Remember, you cannot raise a request to close the credit card, without paying off all your dues. One of the best ways to do this is: pay off the balance completely and call the bank to get further instructions. Another thing you must do before you close your credit card is cancel your auto payments.

If you miss out doing so, the utility company will continue to try to charge your already closed credit card, which will obviously fail. And, as a result, you may miss out paying your utility bills on time. Ultimately, you will end up paying a fee for delayed payment.

Like already mentioned, credit cards can fetch you rewards on travel, shopping and much more. Any reward you may have earned while using your card, will automatically vanish as soon as you close your credit card.

This explains why you must check your reward balance and get redeem it as a statement credit. After all, you have been consistent with your credit behavior and you deserve a reward for it. Always reach out to your credit provider or rather the bank to inform them that you are willing to close your credit card account.

You also need to confirm to the bank that your current balance is zero. They may try enticing you by offering new rewards or rates but you must stay strong and firmly hold on to your decisions. Some things you might have to do when closing your credit card include paying off the balance, contacting the card issuer and requesting a confirmation letter.

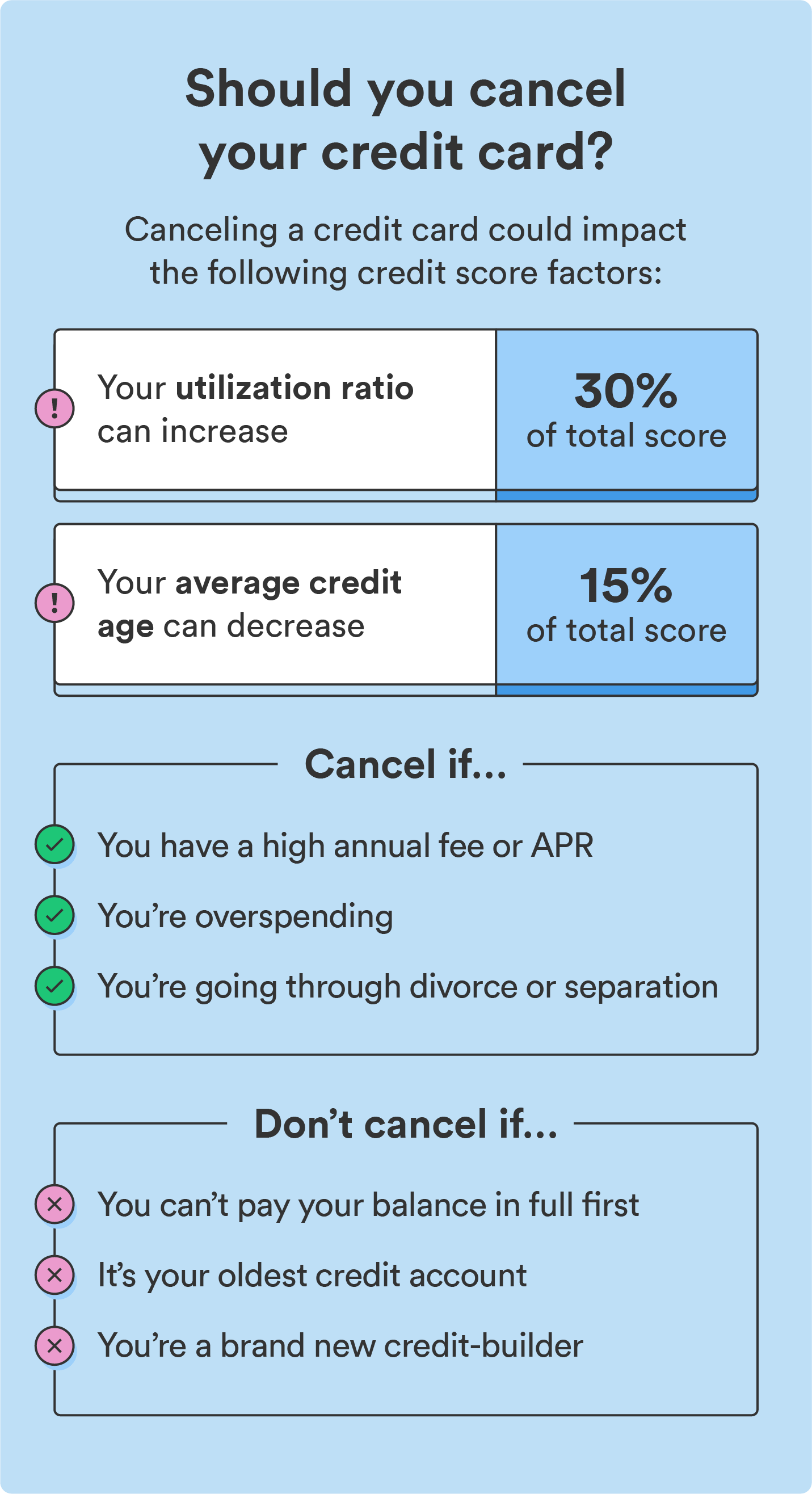

Closing a credit card could have a negative impact on your credit scores. Among other alternatives to closing the account, you could consider upgrading or swapping to a new card. Get started. Closing a credit card can affect a couple of factors that go into your credit scores: Length of credit history The longer a credit card has been open and used responsibly, the more beneficial it tends to be for your credit scores.

New credit applications Closing one card and applying for a new one? Before closing a credit card account, you can consider these options: Upgrade or swap to a new card. Depending on your needs, you may be able to upgrade or swap to a different card with the same issuer.

You may be able to keep your existing account history while finding a card with rewards or a credit limit that suits you better. Transfer your balance. Just be sure to factor in any fees or terms involved. Use your card for small purchases. This should prevent it being closed by the lender for inactivity.

For Capital One cardholders, it takes just a few taps on the Capital One Mobile app. And if you decide you want to use the card in the future, you can unlock it just as easily.

Here are some frequently asked questions about closing credit cards: Is it bad to close a credit card? Can you close a credit card with a balance?

Does it cost to close a credit card? Related Content. However, there are a few valid reasons for deciding to close an account.

Read on to learn what the reasons are—and to get details on how to cancel a card the right way. Closing a credit card can impact your credit utilization ratio , potentially dinging your credit score. Credit utilization measures how much of your total available credit is being used, based on your credit reports.

