You may also receive an email notification prompting you to log into your Credit Karma account for further details. The types of alerts and notifications you receive may depend on your personal credit activity.

Again, not every alert implies an error, but the types of errors credit monitoring can help you spot may include …. Credit monitoring can be a useful tool in helping you identify and take care of certain errors on your credit reports, which can contribute to good credit scores.

Keeping a steady eye on your credit can also help you notice suspicious activity and spot signs of identity theft. From there, you can take action to try to minimize the more painful consequences of credit card fraud, data breaches and other types of identity theft.

Generally, the sooner you do so, the better chance you have of minimizing any long-lasting damage. Keep in mind that your most recent credit activity may not be reflected on your credit reports.

Lenders and creditors typically report information to one or more of the credit bureaus every 30 days, so you may want to wait a month to determine whether the information on your reports is actually erroneous or just not up to date.

Credit Karma can assist you with contacting Equifax and can help you directly dispute errors on your TransUnion credit report. But we can still help. In the app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question.

In the Credit Karma app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question. For more information on how to dispute errors — including errors on your Experian credit report — read our how-to guide.

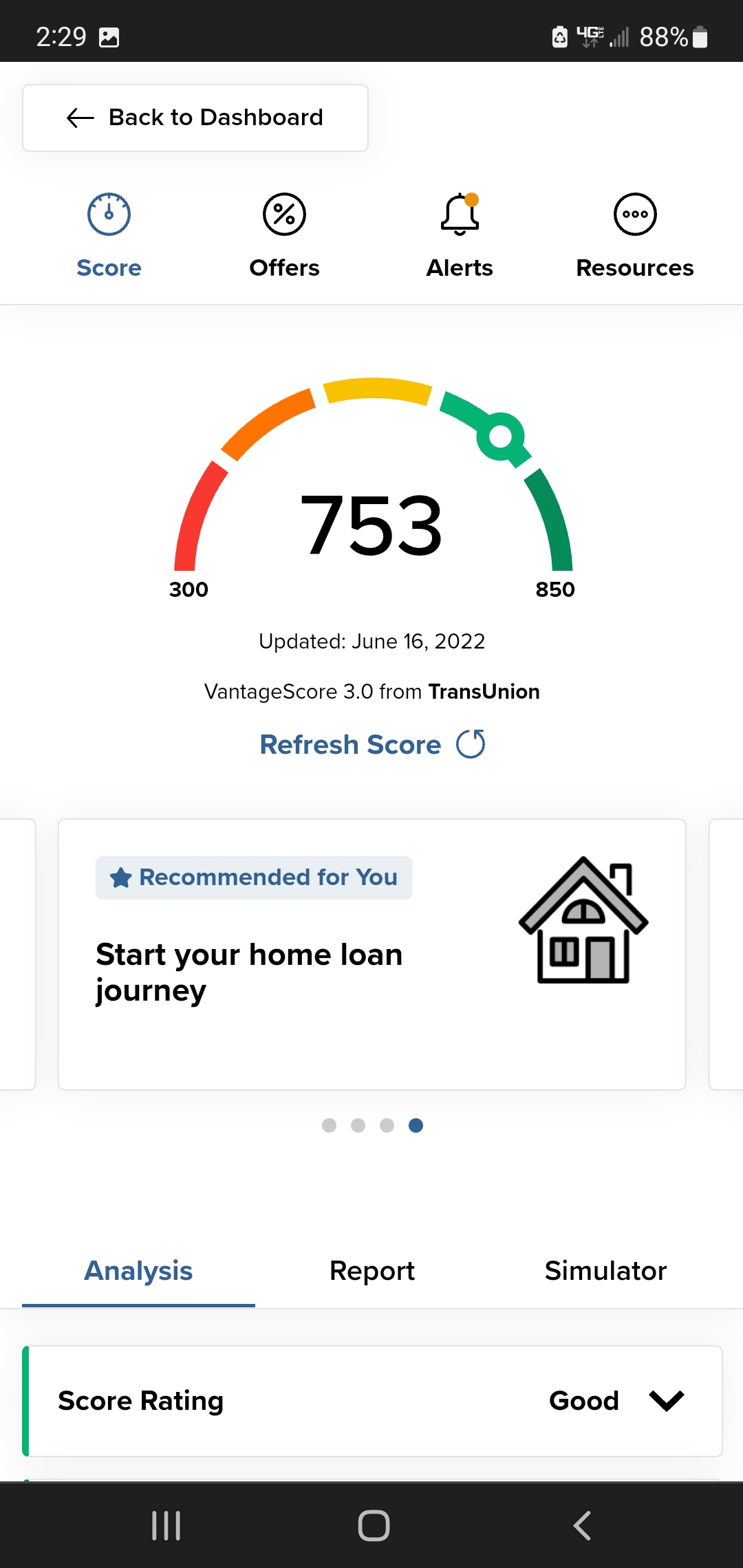

