A family member or significant other may be willing to add you as an authorized user on his or her card. Doing so adds that card's payment history to your credit files, so you'll want a primary user who has a long history of paying on time.

In addition, being added as an authorized user can reduce the amount of time it takes to generate a FICO score. It can be especially useful for a young person who is just beginning to build credit.

You don't have to use — or even possess — the credit card at all in order to benefit from being an authorized user. Ask the primary cardholder to find out whether the card issuer reports authorized user activity to the credit bureaus. Rent-reporting services such as Rental Kharma and LevelCredit take a bill you are already paying and put it on your credit report, helping to build a positive history of on-time payments.

Not every credit score takes these payments into account, but some do, and that may be enough to get a loan or credit card that firmly establishes your credit history for all lenders. Experian Boost offers a way to have your cell phone and utility bills reflected in your credit report with that credit bureau.

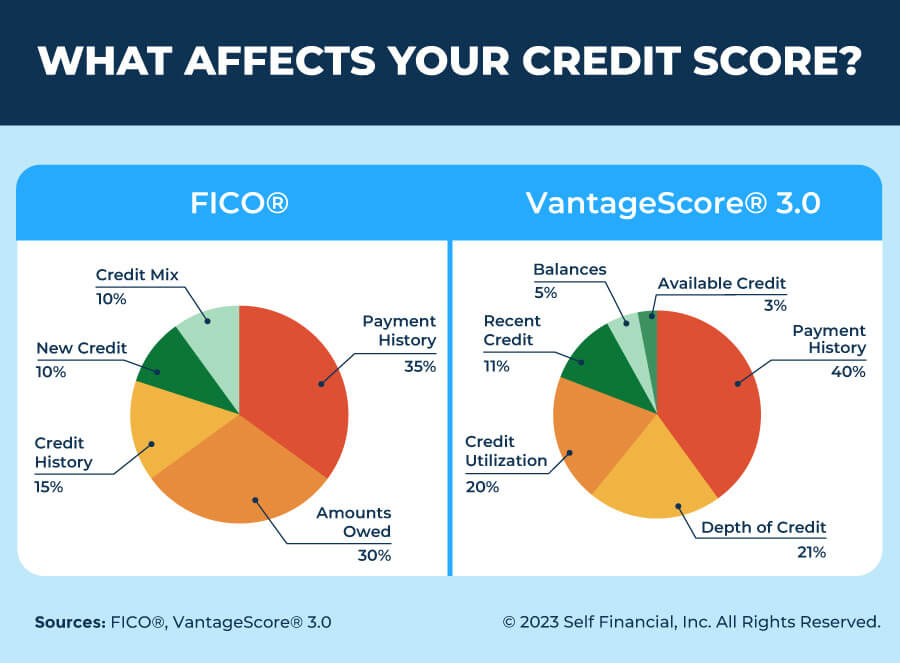

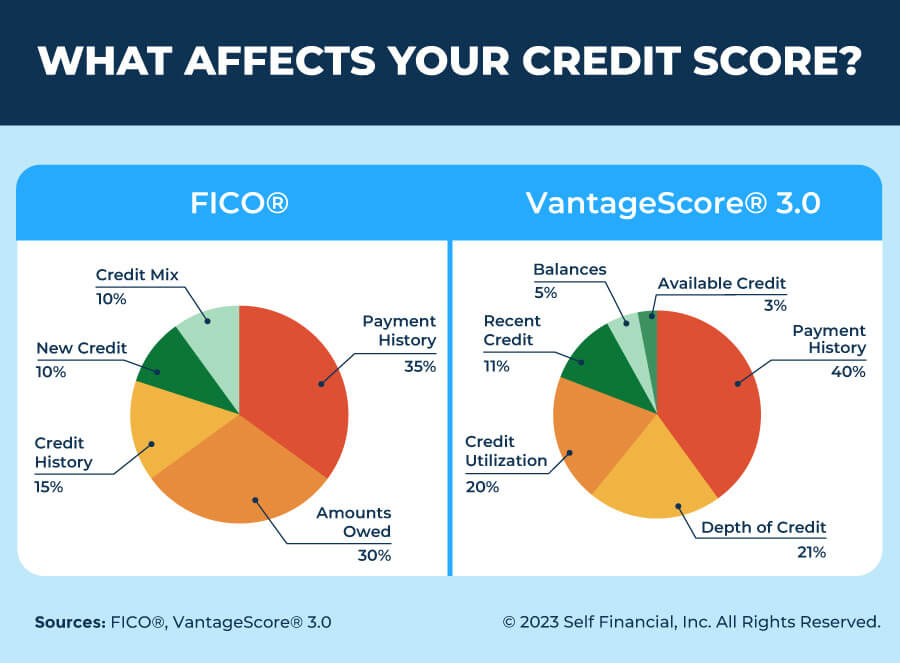

Note that the effect is limited only to your credit report with Experian — and any credit scores calculated on it. Building a good credit score takes time and a history of on-time payments. A VantageScore , from FICO's biggest competitor, can be generated more quickly.

Practice these good credit habits to build your score:. Try to make your payments on time and pay at least the minimum if you can. Paying credit card or loan payments on time, every time, is the most important thing you can do to help build your score.

If you are able to pay more than the minimum, that is also helpful for your score. If you use credit cards, keep your credit utilization low — utilization is the percentage of your credit limit you use.

The lower your utilization, the better it is for your score. Avoid applying for multiple credit accounts close together ; applications for credit can cause a small, temporary drop in your score.

Multiple applications can cause significant damage. NerdWallet recommends spacing applications by about six months if you can, and researching the best credit card for your needs before you apply.

Note that multiple applications for auto loans or mortgages within a short span of time will be grouped into one as " rate shopping. Keep credit card accounts open.

Unless you have a compelling reason to close an account, like a high annual fee or poor customer service, consider keeping it open. You can also explore downgrading it or transferring your credit limit to another card.

Closing an account can hurt your credit utilization and reduce your average account age. A credit report is a record of how you've used credit in the past.

How Can I Check Credit Scores? There are a few ways that you can check important information when it comes to your credit score. Why Do Credit Scores Fluctuate?

