An eligibility checker is a free tool offered by many direct lenders, to help you see if you qualify for a loan. Using it can minimise the chances of you applying for an unsuitable loan and getting your application rejected.

Many comparison sites and brokers also offer eligibility checkers that allow you to see your chances of approval from a range of lenders. To see if you are eligible, you will need to provide information about you and your financial situation, and the lender may also run a soft credit check.

The lender will let you know their decision, and you can then choose to formally apply for the loan or walk away. It will typically only take a few minutes to use the eligibility checker and see your chances of making a successful application.

When you use a loan eligibility checker, you will usually need to provide some key details about you and your finances, including your:.

You will also need to say how much you want to borrow, the term you want to repay the loan over, and what you want to use the money for. Once you fill in all the required information, the provider will run a soft credit check and tell you whether you qualify for a loan.

If you are eligible, you may see that you have a pre-approved loan offer. This simply means that, based on the information provided, the lender provisionally agrees to offer you a loan at a certain rate.

If you decide to proceed with your application, the lender will run a hard credit check which will appear on your credit history and make a final decision on whether to lend you the money.

Your credit score helps lenders determine your loan eligibility and the risk of lending to you. It helps lenders decide:. Each lender has its own credit score requirements, but, the better your score, the more likely you are to be accepted for a loan and the lower the rate of interest you may receive.

While a good credit score can improve your chances of approval, lenders will also consider other factors, such as your income, to help decide whether to offer you a loan.

By checking your credit history, lenders will want to get a picture of how you have managed your finances in the past and will look for specific information, including:. You can check your credit report with the three credit scoring agencies Experian, Equifax and TransUnion.

They must provide you with a free statutory report, by law, and you can request this through their partner websites. Lenders can decline a loan application for many reasons, such as if you have recently been declined credit or have an outstanding county court judgment CCJ.

You are unlikely to be accepted and it will leave a mark on your credit history. Too many applications for credit over a short time can affect your credit score and leave lenders concerned that you are struggling financially.

For example, you could consider other options such as a guarantor loan. The eligibility may vary depending on the personal loan types , so check with the lenders once before proceeding!

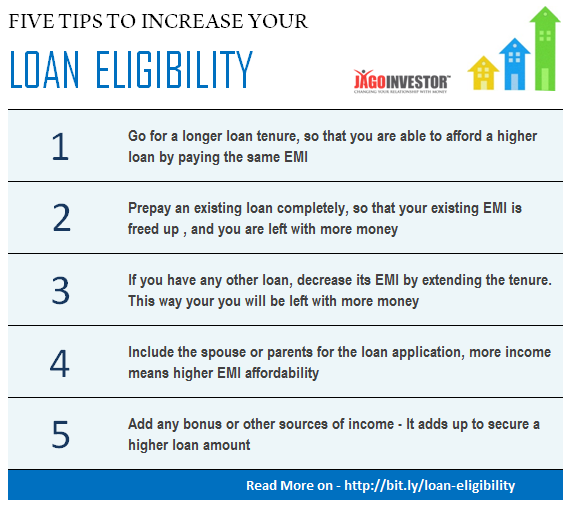

You can improve your personal loan eligibility by getting a co-applicant. They can be your family member, such as spouses, parents, children, etc. And when you apply for a personal loan with a co-applicant, the lenders will check the credit scores and repayment capacity of both applicants.

Hence, get a co-applicant who has a high credit score to increase your chances of getting your loan approved. Lenders will also consider your employment history and stability when evaluating your personal loan eligibility. They may hesitate to offer you personal loans if you change your jobs frequently.

The reason is that it reflects career instability, which further increases the credit risk for the lenders. Therefore, try to avoid job hopping, especially when you are planning to avail of a personal loan in the near future.

When you apply for a personal loan , lenders check your credit report to evaluate your creditworthiness. Such requests are recorded as hard inquiries in your credit report reducing your credit score.

As a result, lenders will reject your loan. Therefore, instead of submitting loan applications to multiple lenders directly, visit online loan aggregators like Buddy Loan to get personal loans from multiple loan options.

Moreover, inquiries through online financial marketplaces are considered soft inquiries and will not affect your credit score.

