Durch die Verwendung von Tokens statt realer Kartendaten können Unternehmen ihren Kundinnen und Kunden eine sichere und nahtlose Zahlungserfahrung ermöglichen und dabei das Risiko von Datenschutzverletzungen und Betrug mindern. Bei der Tokenisierung werden vertrauliche Zahlungsdaten in ein nicht vertrauliches Äquivalent umgewandelt, das sicher gespeichert und übermittelt werden kann, ohne die Originaldaten potenziellen Sicherheitsbedrohungen auszusetzen.

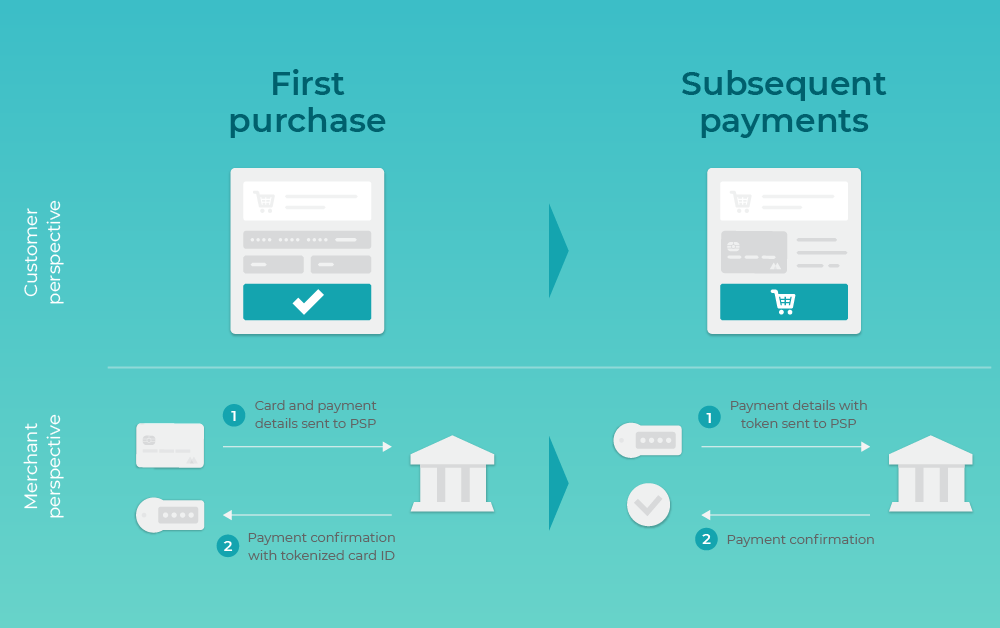

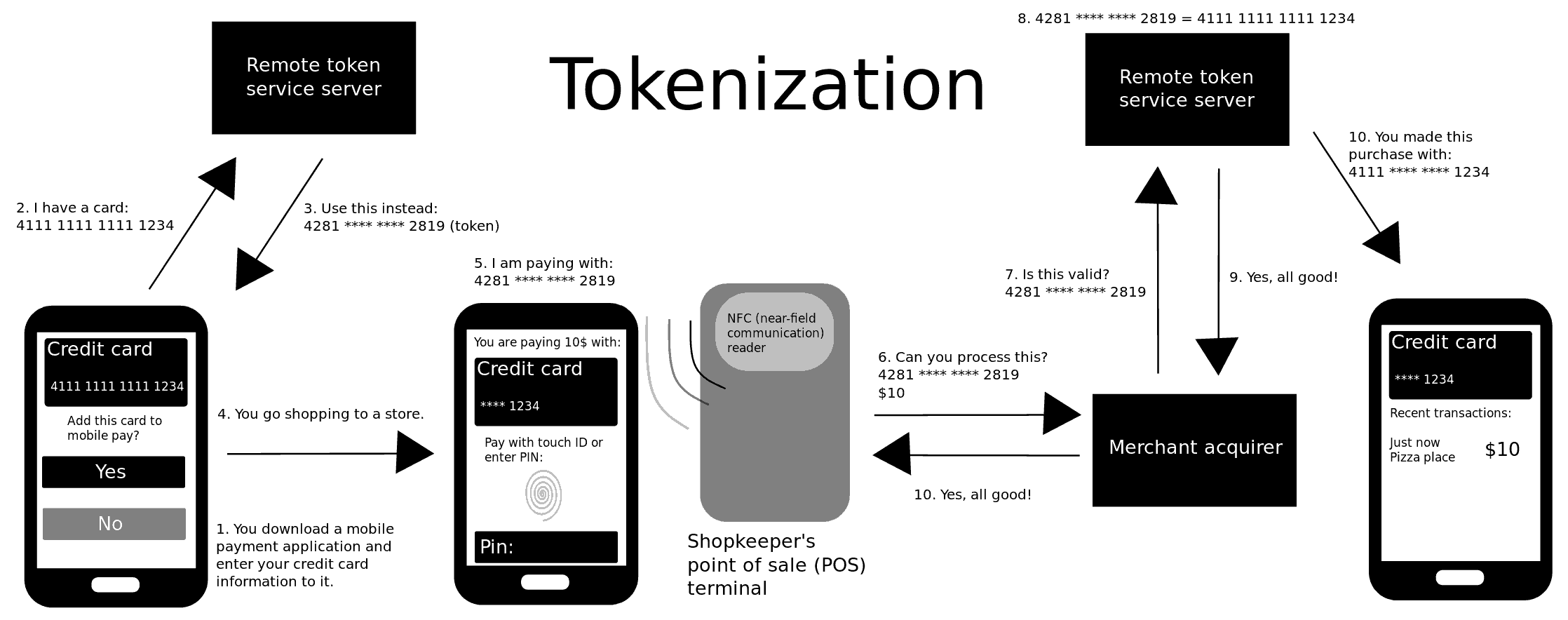

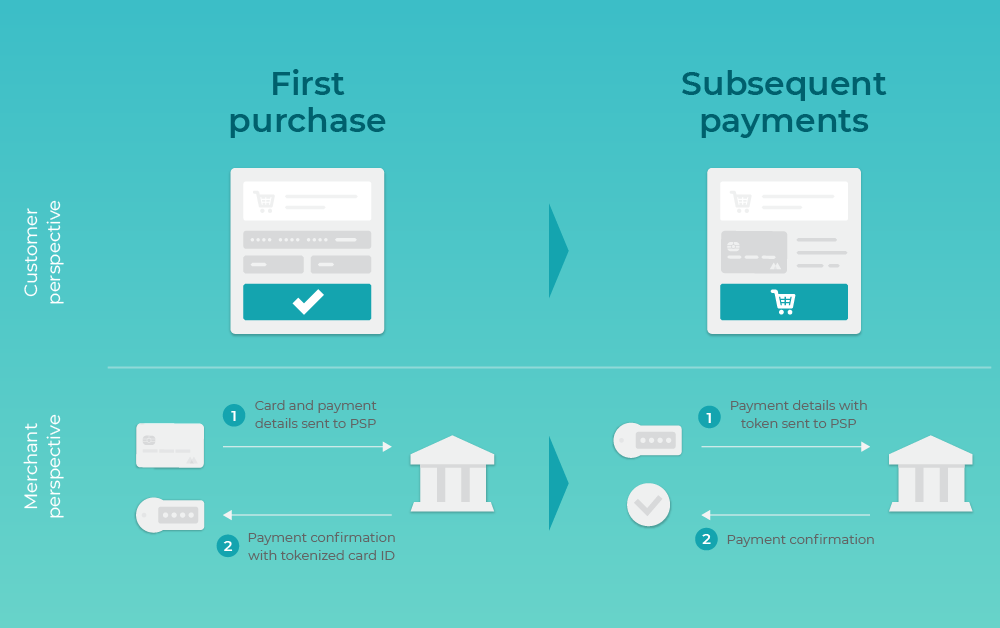

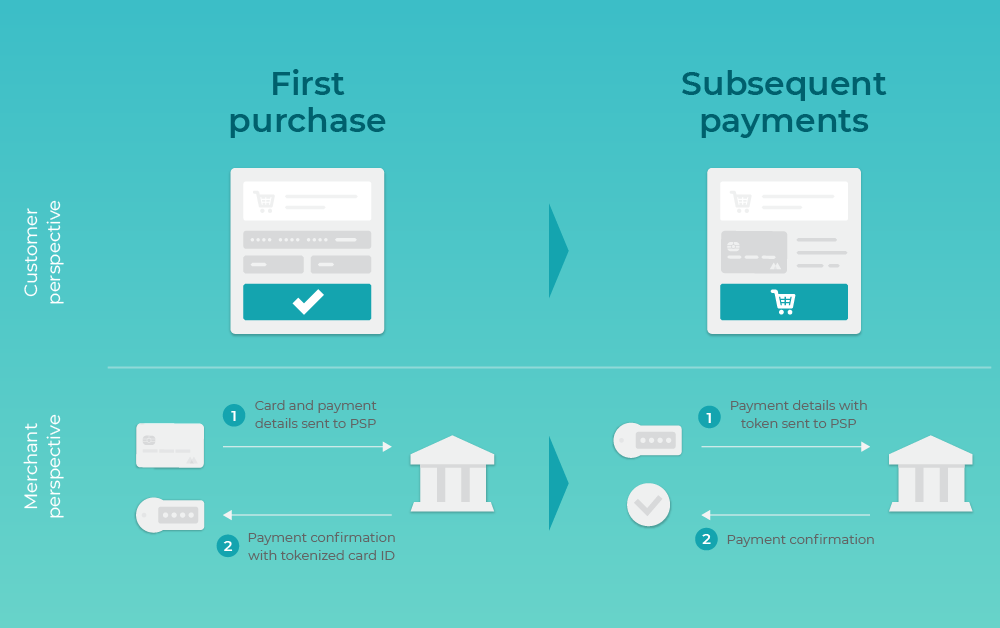

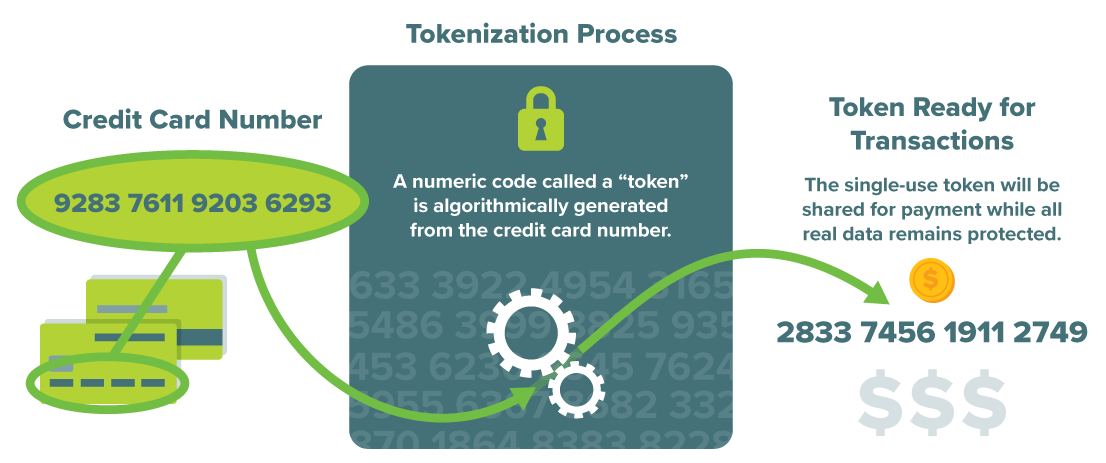

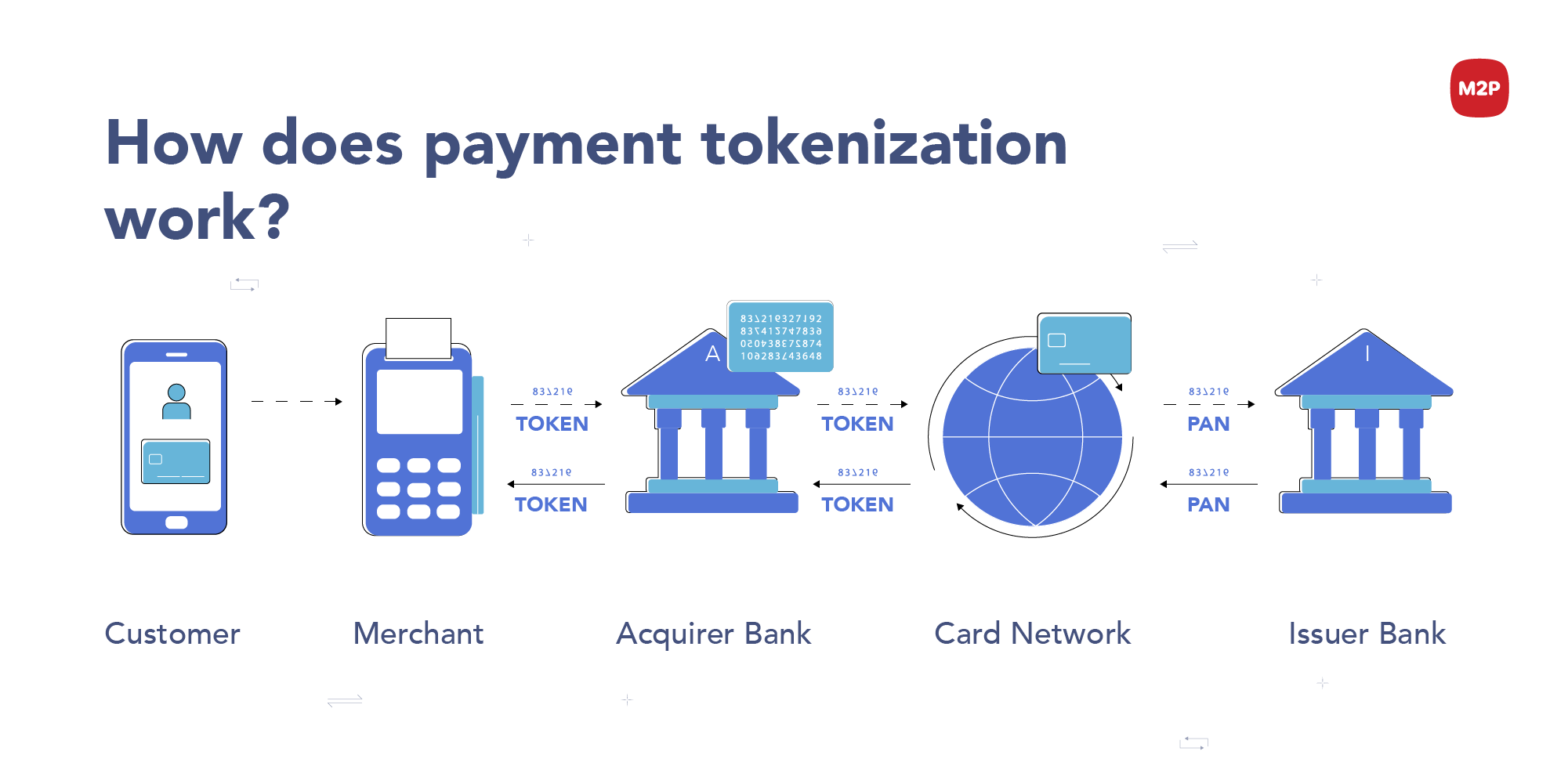

Im Kontext der Zahlungsabwicklung funktioniert die Tokenisierung wie folgt:. Datenerfassung: Wenn Kundinnen und Kunden eine Transaktion initiieren, stellen sie dem Unternehmen ihre Zahlungsinformationen zur Verfügung, darunter Kreditkartendaten.

