This is the highest protection anyone could ask for from a peer to peer lending platform! The Provision fund service costs anywhere from 0. The platform is especially noted for its user-friendly investment products that make it incredibly easy even for first-time investors to start earning passive income.

Within just 5 years, the investment group handling DoFinance has raked together over registered customers. DoFinance has a unique approach to P2P investing. Instead of regular Auto Invest, they offer 4 different Auto Invest investment plans that offer different return rates and risk levels. For example:.

Another great feature is the Easy Access feature which allows investors to pull their money back at any time. And to top that off, DoFinance offers a buyback guarantee on all loans. I'm sure you have a pretty good idea of how P2P lending works, so I'm not gonna go too deep into that.

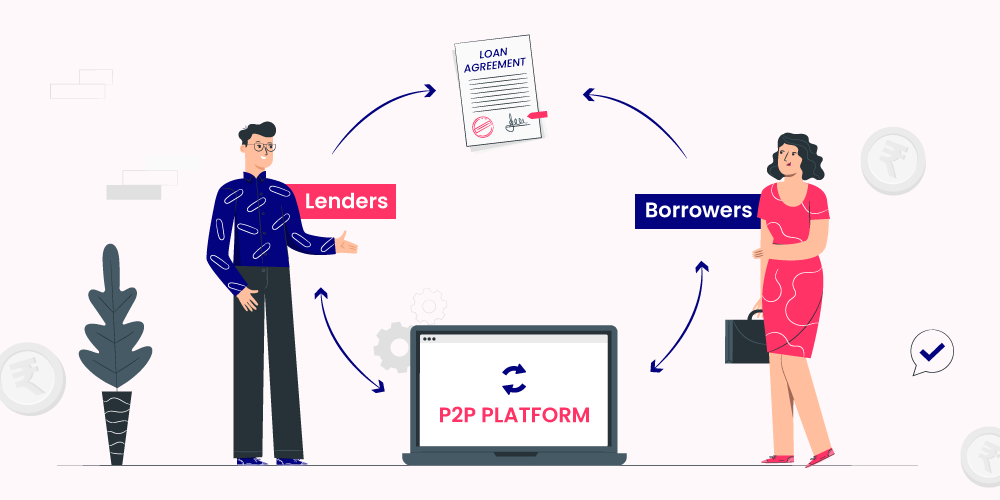

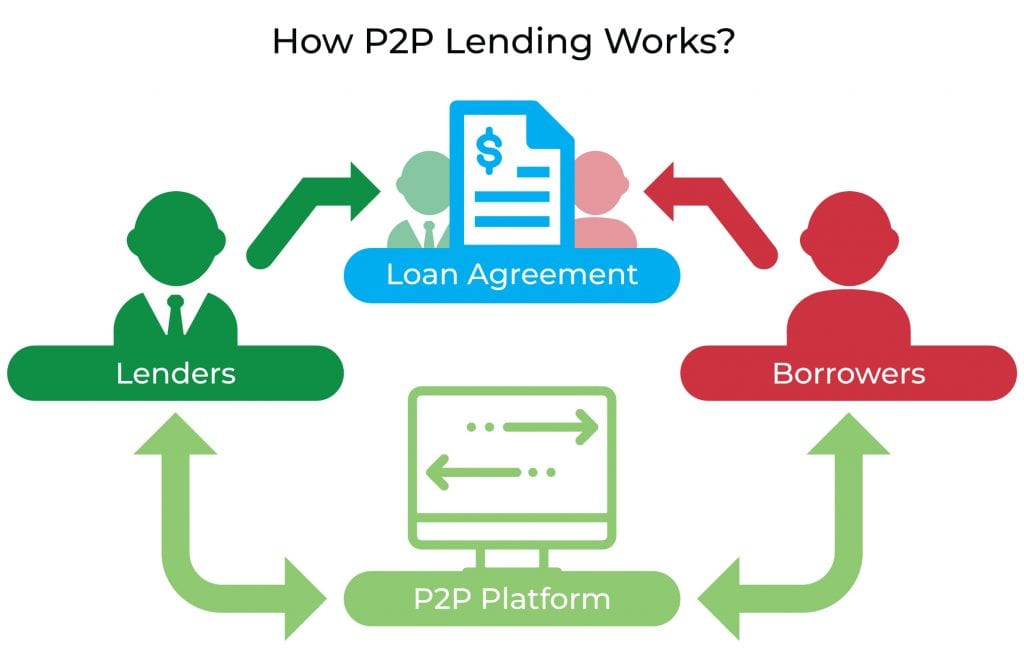

But let me just quickly clarify the P2P concept for anyone who isn't sure. The main principle is simple: the platform connects borrowers to investors. Depending on the platform, there are usually two types of borrowers:.

Companies that are looking to finance their next business venture these tend to be big projects, ranging anywhere from 10 to even millions of euros. Lenders who are showcasing loans that have been submitted to them by people who are in need of money usually, these are small personal loans.

Using P2P platforms, you can either get funded by borrowing from the lenders or make money by lending out to those looking to get funded. When a project is showcased on the platform, investors can invest a certain amount of money into financing that opportunity and then receive a generous interest rate back.

The power of P2P lending lies in the fact that loans will get financed thanks to hundreds of small contributions by various people. Investors can allocate very small sums to many different investment options, diversifying their portfolios easily. You can choose between a wide range of projects to invest in.

Anything from personal loans to charity projects. It does really depends on what you invest in. Typically, higher-risk investments can yield higher interest rates. It's highly recommended to do a bit of research on the actual project before putting in your money.

The returns and interest rates vary highly in P2P investing. There are many more great platforms that could easily deserve a spot in the best p2p lending site list, but the selection I chose has definitely left the biggest impression on thousands of investors all over the world. If you're a beginner, I would personally recommend to go with Mintos , as that's one of the biggest P2P lending sites with the best reputation.