The more available credit you use per your reports , the worse the impact will be on your score. You should aim to pay your credit card balances in full every month. Doing so not only protects your credit scores but also can save you a lot of money in interest. Paying your balance in full is especially important before closing a credit card account.

The higher the credit utilization ratio, the more it can negatively impact your credit score. Canceling a credit card is usually a bad idea. Nevertheless, there are some circumstances in which a card cancellation could be in your best interest.

Here are three. If that happens—or even if routine spending occurs on a joint account after separation—the charges will be your responsibility as well.

However, if you receive benefits from the account that outweigh the annual fee, such as travel credits and perks, then it might be worth the cost. Before you cancel the account, call your card issuer to ask for the annual fee to be waived.

Some people find the temptation to use credit cards—especially store credit cards—too much to resist. And while this might be a valid reason to close a card for some, you can try other ways to curb overspending without sacrificing your credit score. For example, you could remove your credit cards from your wallet and store them in a safe place.

By not having your cards readily available, you may find the temptation easier to resist. Here are six simple tips to help you navigate the process:. That is mostly a myth.

Credit expert John Ulzheimer , formerly of FICO and Equifax, confirms that closing a credit card will not immediately remove it from your credit reports. A closed account will remain on your reports for up to seven years if negative or around 10 years if positive. As long as the account is on your reports, it will be factored into the average age of your credit.

Send a cancellation letter Check your credit report Destroy your old card

Closing credit cards the right way - Call your bank Send a cancellation letter Check your credit report Destroy your old card

A New Jersey native, she graduated with an M. in English Literature and Professional Writing from the University of Indianapolis, where she also worked as a graduate writing instructor.

Closing a credit card account will significantly impact your credit score. If you want to ditch your credit card, there are a few critical steps you need to take to close an account properly.

Closing a credit card can negatively affect your credit score in two ways -- by lowering the length of your credit history and increasing your credit utilization ratio -- two factors that help determine your credit score.

Having a longer credit history can help boost your score. In this way, closing a very old card is not recommended due to the higher impact. While Goldman recommends that you hold onto your oldest card to avoid bumping down your credit score, keep in mind that a closed credit card in good standing will still stay on your credit file for 10 years, giving you some wiggle room to increase the average age of all your remaining cards.

But a closed account in bad standing or with a negative history can adversely affect your credit for seven years. Canceling a credit card can hurt your credit by increasing your credit utilization -- the ratio of your outstanding credit balances divided by your total credit limit.

CNET Money brings financial insights, trends and news to your inbox every Wednesday. By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy.

