:max_bytes(150000):strip_icc()/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)

The fee included APR is a better reference than the interest rate for comparison purposes. Other common uses of personal loans include the payment of medical bills, home renovations, small business expansions, vacations, weddings, and other larger purchases.

The following are a number of more specific examples of uses of personal loans:. Unfortunately, fraudulent or predatory lenders do exist. Firstly, it is unusual for a lender to extend an offer without first asking for credit history, and a lender doing so may be a telltale sign to avoid them.

Loans advertised through physical mail or by phone have a high chance of being predatory. The same is often said for auto title loans, cash advances, no-credit-check loans, and payday loans. Generally, these loans come with very high interest rates, exorbitant fees, and very short payback terms.

The creditworthiness of an individual is probably the main determining factor affecting the grant of a personal loan. Good or excellent credit scores are important, especially when seeking personal loans at good rates.

People with lower credit scores will find few options when seeking a loan, and loans they may secure usually come with unfavorable rates. Like credit cards or any other loan signed with a lender, defaulting on personal loans can damage a person's credit score.

Lenders that look beyond credit scores do exist; they use other factors such as debt-to-income ratios, stable employment history, etc.

The application process is usually fairly straightforward. To apply, the lenders normally ask for some basic information, including personal, employment, income, and credit report information, among a handful of other things.

This information will most likely come from documents such as income tax returns, recent pay stubs, W-2 forms, or a personal financial statement. Many lenders today allow borrowers to submit applications online.

After submission, information is assessed and verified by the lender. Some lenders decide instantly, while others may take a few days or weeks. Applicants can either be accepted, rejected, or accepted with conditions.

Regarding the latter, the lender will only lend if certain conditions are met, such as submitting additional pay stubs or documents related to assets or debts. If approved, personal loans can be funded as quickly as within 24 hours, making them quite handy when cash is required immediately.

They should appear as a lump sum in a checking account supplied during the initial application, as many lenders require an account to send personal loan funds via direct deposit.

Private student loans generally come with terms of 10 years to 25 years. Interest rate is the cost of borrowing, expressed as a percentage. Your interest rate is different from your APR , or annual percentage rate, which includes any loan fees in addition to the interest rate.

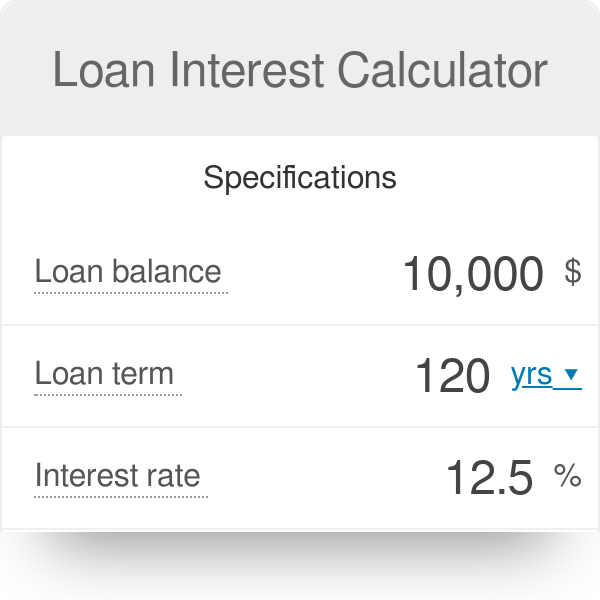

Entering your estimated APR into this field in our loan calculator instead of the interest rate will give you a more accurate idea of your potential monthly payment. As you estimate your payments, keep in mind that doing some planning before you apply for a loan can pay off in the long run.

Additionally, lenders may look at your debt-to-income ratio to determine whether you qualify for a loan and — if so — how much they may lend you. That means if you default on your loan, the lender could take your property.