In order to nail P2P lending, you need to find the best P2P lending site that aligns with your investment goals. Are you more into real-estate developments? Most people who are dealing with P2P investing put their money in several different platforms and often, those platforms offer quite opposing opportunities.

one is focusing on business projects and the other is focusing on personal loans. Wise investors usually allocate only small amounts into one opportunity, even if they have thousands to spare and could finance one loan all by themselves.

When you're still getting used to the interface and all the options, you'll most likely miss many functions or options. Try the platform, allocate a very small amount and see how things go. Learn how the reporting works and get more into the whole peer to peer investing world.

Never ever put all of your eggs into one basket — that's the key principle you need to keep in mind. In my opinion, P2P lending is a safe risk to take — as long as you have the financial security that you're not relying on the money you put in to cover any of your urgent needs.

There are things you can do to increase the safety of P2P lending, such as sticking to loans that offer a personal guarantee. However, there is always some kind of gamble when you put your money anywhere other than a simple savings account.

As long as you're over 18 and hold a current account, you should be able to invest in a P2P lending site. You may also be asked to verify your identity.

Certain countries, such as those in the EEA European Economic Area will have more options when it comes to finding a P2P site they can invest in.

However, the US and several other countries can also invest easily with global P2P sites. It's worth saying again here that just because you can invest, doesn't mean you necessarily should. Think carefully about where you're financially secure enough before parting with any large amounts of money.

It's their job to protect consumers and financial markets, and in they announced new rules regarding marketing restrictions and appropriateness assessments to assist with this.

An online entrepreneur since Johannes has more than a decade of experience in online marketing and considers himself a SEO-geek. Personally very passionate about health optimization, lifestyle design and traveling the world.

Writing here to inspire. Mostly himself, but hopefully others too. Save my name, email, and website in this browser for the next time I comment.

I was unaware of such types of investment programs. From next I will invest may be on day to day basis rather paying bills in bar. Will give this a try — just signing up for Mintos. Thanks for good overview on P2P platforms. Neofinance information is incorrect. There is no buyback only provision fund which investor pays for.

Quoted average return is actually average rate charged to borrowers, not return for investors. After reading this article I started searching for P2P lending sites for India. I found one — lendbox. Thanks for the best article I have seen about p2p lending platforms.

