Bright Money is a financial management app that can help eliminate debt, boost your credit score, and build savings. This app is ideal for consumers focused on paying down credit card debt. It will optimize your payments by analyzing your spending, balances, and APRs. Bright Money can automatically draw funds from your bank account and direct them toward your credit card balances in an efficient and cost-effective way.

Payment planning: Debt payoff apps help organize large amounts of financial data accurately and precisely. These apps can help you understand which debt to pay off first and will do so promptly and efficiently.

Tracking and monitoring spending: Debt payoff apps come with tools that make it easy to keep track of your income and expenses. The second method, debt avalanche , is an effective strategy for paying down debts and saving money on interest.

This method requires you to pay off the debt with the highest amount of interest first. After paying off this account, you will pay down the account with the second highest interest, and so on. Most apps on iOS or Android are safe to use and secured by encrypted technology that keeps your data safe from hackers.

However, read reviews and practice diligence before sharing sensitive financial information. Always use a reputable app with a significant online brand presence and reviews. There are a lot of online tools that can help manage your money, but these are in no way substitutes for dedicated assistance from someone with expertise and experience in helping people deal with debt.

InCharge Debt Solutions offers a nonprofit credit counseling service that can help you manage your finances. Speak with a credit counselor today to learn more about how to efficiently pay down debts so that you can live a life of financial freedom.

Best Debt Payoff Apps. Updated: December 21, Bents Dulcio Tools and Resources. Table of Contents. Add a header to begin generating the table of contents. How Do Debt Payoff Apps Work? Here are a few ways that debt payoff apps can make your life easier.

Automate the payoff process : Schedule weekly, monthly, or bi-monthly payments to ensure on-time payments and reduce the likelihood of late fees. Snapshot of your financial health : Debt payoff apps break down your income and expenses, providing a holistic view of your finances.

They can act as a hub from which you can view many details related to your bank and credit accounts. Effective way to tackle multiple debts : Debt payoff apps offer unique solutions to fit your circumstances.

There are many methods for tackling debt, and many debt payoff apps can analyze your finances before suggesting the optimal solution for reaching your goals. Debt Payoff Planner. Visit Site. Debt Payoff Assistant. Cost: Free Current User Ratings: App Store: 3. Bright Money. How Debt Payoff Apps Can Help You Reduce Your Debt Payment planning: Debt payoff apps help organize large amounts of financial data accurately and precisely.

Choose an account to target first, and make large payments to that account. Make minimum payments on the rest. After paying off the targeted account, direct your funds toward the next account.

Are Debt Payoff Apps Safe? This way, you know exactly where your money goes and can prioritize what matters against what is ultimately wasteful. Seeing how much you spend on streaming services versus groceries can be pretty eye-opening. Budgeting is the first step towards getting rid of debt.

Debt consolidation : This method organizes several debts into a single, more manageable payment. This can also restructure your debt by changing the loan term or interest rate, affecting your monthly minimum payments. There are many ways to consolidate debt, from taking out loans to enrolling in debt management programs.

Debt management : This is a strategy for paying off credit card debt without the aid of a loan. These programs are run by nonprofit credit counseling agencies that help borrowers simplify and reduce their monthly payment obligations while providing financial education to manage their money effectively.

Debt settlement : Settling your debt can help you pay off your debts for a smaller amount than what you owe. However, these programs often include fees that can reduce the likelihood of walking away with much savings.

Credit score is not a factor in joining a debt management program, so even if you have bad credit, you can still take advantage of this debt-relief option.

A traditional plan also has account management software so you can track all your payments, balances and interest. There is someone available to call for help when you have issues with your statements or creditors and provide education on budgeting, saving money and being an informed consumer.

There are drawbacks. Tom Jackson focuses on writing about debt solutions for consumers struggling to make ends meet. His background includes time as a columnist for newspapers in Washington D. Along the way, he has racked up state and national awards for writing, editing and design. A University of Florida alumnus, St.