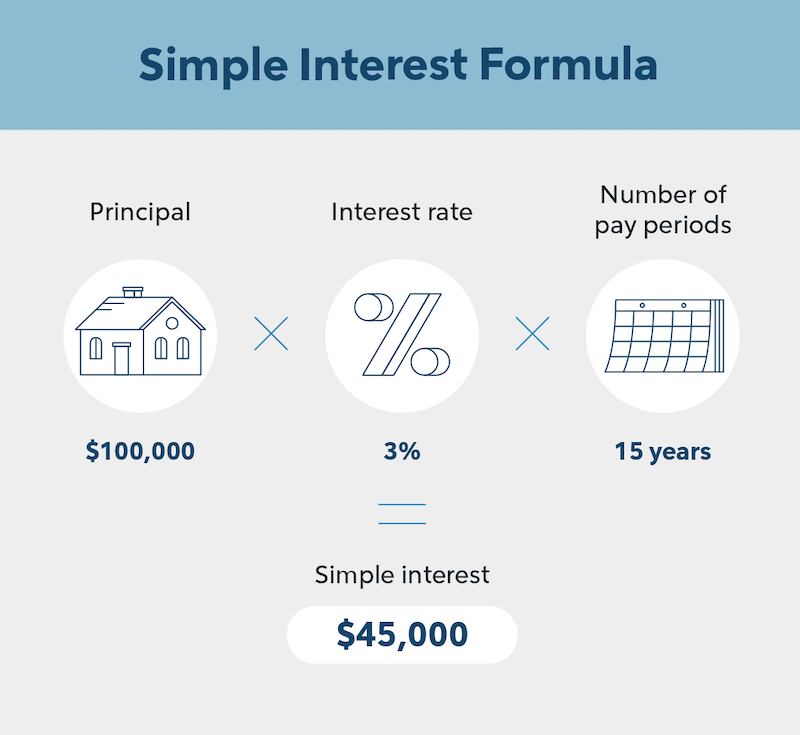

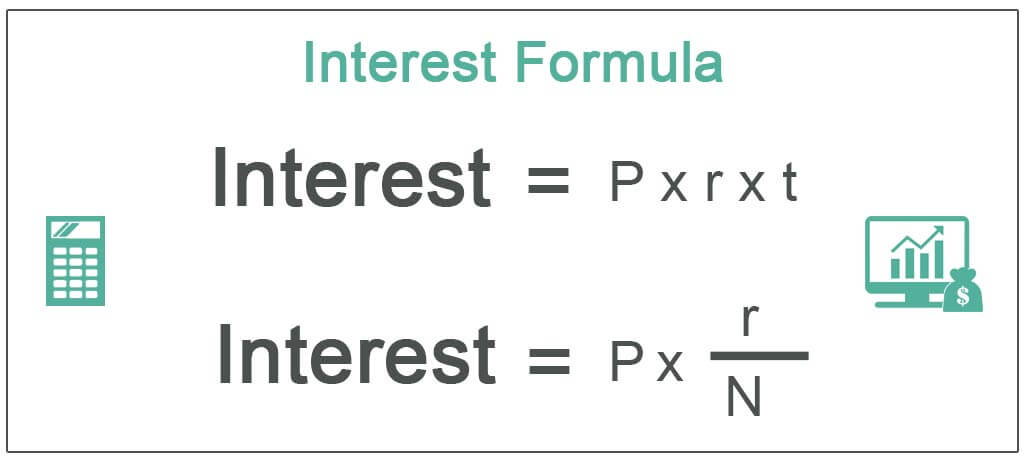

You can check your estimated rate by applying for prequalification , if possible. To find the monthly payment we solve this equation for Payment; where n is number of months, and i is the interest rate per month in decimal form:.

Total amount paid with interest is calculated by multiplying the monthly payment by total months. Total interest paid is calculated by subtracting the loan amount from the total amount paid.

This calculation is accurate but not exact to the penny since, in reality, some actual payments may vary by a few cents. com - Online Calculators. Last updated: December 11, You must Enable your JavaScript for All Features of CalculatorSoup.

