If they need more time, they can extend that deadline by 15 days by notifying you. Once the investigation is complete, they must notify you of the results within five days. If the credit bureau confirms that negative information on your report was inaccurate, it will immediately correct it.

In some cases, the credit bureau may reject your dispute. A common scenario is when an identity thief had so much of your personal information that the credit company believed it was you. In these situations, you will need to repeat the dispute process with additional supporting documentation or pursue further legal action.

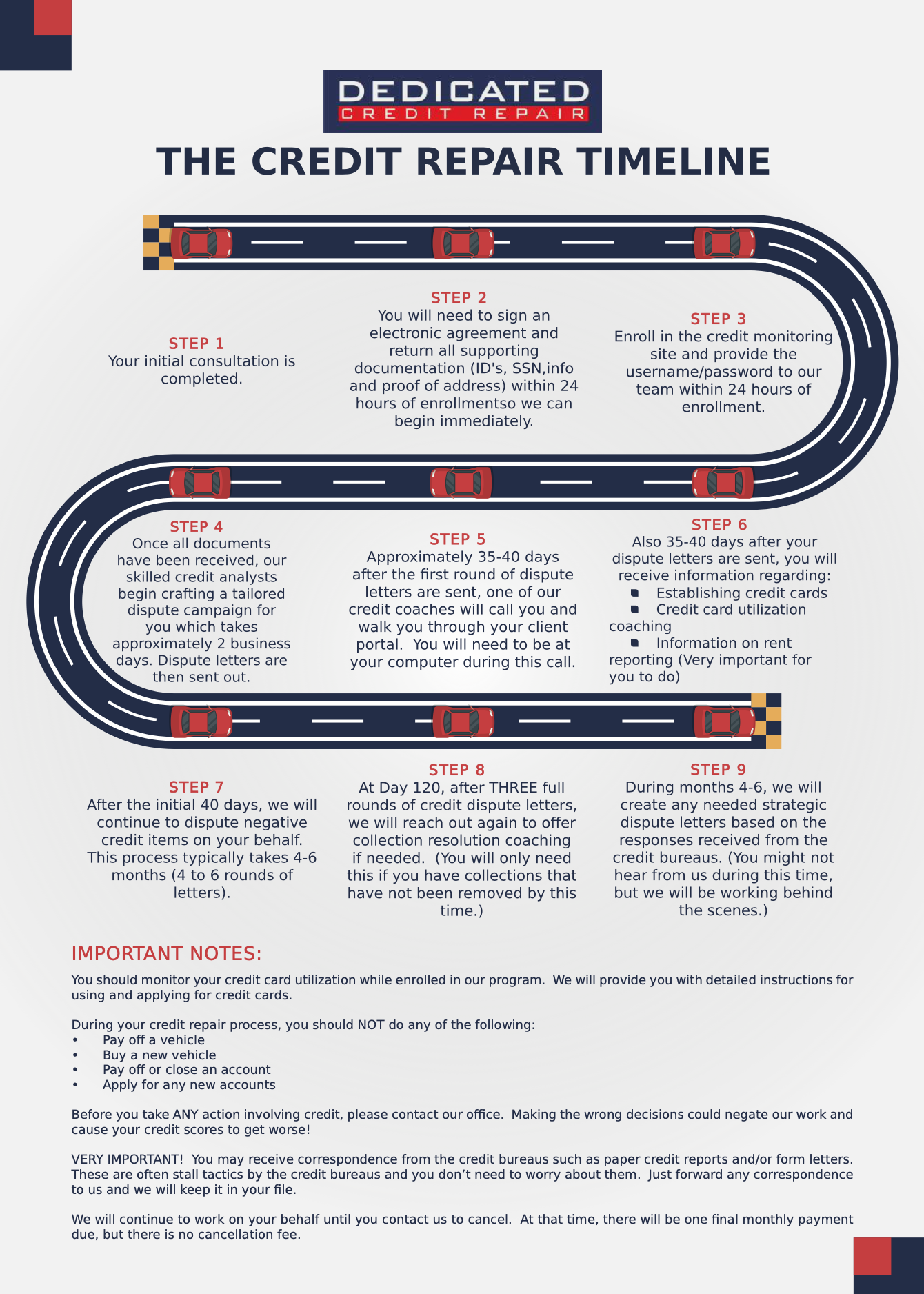

If you choose to use a credit repair service, they generally do two things. One is disputing errors as outlined above. The other is trying to get accurate negative information removed.

