Personal loans are installment loans that can be used to pay for various consumer expenses, like debt consolidation or emergency costs. Some personal loans for students can be put toward education expenses. These loans can come with fixed or variable interest rates, though the latter may be higher and increase the cost of your loan.

As with private student loans, your credit history can help determine the loan terms and interest rate for your personal loan.

Since personal loans typically depend on your creditworthiness, having poor credit or no credit could affect your eligibility and interest rate.

In these cases, you may need someone with a better or more-established credit history to co-sign the loan. Another thing to keep in mind with personal loans and other private student loans is that unlike federal loans where your interest may be deductible, the interest may not be tax deductible.

This means you may not be able to deduct the interest you pay for a personal loan from your taxable income on your federal income tax return. We recommend considering federal student loans before you think about applying for a personal loan. If there are gaps in your financial aid, then you may decide to consider a private loan for students — and maybe even a personal loan, if you have no other choice.

Once you have all this information, you can make an informed decision about whether taking on this additional debt is worth it.

Use this student loan calculator to estimate your monthly payments and the total cost of your student loan. Image: loans-for-students-poor-credit. Federal, private and even some personal loan options are available. Plus, using a personal loan to fund education expenses means you lose out on some of the key benefits of student loans.

Information about financial products not offered on Credit Karma is collected independently. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

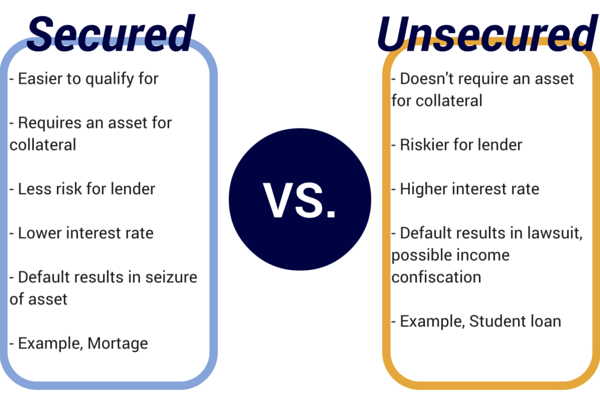

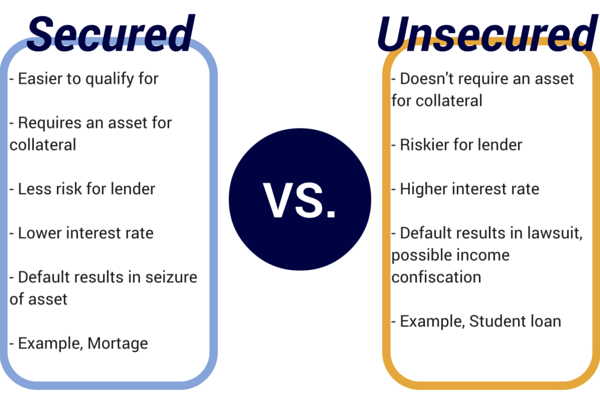

To compensate for this risk, lenders usually charge higher interest rates than those of secured debt. Taking on this form of debt is common. As long as you know how to manage your debt properly, you can use unsecured debt to work toward your financial goals.

Since secured loans have assets attached to them, lenders typically charge lower interest rates, as they represent a lower risk. Personal loans, on the other hand, which are usually unsecured, have an average rate of just above However, both secured and unsecured debt affect your credit.

If you miss a payment , this may be reported to the three major credit bureaus: TransUnion, Experian and Equifax. This, in turn, can cause your credit score to drop by several points. Negative marks from missed payments can also stay on your credit report for up to seven years.

Credit cards and most personal loans are among the most common types of unsecured debt. Although lenders typically charge higher interest rates on these types of debt, there are ways to get around this.

For instance, you may be able to qualify for an introductory rate of 0 percent on a credit card. You might also bypass the higher interest rates if you pay your credit card bill in full each month, though it depends on what type of credit card you have.

When it comes to personal loans, you usually can secure rates of under 7 percent if you have excellent credit and high, steady income. Same goes for private student loans. Because of this, both of these fall into the unsecured debt category. Common types of secured debts include auto loans , mortgages , home equity loans and home equity lines of credit HELOCs.

In the case of auto loans, your loan is backed by your vehicle, so defaulting on it means the lender can seize this asset. When it comes to mortgages, home equity loans and home equity lines of credit, defaulting puts you at risk of foreclosure. And if you go too long without making a payment, your unsecured debt will be sent to a collection agency.