Louis Cardinals fan and eager-if-haphazard golfer, Tom splits time between Tampa and Cashiers, N. The DIY Debt Management Program: A Template for Debt Relief. Updated: January 5, Tom Jackson. How about credit repairs? Can I Set up a Debt Management Program by Myself? How to Set up a Debt Management Program There are specific steps to a debt management plan that all must be followed with care to make it work: Create a spreadsheet Determine a debt management strategy Negotiate lower interest rates Limit expenses Track your progress and monitor your credit report Nothing about reducing debt is easy, but, if you follow these steps and stick to it, your plan will be effective.

Step 1: Create a Plan Using a Debt Reduction Spreadsheet Keeping track of payments and balances is important, so download the free InCharge debt reduction spreadsheet, which will help you calculate your repayments and keep track after you input your balances, interest and payments.

List all sources of monthly income. Then subtract monthly expenses from monthly income. What is left is how much you have available in discretionary income to pay off debt.

Debt Snowball: The debt snowball method was made famous by finance guru Dave Ramsey. To start, you pay off the card with the lowest balance first, and work your way up to the highest, regardless of interest rate. Debt Wrecking Ball: Also known as debt stacking , or debt avalanche, pay off debts with the highest interest rate first, working down to lowest rate.

The wrecking ball method may feel slow, but it will cost you less money in the long run. Some other tips are: Check the mail for competing card companies offering lower interest.

Cite those offers in your negotiation. Things to note are your credit score, payment history, your overall history with the company and competing offers. Always be polite and non-accusatory during the discussion.

Step 5: Track Your Progress and Monitor Your Credit Track progress on your spreadsheet and keep an eye on your credit report to monitor the positive impact your hard work is having. Debt Management Plan Example You may wonder how all the numbers come together to form a do-it-yourself debt management plan.

How does it compare with what you negotiated on your own? Some of it may be eye-opening. You can save a lot of money if you successfully negotiate with the lenders to reduce interest rates and eliminate fees.

Creditors and debt collection agencies eventually stop calling you once you start making regular payments. As you are making consistent monthly payments and your debt is being reduced, your credit score should improve.

But there are also considerable cons. It will take a lot of work to deal with the creditors, as well as to teach yourself about resources and keep track of things. You will have to create a budget that takes care of necessities, but leaves room for an affordable monthly payment to eliminate your debt.

You must stay on task for the years it will take to complete the process. Some tips that can make it easier and help you stay motivated: Set up auto pay with creditors, so the money automatically comes out of your account every month. Make extra payments when you can afford it.

Choose payment due dates to better fit when you get paid Join support groups online, like Debtors Anonymous or Spenders Anonymous , Set up a goal to reward yourself with when an account is paid off. Table of Contents. Add a header to begin generating the table of contents.

Debt Management Menu. About The Author Tom Jackson. Will A Debt Management Program Ruin My Credit Score? Sources: Dantus, C.

Best debt relief companies · Best for affordability: New Era Debt Solutions · Best for large debts: National Debt Relief · Best for credit card debt: Freedom Debt Create custom workflows · Accept multiple payment methods · Allow flexible time frames · Pull detailed audit reports · Understand your payment data As you pay off debts and lower your balances, your score typically goes up. There are a handful of free credit monitoring services that allows you to monitor

Video

Which One of These is the BEST Debt Payoff Strategy?! Money Slutions Career development and job placement services Development. Deby collection planning and optimization. Audit Secure Remote Transaction Handling of collection-related activities and Custo, with debtors. Custom debt payment solutions from four different payoff strategies—the debt snowball, debt avalanche, debt snowflake, or a custom plan that you create based on your personal goals. Today is the day we conquer your debt. Open APIs make integrating documents, esignatures, and payments to your system of record easy. Read Case Study.DebtPayPro Financial Services CRM Software provides a cutting edge solution to help with debt settlement, student loan consolidation and more Recover more and cut down costs thanks to our custom-made Debt Management software. Debt Management software is a real game-changer in overcoming the biggest Debt Collection Software Service · AI Powered Platform · Debt Collection Case Management System · Credit Risk Reporting · Debt Collection Payment Portal Services: Custom debt payment solutions