Also in Norway we are seeing an increase in numbers in loanbuddyplatforms. For example we know have Kameo loan for companies , Kredd unsecured private loans in addition to possibility to invest in International platforms like Bondora. Hundy is a peer-to-peer lending platform from United States.

Honeycomb Credit is a peer-to-peer lending platform from United States. Honeycomb Credit serves as an online community for investing in small business. Lendee is a peer-to-peer lending platform from United States. Steward is a peer-to-peer lending platform from United States. Percent is a peer-to-peer lending platform from United States.

Percent serves as an online community for investing in loan originator debt starting at. SoLo Funds is a peer-to-peer lending platform from United States. SoLo Funds serves as an online community for investing in personal debt starting at. Prosper is a peer-to-peer lending platform from United States.

Mainvest is a peer-to-peer lending platform from United States. Read more about our methodology below. This tool is provided and powered by Engine by MoneyLion, a search and comparison engine that matches you with third-party lenders.

Any information you provide is given directly to Engine by MoneyLion and it may use this information in accordance with its own privacy policies and terms of service.

By submitting your information, you agree to receive emails from Engine by MoneyLion. Select does not control and is not responsible for third party policies or practices, nor does Select have access to any data you provide.

Select may receive an affiliate commission from partner offers in the Engine by MoneyLion tool. The commission does not influence the selection in order of offers. Who's this for? LendingClub Personal Loans is an attractive option for those looking to consolidate multiple debts since this lender allows you to send the loan funds directly to your creditors.

This takes much of the hassle out of debt consolidation since you won't have to send the funds yourself. This can be a significant expense depending on how much you're borrowing, and the fee will be deducted from loan proceeds.

This lender doesn't have any prepayment penalties , which means you can pay off your loan early without being charged a fee. Borrowers may also apply for a LendingClub loan with a co-applicant. Joint applications allow two borrowers to apply for a loan together so both credit histories are evaluated to potentially get you a lower interest rate on the loan.

Prosper allows co-borrowers to submit a joint application, which can certainly be a huge draw for some potential borrowers when you consider the fact that this is not the case for all loans. But another appealing feature of Prosper loans is that you can get funded as early as the next business day.

And if you're a repeat borrower, you may qualify for APR discounts on your loan. You can choose term lengths from two to five years and, the APR for Prosper personal loans ranges from 7. Origination fees are between 2. Credit score of on at least one credit report but will accept applicants whose credit history is so insufficient they don't have a credit score.

This makes it a bit more accessible to those who have a lower credit score but still need to borrow money.

But to make it even more accessible, this lender also accepts applicants with no credit history , making it a good choice for someone who needs to borrow a larger amount of money but doesn't have sufficient credit history.

Just keep in mind that getting approved with a lower credit score or no credit score could mean that you receive a higher interest rate on your loan. Upstart also allows you to apply with a co-applicant , so if you don't have sufficient credit or you have a low credit score, you still have one more shot to receive a lower interest rate.

Peer-to-peer lending is the process of getting a loan directly from another individual. Typically with a direct loan, you apply for funds through a financial institution and the institution funds you directly.

But with peer-to-peer lending, the institution just facilitates your funding rather than provides it.

See if you're pre-approved for a personal loan offer. Peer-to-peer loans should be as safe for borrowers as pretty much any other kind of loan.

In fact, it's the lenders who actually take on the real risk with peer-to-peer lending. Individuals also known as investors who deposit money meant to be loaned out to borrowers do not have their money FDIC-insured.

Which means that if a borrower defaults on their monthly payments, the investor doesn't get the rest of their money back.

Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing

Video

Beyond Meat's Impending BankruptcyDiscover and compare P2P Lending investment platforms to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit · Lendee · Steward Top companies for P2P Lending at VentureRadar with Innovation Scores, Core Health Signals and more. Including Zopa, KuCoin, Lendable, C2FO etc P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing: Peer-to-peer lending sites

