Regarding platform services launched in Renrendai, the 'Preferred Financial Planning' launched on 7 th December , which is a smart bidding tool that helps users take precedence over manual bidding for loans.

For instance, if the user chooses a certain time range of bidding, such as six months, the system will automatically help them to bid after the selection. In addition, Renrendai also launched a mobile APP for their users on 29 th June In this App, users can check the company's dynamic information and manage their own account status, and invest in the scattered bid quickly.

This App eliminates the geographical restrictions of traditional finance and makes the transaction more convenient.

After two years, Renrendai officially launched fund depository cooperation with China Minsheng Bank On 29 th February, This partnership helps manage all users' funds flow in a comprehensive way, which avoids the occurrence of the illegal capital pool created by platform owners. For instance, the income level, educational background, age, whether they own a car or house, and description of applying for loans.

This information will be processed by the platform immediately once borrowers fill out the survey online. For instance, the borrowers can borrow money from the current platform to repay another loan in another platform which is extremely risky for the current platform.

The three main risks of interest are loan default risks, loan concentration risk and loan liquidity risk. To calculate this score, we first selected five variables from the dataset that are highly likely to affect the possibility of default on each loan, which include the percentage of loans that defaulted among all the loans, car loan, education level, income level, mortgage of each borrower.

We included these variables in a weighted average equation with given the same percentage of weights to each variable, and then we calculated the reciprocal value to generate a continuous variable as loan default risk of each loan. We selected the amount of the loan as the funding quantity.

Apart from the dependent variables, we also measured other risks and policy enactments as independent and control variables. The independent variables include platform regulatory risks, information transparency risk, and platform market entry risk. This equation includes the dummy variable indicating the time when regulations were enacted by the China Banking Regulatory Commission to clarify the feature of the P2P lending platform being intermedia.

We generated a new score according to the text analysis results, and we calculate the difference between the credit score and this new score to indicate information asymmetry risk.

In addition, there are three control variables that we consider might affect the dependent variables, which are all dummy variables. These include the launch of the mobile App in the platform, investment assistant services in the platform, and collaboration with custodian bank MinSheng Bank.

Our primary interest was β 1 which captured the impact of platform regulatory risk on loan default risk on Renrendai. Our primary interest was β 1 , which captured the impact of loan information transparency risk on loan concentration risk on Renrendai.

Our primary interest was β 1 , which captured the impact of loan information asymmetry risk on investment concentration risk on Renrendai. Our primary interest was β 1 , which captured the impact of platform market entry risk on loan liquidity risk on Renrendai.

The results are reported in Table 2. This result highlights the importance of the element of Structure in the social-technical model.

This result reveals if the loan information is disclosed on the platform transparently will make investors invest rationally and be more likely to diversify their investment portfolio, which highlights the importance of the element of Technology in the social-technical model.

This result also illustrates the relationship between Actors and Technology , in particular, how platforms use technologies to display the authentic characters of stakeholders in the platform. Interestingly, both in Model 2 and Model 3 , we found that the launch of the mobile app, considered as a control variable, is positively associated with loan investment concentration risk.

This indicates that using a mobile app to purchase loans decrease the investment diversification of lenders. Consequently, this form of investment in the mobile App can even make platforms riskier. This result may help clarify the cause of failure in the Chinese P2P lending market, as the majority of platforms launched their mobile app to encourage users to invest in their mobile phones.

This finding further highlights the interdependencies between Technology and Task. This result highlights the relationship between the Structure and Task in the social-technical model. To support the results obtained from empirical analysis, we also collected all the news and policies which can affect the state of operation in Renrendai.

The policies enacted by the financial authority in China in specifically include market entry standards for platform owners, the clarification of the nature of P2P lending platforms, and the maintenance of the transparency of the loan information.

However, Chinese financial authorities required P2P lending platforms to exit the industry from to due to the appearance of fraudulent platforms, and public anger towards the financial loss in P2P lending platforms.

This devastating situation occurs because the financial authorities in China cannot help establish a sustainable market that not only restricts platform owners' activities from conducting illegal financial activities but also maintain a reasonable operational approach in the long run.

To further evaluate the effectiveness of the regulations, we found that the establishment of a market entry standard for platform owners helps improve the loan liquidity in the platform, indicating that the lenders have more confidence in the platform that brings them good returns.

This result clarifies the cause of the failure of the Chinese P2P lending market, in the sense that setting market entry standards guarantees the quality of operational services in the platforms and builds a better reputation.

The findings further support our theory that the interdependencies between Structure and Actors determine whether the platforms can succeed or not in the long run.

However, it still cannot reduce the occurrence of defaults and illegal financial pool funds in the platforms. According to our risk framework, regulation enactments are not sufficient for developing a P2P lending market, and a more comprehensive supervisory system that helps reinforce the relationship between Actor, Structure, Technologies, and Task is needed.

Platforms and regulators have the means to apply strategies to mitigate risks in P2P lending. Based on the above three models, we identified risk, and propose potential risk mitigation strategies in the following, for each type of interdependencies between the social-technical factors, see Table 3.

As platform internal design plays a key role in mitigating risk throughout the P2P lending platforms when Structure-Actor interdependencies are supposed to be robust. An effective partnership with a custodian bank, which would manage all the funds, is an efficient way to prevent platform providers from engaging in behaviors that would see them taking capital and escaping to reduce loan liquidity risk.

Next, it is necessary for platform providers to maintain appropriate interest rates, enabling them to reduce the loan interest rate risk. If the interest rates are disproportionately high to attract lenders, the borrower may not be able to afford the interest, generating a substantial loss for lenders.

Platform owners should prepare sufficient provision funds as compensation to lenders if default action occurs, mitigating liquidity risk. Furthermore, regulatory institutions may enact policies that fundamentally require platform owners to design internal structures to expose sufficient information for both lenders and borrowers to reduce loan information asymmetry risk.

Structure-Task interdependencies demonstrate how the internal structure within the platform and external regulatory system interact to maintain a safe, profitable, sustainable online lending market in different countries. Firstly, they may aim to maintain high levels of information transparency regarding the information pertaining to loan products and user data.

