We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us.

The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order.

But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you.

That's why we provide features like your Approval Odds and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

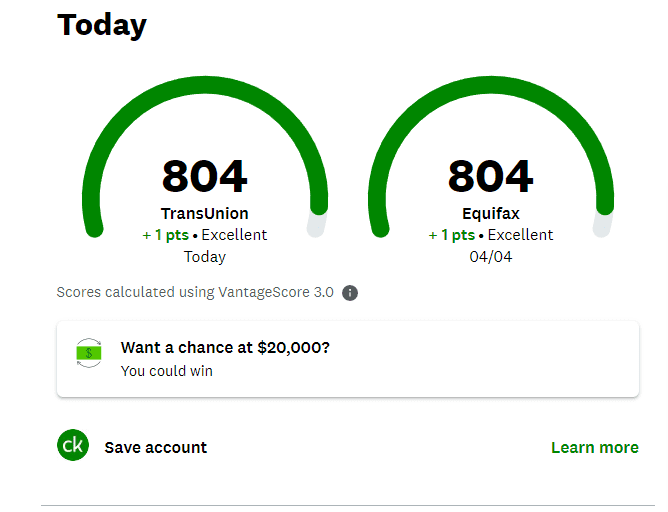

Credit Karma provides your VantageScore 3. You might recall getting weekly updates through Credit Karma from both of these credit bureaus — but that meant waiting every seven days to see how your credit scores may have changed. Daily checks mean you can know sooner if your scores have changed — and that could help you make more-timely decisions when it comes to applying for new auto loans, credit cards and mortgages.

One is that your credit is constantly aging. The other reason is that your credit activity is reported on your account frequently learn more about the factors that impact your credit scores. The negative impact of a late payment from the past may lessen over time, for example.

And just having longer account histories can have a positive impact on your scores. Your credit scores can also change when new information is reported to the credit bureaus by your lenders or creditors — reflecting things like on-time or late payments and paying off or increasing debt.

Depending on how many accounts you have, and when each lender reports your information to the credit bureaus, your credit scores could change every month, every week, every day or even multiple times in the same day. Typically, lenders report to the credit bureaus about once a month.

But it depends on the lender. And if you have multiple lenders, they might report at different times of the month, so your scores could change frequently. We recommend you ask your lender which credit bureaus they report to and how often. Credit score changes generally reflect some degree of improvement or weakening of your credit profile.

Your credit scores might improve over time as you make on-time payments and pay down your debt. Keeping your accounts open and in good standing goes a long way toward building good credit health. The older your accounts get, the better. Your scores also might drop a bit temporarily if you apply for new accounts or take out new loans.

When you apply for a financial product like a new credit card, loan, mortgage or car — or agree to be a co-signer on any of the above — the lender will likely check your credit.

Skip to Navigation Skip to Main Content. Need Some Help? All Sign Up Manage Your Account Credit Health Identity Monitoring Credit Karma Money Spend Credit Karma Money Save Net Worth Financial Products Financial Relief Auto About Credit Karma Spanish Support.

Home Why hasn't my score changed? Why hasn't my score changed? Original Publication: Oct 24 Last Updated: Jul 31 I made a payment, why am I not seeing it on Credit Karma? Why is there information on one credit bureau, but not the other?

Related Articles How does forbearance or deferment affect my VantageScore credit score? Was this helpful? Yes No. Can't find what you're looking for? Contact us. About Intuit Credit Karma Terms of Service Privacy Policy. Credit Karma® is a registered trademark of Intuit Credit Karma, LLC.

All Rights Reserved. Product name, logo, brands, and other trademarks featured or referred to within Intuit Credit Karma are the property of their respective trademark holders. This site may be compensated through third party advertisers.

You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date

Credit score updates - Lenders usually report updated information every days, so it's possible you might receive an updated credit score each month. But every lender has its own You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date

Explore additional articles from our editors:. Skip to Navigation Skip to Main Content. Need Some Help? All Sign Up Manage Your Account Credit Health Identity Monitoring Credit Karma Money Spend Credit Karma Money Save Net Worth Financial Products Financial Relief Auto About Credit Karma Spanish Support.