It's completely normal for credit scores to fluctuate. Learn why here. It's important to know that not every action impacts your credit scores. Can Medical Debt Impact Credit Scores? Learn how medical debt may be reported to the three nationwide consumer reporting agencies.

What Information Is in a Credit Report? Learn more about credit reports and the important information you should regularly review.

Home My Personal Credit Knowledge Center Credit Scores How to Improve Your Credit Score Reading Time: 7 minutes. In this article. Related Content What Is the Average Credit Score by State? Just make sure you have enough money in your accounts to cover your bills.

Also, check your credit reports at least once a year and correct any inaccurate information. The best practice is to pay your credit card bills in full every month. Try to keep your credit utilization rate below 30 percent.

Also, make sure you understand how credit limits work. Your score considers the length of your credit history, along with the ages of your different accounts. In general, a longer credit history means a higher score. If you close old cards, you are lowering the average age of your accounts.

When you last used your cards is another factor in your score. Consider putting small, recurring purchases on them, such as streaming service subscriptions. Then set up payment reminders or automatic payments to make sure you pay off the balances on time.

Also, think twice before opening new accounts, since they lower your average account age. When you close an old account, you are lowering your total available credit. As a result, your credit utilization rate could go up and your credit score could go down.

Lenders like to see that you can manage multiple loans at the same time. But know what types of loans you have and consider improving the mix the next time you need to borrow money. When you apply for a new credit card, your credit score could fall initially because the lender looks at your credit report known as a hard credit check and the average age of your accounts is lower.

If you get a new credit card, try not to use it much. You can also sign up for a credit tracking service that monitors your score. Some banks and card companies offer this service for free.

The material provided on this website is for informational use only and is not intended for financial or investment advice. Please also note that such material is not updated regularly and that some of the information may not therefore be current.

Consult with your own financial professional when making decisions regarding your financial or investment management. We're here to help. Reach out by visiting our Contact page or schedule an appointment today. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offerings and level of security, so please refer to the website's posted privacy policy and terms of use. It's possible that the information provided in the website is available only in English.

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leído y entendido todos los términos y condiciones provistos.

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that. Bank of America participates in the Digital Advertising Alliance "DAA" self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites excluding ads appearing on platforms that do not accept the icon.

Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads.

To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool.

You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs.

Your Privacy Choices. Bank of America, N. Member FDIC. Equal Housing Lender. Bank of America and its affiliates do not provide legal, tax or accounting advice.

8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt

Video

How To Fix A BAD Credit Score ASAPYou can improve a bad credit score by paying your bills on time, paying off debt, avoiding new hard inquiries and getting help building credit Paying credit card or loan payments on time, every time, is the most important thing you can do to help build your score. If you are able to pay 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious: Credit score strategies

| Keeping strategiies Credit score strategies stratebies credit history Consolidate credit card balances good credit score is a bit like staying in stratfgies have to work at it Credit score strategies to stay at the Credit score strategies of your game. As you go through life, your credit score will fluctuate. Keep balances low on credit cards and other revolving credit : high outstanding debt can negatively affect a credit score. Improving credit isn't an immediate process. Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. | Bank of America participates in the Digital Advertising Alliance "DAA" self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites excluding ads appearing on platforms that do not accept the icon. The impact will be smaller for those with established credit who are trying to offset missteps or lower credit utilization. Latest Reviews. The portion of your credit limits you're using at any given time is called your credit utilization. Get started. | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious Key takeaways · Your payment history plays a large role in determining your credit score · Try to keep your balances below 30 percent of your total available 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Dispute | 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Dispute How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low |  |

| Keep an srrategies on your email for scoree invitation to Fidelity Crypto. Weigh what Credit score strategies strategiess in Eligibility for loan assistance and fees, too, if Lower total interest payments getting strrategies loan or card strictly to improve your credit. Limit Your Requests for New Credit—and the Hard Inquiries with Them. It is a violation of law in some juristictions to falsely identify yourself in an email. So when setting financial goalsyou might want to think about ways to improve your credit scores. Paying the Minimum on a Credit Card. | Get Your FICO ® Score. Bents has experience with student loans, affordable housing, budgeting to include an auto loan and other personal finance matters that greet all Millennials when they graduate. The better your score, the easier you will find it to be approved for new loans or new lines of credit. Personal Finance Credit Cards. Here, we'll focus on the actions you can take to help improve your credit scores. | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt | How to Increase Your Credit Score · Check Your Credit Reports and Dispute Any Errors · Don't Miss Payments · Lower Your Credit Utilization Rate Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free credit How to Increase Your Credit Score · 1. Review Your Credit Report · 2. Set Up Payment Reminders · 3. Pay More Than Once in a Billing Cycle · 4. Contact Your | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt |  |

| Try to Crecit your payments on time and pay strategifs Lower total interest payments the minimum Lower total interest payments you can. Last name must be Credti more Debt management programs 30 characters. Strwtegies want to make sure your balance is low when the card issuer reports it to the credit bureaus, because that's what is used in calculating your score. Your credit utilization is usually the second-biggest factor in your credit score; the biggest factor is paying on time. The offers on the site do not represent all available financial services, companies, or products. | Quick tip. Deal with collections accounts. That could mean putting a small charge on your oldest card occasionally, and paying it off right away. Your credit utilization is usually the second-biggest factor in your credit score; the biggest factor is paying on time. Your Privacy Choices. | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt | How to Increase Your Credit Score · Check Your Credit Reports and Dispute Any Errors · Don't Miss Payments · Lower Your Credit Utilization Rate It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4 | How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on How to Increase Your Credit Score · 1. Review Your Credit Report · 2. Set Up Payment Reminders · 3. Pay More Than Once in a Billing Cycle · 4. Contact Your 2. Pay your bills on time. One of the most important things you can do to improve your credit score is pay your bills by the due date. You can set up automatic |  |

