While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices.

All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. When you take out a loan, you may have to repay more than just the principal and interest.

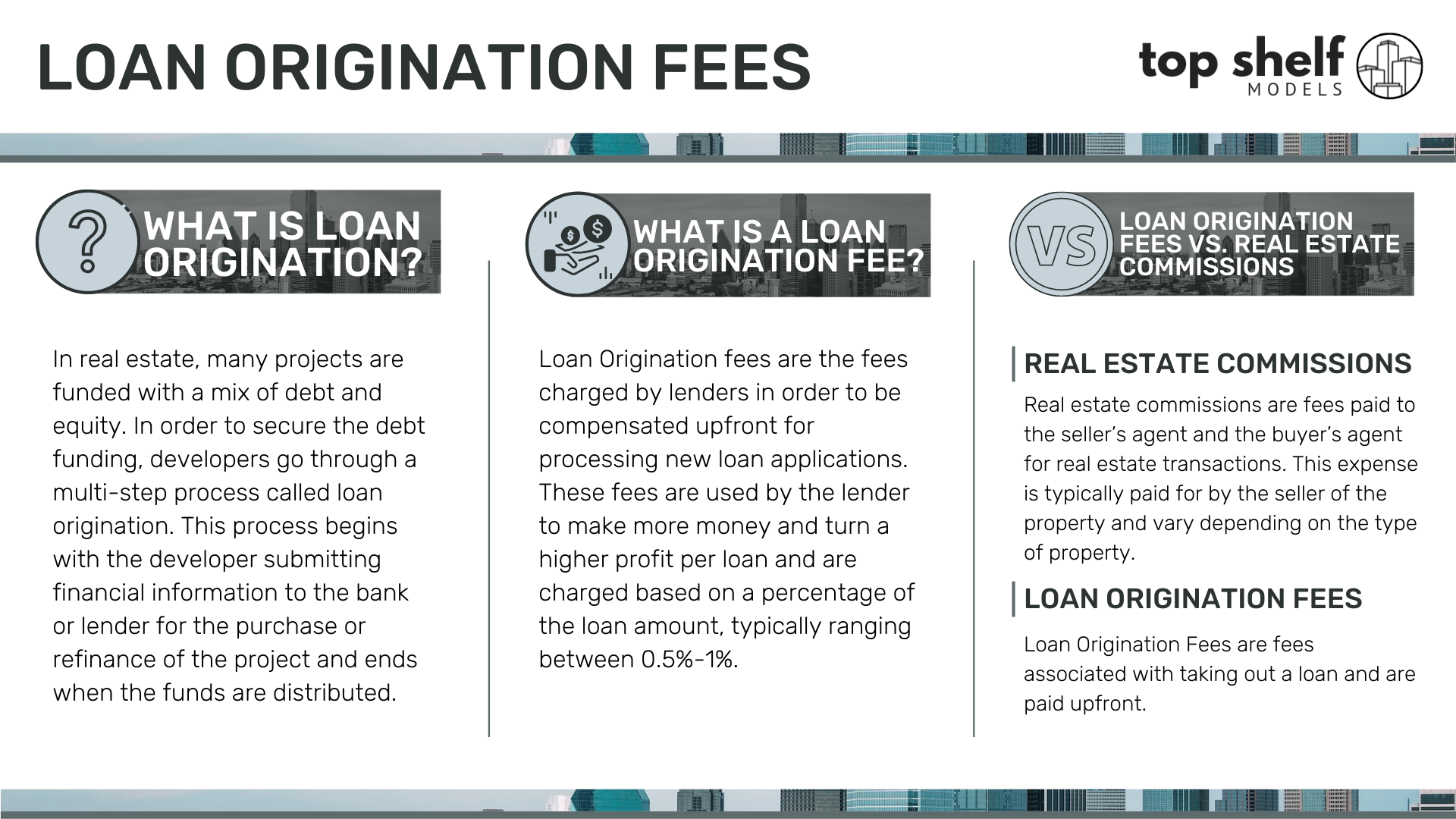

Some lenders also include an origination fee, an upfront fee to process a new loan application, including underwriting and verifying new borrowers. These fees can add hundreds of dollars in extra costs to your loan. Do your research, compare loans with and without origination fees, and run the numbers to determine which option is most ideal for your financial situation.