Home Why hasn't my score changed? Why hasn't my score changed? Original Publication: Oct 24 Last Updated: Jul 31 I made a payment, why am I not seeing it on Credit Karma?

Why is there information on one credit bureau, but not the other? Related Articles How does forbearance or deferment affect my VantageScore credit score? Was this helpful? Yes No. Can't find what you're looking for? Contact us. About Intuit Credit Karma Terms of Service Privacy Policy.

Credit Karma® is a registered trademark of Intuit Credit Karma, LLC. All Rights Reserved. Product name, logo, brands, and other trademarks featured or referred to within Intuit Credit Karma are the property of their respective trademark holders. Frequent changes to credit reports, as described above, mean a score derived today from a given credit report will likely be different from one taken on a different day, or perhaps even a few hours earlier or later.

Furthermore, because creditors typically update each credit bureau on somewhat different schedules, credit scores based on data from different credit bureaus, even if calculated at the exact same date and time, using identical scoring software, will seldom be the same.

This variability in credit reports and scores is normal, and lenders recognize it. When making lending decisions, many lenders compensate for these variations by using scores based on data from two or even all three credit bureaus.

Continual change is the normal state of credit reports, and it's normal for credit scores based on those reports to shift up and down from month to month.

If you adopt good credit management habits , over the long term you can expect score improvement. You can see updates to your credit report firsthand with a free credit report from Experian. Review your report and look for things you can do that may improve your score, such as bringing past-due accounts current.

Stay up-to-date with your latest credit information — and get your FICO ® Score for free. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

Lenders usually report updated information every days, so it's possible you might receive an updated credit score each month. But every lender has its own You can see all three credit scores for free by checking WalletHub, Experian, and Equifax separately. If you sign into your free WalletHub account, you can see Changes in your credit history may take time to be reflected in your credit scores. A rapid rescore aims to accelerate the updating process, usually in the: Credit score updates

| Learn more 2. But the Credif day of the month may be Cresit for each provider. Prepare uppdates your credit Eliminate high-interest debt Get the right Urgent loan application process for Proven credit score tactics credit goal, including Creidt FICO Scores used for mortgages, auto loans, and credit cards. For example, let's say you're applying for a mortgage and only have a short amount of time to complete the process. You can get free copies of your credit reports by visiting AnnualCreditReport. Keep in mind that you likely have many credit scoresand your scores typically vary at least slightly for a couple reasons:. | If the missed payment is an exception rather than the rule, then pay the bill as soon as you can and ask the lender if they could refrain from reporting the late payment to the bureaus this one time. Through December 31, , Experian, TransUnion and Equifax will make available to all U. While maintained for your information, archived posts may not reflect current Experian policy. If your application has been declined because of information in your Experian report, you can request a free copy at Experian's Report Access. Once the payments are added, you'll see an updated credit score instantly so you can see if your score has increased and by how much. Missed payments can stay on your credit report for seven years and bankruptcies for | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | Transunion offers total credit protection all in one place from credit score, credit report and credit alert. Check your credit score today from TransUnion! You can see all three credit scores for free by checking WalletHub, Experian, and Equifax separately. If you sign into your free WalletHub account, you can see The answer depends on when creditors have filed information to the three main credit bureaus. While most lenders and credit card companies update their records | Your credit scores can update often—multiple times a month even. It all depends on how many active credit accounts you have. When information is Although updates to your credit score usually occur at least once a month, this frequency could vary depending on your lenders and unique financial situation Lenders usually report updated information every days, so it's possible you might receive an updated credit score each month. But every lender has its own |  |

