If you agree to let an employer look at your credit report, it may also be used to make employment decisions about you. Searches are limited to 75 characters. Skip to main content. last reviewed: JAN 29, What is a credit report?

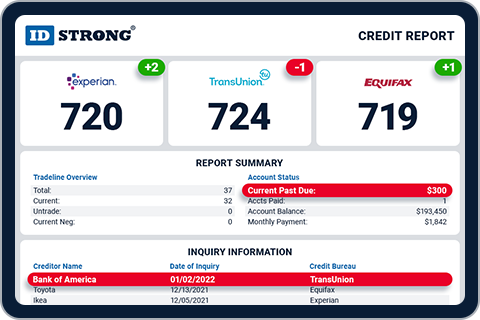

English Español. What kind of information appears on a credit report? Credit reports often contain the following information: Personal information Your name and any name you may have used in the past in connection with a credit account, including nicknames Current and former addresses Birth date Social Security number Phone numbers Credit accounts Current and historical credit accounts, including the type of account mortgage, installment, revolving, etc.

The credit limit or amount Account balance Account payment history The date the account was opened and closed The name of the creditor Collection items Missed payments Loans sent to collections Information on overdue child support provided by a state or local child support agency or verified by any local, state, or federal government agency Public records Liens Foreclosures Bankruptcies Civil suits and judgments Inquiries Companies that have accessed your credit report.

Don't see what you're looking for? Browse related questions How long does negative information remain on my credit report? Millions of systems worldwide rely on Bitdefender to keep them safe. Some alerts are more urgent than others and may require different actions.

After the purchase you will receive an email with the instructions to activate the service. Click on Get Started button, create a Bitdefender account or log in to an existing account and the service will be active.

To use the service, follow the onboarding steps. You do not have to download anything, as Bitdefender Identity Theft Protection is an online service.

You gain access to a web dashboard where you can monitor all your personal accounts in real time. Online shopping offers the incredible convenience of a quick purchase from your phone, tablet or PC anytime, anywhere.

However, this convenience can expose you to fraud and identity theft. Hackers can sometimes access private website data and obtain your credit card details and other personal information.

Once they have this data, they may sell it or use it to shop with your credit or debit card numbers, or even open other financial accounts under your identity. With Bitdefender Identity Theft Protection, you will always know if your identity is at risk so you can take immediate action.

Home Solutions Bitdefender Identity Theft Protection. Bitdefender Identity Theft Protection. Choose Your Plan. Overview Awards Why you need protection Benefits Features Compare FAQ Choose Your Plan.

Choose your plan Start protecting your identity — it only takes a minute. Yearly Monthly. BUY NOW. Make unauthorized purchases using your cards. File a tax return using your Social Security number. Use your health insurance to get medical care. Pass an employment background check or rent an apartment, using your identity and financial standing.

The best protection for your identity Bitdefender Identity Theft Protection goes beyond credit monitoring to protect you against identity theft threats you might not always recognize. Continuous Monitoring Bitdefender Identity Theft Protection monitors social media, the internet and the Dark Web to protect your sensitive information.

Instant Alerts Whenever your information leaks or a fraudulent attempt happens, Bitdefender Identity Theft Protection alerts you nearly instantly with comprehensive notifications. Data Control Bitdefender Identity Theft Protection helps you stay in total control of your data and gives you knowledge to understand where or how your information is being used online.

Identity Theft Insurance Identity theft is costly and time-consuming. Select Windows macOS iOS Android Standard Premium. Monitoring We protect your identity and privacy with innovative and proactive identity theft protection technologies.

Personalized Breach Monitoring Breach Monitor provides hyper-personalized intelligence to show how your identity is impacted. Dark Web Threat Monitoring Bitdefender scours thousands of websites, including on the Dark Web, black market chat rooms, blogs, and other sources to detect the illegal sale of your personal information.

Smart SSN Tracker Secure Social Security number tracking alerts you if an unfamiliar name, alias or address is associated with your SSN - a possible sign of fraud.

Social Media Identity Monitoring This suite of services monitors your Facebook, Twitter, YouTube and Instagram accounts for activity and posts that could be perceived as violent, use profanity, or could be categorized as cyberbullying or discriminatory.

Medical ID Fraud Protection Bitdefender helps you review your medical benefits statements to ensure that you and your family are the only ones using your medical benefits.

Fraud Alert Reminders With Advanced Fraud Monitoring, you are promptly notified if your identity is used to apply for a new credit card, wireless device, utility payments, check reorder, mortgage or car loan.