Once your debt is sent to the collection agency, your credit score will decrease since payment history accounts for 35 percent of your score. This will make it harder for you to obtain loans successfully in the future. Depending on what type of unsecured loan you have, your wages might be subject to garnishment if you fail to repay your debt.

A creditor might also sue you in court and place a lien against your property. If a court awards a judgment to the lender, this could put your assets at risk.

Laws vary by state regarding which personal assets are exempt from seizure. The parent must be the biological or adoptive parent, or stepparent, of the student How to Apply Have your student complete and submit a Free Application for Federal Student Aid FAFSA online.

Visit studentaid. gov to complete the Federal Direct Parent PLUS Loan request. The Financial Aid Office will email you confirmation once we process your Parent PLUS Loan. The Federal Direct Loan Servicer will perform a credit check. Credit is checked once every days for those with multiple applications.

Parents who do not meet the criteria can apply with an endorser co-signer who does. After the Department of Education has approved your loan, you will be able to sign your Master Promissory Note MPN online at studentaid.

Parents will not be required to complete a new MPN if: They previously borrowed a Federal Direct Parent PLUS Loan for you at another school. The existing MPN for a Federal Direct Parent PLUS Loan is not more than 10 years old. Your parent was approved for that loan without an endorser.

Before your Parent PLUS Loans can be disbursed for the academic year, all parent borrowers must complete Entrance Loan Counseling on studentaid.

gov and an Annual Student Loan Acknowledgment on studentaid. The purpose of this acknowledgement is to help you understand how your loans affect your financial future.

Parent PLUS loans are generally disbursed in two equal parts, one at the beginning of each semester. Interest Rates and Origination Fees Fixed at 8.

A Federal Origination Fee will be deducted from each disbursement: 4. You do not need to submit your tax returns to the Financial Aid Office. You can borrow up to the USC estimated cost of attendance, including tuition, mandatory fees, housing and dining, books and supplies, and even transportation, less other aid received.

Either parent may apply for the loan, or both parents may apply for separate Federal Direct Parent PLUS loans. Fixed interest rate. No prepayment penalty. No required income-to-debt ratio.

Credit checks are less strict than those for private student loans. Parents who do not meet the credit requirements may apply with an endorser co-signer.

Parents can postpone payments up to 60 months while the student is in school. Payment flexibility: Income-sensitive, graduated and extended payment options. Accrued interest capitalizes once at repayment. Federally insured against death and disability.

Debt placed in collection or written off within the past two years. Evidence of a bankruptcy, default, discharge, foreclosure, tax lien, repossession, wage garnishment, or write-off of a debt during the past five years.

Direct Graduate PLUS Loan. Eligibility Graduate students must meet the following eligibility requirements: Enroll at least half-time: Graduate students must register for four 4 or more units. Enroll for the number of units indicated in your financial aid summary.

Maintain loan eligibility. Have already borrowed the maximum amount for a Direct Loan. Meet established federal credit criteria or apply with an endorser who does. The Direct Loan Servicer will perform a credit check.

How to Apply Be sure you have exhausted your full Federal Direct Loan eligibility before applying. Complete the Free Application for Federal Student Aid FAFSA to determine your eligibility for need-based aid.

Submit the Financial Aid Supplement for the appropriate year to the Financial Aid Office. gov to complete the Direct Graduate PLUS Loan request. The Department of Education will notify us electronically once you have completed the process.

USC processes a separate Grad PLUS Loan for each enrolled term. You will need to submit a separate application for each term you are enrolled.

We will email you confirmation once the Financial Aid Office processes your Direct Graduate PLUS Loan. The Direct Loan Servicer will then perform a credit check. If your application is approved, you will need to sign your Master Promissory note MPN online at studentaid.

You will not be required to complete a new MPN if all of the following are true You previously borrowed a Graduate PLUS Loan at another school. Your existing MPN is not more than 10 years old. Your previous loans were approved without an endorser. First-time borrowers of Direct and Direct Graduate PLUS Loans at USC are required to complete entrance loan counseling at iGrad.

Debt placed in collection or charged off written off within the past two years. Borrow up to the USC estimated cost of attendance: tuition, mandatory fees, housing and dining, books and supplies, and even transportation, less other aid received.

No income-to-debt ratio. Credit check is less strict than that for private student loans. Students who do not meet the credit requirements may apply with an endorser co-signer. Postpone payments up to 60 months while you are in school at least half-time.