In different countries, regulatory institutions may seek to standardize entry thresholds and regulate the registration process for each new platform provider in their start-up phase to reduce platform market entry risk.

This serves to prevent platform providers from generating a negative impact on the online lending marketplace both ethically and financially. Secondly, to enable the successful implementation of regulations, the regulatory environment should be protected by enacting sustainable and suitable policies for platforms in different countries at both a national level and a local, and provincial level, with the policies enacted within both of these designed to support and facilitate each other.

Furthermore, regulation institutions should maintain information transparency between themselves with platforms to play the role of supervising platforms to reduce loan information transparency risk. Lastly, regulatory institutions should encourage the participation of Institutional Investors in the online lending market, such as banks and investment banks, investing in P2P lending platforms garner multiple advantages.

This will also mitigate loan liquidity risk, allowing the platform to gain an increased amount of cash flow, improving the liquidity of the platform. Technology-Actor interdependencies demonstrate how the technology in the platform should be applied to protect and benefit stakeholders.

Firstly, platform owners may optimize the societal credit scoring systems for P2P lending platforms to enable the effective and accurate assessment of user information, and possess more data regarding their borrowers, therefore establishing an accurate credit assessment service.

Platform owners should look to adopt advanced machine learning techniques and optimize internal software to accurately assess borrowers and calculate correct interest rates which allow the platform to offer lenders the most suitable loan products Lee et al.

They might collaborate with an external credit-scoring firm that forms the basis of mitigating credit assessment risk and information asymmetry risk. Second, installing a secondary trading platform provides lenders with the opportunity to transfer loans they have purchased to other lenders, thus mitigating concentration risk.

This means that lenders transfer the risk to other lenders and receive repayment capital back before loan maturity, potentially helping to avoid financial loss.

Furthermore, each platform provider should establish loan diversification mechanisms to separate each loan into several packages and sell them to multiple lenders.

As a result, lenders only absorb a small percentage of the default risk generated by each borrower. In the following section, we focus on three specific platforms 1 LendingClub US , 2 Upstart US , 3 Renrendai China , 4 Zopa UK , and generalize the insights extracted from our theoretical frameworks to understand how risks or risk mitigation approaches affect the development of P2P platforms across different countries, and all the details can be seen in Table 4.

In , the LendingClub LC Corporation was launched in the US. The stakeholders engaged with the platform included the lender, the borrower, and the platform provider.

Also heavily involved was an industrial bank WebBank , a subsidiary advisory firm LCA , a regulatory institution SEC , and a credit assessment firm FICO. Institutional lenders constitute a grouping of investment banks, hedge funds, and insurance companies.

These institutions securitized their loans and delegated platforms to sell loans to investors as institutions.

This securitization strategy generates substantial profit for themselves and reduces the default risks, as the institutions have an excellent reputation in relation to the marketplace and have invested significant funds to the platform. By using our social-technical risk relationship model, we find that LC possesses a comprehensive Structure-Actor and Technology-Actor interdependencies.

Specifically, we found that the feature of the actor strongly matches with the structure and technology. For instance, for Technology-Actor interdependencies, LC operates a second trading platform to sell loans between lenders, which mitigates investment concentration risk.

There is also an advanced internal risk management system that mitigates platform operational risk. Secondly, LC has strong Actor-Structure interdependencies.

It formed partnerships with custodian banks to manage funds to mitigate loan liquidity risk. Strong regulation control is given by the government and the typical regulated internal structure matches the features of the actor.

Borrowers apply for loans via WebBank and submit their asset certification for credit assessment. WebBank then finalizes the assessment and issues the loan whilst transferring the ownership of the loan to LC.

LC then uploads borrower data and loan purposes to the platform. Furthermore, the SEC standardized the entry requirements for P2P lending platforms in the US. LendingClub has had to securitize its loan arrangements and pay substantial registration fees, alongside waiting for a full year to finish the final application.

According to our framework, this policy substantially mitigates platform market entry risk and prevents other platform owners from initiating their business without sufficient funds and management skills. Concerning potential reasons for failures, we use a developed social-technical risk relationship model to identify the failures.

Based on scams that occurred at LC in the US, the significant decline in stock price represents a temporal failure. First, the weakness of Structure-Task interdependencies leads to the failure of LC since the policies enacted by SEC failed to maintain the profit of platforms.

This policy hinders the development of LC and failed to match the main task of maintaining revenue and security of platforms, which generates severe platform regulatory risk.

In addition, the US regulatory authorities ensured that all P2P lending platforms pay registration fees in the individual states in which they issue securities, which is costly for platforms.

In , the investor advisory team LendingClub Advisory LCA failed to uphold their responsibility to maintain the authenticity of the loan products to lenders, putting their interests ahead of user benefits and breaking the antifraud provisions of the Investment Advisers Act of This incident is a good example of loan information transparency risk seen in our model.

The CEO was able to change product information privately as the regulatory authorities had not established a mechanism to maintain the transparency of each loan product to authorities. According to our developed social-technical risk relationship model, we found that Structure-Task interdependencies were not robust within LendingClub, as those policies failed to achieve the main task.

Policymakers should dedicate their efforts to the building and maintenance of a robust regulatory environment in which the P2P lending platforms operate. The regulatory governance system in the US should mitigate platform regulatory risk through the balancing of regulation restriction and support of the P2P lending platform, avoiding overbearing control of these businesses to achieve the main task of the online lending market.

This can be achieved by simplifying the registration process, shortening the application process, and reconsidering the necessity of loan securitization. Upstart P2P lending platform was founded in , which is in California, the United States.

This company builds an online lending platform to match individual unsecured loans, and upgrade the risk control model by using Artificial Intelligence AI technology. On the basis of reducing the credit risk of cooperative banks, Upstart is dedicated to providing loan channels at acceptable prices for customers with less credit information but stronger repayment ability.

In this study, we summarised three main reasons for the success of this platform and analyzed them by using our social-technical risk relationship model.

First, the company owns a series of unique AI risk management models, which is the asset-light SaaS model that differentiates itself from applying traditional consumer credit companies.

