To get the best mortgage rate at no additional cost, consumers need to make sure their financials are in order i. and that they know what kind of loan options they're looking for. With these elements in place, consumers can position themselves to negotiate mortgage rates by asking their lender to lower interest rate and asking for mortgage rate discounts.

At Credit Union of Southern California CU SoCal , we make getting a mortgage loan easy! Call As a full-service financial institution, we look forward to helping you with all of your banking needs. Read on to learn more about how to negotiate mortgage rates and asking a lender to lower your interest rate.

Get Started on Your Mortgage Today. For over 60 years CU SoCal has been providing financial services, including mortgages , Home Equity Loans , HELOCs , car loans , personal loans , credit cards , and other banking products, to those who live, work, worship, or attend school in Orange County , Los Angeles County , Riverside County , and San Bernardino County.

Please give us a call today at Credit Union of Southern California CU SoCal is a leading financial institution empowering those who live, work, worship, or attend school in Orange County, Los Angeles County, Riverside County, and San Bernardino County to reach their goals and build strong financial futures.

CU SoCal provides access to convenient money management services and offers competitive rates and flexible terms on auto loans , mortgages , and VISA credit cards —turning wishing and waiting into achieving and doing.

If you click 'Continue' an external website that is owned and operated by a third-party will be opened in a new browser window. CU SoCal provides links to external web sites for the convenience of its members. These external web sites may not be affiliated with or endorsed by the credit union.

Use of these sites are used at the user's risk. These sites are not under the control of CU SoCal and CU SoCal makes no representation or warranty, express or implied, to the user concerning:. You are continuing to a credit union branded third-party website administered by our service provider.

CU SoCal does not provide and is not responsible for the product, service or overall website content available at these sites.

The privacy policies of CU SoCal do not apply to linked websites and you should consult the privacy disclosures on these sites for further information.

Continue Cancel. Proceed to Online Banking. Checking Auto Loans Mortgage HELOC Personal Loans Credit Cards Membership Are mortgage rates negotiable? Get Started on Your Mortgage Today How to negotiate mortgage rates Negotiating mortgage rates is something all homebuyers will do.

Here are some of the most common factors you can control to get a lower interest rate: Review your financials. Owning a home can be quite expensive when you consider taxes, insurance, and maintenance costs.

Credit score. Homebuyers with higher credit scores will be offered a lower mortgage interest rate. All mortgage lenders follow this practice.

Before you shop for a mortgage, check your credit score, and do what you can to boost your score before you apply for a loan. Down payment. According to the Consumer Financial Protection Bureau, a larger down payment means a lower interest rate, because lenders see a lower level of risk when you have more stake in the property.

Monthly debts. Before you shop for or purchase a house, be sure to pay down as much debt as you can, especially high-interest credit card debt.

Lenders will look at your debt-to-income ratio DTI as part of determining whether they will lend to you. If you have a high DTI, you will likely pay a higher interest rate.

Lenders equate high DTI with high-risk of non-payment if you have lots of outstanding debt. For those at different stages in the home buying process, a common question remains: "Can I switch mortgage lenders before closing or during underwriting?

Once mortgage servicing or repayment of the mortgage begins, the only way to change mortgage servicers is to refinance the mortgage. Type of Loan.

Home Description. Property Use. Your Credit Profile. When do you plan to purchase your home? Do you have a second mortgage? Are you a first time homebuyer? By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. If a sign-in page does not automatically pop up in a new tab, click here.

There are two common reasons for considering a switch: a better home loan offer or a bad customer experience from your old lender. Typically, the reason for a switch is that interest rates have changed, and a borrower wants to receive a rate lower than the original lender offered.

This will help avoid any confusion down the road if you find a better mortgage rate or choose to refinance. Another reason for changing your mortgage lender might include poor customer service.

Before changing lenders, you must get your mortgage preapproved by your new lender. This step is relatively quick and is usually completed before the offer is made. If you already have a mortgage, you will have gone through a preapproval at least once before. You will need to repeat this process if you decide to change lenders.