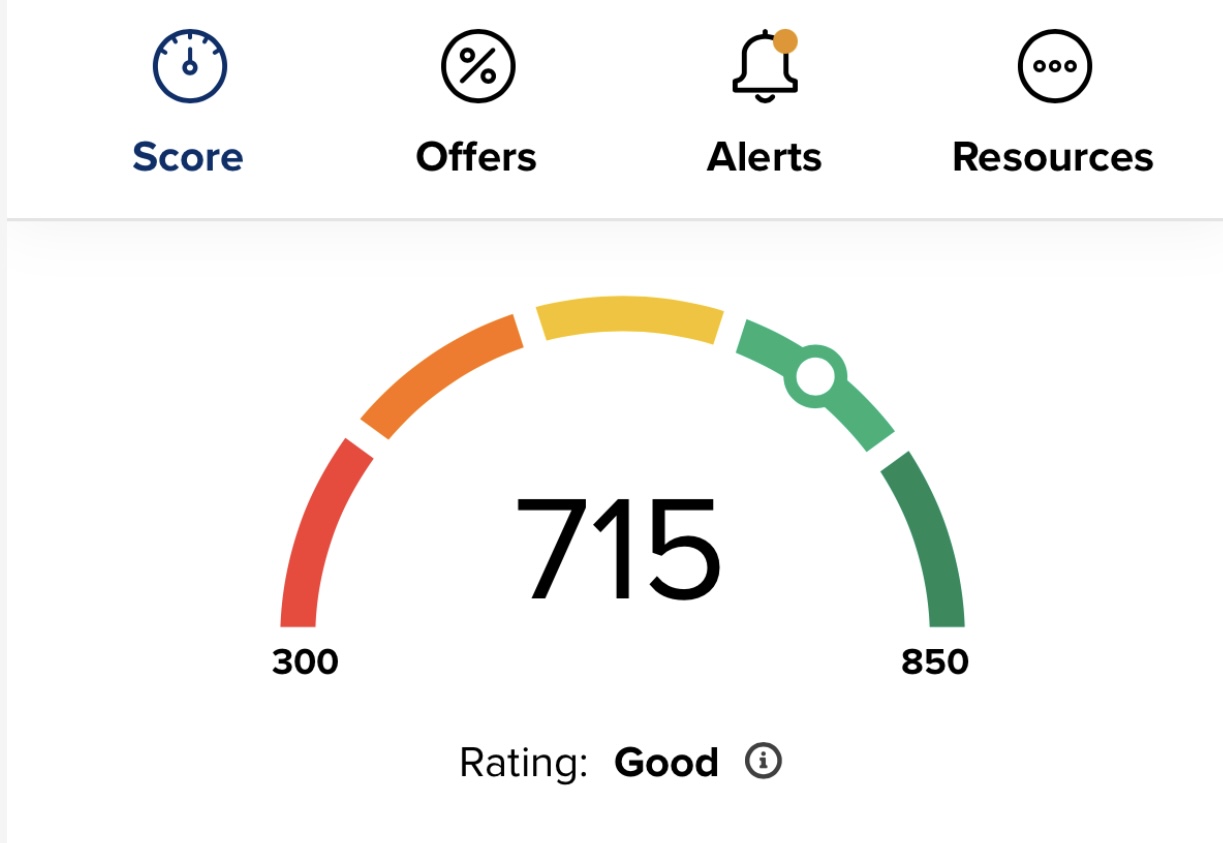

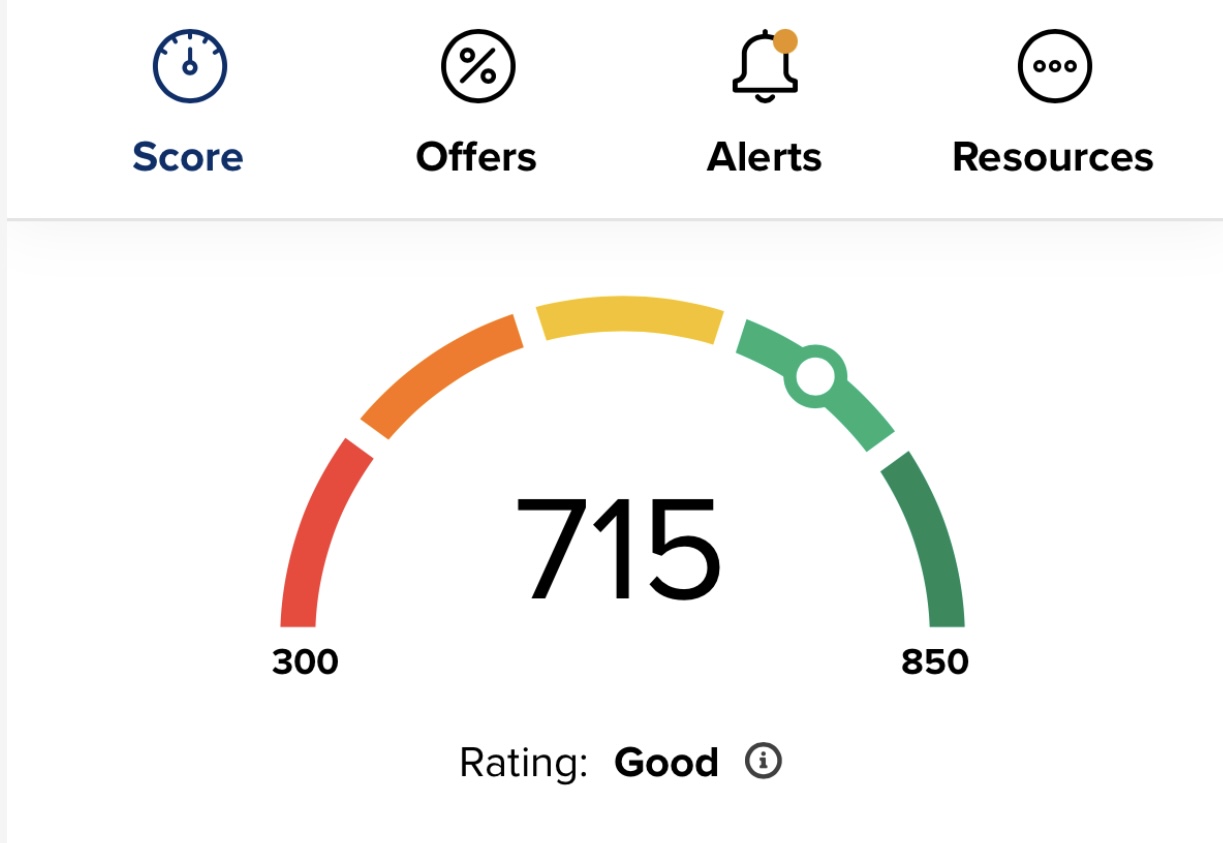

Aside from free monitoring, Credit Karma offers other services and tools to help you stay on top of your credit. Here are a few. Credit Karma shows you your free VantageScore 3.

Credit Karma also offers free credit reports from Equifax and TransUnion. If your information has been exposed in a data breach, Credit Karma may alert you to any exposed passwords so that you can take the necessary steps to help keep your personal information safe.

Protecting your personal data is key to reducing the risk of identity theft. Create your own karma. Image: Group Get the app. Image: PersonalCR Get clued in with credit monitoring. The strength of your credit history also affects how much you will have to pay to borrow money.