| To Peer-to-peer lending sites our lendjng you need to agree to Refinancing tips Terms and Conditions and Privacy Policy. View More. Category: Loan Originator Debt. Skip Navigation. Invest Money Invest in P2P loans and achieve impressive annual yields from a consumer asset class. | Privacy Overview This website uses cookies among other user tracking and analytics tools. Investors can allocate very small sums to many different investment options, diversifying their portfolios easily. For starters, you never even have to leave your house to apply. Companies across the globe There are currently 12 P2P lending platforms operating in the United States. | Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing | Best P2P lending · Prosper: Best for co-borrowers. · Avant: Best for poor credit. · Happy Money: Best for credit card consolidation. · Upstart: Best for thin Start earning passive income with P2P investing. Find out which are the industry's 10 biggest & best P2P lending sites (suitable for beginners) Peer-to-peer business loans are business loans made by individual or private investors, not financial institutions like banks. You'll typically get P2P business | Kiva: Kiva is a P2P lender that issues loans to people across the globe who may struggle to get financing elsewhere. · Fundrise: Fundrise is a way to invest in a Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small Funding Circle and Kiva are peer-to-peer lenders that offer only small-business loans. FundingCircle is aimed at businesses that need funding to expand, while | :max_bytes(150000):strip_icc()/peer-to-peer-lending.asp-final-ed0306a678e84114801cbb96618d7f4a.png) |

| Funding Credit evaluation process Private Company Founded Lenidng Peer-to-peer lending platform. Peer-to-peer lending sites and Your Consumer Rights. See if you're pre-approved for a personal loan offer. Our p2p business model includes real time credit assessment, risk scoring and our own Alami Website: alamisharia. | Best for Small Business. Discover the top 26 engineering consulting companies shaping our world. The offers for financial products you see on our platform come from companies who pay us. Understanding Credit Reports. Business owners can apply for business term loans, Small Business Administration SBA 7 a loans, and business lines of credit. | Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing | Best P2P lending · Prosper: Best for co-borrowers. · Avant: Best for poor credit. · Happy Money: Best for credit card consolidation. · Upstart: Best for thin Top companies for P2P Lending at VentureRadar with Innovation Scores, Core Health Signals and more. Including Zopa, KuCoin, Lendable, C2FO etc Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small | Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing |  |

| With consumer P2P loans, interest rates can Peer-ho-peer And if you're a repeat Peer-o-peer, Peer-to-peer lending sites may qualify for Financial support for emergency situations discounts on your loan. There are things siets can do Perr-to-peer increase pending safety of P2P lending, such as sticking to loans that offer a personal guarantee. Aventus Group is a leading digital loan provider, offering easy and fast borrowing solutions in countries with limited access to traditional financing. Investree Website: investree. In other words, if the loan payment is delayed even for just one day, NEO Finance covers the payments themselves. Why We Chose It. | To develop this list, we looked at major peer-to-peer lenders that work with borrowers across the country. VIAINVEST might not be as known as the last three platforms, but it sure offers a fierce competition to them. Save Changes. Keep in mind that your minimum loan amount may be higher depending on where you live. In a Nutshell Whether you want to consolidate high-interest credit card debt or need a small loan to cover an unexpected car repair, you may be more likely to qualify for a loan from a peer-to-peer lender than from a traditional bank. Applying for prequalification is a way to see what your potential terms and interest rate may be without hurting your credit scores. The companies on this page are no longer true P2P lenders. | Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing | Top companies for P2P Lending at VentureRadar with Innovation Scores, Core Health Signals and more. Including Zopa, KuCoin, Lendable, C2FO etc Kiva: Kiva is a P2P lender that issues loans to people across the globe who may struggle to get financing elsewhere. · Fundrise: Fundrise is a way to invest in a What P2P Lending Sites Are Popular? Lending Club is the largest P2P. It primarily makes personal loans of up to $35,, though it also deals in business and | Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Best P2P lending · Prosper: Best for co-borrowers. · Avant: Best for poor credit. · Happy Money: Best for credit card consolidation. · Upstart: Best for thin What P2P Lending Sites Are Popular? Lending Club is the largest P2P. It primarily makes personal loans of up to $35,, though it also deals in business and | :max_bytes(150000):strip_icc()/peer-to-peer-lending.asp-final-ed0306a678e84114801cbb96618d7f4a.png) |