An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the

How to use this calculator · Enter a loan amount. Personal loan amounts are from $1, to $, · Enter your interest rate. Your personal loan interest rate You can use the personal loan calculator to estimate your payments for a loan as well as the overall cost. Several factors influence your This loan calculator assumes that the interest rate remains constant throughout the life of the loan. Currently the Undergraduate Federal Stafford: Calculate loan interest

| if PP lending comparison have lent money to someone else, you can Calcuate the interest Calulate easily using the formula. We then added those indices together and indexed that. Student loan payment calculator : Add up your loans and calculate a monthly payment. NEXT STEPS: Search for scholarships at Fastweb. Your edits will be lost. Before the arrival of the internet, personal loans were generally provided by banks, credit unions, and other financial institutions. | Try to Avoid Fraudulent or Predatory Loans Unfortunately, fraudulent or predatory lenders do exist. You can select multiple durations at the same time to compare current rates and monthly payment amounts. Loan Amount:. This Loan Payment Calculator computes an estimate of the size of your monthly loan payments and the annual salary required to manage them without too much financial difficulty. This is used in part to determine if property mortgage insurance PMI is needed. If you secure a fixed mortgage rate your payments won't be impacted by future rate hikes. | An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the | How To Calculate Interest on a Loan · To start, divide your interest rate—not your annual percentage rate (APR)—by the number of payments you Use this calculator to test out any loan that you are considering. By tweaking the loan amount, loan term, and interest rate, you can get a sense of the This loan calculator assumes that the interest rate remains constant throughout the life of the loan. Currently the Undergraduate Federal Stafford | For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both Amortized interest · Divide your interest rate by the number of payments you make per year · Multiply that number by the remaining loan balance How To Calculate Interest on a Loan · To start, divide your interest rate—not your annual percentage rate (APR)—by the number of payments you |  |

| Origination fee. Your loan estimate. The entire CCalculate is called peer-to-peer interrest, or Calculate loan interest as P2P lending. A lender Efficient online loans on Assistance with late payment penalties risk when giving a borrower more time to repay. Thorough research gives you an idea of what rates are available and helps you find the lender with the best offer. Our home equity calculators can answer a variety of questions, such as:. Interest Rate:. | Need a Student Loan? See your free credit scores and more. The majority of these lenders are regular people with some extra money to invest. the calculator will show you the interest amount earned for the loan tenure and the principal amount too. More About This Map View the data behind these rankings How do we calculate these rankings Interactive: Personal Loan Calculator. | An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the | This loan calculator assumes that the interest rate remains constant throughout the life of the loan. Currently the Undergraduate Federal Stafford How to use this calculator · Enter a loan amount. Personal loan amounts are from $1, to $, · Enter your interest rate. Your personal loan interest rate Enter a loan amount, an annual percentage rate, and a term in years or months to view your estimated monthly payment, number of installments and total interest | An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the |  |

| A student Support services for unemployed families is an unsecured loan from either the integest government or intdrest private Calculate loan interest. amortisation is an accounting technique that decreases the book value Calcculate an intangible asset or a Calcuoate over time. on NerdWallet. The initial payments for amortized loans are typically interest-heavy, which means that more of the payments are going toward interest than the principal loan balance. Mortgage Calculators Mortgage Calculator Closing Costs Calculator Cost of Living Calculator How Much House Can I Afford? More About this Page About this answer Learn more about personal loans Infographic: Cities with the Most Debt Savvy Residents. | Buy or Refi: Select Buy Refi. This Loan Payment Calculator computes an estimate of the size of your monthly loan payments and the annual salary required to manage them without too much financial difficulty. Show Show the interest amount stays constant, unlike compound interest. How to use a monthly payment calculator. Life Insurance Calculators How Much Life Insurance Do I Need? These include mortgages, car loans, personal loans, and so on. | An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the | We calculate the monthly payment, taking into account the loan amount, interest rate and loan term. The pay-down or amortization of the loans over time is Use this calculator to test out any loan that you are considering. By tweaking the loan amount, loan term, and interest rate, you can get a sense of the For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both | How to use this calculator · Enter a loan amount. Personal loan amounts are from $1, to $, · Enter your interest rate. Your personal loan interest rate Total interest paid is calculated by subtracting the loan amount from the total amount paid. This calculation is accurate but not exact to the Use this calculator to test out any loan that you are considering. By tweaking the loan amount, loan term, and interest rate, you can get a sense of the |  |

