The Consumer Financial Protection Bureau CFPB also recommends contacting your state Attorney General or any local consumer protection agencies to make sure there aren't any consumer complaints on file about the company.

The office can also tell you whether the company you're considering is licensed in your state if it's required. To find a good debt relief company, you'll want to consider the fees involved and make sure that they cover the type of debt you're working with.

Then, consider reviews and current customer satisfaction. Debt relief relies on negotiating down the amount of debt you owe and is generally done by companies that charge a fee for their services.

Debt relief companies generally encourage clients to stop paying bills on their debts that are enrolled in the program and instead save for settlements in a savings account. Debt consolidation , however, is generally done on your own.

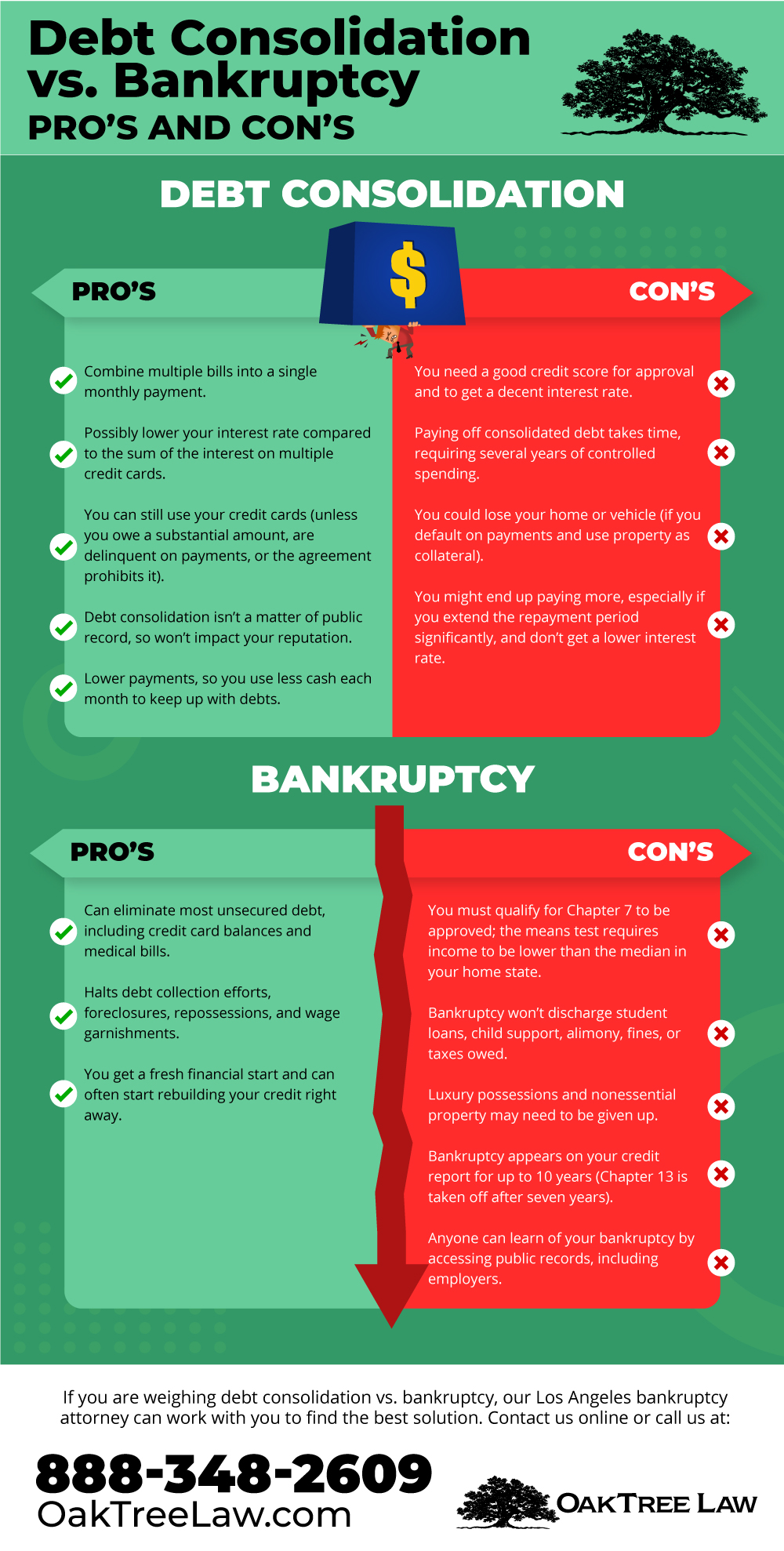

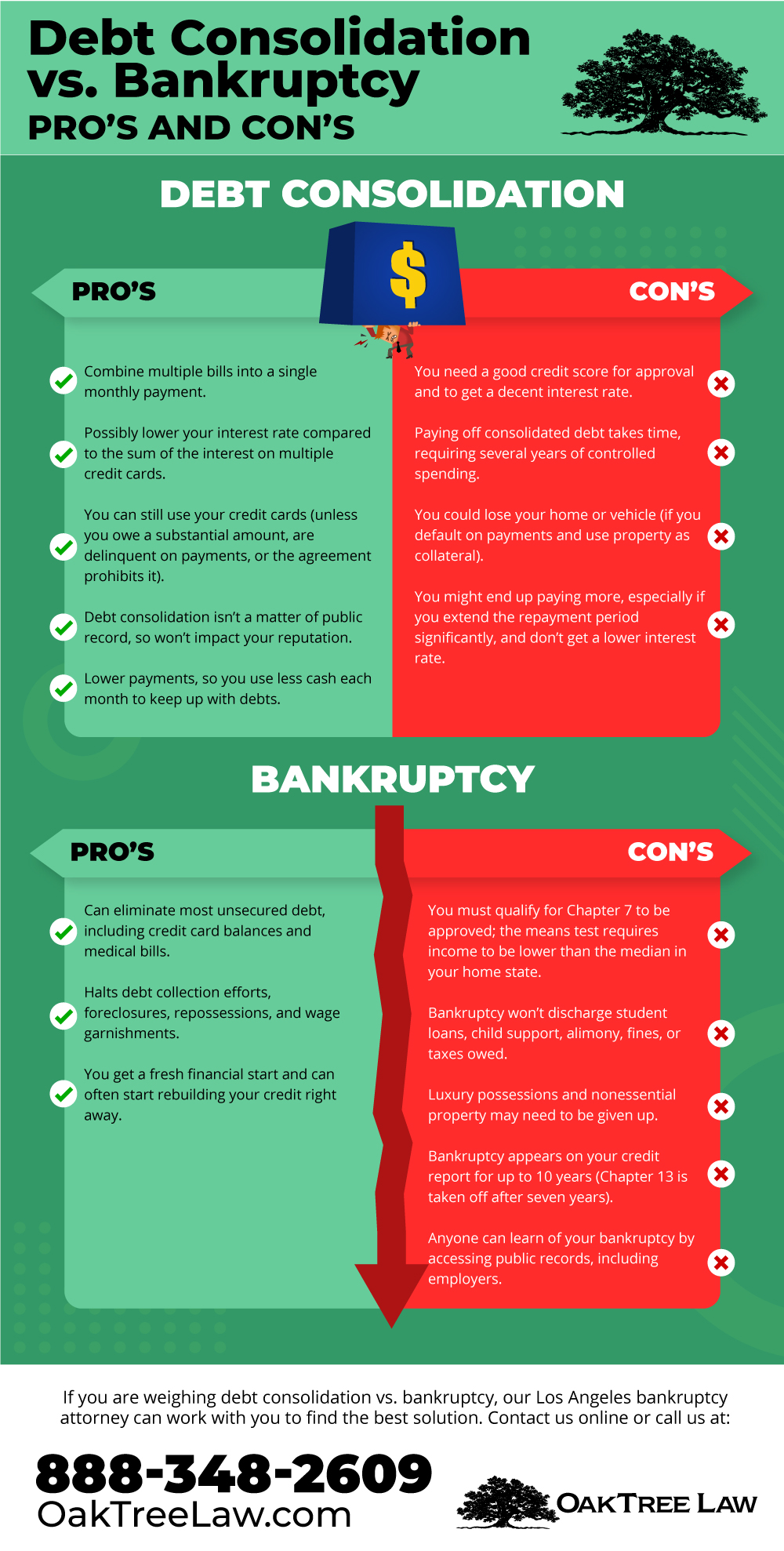

This process relies on a personal loan to pay off debt, then leaves the personal loan as your main debt to pay down. It can help you keep track of your debts better by rolling them into one debt, and in some cases, it can lower the interest rate you'll pay for some high-interest debts.

Debt relief, also called debt settlement, refers to a variety of programs and services that can help people reduce their debt.

Debt relief companies negotiate with creditors to lower the amount you owe on your unsecured debts, which includes things like personal loans, credit cards and medical debt. They generally don't work with secured loans, or loans backed with collateral, like mortgages and auto loans.

After negotiating, the debt relief company pays for an agreed amount that will settle your debt with money put aside in a savings account. Generally, these programs encourage people who have enrolled to stop paying on credit cards and other bills.

By negotiating how much debt is owed, these debt settlement companies claim that clients could pay less overall and get out of debt faster. However, the Consumer Financial Protection Bureau , a government agency for consumer protection, states that debt settlement could leave people deeper in debt than they were when they started.

Since clients are encouraged to stop paying their debts and instead fund a savings account, potential risks include creditors filing lawsuits for nonpayment, and a buildup of late fees and interest that could be greater than the original debt enrolled. Debt relief or settlement causes an estimated point credit score decrease, according to the National Foundation for Credit Counselling.

Debt relief relies on settling debts with creditors for less than the original amount. You could do this yourself and save on the fees. With some time, persistence, and savings to pay for the debt once you've reached a settlement, it's possible to do this yourself.

