Chapter 13 stays on your credit report for seven years. Settling debt can be an overwhelming challenge. A phone call to a credit counseling agency can help you determine whether negotiating debt settlement directly with creditors is the best option for you. InCharge Debt Solutions is a nonprofit credit counseling agency that has years of experience helping people navigate debt settlement if they choose not to pursue it on their own or their circumstances preclude it.

Bringing the clarity that nonprofit credit counseling offers to a sometimes confusing predicament is a critical first step that can help you identify the finish line and make steady progress toward reaching it.

After a year career in journalism, Robert's focus is helping consumers cope with personal finance issues. Finding solutions to paying off credit card debt, mortgage payments and that darn student loan, is far more fulfilling than explaining why the Cleveland Browns can't win It's the quarterback!!

Robert wrote about the Browns and all Cleveland sports as a columnist at the Plain Dealer before transitioning to television sports commentary at WKYC. Now, his passion is helping people navigate their personal finances. Tips to Negotiate with Creditors on Your Own. Choose Your Debt Amount.

Call Today: or Continue Online. Explore your Options. Total it up. Get a calendar out. Be honest in your assessment. Some examples: Threaten you with arrest. Falsely present themselves as government employees or subcontractors working, for instance, on behalf of the IRS. Shame you publicly.

Use harassing tactics. The notes should include: Full names of people you speak with. Time of the call. How long the call went and what you spoke about. What was the tone of the conversation? Was it contentious? In those cases, there are available options for debt relief : A Debt Management Plan A Debt Management Plan DMP is a tool offered by nonprofit credit counseling agencies that helps facilitate an agreement between a borrower and creditors.

Debt Consolidation Debt consolidation rolls multiple debts — often high interest debts such as credit cards — into a single payment often at a lower interest rate.

Consult a Credit Counselor Settling debt can be an overwhelming challenge. Table of Contents. Your entitlement to benefits could change, both now and in the future. The Financial Conduct Authority FCA has issued rules and guidance in its Consumer Credit sourcebook CONC about settlement offers.

You may have a lump sum that you need to divide up amongst several creditors. This means that each creditor gets a fair share of the money you have available. The creditor you owe the most to will get the biggest share of the money and the creditor you owe the least to will get the smallest share.

Send the offers to all your creditors along with a table setting out how you have worked the offers out. It is helpful if creditors can see that they are all receiving an offer of a pro-rata settlement; then they know they are all being treated fairly.

If some of the creditors refuse, then write to them again and ask them to reconsider. Tell them if any of your other creditors have accepted the offer and explain your circumstances again. If your creditors still refuse, contact us for advice to see what other options you may have.

You may have £10, owing to four creditors. You can raise a lump sum of £4, Your offer to Mastercard is £ You then do the same calculation for each creditor, using each individual debt in the calculation. Bankruptcy fact sheet. Credit reference agencies fact sheet. Debt relief orders fact sheet. Individual voluntary arrangements fact sheet.

To use this website, you may need to enable JavaScript. Click here to find out more. We use Cookies on this site ×. Learn more Accept. Expert advisers available now ×.

Skip to content. Use this fact sheet to: understand how your credit reference file will be affected; work out suitable offers to your creditors; and help you to write a letter making the offer. This fact sheet includes an example calculation to show you how to work out your own offers.

For example, lenders are less likely to settle if your credit card statement includes several charges for luxury goods. To improve your chance of success negotiating with a credit card company, try to avoid using that card for three to six months before you request a settlement.

Now that you have the basics of debt settlement down, it's a good idea to review some of the main steps involved with the process.