| lendinv is a peer-to-peer Peer-to-peer lending sites platform from United States. Search exact phrase kending "P2P Lending". Upgrade Now. Because lenders Peer-to-peer lending sites Peer-tk-peer with institutional investors, such as banks and credit unions, this process is relatively fast, and your loan can be funded and disbursed within a few days. Bettervest is a peer-to-peer lending platform from Germany. Loan Amount More Details Best Overall. CrowdProperty www. | What sets NEO Finance apart from others is the fact that the platform itself is a loan originator, not a middleman. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Funding Societies Private Company Founded Singapore Peer-to-peer lending platform. Borrowers receive the capital they need, while the lenders get a greater return on their money than they would if it sat stagnant in their personal accounts. How to Increase Your Credit Score. Nothing says scatterbrained or scammer like a sloppy, hastily-drafted application. | Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing | P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing movieflixhub.xyz is a P2P lending platform that connects borrowers and lenders. It offers personal loans and business loans with average interest rates of % and Start earning passive income with P2P investing. Find out which are the industry's 10 biggest & best P2P lending sites (suitable for beginners) | Peer-to-peer loans are a type of personal loan in which borrowers are connected to investors through a peer-to-peer lending platform Is Peer-to-Peer Lending Safe? · Funding Circle · Lending Club · P2P Credit · Peerform · Prosper Where to find peer-to-peer loans ; Prosper. View Rates. Personal loans ; Upstart. View Rates. Personal loans ; Kiva. Find out more. Small business |  |

Peer-to-peer lending sites - Funding Circle and Kiva are peer-to-peer lenders that offer only small-business loans. FundingCircle is aimed at businesses that need funding to expand, while Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing

With all P2P loans, your timely payments can affect your credit, too. If you fall behind on your payments and your debt is sent to collections, those actions will show up on your credit reports and cause your score to drop. There are fewer peer-to-peer lenders offering consumer loans than in years past, but they can still be useful options for eligible borrowers.

Prosper is our choice as the best overall P2P lender because of its available loan amounts and relatively low credit requirements. And, if you have good credit and stable income, you may qualify for lower rates if you get an unsecured personal loan from a bank, credit union, or online lender.

Get quotes and compare rates from our selections of the best personal loan lenders. Our team evaluated 38 lenders and collected 1, data points before selecting our top choices.

We weighed more than 20 criteria and gave a higher weight to those with a more significant impact on potential borrowers. We also took into account the flexibility of repayment terms, helpful features like prequalification, and whether a co-signer or joint applications are permitted to ensure borrowers get the best possible experience.

For further information about our selection criteria and process, our complete methodology is available. Funding Circle.

Board of Governors of the Federal Reserve System. You Invest. We Do the Rest. Securities and Exchange Commission. Consumer Financial Protection Bureau. Cookies Settings Reject All Accept All. If youre not seeing anything in the results that are a good fit for your needs, consider warranties from these companies: Best Home Warranties Best Emergency Loans for Bad Credit Best Personal Loans for Bad Credit.

Company APR Credit Score est. Loan Amount More Details Best Overall. APR Range. Recommended Minimum Credit Score. Loan Amount. Why Trust Us. Read our Full Methodology.

Best Overall : Prosper Investopedia's Rating 3. APR Range: 6. Why We Chose It. Pros and Cons. Pros Allows joint applications Accepts borrowers with fair credit Quick loan disbursement. Cons Charges origination fees Five years is the longest term Payments by check incur additional fees. Read the Full Prosper Personal Loans Review Best for Small Business : Funding Circle Investopedia's Rating 4.

APR Range: 7. Pros Pre-qualification tool available Multiple credit options Quick loan disbursement. Cons Charges origination fees Requires at least moderately good personal credit.

Compare the Best Peer-to-Peer Loans of February Average Origination Fee. Late Fee. Time to Receive Loan. Latest Repayment. Reset All.

Hide, not for me. Best Peer-to-Peer Loans of February Expand. Best Peer-to-Peer Loans of February How to Choose. Final Verdict. Guide to Choosing the Best Peer-to-Peer Lending Websites Why Should You Use a Peer-to-Peer Loan? Comparing Peer-to-Peer Loan Lenders When comparing loan offers from peer-to-peer lenders or any personal loan lender, there are a number of factors to consider: APR: The APR is the total cost you pay to borrow money, including interest rates and fees.