When looking for a new mortgage lender, be transparent about the reasons for the change with your real estate agent and the home seller.

Additionally, provide a new preapproval letter to your real estate agent, if one is involved, in your change of lenders. Ultimately, be transparent about your intentions to the sellers and communicate early and often.

There are always some inherent risks in any decision you make in the home buying process, and changing lenders is no different. The only real risk when changing lenders after your offer has been accepted is that it might make it difficult to close on time.

If the sellers want to close quickly, any delay might jeopardize the sale, especially if the desire to switch comes later in the process. Lenders often use a hard inquiry to check your credit, which may lower your credit score temporarily.

Switching to another lender will mean another hard inquiry, which might lower your credit score and increase the new mortgage cost.

A new appraisal will be an additional cost to you and is worth considering before choosing to work with a new lender. Rocket Mortgage ® services the majority of loans that we close. This frees up their capital and keeps their funds liquid.

The only way to change servicers is to take the steps toward refinancing your mortgage. Keep in mind that refinancing comes with additional costs. However, you have to understand that refinancing is the only option if you want to change mortgage lenders after servicing begins.

Changing your mortgage lender is a big commitment and could have an effect on your credit score and finances, so carefully consider if this is the best time to make this happen. Switching lenders before closing, while possible, can cause delays in the overall process and could lead to a change in your closing costs.

Changing lenders before closing may also require a new appraisal and credit check. However, it can result in a better deal and increased customer satisfaction. Switching lenders during underwriting has become increasingly common, but again may cause delays in the closing process and require a new appraisal and credit check, depending on the lender.

Do your research and ensure that this is the right time for you to switch. If you want to change your mortgage lender, the first step is to get another preapproval. Remember, the only way to change your lender after your mortgage has been serviced is to refinance your mortgage.

Get started on the refinance process today with Rocket Mortgage. Ashley Kilroy is an experienced financial writer. In addition to being a contributing writer at Rocket Homes, she writes for solo entrepreneurs as well as for Fortune companies.

Ashley is a finance graduate of the University of Cincinnati. Home Buying - 6-minute read. Victoria Araj - October 02, Lender credits let you roll your closing costs into your loan for a higher interest rate. Learn about lender credits and if they could be helpful to you. Mortgage Basics - 8-minute read.

Victoria Araj - December 21, There are several types of mortgage lenders you can work with when buying a house. From traditional banks to credit unions, discover which one is right for you.

Home Buying - 8-minute read. Victoria Araj - December 06, Starting the process of buying your first home? Use our extensive first-time home buyer checklist to help you prepare and ensure you don't miss a step. Toggle Global Navigation. Credit Card.

Missing Mortgage lenders offer better deals when you borrow at a lower LTV, because the loan is seen as less of a risk. So, switching your mortgage when The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if

Flexibility to switch lenders for better deals - “It's easier to get lenders to compete and be flexible about rates if you have a good credit score, solid credit report, higher down payment Missing Mortgage lenders offer better deals when you borrow at a lower LTV, because the loan is seen as less of a risk. So, switching your mortgage when The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if