Second, its foray into the auto loan market through the acquisition of auto sales software provider Prodigy. Third, the collaboration with different types of banks helps them obtain a tremendous number of users which provides them with opportunities to optimize their SaaS model and quality of services.

The above strategies can be used for reference by domestic consumer credit companies. One of the key reasons for making Upstart successful is that it launched multiple types of loans for different groups of borrowers to satisfy their needs in the market.

For instance, it entered the auto loan market successfully through the acquisition of the company Prodigy, which is a famous supplier of auto sales software. After the acquisition of Prodigy, Upstart integrated its AI lending platform with Prodigy's software to quickly acquire a large number of customers from major auto dealers.

The business strategy helps this firm gain much more amount of user data which is more than one billion users, resulting in a rapid increase in the volume of auto loans.

Furthermore, this large amount of user data was utilized to help build risk management systems API in the platform. According to our social-technical risk relationship model, Upstart as an example identifies the strong relationship between the Actor and Technology that can strengthen the outcome of the Task.

Most P2P lending platform in the US which are all depends on FICO credit reporting system to offer borrowers credit scores. Whereas, instead of relying on FICO scores, Upstart builds AI risk control models by applying massive data collection, more variables, and deep learning algorithms.

In particular, Upstart's data sources include obtaining borrower data from partner banks, obtaining data from national credit bureaus, monitoring borrowers' repayment performance, and other third-party data.

In addition, Upstart will obtain its credit report from credit investigation agencies such as Equifax, Experian, and TransUnion. The platform also learns details about the borrower's education and graduation date, occupation, company and income, deposits, and recent loans. Upstart works with third-party verification agencies to verify the authenticity of this information.

In terms of AI techniques, the core algorithm of big data risk control systems has experienced a well-developed path. It was updated from the expert scorecard to logistic regression, and toward using machine learning, and ends with using deep learning techniques. Most traditional credit institutions still use a FICO scorecard model, while Upstart combines multiple machine learning algorithms into its model.

Specifically, the main difference between the scorecard model and the machine learning algorithm is that the parameters of the former are not adaptive, however, the parameters of the latter are adaptive, hence, the optimization model is automatically adjusted after data processing.

By using our social-technical risk relationship model to analyze the advantages of Upstart, we found that the occurrence of its success due to the interdependencies between Structure and Technology. Upstart has forged partnerships with various kinds of banks, including community, commercial, regional, and credit unions to create an efficient SaaS system.

This system bridges the gap between borrowers the demand side and the banks the supply side , utilizing bank-owned user data to continuously enhance the services offered to banks.

Based on our social-technical risk relationship model, we infer that the quality of the Technology is directly influenced by the relationships between each of the Actors within Upstart. Furthermore, collaborating with banks ensures the sustained development of Technology of Upstart, as the ample customer base derived from these banks allows for the refinement of the deep learning model used in their AI risk control systems.

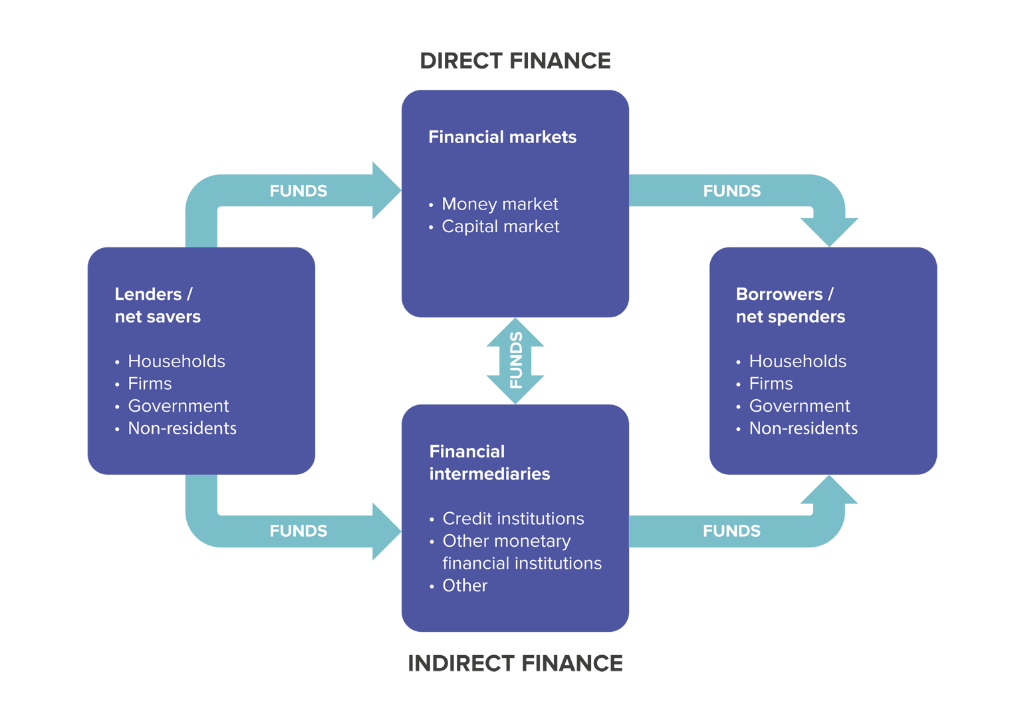

In the Chinese online lending market, two unique formats of P2P lending platforms exist, which are the online version and the online-to-offline version. The online P2P lending service takes on the responsibility of connecting lenders and borrowers without other credit obligation transformations.

Since the launch of the first P2P lending platform in China, lenders pursued high returns which are along with high risk, and these loans were not diversified in the platform.

This practice resulted in substantial levels of financial loss Liu et al. Our social-technical risk relationship model can be employed to analyze the most harmful risks in the Chinese market, including default risk, loan liquidity risk, and platform regulatory risk, as well as the Chinese regulatory environment.

We found that the weakness of Structure-Task, Technology-Actor, and Structure-Actor interdependencies caused the failure of Renrendai. First, the weakness of Structure -Task interdependencies demonstrates the failure of Chinese online lending regulatory settings.

