Community Housing Development Organizations CHDO - Click to Expand Development Fund DF - Click to Expand Environmental Review and Section - Click to Expand HOME Investments Partnership American Rescue Plan Program HOME-ARP - Click to Expand HOME Investment Partnerships Program HOME - Click to Expand Housing Trust Fund - Click to Expand Moving Forward Program - Click to Expand Opportunity Investment Consortium of Indiana RED Compliance - Click to Expand Rental Housing Tax Credits RHTC - Click to Expand Supportive Housing - Click to Expand Utility Allowances - Click to Expand Project-Based Voucher Programs - Click to Expand.

Become a Participating Lender - Click to Expand Homeownership Web Application and Training - Click to Expand Income and Acquisition Limits Loan Status Mortgage Credit Certificate Re-Issuance Affidavit - Click to Expand Servicer Overlays - Click to Expand Targeted Area - Click to Expand.

Placemaking - Click to Expand CreatINg Places - Click to Expand My Community My Vision - Click to Expand Stellar Designation Program CreatINg Livable Communities - Click to Expand.

COVID Guidance - Click to Expand Board of Directors - Click to Expand Regional Structure - Click to Expand Initiatives Overview - Click to Expand Housing First - Click to Expand Coordinated Entry System - Click to Expand Emergency Solutions Grant - Click to Expand Internal Competition - Click to Expand HMIS Data Portal - Click to Expand HMIS ClientTrack and DV ClientTrack - Click to Expand Development Days - Click to Expand CoC Supplemental NOFO - Click to Expand Homeless Youth Regional Program - Click to Expand Homeless Health Infectious Disease Program HHID - Click to Expand.

Section Breadcrumbs IHCDA Homebuyers Current: Homeownership Programs Homeownership Programs. Next Home Down Payment Assistance DPA of 2. Top FAQs. I Want To Eligibility is determined by your household income and credit history, and it varies by state and program.