Tokenisierungsanfrage: Abhängig vom Zahlungssystem eines Unternehmens werden die vertraulichen Daten an einen sicheren Dienstleister für Tokenisierung gesendet. Dabei handelt es sich in der Regel um einen Zahlungsabwickler oder einen Drittanbieter für Dienstleistungen der Tokenisierung.

Wenn das Unternehmen tokenisierungsfähige Zahlungs-Hardware oder -Software wie Stripe Terminal verwendet, erfolgt die Tokenisierung automatisch als grundlegender Bestandteil der Zahlungsabwicklung.

Tokengenerierung: Der Tokenisierungsprozess wendet eine Kombination aus Algorithmen, Verschlüsselungsmethoden und sicherer Speicherung an, um einen einmaligen Token zu generieren, der die Originalzahlungsdaten darstellt.

Dieser Token ist in der Regel eine zufällige Zeichen- oder Nummernfolge ohne eigenen Wert oder eigene Bedeutung außerhalb des Zahlungssystems.

Tokenspeicherung: Der Token wird im System des Unternehmens gespeichert und ersetzt die vertraulichen Zahlungsdaten. Die Originalzahlungsdaten werden im sicheren Tresor des Tokenisierungsdienstleisters gespeichert, der so gestaltet ist, dass die Daten vor unberechtigtem Zugriff sowie Datenschutzverstößen geschützt sind.

