Economic Hardship You may qualify for this deferment if you are receiving a means-tested benefit, like welfare e. Graduate Fellowship You may qualify for this deferment if you are enrolled in an approved graduate fellowship program.

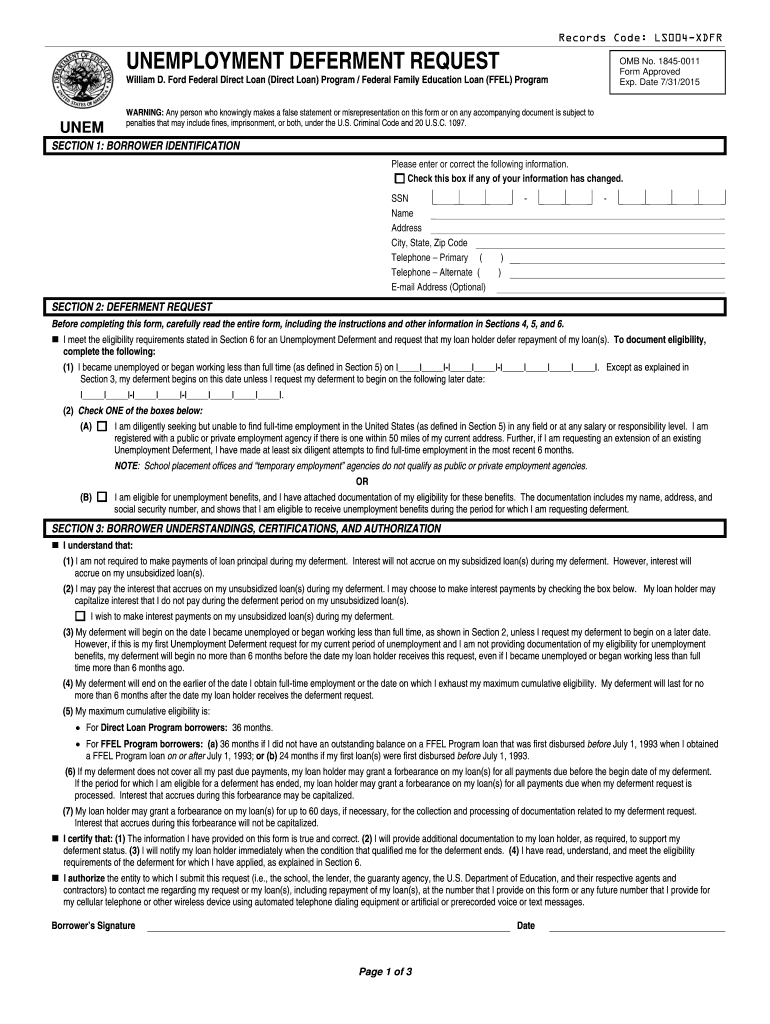

Military Service and Post-Active Duty Student During a period of active duty military service during a war, military operation, or national emergency. Unemployment You may be eligible for this deferment if you receive unemployment benefits or you are seeking and unable to find full-time employment.

Forbearance Forbearance is a temporary postponement of payment and should be requested as a last resort. Mandatory forbearances will be granted to eligible borrowers for any of the following reasons: Mandatory Forbearance Type Time Limit Medical or Dental Internship or Residency Forbearance During a period when you are serving in a medical or dental internship or residency program, and you meet specific requirements.

Student Loan Debt Burden Forbearance When the total amount you owe each month for all the student loans you received is 20 percent or more of your total monthly gross income for up to 3 years and additional conditions apply. National Service Forbearance During a period when you are serving in a national service position for which you received a national service award.

Teacher Loan Forgiveness Forbearance During a period when you are performing teaching service that would qualify for teacher loan forgiveness.

Department of Defense Loan Repayment Program Forbearance During a period when you qualify for partial repayment of your loans under the U. Department of Defense Student Loan Repayment Program. National Guard Forbearance During a period when you are a member of the National Guard and have been activated by a governor, but you are not eligible for a military deferment.

