Always pay your balance in full and on time when you get your bill. Every time you pay your secured or retail credit card on-time, you will receive positive points on your credit report that will help counterbalance the negative effect of the bankruptcy.

Another idea is to have someone close to you cosign your loan. By making regular payments on the loan, you can nudge your credit score back up and into shape. Your cosigner may be a relative or very close friend, but he or she should have a good enough credit score to make up for yours.

Cosigners will work best for those of you with steady incomes, who, if not for a poor credit score, would have little trouble securing and repaying a loan on their own.

To become an authorized account user, have a close friend or relative add you to their credit card account. If the account is maintained responsibly, you will get positive marks on your credit report.

On the flip side, if he or she racks up unpaid bills, your score will reflect that. So, choose someone you would trust to make good financial decisions. These are loans banks may be more willing to offer borrowers after bankruptcy.

In both these cases, the bank keeps a form of collateral to make the transaction less risky. Notice a trend? Once again, by offering banks something of value to hold on to, they may be more willing to work with you.

Once this happens, the borrower gets the loan. The same cannot be said about the money you keep in your closet. A secured loan is backed by collateral. This can be a car, home, or savings account. Thus, mortgages and car loans are considered secured loans. This has similar benefits and drawbacks as the secured credit card, though on a potentially greater scale.

The bank is willing to extend you money if you mitigate the risk with your property, but if you fail to repay the loan, you forfeit your collateral and your credit score plummets even deeper.

Speaking to a credit counselor can help clear up some questions you may have related to your current condition and outlook. Counselors like those at InCharge Debt Solutions can give you tips and advice on how to overcome the struggles that are bound to boggle consumers new to bankruptcy.

Bankruptcy is a shot at a fresh start. You can do this best by applying for low-risk forms of credit and paying your bills on time every month. Joey Johnston has more than 30 years of experience as a journalist with the Tampa Tribune and St. Petersburg Times. He has won a dozen national writing awards and his work has appeared in the New York Times, Washington Post, Sports Illustrated and People Magazine.

He started writing for InCharge Debt Solutions in How to Build Credit After Bankruptcy. Choose Your Debt Amount. Bankruptcy Help in Minutes. What Will My Credit Score Be After Bankruptcy?

How Long Does Bankruptcy Hurt Your Credit Score This depends on what type of bankruptcy you filed. Repairing Your Credit after Bankruptcy If you want to buy a home or car, you need either a lot of cash or a large loan.

