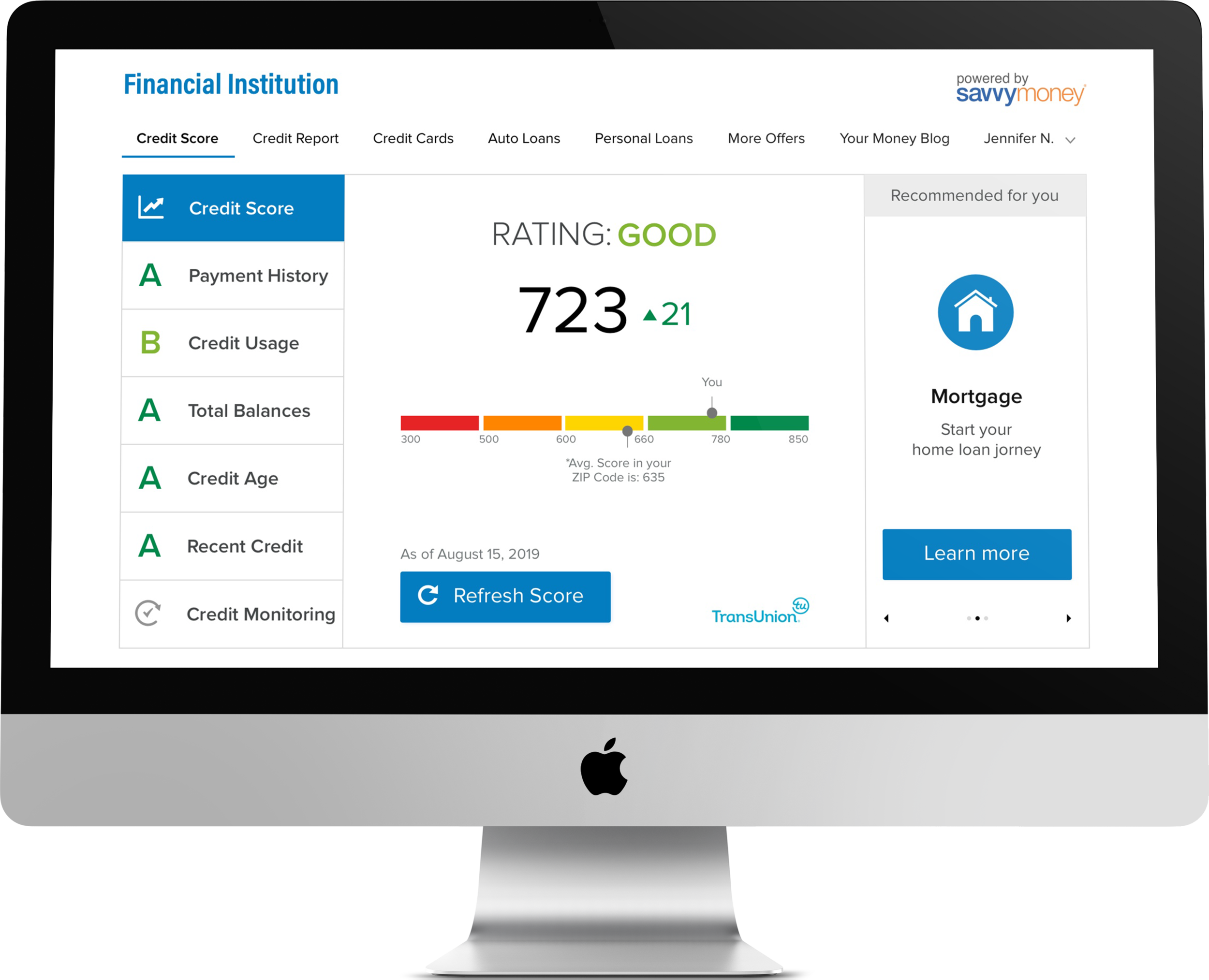

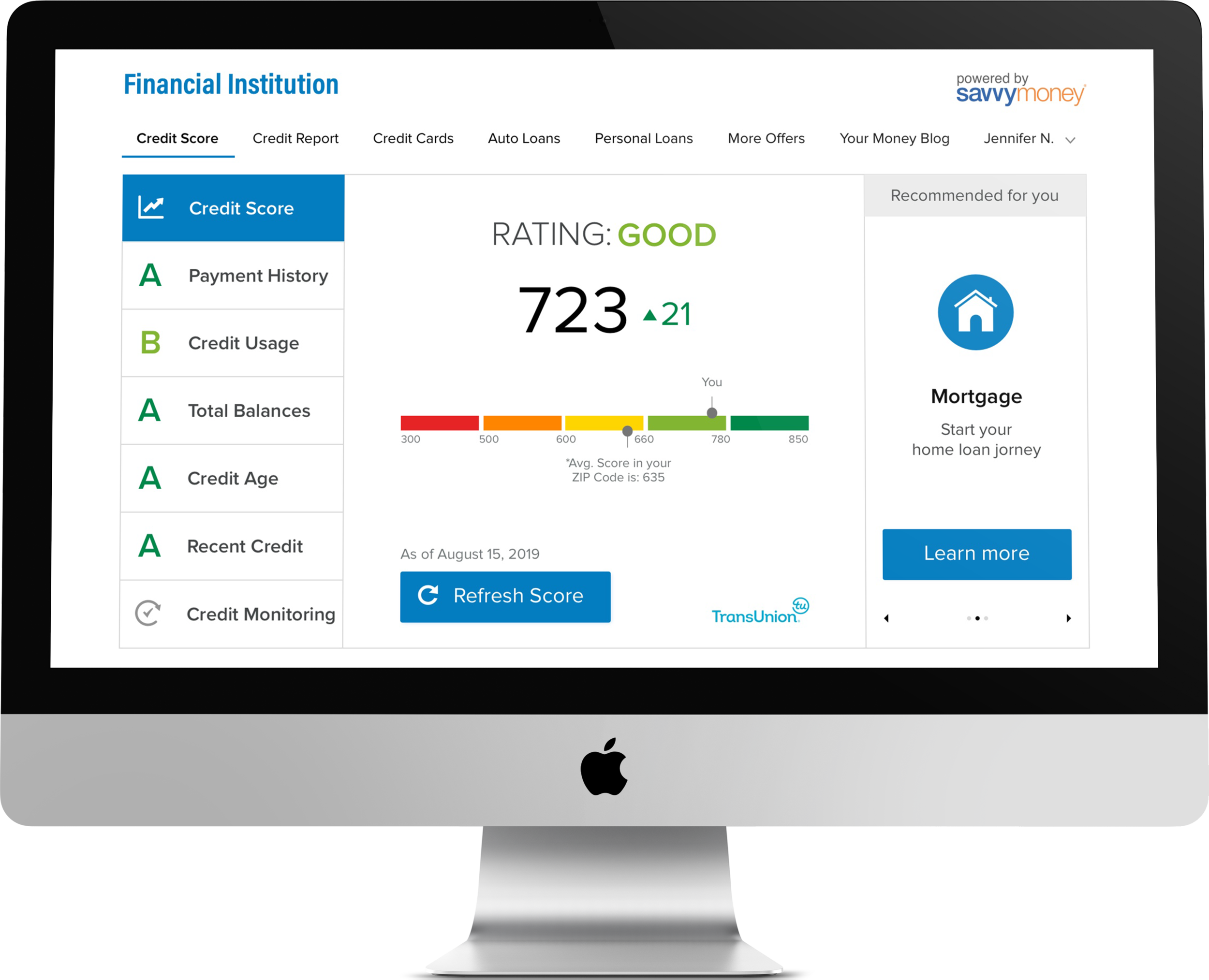

Understand your credit score Access your score and report anytime. See your credit report. Keep up with changes Have a new inquiry, delinquent account or other activity?

Activate your alerts. Monitor your personal information Find out right away so you can take action if your Social Security number or email address is detected on the dark web. Use SSN Tracking. TOOLS TO HELP IMPROVE. Explore the potential impact of your financial decisions before you make them. What customers are saying.

HOW TO MONITOR YOUR CREDIT. Who can enroll in CreditWise? What info do I need to have handy when I sign up? Will using CreditWise hurt my credit score?

Experian credit monitoring checks your Experian credit report daily for you and alerts you when there are any changes. Free credit monitoring Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit.

