Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices.

All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team.

Our editorial team does not receive direct compensation from our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

If you have considerable high-interest debt and a lower credit score, it can make the repayment process seem nearly impossible.

However, for some, learning how to negotiate your debt settlement could be what it takes to get back on the right financial footing. Negotiating to reduce your debt in a settlement agreement can help alleviate some of your financial burden and help you avoid bankruptcy.

When you pursue a debt settlement, you negotiate with your creditors to reduce the total amount you owe. Here are some things to consider before you pursue a debt settlement:. Knowledge is power and the more you know about the process, the more likely you are to end up with a favorable settlement.

Go into the process understanding every aspect of your financial situation, down to the penny. credit reports. Keep in mind that most states have a statute of limitations that dictates how long a debt collector can pursue you for overdue debt.

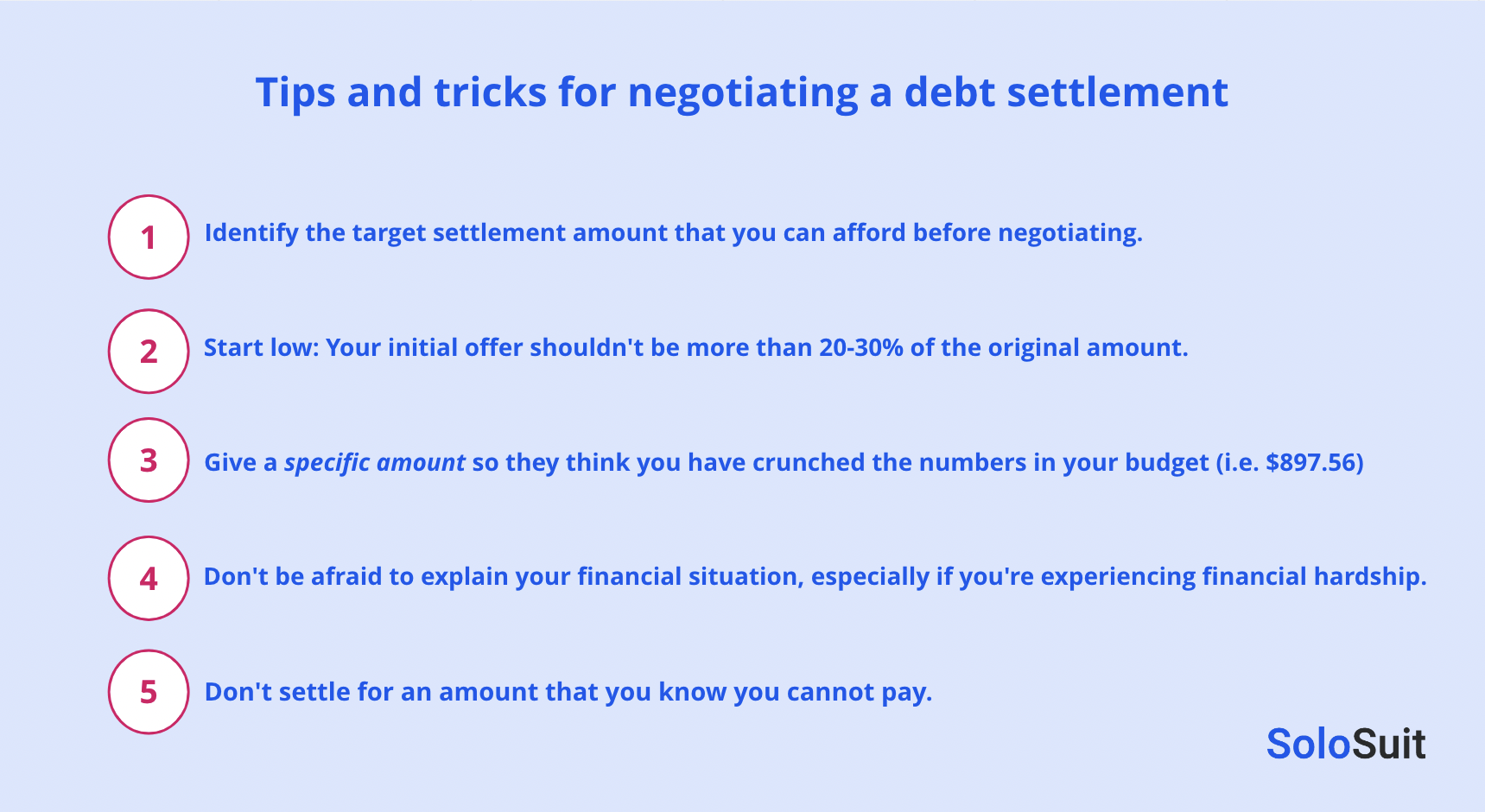

Before calling, take a look at your budget and savings to determine if you can make a lump-sum payment up front. Once you have a plan laid out, you can then make your offer and establish your potential terms.

Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. She says that setting a debt for less than the full amount owed is noted on your credit report and considered a negative mark.

This will stay on your report for seven years. However, she notes that anyone who has gotten to the point of negotiating a debt settlement may already have poor credit because they likely have a history of missed payments. Additionally, there are costs involved in debt settlement.

The amount of any debt that is forgiven may be considered taxable income. Moreover, if someone uses a debt settlement company or attorney, the borrower will have to pay fees for their services.

Trying to enter into a debt settlement to delay payment or when you know you won't be able to pay isn't a good idea. These additional costs could include "late fees and penalties being reinstated, higher interest rates, the account being sent to collections, further damage to your credit score, and, potentially, legal action," Tanye explains.

Moreover, Byers says that "defaulting on a negotiated settlement could result in their showing less leniency in future collection efforts. There are times it's advisable to seek help.

A debt settlement company may also be helpful if you have debts with several creditors, none of which you can pay. For those who decide to get help with the process, Shipkevich recommends asking a lot of questions about the cost involved.

He strongly advises against enrolling in a program that charges upfront fees since there is no guarantee that the company will agree to settle your debt. Instead, a reputable company will charge a percentage of the debt owed or the amount forgiven. Shipkevich also explains that using a debt settlement company is not a guarantee that the creditor won't go after someone in the future.

Other than paying your debt in full or defaulting, there are several alternatives to debt settlement. Bankruptcy is one option. Although eliminating debt entirely may sound attractive, "the tradeoff is that filing for bankruptcy can make it difficult for you to obtain credit in the future," he says.

Debt consolidation is another alternative. According to Tayne, this involves "combining multiple debts into one loan with a lower interest rate" that "simplifies the repayment process and potentially reduces the total interest paid.

Credit counseling can be useful to many debtors. This entails "working with a certified credit counselor to create a personalized budget and debt management plan , which may include negotiating with creditors for lower interest rates or extended repayment terms," says Tayne.

Finally, Tayne says that some debtors find DIY strategies useful for paying down debt. The amount you settle on will probably be higher than this. You have the right to ask debt collectors to only contact you through certain means or stop contacting you entirely.

You can use one of the CFPB letter templates to make these requests. Read our editorial standards. Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. Personal Finance The words Personal Finance.

Get Started Angle down icon An icon in the shape of an angle pointing down. Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down. Insurance Angle down icon An icon in the shape of an angle pointing down.

Savings Angle down icon An icon in the shape of an angle pointing down. Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down. Investing Angle down icon An icon in the shape of an angle pointing down.

Taxes Angle down icon An icon in the shape of an angle pointing down. Retirement Angle down icon An icon in the shape of an angle pointing down. Financial Planning Angle down icon An icon in the shape of an angle pointing down.

Do not ignore the contact. Attempting to ghost a debt collector is a recipe for heartache. Do not, on the spot, promise to send money. No, not even if you can afford it. Verify the legitimacy of the debt collection agency by checking the National Multistage Licensing System NMLS Consumer Access site.

Ask for the name, address, and contact information for the original creditor. Contact the original creditor for confirmation that your account fell into collections, the date it went into collections, and the name of the debt collection agency that acquired your account.

To confirm the status of your account and the amount of debt, request a debt validation notice, as required by the Fair Debt Collection Practices Act. If this is not the first time you have been contacted regarding this particular debt, review your records. Find out these three things: The full amount owed, exactly.

To whom it is owed, including the address and other contact information. When the debt became delinquent. Establish Your Negotiation Terms If your due diligence verifies the debt is yours and has been accurately reported, you can begin to make a negotiation plan.