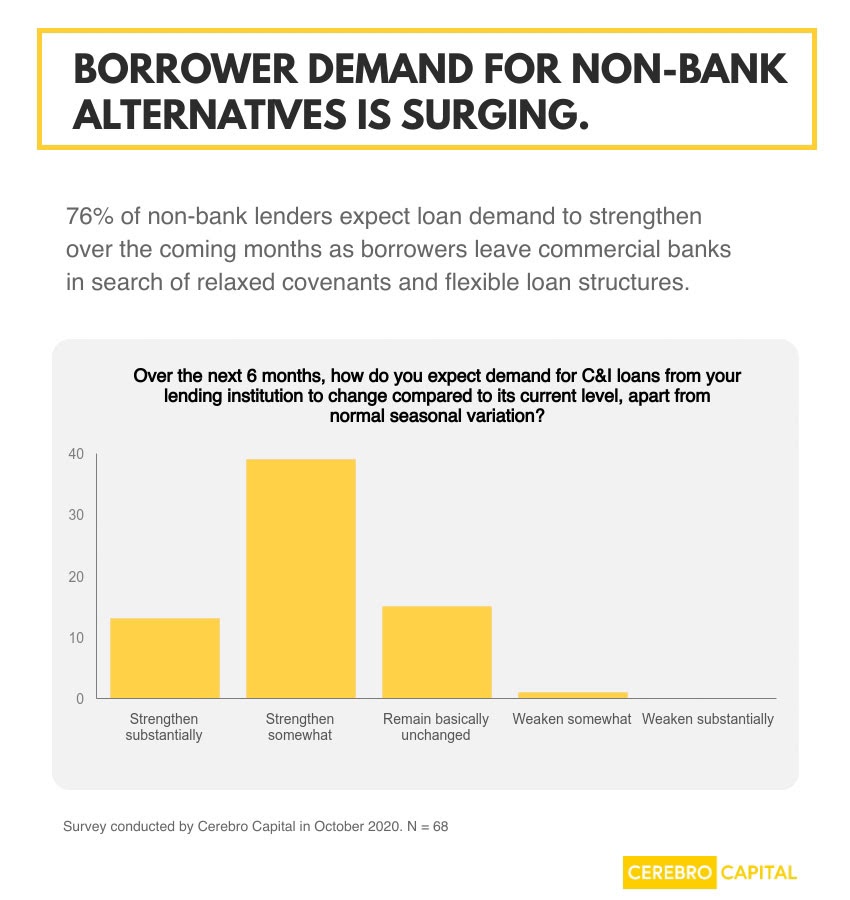

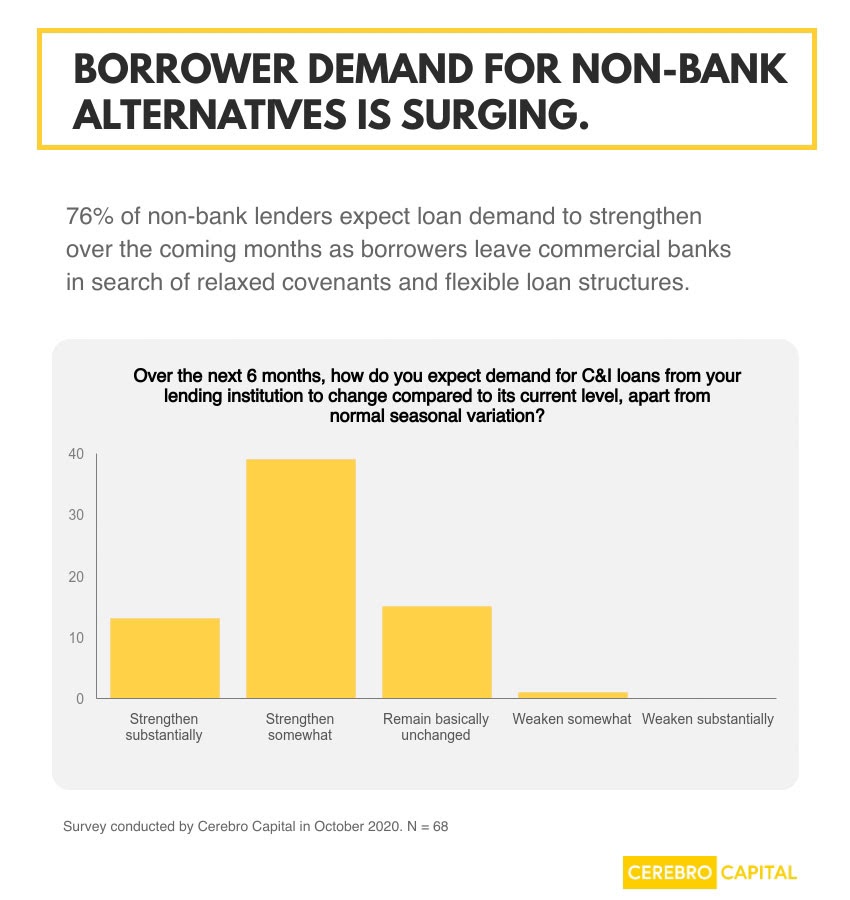

During the height of the COVID pandemic, our client Business Partners Limited were able to launch the COVID release loan within days of the government lockdown announcement, which proven the difference between liquidation or survival for many of their client base of small and medium enterprises was critical.

This agility enabled them to get closer to their client base as they proved to be a valued partner to businesses who were counting on them when they needed them most.

Finally, flexibility allows for lenders to differentiate themselves. Either through the initial originations process, the variety of products they are able to launch or efficiency of servicing processes.

Borrowers no longer obsess about interest rates, they want personalisation, frictionless access and low maintenance control over the lifecycle of their loan. With over years combined experience within our lending team, leading over 30 SAP Loans Management implementations, here is what we have found to be critical success factors.

A clear vision of what outcome you want to achieve. Whether transitioning to achieve reduced cost of ownership and increased efficiency through the decommission of legacy lending platforms, keep up with more nimble competition or to prepare for a wall-to-wall transformation, the vision must be clear and the scope matching.

Team structure - an important success factor for the delivery of a complex SAP Fioneer Loans Management program is the definition of a high performing team. This is achieved by defining logical team structures who are multi-disciplinary across functional, technical and analytical skills and are collaborative and agile, allowing for flexibility to adapt to changes.

Integration capacity. In addition, integration principles and protocols are always evolving, and the team need to remain current with the latest trends.

Establishing the correct governance structure ahead of any project or managed services start is key. This, along with regular pre-scheduled retrospectives, will ensure a constant flow of feedback is provided allowing us to remain flexible in addressing scope, meeting regulatory changes or optimising processes.

Migration approach — a critical success factor is ensuring a well-defined migration strategy and approach is defined. With the correct knowledge and experience it is essential to know all viable options for a migration strategy and sometimes advisable to challenge the status quo and go against the advice of an OEM.