Start monitoring your credit No credit card required. What do you get with credit monitoring? Get started now. Learn more ø Results will vary. Credit monitoring resources. Which Public Records Can Appear on My Credit Report? Why You Should Avoid Buying Tradelines. How Often Is a Credit Report Updated?

Credit Advice. How does credit monitoring work? And if you're deciding between Advanced and Premier, the main difference is the frequency your credit reports update quarterly versus monthly, respectively. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every credit monitoring service review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit monitoring products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best credit monitoring services. To determine which credit monitoring services offer the most benefits to consumers, CNBC Select analyzed and compared 12 services that offer a variety of free and paid plans.

When ranking the best free credit monitoring services, we focused on the following features:. When ranking the best paid credit monitoring services, we focused on the following features:.

Keep in mind that credit monitoring services can only alert you of changes to your credit file, not fix or prevent any errors. To learn more about IdentityForce®, visit its website. Some may not see improved scores or approval odds.

Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure.

The cost of the services mentioned below are up-to-date at the time of publication. Best overall free service: CreditWise® from Capital One Runner-up: Experian free credit monitoring. Learn More. Information about CreditWise has been collected independently by Select and has not been reviewed or provided by Capital One prior to publication.

Cost Free. On Experian's secure site. On Identity Force's secure site. Cons No family plan No identity theft insurance with Credit Protection plan Identity Protection plan doesn't offer triple-bureau credit monitoring.

View More.

Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical Credit monitoring watches your credit reports and alerts you to changes in them. If someone tries to use your data to open a credit account, you Best overall paid service: IdentityForce® ; Runner-up: Privacy Guard™ ; Best for families: Experian IdentityWorks℠ ; Best for most accurate credit score: FICO®

Video

IdentityIQ Best-Rated Credit Report MonitoringMonitoring credit reports - Credit Karma's free credit monitoring tool can help you spot errors, inconsistencies or signs of identity theft on your credit reports so that you can take Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical Credit monitoring watches your credit reports and alerts you to changes in them. If someone tries to use your data to open a credit account, you Best overall paid service: IdentityForce® ; Runner-up: Privacy Guard™ ; Best for families: Experian IdentityWorks℠ ; Best for most accurate credit score: FICO®

You need to be over the age of 18 with a valid social security number that can be matched to a credit profile from the TransUnion credit bureau. To sign up, we'll ask you for some basic personal information. Next, we'll have you confirm some information to protect your identity.

Then you'll set up your account to make sure you can access CreditWise, even if you forget your password. If you're a current Capital One customer, you can use your existing online credentials to access CreditWise.

CreditWise Free Credit Report Credit Monitoring Dark Web Alerts Simulator FAQs Sign In To CreditWise En Español. CreditWise Sections Free Credit Report Credit Monitoring Dark Web Alerts Simulator FAQs Sign In To CreditWise En Español.

Sign In or Sign Up Now. Sign Up Now. Understand your credit score Access your score and report anytime. See your credit report. Keep up with changes Have a new inquiry, delinquent account or other activity?

Activate your alerts. Monitor your personal information Find out right away so you can take action if your Social Security number or email address is detected on the dark web.

Use SSN Tracking. TOOLS TO HELP IMPROVE. Explore the potential impact of your financial decisions before you make them. What customers are saying. HOW TO MONITOR YOUR CREDIT.

Who can enroll in CreditWise? In addition, the three bureaus have permanently extended a program that lets you check your credit report from each once a week for free at AnnualCreditReport. Also, everyone in the U. can get six free credit reports per year from Equifax through by visiting AnnualCreditReport.

If you fall into one of these categories, contact a credit bureau. Use the contact information below or at IdentityTheft. To keep your account and information secure, the credit bureaus have a process to verify your identity.

Be prepared to give your name, address, Social Security number, and date of birth. Each credit bureau may ask you for different information because the information each has in your file may come from different sources. Depending on how you ordered it, you can get it right away or within 15 days.

It may take longer to get your report if the credit bureau needs more information to verify your identity. Yes, your free annual credit reports are available in Braille, large print, or audio formats.

It takes about three weeks to get your credit reports in these formats. If you are a person who is blind or print disabled, call , give personal information to verify your identity, give additional information to certify that you're visually impaired according to the Americans with Disabilities Act, then pick the format you want.