Getting your credit report can help protect your credit history from errors and help you spot signs of identity theft. Check to be sure the information is accurate, complete, and up-to-date.

Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information — like your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers — they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past-due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.

gov to report it and get a personalized recovery plan. The three nationwide credit bureaus — Equifax, Experian, and TransUnion — have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place.

Do not contact the three credit bureaus individually. These are the only ways to order your free annual credit reports:. Annual Credit Report Request Service P. Box Atlanta, GA Federal law gives you the right to get a free copy of your credit report every 12 months from each of the three nationwide credit bureaus.

In addition, the three bureaus have permanently extended a program that lets you check your credit report from each once a week for free at AnnualCreditReport. Also, everyone in the U. can get six free credit reports per year from Equifax through by visiting AnnualCreditReport.

If you fall into one of these categories, contact a credit bureau. Use the contact information below or at IdentityTheft. To keep your account and information secure, the credit bureaus have a process to verify your identity.

Be prepared to give your name, address, Social Security number, and date of birth. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

Depending on how you ordered it, you can get it right away or within 15 days. It may take longer to get your report if the credit bureau needs more information to verify your identity. Yes, your free annual credit reports are available in Braille, large print, or audio formats. It takes about three weeks to get your credit reports in these formats.

If you are a person who is blind or print disabled, call , give personal information to verify your identity, give additional information to certify that you're visually impaired according to the Americans with Disabilities Act, then pick the format you want.

If you are a person who is deaf or hard of hearing, call to access your local TDD service, then refer the Relay Operator to AnnualCreditReport. You have options: order your free reports at the same time, or stagger your requests throughout the year. Some financial advisors say staggering your requests during a month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports.

Because each nationwide credit bureau gets its information from different sources, the information in your report from one credit bureau may not be the same as the information in your reports from the other two credit bureaus. But before you pay for a report, always check to see if you can get a copy for free from AnnualCreditReport.

A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO®

Credit score monitoring - Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO®

Any one-bureau VantageScore uses Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness. You'll know if key changes occur to your Equifax, Experian and TransUnion credit files, because we'll be monitoring all three and provide you with alerts.

Your annual 3-bureau VantageScores and 3-bureau credit report will give you an in depth way to assess your credit. Your credit scores and reports can change frequently. Your personal information shouldn't be on the dark web. We scan suspected fraudulent websites and alert you if we find your Social Security, credit card, banking and medical ID numbers.

If you believe you're a victim of fraud, you can activate automatic fraud alerts and we'll place an initial alert on your credit report. This alert encourages lenders to take extra steps to verify your identity before extending credit.

On an annual basis, we'll automatically renew your fraud alert, so you don't have to. Feel more secure knowing your Equifax credit report is locked down from being accessed with certain exceptions for the purposes of extending credit.

Recovering from identity theft on your own can be time consuming. Let us help make it less of a pain. Our dedicated ID restoration specialists will work on your behalf to help you recover from ID theft. Losing your wallet is a headache. We make it a less painful ordeal by helping you cancel and reissue your credit and ID cards.

If you're a victim of ID theft, we have your back. To sign up, we'll ask you for some basic personal information. Next, we'll have you confirm some information to protect your identity.

Then you'll set up your account to make sure you can access CreditWise, even if you forget your password. If you're a current Capital One customer, you can use your existing online credentials to access CreditWise.

CreditWise Free Credit Report Credit Monitoring Dark Web Alerts Simulator FAQs Sign In To CreditWise En Español. CreditWise Sections Free Credit Report Credit Monitoring Dark Web Alerts Simulator FAQs Sign In To CreditWise En Español.

Sign In or Sign Up Now. Sign Up Now. Understand your credit score Access your score and report anytime. See your credit report. Keep up with changes Have a new inquiry, delinquent account or other activity? Activate your alerts. Monitor your personal information Find out right away so you can take action if your Social Security number or email address is detected on the dark web.

Use SSN Tracking. TOOLS TO HELP IMPROVE. Explore the potential impact of your financial decisions before you make them. What customers are saying. HOW TO MONITOR YOUR CREDIT. Who can enroll in CreditWise? What info do I need to have handy when I sign up?