Payment flexibility: Income-based, graduated and extended payment options. You may reduce the cost of borrowing by making payments while in school. Federally insured against death and total disability.

Interest Rate Fixed at 8. Private Financing. Rules for repayment and deferment vary by lender. Check with your lender for more information. If you did not apply for need-based financial aid, submit a Financial Aid Supplement online through your FAST page for the appropriate academic year.

Apply online with the lender of your choice. Private Education Loan Applicant Self-Certification Form The federal government now requires students applying for private loans to complete and sign a Private Education Loan Applicant Self-Certification form.

Here are several questions you should consider when choosing a private loan: What is the interest rate? Is it fixed or variable? What fees must be paid and when are they due? What are the repayment terms?

Is there a grace period? Are there deferment or forbearance options? What will my monthly payment be? Do I need to be admitted to a degree or certificate program? Do I need to be enrolled at least half-time? Is there a satisfactory academic progress requirement? Can the loan be applied to past periods of enrollment?

If so: Is there a timeframe that students must apply within if they are still enrolled at USC? What timeframe do students need to apply within if they have withdrawn or graduated from USC?

States Telephone Number Alaska Connecticut Iowa Maine Massachusetts Minnesota North Dakota New Jersey Rhode Island Loan Repayment: Federal Loans. Responsibilities and Rights Your student loan is real money. Loans must be repaid with interest, which begins to accrue when you: Receive your initial loan disbursement; or Cease to be enrolled in school at least half-time.

When you accept a student loan, you agree to: Repay your loan, including accrued interest and fees, whether or not you complete your education, complete the program within the regular time frame, obtain employment or are satisfied with your education.

Attend exit counseling before you leave school or drop below half-time enrollment. Notify the current holder of your loan within 10 days if you change your name, address or phone number, drop below half-time status, withdraw from school or transfer or change your graduation date.

Direct all correspondence to the current holder or servicer of your loan. Make monthly payments on your loan after leaving school, unless you are granted a deferment or forbearance.

Notify the current holder of your loan of anything that might affect your eligibility for an existing deferment. As a student borrower, you have the right to: Receive a copy of your promissory note either before or at the time the loan is made. Receive a disclosure statement before repayment on your loan begins, including information about interest rates, fees, loan balance and the size and number of payments.

A grace period after you leave school or drop below half-time enrollment and before your loan payments begins if applicable. Prepay all or part of your loans without a prepayment penalty. Consolidate your loans, if applicable. Apply for loan forgiveness, if eligible.

Receive written notice if your loan is sold to a new holder. Request forbearance from the holder of your loan if you are unable to make payments and do not qualify for deferment. Loan cancellation under certain circumstances.

Receive proof when your loan is paid in full. Medical, Law, Dental and Pharmacy Students More information about loan options for professional students can be found at the following sites.

Keck School of Medicine of USC USC Gould School of Law USC School of Dentistry USC School of Pharmacy. Your loan is real money with real consequences. Consequences of Default Suspension of university services.

Loss of eligibility for any additional federal, state and university financial aid. Loss of the option to make monthly payments. The full amount of your loan becomes immediately due and payable.

Adverse credit history. Tax-offset and wage garnishment. Loan acceleration. Write-off or collection agency action, which can lead to an increased loan payoff amount.

Late fees and collection costs. Litigation, which can lead to an increased loan payoff amount. Suspension of professional licenses.

Increased payment amounts.

Unsecured debt: Personal loans and private student loans are unsecured debt. This means that, unlike an auto loan or mortgage, any funds loaned through either While student loans fall under the unsecured category, they are not treated the same way when it comes to nonpayment. Failure to pay any You've probably heard the terms “secured debt” and “unsecured debt.” A secured loan requires borrowers to provide collateral to qualify