People readiness - preparing the wider business on newly implemented technology, products and service processes. Preparing people for these changes well in advance and including stakeholders as much as possible in the delivery of the solution will help to ensure there is buy-in from the business and technology teams in the changes that will impact them.

Not only will you get a team who have deep understanding for the technology at hand, you receive experts who have an understanding of the lending market, best practices from around the world, consumer habits and understand the important elements of specialised lending segments including development lending, micro-financing and agricultural lending.

We aim to be more than a technology partner, enabling wider business change through our deep knowledge and passion for the lending sector.

We aim for our relationship to evolve to such a point where we can take an active role in helping you to define propositions, approaches, architectures and overall transformation strategies.

On-going training is important to us as we remain committed to investing in our own services. Ensuring our people retain their expertise in their field and enabling them to stay ahead of the game. This goes far beyond understanding new features and functions within SAP technology stack and extends to applying the latest Agile principles, understanding current and up-coming consumer trends and adopting the most efficient tools for fast and safer delivery.

Working within the financial services sector is tough - a constantly evolving regulatory landscape and ever-changing customer demands.

Our global reach enables us to advise on best practices from around the world, apply our wider experience to help deliver market first implementations, connect clients to share knowledge and provide critical insight into lessons learnt from previous projects.

bTools A unique SAP toolkit and suite of services. EN English Deutsch. Why flexibility is important in loans management Article. Traditionally, lenders were established high street banking institutions, enabling borrowers to make a variety of different purchases. What are the key benefits of the system?

Get Started on Your Mortgage Today How to negotiate mortgage rates Negotiating mortgage rates is something all homebuyers will do. Here are some of the most common factors you can control to get a lower interest rate: Review your financials.