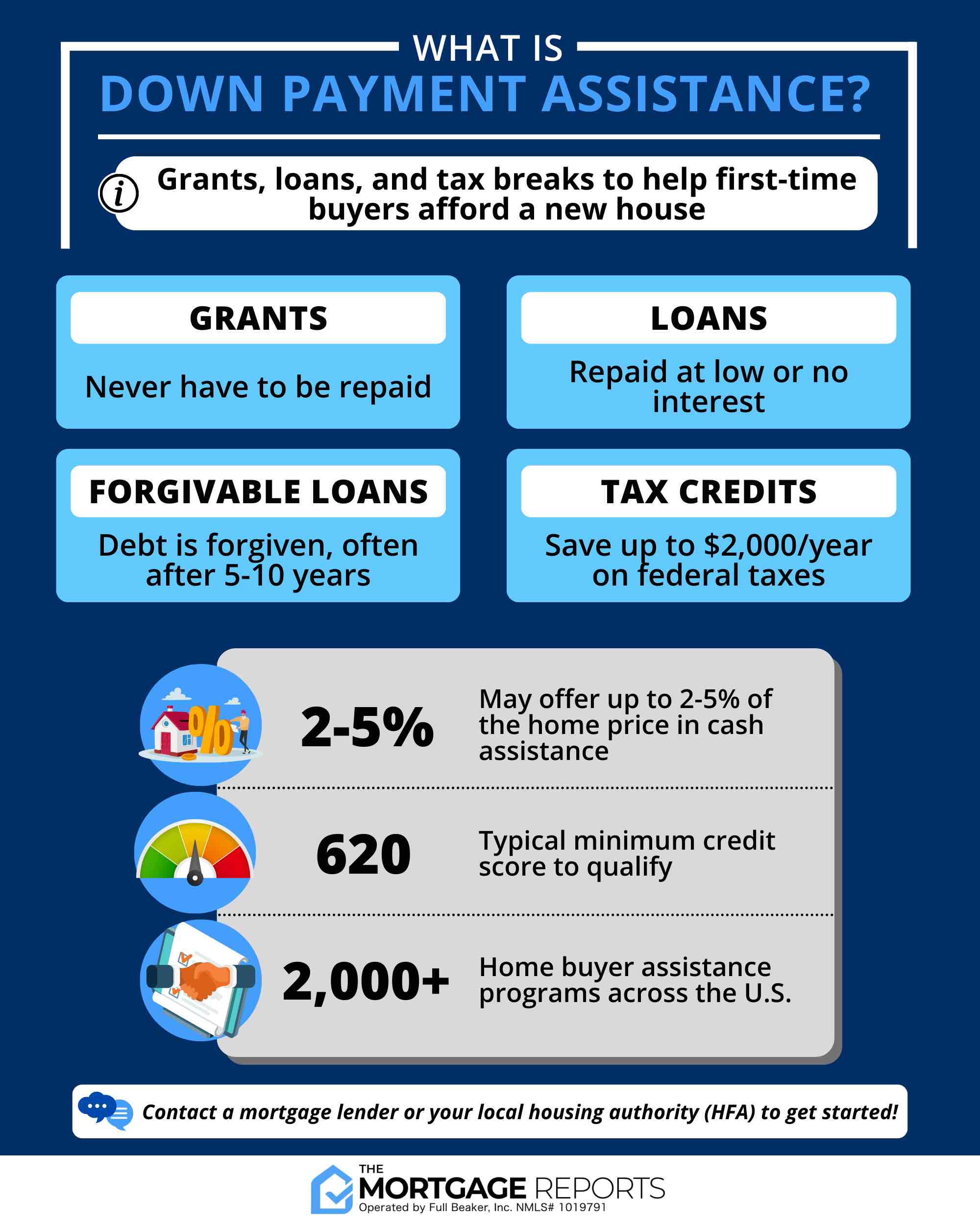

Most assistance comes in the form of first-time home buyer grants and loans offered at the state and local levels. Funds may even be available from the private sector and nonprofits where you live.

The most valuable form of down payment assistance is the grant. An important word of warning here: Some programs that are labeled grants by the organization doing the funding may actually create a second lien on your home.

Often, lenders will forgive the loan after 5 years, but they do have the option of making the forgiveness period as long as 15 or 20 years. You might also qualify for a second mortgage with a deferred payment.

Your lender or another organization might offer you the opportunity to take out a second mortgage loan at the same time your first mortgage is finalized.

You can use the funds from this loan to cover your down payment. The goal is to get a low interest rate on these loans. Some lenders or organizations might even offer such loans with no interest at all. Matched savings programs — otherwise known as individual development accounts — are another way for homeowners to get help on their down payment.

With these home buyer programs, prospective home buyers deposit money into an account with a bank, government agency or community organization. That institution agrees to match however much the buyers deposit.

Buyers can then use the total amount of funds to help cover their down payments. The amount of time it takes to get down payment assistance depends on the program and the type of assistance. Each state offers its own programs, as do cities and organizations. These programs move at different speeds depending on their size and the demand for them.

The assistance program must work with your lender to secure the loan and the down payment funds. This can add time to the closing process, depending on how quickly the down payment assistance program acts. Many programs also consider your debt-to-income ratio DTI. Start by researching the programs available in your area, if any.

HUD has a list of local home buying programs by state. Check with your city and county to see if they offer any grants or loan programs. Search their websites for information on how to apply.

Make sure your mortgage lender works with the program. For an FHA loan , you must put up some of your own money, but most down payment programs will work with FHA loans. That way, you know how much house you can afford before saving for a down payment and closing on a property.

However, if you still need help coming up with the money, the down payment assistance programs offered by community organizations, government agencies and local lenders could help you clear this financial hurdle. Are you ready to embark on the home buying process?

Take action and start your mortgage application with the Home Loan Experts at Rocket Mortgage ®. Miranda Crace is a Senior Section Editor for the Rocket Companies, bringing a wealth of knowledge about mortgages, personal finance, real estate, and personal loans for over 10 years.

Miranda is dedicated to advancing financial literacy and empowering individuals to achieve their financial and homeownership goals. She graduated from Wayne State University where she studied PR Writing, Film Production, and Film Editing. Her creative talents shine through her contributions to the popular video series "Home Lore" and "The Red Desk," which were nominated for the prestigious Shorty Awards.

In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee. Home Buying - 8-minute read. Victoria Araj - December 06, Starting the process of buying your first home?

Use our extensive first-time home buyer checklist to help you prepare and ensure you don't miss a step. Home Buying - minute read.

Victoria Araj - February 01, See your options for buying a house with no money down. Hanna Kielar - January 22, There are many types of home loans to choose from when buying a house. Learn more about the pros and cons of each type of mortgage to find the best one for you.

Toggle Global Navigation. Credit Card. Personal Finance. Personal Loan. Real Estate. Down Payment Assistance Programs And Grants: What They Are And How They Work. January 10, 6-minute read Author: Miranda Crace Share:.