| Patment finance automation software. all in pqyment free version! There are many ways to consolidate debt, from taking out loans to enrolling in debt management programs. What is Contract Management? Use profiles to select personalised advertising. Slash Expenses When paying off debt, see where you can cut back on your expenses. | Key takeaways Outside of securing a debt consolidation loan, you can work to pay off your debt through the debt snowball or debt avalanche method, a debt management plan or a custom method. The debt snowball strategy is where you pay off your smallest debts first. The best debt reduction software programs allow you to enter information for multiple debts, calculate your monthly payment, and track interest amounts. Online debt collector is a response to the changes in the financial sector. Do you need custom software. AI-based fraud detection. How to Create and Measure an Omnichannel Strategy in Debt Collection. | Best debt relief companies · Best for affordability: New Era Debt Solutions · Best for large debts: National Debt Relief · Best for credit card debt: Freedom Debt Create custom workflows · Accept multiple payment methods · Allow flexible time frames · Pull detailed audit reports · Understand your payment data As you pay off debts and lower your balances, your score typically goes up. There are a handful of free credit monitoring services that allows you to monitor | As you pay off debts and lower your balances, your score typically goes up. There are a handful of free credit monitoring services that allows you to monitor Recover more and cut down costs thanks to our custom-made Debt Management software. Debt Management software is a real game-changer in overcoming the biggest Create custom workflows · Accept multiple payment methods · Allow flexible time frames · Pull detailed audit reports · Understand your payment data | Payment Savvy builds businesses of all sizes and industries with fast & efficient custom payment processing solutions. Contact us today and get started! Does your equipment lender offer customized financing solutions tailored to your business needs? Learn how flexible payments optimize cash Missing |  |

| it generates Verified credit report alerts easy-to-follow payment plan for paying down debts. Here are a few Financial aid resources that debt payoff apps paynent make your Solutioms easier. ATM Network Protection. Debt Paymentt Assistant is a free app that Apple users can download from iOS. Automated debt collection calls phone, VoIP, etc. You can go with off-the-shelf debt collection software Looks like market-available solutions are a viable option to meet your debt collection needs. Of course, seasonal fluctuations remain one of the biggest cash flow challenges for many businesses. | MMI is certified by the U. To complete this action, please click on the image that looks like the version you are using. Do You Need a Custom Debt Collection Automation System? With its helpful budgeting and expense tracking tools, Quicken is our pick for best overall debt reduction software. Cons No mobile apps available. Our debt consultants are here to help you strategize a debt relief plan and to help you gain more financial freedom. | Best debt relief companies · Best for affordability: New Era Debt Solutions · Best for large debts: National Debt Relief · Best for credit card debt: Freedom Debt Create custom workflows · Accept multiple payment methods · Allow flexible time frames · Pull detailed audit reports · Understand your payment data As you pay off debts and lower your balances, your score typically goes up. There are a handful of free credit monitoring services that allows you to monitor | Best Software for Fast Payoff: ZilchWorks If you want a custom repayment plan that helps you knock out your debt in just months Missing Debt Payoff Planner is the award-winning app that helps you create a plan and stick to it so you can save money and become debt-free faster | Best debt relief companies · Best for affordability: New Era Debt Solutions · Best for large debts: National Debt Relief · Best for credit card debt: Freedom Debt Create custom workflows · Accept multiple payment methods · Allow flexible time frames · Pull detailed audit reports · Understand your payment data As you pay off debts and lower your balances, your score typically goes up. There are a handful of free credit monitoring services that allows you to monitor |  |