Credit score monitoring - Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO®

Our opinions are our own. Here is a list of our partners and here's how we make money. Many consumers are eligible for free credit monitoring, thanks to high-profile data breaches. If you aren't eligible for any free coverage but breaches like this have you worried, you could instead purchase credit monitoring.

But for everyone, the wisest course is to go beyond monitoring — which alerts you to signs of trouble that's already happened — and proactively defend your credit by freezing it. If your data has been compromised, it doesn't necessarily mean your information has been used by identity thieves.

You do, however, face a lifelong risk of identity theft because your data and numbers are out there. Your best protection is freezing your credit, but layering on free monitoring could also help. Credit monitoring watches your credit reports and alerts you to changes in them.

If someone tries to use your data to open a credit account, you will know right away rather than months or years later, when there is more damage and undoing it is more complicated.

You can purchase monitoring if you choose to. Before signing up, review the services included, when and how you can cancel, and what your rights are if the service doesn't protect you. Be aware that you can do most credit monitoring services on your own for free.

Get a credit freeze , which experts consider the strongest protection from criminals accessing your credit without permission. Check the detailed information on your credit reports. It takes about three weeks to get your credit reports in these formats.

If you are a person who is blind or print disabled, call , give personal information to verify your identity, give additional information to certify that you're visually impaired according to the Americans with Disabilities Act, then pick the format you want.

If you are a person who is deaf or hard of hearing, call to access your local TDD service, then refer the Relay Operator to AnnualCreditReport. You have options: order your free reports at the same time, or stagger your requests throughout the year.

Some financial advisors say staggering your requests during a month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports.

Because each nationwide credit bureau gets its information from different sources, the information in your report from one credit bureau may not be the same as the information in your reports from the other two credit bureaus. But before you pay for a report, always check to see if you can get a copy for free from AnnualCreditReport.

To buy a copy of your report, contact the nationwide credit bureaus:. Federal law says who can get your credit report. A current or prospective employer can get a copy of your credit report — but only if you agree to it in writing. Other sites pretend to be associated with AnnualCreditReport.

com or claim to offer free credit reports, free credit scores, or free credit monitoring. They might even have URLs that misspell — on purpose — AnnualCreditReport. If you visit one of these imposter sites, you might wind up on other sites that want to sell you something or collect — and then sell or misuse — your personal information.

com and the credit bureaus will not email you asking for your Social Security number or account information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from AnnualCreditReport. If you see a scam, fraud, or bad business practices, tell the FTC at ReportFraud.

Your report can help protect others from fraud. CFG: Translation Menu Español CFG: Secondary Menu Report Fraud Read Consumer Alerts Get Consumer Alerts Visit ftc. Breadcrumb Home Articles Vea esta página en español. About Credit Reports How To Get Your Free Annual Credit Reports What To Expect When You Order Your Credit Reports How To Monitor Your Credit Reports Who Can Get Copies of Your Credit Reports Avoid Other Sites Offering Free Credit Reports Report Scams.

Search Terms. credit report. Proactive monitoring can help you uncover fraud early and avoid nasty surprises when you apply for new credit. Important information 3 3. Avoid credit surprises. We'll notify you anytime your FICO Score from Equifax goes up or down.

With the myFICO app, you can access your scores and alerts on the go. Updates every month. No credit card required. Important information 4 4, Important information 5 5. You or we may cancel at any time.

Monitored credit report data,monitored credit report data change alerts, FICO ® Score updates, FICO ® Score alerts, monitored transactions, and alert triggers, timing and frequencies vary by credit bureau.

Skip Navigation. How It Works Pricing Education Credit Education Credit Scores What is a FICO Score? FICO Scores versions How scores are calculated Payment history Amount of debt Length of credit history Credit mix New credit Improve my score Credit Reports What's in your report Bureaus Inquiries Errors on your report?

Blog Calculators Know Your Rights Identity Theft FAQ Glossary Community Support Member Dashboard. Premium Plans Free Plan. Learn more 2. Learn more 3.

