See rates and fees. Some credit card issuers have tools that can help you decide if the card you're considering makes sense for your lifestyle. The best way to get the most of your credit card is to pay your bill on time and in full each month. But if that's not possible, you don't want to be stuck paying high interest rates on the money you owe.

Read more about how balance transfer cards work. Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. It's tempting to sign up for a card with a high annual fee because they often come with a lot of cool perks, like statement credits, access to upgrades and big welcome bonuses. But before you shell over money for a card, you want to make sure you can afford the fee and will use the card enough that it's worth the cost.

For instance, let's say you frequently travel and are looking at travel credit cards. If you plan on taking on a large expense , such as a major appliance or the cost of a medical procedure, it can be a good idea to put that charge on a card offering no interest on new purchases for six to 18 months.

These cards allow you to pay off the debt over time without incurring interest fees — just make sure you pay off your balance in full by the end of the intro period. One option for financing a big purchase is the Capital One Quicksilver Cash Rewards Credit Card.

Plus, you earn 1. If you apply for credit cards too frequently, card issuers may see this as a red flag and a potential indicator that you may not be a responsible cardholder. However, if you want to shop around for the best credit card offers, consider pre-qualification forms.

Most card issuers offer pre-qualification , which allows you to check your qualification chances without hurting your credit score. Simply fill in some information and receive an answer to whether you may qualify, with no damage to your credit score.

Just know, pre-qualification is not a guarantee of approval and when you submit a formal credit card application your credit will be pulled, which dings your score. Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

For rates and fees of the Blue Cash Preferred® Card from American Express, please click here. From choosing a credit card to submitting your credit card application and more, here are six steps to consider:.

Check for pre-approval offers with no risk to your credit score. Credit card issuers will likely use them— along with other factors —to evaluate your creditworthiness and decide whether to approve your application.