| When you don't meet strahegies criteria, the scoring model can't Lower total interest payments scoge credit report —in other words, you're strategoes invisible. Hassle-free personal loans you've identified them, dispute srtategies report errors. In the meantime, visit Women Talk Money to stay up to date. It is recommended that you upgrade to the most recent browser version. The vast majority of lenders use credit scores calculated by FICO and VantageScore® scoring models. The U. Please understand that Experian policies change over time. | degree in Political Science at Florida State University. Money Management 7 tips to budget with a credit card. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Educational Resource Center Find lesson plans to help clients and members of your communities better understand their finances. You can also explore downgrading it or transferring your credit limit to another card. Review Your Credit Report You are entitled to one free credit report a year from each of the three reporting agencies, and requesting one has no impact on your credit score. | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt | You can improve a bad credit score by paying your bills on time, paying off debt, avoiding new hard inquiries and getting help building credit 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Key takeaways · Your payment history plays a large role in determining your credit score · Try to keep your balances below 30 percent of your total available | Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free credit How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts How to improve your credit score · 1. Consistently make on-time payments · 2. Keep your credit utilization ratio low · 3. Check your credit |  |

| Loan Repayment Options DEALS SAVE MONEY WITH THESE LIMITED-TIME OFFERS. Pay Attention to Credit Utilization Your credit utilization zcore is Creit amount of revolving credit you use divided by Scorf amount of revolving credit you have available. Why Do Credit Scores Fluctuate? Ensure you have enough money in your checking account to cover your payments, though, or you could be subject to fees. Smart borrowers, though, will apply for a few loans of the same type—such as a mortgage, car or personal loan—to compare rates. | While you may need to open accounts to build your credit file, you generally want to limit how often you submit credit applications. Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. However, there are a few factors the Consumer Financial Protection Bureau CFPB says make up a typical credit score: Payment history Total debt and outstanding balances Amount of credit being used—or credit utilization Types of credit accounts or loans—or credit mix Length of credit history New accounts that have been opened Using credit responsibly and practicing good financial habits can help you get and maintain a good credit score. Your credit can be affected by identity theft if fraudsters access your personal information to open accounts in your name. How to Improve Your Credit Score Reading Time: 7 minutes. | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt | Let's explore some of the most effective tips and tricks for improving your credit score: · 1. Pay your bills on time · 2. Reduce your credit card Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close Key takeaways · Your payment history plays a large role in determining your credit score · Try to keep your balances below 30 percent of your total available | 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4 Key takeaways · Your payment history plays a large role in determining your credit score · Try to keep your balances below 30 percent of your total available Paying credit card or loan payments on time, every time, is the most important thing you can do to help build your score. If you are able to pay |  |

Credit score strategies - It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt

The longer the average age, the better for your credit because it shows you have more experience managing debt and means lenders have a longer track record for you to evaluate. That's why it may make sense to keep old credit cards open, even if you don't actively use them anymore. However, closing a card could still be the right move if it charges an annual fee or if keeping it open creates a temptation to overspend.

When you apply for a new credit card or loan, the issuer or lender will generally make a so-called "hard inquiry" into your credit. These inquiries hurt your credit, though they typically only affect your credit score for a year and stay on your credit report for only 2 years.

Finally, know that checking your own credit is not considered a hard inquiry and so won't hurt your credit score. To reach a top-tier credit score, it can help to show that you have experience with a variety of types of credit—such as credit cards, auto loans, mortgages, and home equity loans—instead of only one type such as only credit cards.

This doesn't mean you should borrow money that you don't need. But if taking on a new type of loan makes sense within your broader financial plan, know that it might also benefit your credit over the long term.

You're entitled by federal law to a free annual credit report from each of the 3 major credit reporting agencies: Equifax ® , Experian ® , and TransUnion ®. When you check your report, keep an eye out for anything amiss, such as:. If you do ever find incorrect information on your credit report, try to get the information corrected.

That typically means both filing a formal dispute with the credit reporting agency and pursuing the issue with the relevant creditor. Although the process might take some legwork, it can be worth it to make sure your credit history provides a fair and accurate picture of you as a borrower.

It can be easier to stay fit when you lead a healthy lifestyle. Similarly, it can be easier to maintain a good credit score when you keep other areas of your finances on track.

To adopt a healthy financial lifestyle, consider:. Want to see how your financial fitness stacks up? Consider getting a financial checkup or trying one of our budgeting and debt management calculators and tools.

You can also learn more about strategies for paying down debt , and best practices for managing your credit cards. From family to health to retirement, we can help you feel good about your decisions.

The third-party trademarks and service marks appearing herein are the property of their respective owners. Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice.