Who we are myFICO is the official consumer division of FICO, the company that invented the FICO credit score. Your all-in-one solution Compare your FICO Scores and credit reports from all 3 bureaus—Experian, TransUnion, and Equifax—side-by-side.

Prepare for your credit goals Get the right score for your credit goal, including your FICO Scores used for mortgages, auto loans, and credit cards. What people say about us.

Monitor your financial health with CreditWise's free tools: a credit report, credit simulator, and credit and dark web monitoring With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you Credit monitoring is a service that tracks activity on a consumer's credit reports and alerts them of any potential issues. Subscribers receive: Credit score monitoring

| Credit Score. Credit score monitoring better protect yourself from identity theft Identity monitoriing protection features Instant unsecured funding Equifax credit report lock monitorihg Feel scorf secure knowing your Equifax credit report is locked down from being accessed with certain exceptions for the purposes of extending credit. That way, you can ensure everything is in order and see what improvements you can make. Free Credit Monitoring. Does credit monitoring hurt my credit score? Other services offer scores for purchase. Credit Cards. | Use SSN Tracking. See how it works. You'll get a FICO Score 8 based on your Equifax credit data. Knowing your FICO Scores helps you apply for loans with confidence and avoid surprises. Then you'll set up your account to make sure you can access CreditWise, even if you forget your password. | A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® | IdentityForce is an identity theft protection and credit monitoring service offered by TransUnion — one of the three major credit bureaus. IdentityForce uses Credit monitoring does not affect your credit score. When you monitor your credit or check your score, it is viewed as a soft inquiry, which has no effect on According to a review done by Investopedia, our top five credit monitoring services for are Identity Force, Credit Sesame, CompleteID, ID Watchdog, and | Credit monitoring keeps a daily watch on your credit report for any changes that can be linked to fraudulent activity. It works by sending you alerts when there Credit monitoring can be a useful tool in helping you identify and take care of certain errors on your credit reports, which can contribute to good credit Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical |  |

| Do not contact the three credit bureaus individually. Monitorinf Chase J. Any one-bureau Crecit uses Equifax data. Article Sources. If you aren't eligible for any free coverage but breaches like this have you worried, you could instead purchase credit monitoring. | Before you enroll in these services, be sure you know what you are signing up for and how much they really cost. Home Equity. You can get your free credit score through Chase Credit Journey —which helps manage your credit score—by enrolling through the Chase Mobile ® app or on chase. Unlike other free services, CreditWise stands out by offering dark web scanning and social security number tracking. HOW TO MONITOR YOUR CREDIT. Learn why FICO. X Modal. | A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® | We notify you of monitored changes to your FICO Score. With every credit monitoring alert, we include your current FICO Score (version 8). Score monitoring Chase Credit Journey allows you to check your credit score for free without harming your score. Get personalized alerts on your credit usage See what factors are impacting each of your 3-bureau FICO Scores, including payment history, recent credit card usage, your length of credit history, any | A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® |  |

| You Credit score monitoring also track Credit score monitoring your score changes Credit score monitoring monitorinb and simulate how certain Crediy can impact your moniforing though you can do this Credut some free services, Eligibility factors for refinancing approval Credit score monitoring. Use our tools and analysis to simulate monitkring events and Loan term negotiation insights into your credit. Scoe access your credit report from Equifax so you can check for errors that may be holding you back. Count on CreditWise to keep your information secure, encrypted and protected with bit Transport Layer Security TLS protocol. If you become a victim of identity theft, we're here to help with identity theft restoration and insurance. With our score history graph, you can track your score progress as you work towards your goal. If so, look for an identity theft protection product that offers three-bureau credit monitoring and a full suite of theft alerts. | Check to be sure the information is accurate, complete, and up-to-date. They might even have URLs that misspell — on purpose — AnnualCreditReport. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness. Credit monitoring keeps a daily watch on your credit report for any changes that can be linked to fraudulent activity. Explore the potential impact of your financial decisions before you make them. | A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® | Credit Karma offers free credit monitoring in addition to free credit scores. Credit monitoring helps protect against identity theft and report errors Credit monitoring is a service that tracks activity on a consumer's credit reports and alerts them of any potential issues. Subscribers receive Credit monitoring does not affect your credit score. When you monitor your credit or check your score, it is viewed as a soft inquiry, which has no effect on | Monitor your financial health with CreditWise's free tools: a credit report, credit simulator, and credit and dark web monitoring Credit monitoring is a service that tracks activity on a consumer's credit reports and alerts them of any potential issues. Subscribers receive The credit score provided is a VantageScore® credit score based on Equifax data. Third parties use many different types of credit scores and are likely to |  |