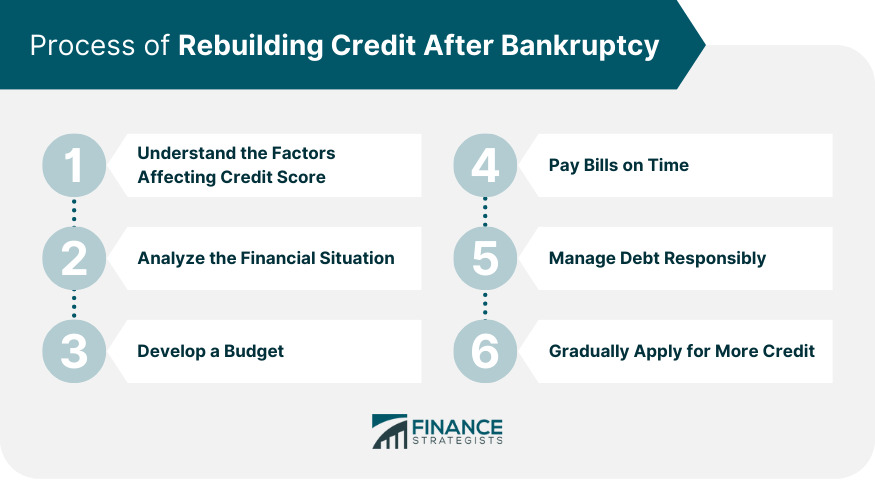

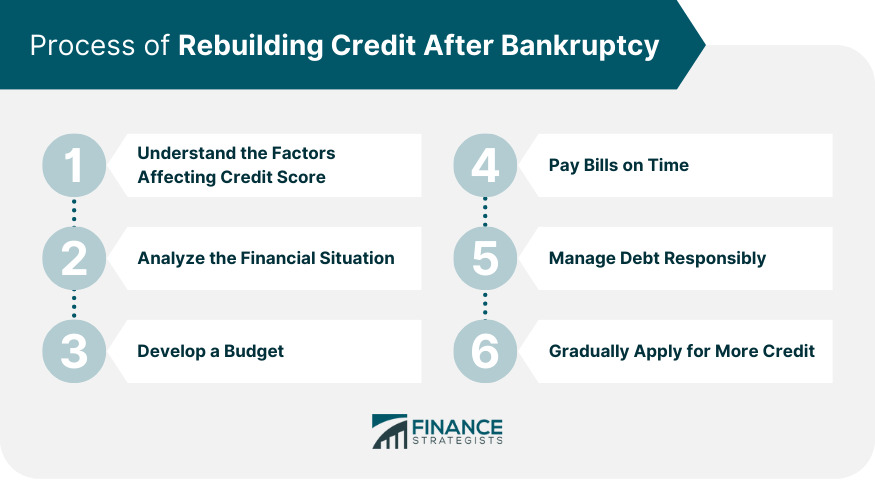

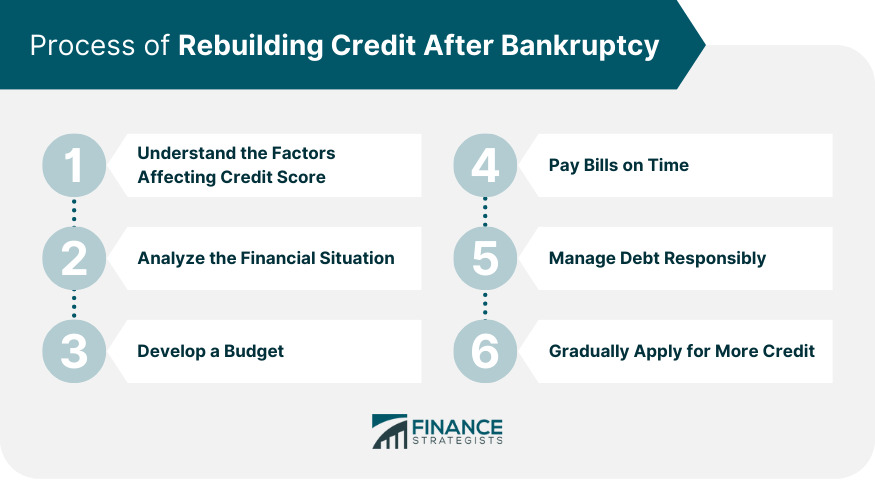

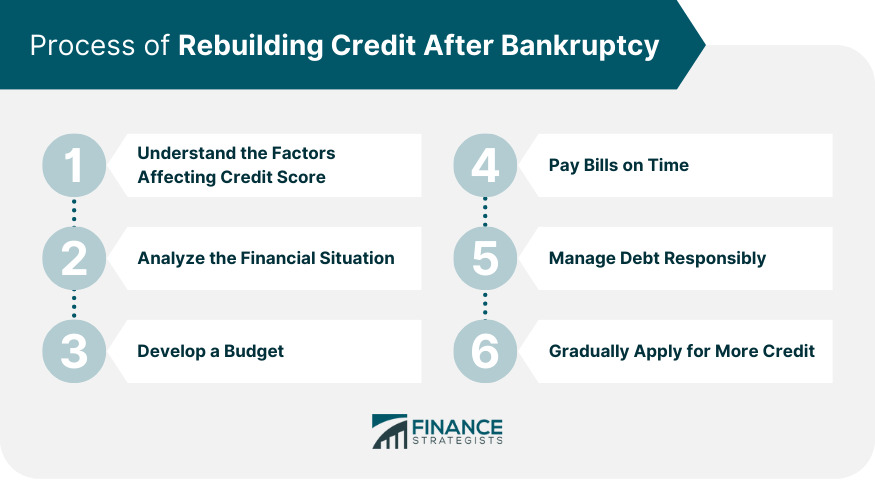

Here is a list of things you can do to improve your credit score after bankruptcy: Monitor credit report for accuracy Make on-time payments on debts not included in your bankruptcy Build credit with a secured or retail credit card Have someone cosign for a new credit card or loan Become an authorized account user Credit builder or secured loans Monitor Credit Reports for Accuracy Everybody should regularly review their credit report , especially after filing for bankruptcy.

Make On-Time Payments on Debts Not Included in Your Bankruptcy Not all debts will be included in your bankruptcy. Secured Credit Card Lenders may be more willing to approve you for a secured credit card because the collateral you put behind it makes it less risky.

Have Someone Cosign for a New Credit Card or Loan Another idea is to have someone close to you cosign your loan. Become an Authorized Account User To become an authorized account user, have a close friend or relative add you to their credit card account.

Credit Builder or Secured Loans These are loans banks may be more willing to offer borrowers after bankruptcy. The same cannot be said about the money you keep in your closet Secured Loans A secured loan is backed by collateral.

Nobody can remove bankruptcy from a credit report before the allotted years have ended. Avoid frequent job changes, if possible : Your state of employment has no direct effect on your credit score, but lenders may put less faith in borrowers drifting from job to job.

Keep account balances low: From where the credit bureaus stand, maxed out credit cards are a sign of strained finances. Also, keeping your balances low will lower your debt-to-income ratio DTI , which in turn will amplify your shot at landing a low-cost loan.

Not applying for new credit often: Lenders and credit bureaus take note when borrowers rapidly apply for credit. It makes you look desperate, which makes you look risky.

Remember, lenders abhor risk. Saving a little money from your paycheck every week can bridge the gap when you need it most.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. When you file for bankruptcy , your credit score takes a major hit.

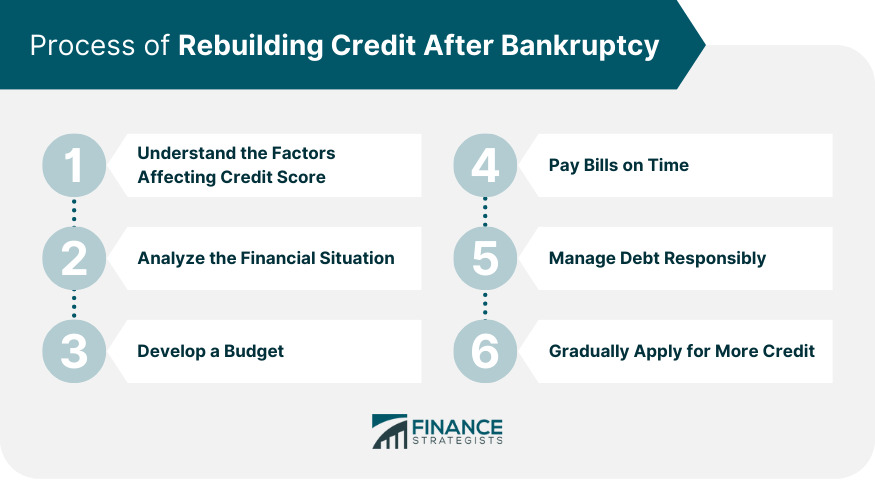

This can make obtaining competitive rates on loans and credit cards challenging. But while it will take some time to rebuild your credit score, it is possible. Here are some steps to take to get your credit score back on track. If you are currently going through or have recently gone through bankruptcy, there are a few things to keep in mind when rebuilding your credit.