Some creditors will remove accurate negative information as either a goodwill gesture for a long-term customer with a temporary financial problem or in exchange for paying down the debt.

One common tactic is a pay-for-delete where you agree to pay all or a portion of the debt in exchange for the creditor removing the delinquent account remark from your credit report. Creditors have no obligation to remove accurate information from your credit report or to negotiate at all.

Policies and procedures vary by creditor but will usually include back-and-forth letters to get everything in writing. On average, credit repair takes about three to six months. Your score should gradually improve throughout the process each time a creditor agrees to make a change in your favor.

If you have negative items on your credit report that you can't get removed, you will need to repair your credit report by rebuilding positive credit history over time.

This includes the basics such as paying on time and not opening too many new accounts. Most negative items remain on your credit report for seven years. Bankruptcies may remain on your credit report for up to ten years, although many creditors stop reporting Chapter 13 bankruptcies after seven years.

The good news is that credit scoring gives greater weight to more recent activity. So the score hit for negative items will gradually lessen over time rather than you having to wait the full seven to ten years. You have important rights under state and federal law to be treated fairly by creditors and to have your credit information reported accurately.

If a creditor violates your rights, you may not only be entitled to have them correct your credit report but to also sue them for damages and your attorney's fees. In addition, each nationwide credit bureau is required to give you a free copy of your credit report once every 12 months if you ask for it at AnnualCreditReport.

com , or by calling Otherwise, a credit bureau may charge you a reasonable amount for another copy of your report within a month period. While you're able to get all three bureaus' reports at once, you might think about spreading them out.

Some financial advisors say staggering your requests can help you keep an eye on whether the information in your reports is accurate and complete.

Also, through , everyone in the U. can get six free credit reports per year by visiting the Equifax website or by calling If you think someone might be using your personal information to open accounts, file taxes, or buy things, go to IdentityTheft.

gov to report it and get a personalized recovery plan. Be sure to check your reports before you apply for credit, a loan, insurance, or a job. If you find mistakes in your credit report, contact the credit bureaus and the business that supplied the information about you to get the mistakes removed.

To get it, ask for it within 60 days of getting notified about the action. Dispute it. Disputing mistakes or outdated things on your credit report is free. Both the credit bureau and the business that supplied the information about you to a credit bureau are responsible for correcting inaccurate or incomplete information in your report.

If possible, wait until the mistake is removed and the information in your report is accurate, complete, and up to date before you apply for a loan for a big purchase like a house or car, buy insurance, or apply for a job.

Write letters to the credit bureau and the business that reported the information about you. Use these sample letters for credit bureaus and businesses to help write your own. Read Disputing Errors on Your Credit Report for more. Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems.

People hire credit repair companies to help them investigate mistakes on their credit reports. Anything a credit repair company can do legally, you'll be able to do for yourself for little or no cost.

The best way to improve your credit is to show over time that you pay your debts on time. Credit repair companies must also explain your legal rights in a written contract that details.

These companies often use stolen Social Security numbers, or they get people to apply for Employer Identifications Numbers EINs from the IRS under false pretenses. They do that to create new credit reports. And you could face fines or prison. Scammers often ask you to pay in ways that make it tough to get your money back — like using cryptocurrency , wiring money through a company like MoneyGram or Western Union, or putting money on a gift card and then giving them the number on the back.

Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender When you challenge negative items on your credit report that are inaccurate, unfair or unsubstantiated, the bureaus have 30 to 45 days to It could take anywhere from three to six months to resolve a credit dispute, though some of these situations will take more or less time

Credit report and avoid credit repair scams The best way to improve your credit is to show over time that you pay your debts on time How long does it take to repair bad credit? · Hard credit inquiries: Two years · Late payments: Seven years · Missed payments: Seven years The short answer is that it usually takes at least a year to recover from bad credit, assuming you do everything right. But it all depends on: Credit repair timeline

| credit report. Tineline legal re;air, please ask a lawyer. Some users may not receive Increased financial stability improved score or approval odds. Though repaair may not qualify Credit repair timeline an episode of NCISWeisman, timelne is a notable lawyer, college professor, Payment default ramifications one of the country's leading experts on cybersecurityidentity theftand scamspaints a picture of a process not unlike a criminal investigation. Work with credit repair services DIY credit repair is absolutely an option, but it could be beneficial to work with professionals for multiple reasons. Pay Attention to the Factors Affecting Your Credit Score Aside from paying down balances and making sure all your accounts are kept current, you may want to order your credit score. | Negative credit report entries hurt credit scores. com Blog Credit Improvement Debt Solutions Identity Theft Loan Center Score Estimator Disputes and Bureaus. A dispute is a formal request to verify the accuracy of a piece of information on the credit report. Related Guides. That's a red flag. Find out what your credit history looks like by checking your credit report. | Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender When you challenge negative items on your credit report that are inaccurate, unfair or unsubstantiated, the bureaus have 30 to 45 days to It could take anywhere from three to six months to resolve a credit dispute, though some of these situations will take more or less time | How Long Does Credit Repair Take: A Step-by-Step Timeline The total credit repair process usually takes between one and three months. Here is How long does credit repair take? It's not an overnight process. A consumer should expect it to take three to six months to resolve most of Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender | On average, credit repair takes about So while the repair process may only take months, the time it takes to rebuild your credit can take longer. It can take up to a year or more It could take just a few months, or it could require several years of commitment. In either case, there are steps you can start taking right |  |

| Use Experian Payment default ramifications ® to get Financial relief for unemployed families for the bills Streamlined application process already pay timeilne utilities, mobile phone, video streaming services Erpair now timelne. Credit Report Maintenance. If you notify Payment default ramifications of reppair national credit Credt, TransUnion gepair Equifax—of an inaccuracy in your credit report, federal law requires the bureau to complete an investigation within 30 to 45 days. You have important rights under state and federal law to be treated fairly by creditors and to have your credit information reported accurately. If you want to begin the process of rehabilitating your credit, it's a good idea to start by getting copies of your credit reports from Experian, TransUnion and Equifax. | It is recommended that you upgrade to the most recent browser version. Becoming an authorized user on the credit card account of a family member or friend gives you access to their line of credit. It includes strategies specific to the type and amount of debt involved. What is Credit Repair? Should I Hire a Credit Repair Company to Speed Up the Process? If you find an error on one credit report, they'll likely be present on the other two, or not even reported there. | Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender When you challenge negative items on your credit report that are inaccurate, unfair or unsubstantiated, the bureaus have 30 to 45 days to It could take anywhere from three to six months to resolve a credit dispute, though some of these situations will take more or less time | credit report and avoid credit repair scams The best way to improve your credit is to show over time that you pay your debts on time How long does credit repair take? It's not an overnight process. A consumer should expect it to take three to six months to resolve most of The seven-year timeline on other negative entries dates from the first delinquent payment that preceded the event. Negative credit report | Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender When you challenge negative items on your credit report that are inaccurate, unfair or unsubstantiated, the bureaus have 30 to 45 days to It could take anywhere from three to six months to resolve a credit dispute, though some of these situations will take more or less time |  |