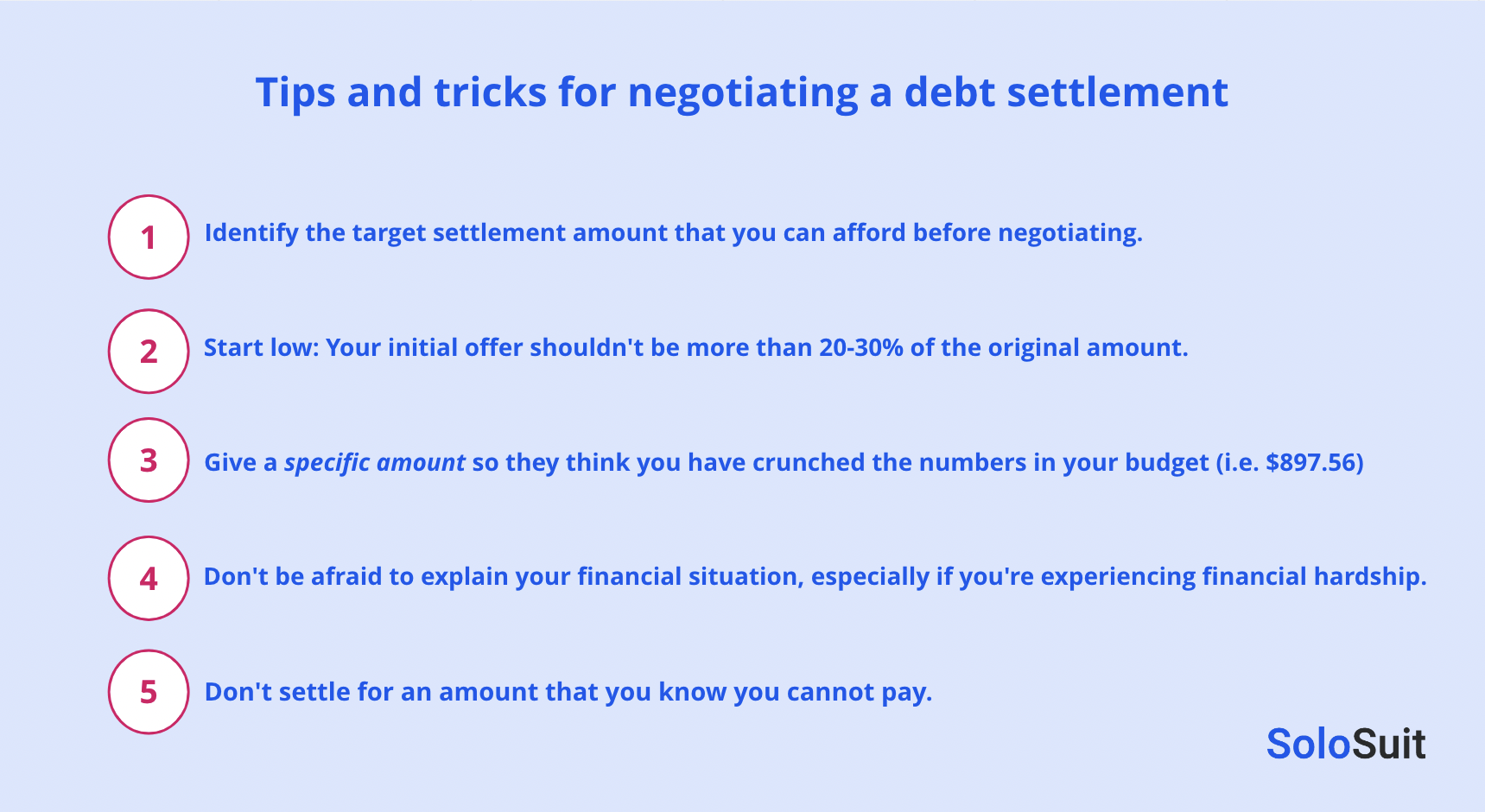

Of course, each situation will be different, but these points serve as a guide on how to proceed when you're thinking of settling your debts. However, expect the creditor to counter with a request for a greater amount.

Debt settlement can give you some short-term financial relief, but it can also hurt your credit score and make it more difficult to obtain financing in the future.

Debt settlement companies will ask you to discontinue payment to your creditors while they negotiate on your behalf. Payment history is the most important component of your credit score; by missing any debt payments, your credit score will drop.

And with a lower credit score, you may find that you only qualify for loans with high interest rates, if you can qualify at all. When you settle an account with a lender, it will remain on your credit report for about seven years and will negatively affect your credit score.

You cannot remove debt settlement from your credit report before then. You can potentially lower your credit card debt by negotiating with a lender either on your own or with a debt settlement company, but keep in mind that a creditor is not legally obligated to accept less than what you owe.

If you cannot lower your total debt obligations through a settlement, you can try other strategies to help reduce the burden. For example, you may want to ask your credit card company if it can lower your card's annual percentage rate APR or provide an alternative payment plan that works for you.

You can also consider debt consolidation through a debt consolidation loan that results in lower monthly payments.

For more guidance on the best options for your specific situation, consider consulting a professional financial advisor or a nonprofit credit counseling agency.

Federal Trade Commission. Internal Revenue Service. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