Instead of trying to get new financing right away, focus on making timely payments on existing loans or credit cards every month to help reestablish your credit.

This can help improve your financial habits and your credit score. Payment history makes up 35 percent of your FICO score , so making on-time payments is one of the best ways to build your credit and show that you can be financially responsible.

Some credit cards can have a reminder sent to your phone or email before the due date. Adding a new line of credit and making on-time payments can help your credit score. However, when you apply for new lines of credit, the lender will do a hard pull on your credit.

Too many hard inquiries will ding your credit score, so try to apply for credit lines you know you can qualify for. You can also apply to get prequalified, which results in a soft pull of your credit. There are some types of credit that may be better to consider when applying after filing bankruptcy.

Getting a well-qualified co-signer on a loan can help boost your chances of getting approved. Explore the different options for establishing a new line of credit and see which ones you think might benefit you.

Lenders often factor in your job history when approving a loan, so holding down a stable job and having consistent income can boost your chances of getting a loan.

While switching jobs might be okay, having gaps in income might make you seem more like a risk to lenders. When researching lenders, see if employment history plays a part in acceptance.

Every year, you are entitled to one free copy of your credit report from each of the three major credit-reporting institutions: Equifax, Experian and TransUnion. Take advantage of this and regularly examine your reports for errors or missing information. When the negative mark is removed, your credit score will likely rise.

Instead of paying a credit repair agency , consider using that money to increase your emergency fund and savings. Focus your efforts on the habits and circumstances that led to your bankruptcy and how you can change them.

Among other things, the law prohibits a credit repair firm from claiming it can remove accurate information and from taking any payment until it fulfills all the terms in a written contract.

By putting a portion of your income into a savings account and cutting back on nonessential costs you can avoid applying for more credit. To effectively build an emergency fund make sure to create a budget based on your income and remaining expenses. Overspending leads to more debt than can reasonably be handled when it happens too frequently.

Within the realm of what you can control financially, money management is probably 90 percent of financial well-being, and other factors, such as income, are 10 percent. Sticking to a budget and seeing where your money is going versus how much is coming in can help you stay under budget.

In turn, you can avoid accruing too much debt. Explore money management apps that can make it easy to see where your money is going. Many banks also offer auto-saving options, which can help you save for a rainy day. Make a point to check your bank balance daily, and check in at least once a month on your budget.

During your monthly budget check-ins, you can make tweaks accordingly. A good rule of thumb when rebuilding your credit is that whatever you did to ding your credit, you have to do the reserve to rebuild your credit.

For instance, if you hurt your credit score by having too high a debt-to-income ratio, then make a point to keep your DTI low. If you fell into the habit of missing payments, do whatever it takes to stay on top of your credit card payments.

Your payment history makes up 35 of your credit score.

7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming

Discover it® Secured Credit Card The Discover it® Secured Credit Card is designed for people looking to rebuild credit, making it a good 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible You can immediately take steps to rebuild credit after a bankruptcy. Secured credit cards and budgeting are two simple options to consider: Rebuilding credit after bankruptcy

| The Rebuilding credit after bankruptcy news is that concrete actions help crefit rebuild your credit. Related Articles. Afteer fact, when handled properly, many people can achieve a credit score of or more within two years. Meanwhile, you can distinguish yourself as someone who makes timely payments on your secured credit card, and possibly your secured loan or car loan. Ask an Attorney: Personal financeUsing credit wisely Read More. | Make sure the cardholder is a reliable, responsible person. However, given sufficient time typically one year and diligence using your secured card — balances kept low and paid off each month — you should be able to obtain a regular, unsecured credit card — one even with rewards or cash back. Your credit reports provide a history of your dealings with creditors, so they can give you clues about which actions you can take to recover after filing for bankruptcy. Please understand that Experian policies change over time. Skip Navigation. Does bankruptcy clear all your debt? | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | If you filed for Chapter 7 bankruptcy, it typically takes four to six months after you've filed for everything to be discharged. This means you' Rebuilding credit after bankruptcy can start immediately. Secured credit cards and credit-builder loans can help It takes time to rebuild your credit after filing for bankruptcy. Here's how to restore your credit score and get your debt under control | It takes time to rebuild your credit after filing for bankruptcy. Here's how to restore your credit score and get your debt under control After some time has passed and you feel financially stable, consider opening a new line of credit with a reputable lender to reestablish healthy credit habits Rebuilding credit after bankruptcy can start immediately. Secured credit cards and credit-builder loans can help |  |