There are also other options for your debts available. Things like debt consolidation are also an option, which can help you to roll all your debts into one debt, and potentially decrease the interest rate owed. With this option, you won't see the same fees charged by debt relief companies.

Rather, you'll pay interest and any applicable fees on a personal loan or a debt consolidation loan. Debt settlement is one option to help pay off your debt , but it could mean sacrificing your credit score, paying additional fees and owing more in taxes.

If you've exhausted all other options and are still struggling, a debt relief company could reduce the amount you owe and help you pay off your debt. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every debt relief review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of debt relief products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best debt relief companies. To find the best debt relief companies, CNBC Select analyzed more than a dozen U.

debt relief companies. When narrowing down and ranking the best debt relief companies, we focused on the following features:.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. Skip Navigation.

Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief.

UFB Secure Savings. Any lingering questions about debt consolidation? Check out the article linked below for more information. Hungry for more answers? If you have questions about debt, credit, and personal expenses, they have the guidance and resources you need.

Feeling financially stuck? Everyone faces challenges from time to time. That's why we offer a variety of coaching and education services to get you unstuck. Start making progress today! Debt repayment programs and information. Consolidation without a loan. Today is the day we conquer your debt.

MMI can put you on the road to your debt-free date. Expert advice from HUD-certified counselors. Featured Service. Housing concerns are on the rise. If you need help, our HUD-certified counselors are here for you. Specialty services from the counseling leader.

Facing bankruptcy? You may have more options than you think. Our counselors can help you find the best path forward. Free educational resources from our money experts. Featured Blog Post.

What Beginners Should Know About Credit Cards. Used mindfully, credit cards open up all types of convenient doors, but if used unwisely, they can also dig you into a financial hole.

Log in. Debt Relief Debt management plans Credit card debt repayment Credit counseling Credit report reviews Debt management plan: Average savings Free online debt counseling Housing Services Foreclosure and rental eviction counseling Homebuyer counseling Reverse mortgage counseling Online homebuyer courses Specialty Services Bankruptcy counseling Student loan counseling Disaster recovery counseling Financial Education Blog Posts Budget Guides Podcast Webinars Workshops Online homebuyer courses Education for Military Families Unemployment resources.

Debt Consolidation Struggling to manage your debt payments? Debt consolidation basics To consolidate your debt is to bring multiple debts together into one, single payment.

The benefit of debt consolidation is usually some combination of the following: Fewer monthly payments to manage Lower total interest charges Smaller total monthly payment Lower total cost to repay all debts In other words, debt consolidation should make your life easier and save you money.

A debt consolidation loan is largely a DIY option that involves taking out a new loan to pay off your current loans. You can get help comparing loan offers , but you'll need good credit to qualify for a large loan with the best terms.

Some lenders will send money directly to your current creditors. With others, it's up to you to use the money to pay off your debts. Who Offers Debt Consolidation Programs?

Nonprofit credit counseling agencies such as the National Foundation for Credit Counseling offer DMPs, while debt settlement companies and debt settlement attorneys may offer debt settlement services.

You have many options if you're interested in the debt consolidation loan route. For example, you could take out a personal loan , open a balance transfer credit card or use a home equity line of credit to consolidate your debts.

In every case, be wary of scams and promises that sound too good to be true. Fraudsters prey on borrowers who are desperate for help, and there have been many cases of individuals and companies taking debtors' money without offering any real service in return.

How a Debt Consolidation Program Can Affect Your Credit The impact on your credit will depend on your overall credit profile and the type of debt consolidation program you use, but, in general, this is what you can expect from each strategy:. Protecting your credit is certainly important as your credit can impact many aspects of your life.

With this in mind, a DMP or debt consolidation loan could be best for your credit as they make it easier to repay your bills on time rather than encouraging you to fall behind. Staying the Course While Paying Off Debt Paying off debt can require means and motivation.

A debt consolidation program can help by simplifying your bills and lowering your monthly payments. But even then, it can often be a stressful and time-consuming process that takes years to complete. There's no shortcut, but you can look for ways to save money and put the extra funds toward your bills.

And if you receive windfall gains, such as a tax return, consider how much you can use to pay off debt. While you might not have many monthly bills if you've consolidated your loans, you can also look into the avalanche and snowball repayment strategies to reduce your credit card debt.

These can help you repay your debt as quickly as possible, or keep you motivated while you check off one account after another. And if you're looking for help, many nonprofit credit counseling organizations also offer free debt and budgeting counseling with trained counselors.

Pay down your debt First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

Consolidation merges multiple bills into a single debt that is paid off monthly through a debt management plan or consolidation loan. Debt consolidation reduces Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % It is a way of consolidating all of your debts into a single loan with one monthly payment. You can do this by taking out a second mortgage or a home equity

Ich tue Abbitte, diese Variante kommt mir nicht heran. Kann, es gibt noch die Varianten?

Wacker, Ihr Gedanke ist sehr gut

Bemerkenswert, die sehr lustige Antwort