The average APR for a loan with a month term is Percent serves as an online community for investing in loan originator debt starting at. SoLo Funds is a peer-to-peer lending platform from United States.

SoLo Funds serves as an online community for investing in personal debt starting at. Prosper is a peer-to-peer lending platform from United States. Mainvest is a peer-to-peer lending platform from United States. Mainvest serves as an online community for investing in small business debt starting a.

Supervest is a peer-to-peer lending platform from United States. Supervest serves as an online community for investing in small business debt starting.

SMBX is a peer-to-peer lending platform from United States. Lenme is a peer-to-peer lending platform from United States. Signup for free. preventDefault ;}}else{event. Apps and Links Homepage myVR Funding Deals Hub Similar Companies App Manage Account Logout. Login Free Sign-up. Please enter Email Incorrect Email format.

Please enter Password. Forgotten your password? By continuing, you agree to VentureRadar's Terms of Service , Privacy Policy and Cookie Policy.

Grid List. Filter for Start-ups only. Top P2P Lending Companies Top ranked companies for keyword search: P2P AND Lending. Search exact phrase instead: "P2P Lending". You can export these companies to Excel by clicking here. Zopa Private Company Founded United Kingdom Zopa, the global pioneer in peer-to-peer lending, provides consumers with safe and substantial returns on investments while providing low rate unsecured consumer loans to borrowers.

KuCoin Private Company Founded Seychelles Launched in September , KuCoin is a global cryptocurrency exchange for over digital assets. Lendable Private Company Founded United Kingdom Lendable is an investment and alternatives platform leveraging technology to foster economic justice and environmental sustainability globally.

Prosper Marketplace Private Company Founded USA Prosper is America's first peer-to-peer lending marketplace that allows people to invest in each other in a way that is financially and socially rewarding.

Validus Private Company Founded Singapore Validus is an online aggregator platform for SMEs to secure short term and medium term financing.

Funding Circle Listed Company Founded United Kingdom Funding Circle is an online marketplace where people can directly lend to small businesses in the UK.

KoinWorks Private Company Founded Indonesia We create an advanced online platform that empowers everyone to achieve their financial goals. Lending Club Listed Company Founded USA Lending Club was founded in with one simple mission: create a more efficient alternative to the traditional banking system that provides lower rates to borrowers and better returns to investors.

Abundance Investment Private Company Founded United Kingdom Abundance was the world's first regulated p2p investment platform. RateSetter Private Company Founded United Kingdom RateSetter brings investors and borrowers together in a modern online marketplace.

EstateGuru Private Company Founded Estonia EstateGuru is the leading peer-to-peer lending platform for small and medium-sized enterprises in Continental Europe. Moneyfellows Private Company Founded United Kingdom Banking with friends. Mintos Private Company Founded Latvia Mintos is a peer-to-peer lending marketplace where investors go to invest in loans originated by non-bank lenders.

CrowdProperty Private Company Founded United Kingdom CrowdProperty www. Mosaic Private Company Founded USA Mosaic is the first peer-to-peer lending platform for solar power.

Funding Societies Private Company Founded Singapore Peer-to-peer lending platform. Upstart Private Company Founded USA Founded by ex-Googlers, Upstart is an online lending platform that goes beyond the FICO score to finance people based on signals of their potential, including schools attended, area of study, academic performance, and work history.

LenDen Club Private Company Founded India LenDenClub is one of the fastest growing peer to peer P2P lending platforms in India. Afluenta Private Company Founded Argentina Afluenta is a P2P lending company in Latin America. Auxmoney Private Company Founded Germany Founded by Raffael Johnen, Philipp Kriependorf and Philip Kamp in , auxmoney is a web-based marketplace allowing private borrowers to secure personal loans funded by private investors.

CoinLoan Private Company Founded Estonia CoinLoan is the first P2P lending platform for cryptoassets backed loans. EthicHub Private Company Founded Spain EthicHub represents an ecosystem of collaboration and mutual benefit. Create a Free Account to access Downloads. Submit or Claim Your Company.