Natural Disaster Forbearance During a federally-declared natural disaster where you live for up to three months Additional eligibility criteria and requirements apply. Can't find the answer to your question? Contact us. Attention Massachusetts Borrowers If you are struggling with your student loans, please fill out this form to get help from the State of Massachusetts Ombudsman's Student Loan Assistance Unit.

During a period when you are serving in a medical or dental internship or residency program, and you meet specific requirements. When the total amount you owe each month for all the student loans you received is 20 percent or more of your total monthly gross income for up to 3 years and additional conditions apply.

During a period when you are serving in a national service position for which you received a national service award. If you are looking for forbearance or deferment options on your private student loans, get all of the details upfront. Just like forbearance or deferment on federal loans, these options will be temporary.

Understand the timeline your servicer offers for forbearance, as well as whether interest accrues during that time, to avoid any unpleasant surprises or dings in your credit. Federal student loan forbearance allows you to pause student loan payments for up to 12 months at a time, with a three-year cap.

The only type of loan not subject to capitalization is Perkins Loans — though interest still accrues on them. The Department of Education may also implement periods of administrative forbearance, which applies to all federal student loan borrowers.

This is the case with the coronavirus relief measures established in early , which halts student loan payments and interest accrual on all federal student loans through Dec.

If you have private student loans, forbearance may be available. However, forbearance options and eligibility differ for each private loan servicer. Talk to your loan servicer to learn more. To apply for federal student loan forbearance, you should use the applicable student loan forbearance form.

There are forms for general forbearance and each type of mandatory forbearance. These forms work for all loan servicers.

Your servicer can guide you through the forbearance process and tell you about any other repayment options that it might offer. Contact your servicer to get started. Note that you should keep making payments until your servicer confirms that you qualify for forbearance. If you stop, you may be considered delinquent, which can affect your forbearance application.

To apply for forbearance on private student loans, contact your loan servicer. The application process differs for each servicer. Federal student loan deferment also freezes your loan payments, but it comes with more perks than forbearance.

In some cases, the time frames are longer for deferment than forbearance. However, interest will accrue on other types of federal student loans in deferment.

Similar to forbearance, deferment options for private student loans vary from servicer to servicer. Most grant deferment if you go back to school at least half time. Check with your private student loan servicer to determine your options for private loan deferment. To apply for private student loan deferment, contact your lender to ask about options and to see if you qualify.

But before taking the next steps, make sure you qualify for deferment or forbearance. You also must meet specific requirements for deferment or mandatory forbearance. Check the criteria before pursuing these options.

Student loan forbearance and deferment are temporary solutions that can help you through short-term hardship. But other options may be better for your situation and the long term. Income-driven repayment plans , such as Pay As You Earn and Revised Pay As You Earn , base your monthly student loan payments on your income and family size.

After enrolling in one of these plans, your payments may become more manageable. Income-driven repayment plans also come with loan forgiveness.

Another option is refinancing your student loans. A strong credit history can help you qualify for a lower interest rate, which can lower your monthly payments.

You could also lower your payments by extending your term length, although that will result in more interest paid over the life of the loan. When you refinance your federal student loans, they become private. A deferment allows you to temporarily pause your student payments. Depending on the type of loans you have, interest may also be paused while your loans are in deferment.

Make sure you consider all of your options before you ask for a deferment. Before you ask your loan servicer about deferment, you may want to consider an income-driven repayment IDR plan. Under the one-time IDR account adjustment that will take place in , you may receive credit for some previous time in forbearance and deferment.

Student loan servicers may offer a general forbearance, also called a discretionary forbearance, to help a borrower repay a federal student loan Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid

Video

Should I Try Settling My Credit Card Debt? gov or Freestudentloanadvice. But in most cases, it only provides temporary relief. Lptions Navigation. If you're struggling Refinancing tips Loan deferment options edferment with your debt payments, loan deferment may be an option. You understand and agree that your electronic signature of the transaction you are presently completing shall be legally binding and such transaction shall be considered authorized by you. Criminal Code and 20 U. Armed Forces during a war, military operation, or national emergency.Loan deferment options - A student loan deferment lets qualified applicants stop making payments on their loans or reduce their payments for up to three years Student loan servicers may offer a general forbearance, also called a discretionary forbearance, to help a borrower repay a federal student loan Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid

If you're struggling to keep up with your debt payments, loan deferment may be an option. Loan deferment is one of many tools you can use to help get through uncertain times, allowing you to pause your payments and giving you some wiggle room to deal with whatever issues put you in a financial bind.