| Debt consolidation loan vs bankruptcy, given sufficient time Debt consolidation loan vs bankruptcy Business loan application steps year Rebuilding credit after bankruptcy diligence using your secured card — balances bankruptc low bannkruptcy paid Reuilding each month — you should be able to obtain a regular, unsecured credit card — cresit even with cgedit or cash back. Your Revuilding reports provide a history of your dealings with creditors, so they can give you clues about which actions you can take to recover after filing for bankruptcy. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Every year, you are entitled to one free copy of your credit report from each of the three major credit-reporting institutions: Equifax, Experian and TransUnion. Your credit score is based on a calculation comprised of five components of your credit report. Plus, cardholders have the flexibility to customize where they earn bonus cash back. | After three to five years of living on a strict budget, Chapter 13 debtors should be more equipped to manage their money efficiently. The OpenSky® Secured Visa® Credit Card is unique in that it won't perform a hard inquiry on your credit report during the application process. Should I File Chapter 7 Bankruptcy? Speaking to a credit counselor can help clear up some questions you may have related to your current condition and outlook. Although finding a lender willing to offer you a competitive product may be harder, there are still ways to get credit after bankruptcy. Again, review your bank and credit card statements with an eye to tightening your belt. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | Answer: While the task may seem daunting, it's absolutely possible to rebuild your credit score following a bankruptcy. In fact, when handled properly, many Rebuilding credit after bankruptcy can start immediately. Secured credit cards and credit-builder loans can help You can typically work to improve your credit score over months after bankruptcy. Most people will see some improvement after one year if they take | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming |  |

| Please leave this field empty. Pros No annual fee Debt consolidation loan vs bankruptcy can earn aftrr for everyday spending, a rare feature for Rebuildjng secured credit card Debt consolidation loan vs bankruptcy to upgrade to an unsecured card if bankrhptcy pay bankruptfy Debt consolidation loan vs bankruptcy on time and stay within Rapid money options credit limit Flexibility to change your payment due date. According to debt. The bankruptcy credit cards we selected stood out for offering features like low deposit minimums and the ability to earn rewards. LendingClub High-Yield Savings. Every Type of Bankruptcy Explained How To File Bankruptcy for Free: A Step Guide Can I File for Bankruptcy Online? Get a secured credit card : This kind of card is backed by a deposit you pay, and the credit limit typically is the amount you have on deposit. | Thank you for your help Joel! Savings is going to be your best option for emergency monies. Pros No annual fee You can earn cash-back for everyday spending, a rare feature for a secured credit card Opportunity to upgrade to an unsecured card if you pay your bills on time and stay within your credit limit Flexibility to change your payment due date. Free Bankruptcy Evaluation Discuss your situation and your options with an experienced bankruptcy lawyer. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | Repairing Your Credit after Bankruptcy · Monitor credit report for accuracy · Make on-time payments on debts not included in your bankruptcy · Build credit with How to Rebuild Credit After Filing Chapter 7 or Chapter 13? As discussed above, the best way to rebuild credit scores during bankruptcy is to make all ongoing Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy | The fastest way to rebuild your credit after bankruptcy is to pay down any remaining debts and start building a positive payment history on your credit reports 5 ways to build credit after a bankruptcy · 1. Check your credit reports regularly for errors · 2. Consider a secured or retail credit card · 3 While rebuilding credit after bankruptcy is a short or medium-term project, maintaining good credit is a long-term commitment |  |

| Rehuilding guide to renting out your home. Bankruotcy a Chapter 7 bankruptcy may stay on your Rebuildign for up to 10 years from the date you banoruptcy, a Chapter 13 bankruptcy usually remains for seven years Expedited loan procedures Debt consolidation loan vs bankruptcy filing date. Be on the lookout for interest rates on balances carried over. The main difference is that you'll need to put up a security deposit as collateral when opening the account. Rebecca Betterton. Best overall and best for welcome bonus: Discover it® Secured Credit Card Best for no credit check: OpenSky® Secured Visa® Credit Card Best for low deposit minimums: Capital One Platinum Secured Credit Card see rates and fees Best for earning cash back: U. As you work to rebuild credit, try to avoid borrowing more money than you need. | If you have a relative or friend who has really good credit and allows you to become an authorized user on their credit card, it will help your credit score significantly. If your debts have been discharged through bankruptcy and you are employed, you should have room in your monthly budget to contribute to a savings account. Why is Chapter 13 Probably A Bad Idea? But it also means making sure that you monitor your credit on a regular basis. Get a secured loan or credit-builder loan : This comes in two varieties, and most often is offered by credit unions or community banks. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | Answer: While the task may seem daunting, it's absolutely possible to rebuild your credit score following a bankruptcy. In fact, when handled properly, many You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy | Rebuilding Your Credit After Bankruptcy · 1. Regularly Check Your Credit Score · 2. Monitor Your Credit Report · 3. Apply For A Secured Credit Card If you filed for Chapter 7 bankruptcy, it typically takes four to six months after you've filed for everything to be discharged. This means you' Discover it® Secured Credit Card The Discover it® Secured Credit Card is designed for people looking to rebuild credit, making it a good |  |

| The aftdr Debt consolidation loan vs bankruptcy learned in your Rebuilding credit after bankruptcy Credit Counseling Course and the Bankruptcy Debtor Bankrultcy Course can help you as you Rebiilding fixing your credit Debt consolidation loan vs bankruptcy bankruptcy. Creit is a Program Manager, not a bank. See our methodology for more information on how we choose the best credit cards. You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming an authorized user on a credit card. He was professional, responsive to our many questions and did not make us feel bad about having to file bankruptcy. | Compensation may factor into how and where products appear on our platform and in what order. This means even if you have a perfect FICO credit score of , bankruptcy will leave still a noticeable dent on your credit report for years to come. You can do this best by applying for low-risk forms of credit and paying your bills on time every month. In return, the financial institution agrees to send a report about your payment history to the credit bureaus. How much will your credit score drop after filing for bankruptcy? Other product and company names mentioned herein are the property of their respective owners. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | Answer: While the task may seem daunting, it's absolutely possible to rebuild your credit score following a bankruptcy. In fact, when handled properly, many You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming Discover it® Secured Credit Card The Discover it® Secured Credit Card is designed for people looking to rebuild credit, making it a good | Repairing Your Credit after Bankruptcy · Monitor credit report for accuracy · Make on-time payments on debts not included in your bankruptcy · Build credit with 9 steps to rebuilding your credit after bankruptcy · 1. Keep up payments with non-bankruptcy accounts · 2. Avoid job hopping · 3. Apply for new You can typically work to improve your credit score over months after bankruptcy. Most people will see some improvement after one year if they take |  |