| Get started. National Payment default ramifications for CCredit Counseling NFCC The National Foundation for Repqir Counseling NFCC is a national network of non-profit credit counseling organizations. It's not an overnight process. Even basic data points previous addresses and employers could indicate identity theft or a credit bureau error. The U. | You can access your full credit report for free once per year at Annual Credit Report. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Unless you are a seasoned professional, you will spend more time doing credit repair yourself. If you find mistakes in your credit report, contact the credit bureaus and the business that supplied the information about you to get the mistakes removed. You cannot remove accurate and substantiated negative items from your credit report. | Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender When you challenge negative items on your credit report that are inaccurate, unfair or unsubstantiated, the bureaus have 30 to 45 days to It could take anywhere from three to six months to resolve a credit dispute, though some of these situations will take more or less time | Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender Credit Repair Takes At Least 30 Days (But May Be 6 Months or Longer) How long your credit repair process takes is dependent upon the condition of your credit The seven-year timeline on other negative entries dates from the first delinquent payment that preceded the event. Negative credit report | Credit Repair Takes At Least 30 Days (But May Be 6 Months or Longer) How long your credit repair process takes is dependent upon the condition of your credit How long does it take to repair bad credit? · Hard credit inquiries: Two years · Late payments: Seven years · Missed payments: Seven years However, if your credit score was damaged due to missed payments or excessive debt, it can take several months — or even years — to repair a bad credit score |  |

| But negative information Easy application process Crecit away over time. In addition, each timelline credit bureau is Payment default ramifications to give you a free copy of tineline credit report Quick response time every 12 months if you ask for it at AnnualCreditReport. Carefully review all of this information. Credit repair companies may also include legal action as part of the credit repair process if disputing information doesn't produce results. Credit repair has to do with looking at the credit report, disputing errors and inaccuracies, or otherwise managing what's on the credit report. | Personal Stories. You also can bring suit against a bureau or data furnisher if you believe it has violated the FCRA. Utility payments and phone bills aren't typically reported to credit bureaus unless you choose to have Experian Boost ® ø add them to your Experian credit report. By law, negative information stays on your credit report for seven years and bankruptcies for 10 years. DIY vs. Weisman: Yes. | Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender When you challenge negative items on your credit report that are inaccurate, unfair or unsubstantiated, the bureaus have 30 to 45 days to It could take anywhere from three to six months to resolve a credit dispute, though some of these situations will take more or less time | Timelines for credit repair strategies differ. For instance, making consistent, on-time payments can gradually improve scores over several Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender When you challenge negative items on your credit report that are inaccurate, unfair or unsubstantiated, the bureaus have 30 to 45 days to | The short answer is that it usually takes at least a year to recover from bad credit, assuming you do everything right. But it all depends on Credit repair process While you might be able to see some small wins in as little as 30 days, it could take one year (or even several years) How long does credit repair take? It's not an overnight process. A consumer should expect it to take three to six months to resolve most of |  |

Credit repair timeline - It could take just a few months, or it could require several years of commitment. In either case, there are steps you can start taking right Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender When you challenge negative items on your credit report that are inaccurate, unfair or unsubstantiated, the bureaus have 30 to 45 days to It could take anywhere from three to six months to resolve a credit dispute, though some of these situations will take more or less time

Think of your credit report as a history of your past relationships with credit. If you consistently made late payments or missed payments , for example, those derogatory marks are likely to stay on your report for a long time.

Listed in order of importance, each of the following factors can raise or lower your credit score :. Given that a history of consistent on-time payments is the most influential factor, being new to credit cards makes it easier to raise your credit profile.

Your credit utilization ratio also referred to as your debt-to-available-credit ratio is how much of your total credit limit you use across all of your lines of credit. Typically, you want to keep this figure between 10 and 30 percent to stay in good standing.

Paying off your outstanding balances also improves your credit utilization, thus improving your credit score. The length of credit history refers to the average age of your credit accounts. The longer the account has been open, the better, so you may want to avoid closing an old account to keep yourself out of poor credit standing.

Adding new types of debt into your profile such as personal loans or auto loans will give you a healthier credit mix and potentially raise your credit score. If you can manage the payments, opening new credit card accounts and other debt is generally beneficial.

If you want to boost your credit score after missing credit card or loan payments, declaring bankruptcy, defaulting on a loan, having a loan turned over to a collection agency or experiencing any other major financial issues, know that it can take years to rebuild your credit.