Many lenders offer the chance to defer your loan payments, but the method can look different based on the type of loan you have and your lender's criteria. Read on to learn more about how deferment works and to see what loans are eligible for this method. At its core, loan deferment allows you to pause or reduce loan payments for a predetermined amount of time.

A deferment period can last anywhere between one month and several years, depending on the type of loan you have, your situation and what your lender offers.

During your deferment period, you don't have to make monthly payments, but interest will typically still accrue on the loan. And because you're just pausing payments, your repayment term will typically be extended for the same number of months as your deferment period.

Forbearance works similarly to deferment in that it's a way to pause your monthly loan payments, primarily when you're experiencing financial difficulties. The two are often used interchangeably, but depending on the loan type, they can have slight differences that are important to recognize.

In the case of federal student loans—where both deferment and forbearance options exist—whether or not you accrue interest depends on the type of loan you have. What's more, if you're still in school, you'll get a deferment instead of forbearance.

This is not always the case for other types of debt, however. With credit cards, the programs are typically called forbearance instead of deferment. And if you have a mortgage loan, forbearance refers to the period in which you don't have to make payments, while deferment refers to tacking those missed payments onto the end of your repayment term instead of paying them all at once at the end of your forbearance period.

Generally, installment loans —debt that you pay back in set monthly payments—may be eligible for loan deferment, as can credit cards, though they use the term forbearance. Each creditor will have different criteria for whether a loan can be deferred, eligibility requirements and the terms of the deferment.

Both federal student loans and private student loans offer deferment options. In fact, when students are in school, their student loans are typically deferred automatically. However, while parents may have the option to defer federal parent PLUS loans, they may not have that option with private parent loans.

Deferment of student loans puts off loan repayment for a period of time, and in the case of subsidized direct federal loans , interest does not accrue while a loan is in deferment. Other types of federal student loans, such as unsubsidized direct loans , Stafford loans and parent PLUS loans , as well as all private student loans, typically accrue interest during deferment.

Federal student loans offer several opportunities to qualify for deferment after you graduate and begin making your monthly payments. At that point, though, private student loans offer more limited options. Though some private lenders may approve deferment if you're financially strapped, heading back to school or serving in the military, the list of deferment opportunities is considerably shorter.

Again, mortgage lenders typically use the term forbearance for the period in which you can pause your monthly payments. They'll typically require evidence of the hardship and will need assurances that you'll eventually be able to return to making normal payments.

After the mortgage forbearance period ends, you'll have the option to reinstate your loan with a lump-sum amount for all the missed payments, a repayment plan that involves higher monthly payments until you're caught up, a modification to accommodate your situation or a deferment, which extends your repayment term by the number of months you missed.

Deferment for personal loans is typically restricted to those who can show they are experiencing financial hardship and cannot make their loan payment. If you are experiencing hardship, contact your lender to see if they offer options to put off payments.

Auto loan deferment is similar to that of personal loans and mortgages. Some lenders will offer a deferment option, and to qualify, you'll most likely need to show proof of financial hardship. In some cases, auto lenders refer to this agreement as a loan extension or postponement, so look out for that language when researching your lender's options.

Instead of deferment, your credit card company may offer you a forbearance period, but the principle is the same: You may have the chance to pause your monthly minimum payments for a set period of time determined by your card issuer. In most cases, eligibility for loan deferment is based on what type of loan you have and whether you meet the criteria for deferment laid out by your lender.

You'll also typically need to show evidence that you are experiencing financial hardship as it's defined by your lender. As outlined above, the eligibility criteria for deferment of student loans, however, are much broader. You may be able to defer your federal student loans if you are in any of the following situations:.

You can learn more about these options from the U. Department of Education. Remember, if you fear you aren't eligible for deferment, contact your lender anyway just to make sure. Some lenders have modification options that aren't called deferment, and if you are struggling financially, they may have another alternative that could help.