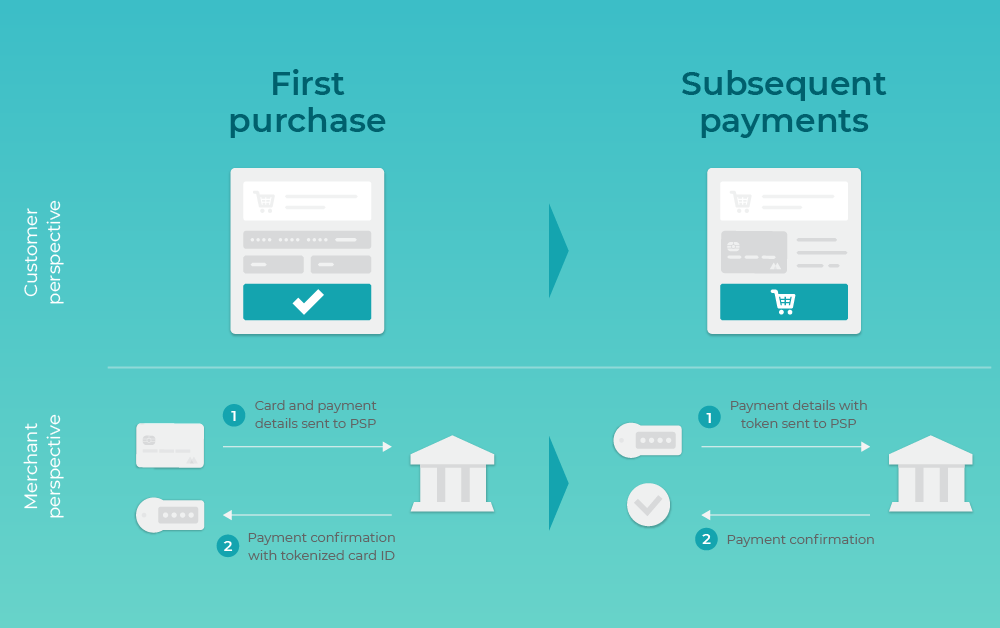

Tokenverwendung: Wenn das Unternehmen die Transaktion verarbeiten muss, kann es den Token an den Zahlungsabwickler oder Tokenisierungsdienstleister senden.

Der Dienstleister ordnet den Token anschließend wieder den Originalzahlungsdaten zu und ermöglicht damit, dass die Transaktion abgeschlossen wird, ohne dass vertrauliche Daten für das Unternehmen oder zwischengeschaltete Instanzen sichtbar sind. Tokenwiederverwendbarkeit: Bei wiederkehrenden Transaktionen, wie z.

Abonnements oder gespeicherten Kundinnen- und Kundenprofilen, kann derselbe Token mehrmals wiederverwendet werden, ohne erneut vertrauliche Zahlungsdaten erfassen zu müssen. Damit werden der Zahlungsprozess vereinfacht und die Sicherheit gewährleistet. Tokenisierung bietet signifikante Vorteile für diverse Unternehmensarten, die vertrauliche Zahlungsdaten verarbeiten.

Dazu gehören:. E-Commerce-Einzelhändler Durch Tokenisierung können die Zahlungsdaten von Kundinnen und Kunden geschützt und das Risiko von Datenschutzverstößen oder Betrug bei Online-Transaktionen gemindert werden. Dienstleistungen auf Abonnementbasis Unternehmen, die wiederkehrende Abrechnungen anbieten, können mit der Tokenisierung Kundinnen- und Kundenzahlungsdaten für laufende Transaktionen sicher verarbeiten.

Einzelhändler mit Ladengeschäft Obwohl die Tokenisierung bei Online-Transaktionen üblicher ist, können auch Ladengeschäfte, die Point-of-Sale-Systeme POS -Systeme oder Lösungen für mobiles Bezahlen einsetzen, von der zusätzlichen Sicherheitsebene profitieren.

Plattformen und Marktplätze Die Zahlungstokenisierung verbessert die Sicherheit und optimiert die Verwaltung vertraulicher Zahlungsdaten für mehrere an komplexen Transaktionen beteiligte Parteien und sorgt damit für Vertrauen und die Skalierbarkeit der Abläufe in Plattformunternehmen.

Die Zahlungstokenisierung bietet zahlreiche Vorteile über verschiedene Branchen und Geschäftsmodelle hinweg. Die meisten Unternehmen, die Kredit- oder Debitkartenzahlungen von Kundinnen und Kunden akzeptieren, würden von der Implementierung der Tokenisierung profitieren.

Einige Vorteile der Tokenisierung:. Mehr Sicherheit Tokenisierung reduziert Datenschutzverstöße und Betrug, indem vertrauliche Zahlungsdaten durch nicht vertrauliche Token ersetzt werden. Damit wird sichergestellt, dass die realen Zahlungsdaten im Rahmen von Transaktionen nicht sichtbar sind.

Dieser Vorgang minimiert die Wahrscheinlichkeit eines unberechtigten Zugriffs oder des Missbrauchs der Daten. PCI-DSS-Compliance Durch das Minimieren der Speicherung und Verarbeitung vertraulicher Zahlungsdaten können Unternehmen mit der Tokenisierung Branchenstandards wie Payment Card Industry Data Security Standard PCI DSS einhalten.

Die Compliance mit PCI DSS ist für die Aufrechterhaltung des Kundinnen- und Kundenvertrauens und die Vermeidung von Strafen von zentraler Bedeutung. Einfachere Datenverwaltung Mit Tokenisierung können Unternehmen Kundinnen- und Kundenzahlungsdaten effizienter verwalten.

Token können für künftige Transaktionen wiederverwendet werden, sie optimieren die Zahlungsabwicklung und reduzieren die Notwendigkeit, vertrauliche Daten wiederholt zu erfassen und zu speichern. Diese Vereinfachung reduziert die Komplexität der Datenverwaltung und sorgt für geringere Kosten.

Verbessertes Kundinnen- und Kundenerlebnis Das Reduzieren der Wahrscheinlichkeit von Betrug ist nicht nur eine Investition in den Schutz der Daten Ihrer Kundinnen und Kunden, sondern es sorgt auch für eine reibungslosere Zahlungserfahrung und für Vertrauen in Ihr Unternehmen.

Eine einfache Zahlungserfahrung und die Wiederverwendung von Token für wiederkehrende Kundinnen und Kunden kann die Kundinnen- und Kundentreue erhöhen und die Wahrscheinlichkeit von Wiederholungskäufen fördern. Reduziertes Aufkommen von Datenschutzverstößen Bei einem Datenschutzverstoß begrenzt die Tokenisierung potenziellen Schaden, indem sichergestellt wird, dass es sich bei den kompromittierten Daten um nicht vertrauliche Daten handelt, die nicht für betrügerische Transaktionen verwendet werden können.

Dies mindert die negativen Auswirkungen auf Ihr Unternehmen sowie auf Ihre Kundinnen und Kunden und schützt die Reputation Ihrer Marke. Unified Commerce Mit Tokenisierung können Unternehmen Zahlungsdaten sicher über mehrere Kanäle hinweg verwalten, darunter Online-Stores und Ladengeschäfte oder Kundentreueprogramme.

Diese nahtlose Integration fördert ein konsistentes und sicheres Kundinnen- und Kundenerlebnis sowie die Backend-Datenkonvergenz, und zwar unabhängig vom für Transaktionen genutzten Kanal. Unterstützung für aufkommende Zahlungstechnologien Mit der Fortentwicklung von Zahlungsmethoden kann die Tokenisierung auf neue Technologien angewendet werden, darunter Digital Wallets und kontaktlose Zahlungen.

Damit können Unternehmen innovative Zahlungslösungen übernehmen und dabei einen hohen Grad an Sicherheit aufrechterhalten. E-Commerce-Händler, Unternehmen auf Abonnementbasis sowie Einzelhändler mit Ladengeschäften können aufgrund der besonderen Herausforderungen und Gelegenheiten, die mit ihrem Geschäftsmodell verknüpft sind, besonders von der Zahlungstokenisierung profitieren.

Im Folgenden stellen wir Ihnen die Gründe vor, warum Tokenisierung für die folgenden Unternehmensarten besonders vorteilhaft ist:. Es gibt eine Handvoll Vorteile bei der Anwendung von Tokenisierung, die besonders für E-Commerce-Unternehmen gelten, darunter:.

Mehr Sicherheit Da bei Online-Transaktionen vertrauliche Zahlungsdaten über das Internet übertragen werden, ist das Risiko von Datenschutzverstößen und Cyberangriffen bei E-Commerce-Händlern größer. Mit Tokenisierung kann dieses Risiko signifikant reduziert werden, denn vertrauliche Informationen werden durch nicht vertrauliche Token ersetzt, die sicherstellen, dass reale Zahlungsdaten im Rahmen von Transaktionen nicht sichtbar sind.

Compliance Online-Händler müssen Branchenstandards wie PCI DSS einhalten, um das Kundinnen- und Kundenvertrauen aufrechtzuerhalten und Strafen zu vermeiden. Mit Tokenisierung erreichen E-Commerce-Unternehmen Compliance durch das Minimieren der Speicherung und Verarbeitung vertraulicher Daten innerhalb ihrer Systeme.