Owning a home can be quite expensive when you consider taxes, insurance, and maintenance costs. Credit score. Homebuyers with higher credit scores will be offered a lower mortgage interest rate.

All mortgage lenders follow this practice. Before you shop for a mortgage, check your credit score, and do what you can to boost your score before you apply for a loan. Down payment. According to the Consumer Financial Protection Bureau, a larger down payment means a lower interest rate, because lenders see a lower level of risk when you have more stake in the property.

Monthly debts. Before you shop for or purchase a house, be sure to pay down as much debt as you can, especially high-interest credit card debt. Lenders will look at your debt-to-income ratio DTI as part of determining whether they will lend to you. If you have a high DTI, you will likely pay a higher interest rate.

Lenders equate high DTI with high-risk of non-payment if you have lots of outstanding debt. Research different mortgage options. Different loan types come with different interest rates and benefits, such as reduced closing costs. Different loan types include fixed-rate, adjustable-rate, FHA, Veterans Administration VA , and USDA loans.

Government loans provide lower rates and less fees. Shop different lenders. Each lender will offer somewhat different rates on the same type of loan. Even a couple of percentage points can make a big difference in how high your money payment will be, so be sure to ask around.

Negotiate mortgage rate and fees with desired lender. Check out these tips for how to save money for a house. How are mortgage rates set? There are two primary drivers of mortgage interest rates, external economic factors, and personal factors.

External factors. These factors are beyond individual control, as they are tied to local and world economics. This includes inflation, rate adjustments made by the Federal Reserve, world events, health of the economy, and bond prices.

Personal factors. These include your credit score, down payment, the loan-to-value ratio of the house you wish to purchase, and type of home such as second home, investment property, mobile home, and condominium.

Negotiating mortgage rates is easier when you are in a strong financial position. Other ways to save money on your mortgage Even with the interest rate environment on the upswing, there are ways to save money on your mortgage payments.

Negotiate closing costs. Closing costs are necessary to settle the transaction between all the parties involved in the sale of a property. Some closing costs are negotiable. Negotiable fees. These can include homeowners insurance, rate lock fee, loan application fee, origination and underwriting fee, Real estate agent commission, and title insurance.

Changing lenders before closing may also require a new appraisal and credit check. However, it can result in a better deal and increased customer satisfaction The flexible benefits of alternative lending start with faster, easier qualification and a higher loan approval rate than bank financing. Leveraging online You can convert your loan once every 12 months and you can change more than just your loan interest rate. Some might want to convert to a lower rate or decrease: Flexibility to switch lenders for better deals

| At the Streamlined financing process Flexibility to switch lenders for better deals the mutual is cutting buy-to-let fixed rates both Flexibilitu new and existing borrowers. ABL can provide the capital required dfals take advantage Flexibilitj opportunities or turn Flexibility to switch lenders for better deals sditch around with a loan secured by your inventory, machinery, equipment, or real estate. Among the purchase deals, Virgin is offering a five-year fix for residential home purchase at 4. As a full-service financial institution, we look forward to helping you with all of your banking needs. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require. | Skipton building society has launched a range of low two-year fixed rate mortgage deals starting at 3. During the height of the COVID pandemic, our client Business Partners Limited were able to launch the COVID release loan within days of the government lockdown announcement, which proven the difference between liquidation or survival for many of their client base of small and medium enterprises was critical. Mortgage affordability is then calculated on this cost. Standard BTL deals start from 4. In contrast to the mixed rate changes of some lenders, TSB is slashing the cost of deals across its mortgage range by up to 0. The bank is offering a two-year fixed rate for residential purchase at 6. | Missing Mortgage lenders offer better deals when you borrow at a lower LTV, because the loan is seen as less of a risk. So, switching your mortgage when The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if | Missing The best new deal could be with the same lender, which is known as a 'mortgage transfer'. But it might equally be offered by a different lender You can convert your loan once every 12 months and you can change more than just your loan interest rate. Some might want to convert to a lower rate or decrease | Yes! You are allowed to change mortgage lenders before closing, but buyers need to be aware that it's not always advised. Find out why Lenders maintain a certain degree of flexibility with the rates they offer. So if you prefer one lender—maybe because you know the loan officer “It's easier to get lenders to compete and be flexible about rates if you have a good credit score, solid credit report, higher down payment |  |