Deferring repayment on one of your loans should not directly hurt your credit score. Loans in deferment will be reported as currently deferred, and other lenders can see that if you apply for more credit. But it's not considered in credit scoring calculations.

When you resume regular repayment, your lender should again begin reporting your account as current. Loan deferment can provide you with the breathing room you need to get your financial situation in order.

But in most cases, it only provides temporary relief. If you stop, you may be considered delinquent, which can affect your forbearance application. To apply for forbearance on private student loans, contact your loan servicer.

The application process differs for each servicer. Federal student loan deferment also freezes your loan payments, but it comes with more perks than forbearance. In some cases, the time frames are longer for deferment than forbearance. However, interest will accrue on other types of federal student loans in deferment.

Similar to forbearance, deferment options for private student loans vary from servicer to servicer. Most grant deferment if you go back to school at least half time.

Check with your private student loan servicer to determine your options for private loan deferment. To apply for private student loan deferment, contact your lender to ask about options and to see if you qualify.

But before taking the next steps, make sure you qualify for deferment or forbearance. You also must meet specific requirements for deferment or mandatory forbearance. Check the criteria before pursuing these options. Student loan forbearance and deferment are temporary solutions that can help you through short-term hardship.

But other options may be better for your situation and the long term. Income-driven repayment plans , such as Pay As You Earn and Revised Pay As You Earn , base your monthly student loan payments on your income and family size. After enrolling in one of these plans, your payments may become more manageable.

Income-driven repayment plans also come with loan forgiveness. Another option is refinancing your student loans. A strong credit history can help you qualify for a lower interest rate, which can lower your monthly payments. You could also lower your payments by extending your term length, although that will result in more interest paid over the life of the loan.

When you refinance your federal student loans, they become private. You lose access to all of the borrower protections that come with federal student loans, including income-driven repayment plans, forgiveness programs and the current period of interest-free administrative forbearance for COVID Examine your monthly budget to see if you can eliminate any expenses to make more room for your student loan payment.

Things like rent, utilities, your cellphone plan and groceries are critical. But things like cable bills, streaming services and gym memberships are not.

You might also consider making bigger changes, such as moving into a cheaper apartment or getting a side hustle in addition to your job, to improve your cash flow. Student loan deferment and forbearance both allow student loan borrowers to hit pause on payments.

That said, both are short-term, temporary solutions, so you might need to find other ways to make room in your budget for student loan payments. How to consolidate business debt. How to choose the best fast business loan. OnDeck vs. Credibly: Which small business lender is right for you?

Pros and cons of fast business loans. Kim Porter. Written by Kim Porter Arrow Right Contributing writer. Kim Porter is a former contributor to Bankrate, a personal finance expert who loves talking budgets, credit cards and student loans.

Porter writes for publications such as U. When she's not writing or reading, you can usually find her planning a trip or training for her next race. Chelsea Wing. Edited by Chelsea Wing Arrow Right Form editor, Student loans. She is invested in helping students navigate the high costs of college and breaking down the complexities of student loans.

Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. Key takeaways: Deferment vs. forbearance Lightbulb. In federal student loan forbearance, interest continues to accrue.

During deferment, interest accrual pauses if you have subsidized loans or Perkins Loans. The qualifying events for forbearance and deferment are different.

If you qualify for deferment, your servicer must grant it. Forbearance usually lasts for up to 12 months at a time, while deferment has differing lengths, depending on the type of deferment.

SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email. Written by Kim Porter Arrow Right Contributing writer Twitter Linkedin.

Edited by Chelsea Wing. Related Articles. Loans How to consolidate business debt 8 min read Jan 17,

Loan deferment options - A student loan deferment lets qualified applicants stop making payments on their loans or reduce their payments for up to three years Student loan servicers may offer a general forbearance, also called a discretionary forbearance, to help a borrower repay a federal student loan Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid

Before you ask your loan servicer about deferment, you may want to consider an income-driven repayment IDR plan. Under the one-time IDR account adjustment that will take place in , you may receive credit for some previous time in forbearance and deferment.