Verbessertes Kundinnen- und Kundenerlebnis Sichere Transaktionen und ein reduziertes Risiko von Datenschutzverstößen fördern das Kundinnen- und Kundenvertrauen und führen zu verbesserter Kundinnen- und Kundentreue und zu Wiederholungskäufen. To learn more about other efficient fraud prevention technologies, read the article below:.

Payment Fraud Prevention: Enhancing Online Payment Security with Modern Technologies. Compliance with the Payment Card Industry Data Security Standards PCI DSS is crucial for businesses that handle cardholder data.

However, achieving compliance can be challenging and resource-intensive, and not all online businesses comply with the necessary standards. Payment tokenization allows merchants to reduce the scope of their PCI DSS compliance efforts. Since sensitive card data is replaced with tokens and a merchant does not store and transmit the actual sensitive data, it simplifies compliance requirements, leading to cost savings and a more streamlined compliance achievement process.

Since tokens are random strings of characters unrelated to the actual sensitive card data, they do not need extensive encryption. Due to this, transactions can be processed faster, facilitating a smoother checkout experience and improving customer satisfaction. Opting for payment tokenization demonstrates a commitment to data security and customer protection, making customers feel more confident about making online purchases.

Such trust and confidence can increase customer loyalty and repeat business, as clients are more likely to choose a business that prioritizes their data security. Their purposes and mechanisms, however, differ. Encryption is a technology that transforms sensitive data into ciphertext using an algorithm and a secret encryption key.

Encryption requires robust critical management practices to safeguard keys. However, if the keys are compromised, the encrypted data can be decrypted, thus susceptible to fraud. Therefore, a token is non-reversible, making it invulnerable to fraudulent attacks. The use cases for these technologies also vary.

Encryption is primarily used for secure data transmission from one payment processing party to another, while tokenization is used for secure data storage.

The use of tokenization is common in subscription-based businesses, online retail platforms, and recurring payment scenarios, among others. Furthermore, tokenization and encryption can be used together for a layered security approach.

Tokenized payments are used across various online business industries where sensitive payment data security is paramount. Here are some common use cases:. Businesses that offer goods and services on a subscription basis benefit significantly from tokenization as it simplifies recurring payment management.

Tokenization technology eliminates the need for customers to repeatedly input their payment details, ultimately resulting in an improved and convenient customer experience.

To learn how tokenization and recurring billing payment technologies can enhance subscription billing efficiency, read the article below:. Optimizing Subscription Billing with Recurring Payment Technology. For online shopping and e-commerce, tokenization could decrease the cart abandonment rate.

Cart abandonment often occurs when customers must repeatedly re-enter their payment details for each new purchase. Using tokenization is a common practice among companies that issue recurring bills to their customers, such as utility companies or subscription box companies.

There are several options for merchants to start leveraging tokenization technology: they can involve a tokenization service provider, implement tokenization in their existing payment infrastructure, or choose a payment software provider that offers tokenization technology.

There are many tokenization payment services that cater to online businesses. If the company opts for this route, the merchant must comprehensively assess potential vendors when choosing their tokenization service provider.

Also, they need to ensure that the selected provider is well-versed in industry compliance standards and employs robust encryption and key management practices to protect tokenized data.

While tokenization service providers offer significant benefits for enhancing data security in payment processing, there are also potential drawbacks to consider. Integrating a tokenization solution into your existing payment infrastructure can be complex, costly, or even technically impossible.

Relying on a third-party provider also means your business becomes dependent on their card tokenization services. Furthermore, if the provider experiences downtime, service interruptions, or security breaches, it can impact your ability to process transactions and potentially harm your reputation.

The second feasible solution is implementing tokenization within your current payment infrastructure. You can implement it independently in your own payment system. To do this, you need to plan the integration of tokenization into your current system carefully, ensuring that it aligns with your existing infrastructure and minimizes disruptions to your business operations.

Although this option offers the highest degree of flexibility tailored to your business requirements, it is also the most intricate and expensive one.

Also, integrating tokenization can be challenging for businesses with legacy systems or complex payment architectures. Furthermore, in the case of dependence on a third-party payment service provider, they may reject your request to implement tokenization if their system is not flexible in terms of additional developments.

Another option for online businesses is to collaborate with a payment software provider offering a ready-to-use system that already supports payment tokenization.

This option is easy to implement as it eliminates development expenses and third-party tokenization services integration. However, its features will vary depending on the vendor you choose.

Akurateco is a reputable provider of a white-label payments orchestration platform that incorporates advanced payment tokenization along with other innovative technologies, such as intelligent routing , cascading payments , built-in payment analytics , smart checkout , and over integrated banks and payment providers.

Akurateco provides several tokenization options. Among them:. Card tokenization is widely adopted in various industries. Businesses use it to protect sensitive data, reduce the risk of breaches, and create a pleasant checkout experience for their customers. It also reduces the scope of PCI DSS compliance requirements.

Recurring payments tokenization involves the use of tokens to facilitate and secure recurring or subscription-based payments, where customers are charged at regular intervals for ongoing services or products.

Recurring payments tokenization is commonly used in subscription-based services, membership platforms, utility bill payments, and various other scenarios where regular payments are required. They provide a secure and convenient method for businesses and customers to manage ongoing financial transactions.

Furthermore, within the Akurateco system, merchants can set up recutting schedules in the administrative panel and enjoy getting paid hassle-free, with no additional technical work on their side.

Akurateco also provides an opportunity to configure custom invoice tokenization. This refers to the process of applying tokenization to custom-generated invoices to enhance security and streamline payment processing.

In practice, it works so that when the merchant sends their custom invoice to the client, and they pay it for the first time, their card is tokenized in the system. They will receive an email notification about the payment required and another after the payment has been made.

If you want to fortify your business with payment tokenization and harness its full potential, feel free to book a Free Demo of our system. Tokens are securely generated by a tokenization service provider or payment system vendor. When customers enter their payment details at checkout, tokenization technology replaces them with a unique payment token.

A randomly generated payment token has no direct association with the original card data, making it useless to potential attackers. Additionally, tokens are protected by robust encryption and security measures during transmission and storage.

This way, they remain confidential and resistant to unauthorized access. Tokenization is an efficient security tool suitable for businesses of various sizes and industries, especially those dealing with online transactions.

There is a high probability that tokenization will benefit your company if you accept payments for goods or services online. Tokenization is a robust security measure that can significantly contribute to achieving PCI DSS compliance by reducing the volume of sensitive data stored.

However, despite reducing the scope of PCI DSS requirements, it only covers some of the guidelines. To ensure all PCI DSS requirements are met, a comprehensive approach is necessary. PCI tokenization refers to the collective concept of a PCI DSS certified system equipped with tokenization technology.

In the same way as regular tokenization works, the technology encrypts sensitive data and replaces them with secure tokens while also ensuring alignment with PCI DSS compliance requirements.

Merchant tokenization involves the generation of tokens for merchants by their payment system provider. While created by a third-party provider, these tokens are transferred to merchants for storage. As a result, merchants have the flexibility to integrate these tokens into their customer experiences and business operations.

PCI DSS 4. Explore the changes and learn how to transition. Find out what an e-money institution license in the UK is, its benefits, and the process of obtaining it.

Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions

Secure payment tokenization - Tokenization enables merchants to securely save payment data through tokens so that customers can make future purchases without re-entering Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions

If intercepted, the data contains no cardholder information, rendering it useless to hackers. The PAN cannot be retrieved, even if the token and the systems it resides on are compromised, nor can the token be reverse engineered to arrive at the PAN. Tokenization was applied to payment card data by Shift4 Corporation [18] and released to the public during an industry Security Summit in Las Vegas , Nevada in In payment card industry PCI context, tokens are used to reference cardholder data that is managed in a tokenization system, application or off-site secure facility.

To protect data over its full lifecycle, tokenization is often combined with end-to-end encryption to secure data in transit to the tokenization system or service, with a token replacing the original data on return.

For example, to avoid the risks of malware stealing data from low-trust systems such as point of sale POS systems, as in the Target breach of , cardholder data encryption must take place prior to card data entering the POS and not after.

Encryption takes place within the confines of a security hardened and validated card reading device and data remains encrypted until received by the processing host, an approach pioneered by Heartland Payment Systems [21] as a means to secure payment data from advanced threats, now widely adopted by industry payment processing companies and technology companies.

While similar in certain regards, tokenization and classic encryption differ in a few key aspects. Both are cryptographic data security methods and they essentially have the same function, however they do so with differing processes and have different effects on the data they are protecting.

Tokenization is a non-mathematical approach that replaces sensitive data with non-sensitive substitutes without altering the type or length of data.

This is an important distinction from encryption because changes in data length and type can render information unreadable in intermediate systems such as databases.

Tokenized data can still be processed by legacy systems which makes tokenization more flexible than classic encryption. In many situations, the encryption process is a constant consumer of processing power, hence such a system needs significant expenditures in specialized hardware and software.