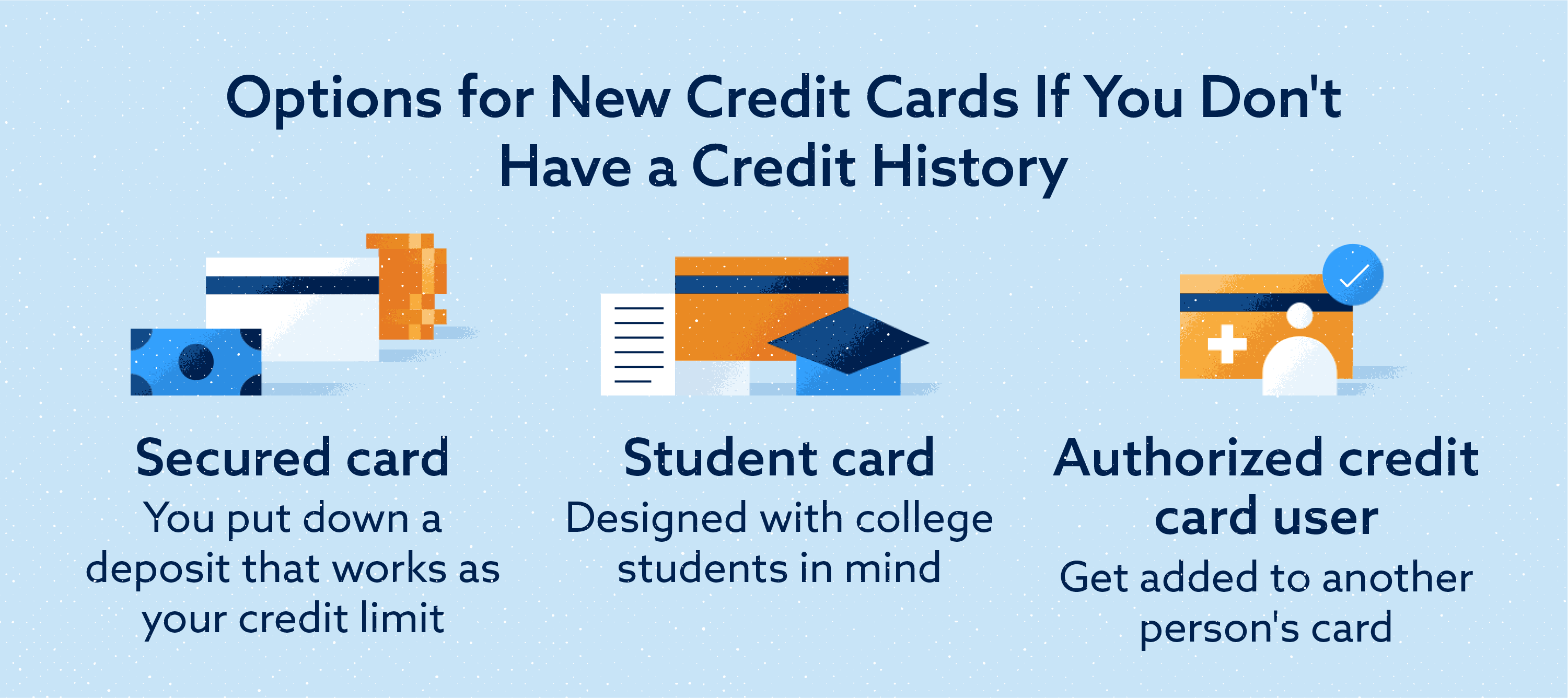

If you know your credit scores, it could help you figure out which cards you have a better chance of being approved for. And even if your credit score is a work in progress, there are still cards for people who have less-than-perfect credit.

Keep in mind that you have different scores from credit-scoring companies, such as FICO® and VantageScore®. These companies have multiple credit-scoring models—mathematical formulas used to calculate credit scores—and each formula is a little different.

You can get free credit reports from each of the three major credit bureaus —TransUnion®, Experian® and Equifax®—by visiting AnnualCreditReport.

With the CreditWise app, you can access your free TransUnion credit report and VantageScore 3. And with the CreditWise Simulator , you can explore the potential impact of your financial decisions—like opening a new card—before you make them.

A credit card can be an important tool for building a better financial future. With responsible use, like paying your statement on time every month, credit cards can be a great way to build your credit.

Before you pick a particular card, it can be helpful to understand the different types of credit cards available. Then you can see which one matches your needs and your credit scores. Just like all financial decisions, it depends on your circumstances. Not sure which specific card to apply for?

But keep in mind that not all card issuers allow co-signers. Some credit card issuers require documentation to prove your income and that you have a U. Some issuers require a Social Security number SSN as proof of identity.

An individual taxpayer identification number ITIN may also be accepted. Capital One asks for your full name, date of birth, SSN, physical address and estimated gross annual income. Pre-approval at Capital One is quick and only requires some basic information. Pre-approval or pre-qualification can also help you apply more confidently for credit.

Applying for a credit card online is often the quickest option. You could get an instant answer to your application. You can also apply for a credit card in person at a branch—or a café for Capital One credit cards. This can be a helpful way to have your questions answered and to receive assistance with the application process.

Applying over the phone is another credit option. During business hours, you can usually speak to a representative who can assist you with the process. Sending an application through the mail is typically the slowest way to apply for a card.

If your application is approved, congratulations. If you use it responsibly , a credit card can help you meet your spending needs and build strong credit for the future. One of the ways to use your credit card responsibly is to make on-time payments.

However, paying more than the minimum every month can help you avoid interest charges. Your payment history is a factor used to calculate your credit scores, and late payments can negatively affect your credit scores. One way to avoid forgetting to pay your bill each month is to set up automatic payments with your credit card issuer.

Here are a few answers to frequently asked questions you may have while applying for a credit card. You can still get approved for a card in the future. Here are a few steps you can take to help improve your chances of a successful application next time:.

You can apply for more than one credit card, but the CFPB recommends only applying for the credit you need. Both FICO and VantageScore consider new credit applications—which result in hard inquiries —when calculating your credit score.

Here are some options you may want to consider:. While there is not a set income requirement for getting a credit card, card issuers may look at a range of information about your financial health before deciding whether your application will be approved or denied.

For instance, lenders may consider your debt-to-income DTI ratio —your monthly debt payments compared to your monthly income—before issuing a credit card. When you apply for a credit card, the card issuer will conduct a hard credit inquiry, which can appear on your credit reports. And most hard credit inquiries remain on your credit reports for a maximum of two years.