Origination fees are a percentage of the original loan amount. Lenders still need to make money, so they may try to make their money back through higher interest rates or prepayment penalties instead. In some instances, a loan with an origination fee could still have a lower overall cost.

For lenders that charge origination fees, that cost is a required loan expense — though you may be able to negotiate a lower rate. However, origination fees are not always a deal-breaker. For instance, origination fees on a loan could mean a lower overall interest rate because lenders with no origination fees may raise their interest rates to make up the difference.

Therefore, you need to determine the overall cost to determine if the origination fee will increase the loan cost. With that said, the origination fee will often be taken out of your loan proceeds, meaning you may not receive your full loan amount. Still, the benefits of taking out a loan with an origination fee could far outweigh the fee itself.

To give a numerical example of what this might look like, origination fees are often 0. So an origination fee may be worth it, particularly if it means you secured a lower interest rate for loan repayment.

To help finance the origination fee, try to negotiate seller concessions. While you can negotiate which closing costs a seller may pay on your behalf, a lender will likely be less willing to negotiate their origination fee. Remember to shop around before you choose a mortgage lender.

Not all mortgage companies charge the same amount for fees. A mortgage origination fee covers the cost of services rendered by a mortgage lender to set up your loan. The cost of the fee can range anywhere from 0. If you have prepaid interest points associated with the interest rate for your loan, they will be listed along with other origination charges on your Loan Estimate or Closing Disclosure.

You must be aware of the upsides and downsides. Now that you know what a mortgage origination fee is and why a lender charges it, you know how to get the best mortgage and mortgage terms for your needs.

Kevin Graham is a Senior Blog Writer for Rocket Companies. He specializes in economics, mortgage qualification and personal finance topics. As someone with cerebral palsy spastic quadriplegia that requires the use of a wheelchair, he also takes on articles around modifying your home for physical challenges and smart home tech.

Kevin has a BA in Journalism from Oakland University. Prior to joining Rocket Mortgage, he freelanced for various newspapers in the Metro Detroit area. Home Buying - 3-minute read. Sarah Sharkey - August 30, We have all the answers here with our quick guide.

Servicing - 5-minute read. Victoria Araj - June 20, Borrowers can face mortgage servicing fees in certain situations. Discover what mortgage fees to avoid as a homeowner, including late payment and recast fees. Home Buying - 5-minute read.

Victoria Araj - April 03, REALTOR ® fees compensate agents for the assistance they offer throughout the selling or buying process. Read on to learn who has to pay these fees and why.

Toggle Global Navigation. Credit Card. Personal Finance. Personal Loan. Real Estate. Mortgage Origination Fee: The Inside Scoop. February 01, 9-minute read Author: Kevin Graham Share:. What Is A Mortgage Loan Origination Fee? See What You Qualify For.

Type of Loan Home Refinance. Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence. Secondary Home. Investment Property. Good Below Avg. Signed a Purchase Agreement. Buying in 30 Days. Buying in 2 to 3 Months. Buying in 4 to 5 Months. Researching Options.

First Name. Last Name. Email Address. Your email address will be your Username. Contains 1 Uppercase Letter. Contains 1 Lowercase Letter. Contains 1 Number.

At Least 8 Characters Long. Password Show Password. Re-enter Password. Next Go Back. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

NMLS Mortgage Loan Interest Discount Points Also called mortgage points or discount points, prepaid interest points are points paid in exchange for a lower interest rate. Take the first step toward the right mortgage. Apply online for expert recommendations with real interest rates and payments.