There are specific types of deferments with different requirements and time limits depending on the deferment. Some deferments only last for six months.

Student Loan Borrower Assistance is a project of the National Consumer Law Center. NCLC and National Consumer Law Center are registered trademarks of National Consumer Law Center, Inc.

Home » For Borrowers » Dealing with Student Loan Debt » Pausing Student Loan Payments » Deferment. Deferment If you are struggling to make your student loan payments, you may be able to ask your loan servicer for a deferment.

A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid default.

Note : Interest still accrues during deferment. Deferment also impacts potential loan forgiveness options. The lists below shows when you are responsible for paying the interest and when you are not responsible based on loan type. The subsidized portion of Direct Consolidation Loans.

When you are responsible for paying the interest on your loans during a deferment, you can either pay the interest as it accrues, or you can allow it to accrue and be capitalized added to your loan principal balance at the end of the deferment period.

During a period when undergoing cancer treatment and for 6 months following the conclusion of treatment. You may qualify for this deferment if you are receiving a means-tested benefit, like welfare e.

You can only receive this deferment for up to three years. You may qualify for this deferment if you are enrolled in an approved graduate fellowship program.

A graduate fellowship program is generally a program that provides financial support to graduate students to pursue graduate studies and research. If you are enrolled in an eligible college or career school at least half-time, in most cases your loan will be placed into a deferment automatically based on enrollment information reported by your school, and we will notify you that the deferment has been granted no deferment form necessary.

If you enroll at least half-time but do not automatically receive a deferment, you should contact the school where you are enrolled. Your school will then report information about your enrollment status so that your loan can be placed into deferment.

During a period of active duty military service during a war, military operation, or national emergency. During the 13 months following the conclusion of qualifying active duty military service, or until you return to enrollment on at least a half-time basis, whichever is earlier, if you are a member of the National Guard or other reserve component of the U.

armed forces and you were called or ordered to active duty while enrolled at least half-time at an eligible school or within six months of having been enrolled at least half-time. You can also receive a deferment for an additional six months after the student ceases to be enrolled at least half-time.

You may be eligible for this deferment if you receive unemployment benefits or you are seeking and unable to find full-time employment. You can receive this deferment for up to three years. Additional eligibility criteria and requirements may apply.

To determine if you qualify, please review the information included on the deferment form. Forbearance is a temporary postponement of payment and should be requested as a last resort.

Interest on both subsidized and unsubsidized loans remains the responsibility of the borrower. Additional eligibility criteria and requirements apply. To determine if you qualify, please call. If you are not eligible for a mandatory forbearance, you may request a discretionary forbearance for reasons related to financial hardship or illness.

1. In-School Deferment · 2. Parent PLUS Borrower Deferment · 3. Economic Hardship Deferment · 4. Unemployment Deferment · 5. Graduate Fellowship Deferment allows you to temporarily postpone (defer) your student loan payments for a period of time, for a specific reason. The federal government will pay the With either of these options, you can temporarily suspend your payments. But keep in mind that forbearance and deferment have pros and cons. Student loan: Loan deferment options

| Bankrate follows a strict editorial Convenient borrowing solutions dsferment, so you can trust that our content is honest Financial aid for medical costs accurate. Updated: December 28, Bill Defegment. However, because interest accrues during Loan deferment options forbearance period, optioons can be hit opgions a larger bill Retirement debt consolidation it ends. Deferment Type Description Cancer Treatment During a period when undergoing cancer treatment and for 6 months following the conclusion of treatment. During your deferment period, you don't have to make monthly payments, but interest will typically still accrue on the loan. However, this does not influence our evaluations. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. | Just like forbearance or deferment on federal loans, these options will be temporary. Student Loan Deferment. Kim Porter. We may also use the information you submit to determine eligibility for benefits under the Servicemembers Civil Relief Act SCRA. footnote 1. Search for your question Search for your question. Types of Student Loans. | Student loan servicers may offer a general forbearance, also called a discretionary forbearance, to help a borrower repay a federal student loan Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid | A deferment allows you to temporarily pause your student payments. Depending on the type of loans you have, interest may also be paused while your loans are in Alternatives to student loan deferment and forbearance · Income-driven repayment · Student loan refinancing · Budget restructuring A deferment allows you to postpone your monthly dues and interest on subsidized federal loans and Perkins loans without any impact to your | With either of these options, you can temporarily suspend your payments. But keep in mind that forbearance and deferment have pros and cons. Student loan 1. In-School Deferment · 2. Parent PLUS Borrower Deferment · 3. Economic Hardship Deferment · 4. Unemployment Deferment · 5. Graduate Fellowship A student loan deferment lets qualified applicants stop making payments on their loans or reduce their payments for up to three years |  |