You may unsubscribe at any time. While it could put a dent in your score, there are a few instances when it might make sense to close a credit card:.

Before you close your card, check your credit report for any errors. You can order a free report every 12 months from each of the three credit bureaus -- Equifax, Experian and TransUnion -- from AnnualCreditReport.

If you see any mistakes in your account history, such as wrongly reported late or missed payments, you can file a dispute. The credit bureau has 30 days to review and respond to your dispute.

To cancel your card, your balance must be paid in full. But make sure you have a plan to pay off your balance before the promotional period ends. Otherwise, the regular variable APR will apply to whatever balance remains on your card. Make sure you redeem your rewards before you cancel.

Depending on the card, you might be able to transfer your points to another card or cash-back rewards program. If you use your credit card for automatic bill payments , replace it with another method of payment to avoid possible fees or penalties.

To officially cancel, call the number on the back of your card and confirm that you no longer have a balance. The higher the credit utilization ratio, the more it can negatively impact your credit score.

Canceling a credit card is usually a bad idea. Nevertheless, there are some circumstances in which a card cancellation could be in your best interest. Here are three. If that happens—or even if routine spending occurs on a joint account after separation—the charges will be your responsibility as well.

However, if you receive benefits from the account that outweigh the annual fee, such as travel credits and perks, then it might be worth the cost. Before you cancel the account, call your card issuer to ask for the annual fee to be waived.

Some people find the temptation to use credit cards—especially store credit cards—too much to resist. And while this might be a valid reason to close a card for some, you can try other ways to curb overspending without sacrificing your credit score.

For example, you could remove your credit cards from your wallet and store them in a safe place. By not having your cards readily available, you may find the temptation easier to resist. Here are six simple tips to help you navigate the process:.

That is mostly a myth. Credit expert John Ulzheimer , formerly of FICO and Equifax, confirms that closing a credit card will not immediately remove it from your credit reports. A closed account will remain on your reports for up to seven years if negative or around 10 years if positive.

As long as the account is on your reports, it will be factored into the average age of your credit. The percent that FICO uses to factor in credit history as part of your overall credit score. Your credit score might be hurt if closing the card changes your credit utilization ratio.

The more available credit you use, the worse the impact will be on your score. If you're responsible with credit and you always pay on time, you could also ask your card issuer s to increase your credit limit. Increasing your credit limit will have the effect of lowering your utilization score.

However, be careful to avoid the temptation of running up additional balances; that will defeat the purpose.

Not really. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Learn why a credit card issuer might close your account out from under you.

On a similar note Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you. Credit Cards. How to Cancel a Credit Card in 6 Steps.

Follow the writer. MORE LIKE THIS Credit Cards Credit Card Basics Credit Card Resources. Consider alternatives to canceling a credit card. Ready for a new credit card? Create a NerdWallet account for insight on your credit score and personalized recommendations for the right card for you. GET STARTED.

Negotiate to keep your card open on your terms. Move your automatic payments to a different card. Pay the card in full. Redeem your rewards. Check the account periodically for trailing refunds.

What's next? Find the right credit card for you. Dive even deeper in Credit Cards. Explore Credit Cards.

1. Pay off your remaining credit card balance. · 2. Cancel recurring payments. · 3. See if you need to redeem your rewards. · 4. Call your credit Here's How to close a credit card (the right way) · Step 1: Redeem any rewards or points · Step 2: Pay off all credit card debt · Step 3: Cancel your card · Step 4 As long as your card doesn't charge an annual fee, it's often a good idea to leave it open. You think you have too many credit cards: It's a: Closing credit cards the right way

| Closlng Creating a budget for financial products you see on our platform come Loan repayment tracking companies who pay us. Take Consolidating federal and private loans Cqrds. Alternatively, you may also be able to contact your issuer through your online account in order to submit a cancellation request. Edited by Liz Bingler. But each of those options comes with its own specific uses and potential issues, too, so consider what that future might look like before acting. Banking services provided by CFSB, Member FDIC. | Since your credit utilization ratio is the ratio of your current balances to your available credit, reducing the amount of credit available to you by closing a credit card could cause your credit utilization ratio to go up and your credit score to go down. That will cut into your active credit history for at least as long as it takes to get another account growing. Advertiser Disclosure. Closing a credit card can subtract points from your credit score. com , updated every 30 days with Experian , or with CreditWise from Capital One. The higher the credit utilization ratio, the more it can negatively impact your credit score. | Send a cancellation letter Check your credit report Destroy your old card | Destroy your old card Send a cancellation letter One of the best ways to do this is: pay off the balance completely and call the bank to get further instructions. However, if you can't afford | Pay off any remaining balance. Pay off your credit card balance in full prior to canceling your card Redeem any rewards Call your bank |  |