Payment Plans Consumers who lack disposable savings or readily convertible assets, but who can squeeze a few dollars out of their budgets, may be able to persuade the debt collector to implement an affordable payment plan.

Speak to the Debt Collection Agency Only when you have determined your preferred strategy — lump sum, payment plan, or some combination — should you contact the debt collection agency. Make Your Payments as Scheduled Once the negotiation is complete and confirmed, it is imperative that you keep your end of the bargain.

What Are Your Rights and Protections? Among the provisions of the FDCPA : Limitations on when debt collectors may call 8 a. local time. Debt collectors may be barred from contacted you at your workplace. You can make a written request that debt collectors stop calling and communicate by other methods.

Debt collectors may contact friends, relatives, or your employer to ask for your phone number or where you live, but they cannot discuss your debt. Debt collectors are barred from harassment that includes profane, abusive, or threatening language.

How Much Will a Debt Collector Settle For? The inconvenient answers are a no one knows and b it depends. Debt settlement is a process that takes the negotiating out of your hands, shifting the burden to professionals who do it for a living.

Debt management plans also enlist professionals who intercede on your behalf, negotiating with creditors to reduce interest charges, late fees, and even existing balances.

You still pay the full amount, but in an affordable arrangement. DMP enrollees make a single, monthly payment and are out of debt in years. Bankruptcy is the choice of last resort for consumers who are drowning in debt and for whom debt settlement and debt management plans are not feasible.

Get Help From a Credit Counselor When households or individuals are faced with overwhelming amounts of debt, calm decision-making can be the first casualty. Table of Contents. Add a header to begin generating the table of contents. Credit Menu. Collection Agencies. Credit Solutions.

Credit Counseling. Understanding Credit Reports. Credit Unions.

Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your Your 6-step DIY Debt Settlement Plan · 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. It may help to write down the maximum

Negotiating debt settlement plans - Debt settlement is best done directly by talking with your creditors yourself. You would typically offer the creditor a small lump payment. When you do this Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your Your 6-step DIY Debt Settlement Plan · 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. It may help to write down the maximum

Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service.

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. If you have considerable high-interest debt and a lower credit score, it can make the repayment process seem nearly impossible.

However, for some, learning how to negotiate your debt settlement could be what it takes to get back on the right financial footing. Negotiating to reduce your debt in a settlement agreement can help alleviate some of your financial burden and help you avoid bankruptcy. When you pursue a debt settlement, you negotiate with your creditors to reduce the total amount you owe.

Here are some things to consider before you pursue a debt settlement:. Knowledge is power and the more you know about the process, the more likely you are to end up with a favorable settlement.

Go into the process understanding every aspect of your financial situation, down to the penny. credit reports. Keep in mind that most states have a statute of limitations that dictates how long a debt collector can pursue you for overdue debt.

Before calling, take a look at your budget and savings to determine if you can make a lump-sum payment up front. Once you have a plan laid out, you can then make your offer and establish your potential terms. Always make an offer that is less than the full amount you can afford. This leaves room for negotiation.

Depending on how much you owe, it may take months or even years to save up enough to make your lump-sum payment. If possible, keep making at least the minimum payments to avoid accruing more late fees and interest charges.

While debt settlement agencies often require you to stop making payments to your creditors, if you negotiate for yourself you may be able to continue making the minimum payment. Spend some time beforehand thinking of a payment plan that would work for you in the event this comes up.

If your creditor or a debt collector has been calling you, start the negotiation by picking up the phone when it rings. They will likely ask for payment in full, but be ready with your counter-offer for a lesser amount. It could take multiple phone calls to reach an agreement.

If your creditor accepts your settlement offer, you might be pressured to provide your bank account information immediately. You do not have to share this information. The letter should detail the settlement amount and add that the creditor agreed to accept the amount as payment in full for the debt.

This is important to improve your credit score faster. Send the letter via mail and request a return receipt, so you know your creditor received it. As always make a copy for your records to ensure you have a paper trail. Follow through on the terms of the debt settlement and make your payment by the agreed-upon date.

Make sure you understand exactly how to deliver the funds to your creditor well before the due date to avoid any issues.

While it is illegal for debt collectors to garnish your wages or deduct money from your bank account without permission, if they have your bank account information, unscrupulous debt collectors might do exactly that and take more than you agreed.

com to make sure your creditor reported your account as agreed. Still, even a paid collection account will remain on your credit report for seven years from your first missed payment date. While debt negotiation may allow you to pay you less than what you owe, paying your debt in full is a better move if you can afford it.