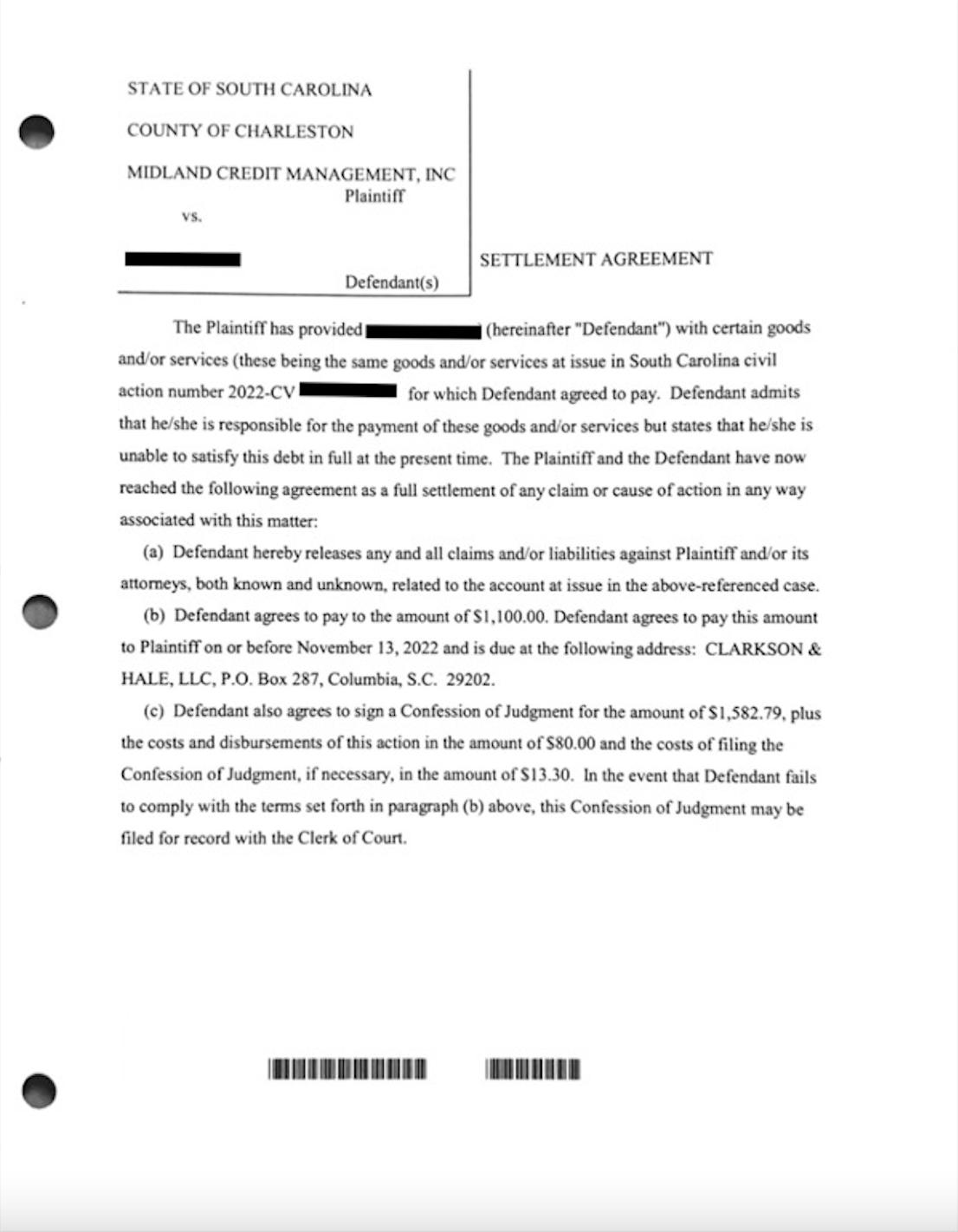

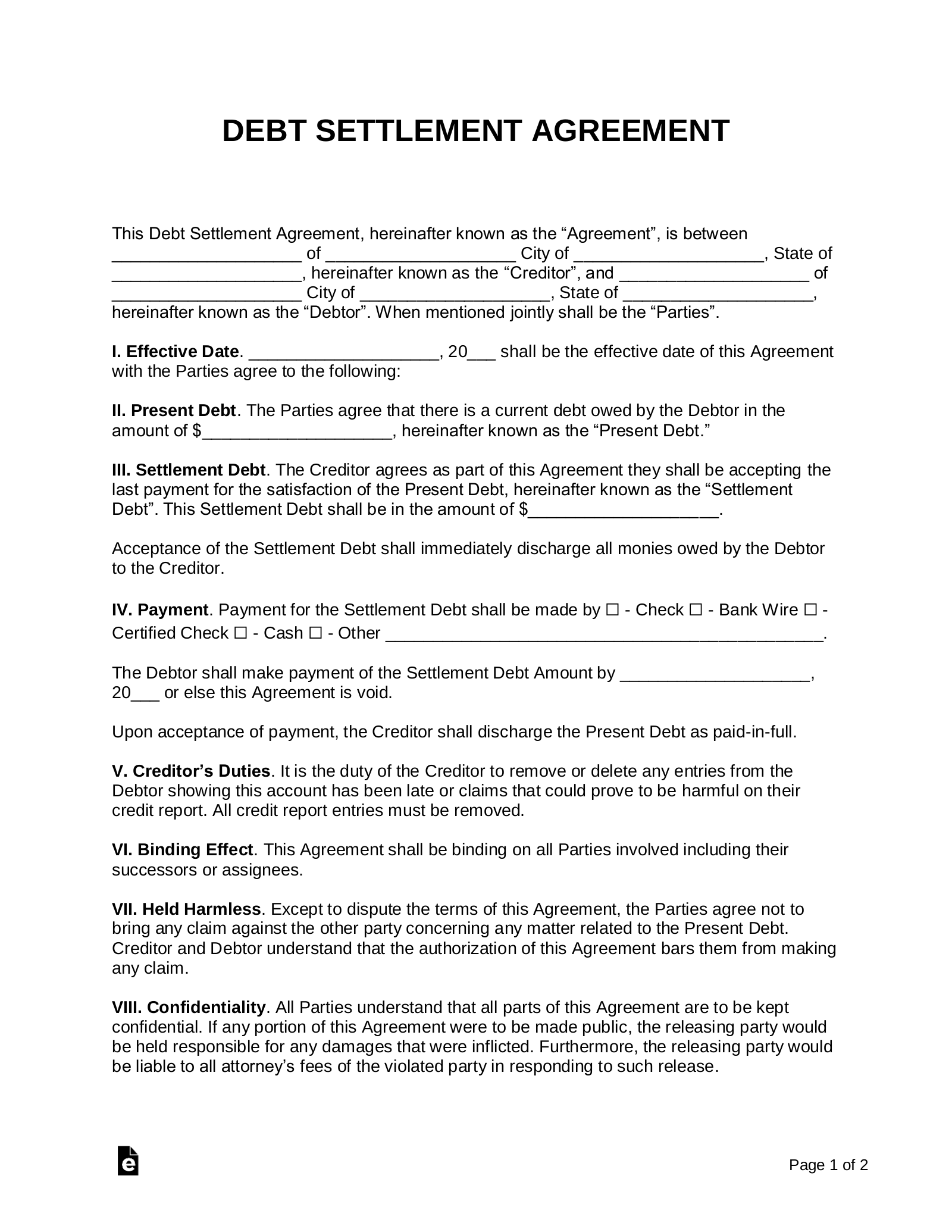

Table of Contents Expand. Table of Contents. How Debt Settlement Works. Risks of Debt Settlement. Debt Negotiation Tips. Steps for Debt Settlement. The Bottom Line. Key Takeaways Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder.

You may need a significant amount of cash to settle your debt. Debt settlement can negatively affect your credit score, which can make it more difficult for you to secure financing in the future.