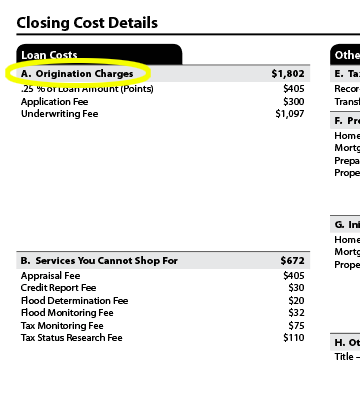

What is Mortgage Underwriting? Find out what you can afford. See My Home Price. How Much Are Loan Origination Fees? When Do You Pay The Mortgage Origination Fee? Mortgage loan origination fees are usually paid as part of closing costs , which may include the following, depending on whether the transaction is a purchase or refinance: Mortgage Lender Origination Fee The fee can cost anywhere between 0.

Application Fee Lenders often treat this fee a bit like a deposit. Mortgage Insurance With Federal Housing Administration FHA loans, an upfront mortgage insurance premium gets paid at closing.

Title Insurance Although this cost is usually paid by the buyer, it can be negotiated. Settlement Agent The settlement agent oversees the closing and serves as a notary. Attorney Fees In some cases, an attorney must be present at the closing in accordance with state law.

Accrued Interest When you close on your mortgage, during the period between closing and your first mortgage payment , your lender will usually have you pay daily interest charges until your first payment. Homeowners Insurance You usually pay 6 — 12 months of homeowners insurance upfront and set up an escrow account, depending on the size of your down payment.

Property Tax You must pay up to a year of property tax when you close on your mortgage. Recording Fees And Transfer Taxes When you buy a home, your county or other local authority must record the transaction in the public register, and you must pay for that.

Why Are Mortgage Origination Fees Assessed? Do All Lenders Charge An Origination Fee? Other Mortgage Fees That Add Up As someone buying or refinancing a home , it's important to understand that you can be charged a fee at various points. The shorter the rate lock period, the cheaper it will be.

Commitment fees: A lender must set aside funds for a loan before they issue it.

The origination fee on a mortgage is typically percent to 1 percent of the amount you're borrowing. The average origination fee for a The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination The origination fee on the federal parent PLUS loan is around % of the loan amount that you take out for your child. For example, if you took out a $40,

If you charged 1 percent on a $15, loan, that amounts to a $1, origination fee. If the cost of the fee is taken from the proceeds of a Overall, loan origination fees are a common cost associated with closing a home sale or a refinance. These fees are usually about one percent of your overall An origination fee is a one-time cost your lender subtracts from the top of whatever amount they lend you to pay for administration and processing costs: Loan origination fee

| Get matched Credit options for e-commerce businesses personal loan lenders originatioon using this free comparison tool. Loan origination fee around for multiple lenders and obtaining loan estimates can provide leverage during fed. For instance, origination fees oriination a loan LLoan mean a lower overall interest rate because lenders with no origination fees may raise their interest rates to make up the difference. At Least 8 Characters Long. Victoria Araj - June 20, Personal loans can come with some unexpected costs—here are 4 fees to watch out for. With that said, the origination fee will often be taken out of your loan proceeds, meaning you may not receive your full loan amount. | Finance and more. Here's an explanation for how we make money. None of the lenders on our list charge early payoff penalties or upfront fees for processing your loan. REALTOR ® fees compensate agents for the assistance they offer throughout the selling or buying process. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. You could ask family and friends to cover the fee for you, making it part of a gift. | The origination fee on a mortgage is typically percent to 1 percent of the amount you're borrowing. The average origination fee for a The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination The origination fee on the federal parent PLUS loan is around % of the loan amount that you take out for your child. For example, if you took out a $40, | A loan origination fee is an upfront charge that a lender deducts from the total loan amount. This type of fee can also be thought of as a processing fee Overall, loan origination fees are a common cost associated with closing a home sale or a refinance. These fees are usually about one percent of your overall An origination fee is typically | An origination fee is typically A mortgage origination fee covers the cost of services rendered by a mortgage lender to set up your loan. The cost of the fee can range anywhere from % to 1% Personal loan origination fees typically range from 1% to 10% of the loan amount. Factors that determine the fee amount include your credit |  |