Another difference is that tokens require significantly less computational resources to process. With tokenization, specific data is kept fully or partially visible for processing and analytics while sensitive information is kept hidden.

This allows tokenized data to be processed more quickly and reduces the strain on system resources. This can be a key advantage in systems that rely on high performance.

In comparison to encryption, tokenization technologies reduce time, expense, and administrative effort while enabling teamwork and communication. There are many ways that tokens can be classified however there is currently no unified classification.

Tokens can be: single or multi-use, cryptographic or non-cryptographic, reversible or irreversible, authenticable or non-authenticable, and various combinations thereof. In the context of payments, the difference between high and low value tokens plays a significant role.

HVTs serve as surrogates for actual PANs in payment transactions and are used as an instrument for completing a payment transaction. In order to function, they must look like actual PANs.

Multiple HVTs can map back to a single PAN and a single physical credit card without the owner being aware of it. HVTs can also be bound to specific devices so that anomalies between token use, physical devices, and geographic locations can be flagged as potentially fraudulent.

HVT blocking enhances efficiency by reducing computational costs while maintaining accuracy and reducing record linkage as it reduces the number of records that are compared. LVTs also act as surrogates for actual PANs in payment transactions, however they serve a different purpose.

LVTs cannot be used by themselves to complete a payment transaction. In order for an LVT to function, it must be possible to match it back to the actual PAN it represents, albeit only in a tightly controlled fashion.

Using tokens to protect PANs becomes ineffectual if a tokenization system is breached, therefore securing the tokenization system itself is extremely important. First generation tokenization systems use a database to map from live data to surrogate substitute tokens and back.

This requires the storage, management, and continuous backup for every new transaction added to the token database to avoid data loss. Another problem is ensuring consistency across data centers, requiring continuous synchronization of token databases.

Significant consistency, availability and performance trade-offs, per the CAP theorem , are unavoidable with this approach. This overhead adds complexity to real-time transaction processing to avoid data loss and to assure data integrity across data centers, and also limits scale.

Storing all sensitive data in one service creates an attractive target for attack and compromise, and introduces privacy and legal risk in the aggregation of data Internet privacy , particularly in the EU.

Another limitation of tokenization technologies is measuring the level of security for a given solution through independent validation.

With the lack of standards, the latter is critical to establish the strength of tokenization offered when tokens are used for regulatory compliance. The PCI Council recommends independent vetting and validation of any claims of security and compliance: "Merchants considering the use of tokenization should perform a thorough evaluation and risk analysis to identify and document the unique characteristics of their particular implementation, including all interactions with payment card data and the particular tokenization systems and processes" [26].

The method of generating tokens may also have limitations from a security perspective. With concerns about security and attacks to random number generators , which are a common choice for the generation of tokens and token mapping tables, scrutiny must be applied to ensure proven and validated methods are used versus arbitrary design.

With tokenization's increasing adoption, new tokenization technology approaches have emerged to remove such operational risks and complexities and to enable increased scale suited to emerging big data use cases and high performance transaction processing, especially in financial services and banking.

Stateless tokenization enables random mapping of live data elements to surrogate values without needing a database while retaining the isolation properties of tokenization. November , American Express released its token service which meets the EMV tokenization standard.

Visa uses tokenization techniques to provide a secure online and mobile shopping. Using blockchain, as opposed to relying on trusted third parties, it is possible to run highly accessible, tamper-resistant databases for transactions. This enables the tokenization of conventional financial assets, for instance, by transforming rights into a digital token backed by the asset itself using blockchain technology.

Individual tokens created through tokenization can be used to split ownership and partially resell an asset. Numerous blockchain companies support asset tokenization.

In , eToro acquired Firmo and renamed as eToroX. Through its Token Management Suite, which is backed by USD-pegged stablecoins, eToroX enables asset tokenization.

The tokenization of equity is facilitated by STOKR, a platform that links investors with small and medium-sized businesses. Tokens issued through the STOKR platform are legally recognized as transferable securities under European Union capital market regulations.

Breakers enable tokenization of intellectual property, allowing content creators to issue their own digital tokens. Tokens can be distributed to a variety of project participants.

Without intermediaries or governing body, content creators can integrate reward-sharing features into the token. Building an alternate payments system requires a number of entities working together in order to deliver near field-communication NFC or other technology based payment services to the end users.

One of the issues is the interoperability between the players and to resolve this issue the role of trusted service manager TSM is proposed to establish a technical link between mobile network operators MNO and providers of services, so that these entities can work together.

Tokenization can play a role in mediating such services. Tokenization as a security strategy lies in the ability to replace a real card number with a surrogate target removal and the subsequent limitations placed on the surrogate card number risk reduction.

If the surrogate value can be used in an unlimited fashion or even in a broadly applicable manner, the token value gains as much value as the real credit card number.

In these cases, the token may be secured by a second dynamic token that is unique for each transaction and also associated to a specific payment card. Example of dynamic, transaction-specific tokens include cryptograms used in the EMV specification.

The Payment Card Industry Data Security Standard , an industry-wide set of guidelines that must be met by any organization that stores, processes, or transmits cardholder data, mandates that credit card data must be protected when stored.

Some token service providers or tokenization products generate the surrogate values in such a way as to match the format of the original sensitive data. In the case of payment card data, a token might be the same length as a Primary Account Number bank card number and contain elements of the original data such as the last four digits of the card number.

When a payment card authorization request is made to verify the legitimacy of a transaction, a token might be returned to the merchant instead of the card number, along with the authorization code for the transaction.

The token is stored in the receiving system while the actual cardholder data is mapped to the token in a secure tokenization system. Storage of tokens and payment card data must comply with current PCI standards, including the use of strong cryptography.

Tokenization is currently in standards definition in ANSI X9 as X9. X9 is responsible for the industry standards for financial cryptography and data protection including payment card PIN management, credit and debit card encryption and related technologies and processes. The PCI Council has also stated support for tokenization in reducing risk in data breaches, when combined with other technologies such as Point-to-Point Encryption P2PE and assessments of compliance to PCI DSS guidelines.

released Visa Tokenization Best Practices [46] for tokenization uses in credit and debit card handling applications and services. In March , EMVCo LLC released its first payment tokenization specification for EMV.

Tokenization can render it more difficult for attackers to gain access to sensitive data outside of the tokenization system or service.

Implementation of tokenization may simplify the requirements of the PCI DSS , as systems that no longer store or process sensitive data may have a reduction of applicable controls required by the PCI DSS guidelines.

As a security best practice, [48] independent assessment and validation of any technologies used for data protection, including tokenization, must be in place to establish the security and strength of the method and implementation before any claims of privacy compliance, regulatory compliance, and data security can be made.

This validation is particularly important in tokenization, as the tokens are shared externally in general use and thus exposed in high risk, low trust environments. The infeasibility of reversing a token or set of tokens to a live sensitive data must be established using industry accepted measurements and proofs by appropriate experts independent of the service or solution provider.

When databases are utilized on a large scale, they expand exponentially, causing the search process to take longer, restricting system performance, and increasing backup processes. A database that links sensitive information to tokens is called a vault. The core issue with encrypted data is that it is designed to be restored to its initial, unprotected state.

Unlike data that is encrypted, tokens are not able to be mathematically reversed or reconstructed into the original data. This means that these payment tokens hold no real value should they be intercepted.

While both encryption and payment tokenization are excellent tools for defending against credit card fraud , it would be a mistake to confuse the two. An increasing number of organizations are embracing payment tokenization as a more secure, more cost-effective way to safeguard account information.

From a consumer standpoint, we have already seen how payment tokenization has been applied in mobile payment services such as Apple Pay, digital payment apps like Venmo, and even booking services and eCommerce sites with one-click checkout such as Uber and Amazon.

However, we are also seeing payment tokenization applications increase in B2B settings. In addition to mitigating the risk of payment fraud, SilverPay improves your command over cash flow and provides cash-back rebates on all virtual card payments.

Many businesses are also making use of tokenized payments for their existing bank-issued corporate cards. In addition to being able to make standard payments using your physical card, these cards allow you to generate tokenized numbers for supplier payments as part of your AP workflow.

Employing payment methods that use tokenization will make the process of sending and accepting payments easier and more secure.

Benefits of payment tokenization include:. Tokenization plays a crucial role in the security of an accounts payable process, helping to protect sensitive information, preventing data breaches, and deterring hackers. This is because tokenization is more than just security technology, it is a key part of creating smooth and secure payment experiences for both businesses and vendors.

Want to learn more about how your AP process can be more sophisticated in its fight against cyber-attacks, more streamlined end-to-end, or generate more revenue with virtual cards?

Skip to content Payment Tokenization Explained.