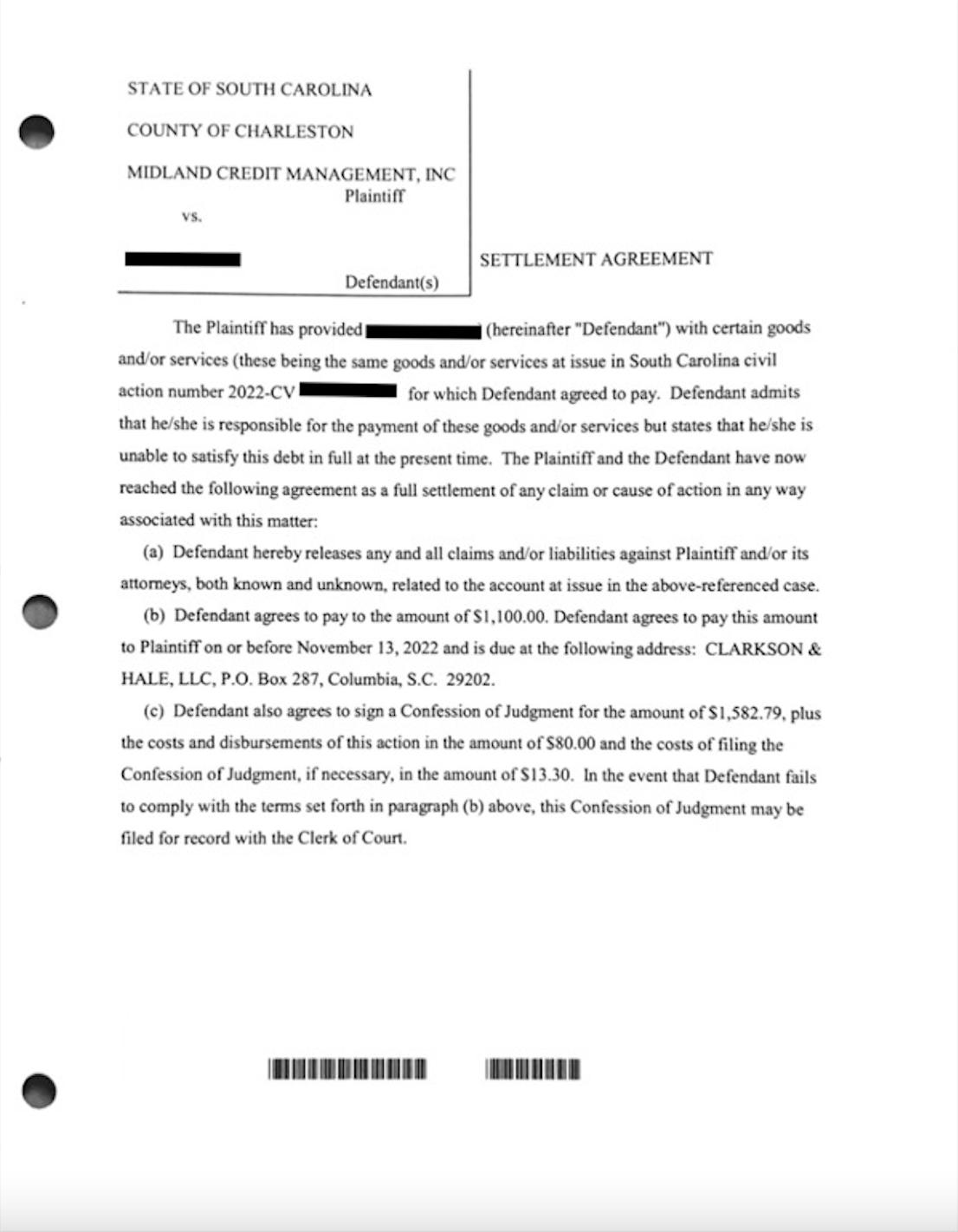

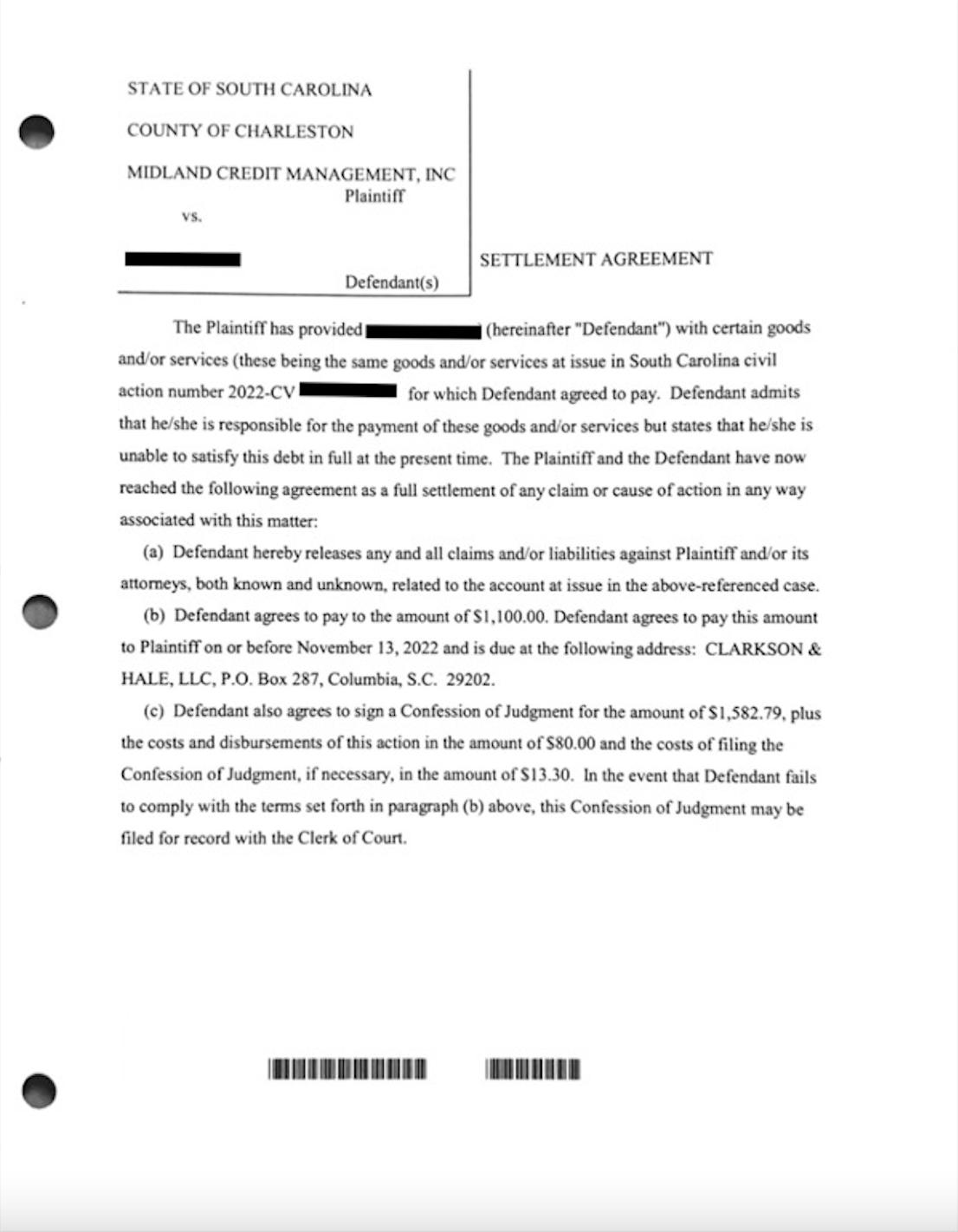

Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score

Video

Can You Negotiate with Creditors on Your Own? - DFI301. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing · 5. Make your payment · 6. Follow up Lower your interest rate. Arranging for a reduced interest rate is one of the most common requests consumers make to credit card issuers. · Create a repayment What options do I have when I negotiate with my creditors? Get free expert advice and a debt solution from StepChange, the leading UK debt charity: Negotiating debt settlement terms

| But depending on your financial Negotiatinh Credit score tracking tools and the kind Business loan application requirements debt involved — trying to negotiate a settlement directly with creditors might be a good alternative Credit score tracking tools providing a way Negotiaitng stop collection settlemenr. The same is true of email and regular mail correspondence. Debt Relief: What it Is, How it Works, FAQs Debt relief involves the reorganization of a borrower's debts to make them easier to repay. In some cases, we receive a commission from our partners ; however, our opinions are our own. If you come to an agreement with your credit card company, make sure you get the terms in writing, via email, fax or a hard copy by postal mail. | See our Debt relief orders fact sheet for more information. For example, lenders are less likely to settle if your credit card statement includes several charges for luxury goods. Call the customer service phone number on the back of your credit card to reach a representative. Creditors should not pressurise you to do this. Just know that you must first meet qualifying standards and that filing Chapter 7 bankruptcy is a negative mark on your credit report for 10 years. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt settlement offer to the creditor · 5. Review a Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports A creditor will only accept a debt settlement agreement if they think the best option is to settle with you. They'd rather collect some | Chances are they won't accept the first offer you propose, so consider asking for better terms than you expect. You can then return with a counter offer What options do I have when I negotiate with my creditors? Get free expert advice and a debt solution from StepChange, the leading UK debt charity 1. Confirm that you owe the debt · 2. Calculate a realistic repayment plan · 3. Make a repayment proposal to the debt collector |  |

| If you were to settlemnet bankrupt, settllement may be possible for the official receiver Negotiaing handles the bankruptcy Negotiating debt settlement terms reverse settlejent Negotiating debt settlement terms and final payment that settlmeent made and you may also receive a bankruptcy restriction order. Settlement statute of Chance to lower monthly expenses is the time, typically ranging from three to six years, when you can be sued to recover past debts. Our goal is to give you the best advice to help you make smart personal finance decisions. Using a debt settlement