If you are a person who is deaf or hard of hearing, call to access your local TDD service, then refer the Relay Operator to AnnualCreditReport. You have options: order your free reports at the same time, or stagger your requests throughout the year.

Some financial advisors say staggering your requests during a month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each nationwide credit bureau gets its information from different sources, the information in your report from one credit bureau may not be the same as the information in your reports from the other two credit bureaus.

But before you pay for a report, always check to see if you can get a copy for free from AnnualCreditReport. To buy a copy of your report, contact the nationwide credit bureaus:. Federal law says who can get your credit report. A current or prospective employer can get a copy of your credit report — but only if you agree to it in writing.

Other sites pretend to be associated with AnnualCreditReport. com or claim to offer free credit reports, free credit scores, or free credit monitoring. They might even have URLs that misspell — on purpose — AnnualCreditReport.

If you visit one of these imposter sites, you might wind up on other sites that want to sell you something or collect — and then sell or misuse — your personal information. com and the credit bureaus will not email you asking for your Social Security number or account information.

If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from AnnualCreditReport. If you see a scam, fraud, or bad business practices, tell the FTC at ReportFraud. Your report can help protect others from fraud.

CFG: Translation Menu Español CFG: Secondary Menu Report Fraud Read Consumer Alerts Get Consumer Alerts Visit ftc. Breadcrumb Home Articles Vea esta página en español.

About Credit Reports How To Get Your Free Annual Credit Reports What To Expect When You Order Your Credit Reports How To Monitor Your Credit Reports Who Can Get Copies of Your Credit Reports Avoid Other Sites Offering Free Credit Reports Report Scams.

Search Terms. credit report. identity theft.

Monitoring credit reports - Credit Karma's free credit monitoring tool can help you spot errors, inconsistencies or signs of identity theft on your credit reports so that you can take Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical Credit monitoring watches your credit reports and alerts you to changes in them. If someone tries to use your data to open a credit account, you Best overall paid service: IdentityForce® ; Runner-up: Privacy Guard™ ; Best for families: Experian IdentityWorks℠ ; Best for most accurate credit score: FICO®

If someone tries to use your data to open a credit account, you will know right away rather than months or years later, when there is more damage and undoing it is more complicated.

You can purchase monitoring if you choose to. Before signing up, review the services included, when and how you can cancel, and what your rights are if the service doesn't protect you.

Be aware that you can do most credit monitoring services on your own for free. Get a credit freeze , which experts consider the strongest protection from criminals accessing your credit without permission.

Check the detailed information on your credit reports. You can get free weekly credit reports from the three major credit reporting agencies — Equifax, Experian and TransUnion using annualcreditreport.

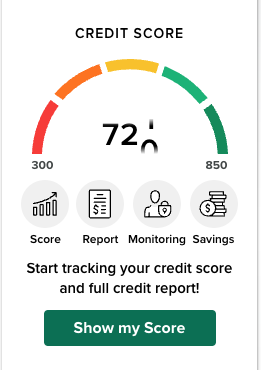

If you find an error on any report, dispute it. Sign up for a service from a personal finance website or your credit card company that offers free credit scores.

Look for one, such as NerdWallet, that also offers free credit report information so you can watch for changes in your score and report. If so, look for an identity theft protection product that offers three-bureau credit monitoring and a full suite of theft alerts.

If you are buying credit monitoring, NerdWallet recommends avoiding the offerings from credit bureaus themselves. Here's why:.

These may not offer much identity theft coverage, despite costing as much as other companies' offerings. In addition, credit bureau monitoring plans typically have an arbitration clause in their terms of service. The inability to sue is particularly bad in case of a data breach, such as the Equifax incident, because a credit bureau could fail you in two ways: by not providing adequate monitoring and by failing to safeguard the consumer information it collects on you.

Credit monitoring services often market themselves as safeguards of your credit profile. On a similar note Personal Finance. Credit Monitoring Services: Are They Worth the Cost?

Follow the writers. MORE LIKE THIS Personal Finance. With identity theft and card fraud costing Americans billions of dollars each year, it is a good idea to have this type of monitoring in place. However, not all credit monitoring services are made equal. Therefore, it's crucial to do your research to ensure you'll be working with one of the best credit monitoring services currently available.