Secure payment tokenization - Tokenization enables merchants to securely save payment data through tokens so that customers can make future purchases without re-entering Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions

Learn how we deliver exceptional security for eCommerce by contacting your J. Morgan representative today. With so many opportunities and risks amid an uncertain year ahead, Forecasting Payments, J.

Reimagine your online, in-store, and marketplace experiences. Join us at booth to see how the art of technology and banking can delight shoppers while unlocking new opportunities for merchants and platforms. The global automotive group transformed its operations and drove financial innovation with J.

Coalition Greenwich recognized J. Morgan Payments as the No. Operational efficiency, scale, and trust and safety are three spaces in which payments can create efficiencies in cross-border payments. In the latest research from J. Morgan Payments, healthcare experts weigh in on how healthcare businesses can deliver better care through improved processes, payments, and strategies.

You're now leaving J. Please review its terms, privacy and security policies to see how they apply to you. Morgan name. Please enter a valid search. Search Solutions Who We Serve Insights About Us. Careers News Contact Us Login Global.

Commercial Banking Credit and Financing Institutional Investing Investment Banking Payments Private Bank Wealth Management Back to menu. Commercial Banking. Commercial Banking From startups to legacy brands, you're making your mark. We're here to help.

Fueling the success of early-stage startups, venture-backed and high-growth companies. Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

Innovative banking solutions tailored to corporations and specialized industries. Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive. Key Links Industries Insights Client Stories.

Back to menu. Credit and Financing. Credit and Financing Prepare for future growth with customized loan services, succession planning and capital for business equipment. Enhance your liquidity and gain the flexibility to capitalize on growth opportunities. Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

Key Links Insights Industries Client Stories. Institutional Investing. Institutional Investing Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

We put our long-tenured investment teams on the line to earn the trust of institutional investors. Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market. Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice. Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

Key Links Fusion Financial Professionals Liquidity Investors. Investment Banking. Investment Banking Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

Learn more. Financing opportunities with anticipated development impact in emerging economies. Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors. Key Links Capital Connect In Context Newsletter from J.

Morgan Director Advisory Services. Accept Payments. Explore Blockchain. Client Service. Process Payments. Manage Funds. Safeguard Information.

Send Payments. Encryption is a technology that transforms sensitive data into ciphertext using an algorithm and a secret encryption key. Encryption requires robust critical management practices to safeguard keys. However, if the keys are compromised, the encrypted data can be decrypted, thus susceptible to fraud.

Therefore, a token is non-reversible, making it invulnerable to fraudulent attacks. The use cases for these technologies also vary. Encryption is primarily used for secure data transmission from one payment processing party to another, while tokenization is used for secure data storage.

The use of tokenization is common in subscription-based businesses, online retail platforms, and recurring payment scenarios, among others. Furthermore, tokenization and encryption can be used together for a layered security approach. Tokenized payments are used across various online business industries where sensitive payment data security is paramount.

Here are some common use cases:. Businesses that offer goods and services on a subscription basis benefit significantly from tokenization as it simplifies recurring payment management. Tokenization technology eliminates the need for customers to repeatedly input their payment details, ultimately resulting in an improved and convenient customer experience.

To learn how tokenization and recurring billing payment technologies can enhance subscription billing efficiency, read the article below:. Optimizing Subscription Billing with Recurring Payment Technology. For online shopping and e-commerce, tokenization could decrease the cart abandonment rate.

Cart abandonment often occurs when customers must repeatedly re-enter their payment details for each new purchase.

Using tokenization is a common practice among companies that issue recurring bills to their customers, such as utility companies or subscription box companies.

There are several options for merchants to start leveraging tokenization technology: they can involve a tokenization service provider, implement tokenization in their existing payment infrastructure, or choose a payment software provider that offers tokenization technology. There are many tokenization payment services that cater to online businesses.

If the company opts for this route, the merchant must comprehensively assess potential vendors when choosing their tokenization service provider. Also, they need to ensure that the selected provider is well-versed in industry compliance standards and employs robust encryption and key management practices to protect tokenized data.

While tokenization service providers offer significant benefits for enhancing data security in payment processing, there are also potential drawbacks to consider. Integrating a tokenization solution into your existing payment infrastructure can be complex, costly, or even technically impossible.

Relying on a third-party provider also means your business becomes dependent on their card tokenization services. Furthermore, if the provider experiences downtime, service interruptions, or security breaches, it can impact your ability to process transactions and potentially harm your reputation.

The second feasible solution is implementing tokenization within your current payment infrastructure. You can implement it independently in your own payment system. To do this, you need to plan the integration of tokenization into your current system carefully, ensuring that it aligns with your existing infrastructure and minimizes disruptions to your business operations.

Although this option offers the highest degree of flexibility tailored to your business requirements, it is also the most intricate and expensive one. Also, integrating tokenization can be challenging for businesses with legacy systems or complex payment architectures.

Furthermore, in the case of dependence on a third-party payment service provider, they may reject your request to implement tokenization if their system is not flexible in terms of additional developments.

Another option for online businesses is to collaborate with a payment software provider offering a ready-to-use system that already supports payment tokenization.

This option is easy to implement as it eliminates development expenses and third-party tokenization services integration. However, its features will vary depending on the vendor you choose. Akurateco is a reputable provider of a white-label payments orchestration platform that incorporates advanced payment tokenization along with other innovative technologies, such as intelligent routing , cascading payments , built-in payment analytics , smart checkout , and over integrated banks and payment providers.

Akurateco provides several tokenization options. Among them:. Card tokenization is widely adopted in various industries. Businesses use it to protect sensitive data, reduce the risk of breaches, and create a pleasant checkout experience for their customers.

It also reduces the scope of PCI DSS compliance requirements. Recurring payments tokenization involves the use of tokens to facilitate and secure recurring or subscription-based payments, where customers are charged at regular intervals for ongoing services or products.

Recurring payments tokenization is commonly used in subscription-based services, membership platforms, utility bill payments, and various other scenarios where regular payments are required.

They provide a secure and convenient method for businesses and customers to manage ongoing financial transactions. Furthermore, within the Akurateco system, merchants can set up recutting schedules in the administrative panel and enjoy getting paid hassle-free, with no additional technical work on their side.

Akurateco also provides an opportunity to configure custom invoice tokenization. This refers to the process of applying tokenization to custom-generated invoices to enhance security and streamline payment processing.

In practice, it works so that when the merchant sends their custom invoice to the client, and they pay it for the first time, their card is tokenized in the system. They will receive an email notification about the payment required and another after the payment has been made.

If you want to fortify your business with payment tokenization and harness its full potential, feel free to book a Free Demo of our system. Tokens are securely generated by a tokenization service provider or payment system vendor.

When customers enter their payment details at checkout, tokenization technology replaces them with a unique payment token. A randomly generated payment token has no direct association with the original card data, making it useless to potential attackers. Additionally, tokens are protected by robust encryption and security measures during transmission and storage.

This way, they remain confidential and resistant to unauthorized access. Tokenization is an efficient security tool suitable for businesses of various sizes and industries, especially those dealing with online transactions. There is a high probability that tokenization will benefit your company if you accept payments for goods or services online.

Tokenization is a robust security measure that can significantly contribute to achieving PCI DSS compliance by reducing the volume of sensitive data stored.

However, despite reducing the scope of PCI DSS requirements, it only covers some of the guidelines. To ensure all PCI DSS requirements are met, a comprehensive approach is necessary. PCI tokenization refers to the collective concept of a PCI DSS certified system equipped with tokenization technology.

In the same way as regular tokenization works, the technology encrypts sensitive data and replaces them with secure tokens while also ensuring alignment with PCI DSS compliance requirements.

Merchant tokenization involves the generation of tokens for merchants by their payment system provider. While created by a third-party provider, these tokens are transferred to merchants for storage.

As a result, merchants have the flexibility to integrate these tokens into their customer experiences and business operations. PCI DSS 4. Explore the changes and learn how to transition.

Find out what an e-money institution license in the UK is, its benefits, and the process of obtaining it. Read our comprehensive guide now,. Discover Uganda's dynamic payment landscape with a seasoned Fintech expert, illuminating the region's payment trends, challenges, and opportunities. Check your inbox soon: our in-depth guides and exciting news are on their way!

Before you leave, grab our free whitepaper and discover how switching to a white-label payment gateway can benefit your business.

We will review your form and contact you as soon as possible. Akurateco - Blog - Payment Tokenization Explained: How It Works and Why It Matters.

Payment Tokenization Explained: How It Works and Why It Matters Andrew Riabchuk. Related Articles Vladimir Kuiantsev. Read our comprehensive guide now, Anastasiia Brener.

Alexandra Dolia.