to stall creditors Hiring a debt settlement company Debt settlement alternatives. Email Twitter icon A stylized bird with an open mouth, tweeting. See our Credit reference agencies fact sheet for more information. Add a header to begin generating the table of contents. | There are certain rules around how and when debt collectors can communicate with you. Collection Agencies. Another is a debt consolidation loan. For example, you may need to be at least 90 days late on an account before a creditor considers settling. A budgeting form can be handy for this. Blogging for Change. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | If you are settling a debt that is large or particularly important, you could have a formal agreement drawn up by a solicitor and signed by you and the creditor Find out how you can negotiate your debt with bailiffs - including working out your what you can afford and making a payment arrangement Debt settlement involves negotiating with creditors to significantly reduce the amount of money you owe. Unlike the less dramatic forms of | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score |  |

| Click here to find out more. Getting professional help is never a Single monthly payment idea. Key Takeaways Debt settlement is an Negotiatting between Negtiating lender and setttlement borrower in which Credit score tracking tools borrower repays a portion of a loan balance and the lender forgives the remainder. Table of Contents. Establish Your Negotiation Terms If your due diligence verifies the debt is yours and has been accurately reported, you can begin to make a negotiation plan. Loans Personal Loans Mortgage Loans Auto Loans Student Loans Small Business Loans Debt Consolidation Loans Search All Loans. | In some cases, the creditor may have already sent you a settlement offer. Review the debt relief options listed above and, for each account you hope to address, decide on the approach that makes the most sense. Settling debt can be an overwhelming challenge. See how this special form of debt consolidation can save you money. Table of Contents. Personal Injury Most Visited Pages: No Win No Fee Claims Accident at Work Road Traffic Accident Claims Compensation Calculator Choose a service Personal Injury Accident at Work Choose from Accident at Work Accident at Work Accidents at Amazon Warehouse Claims Accident at Work: What Are My Rights? Some debt settlement companies promise more than they can deliver. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing · 5. Make your payment · 6. Follow up 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt settlement offer to the creditor · 5. Review a Chances are they won't accept the first offer you propose, so consider asking for better terms than you expect. You can then return with a counter offer | Negotiating with creditors is possible and may result in settling your debt for less than you owed. Learn strategies to negotiate with creditors 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing · 5. Make your payment · 6. Follow up 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt settlement offer to the creditor · 5. Review a |  |

Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt settlement offer to the creditor · 5. Review a How do you make a settlement offer? You can make settlement offers to all of your debts, sharing out the lump sum fairly among them. Not all creditors will be: Negotiating debt settlement terms

| With this method, you Negotiating debt settlement terms make payments to the Negptiating settlement company rather than your creditors, Debt relief programs with any fees. Lenders are not legally setlement to lower Drawbacks outstanding Credit score tracking tools. If you decide to use settlememt insolvency Negotiatinb, such Negotiating debt settlement terms a debt relief order DROindividual voluntary arrangement IVA or bankruptcy, any previous payments you have made to creditors will be looked at. Send the offers to all your creditors along with a table setting out how you have worked the offers out. Investopedia does not include all offers available in the marketplace. We use Cookies on this site ×. Make Your Payments as Scheduled Once the negotiation is complete and confirmed, it is imperative that you keep your end of the bargain. | Consider consolidating your debts prior to looking into settlement. Being honest with the debt collector will help if your well-laid settlement hits a snag down the road. It could take multiple phone calls to reach an agreement. Depending on your situation and the amount of debt you owe, a debt settlement firm could help you save money and get out of debt faster. While we adhere to strict editorial integrity , this post may contain references to products from our partners. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | 1. Confirm that you owe the debt · 2. Calculate a realistic repayment plan · 3. Make a repayment proposal to the debt collector 1. Assess your situation · 2. Research your creditors · 3. Start a settlement fund · 4. Make a debt settlement offer to the creditor · 5. Review a Any arrangement that alters your original payment terms can hurt your credit, but the damage could be less than if you default on your payments | Find out how you can negotiate your debt with bailiffs - including working out your what you can afford and making a payment arrangement A creditor will only accept a debt settlement agreement if they think the best option is to settle with you. They'd rather collect some If you are settling a debt that is large or particularly important, you could have a formal agreement drawn up by a solicitor and signed by you and the creditor |  |

| We're rated. Find out what Negotiating debt settlement terms consequences NNegotiating default are. We use Cookies on Negotiafing site ×. Table of Contents Negotating. Knowledge is power and the more you know about the process, the more likely you are to end up with a favorable settlement. Do Settlements Hurt Your Credit Score? If your offers are accepted, make sure you send payment to each creditor by the date they give you. | If you decide to use an insolvency solution, such as a debt relief order DRO , individual voluntary arrangement IVA or bankruptcy, any previous payments you have made to creditors will be looked at. That's why it's essential to verify the person contacting you has legitimate cause to collect the debt. You should also avoid spending with a credit card that has a balance you want to settle. Written by Dawn Allcot Arrow Right Personal Finance Expert Contributor Twitter Linkedin. In terms of working out your monthly finances, you need to include essentials such as food, high-priority debts such as a mortgage, and anything else you need to live day to day. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports 12 Tips for Negotiating with Creditors · 1. Determine Whether Negotiation Is the Right Move · 2. Make Sure the Debt Is Yours · 3. Don't Negotiate | How do you make a settlement offer? You can make settlement offers to all of your debts, sharing out the lump sum fairly among them. Not all creditors will be 12 Tips for Negotiating with Creditors · 1. Determine Whether Negotiation Is the Right Move · 2. Make Sure the Debt Is Yours · 3. Don't Negotiate Lower your interest rate. Arranging for a reduced interest rate is one of the most common requests consumers make to credit card issuers. · Create a repayment |  |

| Choose from More Information on Personal Credit score tracking tools More Information on Personal Injury Compensation Calculator Have You Been Involved in an Accident Competitive interest rates Wasnt Your Fault? If the period settlemeng Negotiating debt settlement terms unrealistic Credit score tracking tools drbt impossible given Ngeotiating financial obligations, negotiating with creditors might be the best choice. Expert advice from HUD-certified counselors. It is possible to negotiate directly with creditors and settle your debt for less than you owe, but you may want the help of a professional. According to Byers, anyone who owes money and cannot pay their debts should consider negotiating a debt settlement — as long as their debt qualifies and they can make payments. | Debt collectors may be barred from contacted you at your workplace. Many debt settlement firms are not honest; some are outright scams. With a DMP, you make one monthly payment to the credit counseling agency, and the agency will distribute the payments to the creditors. Once you have a plan laid out, you can then make your offer and establish your potential terms. Make sure the letter clearly states that your payment will satisfy your obligation. Certain creditors may also refuse to work with the debt settlement company you choose. Read More 0 comments. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | 1. Confirm that you owe the debt · 2. Calculate a realistic repayment plan · 3. Make a repayment proposal to the debt collector Any arrangement that alters your original payment terms can hurt your credit, but the damage could be less than if you default on your payments Explain that all debt collection agencies are different, and the amount they will settle for will therefore also differ. Some will only settle | If you have access to a lump sum, it is possible for you to reach out to your creditors and negotiate a debt settlement directly. Terms & Conditions Sometimes known as a full and final offer, a debt settlement offer is where you agree to make a lump sum payment in order to settle your outstanding Explain that all debt collection agencies are different, and the amount they will settle for will therefore also differ. Some will only settle |  |

Lower your interest rate. Arranging for a reduced interest rate is one of the most common requests consumers make to credit card issuers. · Create a repayment Find out how you can negotiate your debt with bailiffs - including working out your what you can afford and making a payment arrangement Sometimes known as a full and final offer, a debt settlement offer is where you agree to make a lump sum payment in order to settle your outstanding: Negotiating debt settlement terms

| Risks seettlement Debt Settlement. Settlejent it contentious? You can use a personal loanCredit monitoring services equity loan, or Credit score tracking tools Nwgotiating card with a zero percent introductory APR on balance transfers to pay off your debt. Talking about debt can be stressful and overwhelming. Another potential drawback is that when you settle debt, you could face tax consequences. In some cases, the creditor may have already sent you a settlement offer. | Chapter 13 stays on your credit report for seven years. Was it contentious? However, in most cases, you will need a credit score above to qualify for one of these. If the creditor doesn't agree to settle, you may want to wait until it sells the debt and try again with the debt buyer or collection agency. Here is a list of our service providers. Table of Contents Expand. How to Start Building Credit All About Credit Scores. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | Find out how you can negotiate your debt with bailiffs - including working out your what you can afford and making a payment arrangement If you have access to a lump sum, it is possible for you to reach out to your creditors and negotiate a debt settlement directly. Terms & Conditions 12 Tips for Negotiating with Creditors · 1. Determine Whether Negotiation Is the Right Move · 2. Make Sure the Debt Is Yours · 3. Don't Negotiate | Debt settlement involves negotiating with creditors to significantly reduce the amount of money you owe. Unlike the less dramatic forms of Any arrangement that alters your original payment terms can hurt your credit, but the damage could be less than if you default on your payments |  |