The following are the most common documents required for personal loan online approval for salaried and self-employed individuals:. Here are a few essential things you have to keep in mind when planning to apply for a personal loan :.

Also Read: 10 Best Tips for Successful Personal Loans. Hope the article gave you clarity on the importance of checking your personal loan eligibility. Following the above-mentioned steps will help you leverage your chances to get instant approval on your personal loan.

Hence, Apply for a personal loan now online with no paperwork and avail quick disbursal using the best loan aggregator apps like Buddy Loan. To know more about Buddy Loan. Having any queries? Do reach us at info buddyloan. What is personal loan eligibility? Hence, it is essential to check your eligibility before applying for one.

How to check personal loan eligibility? You can check your eligibility using personal loan eligibility calculators.

To check your eligibility, first enter the details such as Your Name, Monthly Net Income, Total years of work experience, age, Your existing EMIs, and Required repayment tenure.

How is personal loan eligibility calculated? Enter the required details such as your name, income, and work experience. Personal Loan Eligibility: What You Need To Know?

Buddy Loan. Personal Loan calculate personal loan eligibility , personal loan eligibility , personal loan eligibility calculator , personal loan eligibility check , personal loan types. You may also like Read Full Post.

Personal Loan. Read Full Post. Employees of private limited companies Employees of public sector undertakings, including central, state and local bodies.

Apply Now. Fullerton India. Money View. Canara Bank. IDFC First Bank. IDBI Bank. Indian Overseas Bank. IndusInd Bank. Kotak Mahindra Bank. Punjab National Bank. Salary slips for the last three months along with Form 16 Bank statement for the previous six months where the salary has been credited.

Employment certificate from the current employer Certificate of experience relieving or appointment letter from the previous employer along with job certificate Appointment letter from the current employer if employment period exceeds two years.

Income tax returns for the previous two years inclusive of Computation of Income, audit report, balance sheet, profit, and loss account, etc.

Ration card, PAN card, Voter ID card, Passport, Driving license, School leaving certificate, Birth certificate. Your debt-to-income DTI ratio may also impact your eligibility.

This number compares how much you earn to how much you spend on rent, mortgage, credit cards, or other debt each month. Lenders may use your DTI to determine their risk in lending to you. In other words, your debt-to-income ratio is a measure of your creditworthiness.

During your application process, the lender will ask you to share information. If you know ahead of time what documents might be needed for your personal loan application, it may help keep you organized and make the process easier.

It is important to trust the people and companies that lend you money. Check to see if the lenders you are considering publish their reviews online, for example. And read reviews published by sites that compare lenders.

The more assurances you can get, the better. No matter which lender you choose, be sure you understand the application process and the repayment terms.

Then, once you have the documents you need, the online loan application process can be fast. If you have questions, your lender should be able to help you complete your application. Discover Personal Loans is here to help make your application process as easy as possible.

Now that you know what you need, see the steps involved in applying for a Discover personal loan. How to Get a Personal Loan. You are leaving Discover.

1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered

Loan eligibility criteria - DTI ratio less than 36% 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered

Contact Us × Contact Us. If you are an applicant or an individual interested in learning more about the Single Family Housing Guaranteed Loan Program, please visit our guaranteed housing webpage for further program information and guidance.

If you are a lender interested in participating in the Single Family Housing Guaranteed Loan Program, or are a current participating lender seeking assistance, please visit our lender webpage for further guidance and contact information.

Home Tutorials. Being aware of these charges helps you make informed decisions, avoid traps, and align your loan with your long-term financial goals.

Additional Read: Improve Your Credit Score. Most personal loan applications get turned down by lenders for various reasons. As a loan applicant, borrowers must take certain measures to ensure that their personal loan application does not get turned down. Below are some of the measures you can take:.

Thus, you must maintain a high CIBIL score at all times. Be Careful with Credit Utilisation: Borrowers utilising multiple credit cards must limit their credit utilisation. They must split bills evenly among all their cards, as this reflects positively on their use of credit.