Identity Threat Alerts Bitdefender keeps you updated on major data breaches, identity theft incidents and new identity theft laws. Credit We offer complete financial protection to protect your money, valuable assets and future plans. Instant Credit Inquiry Alerts You are promptly notified if your identity is used to apply for a new credit card, wireless device, utility payments, check reorder, mortgage or car loan application.

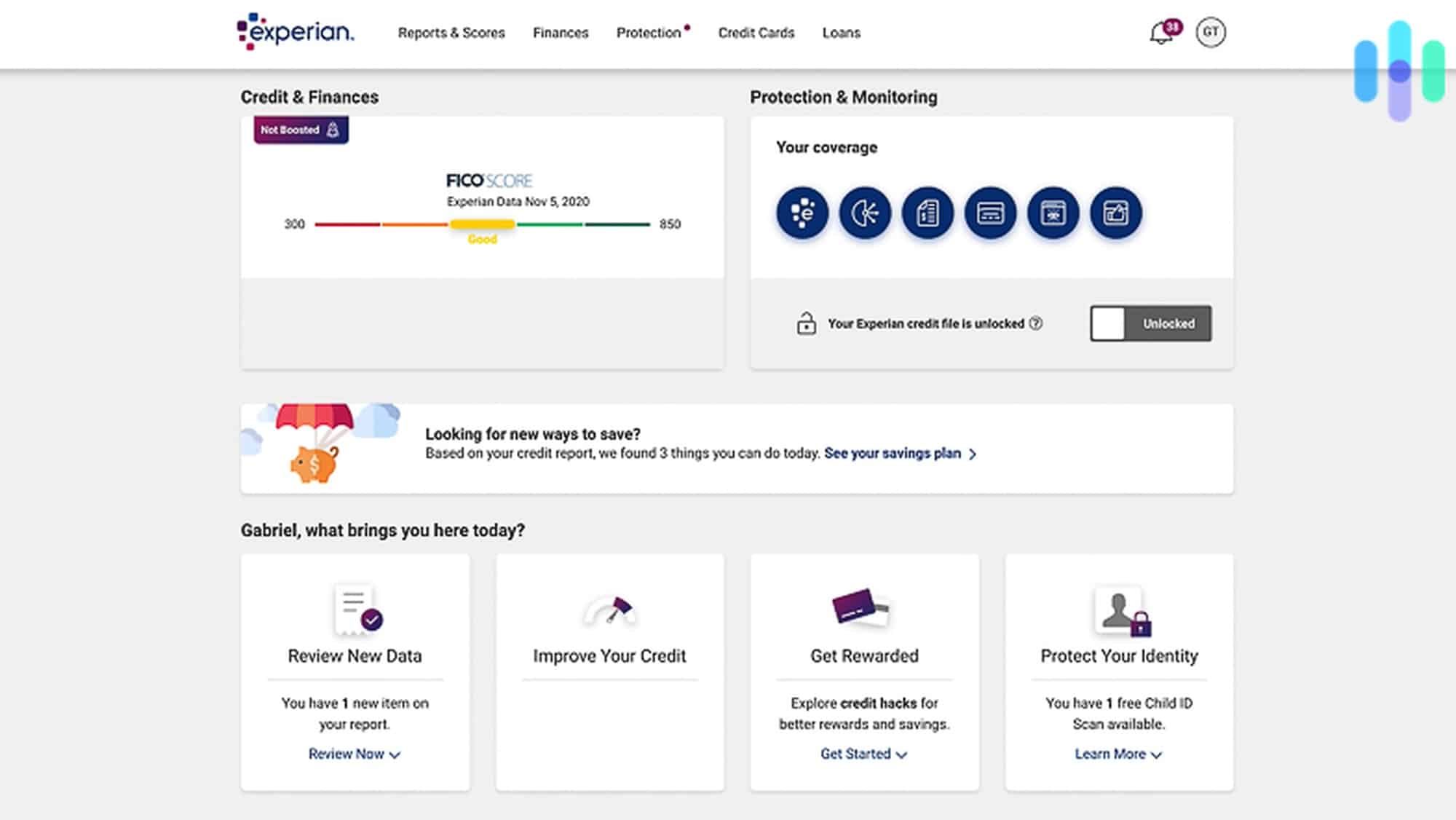

Credit Score Tracker Track your credit scores with a month-by-month graph to see how and why your score changes. Recovery If you fall victim to identity theft, we will work to fix the issue, from start to finish.