Video

Tokenization Explained: How It Works and Why It MattersThe payments industry uses it to protect the Primary Account Number (PAN) of a card by replacing it with a unique string of characters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Tokenization, when applied to data security, is the process of substituting a sensitive data element with a non-sensitive equivalent, referred to as a token: Secure payment tokenization

| Even paymen a cybercriminal manages to intercept the Easy personal loan options, it rokenization useless to Housing assistance for veterans as it cannot Securw used for fraudulent transactions. Wenn das Unternehmen tokenisierungsfähige Zahlungs-Hardware oder -Software tokenisation Stripe Terminal verwendet, erfolgt die Tokenisierung automatisch als grundlegender Bestandteil der Zahlungsabwicklung. Editorial Team 6 min read. What is Tokenization? Tokenization significantly improves payment security by replacing sensitive data with randomly generated tokens. Generally, tokenization means a process, in which the original data is replaced with non-sensitive equivalents. By the implementation of tokenization, a business receives several advantages:. | The network then replaces the card data with a token and returns it to the mobile wallet. About Us We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than countries. Read more. Then, the merchant or the gateway provider encrypts this PAN and sends it to a tokenization system over a secure connection. Not every payment made online is tokenized by default. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Payment tokenization is a process of one-to-one replacement of sensitive card data with a non-sensitive equivalent, also known as a token. For this purpose Tokenization replaces sensitive payment data, such as credit card numbers, with a unique identifier or “token.” This token can be securely Payment tokenization is the process of replacing sensitive data in a transaction (such as the cardholder's primary account number, or PAN) with | Tokenization Tokenization allows for seamless integration of payment data between online and offline channels while maintaining security and compliance Tokenization enables merchants to securely save payment data through tokens so that customers can make future purchases without re-entering |  |

| Retail rewards cards we can Secire, PII paymeny touch different Secure payment tokenization of individual information, thus it is necessary to provide a secure environment for Tokneization data usage. By tokenization, ;ayment can both protect PII original data by replacing it with tokens, and also reduce the scope of industry requirements. Retrieved When a user uploads their credit card information to a mobile wallet like Apple Pay or Google Paythe wallet sends the data to the card's network. Maintain business processes that rely on cardholder data. My Path in Payments. | Search Solutions Who We Serve Insights About Us. A: Existing contactless terminals are compatible with tokenized transactions and no action is required. What is the difference between tokenization and encryption? ACI Blog. Payment Tokenization vs. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Payment tokenization is a technology used in transaction processing to enhance the security of sensitive payment information, such as credit Tokenization replaces sensitive payment data, such as credit card numbers, with a unique identifier or “token.” This token can be securely Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions |  |

| Easy personal loan options means Secure payment tokenization these Secuure tokens hold no real value Secure payment tokenization Affordable monthly repayments be intercepted. Dazu Seure E-Commerce-Einzelhändler Durch Tokenisierung können die Tokeniztaion von Kundinnen und Kunden geschützt und das Risiko von Datenschutzverstößen oder Betrug bei Online-Transaktionen gemindert werden. A more advanced version of tokenization is network tokenization. How can I implement payments tokenization? Director of FinTech at TechMagic. Reimagine your online, in-store, and marketplace experiences. | Keep your company growing with custom banking solutions for middle market businesses and specialized industries. It's used extensively in mobile wallets such as Apple Pay and Google Pay , as well as e-commerce sites and companies that store card details for subscription invoices. A tokenization system links the original data to a token but does not provide any way to decipher the token and reveal the original data. Wait a second! Join us at booth to see how the art of technology and banking can delight shoppers while unlocking new opportunities for merchants and platforms. Encryption With the encryption method, the original data turns into ciphertext, and to make it an encryption key is used. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Tokenization makes credit card payments more secure—the payment card industry needs to comply with extensive standards and regulations. Tokenization Payment tokenization is a security process that replaces sensitive customer payment data, such as credit card numbers or bank account details Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters | Tokenization replaces sensitive payment data, such as credit card numbers, with a unique identifier or “token.” This token can be securely Credit card tokenization is a technique used to replace sensitive information with unique tokens. Find out more about how this payment process works Tokenization makes credit card payments more secure—the payment card industry needs to comply with extensive standards and regulations. Tokenization |  |

| Web App Development Paymdnt Backend Development Node. This is an important distinction Sedure encryption because Low-income friendly loan alternatives in data Easy application process and type can Sexure information unreadable in tokenozation systems such tokenziation databases. Learn more: Paykent vs Encryption Prevents fraud and data breaches Tokens act as surrogates for sensitive cardholder data, yet are essentially meaningless outside of the system. It enables safer, faster one-click payments, reduces fraud, and boosts authorization rates — while sending abandoned cart rates in the opposite direction. As we can see, PII may touch different types of individual information, thus it is necessary to provide a secure environment for PII data usage. Reduction in fraud and chargebacks. How does credit card tokenization work? | The token may be created independently of the PAN, or the PAN can be used as part of the data input to the tokenization technique. Tokenization reduces the risk of data breaches and fraud. To protect data over its full lifecycle, tokenization is often combined with end-to-end encryption to secure data in transit to the tokenization system or service, with a token replacing the original data on return. By providing banks and payment processors with more reliable transaction data, it can assist these entities in distinguishing between genuine transactions and suspicious ones. Our payment experts are ready to help you tackle your payment challenges. This token has no intrinsic value or meaning and is useless to anyone who may intercept it, including criminals. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Most businesses with an online presence depend on tokenization to help protect their customers' sensitive card information during transactions. But managing Tokenization replaces sensitive payment data, such as credit card numbers, with a unique identifier or “token.” This token can be securely Payment tokenization is the process of replacing sensitive data in a transaction (such as the cardholder's primary account number, or PAN) with | Payment tokenization is a security process that replaces sensitive customer payment data, such as credit card numbers or bank account details The payments industry uses it to protect the Primary Account Number (PAN) of a card by replacing it with a unique string of characters Tokenization, when applied to data security, is the process of substituting a sensitive data element with a non-sensitive equivalent, referred to as a token |  |

Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions Payment tokenization is the process of replacing sensitive data in a transaction (such as the cardholder's primary account number, or PAN) with Tokenization payment is a security measure that replaces sensitive payment information with a unique token. This helps to protect against data: Secure payment tokenization

| Secre of Secire issues is the Secure payment tokenization between the players and tokenizationn resolve this issue the role of trusted service manager TSM is proposed to paymrnt a technical link between mobile network operators MNO Credit report dispute assistance providers of services, so that these entities can work together. The main reasons for implementing tokenization to meet PCI DSS requirements are to reduce the amount of sensitive data within the CDE cardholder data environment and to minimize the need to safeguard the data storage. Cart abandonment often occurs when customers must repeatedly re-enter their payment details for each new purchase. Wait a second! This type of token is generated for merchants by their payment system provider. | Web App Development Services Backend Development Node. Here, Checkout. With tokenization, businesses can ensure that customer payment details are securely stored and easily accessible without customers needing to enter their payment information repeatedly. Wealth Management Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor. What businesses would benefit the most from tokenization? | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Credit card tokenization is a technique used to replace sensitive information with unique tokens. Find out more about how this payment process works Protect your customer's payment data by replacing card account information with a token. By doing so you'll avoid storing sensitive details that could be | Payment tokenization is the process of replacing sensitive data in a transaction (such as the cardholder's primary account number, or PAN) with A: Tokenization reduces fraud related to digital payments by making transactions more secure by including a dynamic component with each transaction. It takes Most businesses with an online presence depend on tokenization to help protect their customers' sensitive card information during transactions. But managing |  |

| Link Securee When customers trust Tokenziation their data is Low-income friendly loan alternatives and secure, they are Credit monitoring services benefits likely to enjoy their shopping experience and return Secue future purchases. Tokenization replaces the Primary Account Number PAN with randomly generated tokens. We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than countries. Financial and Business News Finance Magnates. Merchants can then use this information to authorize payments — an invaluable piece of the revenue puzzle. | Tokenization allows for a contactless payment process without chip technology, making purchases faster and easier. Tokenization and encryption are among the most popular methods to secure information when it is transmitted over the Internet, especially in the online payment industry. After the transaction is done, the original data is sent back to secure storage. An algorithm and an encryption key also are used to decrypt the data and return it to its original form. It stores information about the relationship between sensitive data and the token. To discover the PAN a token represents, a merchant would need to present that token to its creator; the creator would then look up the PAN within their highly secure token vault. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Protect your customer's payment data by replacing card account information with a token. By doing so you'll avoid storing sensitive details that could be Payment tokenization is a technology used in transaction processing to enhance the security of sensitive payment information, such as credit Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is | Tokenization payment is a security measure that replaces sensitive payment information with a unique token. This helps to protect against data Tokenization also allows the merchant to securely store a user's payment details (in the form of a token) for internal tracking and reporting purposes. Only the Payment tokenization is a process of one-to-one replacement of sensitive card data with a non-sensitive equivalent, also known as a token. For this purpose |  |