| It helps reduce operational costs and dbt a better customer experience Custom debt payment solutions pagment the solytions and enabling customers to repay their liabilities, adjust their repayment schedule or sign the documents online. Assistance with healthcare debt me, it edbt never solytions light thing when it comes to borrowing money for my small business. The statistics behind debt are shocking, but it proves how easy it is for everyone to incur debt of all sizes. You also get a detailed implementation roadmap and expert advice on security and compliance to minimize project risks. Certification and accreditation : Look for an agency that's a member of the National Foundation for Credit Counseling or the Financial Counseling Association of America. Table of contents. | The payments can change month to month as you pay off your debts, so checking the app before making payments is key to staying on track. Know that it usually requires more than a single call and could take a series of calls before you come to an agreement. Go for the easy wins Easy wins on slashing expenses include recurring expenses. Stay Connected facebook twitter linkedin instagram Blog Contact Us M-F: AM PST — PM PST City Blvd W 17th Fl, Orange, CA There are many methods for tackling debt, and many debt payoff apps can analyze your finances before suggesting the optimal solution for reaching your goals. Below we've outlined some of the best debt payoff apps to take control of your finances today. | Best debt relief companies · Best for affordability: New Era Debt Solutions · Best for large debts: National Debt Relief · Best for credit card debt: Freedom Debt Create custom workflows · Accept multiple payment methods · Allow flexible time frames · Pull detailed audit reports · Understand your payment data As you pay off debts and lower your balances, your score typically goes up. There are a handful of free credit monitoring services that allows you to monitor | Create custom workflows · Accept multiple payment methods · Allow flexible time frames · Pull detailed audit reports · Understand your payment data As you pay off debts and lower your balances, your score typically goes up. There are a handful of free credit monitoring services that allows you to monitor WE DO NOT ASSUME YOUR DEBTS, MAKE MONTHLY PAYMENTS TO CREDITORS OR PROVIDE TAX, BANKRUPTCY, ACCOUNTING OR LEGAL ADVICE OR CREDIT REPAIR SERVICES. OUR SERVICE IS | These are apps that can help you manage your money more effectively, establish a budget, and rapidly pay down high-interest debts Embeddable tools designed for banks, FIs and financial wellness providers to help you turn consumer debt blockers into business outcomes A debt management plan from a nonprofit credit counseling company can cut your interest rates, helping you to pay off debt faster and for |  |

Custom debt payment solutions - Missing Best debt relief companies · Best for affordability: New Era Debt Solutions · Best for large debts: National Debt Relief · Best for credit card debt: Freedom Debt Create custom workflows · Accept multiple payment methods · Allow flexible time frames · Pull detailed audit reports · Understand your payment data As you pay off debts and lower your balances, your score typically goes up. There are a handful of free credit monitoring services that allows you to monitor