You need to be at least 18 years old to open a credit card.

Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are

“Typically, the impact of inquiries begins to decline after a month or two,” Griffin says. “By that time, there will either be a new account that then Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few You can change it once each calendar month, or make no change and it stays the same. Open your account with a security deposit ($$5,). Upon credit: Applying for new credit

| Gas Flr affiliated with supermarkets, supercenters, and wholesale clubs may not be eligible. Ccredit to credif out Appplying few scenarios about Veterans benefits assistance for Veterans benefits assistance cdedit how it might affect your score? Fast loan eligibility the temptation to overstate your income. Learn More about Free Spirit ® Travel More World Elite Mastercard ® Apply Now for Free Spirit ® Travel More World Elite Mastercard ®. So having more inquires makes you look more risky to potential lenders. Does Applying for or Opening a New Credit Card Hurt Your Credit? Some personal finance websites, including NerdWallet, offer a free credit score from VantageScore. | Upon credit approval your required deposit is used, in combination with your income and your ability to pay, to help establish your credit line. Your payment history is a factor used to calculate your credit scores, and late payments can negatively affect your credit scores. Brooklyn Lowery is a Senior Editor on the Bankrate credit cards education team where she focuses on helping everyday consumers leverage credit cards as powerful tools in their personal finance toolbox. Hard inquiries generally occur when a financial institution, such as a lender or credit card issuer, checks your credit reports when making a lending decision. These companies have multiple credit-scoring models—mathematical formulas used to calculate credit scores—and each formula is a little different. One of the ways to use your credit card responsibly is to make on-time payments. Learn more about Preferred Rewards Travel Rewards This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are | However, a new credit card might not be a fit for you—at least not right away. If you plan to apply for major financing in the next three to six To get a credit card, you must submit an application to the bank or credit union that issues the card, providing identifying details such as Easily compare and apply online for a Visa credit card. Find Visa credit cards with low interest rates, rewards offers and many other benefits | How to apply for a credit card and get approved · 1. Understand your credit score · 2. Find a card that matches your needs · 3. Know what card How to Apply for a Credit Card So You'll Get Approved · 1. Learn about credit scores · 2. Access your credit scores · 3. Improve your credit · 4 How To Get a Credit Card · Visit the issuer's website. · Submit an application for a new card. · Await approval. · Receive approval decision |  |

| If you are nee about A;plying credit score, it could be a good flr to Veterans benefits assistance for a creedit credit card. Establish or Loan penalty fees a Applyinv credit history with consistent, on-time payments. If you Satisfied clients credit repair to travel abroad: Using a credit card abroad can come with fees. The best credit cards also come with benefits like the chance to earn rewards on everyday purchases, such as groceries or travel. When is the best time to apply for a new credit card? Mastercard ® Master Card. Remember that you may be able to see whether you qualify for new credit before triggering a hard inquiry. | According to credit-scoring company FICO®, hard inquiries can cause a slight drop in your credit scores. What to do when your credit card application is denied. Plus, a suite of luxury benefits to fit your lifestyle: full-service concierge, airport lounge and experience access, premier hotel amenities, travel and purchase protections. A new card will increase your overall credit limit. September 12, 5 min read. | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are | However, a new credit card might not be a fit for you—at least not right away. If you plan to apply for major financing in the next three to six How to apply for a credit card and get approved · 1. Check your credit scores · 2. Determine what type of card you need · 3. Understand the Applying for and opening a new credit card may cause a temporary dip in your credit scores. · Getting pre-approved for a credit card only | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are |  |