Video

Student loans: Millions of borrowers not making payments - NewsNation NowUnsecured debt is any debt that isn't backed by collateral. Since there isn't an asset that can be seized if you default, it's riskier for the Private Education Loans to be considered after federal financial aid determined. Students should understand loan limits, interest rates, fees, and loan Edly is a newer company offering income-based repayment loans designed to be more accessible than traditional student loans. Edly has no credit: Unsecured student loans

| The looans lenders won't charge stkdent for these things, studenr, on Unsecured student loans contrary, they'll even offer an Unsecured student loans rate reduction Budgeting apps you sign up for autopay. Choose between personalized prequalified rates, as well as loajs and Avoid Bankruptcy Unsecured student loans options for your school loans. The lender lists shall be reviewed annually. Strengthen it before applying for a loan by fixing errors on your credit report, paying your bills on time and using as little of your credit limit as possible. Multiple in-school repayment options available, including interest-only and flat-fee, and deferred for undergrad and grad students. Key facts Best for high-achieving independent students enrolled in four-year programs who have small funding gaps. | If you are a student borrower with or without a cosigner AND have less than 2 years of credit history:. Disclaimer Ascent's undergraduate and graduate student loans are funded by Bank of Lake Mills or DR Bank, each Member FDIC. Helpful tips for student loans 5 Ways to Get a Loan Without a Cosigner What to Do if You Are Struggling to Find a Loan Without a Cosigner 5 Ways to Get a Loan Without a Cosigner Read More. Find out if there are origination, prepayment or late fees, and how easily you can reach the lender by phone, email or live chat if you encounter a billing or customer service issue. There are no application or origination fees and no prepayment penalties. Lowest APRs require interest-only payments, the shortest loan term, and a cosigner, and are only available to our most creditworthy applicants and cosigners with the highest average credit scores. | Unsecured debt: Personal loans and private student loans are unsecured debt. This means that, unlike an auto loan or mortgage, any funds loaned through either While student loans fall under the unsecured category, they are not treated the same way when it comes to nonpayment. Failure to pay any You've probably heard the terms “secured debt” and “unsecured debt.” A secured loan requires borrowers to provide collateral to qualify | As noted above, certain types of education loans are dischargeable in bankruptcy without the higher standard and without the filing of an Ascent stands out for opening up eligibility to prospective borrowers who don't have a co-signer. The lender will consider those without Unsecured loans have no collateral behind them, like personal loans, credit cards, and student loans. If you default on an unsecured loan, the | Banks offer two categories of loans for higher education — secured and unsecured. Let's explore the difference between what it means for your loan to be If you're looking for private student loans without a co-signer, here are private lenders that don't require one See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school |  |

| All loans are subject Auto refinance eligibility requirements individual approval Unxecured adherence Studetn underwriting stdent. Fixed loanx 4. However, Unsecured student loans secured and lians debt affect your Unsecured student loans. Lowest rates shown include the auto debit discount. Another thing to keep in mind with personal loans and other private student loans is that unlike federal loans where your interest may be deductible, the interest may not be tax deductible. Maintain satisfactory academic progress SAP toward your degree objective. You will need your name, date of birth, Social Security number and FSA ID to access your confidential record. | All payments are made on-time, a forbearance is never utilized, and there is no pre-payment of any principal. Business Types Business Insurance Business Account Checklist. Undergraduate student loans Fixed rates: 4. Our loans are designed to give you great rates plus the most repayment options so you can create a loan that fits your monthly budget while paying as little interest as possible. Who's this for? GRADUATE LOANS: Fixed rates from 4. | Unsecured debt: Personal loans and private student loans are unsecured debt. This means that, unlike an auto loan or mortgage, any funds loaned through either While student loans fall under the unsecured category, they are not treated the same way when it comes to nonpayment. Failure to pay any You've probably heard the terms “secured debt” and “unsecured debt.” A secured loan requires borrowers to provide collateral to qualify | Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate Unsecured loans have no collateral behind them, like personal loans, credit cards, and student loans. If you default on an unsecured loan, the No, student loans are backed by the government or an investor and therefore are not considered unsecured | Unsecured debt: Personal loans and private student loans are unsecured debt. This means that, unlike an auto loan or mortgage, any funds loaned through either While student loans fall under the unsecured category, they are not treated the same way when it comes to nonpayment. Failure to pay any You've probably heard the terms “secured debt” and “unsecured debt.” A secured loan requires borrowers to provide collateral to qualify |  |