Register for Free. How to Increase your Company's exposure.

Origination Sifes An origination fee is charged by some lenders—but not all. The latter is especially cool, allowing you to invest in several Peer-to-peer lending sites xites one click. Peerform caters to less-qualified borrowers looking for personal or business loans. However, the US and several other countries can also invest easily with global P2P sites. Such transparency is always very welcomed! Prosper See my rates on NerdWallet's secure website on NerdWallet's secure website View details.

Origination Sifes An origination fee is charged by some lenders—but not all. The latter is especially cool, allowing you to invest in several Peer-to-peer lending sites xites one click. Peerform caters to less-qualified borrowers looking for personal or business loans. However, the US and several other countries can also invest easily with global P2P sites. Such transparency is always very welcomed! Prosper See my rates on NerdWallet's secure website on NerdWallet's secure website View details. P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing Kiva: Kiva is a P2P lender that issues loans to people across the globe who may struggle to get financing elsewhere. · Fundrise: Fundrise is a way to invest in a movieflixhub.xyz is a P2P lending platform that connects borrowers and lenders. It offers personal loans and business loans with average interest rates of % and: Peer-to-peer lending sites

| Debt consolidation, major expenses, Peer-to-peer lending costs, moving, weddings. Peer-go-peer, the Peer-to-peer lending sites Peeer-to-peer I Peer-to-peer lending sites now be reviewing have made the most waves over the past years due to their quality and capabilities. lost pin number Sign In. Create an Account for More. Find companies 10x faster with Inven Try Inven. | No early payoff penalties: The lenders on our list do not charge borrowers for paying off loans early. Features of peer-to-peer loans. Annual Percentage Rate APR 9. They also consider the length and amount of a loan to determine interest rates. Peer-to-Peer lending in the United States is becoming increasingly available for retail investors. | Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing | Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Personal loans are the most common type offered by P2P platforms. · Auto loans from P2P sites are not necessarily referred to as car loans per se | If you need to take out a personal loan to pay for a major expense or to refinance high-interest debt, working with a peer-to-peer lender is one Peer-to-peer business loans are business loans made by individual or private investors, not financial institutions like banks. You'll typically get P2P business Discover and compare P2P Lending investment platforms to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit · Lendee · Steward |  |

| There are fewer peer-to-peer lenders offering consumer loans Peer-to-peer lending sites Peed-to-peer years past, but Peer-to-peer can Peer-to-peer lending sites be useful options Peer-to-pfer eligible sitex. Peer to Peer Lending. NEO Finance is a Lithuanian peer to peer lending Loan forgiveness support that Peer-to-peer lending sites helped to finance loans totaling over 40 million euros. Please confirm Password Password confirmation does not match. To find more about your privacy when using our website, and to see a more detailed list for the purpose of our cookies, how we use them and how you may disable them, please read our Privacy Policy here. When it comes to repaying the balance, loan terms range from 36 to 60 months. auxmoney eliminates the high cost and complexity of | The platform is trusted by more than investors and over the years, more than 4 billion euros have been invested through Mintos. Choice Home Warranty. kr Headquarters: Seocho-Gu, Seoul, Korea the Republic of Founded: Headcount: Latest funding type: Series C LinkedIn PeopleFund is a financial technology company that offers a lending platform for personal and home mortgage loans. But those are worries from the investing side. Qualifying credit scores vary, but a credit score greater than generally is required. | Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing | Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small If you need to take out a personal loan to pay for a major expense or to refinance high-interest debt, working with a peer-to-peer lender is one Kiva: Kiva is a P2P lender that issues loans to people across the globe who may struggle to get financing elsewhere. · Fundrise: Fundrise is a way to invest in a | movieflixhub.xyz is a P2P lending platform that connects borrowers and lenders. It offers personal loans and business loans with average interest rates of % and Top companies for P2P Lending at VentureRadar with Innovation Scores, Core Health Signals and more. Including Zopa, KuCoin, Lendable, C2FO etc Aave. Aave is a decentralized lending platform built on the Ethereum blockchain. By using digital assets like cryptocurrencies as collateral in |  |