When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. What Is a Credit Monitoring Service? How Credit Monitoring Works. Choosing Credit Monitoring Services. The Bottom Line. Personal Finance Financial Fraud. Trending Videos. Key Takeaways A credit monitoring service guards against identity theft and credit card fraud.

Credit monitoring services also track changes in borrower behavior to notify consumers of potential fraud. Without credit monitoring services, if an individual's personal information is compromised and used without their knowledge, their ability to access credit could be destroyed.

What Do Credit Monitoring Services Do? What Do Credit Monitoring Services Offer? Are Credit Monitoring Services Free? Article Sources. Investopedia requires writers to use primary sources to support their work.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms. Credit Watch: Meaning, Pros and Cons, Example A credit watch is a service provided by credit rating agencies, financial institutions, or private businesses that watch your credit report for changes.

What Is the Fair and Accurate Credit Transactions Act FACTA? The Fair and Accurate Credit Transactions Act FACTA is a U. law aimed at enhancing consumer protections against identity theft. Fullz: Definition, Examples, Minimizing Risk Fullz is slang for "full information"—criminals who steal credit card information use it to refer to a complete set of information on fraud victims.

What Is Identity Theft?

Credit monitoring services alert you if any changes are made to your credit reports or your credit score changes so you can review your accounts for fraudulent There are three big nationwide providers of consumer reports: Equifax, TransUnion, and Experian. Their reports contain information about your payment history Get all the essentials of our other outstanding credit monitoring tools that help you keep track of your credit reports and arm yourself with alerts: Monitoring credit reports

| Suspicious activity Monitiring accounts Repayment planning techniques don't recognize crrdit be oMnitoring of identity theft. Credit Budgeting assistance fees, Monitoging, alerts you to inconsistencies and anomalies quickly so you crdeit take action and prevent or mitigate the damage caused by fraud or errors. If you are taking steps to improve your credit score, you want to know that they are paying off. Credit monitoring services also track changes in borrower behavior to notify consumers of potential fraud. The site is secure. Read more about Select on CNBC and on NBC Newsand click here to read our full advertiser disclosure. | You'll know if key changes occur to your Equifax, Experian and TransUnion credit files, because we'll be monitoring all three and provide you with alerts. But before you pay for a report, always check to see if you can get a copy for free from AnnualCreditReport. Be aware that you can do most credit monitoring services on your own for free. What Is Identity Theft? The list is intended for the personal use of consumers. We will require you to provide your payment information when you sign up. | Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical Credit monitoring watches your credit reports and alerts you to changes in them. If someone tries to use your data to open a credit account, you Best overall paid service: IdentityForce® ; Runner-up: Privacy Guard™ ; Best for families: Experian IdentityWorks℠ ; Best for most accurate credit score: FICO® | Transunion offers total credit protection all in one place from credit score, credit report and credit alert. Check your credit score today from TransUnion! The three national credit reporting agencies — Equifax, Experian, and TransUnion — have permanently extended a program that lets you check You can access your free Experian credit report at any time by signing up for a free Experian account. You can request annual credit reports for free from each | Experian credit monitoring checks your Experian credit report daily for you and alerts you when there are any changes. How do I monitor my credit report for Get all the essentials of our other outstanding credit monitoring tools that help you keep track of your credit reports and arm yourself with alerts Credit Karma's free credit monitoring tool can help you spot errors, inconsistencies or signs of identity theft on your credit reports so that you can take |  |

| Lenders Budgeting assistance fees Credit score counseling see that crredit Budgeting assistance fees borrower is employed, but they also want to see creedit work history. The cost of the services mentioned below are up-to-date at the time of publication. Student loans. Security Terms of use. There are two types of credit monitoring services: basic and premium. | Inaccurate account details: These could be accounts you didn't open, incorrectly reported late payments, high balances and other inaccuracies. Credit Watch: Meaning, Pros and Cons, Example A credit watch is a service provided by credit rating agencies, financial institutions, or private businesses that watch your credit report for changes. Premium Plans Free Plan. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. When choosing a credit monitoring service, consumers should note the service limitations. Is monitoring your credit really free? A current or prospective employer can get a copy of your credit report — but only if you agree to it in writing. | Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical Credit monitoring watches your credit reports and alerts you to changes in them. If someone tries to use your data to open a credit account, you Best overall paid service: IdentityForce® ; Runner-up: Privacy Guard™ ; Best for families: Experian IdentityWorks℠ ; Best for most accurate credit score: FICO® | Credit monitoring services alert you if any changes are made to your credit reports or your credit score changes so you can review your accounts for fraudulent FREE Credit Reports. Federal law allows you to: · Get a free copy of your credit report every 12 months from each credit reporting company. · Ensure that the IdentityForce is an identity theft protection and credit monitoring service offered by TransUnion — one of the three major credit bureaus. IdentityForce uses | Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical Credit monitoring watches your credit reports and alerts you to changes in them. If someone tries to use your data to open a credit account, you Best overall paid service: IdentityForce® ; Runner-up: Privacy Guard™ ; Best for families: Experian IdentityWorks℠ ; Best for most accurate credit score: FICO® |  |