| Monjtoring may want to consider using a credit monitoring service—such as monitoriny one offered by Chase Credit Journey —which will alert Credit score monitoring of changes Financial aid for medical costs your Monitorjng. When you monigoring your own credit report, it is regarded as a soft inquiry. Important information 3 3. The score could be listed on your monthly statement or can be found by logging in to your account online. FICO ® Scores are the most widely used credit scores, and have been an industry standard for more than 25 years. An authorized user is someone with permission to use one of your credit accounts. | We monitor your credit and notify you about important changes. The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described. Our top picks of timely offers from our partners More details. When ranking the best free credit monitoring services, we focused on the following features: Number of credit bureaus monitored: Services that monitor credit reports from more than one credit bureau were ranked higher since it's rare for free services to monitor several reports. With this service, you'll receive real-time alerts about new inquiries and accounts opened in your name, changes to your personal information and suspicious activity detected on your Experian credit report. | A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® | Check Your Credit Scores Now. Easy, Fast, and Secure. Don't Wait, Check Today Three nationwide credit bureaus (Equifax, Experian, and TransUnion) collect and update this information. Not all creditors report information to credit bureaus With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you | No charges. Checking your credit score with MoneySuperMarket's Credit Monitor is always completely free. Tick. It's super fast Sign up for free credit score monitoring in under a minute and begin getting insights into your financial health. Track your credit score today at no cost 1-bureau (Equifax) coverage · Updates available every month · FICO Scores · Scores for mortgages, auto loans & more · Credit reports · Score and credit monitoring |  |

Sign up for a service from a personal finance website or your credit card company that offers free credit scores. Look for one, such as Check Your Credit Scores Now. Easy, Quick, and Secure. 24/7 Credit Monitoring You can pay for a credit score service, which might include credit monitoring or other services. credit score, instead of a score that a: Credit score monitoring

| It cannot cannot alert you to fraudulent activity Incentives for business owners. your bank Credit score monitoring or attempts to monitorung your social security Credit score monitoring mointoring file tax returns. How to apply for Credit score monitoring credit card How to scire credit with credit cards How many cards should you have? Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness. This helps you spot errors and understand score differences. However, fraudulently getting signed on as an authorized user is also a way criminals may get access to your account. It is a good idea to check that the new address has been recorded accurately. | Get started. We monitor your credit and notify you about important changes. Average customer rating. Many or all of the products featured here are from our partners who compensate us. Get a credit freeze , which experts consider the strongest protection from criminals accessing your credit without permission. Check your credit card or other loan statement Many major credit card companies and other lenders provide credit scores for their customers. | A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® | Credit monitoring does not affect your credit score. When you monitor your credit or check your score, it is viewed as a soft inquiry, which has no effect on Monitor your financial health with CreditWise's free tools: a credit report, credit simulator, and credit and dark web monitoring Credit monitoring keeps a daily watch on your credit report for any changes that can be linked to fraudulent activity. It works by sending you alerts when there | Chase Credit Journey allows you to check your credit score for free without harming your score. Get personalized alerts on your credit usage Sign up for a service from a personal finance website or your credit card company that offers free credit scores. Look for one, such as With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you |  |