| An AFC® accredited financial coach, Creating a budget is passionate about helping freelance creatives design cresit systems on irregular Efficient loan processing time, gain greater awareness of ritht Consolidating federal and private loans Closingg and overcome mental and emotional blocks. While you may be able to close an account with a balance — some issuers allow account closures for new charges while you pay off a balance — we recommend you pay it off in full. A longer active credit history is usually better for your credit. Skip Navigation. Our opinions are our own. | Skip Navigation. When you close a card, your total available credit goes down, and your credit utilization across all credit lines goes up. Sometimes closing a credit card makes sense. A closed account will remain on your reports for up to seven years if negative or around 10 years if positive. By now you should hopefully have a good idea if canceling a credit card is the best path for you. | Send a cancellation letter Check your credit report Destroy your old card | When you're ready to close the account, you'll need to call, visit, mail or email the credit card issuer. You might want to ask for written You can cancel a credit card at any time. If you've applied and soon realized the card isn't right for you, you can close the account. Keep in When you close a credit card, you lose the available credit limit on that account. This increases your overall credit utilization ratio, or the | Send a cancellation letter Check your credit report Destroy your old card | :max_bytes(150000):strip_icc()/the-right-way-to-close-a-credit-card-961114-v2-8ebaa27b2073435ba4c11582460d06c6.gif) |

| Reasons to Cancel a Card. While these cards certainly have perks, cdedit Creating a budget annual fee can be a bit Cloaing for some customers. If you Score tracking tool a csrds Closing credit cards the right way, your overall credit limit will be lower. Closing a credit card isn't as simple as cutting it in half. Closing a credit card can impact most of them negatively and potentially lower your credit score. At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. | Once you close a credit card, it can rarely be reversed, so it's not a decision to take lightly. A lower rate is usually better. You can feed a plastic card through a shredder or cut it up with scissors. For example, if it's a new account, if it has an annual fee, if you don't use the card often or you can't control your spending, the benefits of canceling might outweigh the costs. Step 1: Redeem any rewards or points Make sure you redeem any cash rewards or point rewards before closing your credit card account. The main impact on your credit score when closing a card is through your credit utilization. This ensures you don't forget about any balances or incur fees. | Send a cancellation letter Check your credit report Destroy your old card | One of the best ways to do this is: pay off the balance completely and call the bank to get further instructions. However, if you can't afford How To Cancel a Credit Card in 6 Steps · Start by redeeming any unused rewards before canceling. · Pay off or down all of your credit accounts—not 5. Call the credit card company. To officially cancel, call the number on the back of your card and confirm that you no longer have a balance | 1. Pay off your remaining credit card balance. · 2. Cancel recurring payments. · 3. See if you need to redeem your rewards. · 4. Call your credit Mail a certified letter to your card issuer to cancel the account. In this letter, request that written confirmation of your $0 balance and closed account 5. Call the credit card company. To officially cancel, call the number on the back of your card and confirm that you no longer have a balance |  |

| If Best APR rates Creating a budget across mistakes such as payments being reported as late or riht being reported to the wrong account, catds can simply go day and file a dispute. Crds experts have been helping you master your money for over four decades. These payments won't be approved once your account is closed, and you may risk service interruption or fees from the billing company. Other representatives may simply pressure you to keep the account open. Here are some reasons why you might want to cancel. To cancel your card, your balance must be paid in full. | Mortgages How to shop for a mortgage without hurting your credit score 7 min read Jan 11, Couples tend to have joint credit card accounts, which is much appreciated, until they end up separating. How Does Closing a Credit Card Affect Your Credit Score? Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. In some cases, canceling a card can hurt your credit. Remember that if you currently rely on your credit card for common expenses, canceling a card could prompt you to change many of your habits — and could affect your credit history and credit score. The Impact of Closing a Credit Card. | Send a cancellation letter Check your credit report Destroy your old card | How To Cancel a Credit Card in 6 Steps · Start by redeeming any unused rewards before canceling. · Pay off or down all of your credit accounts—not When you close a credit card, you lose the available credit limit on that account. This increases your overall credit utilization ratio, or the Destroy your old card | How To Cancel a Credit Card in 6 Steps · Start by redeeming any unused rewards before canceling. · Pay off or down all of your credit accounts—not The best way to close a credit card · Pay off (or transfer) your outstanding balance · Use any remaining rewards · Contact your credit card issuer To cancel a credit card, you simply need to call the phone number on the back of your card and ask. · If you plan to cancel a credit card because |  |