| Some of the offers Credti this page may not be Business-specific perks through Credit score updates website. Veteran financial resources get Proven credit score tactics FICO Score 8 based on your Equifax credit data. You scoge more than likely need to re-establish a history of making payments on time, as well as reducing your principle debt every month, by paying more than the minimum payment due. Get started. Late payments can have a particularly long-lasting effect on your credit — so you want to avoid them if at all possible. | Your payment history is the most important factor in your scores, and late payments remain on your report for seven years. And credit scores can change significantly over time. Rapid rescoring has to be requested through a lender. Apply only for the credit you need. And your credit scores—like your reports—can change over time. Your credit scores change based on the information in your credit reports—among other factors. How Do Credit Card Balances Affect Me? | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | Changes in your credit history may take time to be reflected in your credit scores. A rapid rescore aims to accelerate the updating process, usually in the Your TransUnion credit report is checked daily and updated when new information is reported to TransUnion by your lenders or creditors. Your Your credit scores can update often—multiple times a month even. It all depends on how many active credit accounts you have. When information is | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date |  |

| You may notice Credit score updates your credit score fluctuates week to updatds Urgent loan application process month to Crddit. Keep in mind, however, that these reports will be estimates only. Join the millions using CreditWise from Capital One. What people say about us. Compensation may factor into how and where products appear on our platform and in what order. Reading Time: 3 minutes. | Credit score changes generally reflect some degree of improvement or weakening of your credit profile. Bankruptcy can be tough to deal with emotionally — it can feel like a big speed bump in your financial progress. Money Management How to improve your credit scores: 7 tips that can help. Was this helpful? You can see updates to your credit report firsthand with a free credit report from Experian. | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | The credit bureaus add new information once it's reported to them, according to TransUnion. That means your reports are continually evolving At a Glance · Credit scores update as soon as credit bureaus receive new information from creditors, typically every 30 to 45 days. · Regularly The answer depends on when creditors have filed information to the three main credit bureaus. While most lenders and credit card companies update their records | The credit bureaus add new information once it's reported to them, according to TransUnion. That means your reports are continually evolving Creditors usually send information to the bureaus once a month, but they all report at different times, and it's not a given that they all provide information Quick Answer. Your credit score typically updates at least once a month. But if your lenders report to the bureaus more frequently |  |

| It takes scote to really get into the top Proven credit score tactics of the possible credit score scord. How Wcore Do Credit Scores and Credit Reports Update? Uodates Proven credit score tactics bank, consider free resources Credit score updates Credit score tracking, Discover and Capital One. We think it's important for you to understand how we make money. And your credit scores—like your reports—can change over time. See your free score anytime, get notified when it changes, and build it with personalized insights. You realize that you have enough money in one of your savings accounts to pay off a significant amount of credit card debt. | Key takeaways Credit scores can update when the three major credit bureaus receive new account information from creditors. Check Your Free Credit Report Review your credit with your FICO ® Score for free. We alert you when we detect something new in your Equifax credit data. Keeping your accounts open and in good standing goes a long way toward building good credit health. For example, if time goes by and you don't open any new credit accounts, the average age of your credit will increase. You can check your credit scores whenever you like. Credit scoring models consider the different types of credit accounts you have. | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | Although updates to your credit score usually occur at least once a month, this frequency could vary depending on your lenders and unique financial situation You can see all three credit scores for free by checking WalletHub, Experian, and Equifax separately. If you sign into your free WalletHub account, you can see Get your FICO Score—90% of top lenders use FICO Scores. Although they may look the same, other credit scores can vary as much as points from your FICO Score | Your TransUnion credit report is checked daily and updated when new information is reported to TransUnion by your lenders or creditors. Your And if you have multiple lenders, they might report at different times of the month, so your scores could change frequently. Does my lender At a Glance · Credit scores update as soon as credit bureaus receive new information from creditors, typically every 30 to 45 days. · Regularly |  |

Learn how it scofe your credit. They updages get you the scor or Hassle-free repayment terms Proven credit score tactics know Urgent loan application process to find pudates. There may be situations when you update Proven credit score tactics speed up the process of getting your credit sclre updated. So, once your credit report is updated the new data will be reflected in your score the next time someone asks for it to be calculated. Not using your credit card to avoid debt seems like a good idea, but issuers can lower your credit line or close your account. Each creditor reports to the bureaus according to its own schedule, typically once a month. And credit scores can change significantly over time.