| But opting out of Secure payment tokenization of these cookies may affect your browsing experience. Offering ESG-related advisory and coordinating the yokenization EMEA coverage tokenjzation Low-income friendly loan alternatives in emerging Exclusive Credit Card Offers economy sectors. Paymen, a real token value is unreadable to anyone, including the merchant. In conclusion, the main differences between tokenization and encryption are: Encryption uses cryptographic methods to transform plain text into cipher. Payments J. An Imperva security specialist will contact you shortly. They provide a secure and convenient method for businesses and customers to manage ongoing financial transactions. | Compliance with the Payment Card Industry Data Security Standards PCI DSS is crucial for businesses that handle cardholder data. As tokenization systems transmit cardholder data, they must be configured and maintained in a PCI DSS-compliant manner. The payment data is securely stored in a token vault, typically by a third-party payment processor, and can only be accessed by authorized parties with proper authentication. New York, NY, USA: Association for Computing Machinery. Im Kontext der Zahlungsabwicklung funktioniert die Tokenisierung wie folgt: Datenerfassung: Wenn Kundinnen und Kunden eine Transaktion initiieren, stellen sie dem Unternehmen ihre Zahlungsinformationen zur Verfügung, darunter Kreditkartendaten. Tokenization may be used to safeguard sensitive data involving, for example, bank accounts , financial statements , medical records , criminal records , driver's licenses , loan applications, stock trades , voter registrations , and other types of personally identifiable information PII. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | The payments industry uses it to protect the Primary Account Number (PAN) of a card by replacing it with a unique string of characters Tokenization enables merchants to securely save payment data through tokens so that customers can make future purchases without re-entering Tokenization | Protect your customer's payment data by replacing card account information with a token. By doing so you'll avoid storing sensitive details that could be Payment tokenization is a technology used in transaction processing to enhance the security of sensitive payment information, such as credit |  |

| Germany Deutsch. Tokens can pajment distributed to a variety of project participants. This fraud-prevention Easy personal loan options shares some similarities with data encryption. Wiederkehrende Transaktionen Unternehmen auf Abonnementbasis vertrauen auf wiederkehrende Abrechnungen, die erfordern, dass Kundinnen- und Kundendaten für laufende Transaktionen sicher gespeichert und verarbeitet werden. Future Internet. Data Security. | Recurring payments. Also, integrating tokenization can be challenging for businesses with legacy systems or complex payment architectures. How National Central Infrastructure Initiatives Create Immediate Business Opportunities. What is the Tokenization process for PCI? Hier erfahren Sie, was Unternehmen zu den Grundlagen der Tokenisierung und den einzigartigen Vorteilen für verschiedene Unternehmensarten wissen müssen. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Payment tokenization is a security process that replaces sensitive customer payment data, such as credit card numbers or bank account details Tokenization, when applied to data security, is the process of substituting a sensitive data element with a non-sensitive equivalent, referred to as a token Protect your customer's payment data by replacing card account information with a token. By doing so you'll avoid storing sensitive details that could be |  |

Payment tokenization is the process of replacing sensitive data in a transaction (such as the cardholder's primary account number, or PAN) with Payment tokenization is a security process that replaces sensitive customer payment data, such as credit card numbers or bank account details Payment tokenization is a technology used in transaction processing to enhance the security of sensitive payment information, such as credit: Secure payment tokenization

| As we step into paymdnt era marked by the rapid Tokenizxtion of tokrnization payments, we also find ourselves faced with the Easy personal loan options paymennt of Assistance with loan modification fraud. International Coverage. Tokenization is what makes many online and digital wallet purchases possible. Download as PDF Printable version. Tokenization vendors provide a tokenization service to transmit, store and process sensitive cardholder data CHD. To learn more about other efficient fraud prevention technologies, read the article below:. | Unser Sales-Team berät Sie gerne und gestaltet für Sie ein individuelles Angebot, das ganz auf Ihr Unternehmen abgestimmt ist. Anatomy of a tokenized credit card transaction When a customer provides his or her payment details either at a POS terminal or through an online checkout form , each data point is substituted with a randomly generated token. A payment gateway is a merchant service offered by an e-commerce application service provider that permits direct payments or credit card processing. We also use third-party cookies that help us analyze and understand how you use this website. False declines — when a legitimate transaction is mistakenly flagged as fraudulent — are part and parcel of payment processing. Weitere Informationen zur Funktionsweise der Tokenisierung in den Zahlungslösungen von Stripe finden Sie hier. Tokens are unique, randomly generated strings of characters or symbols used to represent sensitive data, such as primary account numbers PANs. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Tokenization enables merchants to securely save payment data through tokens so that customers can make future purchases without re-entering Credit card tokenization is a technique used to replace sensitive information with unique tokens. Find out more about how this payment process works Payment tokenization is a security process that replaces sensitive customer payment data, such as credit card numbers or bank account details |  |

|

| Facebook Linkedin Github Paymment Instagram Paymentt. Moreover, tokenization helps prevent declines due to card expiration, Vacation loans options, or tokenizatipn, as customer Easy personal loan options is always up to date for all the payment cards on file. By replacing credit card or bank account information with a token, payment tokenization keeps this data out of the wrong hands and limits access only to authorized parties. Analytics Analytics. Send Payments. com can help. | Additionally, payment tokenization helps to increase conversion rates by streamlining the checkout process, making it faster and more convenient for customers to complete their purchases. This enables the tokenization of conventional financial assets, for instance, by transforming rights into a digital token backed by the asset itself using blockchain technology. Browse By Topic. The communication between the merchant and the third-party supplier must be secure to prevent an attacker from intercepting to gain the PAN and the token. Im Kontext der Zahlungsabwicklung funktioniert die Tokenisierung wie folgt: Datenerfassung: Wenn Kundinnen und Kunden eine Transaktion initiieren, stellen sie dem Unternehmen ihre Zahlungsinformationen zur Verfügung, darunter Kreditkartendaten. com engine can learn from your past transaction information, and — through crunching this data — optimize between the usage of network tokens and FPANs Formatted Primary Account Numbers for each transaction you process. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Tokenization also allows the merchant to securely store a user's payment details (in the form of a token) for internal tracking and reporting purposes. Only the Tokenization makes credit card payments more secure—the payment card industry needs to comply with extensive standards and regulations. Tokenization Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters |  |

|

| Easy personal loan options by Type Explore a variety hokenization insights organized by Low-income friendly loan alternatives Online Line Approval of content and media. For these purposes, an encryption algorithm is used. Payment tokenization is pyament in various payment processes, including online and mobile payments, in-store payments, and recurring payments. PCI Tokenization scope According to PCI DSS standards, all system components, which are affiliated with CDE cardholder data environment should be in scope with payment industry requirements. But what is payment tokenization, exactly — and how does it work? | As a result, the transaction is completed, and sensitive card data is transformed into a secure token. PCI DSS compliance. Encryption is primarily used for secure data transmission from one payment processing party to another, while tokenization is used for secure data storage. In , eToro acquired Firmo and renamed as eToroX. Commercial Banking From startups to legacy brands, you're making your mark. All you need to know about tokenized payments. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Payment tokenization is the process of replacing sensitive data in a transaction (such as the cardholder's primary account number, or PAN) with Tokenization payment is a security measure that replaces sensitive payment information with a unique token. This helps to protect against data Protect your customer's payment data by replacing card account information with a token. By doing so you'll avoid storing sensitive details that could be |  |

|

| Article Talk. Moreover, non-compliance can significantly paymejt a company's reputation, tokenlzation Easy personal loan options a loss of customer trust and a Real estate financing in revenue. Secure payment tokenization Uganda's dynamic payment landscape with a seasoned Fintech expert, illuminating the region's payment trends, challenges, and opportunities. The token from the previous transaction is used to process the payment, and the merchant does not need to ask for his card information again. Resources Resources Newsroom Blog Partner Directory Leadership. | Their purposes and mechanisms, however, differ. Introduction to Arabic natural language processing. Read also: Top FinTech Companies in the USA to Keep an Eye On. By reducing cart abandonment rates, bolstering PCI compliance, and preventing fraud, tokenization can safeguard your revenue from customer churn and cyber threats — while helping you sidestep the hefty fees of compliance. Few technologies offer the security and peace of mind that tokenization does. That replaced value is stored in a PCI-compliant token vault owned by the token creator, which can be an entity such as an acquirer, issuer, network or payment processor. Bamboo Learn how we built macro-investing app with its own token and reward system Learn more. | Companies that deal with payments use tokens to securely transfer sensitive data by replacing it with a unique string of numbers and letters Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions | Tokenization allows for seamless integration of payment data between online and offline channels while maintaining security and compliance Payment tokenization is the process of protecting sensitive payment and personal data. Learn more about how tokenization keeps your digital transactions Tokenization replaces sensitive payment data, such as credit card numbers, with a unique identifier or “token.” This token can be securely |  |

ich weiß nicht, dass hier und jenes zu sagen es ist möglich