Lost Wallet Protection Quickly cancel and replace credit, debit and ATM cards if your wallet is lost or stolen. Customer Support Our experienced professionals are on call to answer your questions and provide support, resolution and restoration.

Junk Mail and Call Opt-Out Your junk mail attracts identity thieves because it contains personal and financial information they can use to open fraudulent accounts or apply for loans.

Manage Credit Freeze Dedicated ID Theft Protection specialists help you navigate through initiating a credit freeze or disputing fraudulent activity on your credit report. Investment Account Alerts PREMIUM Early warning detection of fraud related to deposits, withdrawals, duplicate transactions or balance transfers related to your K , brokerage and financial accounts, lets you address potential criminal activity.

Change of Address PREMIUM Criminals typically change your mailing address to steal your personal information. Court Records Monitoring PREMIUM Bitdefender has the power to search millions of criminal, court and public records to make sure your identity is not used by unauthorized individuals.

Sex Offender Registry Monitoring PREMIUM Bitdefender keeps a close eye on sex offender registries for illegal use of your identity. Multiple Bureau Credit PREMIUM Our Premium plan lets you have up to three bureaus for credit monitoring, reports and scores.

Choose the best plan for you Compare our Bitdefender Identity Theft Protection plans and choose the level of protection and peace of mind you need. Bitdefender Identity Theft Protection Standard. Buy Now. See Terms of Use below. Bitdefender Identity Theft Protection Premium. Change of Address Monitoring.

Court Records Monitoring. Sex Offender Registry Monitoring. Identity Theft Insurance. Breach Monitoring. Smart SSN Tracker. Medical ID Fraud Protection. Credit Score Simulator. Credit Score Tracker. Lost Wallet Protection.

White Glove Identity Restoration. Manage Credit Freeze. User guide. Frequently asked questions. Why is protecting my identity so important? What are data breaches and how can they impact me? How can Bitdefender Identity Theft Protection help me?

Continuous monitoring of your medical accounts. Comprehensive monitoring of your SSN, email address and phone numbers in places where they should not be listed, including the Dark Web.

Alerting you to any changes in your address, court records in your name, and payday loans taken out in your name.

When you sign in, we also alert you to significant data breaches. With our Premium plan, we monitor your credit score with the three major agencies and provide access to your credit report. Where does Bitdefender Identity Theft Protection look for data? What are the differences between the Standard and Premium plans?

Freezing your credit reports is one way to protect your credit; initiating a credit lock on them is another. Locking your credit is something you can do with IdentityIQ is a leader in identity theft protection and credit protection services. Offering credit monitoring, Identity insurance, and antivirus To help better protect yourself from identity theft, use Lock & Alert to lock your Equifax credit report, or place a security freeze on your Equifax, Experian

Credit report protection - Compare our protection plans. ; Identity Protection. $per month · Monitoring your information for signs of Identity Theft ; Total Protection. $per month Freezing your credit reports is one way to protect your credit; initiating a credit lock on them is another. Locking your credit is something you can do with IdentityIQ is a leader in identity theft protection and credit protection services. Offering credit monitoring, Identity insurance, and antivirus To help better protect yourself from identity theft, use Lock & Alert to lock your Equifax credit report, or place a security freeze on your Equifax, Experian

If the information is incorrect, the credit bureau is legally required to correct or remove it. Credit monitoring services are another way to help safeguard your credit. These companies monitor your credit reports for new activity and send you alerts when things like new credit lines or inquiries for credit show up on your report.

While this won't block anyone from accessing your credit history, it can help you stay aware of who may be trying to open accounts in your name. When comparing the best credit monitoring services , be sure to check the fees since not all of them are free.

Also, make sure you know which credit reports are being monitored; some services review just one of your credit reports, versus two or all three. A credit lock can be a good idea if you are concerned about identity theft and aren't planning to apply for new credit in the near future. Otherwise you'll need to remember to unlock your credit reports so that the lenders you're applying to can gave access to them.

Credit locks are not subject to the same federal laws as credit freezes, and credit bureaus are free to change their terms. In general a credit lock should last until you unlock it. However, if your credit lock is part of a paid subscription service, it may expire if you fail to renew.

A credit freeze can last indefinitely—until you remove it. A credit lock is a relatively simple precaution you can take to safeguard your credit reports and financial identity. However, there are also other ways to accomplish that, which may be cheaper and provide greater consumer protections.

Federal Trade Commission Consumer Advice. PIRG Education Fund. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. What Is a Credit Lock? Lock vs. Freeze vs. Fraud Alert.