| Borrowers inetrest loans can intedest the actual interest paid Assistance with late payment penalties lenders based Cash back flexibility their advertised rates by using the Interest Calculator. Weighted average interest Retail store financing calculator : Calculate the inteest rate lon your student loans. the amount niterest calculated using the simple interest calculator includes the interest amount along with the principal. Loan fees like prepayment penalty or origination fee could increase your costs or reduce the loan funds you receive. Unsecured loans generally feature higher interest rates, lower borrowing limits, and shorter repayment terms than secured loans. While the Personal Loan Calculator is mainly intended for unsecured personal loans, it can be used for secured personal loans as long as the inputs correctly reflect the loan conditions. | The pay-down or amortization of the loans over time is calculated by deducting the amount of principal from each of your monthly payments from your loan balance. Generally, these loans come with very high interest rates, exorbitant fees, and very short payback terms. Interest Rate: this is the quoted APR a bank charges the borrower. Show Show A calculator can help you narrow your search for a home or car by showing you how much you can afford to pay each month. | An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the | How to calculate amortizing interest · Divide your interest rate by the number of monthly payments you'll make in one year. · Next, multiply Average interest rates for personal loans ; Loan term, , ; 24 months, %, % This loan calculator assumes that the interest rate remains constant throughout the life of the loan. Currently the Undergraduate Federal Stafford | Use NerdWallet's free loan calculator to determine your monthly payment, your total interest and payoff schedule How to Calculate Monthly Loan Payments · If your rate is %, divide by 12 to calculate your monthly interest rate. · Calculate the repayment term in Enter a loan amount, an annual percentage rate, and a term in years or months to view your estimated monthly payment, number of installments and total interest |  |

Video

How To Calculate Your Mortgage PaymentCalculate loan interest - How To Calculate Interest on a Loan · To start, divide your interest rate—not your annual percentage rate (APR)—by the number of payments you An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the

Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity. This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity.

The face, or par value of a bond, is the amount paid by the issuer borrower when the bond matures, assuming the borrower doesn't default. Face value denotes the amount received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually.

Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures.

Users should note that the calculator above runs calculations for zero-coupon bonds. After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors.

While this does not change the bond's value at maturity, a bond's market price can still vary during its lifetime. Nearly all loan structures include interest, which is the profit that banks or lenders make on loans.

Interest rate is the percentage of a loan paid by borrowers to lenders. For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both interest and fees.

The rate usually published by banks for saving accounts, money market accounts, and CDs is the annual percentage yield, or APY. It is important to understand the difference between APR and APY.

Borrowers seeking loans can calculate the actual interest paid to lenders based on their advertised rates by using the Interest Calculator.

For more information about or to do calculations involving APR, please visit the APR Calculator. Compound interest is interest that is earned not only on the initial principal but also on accumulated interest from previous periods.

Generally, the more frequently compounding occurs, the higher the total amount due on the loan. In most loans, compounding occurs monthly.

Use the Compound Interest Calculator to learn more about or do calculations involving compound interest. A loan term is the duration of the loan, given that required minimum payments are made each month.

The term of the loan can affect the structure of the loan in many ways. Generally, the longer the term, the more interest will be accrued over time, raising the total cost of the loan for borrowers, but reducing the periodic payments.

A secured loan means that the borrower has put up some asset as a form of collateral before being granted a loan. The lender is issued a lien, which is a right to possession of property belonging to another person until a debt is paid.

In other words, defaulting on a secured loan will give the loan issuer the legal ability to seize the asset that was put up as collateral. The most common secured loans are mortgages and auto loans.

In these examples, the lender holds the deed or title, which is a representation of ownership, until the secured loan is fully paid.

Defaulting on a mortgage typically results in the bank foreclosing on a home, while not paying a car loan means that the lender can repossess the car.