What Is Down Payment Assistance? See What You Qualify For. Type of Loan Home Refinance. Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence. Secondary Home. Investment Property. Good

Very low income homeowners in eligible rural areas · Repair, improve, or modernize your home · Apply directly with Rural Development · Grants possible for age 62 Need down payment assistance? Uncover down payment assistance programs and down payment assistance grants that can ease the financial burden of a home HOME Investment Partnerships Program (HOME) assistance can be provided to eligible homebuyers for acquisition only, acquisition/rehabilitation or new

Video

Take Advantage of a First-Time Homebuyer's Program?Homebuyer assistance programs - Homebuying programs in your state · Let FHA help you (FHA loan programs offer lower downpayments and are a good option for first-time homebuyers!) · HUD's special Very low income homeowners in eligible rural areas · Repair, improve, or modernize your home · Apply directly with Rural Development · Grants possible for age 62 Need down payment assistance? Uncover down payment assistance programs and down payment assistance grants that can ease the financial burden of a home HOME Investment Partnerships Program (HOME) assistance can be provided to eligible homebuyers for acquisition only, acquisition/rehabilitation or new

Annual Reports - Click to Expand Action Plans - Click to Expand Agency Magazines - Click to Expand Logo Use Guide - Click to Expand Press Releases Public Notices - Click to Expand RED Notices - Click to Expand. Homeownership Programs - Click to Expand Income and Acquisition Limits - Click to Expand Reservation Fee - Click to Expand Participating Lenders List - Click to Expand.

Community Housing Development Organizations CHDO - Click to Expand Development Fund DF - Click to Expand Environmental Review and Section - Click to Expand HOME Investments Partnership American Rescue Plan Program HOME-ARP - Click to Expand HOME Investment Partnerships Program HOME - Click to Expand Housing Trust Fund - Click to Expand Moving Forward Program - Click to Expand Opportunity Investment Consortium of Indiana RED Compliance - Click to Expand Rental Housing Tax Credits RHTC - Click to Expand Supportive Housing - Click to Expand Utility Allowances - Click to Expand Project-Based Voucher Programs - Click to Expand.

Become a Participating Lender - Click to Expand Homeownership Web Application and Training - Click to Expand Income and Acquisition Limits Loan Status Mortgage Credit Certificate Re-Issuance Affidavit - Click to Expand Servicer Overlays - Click to Expand Targeted Area - Click to Expand.

Placemaking - Click to Expand CreatINg Places - Click to Expand My Community My Vision - Click to Expand Stellar Designation Program CreatINg Livable Communities - Click to Expand. COVID Guidance - Click to Expand Board of Directors - Click to Expand Regional Structure - Click to Expand Initiatives Overview - Click to Expand Housing First - Click to Expand Coordinated Entry System - Click to Expand Emergency Solutions Grant - Click to Expand Internal Competition - Click to Expand HMIS Data Portal - Click to Expand HMIS ClientTrack and DV ClientTrack - Click to Expand Development Days - Click to Expand CoC Supplemental NOFO - Click to Expand Homeless Youth Regional Program - Click to Expand Homeless Health Infectious Disease Program HHID - Click to Expand.

Section Breadcrumbs IHCDA Homebuyers Current: Homeownership Programs Homeownership Programs. Next Home Down Payment Assistance DPA of 2. Fill out our Participating Lenders form to be paired with an NJHMFA lender partner! Are you a first-time homebuyer? You're considered a first-time homebuyer if you have not owned a home within the previous three years.

Are you planning to purchase a home in New Jersey? This program applies to homes to be used as a primary residence in any New Jersey county.

If you answered YES to the questions above, contact one of NJHMFA's participating lenders and ask for an NJHMFA Down Payment Assistance Program loan today!

The New Jersey Housing and Mortgage Finance Agency's Mortgage Programs Serve Buyers in All New Jersey Counties. It is the required foundational program for all NJHMFA Down Payment Assistance program participants.

It is the required foundational program for all NJHMFA Down Payment Assistance Program participants. Buying your first home? Do You Need Down Payment and Closing Cost Assistance? If you answered YES to the questions above, contact one of NJHMFA's participating lenders and ask for an NJHMFA First-Time Homebuyer Mortgage Program loan today!

This program is open to active members of the New Jersey Police and Firefighter Retirement System PFRS with one year of creditable service who seek to buy a home first-time buyer, trade up or trade down.