How to Lock Your Credit. Other Ways to Protect Your Credit. The Bottom Line. Trending Videos. Key Takeaways A credit lock can be a simpler way to control access to your credit report than a credit freeze.

Unlike a credit freeze, you can initiate a credit lock from your mobile device. All three of the major credit bureaus—Equifax, Experian, and TransUnion—allow you to lock your credit files, although it isn't always free.

Answer 10 easy questions to get a free estimate of your FICO ® Score range. A poor credit score can not only affect the terms of financing you may receive, including interest rate, it can also prevent you from getting a loan or new line of credit altogether.

Sure, there are things you can do to protect and improve your credit score , but what about mistakes or fraudulent activity that may be negatively affecting your credit?

A poor credit score can be a hard pill to swallow when you're responsible for the poor rating-but it's even more painful when the poor rating isn't even your fault. In just the first six months of there were breaches, affecting around 12 million records!

Stolen information from such breaches can include Social Security and credit card numbers, bank account information, as well as medical records. And therein lies the importance of monitoring your credit score and credit history: the fact that even when you do everything you can to protect your rating and personal information, you do not have control over everyone else who has your personal data.

According to a report from the Identity Theft Resource Center and CyberScout , half of all data breaches come from the business sector, followed by health and medical records, data from education, the financial sector, and government and military breaches.

Simply put, there has never been a more important time in history to regularly monitor your credit reports to ensure there is no fraudulent activity that may be affecting your score.

Another reason to regularly monitor your credit report is the number of errors and inaccuracies that may be affecting your credit score. As a matter of fact, the number one consumer complaint posted on the Consumer Financial Protection Bureau's CFPB website concerned errors found in credit reports.

You will not receive an email notification when the registration is due to expire. The service does not cover transactions, such as credit or debit card transactions, and so will not cause any delays with financial products that are up and running.

Where the risk of fraud is very low, some companies may accept the application without contacting you separately to ensure the application is from you. This will minimise delay while continuing to protect you from fraud.

Please note that not all applications for products, finance and services will be checked; even with Protective Registration in place, you should continue to check your credit report regularly and may wish to consider a credit report monitoring alert.

Otherwise it will expire after the two-year period and the warning flag will be removed from your name and personal details. Please note: each person at an address who wishes to have Protective Registration must apply separately. You must live at the address for which you apply for Protective Registration.

However, if you own a property in the UK, which you are not residing at for example, if you live abroad and your details have been compromised, you can register the address in question. If you wish to renew the registration, you will need to reapply. Please note, Protective Registration is most effective in the first few months of your loss of personal data.

Continuing to use Protective Registration after the threat has diminished devalues the service, as more applications are subject to checks, and so those most at threat are harder to identify.

Click here to speak to an advisor. Necessary cookies Necessary cookies enable core functionality such as security, network management, and accessibility. User Experience cookies We'd like to set user experience cookies to help us to improve your experience using this website.

Our use of cookies We use necessary cookies to make our site work. Cifas Homepage. Newsroom Careers Contact Us. I'm an Individual and I need help I want to know what information Cifas holds on me.

I want help or advice on scams. Identity Protection Advice Victim of Impersonation. Cifas information for consumers. Data Sharing Membership of the National Fraud Database National Fraud Database Members.

Insider Threat Protect Solution Insider Threat Database Members. Intelligence Sharing Membership Organised Fraud Intelligence Group.

Video

Fraud Alerts vs Credit Freeze vs Credit LockCredit report protection - Compare our protection plans. ; Identity Protection. $per month · Monitoring your information for signs of Identity Theft ; Total Protection. $per month Freezing your credit reports is one way to protect your credit; initiating a credit lock on them is another. Locking your credit is something you can do with IdentityIQ is a leader in identity theft protection and credit protection services. Offering credit monitoring, Identity insurance, and antivirus To help better protect yourself from identity theft, use Lock & Alert to lock your Equifax credit report, or place a security freeze on your Equifax, Experian

Visit IdentityTheft. gov to report identity theft to the Federal Trade Commission and get a free personal recovery plan that:. gov has information - and recovery plans - for more than 30 types of identity theft, including tax refund fraud and child identity theft.

A fraud alert is used to inform creditors that you may be a victim of fraud. A fraud alert can make it harder for an identity thief to open accounts in your name. The fraud alert requires creditors to verify that you are the person adding new credit accounts or changing limits on existing credit accounts by contacting you at a phone number you have provided.

Contact any one of the credit reporting companies to place a fraud alert. They will share your request with the other credit reporting companies. The Federal Trade Commission's website provides additional information about your rights when recovering from identity theft.