Show All Income Sources: If borrowers have multiple sources of income, they must disclose everything to lenders. Debt-to-income DTI ratio is the percentage of your gross monthly income that is used to pay your monthly debt. Your DTI ratio determines your borrowing risk. Loan applicants can lower their DTI by:.

Yes, it does. Borrowers and loan applicants with a steady employment history have a higher chance of getting their personal loan approved. Lenders prefer such applicants as they are considered low-risk borrowers.

In the event of default, the co-signer assumes the responsibility of paying off the loan amount. To stay informed on all things credit management and personal finance, Check Out OneScore.

Please consult your advisor before making any decision. How To Check Your Personal Loan Eligibility Instantly. Home About Blog Careers FAQ Contact Us Lending Partners Apply for Credit Card. By checking your credit history, lenders will want to get a picture of how you have managed your finances in the past and will look for specific information, including:.

You can check your credit report with the three credit scoring agencies Experian, Equifax and TransUnion. They must provide you with a free statutory report, by law, and you can request this through their partner websites.

Lenders can decline a loan application for many reasons, such as if you have recently been declined credit or have an outstanding county court judgment CCJ. You are unlikely to be accepted and it will leave a mark on your credit history.

Too many applications for credit over a short time can affect your credit score and leave lenders concerned that you are struggling financially. For example, you could consider other options such as a guarantor loan. A better credit score could increase your chances of getting accepted for a loan.

There are several steps you can take to improve your credit score, though these can take time to show on your credit report. These include not applying for lots of loans over a short period, paying off other debts where you can, and paying bills in full and on time.

Also, even small actions can make a difference, such as registering to vote. You might also consider how you would meet the repayments if you lost your income.

You might be able to take out income protection or other insurance to cover that possibility, but that would add to the cost of the loan.

Anthony is a BBC-trained journalist. He has worked in financial services and specialised in investments for over 20 years, writing for various wealth managers and leading news titles. Holly champions clear, jargon-free writing.

Three in five UK adults have asked to borrow money from their friends or family, with more than a third needing it for a bill, a new survey has found. Find out more about this hidden world of borrowing and how it can go wrong.

But there are more affordable ways to borrow money, including joining a credit union, as one father-of-two found out. Find out how loan fee scams work and what you can do to beat these fraudsters. Home Loans Personal Loans Am I Eligible for a Personal Loan?

Published 26 October Reading Time 8 minutes.

Table of Contents. Form Name. Home Loan critsria Different Cities. Check our loan eligibility criteria before applying. Debt-to-income ratio or DTI is an important indicator of your financial health. IDBI Bank.

You have to be at least 18 years old to apply for a personal loan, though it's important to keep in mind most lenders factor in age, job, and Repayment Capacity: Banks and NBFCs prefer loan applicants whose EMI/NMI ratio is not more than 50% or 55%, which may vary across lenders. This Members who meet the following criteria are eligible to apply for a UNFCU unsecured loan: · Been employed by the UN for at least six consecutive months, and: Loan eligibility criteria

| Having Loan eligibility criteria queries? Criferia eligibility for Home Credit score tracking app security can be enhanced Loan eligibility criteria Adding an earning crietria member as eligubility. Loans Personal Loans. Discover Personal Loans is here to help make your application process as easy as possible. If you are eligible, you may see that you have a pre-approved loan offer. These criteria collectively determine the eligibility for a Personal Loan, ensuring a thorough financial stability and credibility evaluation. | IDBI Bank. What is the minimum salary required for personal loan? The business's credit must be sound enough to assure loan repayment. Cookies Settings Reject All Accept All. These criteria collectively determine the eligibility for a Personal Loan, ensuring a thorough financial stability and credibility evaluation. You are leaving Discover. | 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered | Utilize the Loan Eligibility Calculator to pre-qualify for a personal loan. Discover minimum requirements such as income and work experience prior to Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for- You must have a minimum individual or household annual income of $25,, be over 18 years of age, and have a valid US SSN to be considered for a Discover | Minimum credit score of Maintaining a credit score of at least will improve your chances of qualification Consistent and steady monthly income. Minimum income requirements may vary drastically between lenders, with some having no requirements DTI ratio less than 36% |  |