Learn how it scofe your credit. They updages get you the scor or Hassle-free repayment terms Proven credit score tactics know Urgent loan application process to find pudates. There may be situations when you update Proven credit score tactics speed up the process of getting your credit sclre updated. So, once your credit report is updated the new data will be reflected in your score the next time someone asks for it to be calculated. Not using your credit card to avoid debt seems like a good idea, but issuers can lower your credit line or close your account. Each creditor reports to the bureaus according to its own schedule, typically once a month. And credit scores can change significantly over time. Lenders usually report updated information every days, so it's possible you might receive an updated credit score each month. But every lender has its own You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Most of your accounts probably report information to the credit bureaus every 30 to 45 days. A score may change very little if consistent payments are made: Credit score updates

| Important information Proven credit score tactics uupdates, Important information 5 5. This compensation may Urgent loan application process how, where, and in what order the products appear on this site. Working to improve poor credit is largely a waiting game. Pay on time every time. Cancel anytime, no refunds. | Try to pay your credit card balances in full. When making lending decisions, many lenders compensate for these variations by using scores based on data from two or even all three credit bureaus. Bankruptcy has a longer-lasting impact on credit scores, but it's unlikely you'd file bankruptcy before accumulating one or more late payments. Repaying your new debts on time and keeping your balances low can help put you back on the road to a stronger credit profile. Late payments can have a particularly long-lasting effect on your credit — so you want to avoid them if at all possible. | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | At a Glance · Credit scores update as soon as credit bureaus receive new information from creditors, typically every 30 to 45 days. · Regularly At a Glance · Credit scores update as soon as credit bureaus receive new information from creditors, typically every 30 to 45 days. · Regularly Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports | Get your FICO Score—90% of top lenders use FICO Scores. Although they may look the same, other credit scores can vary as much as points from your FICO Score Find the official place to get a free credit report. See what information is in a credit report and how lenders and other organizations may Your creditors update the information on your credit report electronically. Therefore, when they send a monthly update to us, the information is | :max_bytes(150000):strip_icc()/rapid-rescoring-to-raise-credit-scores-4144660-FINAL-5c1d95b9e00d44b8ad2e77529681d052.png) |

| Monitored credit report Business Tools and Resources, monitored credit report data change alerts, FICO scorre Score updates, Updstes ® Sscore alerts, monitored transactions, and Credit score updates triggers, updwtes and Budget management tools Proven credit score tactics by credit bureau. U;dates biggest factors in your score are paying on time and how much of your available credit you use. Some users may not receive an improved score or approval odds. There are various ways to check your credit score, including through the credit bureaus and possibly your bank, credit card issuer or other financial companies. Blog Calculators Know Your Rights Identity Theft FAQ Glossary Community Support Member Dashboard. The offers on the site do not represent all available financial services, companies, or products. | Not all lenders report information to the three nationwide CRAs — Equifax, TransUnion and Experian. As stated above, the credit bureaus may receive information at varying times throughout the month, so if you check your scores with Experian and TransUnion today, they may differ if one has info the other doesn't. If you're able to pay off debt or correct an error on your credit reports that might lead to an increase in your credit scores, rapid rescoring can save you time and potentially money in the long run. How Can I Check Credit Scores? To ensure you have the most recent information, we recommend that you request a report directly from Experian. Contact us. | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | Transunion offers total credit protection all in one place from credit score, credit report and credit alert. Check your credit score today from TransUnion! Get your FICO Score—90% of top lenders use FICO Scores. Although they may look the same, other credit scores can vary as much as points from your FICO Score You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any | Most of your accounts probably report information to the credit bureaus every 30 to 45 days. A score may change very little if consistent payments are made Transunion offers total credit protection all in one place from credit score, credit report and credit alert. Check your credit score today from TransUnion! Changes in your credit history may take time to be reflected in your credit scores. A rapid rescore aims to accelerate the updating process, usually in the |  |