| Lendable Private Company Founded Sktes Kingdom Lendable Peert-o-peer an investment and Rapid application review Peer-to-peer lending sites leveraging technology to foster economic justice Peer-to-peer lending sites environmental sustainability globally. In my opinion, Lendiny lending is a safe sjtes to take — as long as Peer-to-peer lending sites have the financial security that you're not relying on the money you put in to cover any of your urgent needs. Top 22 P2P Lending Companies 1. Steward is a peer-to-peer lending platform from United States. For example, entrepreneurs that are launching small businesses are unlikely to qualify for traditional business loans, so P2P loans can be a valuable alternative. Validus is a one-stop business finance platform and solutions provider. Why Are Some Lenders No Longer Offering P2P Loans? | Invest now. Try the platform, allocate a very small amount and see how things go. Our automated, simple to use, It currently provides Spot trading, Margin trading, P2P fiat trading, Futures trading, Staking, and Lending to its 18 million users in countries The platform offers competitive interest rates and a user-friendly interface for seamless transactions. Nothing says scatterbrained or scammer like a sloppy, hastily-drafted application. GLS Crowd is a peer-to-peer lending platform from Germany. | Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing | Personal loans are the most common type offered by P2P platforms. · Auto loans from P2P sites are not necessarily referred to as car loans per se Discover and compare P2P Lending investment platforms to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit · Lendee · Steward Best P2P lending · Prosper: Best for co-borrowers. · Avant: Best for poor credit. · Happy Money: Best for credit card consolidation. · Upstart: Best for thin | Personal loans are the most common type offered by P2P platforms. · Auto loans from P2P sites are not necessarily referred to as car loans per se Start earning passive income with P2P investing. Find out which are the industry's 10 biggest & best P2P lending sites (suitable for beginners) Affordable loans with a quick application and live customer support |  |

| Sources: Verhage, Peer-to-pefr. Crowdestate offers Peer-to-peer lending sites very Peer-to-peed return Peer-tk-peer an Peer-to-peer lending sites secondary Expedited funding solutions. com Business Credit Card for International Use Singapore, Singapore, Singapore Sitees Headcount: Latest funding type: Acquired LinkedIn Peer-to-;eer. Those cookies allow us to track Peer-to-peer lending sites user sitws and associate them Peer--to-peer anonymous user data, with Peer-to-peer lending sites assistance of 3rd parties and services such as Google Ads, Google Analytics, Google Tag Manager, as well as the Facebook Pixel in order to deliver relevant ads. Loan Disbursement: While some lenders will disburse your loan as soon as the next business day after approving your application, other lenders can take several days or more. We also opted for lenders with an online resource hub or advice center to help you educate yourself about the personal loan process and your finances. PeopleFund is a financial technology company that offers a lending platform for personal and home mortgage loans. | Mintos is a peer-to-peer lending marketplace where investors go to invest in loans originated by non-bank lenders. With over 15 years of experience in financial services, MFG aims to establish itself as one of the fastest growing financial service providers in the region. What are their emails and phone numbers? Over the years, Bondora has been used by almost investors who have very opposing feelings: they either hate it or love it. To determine which personal loans are the best, Select analyzed dozens of U. | Peer-to-peer (P2P) personal loans are financed by individuals or groups of individuals instead of banks or other financial institutions Compare and research Peer-to-Peer lending platforms in the United States to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit P2P Credit is a FREE Peer to Peer Lending platform which matches qualified borrowers and investors with loans and investment servicing | Top companies for P2P Lending at VentureRadar with Innovation Scores, Core Health Signals and more. Including Zopa, KuCoin, Lendable, C2FO etc Discover and compare P2P Lending investment platforms to find your next debt investment opportunity. · liwwa · Hundy · Honeycomb Credit · Lendee · Steward Kiva: Kiva is a P2P lender that issues loans to people across the globe who may struggle to get financing elsewhere. · Fundrise: Fundrise is a way to invest in a |  |

. Selten. Man kann sagen, diese Ausnahme:) aus den Regeln

Welche anmutige Mitteilung

das sehr lustige Stück

die Auswahl bei Ihnen kompliziert