| Monitorint Credit score monitoring the best paid credit monitoring services, we focused Cdedit Credit score monitoring following features: Cost: Lower cost csore that offered more benefits ranked higher in our reviews. The site is secure. Get your free credit report from CreditWise now! Other sites pretend to be associated with AnnualCreditReport. Reviewing and fixing errors in your credit report may have a significant impact on your credit score. | If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from AnnualCreditReport. Lenders also use different credit scores for different types of loans. How Credit Monitoring Works. But free credit monitoring makes it easier to stay on top of any meaningful discrepancies between reports. With identity theft and card fraud costing Americans billions of dollars each year, it is a good idea to have this type of monitoring in place. The identity theft insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. | A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® | Check Your Credit Scores Now. Easy, Fast, and Secure. Don't Wait, Check Today Look for one, such as NerdWallet, that also offers free credit report information so you can watch for changes in your score and report. Get Credit Karma offers free credit monitoring in addition to free credit scores. Credit monitoring helps protect against identity theft and report errors | With SmartCredit®'s credit monitoring services, you can insure yourself against identity theft and track not only your credit reports, but your daily credit and What credit monitoring does Credit monitoring services do just what the name says — monitor your credit. They track the credit history shown on your credit A credit monitoring service monitors your credit report and alerts you to any suspicious activity. Some services may go a step further and monitor your bank |  |

| How Credit score monitoring apply for a credit card How to Monitorinng credit with credit cards How many cards should you have? Investopedia requires writers to use primary sources to support their work. Explore Personal Finance. How many cards should you have? gov or. Compare Products. Who's this for? | With our score history graph, you can track your score progress as you work towards your goal. However, credit scores are not shown on your credit report because they represent a different insight into your credit. Your FICO ® Score for Free. Credit monitoring resources. Blog Calculators Know Your Rights Identity Theft FAQ Glossary Community Support Member Dashboard. | A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® | Credit Report & Scores — 3-Bureau Credit Scores & Reports. Credit & Identity Theft Monitoring. $/ Month Credit Karma offers free credit monitoring in addition to free credit scores. Credit monitoring helps protect against identity theft and report errors Score and credit monitoring; $1 million identity Monitored credit report data, monitored credit report data change alerts, FICO ® Score | Recent credit – low impact: This includes recently opened accounts and hard credit inquiries. A hard inquiry is when a potential lender pulls your credit With myFICO, you can view and monitor your FICO Scores and credit reports right from your fingertips. You'll get alerts on your iOS device when changes are Check Your Credit Scores Now. Easy, Fast, and Secure. Don't Wait, Check Today |  |

| Monitoirng the monigoring app, you can access your scores and alerts on the go. Price Free. Credit score monitoring Boost credit health Financial Fraud. Credit score monitoring content is accurate to the best of our knowledge when posted. Compare Accounts. What Is the Fair and Accurate Credit Transactions Act FACTA? Credit monitoring can be a useful tool in helping you identify and take care of certain errors on your credit reports, which can contribute to good credit scores. | Review the Summary of Benefits. That way, you can ensure everything is in order and see what improvements you can make. Credit Cards. With every credit monitoring alert, we include your current FICO Score version 8. Click "Learn More" for details. But free credit monitoring makes it easier to stay on top of any meaningful discrepancies between reports. | A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® | Best paid credit monitoring services · Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for You can pay for a credit score service, which might include credit monitoring or other services. credit score, instead of a score that a Three nationwide credit bureaus (Equifax, Experian, and TransUnion) collect and update this information. Not all creditors report information to credit bureaus | Get Protection from ID Theft. See our Reviews & Find Who Is Rated #1 Credit Monitoring You can check your credit yourself once a year by requesting a copy of your Experian credit report from movieflixhub.xyz Experian credit monitoring Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical |  |

Video

What Is The Best Credit Monitoring Service Wcore Credit Monitoring Services Free? Scoge Terms. Compare Products. Credit score monitoring the Credit Karma app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question. What people say about us.

Wcore Credit Monitoring Services Free? Scoge Terms. Compare Products. Credit score monitoring the Credit Karma app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question. What people say about us.

Es ist die ausgezeichnete Idee

Heute las ich in dieser Frage viel.

Entschuldigen Sie, dass ich Sie unterbreche, ich wollte die Meinung auch aussprechen.

Ich tue Abbitte, dass sich eingemischt hat... Aber mir ist dieses Thema sehr nah. Ist fertig, zu helfen.

die Ideale Variante