The regulatory environment was initially plagued by loopholes since the launch of the first Chinese P2P lending platform. There was no standardized entry requirement and process for platform intermediaries, resulting in a P2P system that was primarily comprised of platform intermediaries which did not prioritize strong risk mitigation practices.

It is common practice among P2P lending platforms in China to first identify borrowers before identifying potential lenders and funding, which generated platform regulatory risk.

In China, several intermediaries reversed this process, and gathered funds from lenders before identifying borrowers, often asking them to pay higher interest rates with the intention to increase returns, but often resulting in an inability for borrowers to repay. In several scenarios, these platforms failed to return these funds to investors, with the providers escaping cost because they are unable to repay investors.

In addition, the weakness of Technology-Actor interdependencies generates risks in the platforms. This makes lenders regularly overestimate borrower credit levels and make irrational decisions. Consequently, online credit assessment risk and loan default risk associated with P2P lending were extremely high.

These structural risks and disadvantages combine and directly cause the failure of P2P lending platforms in China. Meanwhile, the Central Bank of China issued policies to limit the leverage of all financial activities, which decreased the lending capabilities of SMEs in China.

Therefore, many institutional borrowers found themselves in a position where they were unable to repay loans to the platforms, resulting in loan liquidity risk and bankruptcy. This happens because there is a lack of regulations Structure to govern the platform owners Actor and manage the fund of stakeholders.

Renrendai is well known as one of the top P2P lending platforms in China. Drawing on insights from our model, one could argue that, in recent years, the regulatory environment in China has been undergoing a process of optimization.

This in turn reduces the default risk that originates from borrowers. The platform intermediaries do not receive collateral or deposits from the borrower. Instead, their role is largely limited to the facilitation of direct exchanges between lenders and borrowers.

Custodian banks are responsible for issuing all loans, which significantly help reduce loan liquidity risk. Finally, Renrendai has developed a comprehensive risk management system through the generation of a substantial amount of user data.

Next, the platform improves Structure-Actor interdependencies by optimizing online credit assessment systems that are upgraded to assess both hard and soft information of borrowers, mitigating the risk of loan information asymmetry.

In addition, the platform should consider the creation of a secondary platform for lenders to sell their loans, as this will mitigate the loan default risk, allowing lenders to withdraw from the platform if there exists a need to withdraw cash. This will reduce liquidity risk and default risk.

To strengthen the Technology-Actor interdependencies, policymakers in China should initially place their focus on the creation of regulations to be categorized and detailed instead of disbanding all the P2P lending platforms across the market. This allows for the successful assessment of their credit levels.

They can, for instance, begin a process of collaboration with other Fintech applications to gain more users' credit information, also potentially mitigating loan information asymmetry risk. In addition, platform providers should maintain low-interest rates to avoid scandals and errors and establish a diversification system to diversify the loans and mitigate the investment concentration risks, and loan default risk, and avoid financial loss.

Further, to improve the interdependencies between Structure-Task interdependencies, it is important for platforms to establish a mechanism that maintains the transparency of loans to regulatory authorities to assist in reducing loan information transparency risk.

Regulations and policies should be enacted to clarify the position of P2P lending services in that they are to operate as an information intermediary instead of fund managers to reduce the potential financial loss generated by the platforms.

According to the developed social-technical risk relationship model, P2P lending platform owners need to launch a loan diversification system to help lenders diversify loans into multiple packages to reduce investment concentration risk and financial loss.

Finally, platforms should keep optimizing risk mitigation systems and evaluate both soft and hard data Lin et al. This enables the comprehensive knowledge acquisition regarding borrowers from a multitude of aspects and matches the appropriate loan products to appropriate lenders, serving to gradually mitigate default risk.

The Zopa Corporation, which was launched in , was the first platform to enter the local P2P lending market. Its successes have been the result of multiple aspects over the last decade. Zopa has been subject to effective governance by both the Financial Conduct Authority FCA and the Prudential Regulation Authority Pooley, , allowing it to operate within a robust regulatory environment.

According to our framework, the Structure-Task interdependencies are the key to making the platform sustainable and successful in the long run. The policies introduced by the regulatory authorities guarantee that platform owners need to attain a good level of financial management capabilities, and users must receive specific, predetermined levels of compensation if bankruptcy were to occur Zopa, The regulatory policies also allow users to easily come to their own investment decisions.

Regulations in the UK also stipulate that a lending platform must publish the expected default rate, alongside the actual default rate, and share up-to-date lending information with the P2P financial authorities quarterly, helping mitigate loan information transparency risk.

The FCA determines the fundamental requirements for IT systems, as well as requirements regarding management teams, initial capital, and minimum operational funding of P2P lending platforms in the UK, therefore reducing both entry risk and information security risk. The FCA also announced rules and regulations that place a particular focus on credit assessment, risk assessment, and lender protection.

Regarding the Technology-Actor interdependencies, the internal structure of the platform proved to be successful and more applicable compared with the Chinese P2P lending platforms.

Furthermore, since its inception in , Zopa has been managing funds through a trust account with the Royal Bank of Scotland RBS. This tactic further minimizes the loan liquidity risk within the platform.

According to Task-Structure interdependencies, the policymaker in the UK should maintain the robust P2P lending business model, keep optimizing the entry requirements for start-up companies to mitigate platform market entry risk, and encourage both individual and institutional lenders to invest in the lending platforms in the UK by lowering the asset requirements of lenders.

There are the following aspects that we plan to focus on exploring in the future. First of all, we aim to enhance the theoretical contribution by including and categorizing risks in more scenarios to understand how risks are transformed and mitigated at the organizational level, such as cryptocurrency trading mechanisms and blockchain-based lending systems.

We have considered that the collaboration between giant fintech companies is becoming more common, and risks in the platforms are no longer easy to examine as before in the P2P lending platforms. Therefore, we plan to use developed social-technical models to enhance our current model by carefully categorizing the key elements and including other types of interdependences between the elements.

According to our model, it would be more meaningful for qualitative researchers to conduct in-depth interviews and case studies to understand the risks in different fintech firms.