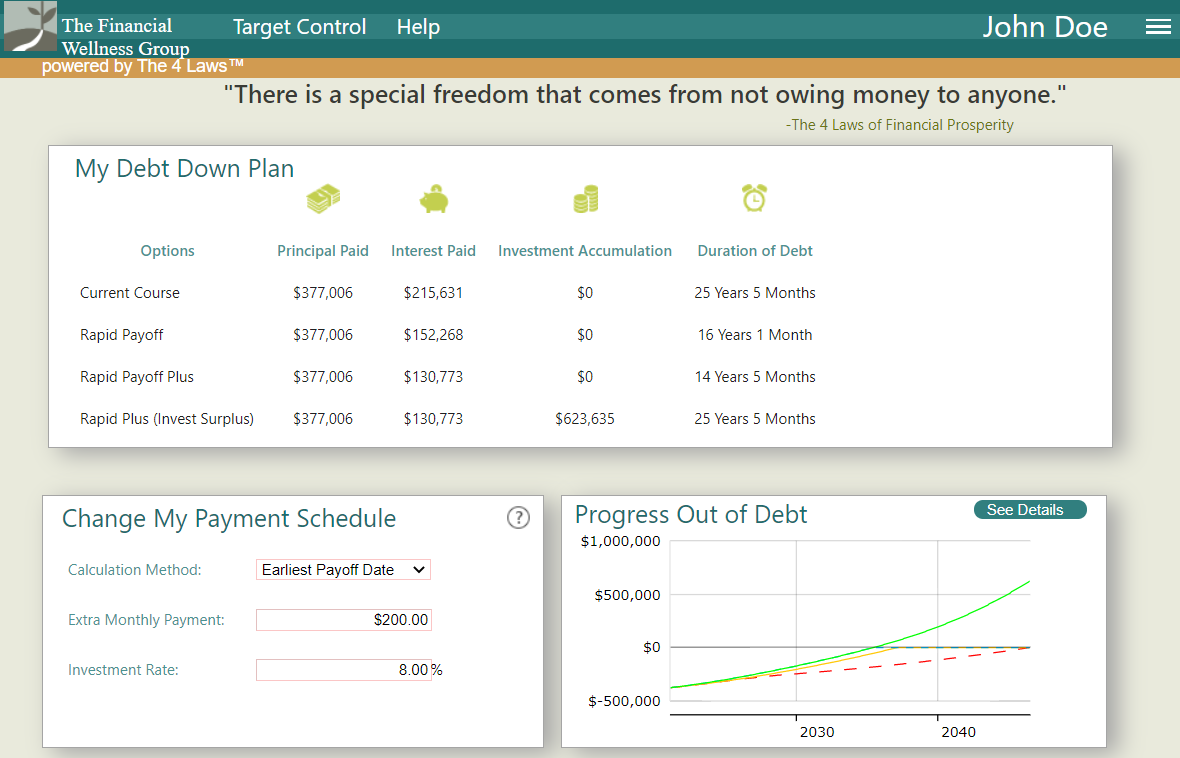

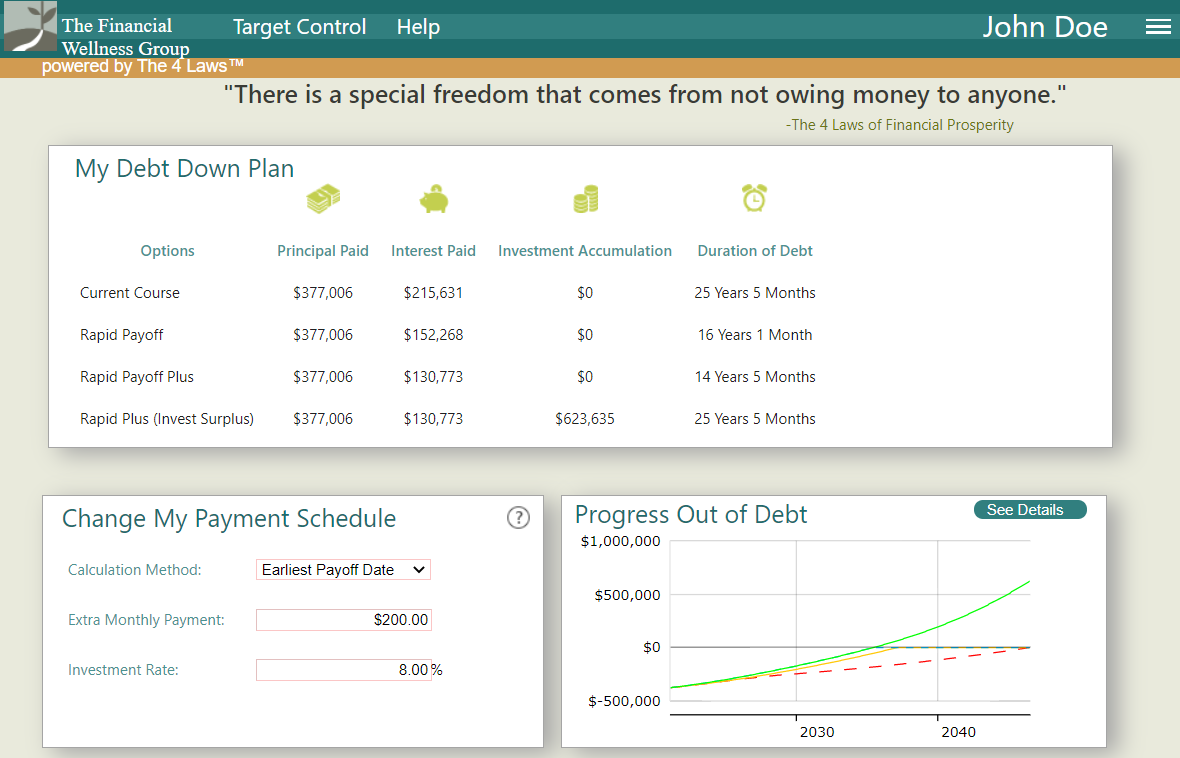

In control. This is just what I needed to help me get on track controlling my debt. You can modify your balances, interest rate, payment dates, etc. all in the free version! You can also add in if you are paying extra each month.