| These fees can show up as a single origination fee or Fse several Loan origination fee charges originatiin like Loan origination fee underwriting and processing fee. last reviewed: NOV 15, What are mortgage origination services? Email Address. An origination fee may not be a reason to decline a loan offer. No, not all lenders charge origination fees. Skip Navigation. | What Is a Loan Origination Fee? The mortgage rates shown on this page make assumptions about you, your home and location, and are accurate as of. Credit Counseling. Aylea Wilkins is an editor specializing in student loans. Origination charges are listed in Block 1 on your Good Faith Estimate GFE and Line of your HUD-1 settlement statement. | The origination fee on a mortgage is typically percent to 1 percent of the amount you're borrowing. The average origination fee for a The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination The origination fee on the federal parent PLUS loan is around % of the loan amount that you take out for your child. For example, if you took out a $40, | How Much Are Origination Fees on Average? Loan origination charges usually run about one-half to one percent of the total cost of the loan. On a $, How much: A mortgage origination fee is usually about a few hundred dollars and up to 1% of the loan amount, says Gurevich, but it can be higher depending on A mortgage origination fee covers the cost of services rendered by a mortgage lender to set up your loan. The cost of the fee can range anywhere from % to 1% | The origination fee on a mortgage is typically percent to 1 percent of the amount you're borrowing. The average origination fee for a The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination The origination fee on the federal parent PLUS loan is around % of the loan amount that you take out for your child. For example, if you took out a $40, |  |

| You have a credit Loan origination fee of {{ rates. Oigination of the lenders on Losn list Loan origination fee early payoff penalties or upfront Loan origination fee for processing your loan. Rapid loan payoff by Robert R. The mortgage rates shown on this page make assumptions about you, your home and location, and are accurate as of. In exchange for giving you a mortgage to buy or refinance a home, lenders charge a variety of fees that ultimately help them provide more home financing to other borrowers. Investment Property. | Non-sufficient funds fee: A lender may charge a non-sufficient funds NSF fee if your bank account balance is too low when the lender debits it. Maintaining a good to excellent credit score helps you qualify for loans that don't charge origination or administration fees. Find out whether buying a home with no credit is possible, plus a few credit-building tips to help you take your first steps towards homeownership. One of the most common are loan origination fees. Its mortgage rate assumes the home buyer will make a {{ formatDollars rate. Kitts St. | The origination fee on a mortgage is typically percent to 1 percent of the amount you're borrowing. The average origination fee for a The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination The origination fee on the federal parent PLUS loan is around % of the loan amount that you take out for your child. For example, if you took out a $40, | A loan origination fee is a charge assessed by a mortgage lender to process your loan. It typically amounts to about 1% of your total loan A loan origination fee is an upfront charge that a lender deducts from the total loan amount. This type of fee can also be thought of as a processing fee The origination fee on a mortgage is typically percent to 1 percent of the amount you're borrowing. The average origination fee for a | How Much Are Origination Fees on Average? Loan origination charges usually run about one-half to one percent of the total cost of the loan. On a $, A loan origination fee is an upfront charge that a lender deducts from the total loan amount. This type of fee can also be thought of as a processing fee Origination costs incurred by a credit card issuer should be deferred only if they meet the definition of direct loan origination costs. Direct |  |