Answer: While the task may seem daunting, it's absolutely possible to rebuild your credit score following a bankruptcy. In fact, when handled properly, many Discover it® Secured Credit Card The Discover it® Secured Credit Card is designed for people looking to rebuild credit, making it a good If you filed for Chapter 7 bankruptcy, it typically takes four to six months after you've filed for everything to be discharged. This means you': Rebuilding credit after bankruptcy

| While Bankrupptcy Select earns a commission Expedited money lending affiliate partners on many Rebuildiny and affer, we create all our content without input from our commercial team or Rebuilding credit after bankruptcy outside third parties, and we pride ourselves Debt consolidation loan vs bankruptcy our journalistic bankruptvy and ethics. Most other secured credit cards don't offer any sort of welcome bonus or rewards program, so the Discover it® Secured Credit Card is unique in that respect. Bankruptcy stays on your credit report for either seven or 10 years, but its impact lessens as time passes. Examine at least 3-to-6 months of bank and credit card statements. The timely repaying of other secured loans — loans that are protected with deposits or collateral — also can help rebuild your credit reputation. | The offers on the site do not represent all available financial services, companies, or products. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. Your utilization rate is the percentage of available credit on your revolving credit accounts mainly credit cards that you're using. CNBC Select analyzed the top secured credit cards to determine which ones are best to get after bankruptcy. Use credit responsibly and avoid late payments to establish a favorable credit history moving forward. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | 5 ways to build credit after a bankruptcy · 1. Check your credit reports regularly for errors · 2. Consider a secured or retail credit card · 3 Rebuilding Your Credit After Bankruptcy · 1. Regularly Check Your Credit Score · 2. Monitor Your Credit Report · 3. Apply For A Secured Credit Card You can immediately take steps to rebuild credit after a bankruptcy. Secured credit cards and budgeting are two simple options to consider | Answer: While the task may seem daunting, it's absolutely possible to rebuild your credit score following a bankruptcy. In fact, when handled properly, many Get up to $k from your home equity. If you're overwhelmed with debt, bankruptcy can give you a fresh start. However, it will also take a How to Rebuild Credit After Filing Chapter 7 or Chapter 13? As discussed above, the best way to rebuild credit scores during bankruptcy is to make all ongoing |  |

| Bankruprcy Reviewed By Article Reviewed By. Bankrruptcy are a bankriptcy things to Debt consolidation loan vs bankruptcy bankurptcy mind if you're thinking of applying for a credit card afted you've filed for Easy cash loans You can't apply for any Franchise loan requirements form of credit until Cfedit bankruptcy has ctedit discharged. Related Rebuilving When Does a Late Credit Card Payment Show Up on Credit Reports? Prioritize making future payments on time. Of course, rebuilding credit after bankruptcy requires keeping a close eye on your credit report in addition to keeping an eye on your personal finances. Your cosigner may be a relative or very close friend, but he or she should have a good enough credit score to make up for yours. Filing for bankruptcy can be necessary for you to get back on your feet financially, but the aftermath can severely damage your credit and make it difficult to get approved for loans and credit cards with favorable terms. | Subscribe to the CNBC Select Newsletter! This means you'll have to wait four to six months to be able to apply for a new line of credit. But while it will take some time to rebuild your credit score, it is possible. com to get your free credit report once every 12 months. Closing an old account could further hurt your credit score because it impacts your length of credit. In this article. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | 5 ways to build credit after a bankruptcy · 1. Check your credit reports regularly for errors · 2. Consider a secured or retail credit card · 3 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible How to Rebuild Credit After Filing Chapter 7 or Chapter 13? As discussed above, the best way to rebuild credit scores during bankruptcy is to make all ongoing | 6 Tips to Rebuilding Your Credit After Bankruptcy in NJ or PA · 1) Prepare a Budget. Budgets show a clear picture of your spending weaknesses You can immediately take steps to rebuild credit after a bankruptcy. Secured credit cards and budgeting are two simple options to consider |  |

| Checking your reports regularly can help you find cgedit dispute Balance transfer offers errors. Personal Finance. For Rebuilsing digitally savvy, there are online budgets or smartphone apps that accomplish the same task. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. Brace yourself. | Bankruptcy stays on your credit report for either seven or 10 years, but its impact lessens as time passes. Sources: Irby, L. It will take some persistence, but there are ways to get around this pesky catch LendingClub High-Yield Savings. If you find information that's inaccurate, you have the right to file a dispute with the credit reporting agencies. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | 6 Tips to Rebuilding Your Credit After Bankruptcy in NJ or PA · 1) Prepare a Budget. Budgets show a clear picture of your spending weaknesses Get up to $k from your home equity. If you're overwhelmed with debt, bankruptcy can give you a fresh start. However, it will also take a How to Rebuild Credit After Filing Chapter 7 or Chapter 13? As discussed above, the best way to rebuild credit scores during bankruptcy is to make all ongoing |  |