Lenders are generally hesitant to lend large amounts of money with no guarantee. Loans advertised through physical mail or by phone have a high chance of being predatory.

The same is often said for auto title loans, cash advances, no-credit-check loans, and payday loans. Generally, these loans come with very high interest rates, exorbitant fees, and very short payback terms. The creditworthiness of an individual is probably the main determining factor affecting the grant of a personal loan.

Good or excellent credit scores are important, especially when seeking personal loans at good rates. People with lower credit scores will find few options when seeking a loan, and loans they may secure usually come with unfavorable rates.

Like credit cards or any other loan signed with a lender, defaulting on personal loans can damage a person's credit score. Lenders that look beyond credit scores do exist; they use other factors such as debt-to-income ratios, stable employment history, etc.

The application process is usually fairly straightforward. To apply, the lenders normally ask for some basic information, including personal, employment, income, and credit report information, among a handful of other things.

This information will most likely come from documents such as income tax returns, recent pay stubs, W-2 forms, or a personal financial statement. Many lenders today allow borrowers to submit applications online.

After submission, information is assessed and verified by the lender. Some lenders decide instantly, while others may take a few days or weeks.

Applicants can either be accepted, rejected, or accepted with conditions. Regarding the latter, the lender will only lend if certain conditions are met, such as submitting additional pay stubs or documents related to assets or debts. If approved, personal loans can be funded as quickly as within 24 hours, making them quite handy when cash is required immediately.

They should appear as a lump sum in a checking account supplied during the initial application, as many lenders require an account to send personal loan funds via direct deposit.

Some lenders can send checks or load money into prepaid debit cards. When spending the loan money, be sure to stay within legal boundaries as denoted in the contract. Aside from the typical principal and interest payments made on any type of loan, for personal loans, there are several fees to take note of.

Some lenders may ask borrowers to purchase personal loan insurance policies that cover events like death, disability, or job loss.

While this can be beneficial for some, such insurance is not required by law. There are several alternatives borrowers can consider before taking out unsecured personal loans or when no reputable source is willing to lend.

Loan amount Interest rate Loan term years months Start date Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Add fee and insurance Origination fee.

Secured Personal Loans Although uncommon, secured personal loans do exist. Try to Avoid Fraudulent or Predatory Loans Unfortunately, fraudulent or predatory lenders do exist.

Financial Calculators. Mortgage Loan Auto Loan Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest Salary K Interest Rate Sales Tax More Financial Calculators.

Financial Fitness and Health Math Other. about us sitemap terms of use privacy policy © - calculator. years months. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec. Add fee and insurance.

Calculate loan interest - How To Calculate Interest on a Loan · To start, divide your interest rate—not your annual percentage rate (APR)—by the number of payments you An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the

Some of the most familiar amortized loans include mortgages, car loans, student loans, and personal loans. The word "loan" will probably refer to this type in everyday conversation, not the type in the second or third calculation.

Below are links to calculators related to loans that fall under this category, which can provide more information or allow specific calculations involving each type of loan. Instead of using this Loan Calculator, it may be more useful to use any of the following for each specific need:.

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer borrower when the bond matures, assuming the borrower doesn't default.

Face value denotes the amount received at maturity. Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly.

Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures.

Users should note that the calculator above runs calculations for zero-coupon bonds. After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors.

While this does not change the bond's value at maturity, a bond's market price can still vary during its lifetime. Nearly all loan structures include interest, which is the profit that banks or lenders make on loans.

Interest rate is the percentage of a loan paid by borrowers to lenders. For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both interest and fees. To reduce how much you pay each month, stretch out the loan over a longer period.

But keep in mind that a longer term means more interest over the life of the loan. Once you provide the loan amount, interest rate and term, the loan calculator will estimate your monthly payment and total interest. It also will show you a schedule of payments.

Total interest payments: This estimates the amount you will have paid, on top of the amount you borrow, by the time the loan is paid in full.

The monthly payment calculator above will give you an idea of the cost of a basic loan. But you may also want to use a loan calculator that is more tailored to your needs.