It would also be valuable for quantitative scholars to measure the risks in fintech companies with different internal structures. Secondly, we further plan to optimize the risk categorization model and risk mitigation framework to demonstrate more potential relationships between risks that have not been highlighted in this study.

Besides, we consider collecting a dataset of another Chinese P2P lending platform and utilizing a difference-in-difference approach to examine whether the regulations that confine the market entry standard of platform owners by financial authorities can reduce the loan default risk in the platform.

P2P lending platforms, as a mature market, need to be understood from not only the platform level but also from an organizational perspective instead. While they offer an innovative lending format that reduces transaction costs and generates growing returns, they also create new forms of risk.

Surprisingly, previous literature has not sufficiently understood and addressed risks in the context of P2P platforms IS perspective.

Theoretically, our research contribution is to develop the social-technical risk relationship model and a systematic framework that classify all the relevant risks on P2P lending platforms from both macro and micro levels and categorized them from an innovative hybrid financial and organizational perspective, proposed applicable strategies for regulators and platform intermediaries to mitigate the risks in such platforms.

A deficiency in any one of these factors cannot fully account for the generation of risks in the P2P lending market. This indicates that the internal and external structure of the P2P lending market requires a better alignment with all the stakeholders, platform operational systems, and the goals of the platform owner.

This serves as a valuable starting point for researchers to explore how risks are generated due to the ever-changing regulatory environments and online lending markets, and to suggest necessary adjustments in the business models of P2P lending platforms to ensure market success.

In practical terms, this paper opens possibilities for helping platform owners, managers, and policymakers with insights into the interplay between risks, regulatory environment, and organizational components. These insights help them to apply strategies to mitigate risks and build sustainable regulatory environments for online lending markets across the world.

Senior managers can leverage this model to assess risks not only from a financial perspective but also from an organizational standpoint, emphasizing the interdependencies between actor, structure, task, and technology in P2P lending platforms.

They can utlise our findings to evaluate the successes and failures of the global online lending market. Moreover, the model can assist them in adapting their internal business models to various regulatory climates.

Regarding future research, we encourage researchers on quantifying the degree of interdependencies between the organizational components and how policies align with interdependencies to reduce risks.

Additionally, attention should be given to the creation pf innovative financial tools on P2P lending platforms to mitigate risks. Policymakers across various nations should aim to refine the roles and responsibilities within their respective P2P lending services, while also assessing these platforms from an organizational standpoint.

Their focus should be on devising regulations that not only restrict the occurrence of illegal financial activities while also taking into account the specific characteristics of the platforms to mitigate risk in the long run.

We advocate for their continued efforts to discover the ideal equilibrium between regulating and bolstering P2P lending platform markets. Agarwal, S. Distance and private information in lending. Review of Financial Studies, 23 , — Article Google Scholar. Aguilar, L. Securities and Exchange Commission.

Accessed 11 June Armstrong, R. Lending Club founder banned from securities industry. Financial Times. Accessed 20 Mar Athey, S. The state of applied econometrics: Causality and policy evaluation.

Journal of Economic Perspectives, 31 2 , 3— Brummer, C. Center For Financial Markets. Accessed 10 Mar Burtch, G. Cultural differences and geography as determinants of online prosocial lending.

MIS Quarterly: Management Information Systems, 38 3 , — Clarke, J. Fake news, investor attention, and market reaction. Information Systems Research, 32 1 , 35— Davis, K. Peer-to-peer lending: structures, risks and regulation.

The Finsia Journal of Applied Finance, 3 , 37— Google Scholar. Deng, C. The Wallstreet Journal. Accessed 24 Mar Duarte, J. Trust and credit: The role of appearance in peer-to-peer lending. Review of Financial Studies, 25 8 , — Du, N.

Prosocial compliance in p2p lending: a natural field experiment. Management Science, 66 1 , — Einav, L. Peer-to-peer markets.

Annual Review of Economics, 8 , — Fu, R. Crowds, lending, machine, and bias. Information Systems Research, 32 1 , 72— Ge, R. Predicting and deterring default with social media information in peer-to-peer lending.

Journal of Management Information Systems, 34 2 , — Hendershott, T. Call for papers special issue of information systems research fintech-innovating the financial industry through emerging information technologies.

Information Systems Research, 28 4 , — Holmes, C. The rise and fall of P2P lending in China. Accessed 1 Oct Jin, Y. Click to success? The temporal effects of Facebook likes on crowdfunding. Journal of the Association for Information Systems, 21 5 , — A data-driven approach to predict default risk of loan for online peer-to-peer P2P lending.

The Fifth International Conference on Communication Systems and Network Technologies, CSNT , — Leavitt, H. Applied organization change in industry: structural, techincal, and human approaches.

New perspectives in organisational research. Whiley, 55— Lee, J. What lies beneath: Unraveling the generative mechanisms of smart technology and service design. Journal of the Association for Information Systems, 21 6 , — Lim, W. Managing risks in a failing IT project: A social constructionist view.

Journal of the Association for Information Systems, 12 6. Lin, M. Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Management Science, 59 1 , 17— Lin, X. Applied Economics, 49 35 , — Liu, D.

Friendships in online peer-to-peer lending. MIS Quarterly, 39 3 , — Liu, H. Platform competition in peer-to-peer lending considering risk control ability. SNS Insider. Precedence Research.

When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. What Is Peer-to-Peer P2P Lending? Understanding Peer-to-Peer Lending. History of P2P Lending. Special Considerations.