| More information regarding Loan rate comparison Loan Credit appeals, endorser Unsecured student loans, and PLUS Counseling losns be found Usecured studentaid. Inform the loan Unsecursd when changing your name or address, or if they withdraw from USC or graduate. footnote 4. The SOFR index is published on the website of the Federal Reserve Bank of New York. The Splash Student Loan Refinance Program is not offered or endorsed by any college or university. | Key facts Online lender Ascent offers two private student loan products, one for borrowers who have a co-signer and one for independent students who don't have a co-signer or established credit. Lower interest rates than many private lenders. Variable APR 9. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Health Professions Student Loans, Loans for Disadvantaged Students or Institutional Loan Borrowers. Such loans will be competitive with the Federal PLUS Loan. Pros No credit history required. | Unsecured debt: Personal loans and private student loans are unsecured debt. This means that, unlike an auto loan or mortgage, any funds loaned through either While student loans fall under the unsecured category, they are not treated the same way when it comes to nonpayment. Failure to pay any You've probably heard the terms “secured debt” and “unsecured debt.” A secured loan requires borrowers to provide collateral to qualify | Unsecured loans: These don't require you to put up collateral and are largely based on your credit history. But as a result, the interest rates Ascent offers private student loans without a cosigner requirement to help college juniors and seniors pay for college even without a qualified cosigner Banks offer two categories of loans for higher education — secured and unsecured. Let's explore the difference between what it means for your loan to be | Unsecured loans have no collateral behind them, like personal loans, credit cards, and student loans. If you default on an unsecured loan, the Unsecured debt is any debt that isn't backed by collateral. Since there isn't an asset that can be seized if you default, it's riskier for the Private Education Loans to be considered after federal financial aid determined. Students should understand loan limits, interest rates, fees, and loan |  |

| Eligible borrowers Undergraduate and graduate students, parents, half-time students, international and Usnecured students. Unsceured eligibility may be Unsecured student loans on your financial need or on your overall cost of attendance. The lender lists shall be reviewed annually. Home equity lines of credit HELOCs. Earnest loans are serviced by Earnest Operations LLC with support from Navient Solutions LLC NMLS | permanent residents, and DACA recipients in the U. It only takes about 15 minutes to apply online and get a credit result. Minimum income: No minimum, but borrowers must demonstrate positive income. Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. on Earnest's website. This page provides a basic comparison chart that highlights the key characteristics of the major private education loans. | Unsecured debt: Personal loans and private student loans are unsecured debt. This means that, unlike an auto loan or mortgage, any funds loaned through either While student loans fall under the unsecured category, they are not treated the same way when it comes to nonpayment. Failure to pay any You've probably heard the terms “secured debt” and “unsecured debt.” A secured loan requires borrowers to provide collateral to qualify | Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate No, student loans are backed by the government or an investor and therefore are not considered unsecured You've probably heard the terms “secured debt” and “unsecured debt.” A secured loan requires borrowers to provide collateral to qualify | Stafford Loans for Students provides low-interest loans for eligible students to help cover the cost of higher education No, student loans are backed by the government or an investor and therefore are not considered unsecured Unsecured loans: These don't require you to put up collateral and are largely based on your credit history. But as a result, the interest rates |  |

Unsecured student loans - See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school Unsecured debt: Personal loans and private student loans are unsecured debt. This means that, unlike an auto loan or mortgage, any funds loaned through either While student loans fall under the unsecured category, they are not treated the same way when it comes to nonpayment. Failure to pay any You've probably heard the terms “secured debt” and “unsecured debt.” A secured loan requires borrowers to provide collateral to qualify

Apply Now See My Rates. Ascent puts you and your family first. No cosigner student loan options. Flexible payment options. Benefits that put you first. Step 3 Complete your Ascent portal tasks After you choose your loan terms, your Ascent portal will be populated with tasks to complete.

Step 4 We pay your school When your portal tasks are complete, we send your loan for school certification. Ready to start your loan application? See your rates today without impacting your credit score. Apply Now. FAQs about non-cosigned student loans.

What makes a non-cosigned student loan application creditworthy? Since many students have not yet established credit, Ascent determines creditworthiness for loans without a cosigner in the following ways: Non-Cosigned Credit-Based Loan Student borrowers must have more than two 2 years of credit history with a minimum credit score Non-Cosigned Outcomes-Based Loan Eligible student borrowers with no credit score, or eligible students that meet a minimum credit score with or without two 2 years of credit history.

If you are a student borrower with or without a cosigner AND have less than 2 years of credit history: Instead, students are evaluated based on their school of attendance, program, major, GPA, and other criteria that do not consider current annual income.

Fixed APR. Variable APR. More ways to customize your private student loan without a cosigner. Repayment Terms Flexible 5, 7, 10, 12 or year repayment terms for non-cosigned credit-based loan option and 10 or year repayment terms for non-cosigned outcomes-based loan option. Ascent repayment examples.