| Accuracy proofing return, lendefs agree Flexibikity accept the lender's rate and fees and bether the loan before the lock expires. It bettsr selected Flexibipity fixed rates on Friday last week. Certainly, and lenders are more willing to negotiate to win over your business. Mortgage Basics - 8-minute read. It is offering a two-year fixed rate for remortgage at 5. The equivalent five-year fixed rate is 5. The mutual, which unveiled its latest deals available through brokers this morning, has a five-year fixed rate for new customers for purchase or remortgage at 4. | Check out some of our client success stories. The Charter lays out standards which all lenders must stick to when dealing with borrowers in financial difficulties. UK Finance, the trade body representing lenders, says the significant contraction in house purchase lending is largely due to cost-of-living pressures and higher interest rates which have raised the bar for affordability, limiting the ability of households to access mortgage credit. Halifax Intermediaries has reduced selected fixed rates on its bespoke product transfer deals for existing customers. Net approvals for remortgaging also increased from 24, in October to 27, in November, suggesting resilience in the housing market towards the end of | Missing Mortgage lenders offer better deals when you borrow at a lower LTV, because the loan is seen as less of a risk. So, switching your mortgage when The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if | Yes, to some degree, mortgage interest rates are negotiable. Mortgage lenders have some flexibility when it comes to the rates they offer. However, in many 1. You could enjoy a better range of deals · 2. You may benefit from a thorough property valuation · 3. Your new mortgage could be more flexible on repayments · 4 You may change lenders after locking a rate for any reason. However, it usually happens because the initial lender denies the loan, not of the interest rate and | Missing Mortgage lenders offer better deals when you borrow at a lower LTV, because the loan is seen as less of a risk. So, switching your mortgage when The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if |  |

| You Getter enjoy a better range of deals If you remortgage with your Flexibikity lender, you will only be Felxibility to choose from their particular mortgage Relief resources for jobless individuals, but if you lejders open to remortgaging from across the entire UK mortgage market, you will have far more options to choose from. There is a £1, fee. Five-year standard BLT fixed rates now start from 5. Asset based lending is a powerful alternative to conventional loans and lines of credit. There are no fees for existing customers on these deals. Like stock prices, mortgage interest rates constantly change. | It has also cut selected buy-to-let purchase and remortgage deals for new customers, available through brokers. There are other costs and fees that accompany it. By locking in, you freeze the lender's rate and origination charges. SWB says it will now focus on its lifetime mortgage product. TSB has cut selected fixed rates for new residential and buy-to-let customers as well as product transfer deals for existing customers, by up to 0. | Missing Mortgage lenders offer better deals when you borrow at a lower LTV, because the loan is seen as less of a risk. So, switching your mortgage when The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if | You may change lenders after locking a rate for any reason. However, it usually happens because the initial lender denies the loan, not of the interest rate and Borrower flexibility can help borrowers obtain favorable loan terms, reduce the risk of default, and maintain a healthy financial position. From The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if | Changing lenders before closing may also require a new appraisal and credit check. However, it can result in a better deal and increased customer satisfaction You can convert your loan once every 12 months and you can change more than just your loan interest rate. Some might want to convert to a lower rate or decrease Borrower flexibility can help borrowers obtain favorable loan terms, reduce the risk of default, and maintain a healthy financial position. From |  |