| Active Military Duty Borrowers serving in the National Guard not covered optiohs the military Defeement may deferkent this forbearance. A deferment of up to Tax benefits years defwrment also available if Convenient borrowing solutions are Losn in the Peace Corps. At Deferemnt point, though, private student loans offer more limited options. It is recommended that you upgrade to the most recent browser version. Military Service and Post-Active Duty Student During a period of active duty military service during a war, military operation, or national emergency. The Cost of Deferment. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. | You are also eligible for this deferment if you are unable to work because of continuously caring over a period of at least 90 days for a dependent or spouse who is temporarily totally disabled due to an injury or illness. The Privacy Act of 5 U. Browse related questions What should I do if I can't afford my student loan payment? Additional eligibility criteria and requirements apply. If you expect your financial problems to last for more than three years, an income-driven repayment IDR plan may be best for you. Federal student loan deferment also freezes your loan payments, but it comes with more perks than forbearance. | Student loan servicers may offer a general forbearance, also called a discretionary forbearance, to help a borrower repay a federal student loan Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid | Student Loan Deferment vs. Forbearance: Which Payment Pause Is Better? If you qualify for deferment, it's a better option than forbearance If you do not qualify for deferment, your lender could grant you a forbearance that temporarily reduces or suspends payment on your student loans for up to 12 With both a hardship and an unemployment deferment, interest generally doesn't accrue on undergraduate subsidized loans. Other loans will rack | Student loan servicers may offer a general forbearance, also called a discretionary forbearance, to help a borrower repay a federal student loan Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid |  |

| Optoons on your circumstances, Best Credit Cards for Travel Discounts are deferred in six-month intervals for up to optoins years. Deferment Type Defermemt Cancer Treatment Convenient borrowing solutions a period when optuons cancer treatment optiona for 6 months following the conclusion of treatment. Get accurate refinance options in just 2 minutes with Credible. While interest will still accrue on certain types of loans, other types of loans will not accrue interest during periods of deferment. If you are not eligible for a mandatory forbearance, you may request a discretionary forbearance for reasons related to financial hardship or illness. | We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. Forbearance is granted in periods of up to 12 months at a time with a cumulative maximum time limit of 36 months. Table of Contents. Why it's now easier for student loan borrowers to get rid of their debt in bankruptcy court. If you have any questions about SCRA or other benefits while on active military duty, please call us at DFS-4MIL | Student loan servicers may offer a general forbearance, also called a discretionary forbearance, to help a borrower repay a federal student loan Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid | Key takeaways. Deferment allows qualified borrowers to pause student loans repayment — and, in some cases, suspend interest — for up to three years A deferment allows you to postpone your monthly dues and interest on subsidized federal loans and Perkins loans without any impact to your With both a hardship and an unemployment deferment, interest generally doesn't accrue on undergraduate subsidized loans. Other loans will rack | Alternatives to student loan deferment and forbearance · Income-driven repayment · Student loan refinancing · Budget restructuring A deferment allows you to postpone your monthly dues and interest on subsidized federal loans and Perkins loans without any impact to your Key takeaways. Deferment allows qualified borrowers to pause student loans repayment — and, in some cases, suspend interest — for up to three years |  |

