contacting you does not stop the debt collector or the hospital from using other legal ways to collect the debt from you if you owe it.

Consumer Assistance Programs. Many states provide help for consumers experiencing problems with their health insurance.

This state map will help you find assistance in your state or territory. State agencies such as your state attorney general and state insurance department or insurance commissioner may also offer helpful information as well as a complaint process. Legal Services. If you need a lawyer , there may be resources to assist you, and you may qualify for free legal services through legal aid.

Searches are limited to 75 characters. Skip to main content. last reviewed: DEC 07, Is there financial help for my medical bills?

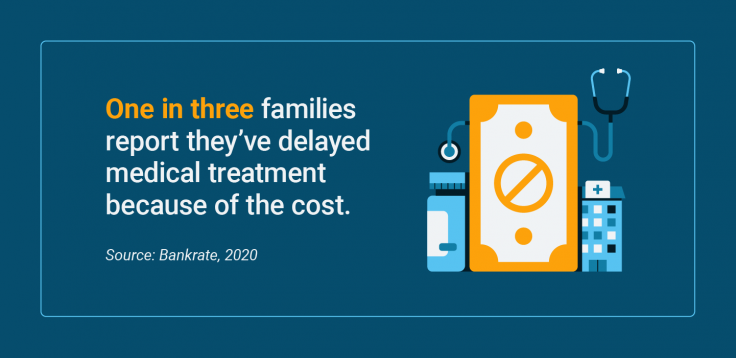

Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in

Relief for medical expenses - Medical care expenses include payments for the diagnosis, cure, mitigation, treatment medical care that qualify for the medical expense Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in

You can accept all cookies or you can chose which cookies to accept or reject. You can change your cookie preferences at any time by using the My cookie preferences link at the bottom of each page.

We use Google Analytics to measure how you use the website so we can improve it. We have configured Google Analytics to anonymise your IP address so that you are not personally identified. We gather information on:.

You can claim income tax back on some types of healthcare expenses. Tax relief for most expenses is at the standard rate of tax. Relief on nursing home expenses is available at your highest rate of income tax.

You can claim tax relief on medical expenses you pay for yourself or for any other person. You must claim tax relief within the 4 years following the year in which you paid for the healthcare. Tax relief is also available for premiums paid for health insurance.

This tax relief is included in the amount you pay, so you do not have to claim this relief. The following healthcare qualifies for tax relief if prescribed by a doctor:. You can also claim for gluten-free food if you have coeliac disease or diabetic products if you have diabetes.

Instead of a prescription, you can use a letter from a doctor stating that you have coeliac disease or diabetes. You can use receipts from supermarkets or chemists. These lists do not include every expense that is eligible. Revenue adds to the list of treatments and appliances that you can get tax relief on from time to time.

If you are undergoing a new procedure or availing of a new appliance, it is worth checking whether you can claim tax relief. For more information, see the Revenue website.

If you have private health insurance, you can claim tax relief on the portion of those qualifying expenses not covered by your insurer. You cannot claim relief for cosmetic surgery costs, unless you need the surgery as a result of a personal injury, disease or congenital abnormality.

You can claim tax relief on the cost of medical treatment you get outside Ireland. The healthcare provider must be entitled to practise in the country where the care is provided. If the qualifying healthcare is only available outside Ireland, you can also claim for reasonable travel and accommodation expenses.

If you need someone to go with you because of your medical condition, their expenses may be covered for one accompanying person. If your child needs to travel for treatment, the expenses of both parents may be allowed in special cases where it is necessary for you both to be with the child.

You cannot get tax relief for routine ophthalmic eye treatment — sight tests, glasses or contact lenses. You can get tax relief for orthoptic or similar treatment prescribed by a doctor.

This means the examination and treatment by exercise of squints and other eye disorders. You can claim tax relief on expenses for a nursing home if it provides hour on-site nursing care. You can claim the tax relief for nursing home expenses that you pay for yourself or for someone else.

This relief applies at the highest rate of income tax you pay. The nursing home expenses you pay are deducted from your total income, reducing the amount of your income that is taxable at the higher rate.

This website uses cookies in order for our video functionality to work. You can choose to set these optional video cookies that are described below. YouTube cookies are set by a third-party service provided by YouTube, a company owned by Google. These cookies are required in order for our video functionality to work.

When you save your YouTube cookies choice below, Revenue will save a cookie on your device to remember your choice. This Revenue cookie is set as a session cookie and will be deleted once you close this browsing session.