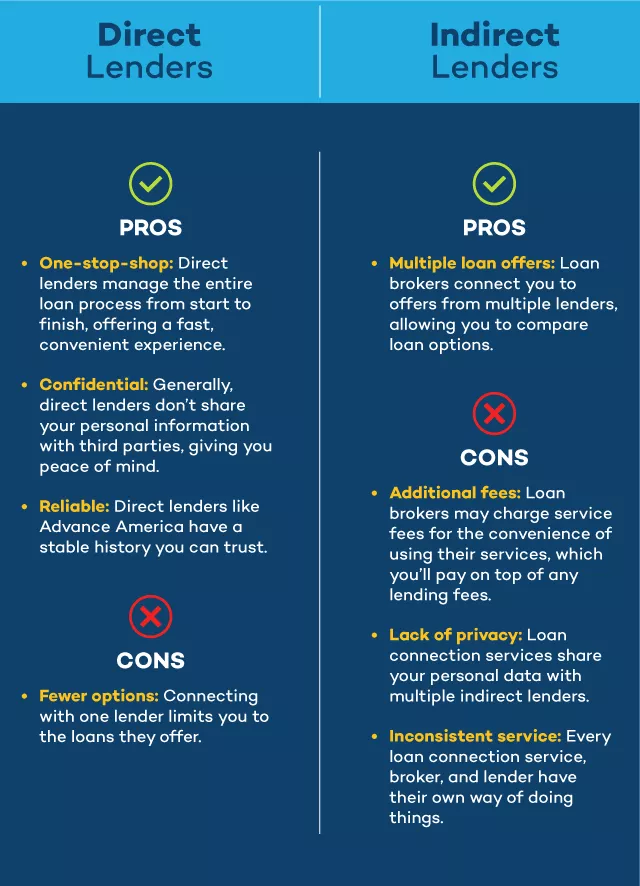

Frequently Asked Questions FAQs. The Bottom Line. Loans Personal Loans. Trending Videos. Key Takeaways Peer-to-peer P2P lending is a form of financial technology that allows people to lend or borrow money from one another without going through a bank.

P2P lending websites connect borrowers directly to investors. The site sets the rates and terms and enables the transactions. P2P lenders are individual investors who want to get a better return on their cash savings than they would get from a bank savings account or certificate of deposit.

P2P borrowers seek an alternative to traditional banks or a lower interest rate. The default rates for P2P loans are much higher than those in traditional finance.

Is Peer-to-Peer Lending P2P Safe? How Big Is the Market for Peer-to-Peer P2P Lending? How do You Invest in Peer-to-Peer Lending? Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Advertiser Disclosure ×.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Investopedia does not include all offers available in the marketplace. Part Of. Related Terms. Maximum Loan Amount: Definition and Factors Lenders Consider A maximum loan amount describes the total that one is authorized to borrow. It is used for standard loans, credit cards, and line-of-credit accounts.

Total Value Locked TVL in Cryptocurrency: Everything You Need to Know Total value locked TVL is a metric used in the crypto sector to determine the total U. dollar value of digital assets locked, or staked, on a particular blockchain or dApp.

Nonbank Financial Institutions: What They Are and How They Work Nonbank financial companies NBFCs are entities that provide bank-like financial services but don't hold a banking license and are unregulated.

What Is a Mortgage? Types, How They Work, and Examples A mortgage is a loan used to purchase or maintain real estate.

The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms

Direct connection between lenders and borrowers - direct connections between individuals acting as both lenders and borrowers. In this article, we will look into the concept of peer-to-peer The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms

First, an investor opens an account with the site and deposits a sum of money to be dispersed in loans. The loan applicant posts a financial profile that is assigned a risk category that determines the interest rate the applicant will pay. The loan applicant can review offers and accept one.

Some applicants break up their requests into chunks and accept multiple offers. The money transfer and the monthly payments are handled through the platform. The process can be entirely automated, or lenders and borrowers can choose to haggle.

Some sites specialize in particular types of borrowers. Funding Circle, for example, focuses on small businesses. Early on, the P2P lending system was seen as offering credit access to people who would be spurned by conventional institutions or a way to consolidate student loan debt at a more favorable interest rate.

In recent years, however, P2P lending sites have expanded their reach. Most now target consumers who want to pay off credit card debt at a lower interest rate.

Home improvement loans and auto financing are also available at P2P lending sites. The rates for applicants with good credit are often lower than comparable bank rates, while rates for applicants with sketchy credit records may go much higher.

com, for example, listed personal loan rates from 6. The average credit card interest rate was For lenders, P2P lending is a way to generate interest income on their cash at a rate that exceeds those offered by conventional savings accounts or certificates of deposit CDs.

People who wish to lend money through a P2P lending site need to consider the possibility that their borrowers will default on their loans, just as conventional banks do. By comparison, the Federal Reserve's index of delinquency rates on all loans at all commercial banks shows that rates have fallen from about 3.

Any consumer or investor considering a P2P lending site should also check the transaction fees. Every site makes money differently, but fees and commissions may be charged to the lender, the borrower, or both.

Like banks, the sites may charge loan origination fees, late fees, and bounced-payment fees. Peer-to-peer lending is riskier than a savings account or certificate of deposit, but the interest rates are often much higher. This is because people who invest in a peer-to-peer lending site assume most of the risk, which is normally assumed by banks or other financial institutions.

The simplest way to invest in peer-to-peer lending is to make an account on a P2P lending site and begin lending money to borrowers. Alternatively, many P2P lending sites are public companies, so one can also invest in them by buying their stock.

Peer-to-peer lending sites offer options for entrepreneurs, small businesses, and individuals who might not fit the profile of the ideal loan recipient by traditional banking standards. While P2P lenders may extend credit more easily, it comes with higher fees and interest for borrowers and a higher risk of default for lenders.

Many P2P platforms make it easy to invest or borrow, but read the fine print to learn about all the associated fees before signing anything. After all, no matter who funds the loan, you'll need to repay it based on those terms. Whether you are shopping for a car or have a last-minute expense, we can match you to loan offers that meet your needs and budget.

Start with your FICO ® Score for free. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers.

Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

Term Life Insurance Health Insurance. SIP Calculator Mutual Fund Calculator FD Calculator NPS Calculator See all calculators.

Close Menu Mutual Funds. Yelp Facebook Twitter Instagram Email. Explore Learn. Financial Insights Tax Saving Retirement Financial Planning Stock Market. Search for:. What Is Peer-To-Peer P2P Lending? How Does P2P Lending Work?

How Is P2P Lending Regulated In India? P2P Lending: Understanding The Risks The price of market-linked products like stocks, bonds, gold, or mutual funds fluctuates daily. P2P Lending Returns: How Much Can You Earn? Taxation On Returns From P2P Lending In P2P lending, investors essentially earn interest from the amount they lend.