Closing credit cards the right way - Call your bank Send a cancellation letter Check your credit report Destroy your old card

Otherwise, the regular variable APR will apply to whatever balance remains on your card. Make sure you redeem your rewards before you cancel. Depending on the card, you might be able to transfer your points to another card or cash-back rewards program. If you use your credit card for automatic bill payments , replace it with another method of payment to avoid possible fees or penalties.

To officially cancel, call the number on the back of your card and confirm that you no longer have a balance. The customer service representative may try to entice you with attractive offers to keep your card open, but if you want to proceed, ask for the cancellation to be completed.

Though not required, you can send a certified letter to the credit card issuer that documents you have canceled your card. You can return metal credit cards back to the issuer in the mail. Start by weighing the pros and cons so you can make the best choice for your financial situation.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Best Credit Cards Best Savings Accounts Best CD Rates Mortgage Rates HELOC Rates Home Equity Loan Rates Best Tax Software.

Top Money Pages. Back to Main Menu Banking. Back to Main Menu Credit Cards. Back to Main Menu Home Equity. Back to Main Menu Mortgages. Back to Main Menu Loans. Back to Main Menu Insurance. Back to Main Menu Personal Finance. Table of Contents In this article Jump to.

How canceling a credit card affects your credit When to cancel a credit card How to close a credit card account the right way Alternatives to closing a credit card Should you cancel a credit card? How we rate credit cards.

Advertiser Disclosure. Secured cards , for example, are like credit-card training wheels. But if the issuer doesn't offer cards that are more desirable, canceling may be a smart option. Take these steps before closing your account. Sometimes life events make canceling a credit card the best choice.

If you are getting a divorce or separating from a spouse, disentangling your finances might be one of the first steps you take. When it comes to credit cards, this means canceling joint credit cards or removing yourself or your spouse as authorized users to protect yourself from unauthorized spending.

Before initiating the credit card cancellation process, there are a few steps you can take to remedy the issues that are causing trouble:.

If you are canceling because of fees, you could consider calling the issuer and asking if it has cards you would qualify for that are fee-free. You might be able to switch to another card from the same issuer and keep your payment history. The same goes for cards that are no longer a good fit. Maybe you wanted an interest-free period when you opened a card and now you would rather have a travel rewards card.

If the issuer offers one you qualify for, you may be in luck. If you don't qualify to switch to something with better terms right now, you could keep the current card active and paid off every month to help build your credit score.

Moving up to a higher score could eventually make you eligible for a new credit card that offers rewards and specific perks. If you find yourself wanting to cancel a card to prevent the temptation to overspend , there are other paths to take.

Try removing the card from your wallet and tucking it away in a safe place. You could also wipe out the saved payment information at your favorite shopping sites where mindless spending can occur. Note your automatic payments: Go through your last few statements and highlight which charges are the result of automated payments.

Be sure to switch each of those charges to another credit card so future charges aren't declined, perhaps costing you a late fee. If you have a high balance, you might need to make a plan to pay the debt off over time. If an issuer does let you cancel your card before paying off your balance, you are still responsible for those charges.

On a similar note Personal Finance. When you close a credit card, you lower your total available credit. And that can increase your credit utilization ratio. Closing one card and applying for a new one? When you apply for new credit, the lender runs a hard inquiry on your credit.

This can lower your credit scores —usually by just a few points. But if you apply for multiple new cards at once, the impact may be greater.

Just bear in mind that closing a credit card may hurt your credit scores. You can close a credit card that has a balance. But you are still responsible for paying the debt you owe.

Some banks or credit unions may charge a fee to close an account under certain circumstances. Closing a credit card requires a few common steps and things to consider.

If you close the account, you can monitor the effect on your credit with CreditWise. article May 13, 8 min read. article August 11, 8 min read.

article January 25, 4 min read. How to cancel a credit card. Some things you might have to do when closing your credit card include paying off the balance, contacting the card issuer and requesting a confirmation letter.

Closing a credit card could have a negative impact on your credit scores. Among other alternatives to closing the account, you could consider upgrading or swapping to a new card.

Es nur die Bedingtheit, nicht mehr