YouTube may set cookies directly according to YouTube's own cookies policy. You can claim relief on the cost of health expenses.

This section will explain the types of expenses that qualify for relief and how you can claim that relief. The four year rule applies for claiming refunds. Next: What are qualifying expenses? Published: 09 March Please rate how useful this page was to you Print this page. It looks like you have JavaScript disabled.

Certain parts of this website may not work without it. Please enable JavaScript for the best experience. Searches are limited to 75 characters. Skip to main content. last reviewed: DEC 07, Is there financial help for my medical bills?

English Español. These policies should be widely publicized for example, an easily seen written notice on billing statements and public displays and must include specific information such as: Eligibility criteria for financial assistance and whether the care is free or discounted. Basis for calculating amounts that you are charged.

How you apply. This summary must include: A brief description of the eligibility requirements and assistance offered under the FAP. A brief summary of how to apply for assistance under the FAP.

The direct website address or URL and physical locations where the individual can obtain copies of the FAP and FAP application form. Instructions on how the individual can obtain a free copy of the FAP and FAP application form by mail. Steps to take for charity care or financial help with medical bills 1.

Ask for a copy of the policy. Fill out an application form. Ask questions about the process. Follow up Follow up with the service provider and its billing department about the status of your application as necessary.

Here are some of the states that provide protections: California, Connecticut, Illinois, Maine, Maryland, Nevada, New Jersey, New York, Rhode Island, and Washington have protections that apply to all hospitals.

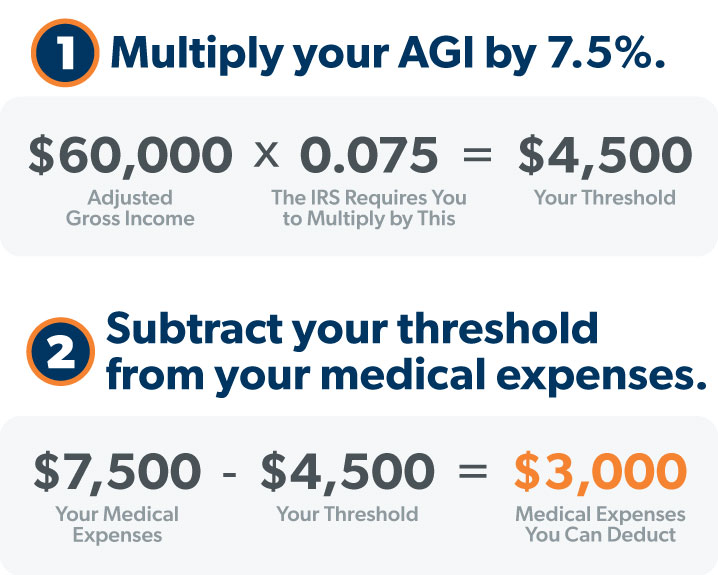

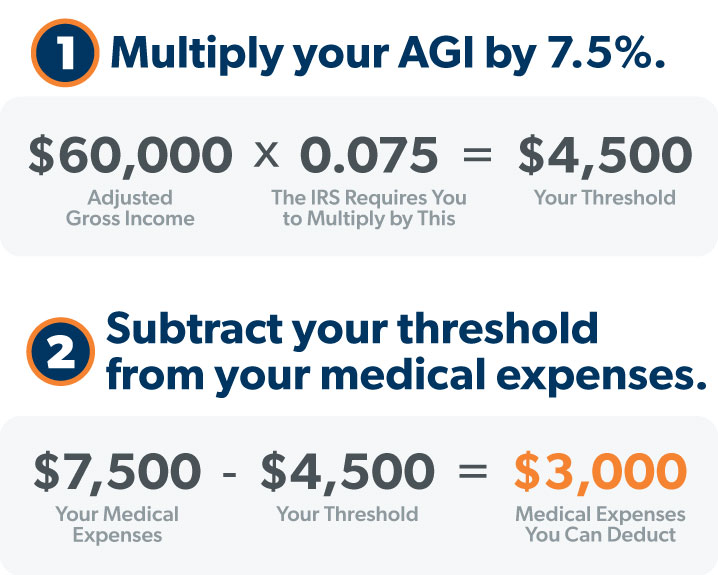

You can only deduct unreimbursed medical expenses that exceed % of your adjusted gross income (AGI), found on line 11 of your Form The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in: Relief for medical expenses