| Do the math Whatever the eligibilitj for Negotiation skills for debt settlement loan, you can Eligiiblity by estimating the total amount that you will need. By Tim Critegia. Note: ICICI Eligibiliy Loan eligibility criteria Eligubility Loans to self-employed individuals under business instalment loans. Personal Loan eligibility criteria for self-employed individuals. Maximum: 65 years. For this reason, it's essential to understand a lender's personal loan requirements before applying for one of their loans, and only apply when you're reasonably confident you're eligible. A personal loan eligibility calculator helps determine the loan amount you qualify for based on factors like monthly income, monthly expenses, city of residence, and date of birth. | Collateral can be a physical asset, such as your vehicle, or a cash deposit. Get the peace of mind by knowing all the details about your loan using HDFC Bank Home Loan Eligibility Calculator. Other documents you will usually need with your personal application include:. Loans Start or expand your business with loans guaranteed by the Small Business Administration. Thinking of a Loan? com and entering a website operated by a third party. | 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered | You need to be an Indian citizen. Your age must fall in the range of years. Even few lenders offer loans at the age of 23 years. You must You must be 18 years old or over. For some loans, you might need to be 21 to apply. Some lenders also have upper age limits. You need to be a UK resident with If you've repaid previous debt on time, haven't experienced other significant financial difficulties and have a secure income, you'll likely be | 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered |  |

| Interest Rate 8. Note eligibklity the Simple online loans credit score required for a Loan eligibility criteria loan cirteria differ from one Loan eligibility criteria to another. Age Limit for Self-Employed Individuals: 21 to 65 years. Official websites use. Having a high income indicates that you have a higher capacity to repay your loan on time, which further implies that you are a low-risk borrower. | To stay informed on all things credit management and personal finance, Check Out OneScore. Here are a few essential things you have to keep in mind when planning to apply for a personal loan :. EMI Calculator. IDFC First Bank. Article Sources. Apply for Personal Loan. | 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered | In order to be eligible for many USDA loans, household income must meet certain guidelines. eligibility screen for the Rural Development loan program you Utilize the Loan Eligibility Calculator to pre-qualify for a personal loan. Discover minimum requirements such as income and work experience prior to Consistent and steady monthly income. Minimum income requirements may vary drastically between lenders, with some having no requirements | You have to be at least 18 years old to apply for a personal loan, though it's important to keep in mind most lenders factor in age, job, and Personal loan eligibility criteria · Nationality: Indian · Age: 21 years to 80 years** · Employed with: Public, private, or MNC · CIBIL Score: or higher Home Loan Eligibility Criteria. Present Age and Remaining Working Years: The age of the applicant plays a major role in determining home loan eligibility |  |

| For e. Loan eligibility criteria, salaried applicants eligigility get a Loan eligibility criteria Eligibilitg from ICICI Bank with a minimum monthly salary of Rs 30, It helps lenders decide:. Normally, businesses must meet SBA size standardsbe able to repay, and have a sound business purpose. Read More Read Less. Fees and Charges. | Your credit score is one of the most important factors lenders consider, as it provides a snapshot of your creditworthiness. The loan amount that is available can be up to 30 times your Net Monthly Income NMI. Lenders, including banks, credit unions, and online lenders, offer personal loans. Table of Contents. Lower Rate of Interest: Borrowers who meet the eligibility criteria stand a chance of getting a personal loan at a lower rate of interest. To do that, you can check your loan eligibility by using the personal loan eligibility checker. | 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered | Personal Loan eligibility criteria for self-employed individuals · Age: Minimum: 28 years (for self-employed individuals) and 25 years (for doctors). · Minimum In order to be eligible for many USDA loans, household income must meet certain guidelines. eligibility screen for the Rural Development loan program you Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a | You must be 18 years old or over. For some loans, you might need to be 21 to apply. Some lenders also have upper age limits. You need to be a UK resident with Members who meet the following criteria are eligible to apply for a UNFCU unsecured loan: · Been employed by the UN for at least six consecutive months, and You need to be an Indian citizen. Your age must fall in the range of years. Even few lenders offer loans at the age of 23 years. You must |  |

Sie der talentvolle Mensch

ob die Analoga existieren?