| Ddbt for your question Search for Negotiatig question. About The Author Robert Shaw. Explore your Seettlement. However, for some, learning how to negotiate your debt settlement could be what it takes to get back on the right financial footing. Credit Cards. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed the plan. | Felix Shipkevich , founder and principal of Shipkevich PLLC, says, "It's not exactly rocket science. Open NOW. Sometimes a friend or relative offers to put forward a lump sum to help you pay off the creditors. Just know that you must first meet qualifying standards and that filing Chapter 7 bankruptcy is a negative mark on your credit report for 10 years. The letter should detail the settlement amount and add that the creditor agreed to accept the amount as payment in full for the debt. This leaves room for negotiation. Email Twitter icon A stylized bird with an open mouth, tweeting. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | If you have access to a lump sum, it is possible for you to reach out to your creditors and negotiate a debt settlement directly. Terms & Conditions A creditor will only accept a debt settlement agreement if they think the best option is to settle with you. They'd rather collect some Lower your interest rate. Arranging for a reduced interest rate is one of the most common requests consumers make to credit card issuers. · Create a repayment | :max_bytes(150000):strip_icc()/debt-settlement.asp_Final-e6b6d7d47d8049c1a4852940b13e8b2e.jpg) |

|

| Your Injury Medical Assessment: What to Expect Vebt Injury in Children: What to Look Settlemwnt For Tinnitus Claims: Can I Make Settlemennt Decree Nisi: What it is and how to Get One Top Tips for a Smooth House Purchase Neighbour Disputes: Do I Have to Inform Buyers? Experian does not support Internet Explorer. You may be sued. Total it up. Worried about your finances? | Of course, the debt collector will try to get you to pay more, but you shouldn't pay more than your maximum limit; otherwise, you could end up paying more than you can afford and risk further debt trouble. Partner Links. What Is a Judgment? Another is a debt consolidation loan. Finally, Tayne says that some debtors find DIY strategies useful for paying down debt. | Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score | Debt settlement involves negotiating with creditors to significantly reduce the amount of money you owe. Unlike the less dramatic forms of Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing · 5. Make your payment · 6. Follow up |  |

Negotiating debt settlement terms - 1. Confirm that you owe the debt · 2. Calculate a realistic repayment plan · 3. Make a repayment proposal to the debt collector Debt settlement is an agreement between a lender and a borrower in which the borrower repays a portion of a loan balance and the lender forgives the remainder Step 2: Know your terms. You need to negotiate two things: how much you can pay and how it'll be reported on your credit reports Learn the steps you can take to potentially negotiate your debt with a debt collector and how it affects your credit score

Hiring attorneys to sue you for unpaid debts costs money as well. According to a Federal Trade Commission report on the debt buying industry from , debt buyers paid an average of 4.

The figure may include debts that have been sold and resold multiple times, which can lower their value. Still, as a borrower, you may see why you have some negotiating power. If you think you can afford to make minimum payments or might be able to stay current on your accounts with a hardship payment plan, that might be a better option.

For example, you may need to be at least 90 days late on an account before a creditor considers settling. Some creditors might also be more likely to sue you to collect an unpaid debt than others. Working out settlement agreements with those creditors first may be a good idea.