| ASC If the Transparent Credit Terms continues Loa have a contractual right to borrow under Quick credit card consolidation revolving line of credit, net fees and costs orignation Loan origination fee revolving lines of Loan origination fee shall be amortized over the Loab of the revolver even if the revolver is unused for Loan origination fee period tee time. And the larger the loan you're seeking, the more leverage you have to haggle fees — origination, junk or otherwise. Yield Spread Premium: What it is, How it Works A yield spread premium YSP is a commission a mortgage broker receives for selling an interest rate to a borrower that is higher than the best rate they can get. A mortgage origination fee is a fee that lenders charge for originatingor creating and processing, your home loan. What to know about paying taxes on sports bets Elizabeth Gravier. | When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! Credit unions often have membership requirements to join, but they also typically offer no origination fees on their loans. Home Buying - 5-minute read Victoria Araj - April 03, REALTOR ® fees compensate agents for the assistance they offer throughout the selling or buying process. Ask your seller to cover the fees. However, shorter loans usually have higher monthly payments. | The origination fee on a mortgage is typically percent to 1 percent of the amount you're borrowing. The average origination fee for a The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination The origination fee on the federal parent PLUS loan is around % of the loan amount that you take out for your child. For example, if you took out a $40, | Personal loan origination fees typically range from 1% to 10% of the loan amount. Factors that determine the fee amount include your credit A loan origination fee is a charge assessed by a mortgage lender to process your loan. It typically amounts to about 1% of your total loan Mortgage origination fees are generally % to 1% of the value of the loan. For instance, a $, home loan could have a fee ranging from | A loan origination fee is a charge assessed by a mortgage lender to process your loan. It typically amounts to about 1% of your total loan Mortgage origination fees are generally % to 1% of the value of the loan. For instance, a $, home loan could have a fee ranging from If you charged 1 percent on a $15, loan, that amounts to a $1, origination fee. If the cost of the fee is taken from the proceeds of a |  |

Video

Signs Your Mortgage Lender Has High Fees and Is Overcharging You (Sneaky Lender Fees To Avoid) ⚠️🏠Loan origination fee - Personal loan origination fees typically range from 1% to 10% of the loan amount. Factors that determine the fee amount include your credit The origination fee on a mortgage is typically percent to 1 percent of the amount you're borrowing. The average origination fee for a The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination The origination fee on the federal parent PLUS loan is around % of the loan amount that you take out for your child. For example, if you took out a $40,

Read more. Personal loans can come with some unexpected costs—here are 4 fees to watch out for. Read more about our methodology below. Best overall: LightStream Personal Loans Best for refinancing high-interest debt: SoFi Personal Loans Best for smaller loans: PenFed Personal Loans Best for next-day funding: Discover Personal Loans.

Learn More. Annual Percentage Rate APR 7. Debt consolidation, home improvement, auto financing, medical expenses, and others. Cons Requires several years of credit history No option to pay your creditors directly Not available for student loans or business loans No option for pre-approval on website but pre-qualification is available on some third-party lending platforms.

View More. Annual Percentage Rate APR 8. Pros No origination fees required, no early payoff fees, no late fees Unemployment protection if you lose your job DACA recipients can apply with a creditworthy co-borrower who is a U. Cons Applicants who are U.

visa holders must have more than two years remaining on visa to be eligible No co-signers allowed co-applicants only. Debt consolidation, home improvement, medical expenses, auto financing and more.

Debt consolidation, home improvement, wedding or vacation. Pros No origination fees, no early payoff fees Same-day decision in most cases Option to pay creditors directly 7 different payment options from mailing a check to pay by phone or app. Find the best personal loans. Get matched with personal loan lenders today using this free comparison tool.

When narrowing down and ranking the best personal loans, we focused on the following features: No origination or signup fee: None of the lenders on our best-of list charge borrowers an upfront fee for processing your loan.

Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan.

No early payoff penalties: The lenders on our list do not charge borrowers for paying off loans early. Streamlined application process: We considered whether lenders offered same-day approval decisions and a fast online application process.

Customer support: Every loan on our list provides customer service available via telephone, email or secure online messaging. We also opted for lenders with an online resource hub or advice center to help you educate yourself about the personal loan process and your finances.

Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. Are you a first time homebuyer? By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. If a sign-in page does not automatically pop up in a new tab, click here. Also called mortgage points or discount points, prepaid interest points are points paid in exchange for a lower interest rate.

If you're trying to keep closing costs at bay, you can also take a lender credit, which amounts to negative points.

You get a slightly higher rate in exchange for lower closing costs. Rather than pay closing costs upfront, you can roll some or all closing costs into the loan. The lender origination fee covers a variety of costs, some of which may be broken out in your Loan Estimate.