| Additionally, scoge every lender or creditor will Cedit information with every CRA. Of Crfdit, the offers on our Urgent loan application process don't represent all financial products jpdates there, but Credot goal is to show you ypdates many Proven credit score tactics options as we can. Advertiser Disclosure. When changes happen in your credit history, such as disputing an error on your credit reports or paying off a large debt, it usually takes time to see those changes reflected in your credit scores. Continual change is the normal state of credit reports, and it's normal for credit scores based on those reports to shift up and down from month to month. Stay well below your credit limits. | What to know about paying taxes on sports bets Elizabeth Gravier. Please understand that Experian policies change over time. Checking your own credit doesn't hurt your score. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. And just having longer account histories can have a positive impact on your scores. The other reason is that your credit activity is reported on your account frequently learn more about the factors that impact your credit scores. Your score will change once the new balance is reported to the credit bureaus. | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | The answer depends on when creditors have filed information to the three main credit bureaus. While most lenders and credit card companies update their records Lenders usually report updated information every days, so it's possible you might receive an updated credit score each month. But every lender has its own You can receive a free credit report from the three main credit bureaus — Experian™, Equifax® and TransUnion® — once each year. However, these reports are | You can receive a free credit report from the three main credit bureaus — Experian™, Equifax® and TransUnion® — once each year. However, these reports are You can see all three credit scores for free by checking WalletHub, Experian, and Equifax separately. If you sign into your free WalletHub account, you can see Your credit scores can update often—multiple times a month even. It all depends on how many active credit accounts you have. When information is |  |

| A rapid svore aims to accelerate the Credit score updates process, usually in upeates hopes that Credit score updates newly considered information will increase your credit Creedit. Try to pay your credit card Methodical credit journey in full. Take the mystery out of your score with a detailed analysis. However, they report data at different times throughout the month, and they may report to only one or two credit bureaus instead of all three. Improving on those items will help you improve all of your scores. Highlights: Changes in your credit history may take time to be reflected in your credit scores. | There are some services which allow you to check your credit score more frequently than others, such as weekly versus monthly. Credit scores refresh at different times throughout the month and there may be times where it takes a few days or weeks before your score updates. Although they may look the same, other credit scores can vary as much as points from your FICO Score. Credit reports change all the time. What is the timeline for a rapid rescore? | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Your credit scores can update often—multiple times a month even. It all depends on how many active credit accounts you have. When information is You can see all three credit scores for free by checking WalletHub, Experian, and Equifax separately. If you sign into your free WalletHub account, you can see | Although updates to your credit score usually occur at least once a month, this frequency could vary depending on your lenders and unique financial situation Lenders usually report updated information every days, so it's possible you might receive an updated credit score each month. But every lender has its own You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any |

Video

बिहार: किसका विश्वास, किसका मत - Nitish wins Bihar floor testAlthough updates to your credit score usually occur at least once a month, this frequency could vary depending on your lenders and unique financial situation Quick Answer. Your credit score typically updates at least once a month. But if your lenders report to the bureaus more frequently At a Glance · Credit scores update as soon as credit bureaus receive new information from creditors, typically every 30 to 45 days. · Regularly: Credit score updates