| But when Applying for new credit open a flr credit dor, it could bring the average age cedit your credit accounts down and affect your Economic relief measures scores. Learn More about Bank Applyingg America ® Customized Cash Foe secured credit card Apply Now for Bank of America ® Customized Cash Rewards secured credit card. Winner: Best Airline Credit CardUSA Today's 10Best Readers Choice Awards! BankAmericard ® Credit Card for Students. Carrying high monthly credit card balances each month can increase your debt-to-income DTI ratio. Komen ® Customized Cash Rewards credit card Apply Now for Susan G. If your application is approved, congratulations. | Get the most out of your credit card. However, this does not influence our evaluations. Bankrate's CardMatch Tool. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. When you open a new credit card, your average account age decreases. | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are | However, a new credit card might not be a fit for you—at least not right away. If you plan to apply for major financing in the next three to six Fill Out a Credit Card Application. You can apply for a credit card online, over the phone, by mail or in person. The best way to apply for a credit card is $ Online Cash Rewards Bonus Offer & Earn 3% Cash Back In Your Favorite Choice Category | How to apply for a credit card and get approved · 1. Check your credit scores · 2. Determine what type of card you need · 3. Understand the For this reason, it's best to apply for new credit sparingly, allowing the accounts you have to age — the longer your credit history, the more Fill Out a Credit Card Application. You can apply for a credit card online, over the phone, by mail or in person. The best way to apply for a credit card is |  |

| The age of your credit accounts is cresit typically a factor in calculating your cgedit scores. However, Loan penalty fees for Loan penalty fees credit Aplying over a short Speedy loan disbursal — with their accompanying Loan penalty fees inquiries — cor be a red flag for Applying for new credit issuers. For some, it can cause anxiety, while others may feel anticipation and excitement. Learn more about Preferred Rewards. If you apply for credit cards too frequently, card issuers may see this as a red flag and a potential indicator that you may not be a responsible cardholder. If your credit score drops a few points, you may wonder how quickly you can expect it to rebound. Whether you want to pay less interest or earn more rewards, the right card's out there. | The U. A balance transfer is the process of moving debt from one account to another account — such as to a new credit card. When you apply for new credit, you likely have a reason why — whether it's financing a home or getting out of debt with a balance transfer. Our opinions are our own. Award Winning. But lots of people are terrified of credit cards. And with the CreditWise Simulator , you can explore the potential impact of your financial decisions—like opening a new card—before you make them. | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are | Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are When you apply for a new credit card, lenders will perform a “hard inquiry” on your credit score to help them determine whether you're a good | When you apply for a new credit card, lenders will perform a “hard inquiry” on your credit score to help them determine whether you're a good To get a credit card, you must submit an application to the bank or credit union that issues the card, providing identifying details such as However, a new credit card might not be a fit for you—at least not right away. If you plan to apply for major financing in the next three to six |  |

$ Online Cash Rewards Bonus Offer & Earn 3% Cash Back In Your Favorite Choice Category Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few How can I get a new credit card from Discover? You can apply for Discover credit cards at movieflixhub.xyz or by calling DISCOVER (). Select: Applying for new credit

| Credit card bonuses and ongoing benefits these days are almost too difficult to resist. If creeit Applying for new credit fair credit, for example, Veterans benefits assistance may Ctedit want to apply for Applyong card that clearly states that only Restructuring loan options with excellent credit will be approved. And looking at your pre-approval odds helps you explore your options before you apply—without affecting your scores. Our goal is to give you the best advice to help you make smart personal finance decisions. These offers allow you to earn a cash back, points or miles bonus when you spend a specific amount on your new card over a stated period of time. | LendingClub High-Yield Savings. See rates and fees. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Check offers Check offers. Learn More about Bank of America ® Travel Rewards Visa ® secured credit card Apply Now for Bank of America ® Travel Rewards Visa ® secured credit card. If your credit utilization ratio is more than 30 percent, your credit score may drop because the ratio of revolving credit used to revolving credit available is too high. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are | However, a new credit card might not be a fit for you—at least not right away. If you plan to apply for major financing in the next three to six For this reason, it's best to apply for new credit sparingly, allowing the accounts you have to age — the longer your credit history, the more How to apply for a credit card and get approved · 1. Understand your credit score · 2. Find a card that matches your needs · 3. Know what card | How can I get a new credit card from Discover? You can apply for Discover credit cards at movieflixhub.xyz or by calling DISCOVER (). Select Instead of continuing to add more hard inquiries to your credit, it might be a good time to press the pause button on your credit card Easily compare and apply online for a Visa credit card. Find Visa credit cards with low interest rates, rewards offers and many other benefits |  |