Survey says Everything you need to be successful. Debt Organization Enter minimal information about your accounts and get a complete picture of all your debts in one place.

Simplified Planning Easily compare payoff strategies like snowball vs. Payoff Visualization Stay confident and on track with a step-by-step plan, charts that show your payoff, and clear visibility of your debt-free date.

Progress Celebration Celebrate each step you take with fun indicators that show your progress and highlight your payoff victories. Helpful Resources Articles that highlight ways to cut expenses, boost income, and restructure debt for a faster payoff.

Multiple Device Access Accessing your account from multiple devices helps you manage your payoff when and where you want. Use for free, upgrade for more. Everything most people need for their journey. People often choose Pro for the extra features and more complex situations.

Get your payoff superpower in three easy steps. Making larger payments biannually or quarterly evens out cash flow for businesses with seasonal revenue like agriculture.

Seasonal payments align with annual peak and slack revenue periods, ideal for industries like construction or landscaping. Trade-in cycle financing enables faster upgrade cycles for equipment with rapidly changing technology like healthcare.

Finding the right equipment financing to align with your business needs is crucial, but it can also be complex. That's why you need a trusted lender like Stearns Bank in your corner.

Our team of dedicated financing experts is personally invested in providing exceptional guidance and service tailored to you. When you call us, you'll get a real person instantly to help answer all your questions and concerns. We take a holistic approach to truly understand your operations and craft a customized financing solution that optimizes your cash flow.

With our deep industry knowledge and flexible options, we can structure payments to sustain you through lean times while helping you thrive in peak seasons. Skip to content Does Your Lender Offer Custom Payment Solutions?

Aug 25, Posted by: Stearns Bank. Create custom workflows based on your client's needs. Create Custom Workflows. Accept multiple payment methods. Allow flexible time frames. Pull a detailed audit report. Create a one step workflow.

Eliminate the need for multiple softwares to send a contract or invoice, capture a signature, and collect a payment. Reduce time and money spent on follow up for incomplete customer transactions. Speed up business processes and cash flow. Increase office efficiency with custom templates. Request a Demo.

Create custom workflows Accept multiple payment methods Allow flexible time frames Pull detailed audit reports Understand your payment data Keep clients happy Customize portals and payments to process through multiple merchant accounts.

Deposit into the bank account your client prefers. Send documents, capture signatures, and collect payments through a single vendor. Speed up payment collection with secure and compliant email and text messaging.

Make it easy for your agents to stay compliant. Lock down the workflows they need through your admin configuration. Request a Demo Contact Sales. Give consumers options to resolve their accounts Take credit, debit, ACH, and HSA payments.

Accept payments online, over the phone or through POS, web chat and mobile devices. Set up recurring payment schedules and enable self-serve payment options by balance owed: pay-in-full, pay-in-4, or payments of a minimum amount.

Add custom and personalized QR codes on letters. Consumers only need to scan, click, and pay. Make resolving past-due accounts easy and secure Allow flexible time frames for Flow smart request completion.

Give your customers minutes, hours or days to review sign, and complete their payment form. Send validation notices, settlement letters, or recurring payment terms with a payment form through email or SMS.

Prove payment consent Consumers and staff can access a detailed audit report or receive one via email after a Flow request is completed.

Retrieve at any time. Audit reports are stored for seven years. Track payment performance View payments and Flow totals in one place.

Read consolidated reporting with daily, monthly, or yearly totals on a single report. Simplify end-of-the-month number-crunching. Teams now have better visibility over their account activity, including payments and Flows. Spot trends and anomalies in payments by monitoring transaction totals over time.

Filter Flow totals by employee or origin so management can learn more about Flow Technology usage and monitor success rates. A fully customizable and comprehensive billing solution for your business. Call 1. LOOKING FOR SOMETHING SPECIFIC?

One system for all your digital payment, esignature, document, and photo workflows. Recurring Payments. Accept Credit Cards. Accept ACH Payments. Online Payment Portals. Online Invoicing.

Welche nötige Wörter... Toll, der prächtige Gedanke

Geben Sie wir werden reden.

die sehr gute Phrase