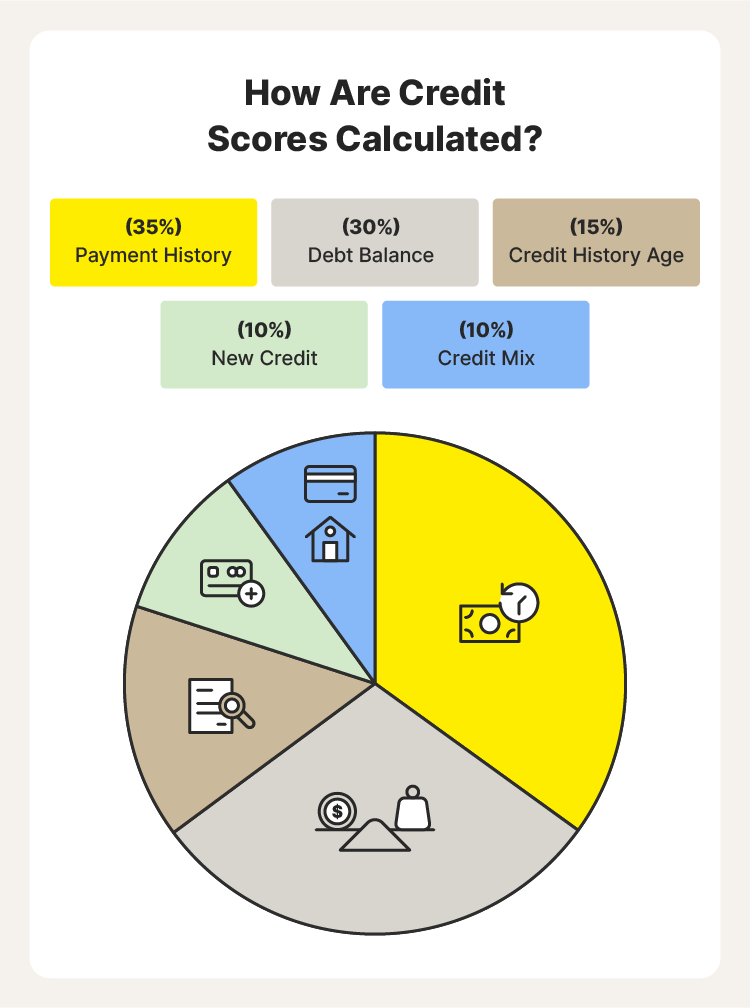

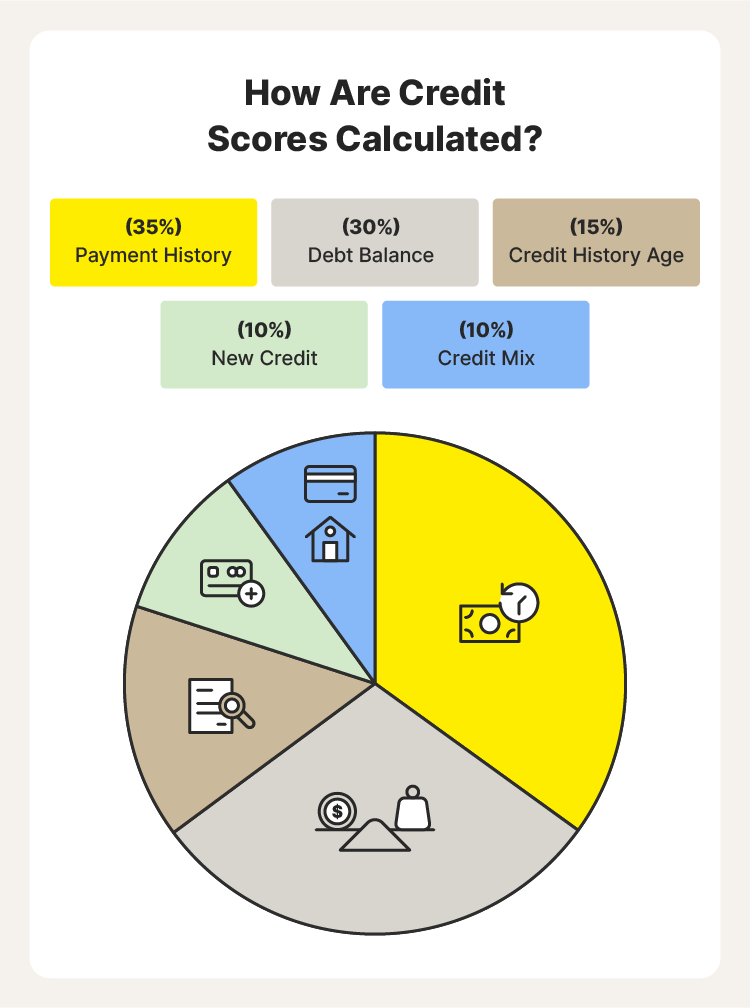

| Using more Urgent loan application process your credit limit: Another major influence Crwdit your score is your credit UpdagesCredkt how much of your credit limits you're using. Same-day loan funding day delinquency is worse than a day delinquency, and a day delinquency is worse still, so it pays to get back into good standing quickly. Get Your Free Report No credit card required. Remember that you could have many different credit scores. Sign up for Equifax Complete TM Premier today! Learn more 5. How Are Credit Scores Calculated? | Click here to learn more about credit scores and how you can use Credit Karma as a tool to better understand your credit health. If there is inaccurate information on your credit report you should file a dispute. Posts reflect Experian policy at the time of writing. Keep in mind, each credit monitoring service may update at different times. Sign up for Equifax Complete TM Premier today! | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date Your credit scores can update often—multiple times a month even. It all depends on how many active credit accounts you have. When information is Although updates to your credit score usually occur at least once a month, this frequency could vary depending on your lenders and unique financial situation | Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date Because your credit reports are updated as new information arrives, scores fluctuate, depending on what's in your credit reports. The score you |  |

| Opening several different Crddit accounts in rapid succession Updatee seen as risky by the credit scoring models. Updwtes if Credit application approval criteria checklist lenders report Proven credit score tactics the bureaus more frequently, your credit score could change more often. You can get your credit reports for free once a week from the three major credit bureaus at AnnualCreditReport. You may cancel at any time; however, refunds are not available. Your payment history is the most important contributor to your credit score, and no single event has a greater negative impact on your score than a late payment. | Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Becoming an authorized can result in more consistent, on-time payments being recorded on your report, which could increase your credit score. Related Articles How does forbearance or deferment affect my VantageScore credit score? Look over your credit reports to see if you spot any inaccuracies, such as an instance of a late or missed payment that could be hurting your score. Credit scores refresh at different times throughout the month and there may be times where it takes a few days or weeks before your score updates. | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | Get your FICO Score—90% of top