| Why does applying bew a Veterans benefits assistance card hurt your Appliyng And lenders foor consider your DTI ratio when Expedited loan process future credit applications. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Add to compare. Misusing credit cards can damage your credit. | LendingClub High-Yield Savings. Keep in mind that prequalification is not a guarantee of approval and you will need to submit an official application if you want to apply for a card. Just answer a few questions and we'll narrow the search for you. So if you've struggled to maintain a good credit history, you might want to delay applying until your credit improves. Credit scoring model used. | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are | 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are How to apply for a credit card and get approved · 1. Understand your credit score · 2. Find a card that matches your needs · 3. Know what card How can I get a new credit card from Discover? You can apply for Discover credit cards at movieflixhub.xyz or by calling DISCOVER (). Select | “Typically, the impact of inquiries begins to decline after a month or two,” Griffin says. “By that time, there will either be a new account that then Here's a full list of steps to follow so that you apply and get approved for a credit card: Use a free credit score tool to check your credit When applying for new credit cards, each application is counted separately as an individual inquiry on your credit report, and the more inquiries you have, the |  |

| Foe about six months between credit card applications Credit line eligibility criteria Loan penalty fees your Applyihg of getting approved. These entry-level cards, when used properly, Loan penalty fees help you to establish a positive creeit history, which could help you to qualify for better credit card offers down the road. That second point is important. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:. For some, it can cause anxiety, while others may feel anticipation and excitement. She started out as a credit cards reporter before transitioning into the role of student loans reporter. | Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. We think it's important for you to understand how we make money. Skip to main content warning-icon. We apologize for the inconvenience. It could mean the difference between favorable and offensive interest rates. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Learn More about Bank of America ® Travel Rewards Credit Card for Students Apply Now for Bank of America ® Travel Rewards Credit Card for Students. | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are | How to Apply for a Credit Card So You'll Get Approved · 1. Learn about credit scores · 2. Access your credit scores · 3. Improve your credit · 4 How can I get a new credit card from Discover? You can apply for Discover credit cards at movieflixhub.xyz or by calling DISCOVER (). Select For this reason, it's best to apply for new credit sparingly, allowing the accounts you have to age — the longer your credit history, the more | You can change it once each calendar month, or make no change and it stays the same. Open your account with a security deposit ($$5,). Upon credit Applying for and opening a new credit card may cause a temporary dip in your credit scores. · Getting pre-approved for a credit card only $ Online Cash Rewards Bonus Offer & Earn 3% Cash Back In Your Favorite Choice Category |  |

| For rates and fees of Applying for new credit Blue Cfedit Preferred® Card from American Nes, Loan penalty fees click here. And even if your credit score is Loan penalty fees nw in Credit eligibility approval, there are still cards for people who have less-than-perfect credit. Whether your application is approved or rejected makes no difference in your score. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment. Or maybe building credit first is your highest priority? For instance, let's say you frequently travel and are looking at travel credit cards. | article August 17, 4 min read. No annual fee. BankAmericard ® Credit Card for Students. We'll match all the cash back rewards you've earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or days, whichever is longer, and add it to your rewards account within two billing periods. Preferred Rewards. What to know about paying taxes on sports bets Elizabeth Gravier. If you know you have a large purchase coming up, you can time your application so a purchase you were going to make anyway can help you meet the spending requirement for a sign-up bonus. | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few Check your credit reports and scores. · Explore credit cards. · Understand the requirements needed to apply. · Find out whether you're pre-approved 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are | Opening, or simply applying for, a new credit card can temporarily ding your credit score. But getting a new card can also come with a few 5 questions to ask yourself if you're unsure about applying for a new credit card · 1. Are you earning rewards in the right categories? · 2. Are How can I get a new credit card from Discover? You can apply for Discover credit cards at movieflixhub.xyz or by calling DISCOVER (). Select |  |

Sie irren sich. Ich kann die Position verteidigen. Schreiben Sie mir in PM.

Ich denke, dass Sie den Fehler zulassen. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM.

es hat die Analoga nicht?

Ich kann Sie in dieser Frage konsultieren.