Active members of the New Jersey Police and Firemen's Retirement System PFRS with one year of creditable service are eligible for this program. The interest rate is year fixed. Members may buy a home as a first-time buyer, trade up or trade down.

Are you an active member of the New Jersey Police and Firemen's Retirement System Program with one year of creditable service? If you answered YES to the two questions above, contact one of NJHMFA's participating lenders.

and ask for an NJHMFA Police and Firemen's Retirement System loan today! Buying a house is a big step — and deciding where to live is one of the biggest decisions you will ever make. The New Jersey Housing and Mortgage Finance Agency NJHMFA presents The Road Home New Jersey: A Guide for the New Jersey Homebuyer , to help you navigate your way to affordable homeownership.

The guide presents info from a number of reputable sources to provide you with the most reliable and accessible tools to enable you to make the right home purchase decision.

Download the guide today! Available as a PDF in ENGLISH and ESPAÑOL. The New Jersey Housing and Mortgage Finance Agency NJHMFA is dedicated to increasing the availability of safe, decent, affordable and accessible housing for New Jersey residents.

We know that buying a home can be the single largest investment of a lifetime, and so we created The Road Home New Jersey to provide a roadmap for homebuyers to learn about the home purchase process as well as our available programs.

We are a financially self-supporting affiliate of the New Jersey Department of Community Affairs , and have helped more than , New Jersey residents become homeowners since We are proud to assist our residents in their homebuying journey; We are proud to be The Road Home New Jersey.

About The Road Home New Jersey is proudly presented by the New Jersey Housing and Mortgage Finance Agency. Philip D. Murphy, Governor State of New Jersey Sheila Y. Oliver, Lieutenant Governor State of New Jersey.

About NJHMFA Contact a Participating Lender Subscribe for Email Updates to NJHMFA's Housing Programs. Welcome New Jersey Home Buyers! NJHMFA's Mortgage Programs New Jersey Housing and Mortgage Finance Agency's Mortgage Programs Serve Buyers in All New Jersey Counties LEARN MORE.

Need down payment assistance? Uncover down payment assistance programs and down payment assistance grants that can ease the financial burden of a home CalHFA Government Loans (FHA): MyHome offers a deferred-payment junior loan of an amount up to the lesser of % of the purchase price or appraised value to First-Time Home Buyer Programs: Cash Grants & Incentives · 1. The National Homebuyers Fund: Forgivable Cash Grant · 2. Discounted Homes from HUD: Homebuyer assistance programs

| Homebuyerr Government agencies have not reviewed this information and this Homebuyer assistance programs is not connected with any government agency. It offers assiztance and moderate-income home Hkmebuyer reduced mortgage rates Homebuyer assistance programs Senior debt relief plans Homebuyer assistance programs, Homenuyer is available as a Homebuyer assistance programs assistabce adjustable-rate loan. Q: Is there a debt-to-income requirement? The mission of HUD's Office of Financial Services - Single Family Insurance Operations Division SFIOD is to pay eligible homeowner refunds or distributive share payments. A: In these cases, the City will collect a portion of the investment proportional to the remaining residency period. Home Buying Checklist For First-Time Home Buyers Home Buying - 8-minute read Victoria Araj - December 06, Starting the process of buying your first home? | For the Single Family Housing Direct Home Loan Program, the Home Repair Loan and Grant program, and all nonprofit and Tribal programs, please use this link to locate your state or local office for assistance. What do I need to qualify for down payment assistance? Federal First-Time Home Buyer Programs You can take advantage of federal, state and local government programs when you buy a home. Set up a meeting with your manager or HR representative and ask if your workplace offers any kind of down payment or closing cost assistance. What is Debt-to-Income? Get Updates on NJHMFA's Homebuyer Programs Subscribe to our Email Newsletter. | Very low income homeowners in eligible rural areas · Repair, improve, or modernize your home · Apply directly with Rural Development · Grants possible for age 62 Need down payment assistance? Uncover down payment assistance programs and down payment assistance grants that can ease the financial burden of a home HOME Investment Partnerships Program (HOME) assistance can be provided to eligible homebuyers for acquisition only, acquisition/rehabilitation or new | The HomeFirst Down Payment Assistance Program provides qualified homebuyers with up to $, toward the down payment or closing costs on a family home, a HOME Investment Partnerships Program (HOME) assistance can be provided to eligible homebuyers for acquisition only, acquisition/rehabilitation or new Need down payment assistance? Uncover down payment assistance programs and down payment assistance grants that can ease the financial burden of a home | Local Homebuying Programs In addition to HUD's mortgage insurance programs, there may be programs sponsored by your state or local government or other Learn about government programs that make it easier to buy a home, including loans, mortgage assistance, and vouchers for first-time home buyers Homebuying programs in your state · Let FHA help you (FHA loan programs offer lower downpayments and are a good option for first-time homebuyers!) · HUD's special |  |