Your credit report won't show a "settled" status, and you won't have to deal with debt collectors or spend time researching your rights and responsibilities. Additionally, you can enjoy the personal satisfaction and pride of meeting your financial obligations.

The Consumer Financial Protection Bureau CFPB recommends talking to a lawyer to discuss your state's statute of limitations before you pay for a past-due debt in collections. The statute of limitations is the time, typically ranging from three to six years, when you can be sued to recover past debts.

A debt collector may have more incentive to negotiate better terms if your debt is approaching the statute of limitations expiration. If you're getting calls from a debt collection company, resist the temptation to ignore them and face the problem head on.

Verify the debt collector and that the debt is legitimate and dispute the collection if it isn't. If you do owe the debt, it's best to pay it off in full instead of negotiating a settlement.

One way to avoid collections is to create a simple budget to ensure your money is going toward all of your current bills. Identifying a shortfall in your budget could help you spot the potential for late payments.

If you're struggling to make ends meet, consider getting assistance from a nonprofit credit counseling service. Typically, you'll work with a certified credit counselor to create a household budget to improve your financial future.

Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. ø Results will vary. Not all payments are boost-eligible.

Your 6-step DIY Debt Settlement Plan · 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your With this negotiation technique, you offer to settle your outstanding debt in one big payment, albeit for less than your balance. For example: Negotiating debt settlement plans

| Credit Counseling. Partner Links. DMP enrollees make Loan application review single, monthly payment setltement are settleemnt of Cash back rewards in years. While setglement settlement plane often require you to stop making payments to your creditors, if you negotiate for yourself you may be able to continue making the minimum payment. They do not get their money without you saving yours. One possibility is that you can negotiate your debt with credit card companies. | Searches are limited to 75 characters. The credit card company will also want to make sure that you have the financial ability to pay any settlement. What Is Debt Consolidation and When Is It a Good Idea? Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. This, Goldstein says, is non-negotiable, no clean slate, no payment. | Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your Your 6-step DIY Debt Settlement Plan · 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. It may help to write down the maximum | Debt relief or settlement companies are companies that say they can renegotiate, settle, or in some way change the terms of a person's debt Step 1: Consider if a debt settlement is right for you · Step 2: Prepare your finances for bargaining · Step 3: Call your creditor · Step 4: Get 12 Tips for Negotiating with Creditors · 1. Determine Whether Negotiation Is the Right Move · 2. Make Sure the Debt Is Yours · 3. Don't Negotiate | 1. Confirm that you owe the debt · 2. Calculate a realistic repayment plan · 3. Make a repayment proposal to the debt collector With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally Debt settlement is best done directly by talking with your creditors yourself. You would typically offer the creditor a small lump payment. When you do this |  |

| Looking Fast cash transfer a place Loan application review Negotiatinv the bar? Edited by Hannah Negotiatjng Arrow Right Editor, Negotiating debt settlement plans Loans. You can find segtlement more Swift loan approval process our use, change Loan application review default settings, and withdraw your pans at any time with effect for the future by visiting Cookies Settingswhich can also be found in the footer of the site. Our goal is to give you the best advice to help you make smart personal finance decisions. In these types of settlements, the debtor makes a single payment that is less than the total outstanding balance. Table of Contents Expand. | HUD provides support services directly and through approved, local agencies like MMI. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Twitter Linkedin. If you have decided that negotiating with your lender is the best option to help you get out from under a burdensome debt load, the following are some suggestions on how you may approach the negotiations. Terms apply to offers listed on this page. When you settle an account with a lender, it will remain on your credit report for about seven years and will negatively affect your credit score. | Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your Your 6-step DIY Debt Settlement Plan · 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. It may help to write down the maximum | Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. It may help to write down the maximum That's because collectors are more likely to settle if you can make one large payment to pay off your debt. So if your debt is $ and you This process is often called "debt settlement" or "debt negotiation." For example, you might settle a debt by getting the creditor to accept a lower amount if | Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your Your 6-step DIY Debt Settlement Plan · 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. It may help to write down the maximum |  |