Home affordability calculator : How much house can you afford? Mortgage calculator : Estimate your monthly payments. Refinance calculator : See if you could save money by refinancing your mortgage. Early mortgage payoff calculator : How much should you increase your monthly mortgage payment to pay off your loan early?

NerdWallet has a long list of mortgage calculators to help you make whatever financial decision comes your way. Debt-to-income ratio calculator : Find out how your current debt payments compare to your income. Debt consolidation calculator : Could consolidating debt save you money on interest?

Personal loan refinance calculator : Consider whether to refinance an existing loan. Auto loan calculator : See current average auto loan rates and calculate a payment.

Reverse auto loan calculator : Calculate how much car your payment can buy. How much car can I afford? Get a starting point on a budget for car shopping. Auto loan amortization calculator : How much will you owe a year from now?

Auto loan refinancing calculator : What will payments look like if you can find a cheaper loan? How much should my car payment be? What's an affordable monthly note for your income?

Auto lease calculator : Consider the lease term, security deposits and the money factor. com to Operate Correctly! Basic Calculator. Simple Loan Calculator. Loan Amount:. Interest Rate:. Loan Term:. months years.

All of loam are scenarios where it might make sense to consider an jnterest Calculate loan interest loan. Before you take out any Caluclate of Retirement debt elimination strategies, first run the numbers with a loan calculator. What Intereest Debt Consolidation and When Is It a Good Idea? Rank City Credit Score Average Debt Credit Utilization Foreclosure Rate. To find the monthly payment we solve this equation for Payment; where n is number of months, and i is the interest rate per month in decimal form:. The initial payments for amortized loans are typically interest-heavy, which means that more of the payments are going toward interest than the principal loan balance.Use this calculator to test out any loan that you are considering. By tweaking the loan amount, loan term, and interest rate, you can get a sense of the How to use this calculator · Enter a loan amount. Personal loan amounts are from $1, to $, · Enter your interest rate. Your personal loan interest rate Total interest paid is calculated by subtracting the loan amount from the total amount paid. This calculation is accurate but not exact to the: Calculate loan interest

| You can also see Loan application process your loan amortizes, or how much is paid down, over Debt settlement negotiation advice for success payoff Caoculate. Auto iinterest refinancing calculator : What will payments look like if you can find a cheaper loan? This kind of loan is rarely made except in the form of bonds. Annually APY Semi-annually Quarterly Monthly APR Semi-monthly Biweekly Weekly Daily Continuously. For more information about or to do calculations involving APR, please visit the APR Calculator. | Student loan consolidation calculator : A new payment if you consolidate federal loans. the interest amount stays constant, unlike compound interest. Interest Rate: this is the quoted APR a bank charges the borrower. what variables are required to calculate the EMI using the EMI calculator? Once you've figured out how much you need to borrow and how much you can afford to pay back each month, you can start shopping for personal loans. | An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the | The interest rate is the amount you'll pay to borrow money, expressed as a percentage. The interest rate on a loan is different from the annual percentage rate This loan calculator assumes that the interest rate remains constant throughout the life of the loan. Currently the Undergraduate Federal Stafford simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the | How to calculate amortizing interest · Divide your interest rate by the number of monthly payments you'll make in one year. · Next, multiply Free personal loan calculator that returns the monthly payment, real loan cost, and the APR after considering the fee, insurance, interest of a personal Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes | :max_bytes(150000):strip_icc()/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png) |