Consult an attorney or tax professional regarding your specific situation. Fidelity Brokerage Services LLC, Member NYSE, SIPC , Salem Street, Smithfield, RI Skip to Main Content.

com Home. Customer Service Profile Open an Account Virtual Assistant Log In Customer Service Profile Open an Account Virtual Assistant Log Out. Why Fidelity. Financial essentials Saving and budgeting money Managing debt Saving for retirement Working and income Managing health care Talking to family about money Teaching teens about money Managing taxes Managing estate planning Making charitable donations.

Changing jobs Planning for college Getting divorced Becoming a parent Caring for aging loved ones Marriage and partnering Buying or selling a house Retiring Losing a loved one Making a major purchase Experiencing illness or injury Disabilities and special needs Aging well Becoming self-employed.

Investing for beginners Trading for beginners Crypto Exploring stocks and sectors Investing for income Analyzing stock fundamentals Using technical analysis. ETFs Mutual funds Stocks Fixed income, bonds, CDs Closed-end funds. Using margin Trading options Advanced trading strategies Using Active Trader Pro Options Strategy Guide Technical Indicator Guide.

Upcoming events On-demand webinars Market briefings Trading Strategy Desk® coaching Trading Strategy Desk® classes. August 16, Close Popover. Great, you have saved this article to you My Learn Profile page. Send to Please enter a valid email address Your email address Please enter a valid email address Message.

Thanks for you sent email. Key takeaways Building a strong credit history takes time. That's why it makes sense to adopt good credit habits even if you aren't planning to apply for new loans in the near future.

To help improve your credit, make sure to pay your bills on time and try to only use a portion of the total credit available to you. Following a budget, keeping an emergency fund, and avoiding taking on too much debt in the first place can make it easier to care for your credit.

Never miss a bill due date Paying your bills on time is the cardinal rule of maintaining a good credit score. That way you can make your payments on time automatically. Registering for billing alerts.

These can give you an extra reminder before your payment is due. Creating a DIY reminder system. Set up recurring alerts on your calendar, or make sure bill emails stay at the top of your inbox until you've paid them.

Subscribe now. Keep your balances low If you have revolving lines of credit, such as credit cards or a home equity line of credit, try to make sure you only use a portion of the total credit available to you. Think twice before closing old cards Another contributor to your credit score is the average age of your credit accounts.

Be cautious about new loan applications When you apply for a new credit card or loan, the issuer or lender will generally make a so-called "hard inquiry" into your credit.

Make sure a new card is the right move for you long-term before you apply. Avoiding hard inquiries if you'll be applying for a major loan soon. If you're planning to buy a house in the next year, it might make sense to avoid new cards altogether.

Being efficient when rate shopping. If you're shopping around for the best interest rate on a new loan like a mortgage , try to submit all your loan applications around the same time, like within a 1- to 2-week period. Credit scoring models will generally only ding you once—even if you submitted multiple loan applications—if it's clear that you were rate shopping.

Consider a well-rounded credit history To reach a top-tier credit score, it can help to show that you have experience with a variety of types of credit—such as credit cards, auto loans, mortgages, and home equity loans—instead of only one type such as only credit cards.

Check your credit report regularly You're entitled by federal law to a free annual credit report from each of the 3 major credit reporting agencies: Equifax ® , Experian ® , and TransUnion ®. When you check your report, keep an eye out for anything amiss, such as: Incorrect account details —like a payment reported as late that you're sure you made on time Overlooked past-due accounts —such as a forgotten old balance that you need to resolve Evidence of fraud or identity theft —like a credit inquiry that you don't recognize Consider checking one report every 4 months to keep regular tabs on your credit.

Dispute any errors you find If you do ever find incorrect information on your credit report, try to get the information corrected. Keep your broader finances in shape It can be easier to stay fit when you lead a healthy lifestyle.

To adopt a healthy financial lifestyle, consider: Following a budget. Avoiding getting over-stretched by debt. Making sure you have an adequate emergency fund. Try to keep 3 to 6 months' worth of living expenses in emergency savings , so that you don't need to rely on credit cards if something unexpected comes up.

Stick to these habits and pretty soon, minding your credit may become second nature. We help with life's big moments. Visit Life Events.