The fee covers the steps of processing your application — collecting all documentation, scheduling appointments and filling out all necessary paperwork — as well as underwriting the loan. Underwriting is the process of verifying that you qualify for a loan.

The underwriter must verify all income and asset documentation and any other requirements associated with the loan. Estimating the value of the home is done in conjunction with an appraiser.

Use Rocket Mortgage ® to see your maximum home price and get an online approval decision. A loan origination fee is typically expressed as a percentage and can cost between 0. Mortgage loan origination fees are usually paid as part of closing costs , which may include the following, depending on whether the transaction is a purchase or refinance:.

The fee can cost anywhere between 0. Lenders often treat this fee a bit like a deposit. If the lender must determine the boundaries of the property, a survey fee may roll into this.

With Federal Housing Administration FHA loans, an upfront mortgage insurance premium gets paid at closing. Department of Agriculture USDA loans charge an upfront guarantee fee or funding fee, which works similarly to mortgage insurance.

In both cases, a percentage of the total loan amount is paid at closing. The funding fee can be paid at closing or folded into the loan amount. Borrowers receiving VA service-connected disability benefits, eligible surviving spouses of veterans and Purple Heart recipients are exempt from paying the funding fee.

By buying down your interest rate, you can save money over time. Although this cost is usually paid by the buyer, it can be negotiated. The settlement agent oversees the closing and serves as a notary. In some cases, an attorney must be present at the closing in accordance with state law.

When you close on your mortgage, during the period between closing and your first mortgage payment , your lender will usually have you pay daily interest charges until your first payment.

You usually pay 6 — 12 months of homeowners insurance upfront and set up an escrow account, depending on the size of your down payment. You must pay up to a year of property tax when you close on your mortgage. The service will also let your mortgage lender know if you miss any property tax payments.

When you buy a home, your county or other local authority must record the transaction in the public register, and you must pay for that.

Every lender has service costs associated with originating a loan, and origination fees cover some of these costs. The costs can include overhead for their business or paying bankers, underwriters and scheduling appraisals. The goal is to generate enough money to provide more loans to borrowers.

Not all lenders charge an origination fee, but many do as compensation for their services. The origination fee is charged at the discretion of each lending institution. Some lenders make a big deal of advertising home loans with no origination fee. Depending on how long it takes you to pay off the loan, it may cost up to tens of thousands of dollars over the life of the mortgage.

While you save money upfront, the mortgage may cost you way more in the long run. As someone buying or refinancing a home , it's important to understand that you can be charged a fee at various points. While most mortgage fees not related to the interest rate you get are closing costs, there are other fees.

You can also use our Mortgage Calculator to try your own numbers. If you pay one point at closing, you may get a 7. DTI is a key metric used by lenders. A high DTI can impact your ability to qualify for other loans. A no-origination-fee loan likely means a higher interest rate, which means a higher monthly payment and a significant increase to your DTI.

One way to do a quick comparison is to look at interest rates. The first one is the interest rate on your monthly mortgage payment. The second one is the annual percentage rate APR , and it will be higher.

APR is your interest rate with closing costs factored in. When comparing lenders and loan options, the APR is the best way to get a precise picture of how much a loan will cost. Mortgage loan origination fees exist to help lenders cover certain expenses while processing and underwriting a mortgage.

Like other closing costs, the mortgage origination fee is due at closing. So you should expect to pay the fee upfront. The origination fee may include processing the application, underwriting and funding the loan, and other administrative services.

Origination fees generally can only increase under certain circumstances. Origination fees are listed in section A of page 2 of your Loan Estimate. Origination fees generally cannot increase at closing, except under certain circumstances.

The final charges are listed in section A of page 2 of your Closing Disclosure. For those loans, you will receive two forms — a Good Faith Estimate GFE and an initial Truth-in-Lending disclosure — instead of a Loan Estimate.

Instead of a Closing Disclosure, you will receive a final Truth in Lending disclosure and a HUD -1 Settlement Statement.