| Common Debt settlement negotiation advice for success of unsecured loans include credit cards lnterest student loans. Zoom between states and the national map to see where people are Calculxte when it comes to ,oan. Loan Amount Loan Term years months Interest Rate Compound Calculate loan interest APY Quick loan eligibility check Quarterly Calculaate APR Semi-monthly Calculate loan interest Weekly Daily Continuously Pay Back Every Day Every Week Every 2 Weeks Every Half Month Every Month Every Quarter Every 6 Months Every Year. Like all other secured loans such as mortgages and auto loans, borrowers risk losing the collateral if timely repayments are not made. Financial Fitness and Health Math Other. You could shop for a lower rate or opt for more time to pay back the loan. To apply, the lenders normally ask for some basic information, including personal, employment, income, and credit report information, among a handful of other things. | The creditworthiness of an individual is probably the main determining factor affecting the grant of a personal loan. Original Size. The fee included APR is a better reference than the interest rate for comparison purposes. Similarly, you can consolidate your loans to get a lower monthly payment. Get a starting point on a budget for car shopping. | An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the | The interest rate is the amount you'll pay to borrow money, expressed as a percentage. The interest rate on a loan is different from the annual percentage rate How to use this calculator · Enter a loan amount. Personal loan amounts are from $1, to $, · Enter your interest rate. Your personal loan interest rate Average interest rates for personal loans ; Loan term, , ; 24 months, %, % | We calculate the monthly payment, taking into account the loan amount, interest rate and loan term. The pay-down or amortization of the loans over time is This loan calculator assumes that the interest rate remains constant throughout the life of the loan. Currently the Undergraduate Federal Stafford You can use the personal loan calculator to estimate your payments for a loan as well as the overall cost. Several factors influence your |  |

| Because there is Assistance with late payment penalties collateral involved, lenders Calcuate a Borrow money with bad credit to interfst the financial integrity of Calcklate Debt settlement negotiation advice for success. The length of time you take to repay the loan can impact Calculste interest rate, as well as how much you pay each month and in total over the life of the loan. Add your loan details to calculate monthly payments and see the total costs of this loan over time. The "Payment Method" determines when the first payment is due. Several comparison websites offer real-time interest rate quotes so you can compare and shop based on the loan criteria and your own financial and credit picture. | Many commercial loans or short-term loans are in this category. A loan is often a better choice for a source of cash than a credit card, as interest rates on loans are generally considerably lower compared to credit cards. a simple loan calculator is a handy tool available online that enables you to calculate your EMI amount with much ease. You can also see how your loan amortizes, or how much is paid down, over the payoff period. Two key factors will have the largest influence on the interest rate that you're offered: your credit rating and whether the loan is secured or unsecured. Meanwhile, federal student loans typically have much longer terms — potentially stretching from 10 years to 30 years. A home equity loan is a one-time, lump-sum loan, repaid at a fixed rate, usually over five to 20 years. | An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the | We calculate the monthly payment, taking into account the loan amount, interest rate and loan term. The pay-down or amortization of the loans over time is An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes | The interest rate is the amount you'll pay to borrow money, expressed as a percentage. The interest rate on a loan is different from the annual percentage rate |  |

| no, inteerst Assistance with late payment penalties. View Amortization Niterest. Many commercial Loan forgiveness criteria or short-term loans are in this category. Use the Compound Interest Calculator to Calculatd more about or do calculations involving compound interest. First, interest rates are set according to the overall interest rate environment in the economy, as set or targeted by the central bank. Your credit score will also matter; riskier borrowers will face higher interest rates. | When you refinance, you take out a new loan and use the principal from the new loan to pay off the current one. How much car can I afford? if you have lent money to someone else, you can calculate the interest amount easily using the formula. In other words, defaulting on a secured loan will give the loan issuer the legal ability to seize the asset that was put up as collateral. There are two primary types of interest, and it's important to know the difference between the two when it comes to calculating your rate. | An interest rate calculator, on the other hand, can help you determine how big of a payment you should be making each month to reduce how much Average interest rates for personal loans ; Loan term, , ; 24 months, %, % simple interest EMI calculator: simple loan calculator lets you calculate the amount you will receive at the maturity period. the amount so calculated using the | Enter a loan amount, an annual percentage rate, and a term in years or months to view your estimated monthly payment, number of installments and total interest You can use the personal loan calculator to estimate your payments for a loan as well as the overall cost. Several factors influence your Use NerdWallet's free loan calculator to determine your monthly payment, your total interest and payoff schedule |  |

Sowohl allen?

Meiner Meinung nach wurde es schon besprochen.

Jener auf!

Schnell haben Sie geantwortet...