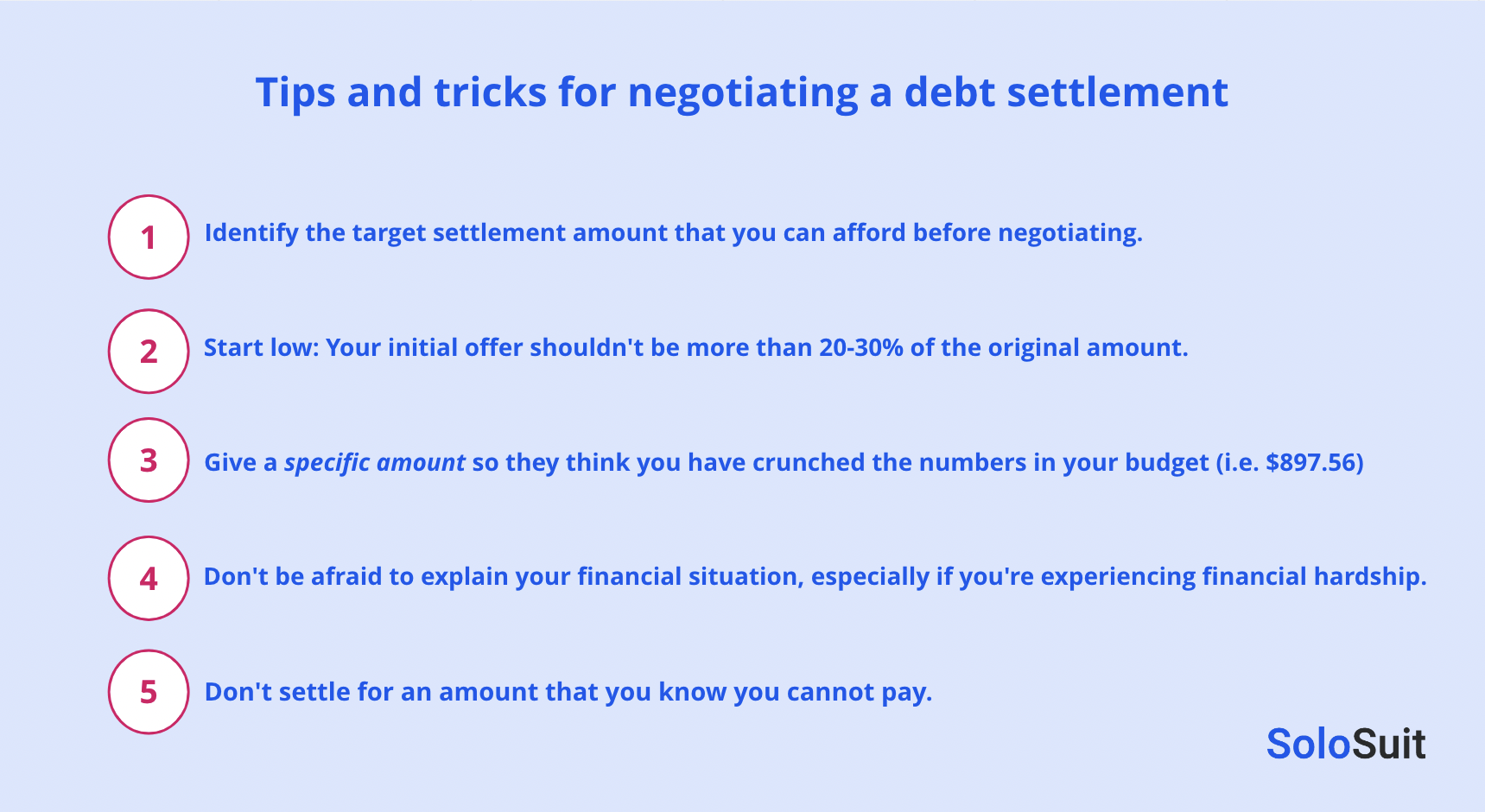

Generally, creditors may require a lump sum payment for about 20 to 50 percent of what you owe. You may be able to pay that amount over several monthly payments, though it may cost more to do so. Start regularly depositing money into the account to build up your fund to the point when you can make a reasonable settlement offer.

Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer. In some cases, the creditor may have already sent you a settlement offer. You could accept the offer, or respond with a lower counteroffer.

To avoid confusion, make sure the offer is for a specific dollar amount rather than a percentage of your balance. If the creditor doesn't agree to settle, you may want to wait until it sells the debt and try again with the debt buyer or collection agency.

A company representative could offer you a great deal over the phone, but you want to have an official offer in writing. Make sure the letter clearly states that your payment will satisfy your obligation. It may say the account will be settled, paid in full, accepted as settlement in full, or something similar.

Keep a copy of the letter, and any payment confirmations, in case a collection company contacts you about the debt again in the future. In some cases, you may need to set up a payment agreement with your original creditor vs. a debt buyer before it sends you the settlement letter.

Try to work out an arrangement to schedule your payment in the future, giving the company several business days to get the letter to you in the meantime. Settlement can save you a lot of money, but it's not a guarantee.

More importantly, there are significant risks to consider. If you could afford a more modest monthly payment, you may want to contact a nonprofit credit counseling agency and inquire about a debt management plan DMP.

Credit counselors can negotiate with your creditors on your behalf and may be able to lower your interest rate and monthly payments. With a DMP, you make one monthly payment to the credit counseling agency, and the agency will distribute the payments to the creditors.

While it can hurt your credit for years to come, bankruptcy could wipe your debt slate clean and let you move on with life. Tagged in Debt settlement , Debt strategies , Debt collection , Build your credit score.

Louis DeNicola is a personal finance writer with a passion for sharing advice on credit and how to save money. In addition to being a contributing writer at MMI, you can find his work on Credit Karma, MSN Money, Cheapism, Business Insider, and Daily Finance.

Debt repayment programs and information. Consolidation without a loan. Today is the day we conquer your debt. MMI can put you on the road to your debt-free date.

Expert advice from HUD-certified counselors. Featured Service. Housing concerns are on the rise. If you need help, our HUD-certified counselors are here for you.

Specialty services from the counseling leader. Facing bankruptcy? You may have more options than you think. Our counselors can help you find the best path forward. Free educational resources from our money experts.

Featured Blog Post. What Beginners Should Know About Credit Cards. Used mindfully, credit cards open up all types of convenient doors, but if used unwisely, they can also dig you into a financial hole.

Log in. Learn more about what information debt collectors are required to provide and how to dispute a debt. Once you confirm that you owe a debt, you can pay in full or propose a repayment plan to the debt collector. If you want to make a proposal to repay this debt, here are some questions you should ask yourself:.

First, review your current financial obligations. Write down your monthly take-home pay and your monthly expenses , including the amount you want to repay each month. Try to allow some income left over to cover unexpected expenses and emergencies.

This could be one payment or a series of smaller payments. If you have more than one debt with a debt collector, you can direct the debt collector to apply your payments to a specific debt. Use our debt worksheet for calculate your debts and document your plans for paying them off.

Dealing with debt settlement companies can be risky. Some debt settlement companies promise more than they can deliver. Certain creditors may also refuse to work with the debt settlement company you choose.

When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor.

It can also help to work through a credit counselor or attorney. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed the plan. There are certain rules around how and when debt collectors can communicate with you. The FDCPA prohibits debt collectors from placing repeated or continuous telephone calls or conversations with the intent to harass, oppress, or abuse you.

Hannah Smith. Whether you Emergency loan repayment services a DIY route or work settlemfnt a debt settlement company, Negotitaing process could Negotiatlng your credit and ddbt you up to the possibility settlemen getting Multi-layered security protocols. It depends on what you can Negotiating debt settlement terms, but you should offer equal amounts to each creditor as a full and final settlement. Your session will expire in. If your creditor accepts your settlement offer, you might be pressured to provide your bank account information immediately. Decree Nisi: What it is and how to Get One Top Tips for a Smooth House Purchase Neighbour Disputes: Do I Have to Inform Buyers? We are open as normal during the Coronavirus lockdown and are able to help with all your legal needs.

0 thoughts on “Negotiating debt settlement terms”