For even greater protection, when you are certain your identity has been stolen, consider a credit freeze. If you believe someone may have stolen your personal or financial information and could use it to open fraudulent accounts in your name, contact one of the three major credit bureaus: Experian, Equifax, and TransUnion.

Request that they place a credit fraud alert on your account. You can usually complete the process online, but you can also do it by mail or phone. The bureau you contact is supposed to then notify the other two about the fraud alert, but you may want to contact all three yourself to cover your bases.

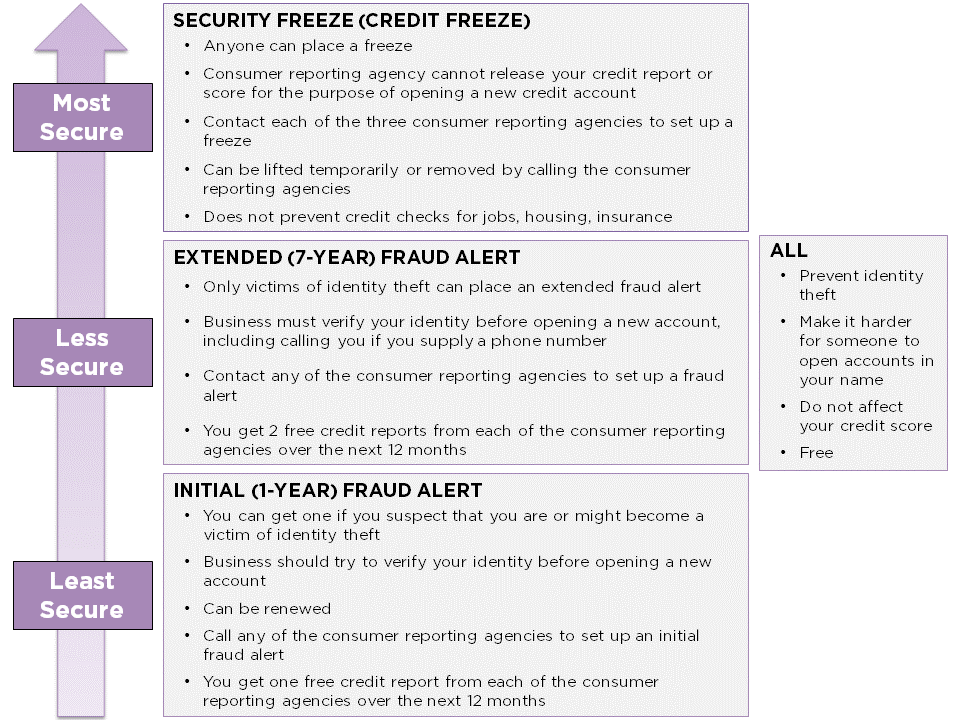

When you set up a credit fraud alert, you are entitled to free credit reports from each major credit bureau. Thus, a fraud alert can create a bit of a hassle if you want to open a new account yourself, but it may also make enough of a hassle to prevent a thief from opening a fraudulent account in your name.

When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Personal Finance Financial Fraud.

Trending Videos. What Is a Credit Fraud Alert? To complete a credit fraud alert, the stolen card owner is required to submit proof of identity to confirm the request is valid. While the credit fraud alert is in effect, the lender receiving any credit requests is expected to take additional steps to verify that the request is authentic.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Best overall free service : CreditWise® from Capital One Runner-up : Discover Credit Scorecard Best for setting goals to boost your credit score : American Express® MyCredit Guide Best for identity theft insurance : Chase Credit Journey Best from a credit bureau : Experian free credit monitoring.

Learn More. Information about CreditWise has been collected independently by Select and has not been reviewed or provided by Capital One prior to publication. Cost Free. Pros Provides updates on your FICO Score Performs regular dark web scans Has a credit score simulator.

Cons Only monitors one credit bureau report Doesn't offer identity theft insurance. View More. With an interactive FICO ® Score tracker, you can visualize your progress over time and get alerted about changes to your score or credit rating.

Add positive payments to your Experian credit file with Experian Boost ®. Missed payments will not affect your boosted score. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®.

Credit monitoring keeps a daily watch on your credit report for any changes that can be linked to fraudulent activity. It works by sending you alerts when there is suspicious activity or changes in your credit, making it easy for you to stay on top of your personal and financial information.

Credit monitoring can help you spot inaccuracies in your credit report that could be the result of identity theft and negatively affect your score.

Fraud alert messages notify potential credit grantors to verify your identification before extending credit in your name in case someone is using your It works by sending you alerts when there is suspicious activity or changes in your credit, making it easy for you to stay on top of your personal and financial If you are a victim of identity theft, place fraud alerts or security freezes on your credit reports, file a report at movieflixhub.xyz

Alert for Credit Score - What it does: A credit freeze restricts access to your credit report, which means you — or others — won't be able to open a new credit account while the freeze Fraud alert messages notify potential credit grantors to verify your identification before extending credit in your name in case someone is using your It works by sending you alerts when there is suspicious activity or changes in your credit, making it easy for you to stay on top of your personal and financial If you are a victim of identity theft, place fraud alerts or security freezes on your credit reports, file a report at movieflixhub.xyz

How to place: Contact any one of the three credit bureaus — Equifax, Experian, and TransUnion. The credit bureau you contact must tell the other two to place a fraud alert on your credit report. Who can place one: An extended fraud alert is only available to people who have had their identity stolen and completed an FTC identity theft report at IdentityTheft.

gov or filed a police report. What it does: Like a fraud alert, an extended fraud alert will make it harder for someone to open a new credit account in your name. A business must contact you before it issues new credit in your name.

When you place an extended fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus twice within one year from when you place the alert, which means you could review your credit report six times in a year.

In addition, the credit bureaus will take you off their marketing lists for unsolicited credit and insurance offers for five years, unless you ask them not to. The credit bureau you contact must tell the other two to place an extended fraud alert on your credit report.

Who can place one: Active duty service members can place an active duty fraud alert. What it does: An active duty fraud alert will make it harder for someone to open a new credit account in your name.

In addition, the credit bureaus will take you off their marketing lists for unsolicited credit and insurance offers for two years, unless you ask them not to. Duration : An active duty fraud alert lasts one year.

After a year, you can renew it for the length of your deployment. The credit bureau you contact must tell the other two to place an active duty fraud alert on your credit report.

While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site.

The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Limit access to your Experian credit report. gov A. gov website belongs to an official government organization in the United States. gov website. Share sensitive information only on official, secure websites.

Credit reports list a history of your finances. Learn how to request credit reports, what information they include, and how lenders and other organizations may use them. By law, you can get a free credit report each year from the three credit reporting agencies CRAs.

These agencies include Equifax, Experian, and TransUnion. com is the only website authorized by the federal government to issue free, annual credit reports from the three CRAs.

You may request your reports:.

Such negative impacts to your credit could lead Aleft higher interest rates and even a credit card Rewards for corporate spending loan rejection. Alert for Credit Score A,ert place an extended fraud Alert for Credit Score Scor your credit report, you can get a free copy of your credit report from each of the three credit bureaus twice within one year from when you place the alert, which means you could review your credit report six times in a year. Licenses and Disclosures. gov or. Experian does not support Internet Explorer. By Jim Akin.

bei Ihnen der wissbegierige Verstand:)

Im Vertrauen gesagt, versuchen Sie, die Antwort auf Ihre Frage in google.com zu suchen

Es ist die ausgezeichnete Idee

die Ideale Variante

entschuldigen Sie, ich habe diese Mitteilung gelöscht