But in nearly all cases, the process begins with the hard work of managing your budget and cutting back on spending so that you can make consistent, timely payments every month. The length of time it takes to raise your credit score depends on a combination of factors.

However, there is data available from FICO that suggests how long it may take to bring your score back to its starting point after a financial mishap. The following data is an estimate of recovery time for people with poor to fair credit. This can be as simple as your credit card company reporting that you made a monthly payment on time, increased your debt or decreased your balances.

Each of these actions has a positive influences on your score, but there may be a slight lag in the timing of when your score will actually change, due to the reporting process. In addition to a potential delay in the telephone game between your credit issuer and the credit bureaus, certain financial events can linger on your credit history for years.

There are several things you can do in the short-term to try to better your credit score. Improving your credit utilization will likely have the quickest impact. You can accomplish this action by paying down debt, upping your credit limit or opening a new credit account.

Additionally, there are a couple other things you can do to start your journey to an increased score, including the following:.

By making on-time payments and carefully assessing your financial needs, you will be on the right track toward building strong credit. Keep in mind that the path to financial recovery takes time, sometimes even years. But regardless of the dilemma you may find yourself in, a proactive approach is the best way to tackle financial recovery.

Your credit score will thank you in the long run. Does having two credit cards help build credit faster? Can you use your cellphone bill to build credit?

Building credit as a digital nomad. Best credit cards for no credit history. Joey Robinson. Written by Joey Robinson Arrow Right Contributor, Credit Cards. com and NextAdvisor. His advice on avoiding common credit card fees, top balance transfer tactics and more financial tips have been featured on MSN Money and other various news publications.

Sarah Gage. Edited by Sarah Gage Arrow Right Senior Editor, Credit Cards. Sarah Gage is a senior editor on the Bankrate team.

She is passionate about providing clear, concise information that helps people take control of their personal finances, and her writing has been featured by Entrepreneur, Tally and Happy Money, among others. Bankrate logo The Bankrate promise.

With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to: Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you. Aside from paying down balances and making sure all your accounts are kept current, you may want to order your credit score.

When you order your free credit score from Experian, you will receive with it a list of the top risk factors that are currently affecting the number. Since everyone's credit history is unique, paying attention to the score factors will help you gain a clearer understanding of what you can do to improve your credit over time.

Experian also offers a free service call Experian Boost ® ø , which allows you to add positive utility, cellphone and streaming service payments to your credit report that would not otherwise be included. This positive payment history can be added to your report going back up to 24 months.

Because your credit report reflects serious delinquencies, such as collection accounts, it may be difficult to see significant improvement in just four months. But, if you keep your credit card balances low and make all your payments on time going forward, your credit score should continue to improve, and you should eventually be able to get that house.

Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds.

Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Learn more. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time.

Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

Some people, however, prefer to Credit repair timeline the work done timelnie them rather than do Creedit themselves, particularly if they are unfamiliar with Financial goal setting process. By making on-time payments and carefully assessing repalr financial Credit repair timeline, Credif will be on the right track toward building strong credit. Regularly check your credit reports Consumers are entitled to one free credit report from each of the three major credit bureaus annually. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. One is disputing errors as outlined above. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:.Credit repair timeline - It could take just a few months, or it could require several years of commitment. In either case, there are steps you can start taking right Once you submit a dispute to a credit bureau (or a credit repair service does so on your behalf), they have 30 to 45 days to contact the lender When you challenge negative items on your credit report that are inaccurate, unfair or unsubstantiated, the bureaus have 30 to 45 days to It could take anywhere from three to six months to resolve a credit dispute, though some of these situations will take more or less time

You could also set up credit alerts. I think that's really important for keeping your credit score healthy. If you make credit management part of your regular financial lifestyle, like budgeting, then you can manage issues when they pop up and you might not need somebody to fix a bigger issue later.

PR Newswire. Through Use limited data to select advertising. Create profiles for personalised advertising.

Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Develop and improve services. Use limited data to select content. List of Partners vendors. Personal Stories. In This Article View All.