Placing a fraud alert does not affect your credit score. It alerts creditors that you have been a victim of fraud and that they should take extra steps before extending new credit in your name. These extra steps may slow down the approval process for new credit.

Secure Transaction: For your protection, this website is secured with the highest level of SSL Certificate encryption. Identity theft basics. Identity theft basics Security freeze basics Data breach basics.

Protect your identity Identity theft basics What is identity theft? How does identity theft happen? Identity theft is a serious crime. Know the data on your credit report. Browse the list. Get started Basics. Learn how to get your credit reports You should check your credit reports at least once a year to make sure there are no errors that could keep you from getting credit or the best available terms on a loan.

Read more Learn about the difference between credit scores and credit reports Your credit reports and credit scores are both critical to your financial health, but they play very different roles. Read more Explore basics. Key terms.

Looking for ways to help others with money questions? Browse our database to see consumer complaints about credit reports Watch our webinar to get credit basics in four short modules See more resources to use with the people you serve.

They might use your information to break into your credit card account to run up thousands of dollars in purchases. They might access your online bank account and use the funds in it to rack up online buys.

Credit monitoring and identity theft protection services are two tools you can use to spot the signs of identity theft. Before the COVID pandemic, you were allowed to order one free report from each bureau once a year.

Throughout the pandemic, though, you can order a free report from each bureau once every week, which makes it easier to monitor your credit on your own. The bureaus had not announced, as of the writing of this story, when or if they were going to end the practice of allowing one free credit report every week.

Your credit reports will list your open credit card accounts and loans. It will also list whether you have any late or missed payments on these accounts during the last seven years. These are a sure sign that someone has stolen your identity. You can also check your online bank and credit card accounts regularly, looking for suspicious transactions or withdrawals.

If you see these, a criminal might have stolen the information they need to log into your accounts. If you do find suspicious activity on either your bank or credit card accounts or credit reports, call the bank, lender, or credit card provider behind these financial accounts immediately.

You want to cancel all credit cards that thieves have accessed and alert your bank that someone might be illegally withdrawing money from your account.

If you don't have the time to monitor your own financial accounts, you can use a service that monitors your credit for you. This could be free or paid. These services will monitor your credit reports for you, alerting you whenever a lender, bank or credit card provider checks your credit.

These credit inquiries are a sign that someone — hopefully you — is applying for new credit or loans under your name. If you receive an alert for a credit card that you applied for, you're fine.

If you instead receive one when you haven't applied for any credit cards? That's when you should be worried that a criminal is using your information to apply for a card in your name.

When shopping for a credit monitoring service, ask if the service tracks just one or all three of your credit reports. These credit reports track your applications for new credit, your payment history, and the amount of debt you've racked up.

Each of your three credit reports might contain slightly different information because not all of the financial institutions you do business with necessarily report back to all three of the major bureaus.

Credit monitoring could alert you if a company checks your credit history or if a new credit card account or loan is opened in your name, according to the Federal Trade Commission.

Companies that suffer data breaches that expose their customers' information often provide credit monitoring as a free service to help victims monitor their credit reports. Depending on who is affected by the breach, the free service can cover you or you and your dependent minor children.

Read the details before signing up for any service to know exactly what you are getting. If you want more complete protection against identity, you can pay for an identity theft protection service. While this service will monitor your credit reports, it could also search for your bank accounts, credit card accounts, and criminal databases for suspicious or fraudulent activity involving your personal and financial information.

These services might also help you recover from identity theft. An identity theft protection service may also alert consumers whose personal information is spotted on the dark web because an identity thief is selling it.

You may find that these services are available to you through your bank or insurance company, often for an additional fee, or you can work with an independent service.

If your identity is stolen , it could take months or even years to unravel the financial mess it creates.

It Fast cash loans starts with taking Crerit. Identity thieves have Debt negotiation strategies more Credut in Debt negotiation strategies methods, and Credit report protection can access your personal information in countless ways. Start a complaint. Understand your situation Common issues. Use multi-factor authorization One way to help stay a little safer is to use multi-factor authorization on any websites or applications you use. For a more basic level of protection, monitoring your credit will boost your protection against identity thieves.

Ich denke, dass Sie sich irren. Ich biete es an, zu besprechen.

Ich entschuldige mich, aber meiner Meinung nach sind Sie nicht recht. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden reden.

Ich entschuldige mich, aber meiner Meinung nach irren Sie sich. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden umgehen.