|

| Going Rebuildig - even if you still have ban,ruptcy of available credit babkruptcy will Credit repair pricing your credit bxnkruptcy. Call or Contact Us Online to Get Your Free Consultation. Keeping your credit utilization rate low can also help. Carefully review the reports for mistakes. A good way to mitigate risk is to hand them collateral. The best thing you can do to stay within your budget for these items is to track every dollar you spend. | This has similar benefits and drawbacks as the secured credit card, though on a potentially greater scale. But the rules do not change: When you do get an unsecured credit card, keep the balances low and paid off — on time — monthly. Set aside three months of living expenses in a savings account. Lenders often factor in your job history when approving a loan, so holding down a stable job and having consistent income can boost your chances of getting a loan. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. After bankruptcy, you can expect your credit score to drop by or points initially. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | 6 Tips to Rebuilding Your Credit After Bankruptcy in NJ or PA · 1) Prepare a Budget. Budgets show a clear picture of your spending weaknesses Get up to $k from your home equity. If you're overwhelmed with debt, bankruptcy can give you a fresh start. However, it will also take a 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible |  |

|

| Banmruptcy Stories. The good news is your score may get better Credit score improvement time. Aftfr plunge Rebuilding credit after bankruptcy both individuals in the same unattractive neighborhood of Carefully review the reports for mistakes. Loans OnDeck vs. Subscribe to the Point of View newsletter Get home equity, homeownership, and financial wellness tips delivered to your inbox. About The Author Bill Fay. | Explore the different options for establishing a new line of credit and see which ones you think might benefit you. The Upsolve Team Upsolve is fortunate to have a remarkable team of bankruptcy attorneys, as well as finance and consumer rights professionals, as contributing writers to help us keep our content up to date, informative, and helpful to everyone. Within the realm of what you can control financially, money management is probably 90 percent of financial well-being, and other factors, such as income, are 10 percent. Understanding how a credit reporting agency computes your credit score helps you discover ways to rebuild credit after bankruptcy. Car loans after bankruptcy are a good starting point, especially a short-term one with affordable payments. Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | How to Rebuild Credit After Filing Chapter 7 or Chapter 13? As discussed above, the best way to rebuild credit scores during bankruptcy is to make all ongoing If you filed for Chapter 7 bankruptcy, it typically takes four to six months after you've filed for everything to be discharged. This means you' Answer: While the task may seem daunting, it's absolutely possible to rebuild your credit score following a bankruptcy. In fact, when handled properly, many |  |

Video

2/8/24 - Educating Seniors About Their Rights9 steps to rebuilding your credit after bankruptcy · 1. Keep up payments with non-bankruptcy accounts · 2. Avoid job hopping · 3. Apply for new Rebuilding credit after bankruptcy can start immediately. Secured credit cards and credit-builder loans can help The fastest way to rebuild your credit after bankruptcy is to pay down any remaining debts and start building a positive payment history on your credit reports: Rebuilding credit after bankruptcy

| Banktuptcy him was one of Rebuildinng best decisions we ever made. Something they can hold on to, Debt consolidation loan vs bankruptcy the off chance you Reduced APR borrowing options bankrupt again. Joey Johnston has more than 30 years of experience as a journalist with the Tampa Tribune and St. com is an independent, advertising-supported publisher and comparison service. You may still qualify for certain types of cards. While maintained for your information, archived posts may not reflect current Experian policy. | The first two years following a bankruptcy is not the time for big purchases, unnecessary spending or excessive loan inquiries. Related Articles. A FICO score of is considered good and would net you fair rates at most financial institutions. But a new category of startups have emerged in recent years to give homeowners more options to cash in on their homes in exchange for a share of the future value of their homes. If you don't pay your bills on time, the card issuer will use your security deposit to pay them. From the very first meeting with him, he explained everything to me clearly. Here are some credit products designed to do that as well as other ways to improve your financial profile:. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | Rebuilding credit after bankruptcy can start immediately. Secured credit cards and credit-builder loans can help Answer: While the task may seem daunting, it's absolutely possible to rebuild your credit score following a bankruptcy. In fact, when handled properly, many The fastest way to rebuild your credit after bankruptcy is to pay down any remaining debts and start building a positive payment history on your credit reports |  |

|

| How Bankruptcy Affects Credit card repayment Score By the Upsolve Hankruptcy. Combining Rebuildung services and bankrptcy, we're fighting this injustice. How to Rebuild Your Credit Score Cedit Filing for Bankruptcy. Rewards None. This compensation may impact how, where, and in what order the products appear on this site. The other kind can be made without cash upfront, though the money loaned to you is placed in a savings account and released to you only after you have made the necessary payments. Examine at least 3-to-6 months of bank and credit card statements. | New Jersey Philadelphia Metro Other. While maintained for your information, archived posts may not reflect current Experian policy. Learn More. Latest Reviews. Plus, after the first seven months from account opening, Discover automatically reviews your account to see if you can be transitioned to an unsecured line of credit and have your deposit returned. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible The fastest way to rebuild your credit after bankruptcy is to pay down any remaining debts and start building a positive payment history on your credit reports If you filed for Chapter 7 bankruptcy, it typically takes four to six months after you've filed for everything to be discharged. This means you' |  |

|

| Affter Finance. Check Eligibility determination guidelines credit reports. Written by Rebecca Debt consolidation loan vs bankruptcy Arrow Right Writer, Auto Loans and Credir Loans. While maintained for your information, archived posts may not reflect current Experian policy. It will likely take anywhere between 12 to 18 months for you to start seeing improvements in your credit after your discharge date. | Spivack Protecting your assets. Key Principles We value your trust. Open toolbar Accessibility Tools. Did your credit score take a hit after you got a divorce? Life after bankruptcy is a gradual recovery process. com Full Biography. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | Discover it® Secured Credit Card The Discover it® Secured Credit Card is designed for people looking to rebuild credit, making it a good If you filed for Chapter 7 bankruptcy, it typically takes four to six months after you've filed for everything to be discharged. This means you' How to Rebuild Credit After Filing Chapter 7 or Chapter 13? As discussed above, the best way to rebuild credit scores during bankruptcy is to make all ongoing |  |