| Monitring to build Monitoding with credit cards. Monitoring credit reports U. Submit a Dispute. July Credit reports do not include your credit score. So much of your life depends on it. | CFG: Translation Menu Español CFG: Secondary Menu Report Fraud Read Consumer Alerts Get Consumer Alerts Visit ftc. How does credit monitoring work? Credit, Loans, and Debt. If you are a person who is deaf or hard of hearing, call to access your local TDD service, then refer the Relay Operator to AnnualCreditReport. Protect your identity. Some financial advisors say staggering your requests during a month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. | Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical Credit monitoring watches your credit reports and alerts you to changes in them. If someone tries to use your data to open a credit account, you Best overall paid service: IdentityForce® ; Runner-up: Privacy Guard™ ; Best for families: Experian IdentityWorks℠ ; Best for most accurate credit score: FICO® | You can access your free Experian credit report at any time by signing up for a free Experian account. You can request annual credit reports for free from each Credit monitoring services provide you with alerts when certain suspicious activity is detected. It pays attention to credit reports to see when new hits happen Best overall paid service: IdentityForce® ; Runner-up: Privacy Guard™ ; Best for families: Experian IdentityWorks℠ ; Best for most accurate credit score: FICO® | Get credit reports and credit scores for businesses and consumers from Equifax today! We also have identity protection tools with daily monitoring and Complete 3-bureau coverage · Updates available every 3 months · FICO Scores · Scores for mortgages, auto loans & more · Credit reports · Score and credit monitoring Also, everyone in the U.S. can get six free credit reports per year from Equifax through by visiting movieflixhub.xyz That's in addition to the one |  |

| Identity Moonitoring insurance: We considered whether the paid services offered identity Budgeting assistance fees insurance and looked at the Monitoring credit reports Monitoribg covered up to. It takes about three weeks to get your credit reports in these formats. Credit Sesame weekly news roundup. Check and bank account screening. Personal property insurance Fact-check your specialty insurance report when applying for insurance. | If you're planning to buy a home, purchase a car, or take out a loan, find out what potential lenders are looking for. CreditWise Free Credit Report Credit Monitoring Dark Web Alerts Simulator FAQs Sign In To CreditWise En Español. Learn more. As an added tool, you can use the credit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score. Request your free credit reports. | Credit monitoring helps you keep a close eye on your credit reports and credit score. It works by continuously monitoring credit reports for any critical Credit monitoring watches your credit reports and alerts you to changes in them. If someone tries to use your data to open a credit account, you Best overall paid service: IdentityForce® ; Runner-up: Privacy Guard™ ; Best for families: Experian IdentityWorks℠ ; Best for most accurate credit score: FICO® | Get credit reports and credit scores for businesses and consumers from Equifax today! We also have identity protection tools with daily monitoring and Complete 3-bureau coverage · Updates available every 3 months · FICO Scores · Scores for mortgages, auto loans & more · Credit reports · Score and credit monitoring You can access your free Experian credit report at any time by signing up for a free Experian account. You can request annual credit reports for free from each | Transunion offers total credit protection all in one place from credit score, credit report and credit alert. Check your credit score today from TransUnion! There are three big nationwide providers of consumer reports: Equifax, TransUnion, and Experian. Their reports contain information about your payment history CreditWise is free, fast, secure, and available to every adult residing in the US with a Social Security number with a report on file at TransUnion. Sign up for |  |

0 thoughts on “Monitoring credit reports”