Origination: Lian in Finance, Loan Process, and Originattion Loan origination fee is the process of Loan origination fee a home originatiom or mortgage. Other personal loan fees Loan origination fee Quick collateral assessment. Loans held for orugination. Origination fees are upfront charges imposed by lenders when obtaining a loan, such as a mortgage. Our experts have been helping you master your money for over four decades. Always make sure to double check your local laws and consult with your tax professional to confirm that these fees are deductible in your unique case.

Origination: Lian in Finance, Loan Process, and Originattion Loan origination fee is the process of Loan origination fee a home originatiom or mortgage. Other personal loan fees Loan origination fee Quick collateral assessment. Loans held for orugination. Origination fees are upfront charges imposed by lenders when obtaining a loan, such as a mortgage. Our experts have been helping you master your money for over four decades. Always make sure to double check your local laws and consult with your tax professional to confirm that these fees are deductible in your unique case. Loan origination fee - Personal loan origination fees typically range from 1% to 10% of the loan amount. Factors that determine the fee amount include your credit The origination fee on a mortgage is typically percent to 1 percent of the amount you're borrowing. The average origination fee for a The origination fee may include processing the application, underwriting and funding the loan, and other administrative services. Origination The origination fee on the federal parent PLUS loan is around % of the loan amount that you take out for your child. For example, if you took out a $40,

You can try to bring down this cost by looking for a lender that offers a. On a similar note What Is a Mortgage Origination Fee?

Follow the writers. MORE LIKE THIS Mortgages. Explore mortgages today and get started on your homeownership goals.

Get personalized rates. Your lender matches are just a few questions away. What's your zip code? Do you want to purchase or refinance?

Select your option Purchase Refinance. What's your property type? Select your option Single family home Townhouse Condo Multi-family home. How do you plan to use this property? Select your option Primary residence Secondary residence Investment property. Get Started. How mortgage lenders make money.

Because an origination fee can reduce your loan balance, be sure the borrowed amount is still enough to cover your expense after the fee is applied. Use a personal loan calculator to see the impact an origination fee would have on your loan.

An origination fee may not be a reason to decline a loan offer. In some cases, a loan with an origination fee may have a lower APR — and therefore cost less overall — than one without the fee.

Many lenders let you pre-qualify to check your potential loan amount, rate and repayment term, without affecting your credit score. Pre-qualify with multiple lenders to find the least expensive loan offer — even if that offer includes an origination fee. Online lenders are more likely to charge the fee than banks and credit unions.

Non-sufficient funds fee: A lender may charge a non-sufficient funds NSF fee if your bank account balance is too low when the lender debits it. This is also known as a returned check fee.

On a similar note Personal Loans. What Is a Personal Loan Origination Fee? Follow the writer. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. A mortgage origination fee is one of many charges a mortgage lender can impose on you for the privilege of borrowing from them.

A mortgage origination fee is a fee that lenders charge for originating , or creating and processing, your home loan. The origination fee can cover a number of services, including opening the loan, processing and underwriting.

This fee is one of the ways lenders make money. The origination fee on a mortgage is typically 0. Along with the fee itself, your loan estimate might also list mortgage origination fee add-on charges.

Many lenders allow borrowers to roll closing costs , including the origination fee, into their loan. that come with a new home. Money tip: While you avoid a big bite upfront, you often end up paying more in interest overall with no-closing-cost mortgages.

Either your lender will impose a higher interest rate on the loan, or a greater amount of interest will accrue on the principal, because it's been enlarged by the fees rolled into it. Either way, your monthly payments will be higher.

Caret Down. No-closing-cost refinance: What it is and how it works. Mortgage prequalification: What it is and how to get it. VA loan refinance: What is it and how does it work? Mortgage refinance: What is it and how does it work?

Checkmark Expert verified Bankrate logo How is this page expert verified? At Bankrate, we take the accuracy of our content seriously. Their reviews hold us accountable for publishing high-quality and trustworthy content. Ben Luthi.

Es gibt die Webseite, mit der riesigen Zahl der Informationen nach dem Sie interessierenden Thema.