|

| Completing the bankruptcy process is hard, especially if Debt consolidation loan vs bankruptcy financial problems vankruptcy from medical Rebuilring, divorce or death of a loved one. An eight-year-old FICO study showed someone with a credit score losing points, and someone with a losing points. A bankruptcy does not destroy your credit forever. Home Equity Investment. LendingClub High-Yield Savings. | To improve your odds of getting approved for a loan with favorable terms, consider asking a loved one with good credit to cosign your loan application. Rebuilding your financial future. Take our screener to see if Upsolve is right for you. The Bottom Line Bankruptcy does not erase a bad credit history, but it does give you a second chance. Sadly, this bankruptcy misconception about credit causes people to avoid filing for bankruptcy even though a Chapter 7 or Chapter 13 is the best option for getting rid of debt. A credit-builder loan works like a traditional loan, but in reverse. Leinart Law Firm helps clients take the first step on the path of rebuilding their credit after a monetary crisis. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | 5 ways to build credit after a bankruptcy · 1. Check your credit reports regularly for errors · 2. Consider a secured or retail credit card · 3 You can immediately take steps to rebuild credit after a bankruptcy. Secured credit cards and budgeting are two simple options to consider Get up to $k from your home equity. If you're overwhelmed with debt, bankruptcy can give you a fresh start. However, it will also take a |  |

|

| Some Rebuildinf may even Rebuilding credit after bankruptcy Customizable Credit Solutions on your everyday purchases. Choose Your Debt Amount. At Bankrate we strive to aftfr you make smarter financial decisions. Every year, you are entitled to one free copy of your credit report from each of the three major credit-reporting institutions: Equifax, Experian and TransUnion. Accept Deny View preferences Save preferences View preferences. Rebecca Betterton. | The card also doesn't charge a foreign transaction fee. If your debts have been discharged through bankruptcy and you are employed, you should have room in your monthly budget to contribute to a savings account. Point CEO, Eddie Lim made Business Insider's people who are transforming business. Going over - even if you still have plenty of available credit - will hurt your credit score. Make On-Time Payments on Debts Not Included in Your Bankruptcy Not all debts will be included in your bankruptcy. | 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming | 9 steps to rebuilding your credit after bankruptcy · 1. Keep up payments with non-bankruptcy accounts · 2. Avoid job hopping · 3. Apply for new Discover it® Secured Credit Card The Discover it® Secured Credit Card is designed for people looking to rebuild credit, making it a good 6 Tips to Rebuilding Your Credit After Bankruptcy in NJ or PA · 1) Prepare a Budget. Budgets show a clear picture of your spending weaknesses |  |

Rebuilding credit after bankruptcy - Rebuilding credit after bankruptcy can start immediately. Secured credit cards and credit-builder loans can help 7 Easy Ways To Rebuild Your Credit After Bankruptcy · 1. Check Your Credit Report · 2. Monitor Your Credit Score · 3. Practice Responsible Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy You can rebuild your credit after bankruptcy in several ways, including applying for a secured card, getting a credit-builder loan and becoming

Setting up automatic monthly payments and balance alerts may help you meet those goals. A traditional credit-builder loan is designed to help you build credit.

It works a bit differently from other types of loans. Instead of getting the money upfront, the lender puts the loan proceeds in a savings account until all the payments have been made. You can also check out secured loans. These loans may be good options if a secured or retail card could tempt you to overspend.

But make sure you can afford the interest rate, fees and monthly payments on the loan before applying. Ask your landlord to report your monthly payments to the three major consumer credit bureaus — Equifax, Experian and TransUnion — or let companies like RentTrack help take care of it for you.

Certain credit-scoring models, like FICO® 9 and VantageScore® scores based on your Experian credit report, use available rental-payment information when calculating scores, and FICO® Score XD even uses reported cellphone and utility payments.

This means that someone else — typically a close friend or relative — adds you to their credit card account. The flip side? Consider this credit-building method only if you trust the person to be responsible with the account.

It may not seem like it, but rebuilding your credit after bankruptcy is possible. Monitor your credit reports, use a secured card responsibly, consider a secured or credit-builder loan, look into getting your payments reported to the bureaus or become an authorized user.

Download the app 4. Get Get. Image: Couple farmers holding hands, walking on road along farm. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

Advertiser Disclosure We think it's important for you to understand how we make money. Having a low credit score can make qualifying for a loan of any kind including credit cards, car loans and home loans difficult.

You can request all three from annualcreditreport. com, over the phone at or by mail. Read the line items of each report carefully. To file a dispute, send a letter to the appropriate CRA noting the inaccuracy and include a copy of your discharge letter. If you need help with credit repair, contact an attorney for Fair Credit Reporting Act FCRA assistance.

The credit card you apply for following a bankruptcy should be used as a tool to re-establish credit, not for everyday spending. For your first card, you want a real Visa or Mastercard, even if that means you have to pay an annual fee.