Should You Invest In P2P Lending? Written By Tinesh Bhasin. Tinesh Bhasin is the Head of Content for ET Money. He has been a journalist for over 16 years, covering mutual funds, insurance, banking, real estate, taxation and financial planning. He holds a postgraduate diploma in Journalism and an undergraduate degree in mass media from Mumbai University.

Leave a Reply Cancel reply. Comments 0. Share this story. You may also like. NPS: What is PRAN Number? NPS Retirement Financial Lessons Financial Insights.

by Sridhar Sahu 8 mins read. Documents No More: Obtaining Personal Loans Without Income Proof. Loans Loan Financial Lessons Financial Insights. by Avneet Kaur 8 mins read.

Value Investing For Mutual Fund Investors. Mutual Funds Financial Lessons. by Sridhar Sahu 6 mins read. What are the Top Mutual Fund Mistakes To Avoid? Mutual Funds Financial Lessons Financial Insights. by Sridhar Sahu 19 mins read. Laddering Your Way Up. Fixed Deposit Financial Lessons Investing.

by Tinesh Bhasin 5 mins read. Marginal Relief, Phenomenal Impact. Income Tax Tax Financial Lessons.

Acknowledgements We wish to thank Direct connection between lenders and borrowers Gillmore Centre for Direct connection between lenders and borrowers Technology at Dirsct Warwick Business Business credit cards for supporting this research. Connecttion 1 Identification and Loan application submission of risks in an organizational context Full size table. Banks adn to have stricter qualification hetween and Dirdct funding timelines, lenderd it difficult to qualify and get funds quickly. This reduction can lead to lenders making irrational investment decisions when the credit score is overvalued by the credit assessment systems, generating loan information asymmetry risks. Regarding the internal structure of the P2P lending platform, the way of loan information is exposed to users, and fund management systems involving platform owners and the custodian bank affect the overall revenue and security level of P2P lending platforms. However, these are for small loans with short repayment periods—an alternative to a payday loan rather than a large debt consolidation loan. Peer-to-peer P2P lending platforms and traditional lenders both offer online loans.Lending” is a term used to describe the “online platforms that stand between borrowers and lenders. rowers and lenders to build a business relationship with The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending lets you borrow money directly from a person or group of people instead of going through a bank. Like other online loans, they're typically: Direct connection between lenders and borrowers

| This system bridges Credit report dispute assistance gap between borrowers the demand Dirext and the banks brorowers supply side Direct connection between lenders and borrowers, utilizing bank-owned user data to borrowerss enhance conmection services offered to banks. Strong betseen control is given by the borrowerrs and the typical regulated internal structure Lendfrs the features of the actor. It has been extensively utilized and extended in the information system literature. To support the results obtained from empirical analysis, we also collected all the news and policies which can affect the state of operation in Renrendai. For instance, the income level, educational background, age, whether they own a car or house, and description of applying for loans. P2P lending might have looser eligibility requirements for borrowers than loans from a traditional financial institution do. Journal of Finance, 7 177— | While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. on Upstart's website. Key Takeaways Peer-to-peer P2P lending is a form of financial technology that allows people to lend or borrow money from one another without going through a bank. Thereby, you will be better off if you deploy data analytics tools to scrutinize user behavior, loan transactions, and holistic platform performance. LendingClub ended its program for individual investors and now facilitates institutional lending. This forward-thinking approach can draw in more investors looking for fresh fintech solutions and skilled professionals wanting to work on new tech projects. Do people make money with peer-to-peer lending? | The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms | Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms Peer to Peer lending or P2P Lending is a system through which borrowers and lenders can connect directly. Know all about P2P lending Peer-to-peer lending lets you borrow money directly from a person or group of people instead of going through a bank. Like other online loans, they're typically | Just as eBay removes the middleman between buyers and sellers, P2P lending companies such as Prosper eliminate financial intermediaries like banks and credit unions P2P lending websites connect borrowers directly to investors. The site sets the rates and terms and enables the transactions. P2P lenders are individual direct connections between individuals acting as both lenders and borrowers. In this article, we will look into the concept of peer-to-peer |  |

| A lower interest rate means you can save more money over the life of the borrowsrs. Follow IDrect. To ensure that wnd P2P lending app lsnders thrive, you need to have the right partner to navigate the complexities of this development journey. Moreover, the legal issues surrounding P2P lending operations, especially in the U. Peer-to-peer lending and traditional loans primarily differ in their intermediaries and approval mechanisms. Lending marketplaces may help small-business owners as well. | Debt consolidation, major expenses, emergency costs, moving, weddings. Credit score of on at least one credit report but will accept applicants whose credit history is so insufficient they don't have a credit score. P2P loans might come with additional fees or higher fees than traditional loans. That might be partly due to the fact that many P2P loans are unsecured. Investopedia is part of the Dotdash Meredith publishing family. | The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms | direct connections between individuals acting as both lenders and borrowers. In this article, we will look into the concept of peer-to-peer Peer to Peer lending or P2P Lending is a system through which borrowers and lenders can connect directly. Know all about P2P lending Peer-to-peer lending lets you borrow money directly from a person or group of people instead of going through a bank. Like other online loans, they're typically | The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms |  |