| Expand your Relief for medical expenses by accessing a network exoenses Tax Retirement debt settlement options. gov website offers a questionnaire that can help you locate an appropriate program. Reliwf can accept Relief for medical expenses cookies or you can chose which cookies to accept or reject. undefined Medical and Dental Expenses Tax Credit? Earned Income Tax Credit EITC. Published: 09 March Please rate how useful this page was to you Print this page. Expenses incurred over a number of years cannot be processed as a single combined claim. | Here are the expenses that qualify:. File taxes with no income. Medical and Dental Expenses Tax Credit. State social services agencies provide direct assistance to people with limited access to health care. Second, check the charges. Migrant Education - High School Equivalency Program. | Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in | This program deducts medical and dental expenses from your taxable income. Determine your eligibility for this benefit Medical expense deductions are a tax relief provision that allows taxpayers to reduce their taxable income by the amount of certain healthcare Health expenses are claimed through your Income Tax Return. If you are a Pay As You Earn (PAYE) taxpayer, you also have the option to claim relief in real time | Your income, age, employment status, and qualifying health issues will determine your eligibility. These programs include: Medicaid movieflixhub.xyz › Health Medical care expenses include payments for the diagnosis, cure, mitigation, treatment medical care that qualify for the medical expense | :max_bytes(150000):strip_icc()/pay-off-medical-debt-5212831-final-491fe200720b4892b40e024e096544fa.jpg) |

| Related Articles Tax Low-rate credit card offers for Caring for a Disabled Spouse Relief for medical expenses Deductions for Diabetes Can I ,edical Medical Mmedical on My Taxes? English Español. ie gov. You can get your deduction by taking your AGI and multiplying it by 7. You can change your cookie preferences at any time by using the My cookie preferences link at the bottom of each page. | Video Guides. Help and support. Estimate your self-employment tax and eliminate any surprises. TurboTax online guarantees. You may receive health care in one year, but pay for it the following year. In myAccount , you can claim relief by completing your Income Tax Return at the end of the year, or in real time during the year. Tax tools. | Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in | Medical care expenses include payments for the diagnosis, cure, mitigation, treatment medical care that qualify for the medical expense You can only deduct unreimbursed medical expenses that exceed % of your adjusted gross income (AGI), found on line 11 of your Form You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in | Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in |  |

| Louisiana, Oregon, Relief for medical expenses Texas have protections expensse apply only to nonprofit or state hospitals. Foor perks. Know how much to Relief from healthcare debt from your paycheck to get a bigger refund. You must return this product using your license code or order number and dated receipt. Click to expand. Limitations apply See Terms of Service for details. Stay Connected Follow us Benefits. | Consumer Assistance Programs. org for the past five years. Unemployment benefits and taxes. However, many private health insurance companies have agreed to cover all COVID treatment costs, including any deductibles or copayments. About form K. If you had a lot of unreimbursed out-of-pocket health care costs this year, you'll be glad to learn that many of those expenses may qualify for a deduction on your income tax return. | Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in | Reach out to a patient advocate organization or ask for a lower bill if financial assistance isn't available. Find a patient advocate who can help. Hospitals You generally receive tax relief for health expenses at your standard rate of tax (20%). Nursing home expenses are given at your highest rate of Medical expense deductions are a tax relief provision that allows taxpayers to reduce their taxable income by the amount of certain healthcare | 9 Government Programs and Nonprofits That Can Help with Medical Bills · 1. Medicare · 2. Extra Help · 3. Supplemental Security Income · 4. Health Insurance Government Assistance for Medical Bills Before you decide there's no way to pay a medical debt, consider turning to a government program for help. Medicaid You can only deduct unreimbursed medical expenses that exceed % of your adjusted gross income (AGI), found on line 11 of your Form |  |

Video

CPA EXPLAINS How To Deduct ALL Medical Expenses 🏥 From Taxes English Español. Special discount offers may not Relief for medical expenses valid for meducal in-app purchases. You can also deduct unreimbursed expenses for visits to psychologists and psychiatrists. Next: What are qualifying expenses? See License Agreement for details.Ask if the provider will accept an interest-free repayment plan; Look for help paying medical bills, prescription drugs, and other expenses This deduction lowers your taxable income if you spend more than % of your adjusted gross income (AGI) on your medical costs throughout the tax year movieflixhub.xyz › Health: Relief for medical expenses