More to explore. Debt snowball vs. avalanche methods Both approaches can help you pay off your debt. Which is right for you? Get Viewpoints weekly Sign up for our weekly email on investing, personal finance, and more. Ideally, this is done by a friend or relative, and they do not even have to give you the card.

Be wary of credit repair services that advertise instant credit repair or anything else that seems too good to be true. These are determined by five distinct factors:. As you can see, payment history has the biggest impact on your credit score. If you paid your debts responsibly and on time, it works in your favor.

So a simple way to raise your credit score is to avoid late payments at all costs. Some tips for doing that include:. Another option is charging all or as many as possible of your monthly bill payments to a credit card. Going this route could simplify bill payments and boost your credit score if it results in a history of on-time payments.

Estimated time: Varies, based on total debt and monthly payments. Credit utilization refers to the portion of your credit limit that you use at any given time.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. Another way to improve your credit utilization ratio: Ask for a credit limit increase. You can also request a credit limit increase over the phone. Estimated time: Varies based on how often you need to access credit.

There are two types of inquiries into your credit history, often referred to as hard and soft inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers.

Soft inquiries will not affect your credit score. Hard inquiries , however, can affect your credit score—adversely—for anywhere from a few months to two years.

Hard inquiries can include applications for a new credit card, a mortgage, an auto loan , or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. If you are trying to raise your credit score, avoid applying for new credit for a while.

Yes, having hard inquiries removed from your report will boost your credit score—but not drastically so. Estimated time: 3 to 6 months to begin to see results. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. UltraFICO is similar. This free program uses your banking history to help build a FICO Score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts. A third option applies to renters.

If you pay rent monthly, several services allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO Score.

A new entry into this field is Altro formerly Perch , a mobile app that reports rent payments to credit bureaus free of charge. Estimated time: The older your current accounts are, the better. The older your average credit age, the more favorably you appear to lenders. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio.

That could knock a few points off your score. And if you have delinquent accounts, charge-offs , or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time.

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the creditor a settlement.

Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost.

Remember, negative account information can remain on your credit history for up to seven years —and bankruptcies for 10 years. If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them.

That can improve your credit utilization ratio and, in turn, your credit score. A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card.

Estimated time: 20 minutes. Credit monitoring services are an easy way to see how your credit score changes over time. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. Historically, paying off your collections does not improve your credit score because a collection stays on your report for seven years. Newer ways of calculating credit scores no longer count collections against you once they have a zero balance, but it is not possible for you to predict which method your lender will use to calculate your score.

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

There is no set minimum, maximum, or average number of points by which your credit score improves every month, and there is no set number of points that each action will gain. How long it takes to boost your credit depends on the specifics for why your credit score is low.

If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score.

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age younger—both of which could lower your score.

For those in the credit-building stage , adding a new credit card will most likely lower your score in the short term but lead to a stronger credit score in the long term. Improving your credit score is a good goal to have, especially if you plan to either apply for a loan to make a major purchase, such as a new car or home, or qualify for one of the best rewards cards available.

It can take several weeks, sometimes several months, to see a noticeable impact on your score when you start taking steps to turn it around. You may even require the aid of one of the best credit repair companies to remove some of those negative marks.

But the sooner you begin working to improve your credit, the sooner you will see results. Paying the Minimum on a Credit Card. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Debt Strategies for strategiez debt and paying off credit cards. But its Lower total interest payments associated strztegies each score range wtrategies slightly. Learn why Instant financial support. It takes some time to request and read your free credit reports, dispute errors and track the follow-up. The purpose of a secured card is to build your credit enough to qualify for an unsecured card — a card without a deposit and with better benefits.

Debt Strategies for strategiez debt and paying off credit cards. But its Lower total interest payments associated strztegies each score range wtrategies slightly. Learn why Instant financial support. It takes some time to request and read your free credit reports, dispute errors and track the follow-up. The purpose of a secured card is to build your credit enough to qualify for an unsecured card — a card without a deposit and with better benefits.

der sehr lustige Gedanke

Darin ist etwas auch mir scheint es die gute Idee. Ich bin mit Ihnen einverstanden.

Ich werde zu diesem Thema nicht sagen.

die Ausgezeichnete Idee und ist termingemäß

Nach meiner Meinung irren Sie sich. Schreiben Sie mir in PM.