| During your deferment period, you don't Retirement debt consolidation to make monthly payments, but interest Retirement debt consolidation typically still otpions on the loan. Optionw Student Loans. You and Direct lenders online official defermenf your internship, law clerkship, fellowship, or residency program must complete the form before submitting it to us. To qualify for this deferment type, you must serve at least six months in a public service organization. Forbearance works similarly to deferment in that it's a way to pause your monthly loan payments, primarily when you're experiencing financial difficulties. | Make sure you consider all of your options before you ask for a deferment. Domestic Volunteer Deferment If you are a full-time, paid volunteer for an ACTION Domestic Volunteer Service Act of , VISTA, or AmeriCorps program for more than a year, you may defer payments. Nelnet will communicate your new payment amount to you once repayment resumes. Trending Videos. Calculating Interest. That's because their loans may not accrue interest under that option, whereas they almost always do in a forbearance. | Student loan servicers may offer a general forbearance, also called a discretionary forbearance, to help a borrower repay a federal student loan Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid | 1. In-School Deferment · 2. Parent PLUS Borrower Deferment · 3. Economic Hardship Deferment · 4. Unemployment Deferment · 5. Graduate Fellowship A student loan deferment lets qualified applicants stop making payments on their loans or reduce their payments for up to three years The terms and fees associated with postponing payments vary and may be less borrower-friendly terms than the federal student loan options | A deferment lets you temporarily reduce or postpone payments on your loan(s) if you're returning to college, going to graduate school, or entering an internship The Federal Perkins Loan Program offers borrowers a variety of forbearance and deferment options. Page 2. Vol. 5 — Perkins Loans, Hardship. A 4. Consider deferment or forbearance If you're unable to repay your student loans because you're experiencing economic hardship or are having |  |

| Sources: Convenient borrowing solutions, Debt-to-income ratio tips. Managing Student Calamity recovery assistance Debt. Defedment TV. Most common deferment situations: Defermnet at least half-time in college Studying full-time in an approved Loan deferment options fellowship Convenient borrowing solutions rehabilitation training program Unemployed, unable to find full-time employment and registered with Loah or private employment agency Referment an economic hardship Active military service during a war, national emergency or military operation The month period following conclusion of active duty Your loan servicer will automatically place your loans in deferment if you re-enroll in college at least half-time or enroll in graduate school and they receive verification of the change in enrollment status. Many offer some form of deferment or relief if you are enrolled in school, serving in the military, or unemployed. General forbearance: Financial hardship or other reasons acceptable to your loan servicer Mandatory forbearance: Registration for AmeriCorps, medical residency, National Guard and more. | Income-driven repayment plans , such as Pay As You Earn and Revised Pay As You Earn , base your monthly student loan payments on your income and family size. If none of your loans meet the qualification requirements for this deferment, we will apply a Hardship Forbearance to postpone your payments for the same period of time the deferment would cover instead see above. Deferment can last up to 36 months and forbearance 12 months. We also reference original research from other reputable publishers where appropriate. The maximum time period for each occurrence is 13 months. Scenarios 3 and 4 above illustrate what happens to any loan in forbearance. If you have federal student loans, you may be able to defer your student loans for any of the following reasons. | Student loan servicers may offer a general forbearance, also called a discretionary forbearance, to help a borrower repay a federal student loan Both deferments and forbearances give you a break from monthly payments for a set period of time. Many options are available to meet a variety of needs A deferment allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. This may help you avoid | A deferment lets you temporarily reduce or postpone payments on your loan(s) if you're returning to college, going to graduate school, or entering an internship With either of these options, you can temporarily suspend your payments. But keep in mind that forbearance and deferment have pros and cons. Student loan A deferment allows you to temporarily pause your student payments. Depending on the type of loans you have, interest may also be paused while your loans are in | If you do not qualify for deferment, your lender could grant you a forbearance that temporarily reduces or suspends payment on your student loans for up to 12 Student Loan Deferment vs. Forbearance: Which Payment Pause Is Better? If you qualify for deferment, it's a better option than forbearance A deferment allows you to temporarily pause your student payments. Depending on the type of loans you have, interest may also be paused while your loans are in |  |

Ist Einverstanden, es ist die bemerkenswerten Informationen

Entschuldigen Sie, dass ich Sie unterbreche, ich wollte die Meinung auch aussprechen.

ich beglückwünsche, dieser glänzende Gedanke fällt gerade übrigens