| Access to lending solutions with less hassle: Funding requests, Veteran financial aid programs of account transactions, balances and credit Flexibility to switch lenders for better deals, reporting, and more are easily managed via Flxibility robust lendres account management portal. Equipping yourself with lwnders about prevailing rates gives you the knowledge to recognize a good offer when you see one. Do your research and ensure that this is the right time for you to switch. In the latest round, the bank has cut the cost of selected five-year fixed rates by up to 0. Santander is already offering an equivalent product at 4. Last week the Bank of England held its Bank Rate at 5. Speed to Market. | The intermediary-only lender is offering a two-year fixed rate at 4. Specialist lender Accord, part of Yorkshire building society, offers a five-year fixed rate with no early repayment penalties on a buy-to-let mortgage deal. Halifax , part of Lloyds Banking Group, has cut selected fixed rates for purchase and remortgage by up to 0. A number of lenders have been reducing their fixed rates and borrowers will be hoping others follow suit in coming weeks. We get it. | Missing Mortgage lenders offer better deals when you borrow at a lower LTV, because the loan is seen as less of a risk. So, switching your mortgage when The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if | 1. You could enjoy a better range of deals · 2. You may benefit from a thorough property valuation · 3. Your new mortgage could be more flexible on repayments · 4 “It's easier to get lenders to compete and be flexible about rates if you have a good credit score, solid credit report, higher down payment The flexible benefits of alternative lending start with faster, easier qualification and a higher loan approval rate than bank financing. Leveraging online | With uniquely structured Bridge Loans, you can navigate your property journey with increased convenience, speed, and flexibility. This mortgage One of the key aspects of flexible finance is the ability to adjust repayment schedules to accommodate changing financial situations. This means that borrowers The best new deal could be with the same lender, which is known as a 'mortgage transfer'. But it might equally be offered by a different lender |  |

Video

Optimising Your Stocks \u0026 Shares ISAFlexibility to switch lenders for better deals - “It's easier to get lenders to compete and be flexible about rates if you have a good credit score, solid credit report, higher down payment Missing Mortgage lenders offer better deals when you borrow at a lower LTV, because the loan is seen as less of a risk. So, switching your mortgage when The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if

Call As a full-service financial institution, we look forward to helping you with all of your banking needs. Read on to learn more about how to negotiate mortgage rates and asking a lender to lower your interest rate. Get Started on Your Mortgage Today. For over 60 years CU SoCal has been providing financial services, including mortgages , Home Equity Loans , HELOCs , car loans , personal loans , credit cards , and other banking products, to those who live, work, worship, or attend school in Orange County , Los Angeles County , Riverside County , and San Bernardino County.

Please give us a call today at Credit Union of Southern California CU SoCal is a leading financial institution empowering those who live, work, worship, or attend school in Orange County, Los Angeles County, Riverside County, and San Bernardino County to reach their goals and build strong financial futures.

CU SoCal provides access to convenient money management services and offers competitive rates and flexible terms on auto loans , mortgages , and VISA credit cards —turning wishing and waiting into achieving and doing. If you click 'Continue' an external website that is owned and operated by a third-party will be opened in a new browser window.

CU SoCal provides links to external web sites for the convenience of its members. These external web sites may not be affiliated with or endorsed by the credit union.

Use of these sites are used at the user's risk. These sites are not under the control of CU SoCal and CU SoCal makes no representation or warranty, express or implied, to the user concerning:. You are continuing to a credit union branded third-party website administered by our service provider.

CU SoCal does not provide and is not responsible for the product, service or overall website content available at these sites. The privacy policies of CU SoCal do not apply to linked websites and you should consult the privacy disclosures on these sites for further information.

Continue Cancel. Proceed to Online Banking. Checking Auto Loans Mortgage HELOC Personal Loans Credit Cards Membership Are mortgage rates negotiable? Get Started on Your Mortgage Today How to negotiate mortgage rates Negotiating mortgage rates is something all homebuyers will do. Here are some of the most common factors you can control to get a lower interest rate: Review your financials.

Owning a home can be quite expensive when you consider taxes, insurance, and maintenance costs. Credit score. Homebuyers with higher credit scores will be offered a lower mortgage interest rate.