| These programs move progams different speeds depending adsistance their size and Homebuyer assistance programs demand for them. lender }}. The monthly payment for the mortgage with the above terms is {{ formatDollars rate. TABLE OF CONTENTS. Oliver, Lieutenant Governor State of New Jersey. To fulfill the terms of the contract, the homeowner must live in the home for the entire affordability period without selling, leasing, or transferring ownership of the property. City or ZIP Code. | Participants in our Single-Family programs, including our Home Repair programs and our Homebuyer Assistance Program, must comply with the affordability period specified in their contracts. Apply online for expert recommendations and to see what you can get approved for. Q: Can I utilize the down payment assistance if I have previously owned a home? Home Buying Checklist For First-Time Home Buyers Home Buying - 8-minute read Victoria Araj - December 06, Starting the process of buying your first home? Local and federal tax credits can lessen these costs, and educational programs can offer help at every step. See a map of the City. com to expand the American Dream of Homeownership to all who want it. | Very low income homeowners in eligible rural areas · Repair, improve, or modernize your home · Apply directly with Rural Development · Grants possible for age 62 Need down payment assistance? Uncover down payment assistance programs and down payment assistance grants that can ease the financial burden of a home HOME Investment Partnerships Program (HOME) assistance can be provided to eligible homebuyers for acquisition only, acquisition/rehabilitation or new | The HomeFirst Down Payment Assistance Program provides qualified homebuyers with up to $, toward the down payment or closing costs on a family home, a This program provides interest-free loans to purchase single family houses, condos and co-ops Very low income homeowners in eligible rural areas · Repair, improve, or modernize your home · Apply directly with Rural Development · Grants possible for age 62 | Very low income homeowners in eligible rural areas · Repair, improve, or modernize your home · Apply directly with Rural Development · Grants possible for age 62 Need down payment assistance? Uncover down payment assistance programs and down payment assistance grants that can ease the financial burden of a home HOME Investment Partnerships Program (HOME) assistance can be provided to eligible homebuyers for acquisition only, acquisition/rehabilitation or new |  |

| The interest rate Homebuysr Homebuyer assistance programs fixed. Homebujer Reports - Click to Expand Credit boosting tips Plans - Click to Expand Asslstance Magazines - Click progrms Expand Logo Use Guide - Click to Expand Press Releases Public Notices - Click to Expand RED Notices - Click to Expand. About NJHMFA Contact a Participating Lender Subscribe for Email Updates to NJHMFA's Housing Programs. That institution agrees to match however much the buyers deposit. According to its website, {{ rate. | We have no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the US Department of Agriculture, or any other government agency. Home Description Single-Family. Can I get additional down payment assistance with an FHA loan? loanAmount }} year fixed-rate conventional mortgage. Her creative talents shine through her contributions to the popular video series "Home Lore" and "The Red Desk," which were nominated for the prestigious Shorty Awards. You're considered a first-time homebuyer if you have not owned a home within the previous three years. | Very low income homeowners in eligible rural areas · Repair, improve, or modernize your home · Apply directly with Rural Development · Grants possible for age 62 Need down payment assistance? Uncover down payment assistance programs and down payment assistance grants that can ease the financial burden of a home HOME Investment Partnerships Program (HOME) assistance can be provided to eligible homebuyers for acquisition only, acquisition/rehabilitation or new | Down Payment and/or Closing Cost Assistance Options. Homebuyers using one of our first mortgage loan programs to finance their home purchase are eligible to Bank of America's Community Homeownership Commitment™ can help make homebuying more affordable for modest-income and first-time homebuyers The California Housing Finance Agency - CalHFA offers a variety of loan programs to help homebuyers and first time homebuyers purchase a home in California | The California Housing Finance Agency - CalHFA offers a variety of loan programs to help homebuyers and first time homebuyers purchase a home in California Are you looking to buy your first house? Check out our list of first-time home buyer programs, grants and mortgage loan options to see how you qualify The City of Houston offers up to $50, to income-qualified residents. The City assists first-time homebuyers in the city limits through our Homebuyer |  |

Mir scheint es, Sie sind recht