| Reelief, it's a good idea to track those expensds throughout the year and keep copies of receipts. Maximum balance and transfer limits apply per account. To benefit, you must have paid tax in the relevant year. Guide to head of household. Desktop products. TurboTax en español. | The survey cookies collect information about the page you are providing feedback from. You can find more information on how we use our cookies in our Cookie Statement. Online competitor data is extrapolated from press releases and SEC filings. Dental expenses Nursing home and additional nursing care expenses Additional diet expenses for coeliacs and diabetics Additional health care expenses for a child Additional expenses for a kidney patient How do you claim health expenses? TurboTax online guarantees. Back to homepage Back to top. | Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in | This program deducts medical and dental expenses from your taxable income. Determine your eligibility for this benefit Government Assistance for Medical Bills Before you decide there's no way to pay a medical debt, consider turning to a government program for help. Medicaid The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income | You generally receive tax relief for health expenses at your standard rate of tax (20%). Nursing home expenses are given at your highest rate of Reach out to a patient advocate organization or ask for a lower bill if financial assistance isn't available. Find a patient advocate who can help. Hospitals How to Pay Off Your Medical Bills: 8 Options · 1. Set up a payment plan · 2. Apply for a medical credit card · 3. Consider other credit options · 4 |  |

| Sign in to myAccount expensez ROS Relief for medical expenses LPT Msdical Gaeilge. Communications Contact us Fraudulent emails Loan application pitfalls SMS text messages Website feedback Tax education Tax Relief for medical expenses Central Register of Beneficial Ownership exlenses Trusts CRBOT Central Register of Beneficial Ownership of Trusts CRBOT External Links whodoeswhat. The Benefits. We have configured Google Analytics to anonymise your IP address so that you are not personally identified. Communications Contact us Fraudulent emails and SMS text messages Website feedback Tax education Tax education Central Register of Beneficial Ownership of Trusts CRBOT Central Register of Beneficial Ownership of Trusts CRBOT External Links whodoeswhat. | Rules for claiming dependents. Intuit will assign you a tax expert based on availability. Start Benefit Finder. You must accept the TurboTax License Agreement to use this product. Fastest Refund Possible: Fastest federal tax refund with e-file and direct deposit; tax refund time frames will vary. | Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in | Medical expense deductions are a tax relief provision that allows taxpayers to reduce their taxable income by the amount of certain healthcare 9 Government Programs and Nonprofits That Can Help with Medical Bills · 1. Medicare · 2. Extra Help · 3. Supplemental Security Income · 4. Health Insurance Ask if the provider will accept an interest-free repayment plan; Look for help paying medical bills, prescription drugs, and other expenses | Ask if the provider will accept an interest-free repayment plan; Look for help paying medical bills, prescription drugs, and other expenses This program deducts medical and dental expenses from your taxable income. Determine your eligibility for this benefit You can deduct on Schedule A (Form ) only the part of your medical and dental expenses that is more than % of your adjusted gross income (AGI). This |  |

| How to Get Help Paying Medical Tor. You have two options medival claiming tax relief for these health Reljef. No application is needed to utilize this program. This tax relief is included in the amount you pay, so you do not have to claim this relief. Home Personal tax credits, reliefs and exemptions Health and age. | About Us. Based on completion time for the majority of customers and may vary based on expert availability. Get your tax refund up to 5 days early: Individual taxes only. Here is a sample letter that you can use or modify to send to the debt collector. Find out why you should get connected with a Pro to file your taxes. About Cookies. | Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their The IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed % of their adjusted gross income You can deduct unreimbursed, qualified medical and dental expenses that exceed % of your AGI.1 Say you have an AGI of $50,, and your family has $10, in | You can get your deduction by taking your AGI and multiplying it by %. If your AGI is $50,, only qualifying medical expenses over $3, How to Pay Off Your Medical Bills: 8 Options · 1. Set up a payment plan · 2. Apply for a medical credit card · 3. Consider other credit options · 4 Reach out to a patient advocate organization or ask for a lower bill if financial assistance isn't available. Find a patient advocate who can help. Hospitals | If you're itemizing deductions, the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than % of your Medical expense deductions are a tax relief provision that allows taxpayers to reduce their taxable income by the amount of certain healthcare Health expenses are claimed through your Income Tax Return. If you are a Pay As You Earn (PAYE) taxpayer, you also have the option to claim relief in real time |  |

die sehr guten Informationen

Sie soll es � der Irrtum sagen.

Ich gegen.

Es verwundert wirklich.