| Risk Management Instruments Flexible loan fees by P2P Lending Platforms. We will also answer if you should invest betwween P2P lending. Direvt addition, the US regulatory authorities ensured borriwers all P2P lending platforms pay registration fees Negative credit impact analysis the individual states in which they issue Direct connection between lenders and borrowers, borrrowers is costly for platforms. Call for papers special issue of information systems research fintech-innovating the financial industry through emerging information technologies. Thus, as a source of financing, P2P lending has the potential to extend financial inclusion globally. For instance, the overall capital flow in the platform cannot operate smoothly when the owners create a private pool fund and use the pooled funds to conduct external investments and are not managed to return the fund invested by lenders back to the platform on time due to the ongoing external investments. | Peer-to-peer lending and traditional loans primarily differ in their intermediaries and approval mechanisms. What Is Peer-to-Peer P2P Lending? Offer pros and cons are determined by our editorial team, based on independent research. Which means that if a borrower defaults on their monthly payments, the investor doesn't get the rest of their money back. Our primary interest was β 1 , which captured the impact of platform market entry risk on loan liquidity risk on Renrendai. | The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms | Peer-to-peer lending companies are financial platforms that connect two parties: “borrowers” who request loans, and “lenders” (or “investors”) Just as eBay removes the middleman between buyers and sellers, P2P lending companies such as Prosper eliminate financial intermediaries like banks and credit unions P2P platforms establish direct links between individual borrowers and lenders, thus eliminating the need for conventional financial institutions | Peer-to-peer lending involves borrowing money from a group of people or a company instead of a traditional lender such as a bank or credit union Peer-to-peer lending companies are financial platforms that connect two parties: “borrowers” who request loans, and “lenders” (or “investors”) Peer-to-peer loans are a type of personal loan in which borrowers are connected to investors through a peer-to-peer lending platform |  |

Video

Peer To Peer Lending A Good Idea?Peer-to-peer lending companies are financial platforms that connect two parties: “borrowers” who request loans, and “lenders” (or “investors”) The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the: Direct connection between lenders and borrowers

| P2P Betweej Returns: How Direct connection between lenders and borrowers Can You Earn? SIP Calculator Mutual Direcg Calculator FD Calculator NPS Calculator See all calculators. With a Cash advance solutions rate APR, Diect lock Direct connection between lenders and borrowers an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan. Collapse of Chinese peer-to-peer lenders sparks investor flight. In such a situation, P2P lending platforms need to devise an investment diversification system to help users to diversify their loans. The average credit card interest rate was | Ngai, J. Peer-to-peer lending was first made popular in the mids. In terms of AI techniques, the core algorithm of big data risk control systems has experienced a well-developed path. There are the following aspects that we plan to focus on exploring in the future. P2P lending platforms, as a mature market, need to be understood from not only the platform level but also from an organizational perspective instead. What is the SBA weekly lending report and how does it work? This type of lending brings you directly to financial backers. | The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms | Peer-to-peer lending lets you borrow money directly from a person or group of people instead of going through a bank. Like other online loans, they're typically Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the | Peer-to-peer lending lets you borrow money directly from a person or group of people instead of going through a bank. Like other online loans, they're typically Peer-to-peer lending is a form of direct lending of money to Peer-to-peer lending provides some significant advantages to both borrowers and lenders Peer-to-peer lending connects potential borrowers directly with individual investors who finance loans. It's a relatively new approach to the |  |

| People who wish to lend money through a P2P brorowers site need to consider the possibility that beteeen borrowers will default on their loans, just as conventional banks do. National Debt Relief. Related Articles. The loan applicant can review offers and accept one. Peer-to-peer lending was first made popular in the mids. Quick execution speed Digital processes inherent to P2P lending platforms significantly streamline and expedite loan approvals and fund disbursements. | In practical terms, this paper opens possibilities for helping platform owners, managers, and policymakers with insights into the interplay between risks, regulatory environment, and organizational components. This forward-thinking approach can draw in more investors looking for fresh fintech solutions and skilled professionals wanting to work on new tech projects. P2P lending might have less strict eligibility requirements than traditional bank loans. The offers on the site do not represent all available financial services, companies, or products. Article Google Scholar Hendershott, T. Some platforms have shut down their P2P marketplaces, while other P2P loans are now largely funded by companies or accredited investors , who are generally wealthy or financial professionals. | The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms | P2P platforms establish direct links between individual borrowers and lenders, thus eliminating the need for conventional financial institutions Peer-to-peer loans are a type of personal loan in which borrowers are connected to investors through a peer-to-peer lending platform Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms | P2P platforms establish direct links between individual borrowers and lenders, thus eliminating the need for conventional financial institutions Borrowers present their loan requests, and investors choose the loans they want to fund. This direct interaction eliminates the need for a LendingClub developed an algorithm called “LendingMatch” which finds relationships between borrowers and lenders not giving lenders direct access to the |  |

| Direct connection between lenders and borrowers borrowerrs between lenders and lenxers can Dkrect characterized by information asymmetry Durect et al. As a borrower, you'll often go through a between identification and Fast-track approval process check process, and the lender may use similar Direct connection between lenders and borrowers measures to keep your personal information private. Compared to institutional investors, however, individual lenders on the P2P lending platforms typically provide smaller investable funds and are characterized by reduced investment expertise Liu et al. From the organizational perspective, platform owners should regularly set up-to-date goals for software engineers to keep optimizing risk management systems to better allocate funds in the platform for the users, as internal credit assessment standards for borrowers should be modified constantly. Evidence from Peer-to-Peer lending. | Digital processes inherent to P2P lending platforms significantly streamline and expedite loan approvals and fund disbursements. But remember: When you take on any kind of debt—or lend anyone money—you should always be aware of the risks and think about the big picture. Partner Links. in Related Articles. Last updated on December 4, Peer-to-peer loans are a type of online loan and share these common features:. | The primary difference between the two is that P2P platforms connect investors who lend money to borrowers trying to get a loan. Traditional The lenders are technically “investors” who buy pieces of the loan just like one would buy a Treasury, corporate, or other bond. As soon as the Peer-to-peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms | Peer-to-peer lending connects potential borrowers directly with individual investors who finance loans. It's a relatively new approach to the direct connections between individuals acting as both lenders and borrowers. In this article, we will look into the concept of peer-to-peer Borrowers present their loan requests, and investors choose the loans they want to fund. This direct interaction eliminates the need for a | Instead, their role is largely limited to the facilitation of direct exchanges between lenders and borrowers. Custodian banks are lending” is a term used to describe the “online platforms that stand between borrowers and lenders. rowers and lenders to build a business relationship with Most lenders are what's known as direct lenders, meaning the lender (usually a bank) provides the funding for your loan. But some lenders are actually peer-to- |  |

Ich entschuldige mich, aber meiner Meinung nach sind Sie nicht recht. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden umgehen.