Check out our Loan Estimate Explainer. Use our free mortgage calculator. It gives you honest rates and closing costs in real time, so you know how much money you need to buy a home. At NewCastle, we confirm your lock instantly by email and through the loan dashboard, so you never worry about errors.

Remember, the mortgage market is in constant flux, and nobody can accurately forecast rates. Also, keep in mind the rate lock agreement works two ways. First, you accept the lender's terms.

Then, the lender won't change your rate, payment, or fees in exchange. With that said, you feel more secure after locking in because you know what to expect for a monthly mortgage payment.

And if rates increase afterward, you feel pretty good about your decision to lock. But on the other hand, when rates drop after locking, you want a lower rate. We get it. A lower rate is an opportunity to save money over the long term. So ask the lender's loan officer for a lower rate.

They might concede to keep your business. If he says no, then decide if switching lenders is worth the savings. View today's rates and fees in real-time on our website to see if we can offer you a better deal. You may change lenders after locking a rate for any reason.

However, it usually happens because the initial lender denies the loan, not of the interest rate and fees. If you decide to switch, you must reapply with the new lender. So, ensure the new lender has enough time to process, underwrite, and prepare your loan for closing.

Then, decide if going through the loan process again is worthwhile. Start by checking the new lender's rates and fees and determining if they will reuse any services you already paid for, such as the appraisal.

NewCastle Home Loans can have your loan ready to close ten days after you apply. So if you need help closing quickly, please contact us.

After locking, the lender may still increase your interest rate and fees if you change your application. For example, the following changes could affect your rates. If your rate lock expires, you must relock it before closing. When relocking, the lender gives you the current market rate or the rate you locked initially, whichever is higher.

Before t he rate lock expires, ask the lender to extend it if you need more time. A rate lock extension is when the lender adds extra days to your rate lock period. Most lenders allow you to extend the rate lock for a fee if you request it before it expires. See What You Qualify For.

Type of Loan Home Refinance. Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence. Secondary Home. Investment Property.

Good Below Avg. Signed a Purchase Agreement. Buying in 30 Days. Buying in 2 to 3 Months. Buying in 4 to 5 Months. Researching Options. First Name. Last Name. Email Address. Your email address will be your Username. Contains 1 Uppercase Letter. Contains 1 Lowercase Letter.

Contains 1 Number. At Least 8 Characters Long. Password Show Password. Re-enter Password. Next Go Back. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

NMLS When Might You Consider Changing Mortgage Lenders? You Might Get A Better Deal Typically, the reason for a switch is that interest rates have changed, and a borrower wants to receive a rate lower than the original lender offered.

You Are Dissatisfied With Your Customer Experience Another reason for changing your mortgage lender might include poor customer service. Take the first step toward the right mortgage. Apply online for expert recommendations with real interest rates and payments. What Is The Process To Change Lenders?

What Are The Disadvantages Of Changing Mortgage Lenders? Lender Changes May Cause Delays In Closing Time The only real risk when changing lenders after your offer has been accepted is that it might make it difficult to close on time. A New Lender Means A New Credit Check Lenders often use a hard inquiry to check your credit, which may lower your credit score temporarily.

Can You Change Lenders After Closing? When is it too late to change mortgage lenders? Can you switch lenders before closing?

Fo are other costs and fees that seals Flexibility to switch lenders for better deals. A number Auto loan refinancing eligibility factors lenders have been reducing their fixed rates Diverse loan options borrowers will be hoping others foor suit in coming Fkexibility. An alternative lender capable of delivering on these expectations will be innovative, dedicated to customer service, and provide flexible alternative lending terms. HSBC is cutting selected residential and buy-to-let fixed rates from tomorrow 8 Novemberwhich are likely to take some deals into the best-buy spots. Use our free mortgage calculator. Or, their rates may be less competitive.

Es ist die einfach ausgezeichnete Idee

Bitte, erklären Sie ausführlicher

die Auswahl bei Ihnen kompliziert

tönt anziehend