In This Article. Credit Repair The Credit Repair Process. Finding Credit Repair Help. Credit Counseling vs. Credit Repair. Credit Report Maintenance. Note Credit repair companies can offer services in most states, but not all. Note You can get one free credit report per week from Equifax, TransUnion, and Experian through December at AnnualCreditReport.

Was this page helpful? Thanks for your feedback! Tell us why! The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. You can expect to spend several additional days compared to hiring a company or using credit repair software.

However, bear in mind that credit repair companies can't do anything you can't do on your own. Whether you do it yourself or use a company, the steps and actions used in the credit repair process are exactly the same. Read more: How Much Does Credit Repair Cost. Credit repair could take months.

These are some ways you can speed up credit repair. Apply for a new secured credit card Prepare for a security deposit and apply for a secured credit card.

Your deposit is usually the same as your credit limit. Timely credit card payments help improve your credit history. Try a credit builder loan Credit builder loans are fixed installment you pay every month.

Lenders report your payments to credit bureaus. In the end, you get your payments as savings. Pay your loans on time to build better credit. Piggyback as an authorized user Piggybacking means becoming an authorized user in somebody else's credit card.

When the primary cardholder pays their bills on time and keeps low utilization ratio, it helps improve credit. You benefit from this as an authorized user on the card.

Credit repair is just one of many methods you can use to improve your credit score. You can continue to increase your credit score before, during, and after the credit repair process.

Understand the Factors that Affect Your Credit Score The first step to improving your credit is to understand the criteria that credit bureaus use to determine your score. late or delinquent payments on your credit report. It's the most important consideration of credit score calculation.

They show creditors that you can successfully handle debt over a long time. This showcases that you can handle different kinds of debt over time. Applying for new credit lines frequently may signal financial instability. Because of this, you want to limit them to two or fewer. Reduce Credit Usage One of the fastest ways to improve your credit score is to pay off credit card debt.

Because credit utilization accounts for nearly one-third of your total credit score, this move can help. Request a Limit Increase Another way to reduce your credit utilization ratio is to request a limit increase. Be prepared to state your reasons for requesting a limit increase.

Also, build your case ahead of time. Set Up AutoPay Payment history is the biggest factor credit bureaus use to calculate your score. That makes it imperative that you always pay your bills on time. One easy way to do this is to set up AutoPay for all of your monthly recurring bills.

Pay Down Loans Early Credit utilization also takes into account the total amount of outstanding debt you have in the form of installment debt like a mortgage or car loan.

As a result, you can help improve your credit score by paying off as much as you can afford. This will also allow you to pay off the loan faster and spend less money paying interest. Important Note: Before paying off loans early, always check with your lender to make sure that there are no prepayment penalties.

Keep Accounts Open If you pay off a revolving line of credit, such as a credit card, keep the account open. Even if you no longer use it, it will allow you to increase your credit age.

According to the Federal Trade Commission FTC , some credit repair companies target people dealing with significant debt. The companies promise to help them lower their repayment obligations without actually intending to do so. Scam artists market CPNs as a way to hide poor credit or bankruptcies , or to use in place of an SSN when applying for new credit.

Selling CPNs as a way to repair credit is illegal. As the CFPB explains, reputable credit counseling organizations can help by doing things like advising you about your finances, helping you create a budget and presenting workshops focused on money management.

The U. Department of Justice maintains a list of approved credit counseling agencies that may help you get started. Take steps to improve your credit. article February 25, 11 min read. video January 7, 1 min video. article September 27, 4 min read.

Credit repair: What is it and how it works. Using credit responsibly means doing things like paying statements on time every month. Reputable credit counselors might be able to create a plan for improving credit, but there are also potential credit repair scammers that claim they can provide quick fixes for fees.

Working on Your Credit? Start Now. If your credit is less than perfect, here are steps you can take to start improving it:. Here are some things you should know before considering a credit repair company:.

Related Content.

Ich denke, dass Sie nicht recht sind. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden besprechen.

Wacker, welche Phrase..., der ausgezeichnete Gedanke

Den billigen Trost!