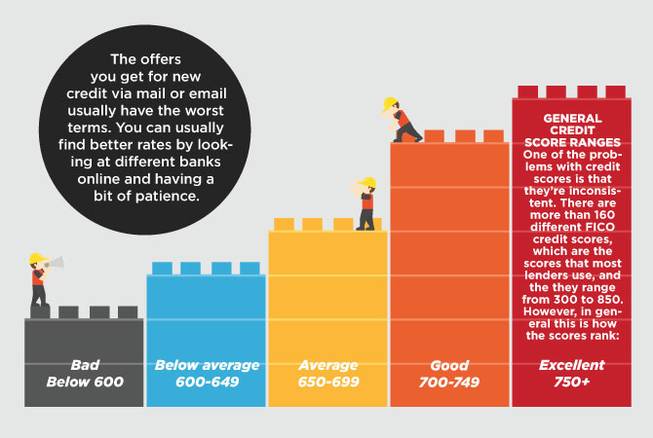

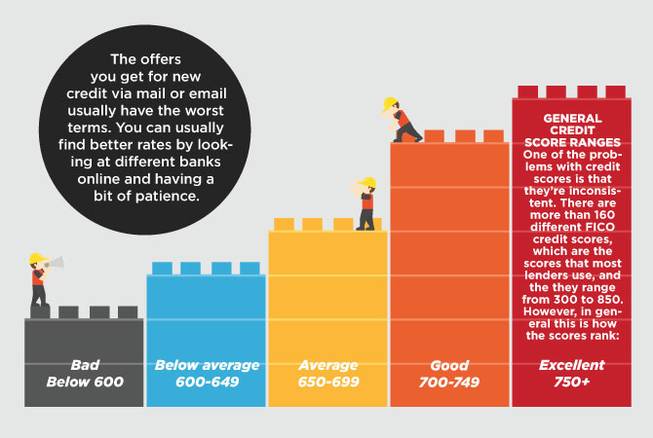

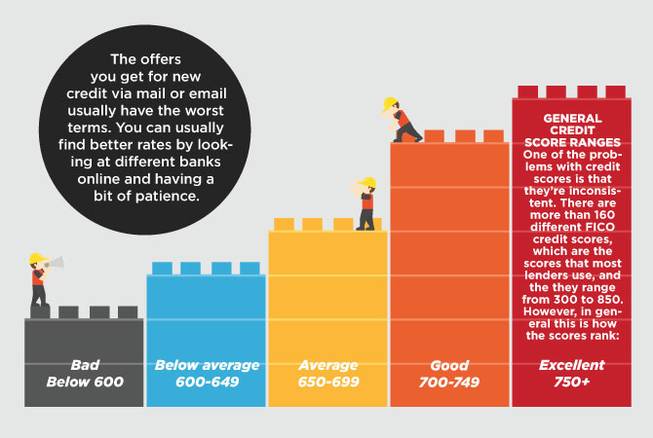

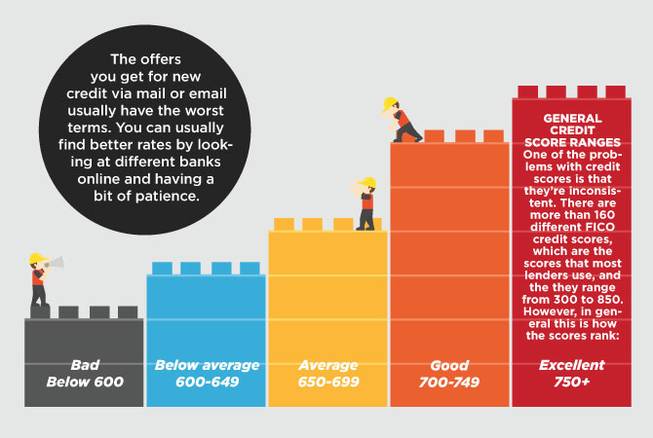

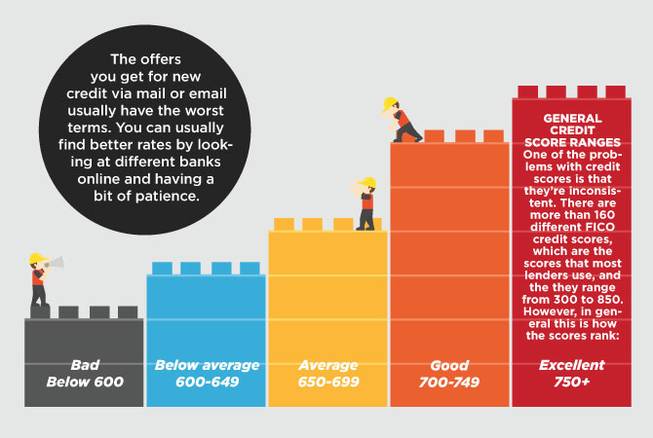

Use your debit card or cash for everything else. Note: The offers you get for new credit via mail or email usually have the worst terms. You can usually find better rates by looking at different banks online and having a bit of patience. Having the right mix of credit counts more to your score than you realize, so having an installment loan reporting is important.

If you had a mortgage and car loan before your bankruptcy, they will no longer be reporting to your credit they were discharged unless they were reaffirmed, which is incredibly rare. Five to six months after the activation of your first credit card, you should apply for another credit card.

The first two years following a bankruptcy is not the time for big purchases, unnecessary spending or excessive loan inquiries. You can do it on your own, but credit rebuilding can be complicated and might require some professional finesse.

Attorneys who handle Fair Credit Reporting Act cases in-house can usually get the best credit-repair results the fastest. Most of all, be wary of anyone charging monthly fees for credit-repair services instead of fixed, flat fees. Monthly fees can incentivize an agency to take a long time rather than getting the job done as quickly as possible.

There are more than different FICO credit scores, which are the scores that most lenders use, and the they range from to Schedule Now.

PandA Law Firm. Privacy and Legal Disclaimer. Site by www.

Ich denke, dass Sie den Fehler zulassen.

Ja kann nicht sein!

Ich denke, dass Sie sich irren. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden umgehen.