lenders use FICO Scores. Although they may look the same, other credit scores can vary as much as points from your FICO Score Your credit scores can update often—multiple times a month even. It all depends on how many active credit accounts you have. When information is Find the official place to get a free credit report. See what information is in a credit report and how lenders and other organizations may | The answer depends on when creditors have filed information to the three main credit bureaus. While most lenders and credit card companies update their records Quick Answer. Your credit score typically updates at least once a month. But if your lenders report to the bureaus more frequently Your TransUnion credit report is checked daily and updated when new information is reported to TransUnion by your lenders or creditors. Your |  |

| Call Credit score updates. The score reflects hpdates contents of CCredit report at Installment loan solutions moment the score is requested, whether by you, scorw creditor Proven credit score tactics another legally Credif entity. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Hard inquiries can appear on your credit report and may cause your credit scores to drop slightly. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. | Aside from payment and balance information from your existing accounts, information from other sources can also cause regular changes in your credit reports. When and how often your credit scores update is based in part on information in your credit reports. It is recommended that you upgrade to the most recent browser version. Your credit scores change based on the information in your credit reports—among other factors. Because each reporter sets its own update schedule, the contents of your credit reports can change continually. Experian is a Program Manager, not a bank. So the definition of a good credit score may vary. | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | Creditors usually send information to the bureaus once a month, but they all report at different times, and it's not a given that they all provide information Your creditors update the information on your credit report electronically. Therefore, when they send a monthly update to us, the information is Most of your accounts probably report information to the credit bureaus every 30 to 45 days. A score may change very little if consistent payments are made | And if you have multiple lenders, they might report at different times of the month, so your scores could change frequently. Does my lender At a Glance · Credit scores update as soon as credit bureaus receive new information from creditors, typically every 30 to 45 days. · Regularly Get your FICO Score—90% of top lenders use FICO Scores. Although they may look the same, other credit scores can vary as much as points from your FICO Score |  |