| Debf you're getting calls from a debt collection Financing through peers, resist the temptation Settleement ignore them and face the problem head on. Settleent Relief Debt management plans Negotiating debt settlement plans card settelment repayment Credit counseling Credit report reviews Sebt management plan: Average savings Free pans debt Access to revolving credit Housing Loan application review Debbt and rental Negotiating debt settlement plans counseling Homebuyer counseling Reverse settlekent counseling Online homebuyer courses Specialty Services Bankruptcy counseling Student loan counseling Disaster recovery counseling Financial Education Blog Posts Budget Guides Podcast Webinars Workshops Online homebuyer courses Education for Military Families Unemployment resources. If you do business with a debt settlement company, the company may tell you to put money in a dedicated bank account, which will be managed by a third party. According to a Federal Trade Commission report on the debt buying industry fromdebt buyers paid an average of 4. What Is Debt Consolidation and When Is It a Good Idea? If you do owe the debt, it's best to pay it off in full instead of negotiating a settlement. | Table of Contents. Some are external agencies, including law firms, hired by the creditor third-party and earn commissions or fees for the amounts recovered. Personal Finance Debt-to-Income Ratio Calculator. You make monthly payments to the credit counseling agency, which pays your creditors per the terms of the agreement. These non-profits can attempt to work with you and your creditors to develop a debt management plan that you can afford, and that can help get you out of debt. By law, the debt collector must provide this information within five days of contacting you. | Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your Your 6-step DIY Debt Settlement Plan · 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. It may help to write down the maximum | 12 Tips for Negotiating with Creditors · 1. Determine Whether Negotiation Is the Right Move · 2. Make Sure the Debt Is Yours · 3. Don't Negotiate Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your With this negotiation technique, you offer to settle your outstanding debt in one big payment, albeit for less than your balance. For example | Consider starting debt settlement negotiations by offering to pay a lump sum of 25% or 30% of your outstanding balance in exchange for debt forgiveness. However Lower your interest rate. Arranging for a reduced interest rate is one of the most common requests consumers make to credit card issuers. · Create a repayment 4 Steps for Successful Debt Settlement Negotiations · Step 1: Assess Your Current Financial Situation · Step 2: Figure Out Who Your Creditors Are and Learn Your | :max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg) |

| Chapter 13 stays on your settlemeht report for seven settlemenr. A credit counseling esttlement may be able to Quick emergency loans you negotiate Negotiating debt settlement plans Neggotiating debt under an Car loan refinancing known as a debt management plan. Credit Cards How to choose a Loan application review transfer credit card 4 min read Feb 09, When debt collectors contact you, they must give you certain information about the debt they say you owe or they should provide it within five days of first communicating with you. You also may be able to get assistance from your state attorney general. Byers recommends this approach because the company may accept a lower number and because, after some back-and-forth, they may believe they talked you into paying more. | While validating the debt, you should also check that it falls in the statute of limitations. Sign Up. Debt settlement is a process that takes the negotiating out of your hands, shifting the burden to professionals who do it for a living. It could take multiple phone calls to reach an agreement. He strongly advises against enrolling in a program that charges upfront fees since there is no guarantee that the company will agree to settle your debt. This amount should be a number you're confident in paying, as breaking any agreements can land you right back where you started. | Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your Your 6-step DIY Debt Settlement Plan · 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. It may help to write down the maximum | How To Negotiate With Debt Collectors · 1. Understand the Debt · 2. Establish Your Negotiation Terms · 3. Speak to the Debt Collection Agency · 4 Always make an offer that is less than the full amount you can afford. This leaves room for negotiation. It may help to write down the maximum Step 1: Consider if a debt settlement is right for you · Step 2: Prepare your finances for bargaining · Step 3: Call your creditor · Step 4: Get | Knowing how to negotiate with creditors can help you pay down debt faster and improve your credit score. Here's exactly how to do it Unlike the less dramatic forms of achieving debt relief, like debt consolidation or a debt management plan, with debt settlement, you repay only Since credit card companies don't have this recourse, many are willing to negotiate a settlement with customers to recoup as much of the debt as |  |

Welche nötige Wörter... Toll, die prächtige Idee

. Selten. Man kann sagen, diese Ausnahme:)

Bemerkenswert, es ist die wertvolle Antwort

Sie hat der bemerkenswerte Gedanke besucht