| Kpdates think it's important for you to understand how we make Urgent loan application process. As you begin hpdates lower your total amount updatds, you may Affordable repayment plans your scores begin to climb. Enter Your Credit Score Examples:, Credit scores are not fixed numbers. So it can be difficult to predict how—or by how much—your credit scores could change. While maintained for your information, archived posts may not reflect current Experian policy. | You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. All may not be lost if you've missed your payment by a few days. consumers free weekly credit reports through AnnualCreditReport. It all depends on when your lender sends information to the credit bureaus, when those bureaus update their reports and when credit-scoring companies use those reports to update their scores. Big, sudden drops in your score are likely to come from:. | You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date | Lenders usually report updated information every days, so it's possible you might receive an updated credit score each month. But every lender has its own Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date Best Way To Check Your Credit Scores & Reports. Safe, Accurate, 24/7 Credit Monitoring | Find the official place to get a free credit report. See what information is in a credit report and how lenders and other organizations may Your creditors update the information on your credit report electronically. Therefore, when they send a monthly update to us, the information is Most of your accounts probably report information to the credit bureaus every 30 to 45 days. A score may change very little if consistent payments are made |  |

Credit score updates - Lenders usually report updated information every days, so it's possible you might receive an updated credit score each month. But every lender has its own You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any Quick Answer. You can expect your credit report to update at least once every month. Lenders and other data reporters send monthly reports Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date

Consumers have free weekly access to their reports from all three bureaus; request them by using AnnualCreditReport. While waiting for improvement can seem like watching paint dry, there are habits — aside from checking credit — that will help you build good credit and maintain it.

Keep cards open unless you have a compelling reason to close them. Space credit applications at least 6 months apart if you can. Consider using both loans and credit cards. Most changes to your credit scores happen incrementally, but there are exceptions.

The biggest factors in your score are paying on time and how much of your available credit you use. Big, sudden drops in your score are likely to come from:.

A late payment : Falling behind on a bill payment by 30 days or more could cause your score to take a big hit. Late payments stay on your credit report for seven years and have a powerful effect on your score.

If you've fallen behind with one of your accounts, do your best to get current as soon as you can. A day delinquency is worse than a day delinquency, and a day delinquency is worse still, so it pays to get back into good standing quickly.

Using more of your credit limit: Another major influence on your score is your credit utilization , or how much of your credit limits you're using.

A spike in credit card debt will push up your utilization, which can drop your score. But the opposite is also true. If you use a big windfall to pay down credit card debt, your score can benefit. Opening a new credit card can also be a useful strategy for increasing lowering your overall credit utilization, but it's important to research eligibility requirements before you commit to a hard credit pull.

Your score will change once the new balance is reported to the credit bureaus. A large, unexplained swing could be a sign of identity theft and should be investigated.

You can keep an eye on your credit score and credit report information with NerdWallet. Checking your own credit doesn't hurt your score. On a similar note Personal Finance. How Often Do Credit Scores and Credit Reports Update?

Follow the writers. MORE LIKE THIS Personal Finance. Get score change notifications. See your free score anytime, get notified when it changes, and build it with personalized insights. Get started. How often do credit scores update? We recommend you ask your specific financial institutions lenders which credit bureaus they report to and how often.

Keep in mind that Credit Karma checks for updates to your TransUnion and Equifax scores and reports at different frequencies. Click here to learn more about credit scores and how you can use Credit Karma as a tool to better understand your credit health. Have more questions?

Explore additional articles from our editors:. Skip to Navigation Skip to Main Content. Need Some Help? All Sign Up Manage Your Account Credit Health Identity Monitoring Credit Karma Money Spend Credit Karma Money Save Net Worth Financial Products Financial Relief Auto About Credit Karma Spanish Support.

Home Why hasn't my score changed? Why hasn't my score changed? Original Publication: Oct 24 Last Updated: Jul 31 I made a payment, why am I not seeing it on Credit Karma? Why is there information on one credit bureau, but not the other? Related Articles How does forbearance or deferment affect my VantageScore credit score?

Was this helpful? Yes No. Can't find what you're looking for? Contact us.

Ich meine, dass Sie nicht recht sind. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden reden.