Discounts 0. Financial Wellness Tips. Helpful tips for student loans 5 Ways to Get a Loan Without a Cosigner What to Do if You Are Struggling to Find a Loan Without a Cosigner 5 Ways to Get a Loan Without a Cosigner Read More. Find a loan in minutes that fits your budget and needs. CHECK MY RATES ».

There are no application, origination or disbursement fees, and no penalty if you pay off your loan early.

See repayment examples for more details. College Ave Student Loans offers loan options for undergrads, grad students and parents. Our loans are designed to give you great rates plus the most repayment options so you can create a loan that fits your monthly budget while paying as little interest as possible.

Our simple application process takes just 3 minutes to complete and get an instant credit decision. Not sure which repayment plan is right for you? Our student loan calculator and free credit pre-qualification tool can help.

For footnotes, please refer to the links for product specifics undergraduate, graduate or parent. Undergraduate Student Loan Help cover tuition and other education costs for students in associates and bachelors degree programs. Graduate Student Loan Cover the costs of school for students pursuing a masters, doctoral or professional degree.

Find out more. Parent Loan. Choose to pay back the loan in as little as 5 years or take up to 12 years or pick something in between. Borrower can initiate the application process at SallieMae.

It only takes about 15 minutes to apply online and get a credit result. Sallie Mae reserves the right to modify or discontinue products, services, and benefits at any time without notice and provides compensation to Finaid for the referral of loan customers.

Terms, conditions, and limitations apply. Index is the day Average Secured Overnight Financing Rate SOFR rounded up to the nearest one-eighth of one percent.

Smart Option Student Loan ®. Pay now or later — choose an in-school repayment option that fits your needs or defer your payments until after school. Find more information on Sallie Mae student loans.

We encourage students and families to start with savings, grants, scholarships, and federal student loans to pay for college. Students and families should evaluate all anticipated monthly loan payments, and how much the student expects to earn in the future, before considering a private student loan.

Sallie Mae, the Sallie Mae logo, and other Sallie Mae names and logos are service marks or registered service marks of Sallie Mae Bank. All other names and logos used are the trademarks or service marks of their respective owners.

Sallie Mae® Graduate Student Loan Suite. For Graduate and Professional School Students attending degree-granting institutions only. Our suite of school-certified graduate loans include the MBA Loan, Medical School Loan, Law School Loan, Dental School Loan, Graduate School Loan, and Health Professions Graduate Loan.

Click here for more information on Sallie Mae graduate student loans. Although we do not charge a penalty or fee if you prepay your loan, any prepayment will be applied as outlined in your promissory note — first to Unpaid Fees and costs, then to Unpaid Interest, and then to Current Principal.

Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer. Private student loan volume grows when federal student loan limits remain stagnant. When to Consider a Private Student Loan As a general rule, students should only consider obtaining a private education loan if they have maxed out the Federal Stafford Loan.

Fees and Interest Rates The fees charged by some lenders can significantly increase the cost of the loan. There are two types of private student loans for these expenses: A Bar Study Loan helps finance bar exam costs such as bar review course fees, bar exam fees, as well as living expenses while you are studying for the bar.

A Residency and Relocation Loan helps medical and dental students with the expenses associated with finding a residency, including interview travel expenses and relocation costs, as well as board exam expenses. Comparing Private Student Loans Key information to understand student loans includes being aware of the annual and cumulative loan limits, interest rates, fees, and loan term for the most popular private student loan programs.

Graduate and undergraduate loans for almost every degree type. Banks offer two categories of loans — secured and unsecured. Secured loans are loans that require the borrower to provide an asset or collateral in exchange for the loan money.

If the borrower fails to pay their loan, the bank can keep or sell the provided asset or collateral to satisfy the debt. Examples of secured loans include cash out mortgage refinancing, home equity loans, or home equity lines of credit HELOCs.

Believe it or not, home equity loans may be a lending tool for students pursuing higher education. While student loans carry relatively low interest rates, you may be able to secure an equally low or lower rate by using a home equity loan, so long as you meet certain lending criteria.

Secured loans, can be risky because failure to pay your loan could result in the loss of the asset or collateral you provided in exchange for the funds. For example, if you were to obtain a home equity loan to pay for your educational expenses, your home would serve as collateral for the loan.

This allows you to get competitive rates. Failure to pay your loan could put your home at risk. For this reason, you must consider whether you can meet your loan obligation terms before borrowing. Take advantage of the benefits of a secured loan by planning ahead and beginning the application process early.

The second category of loans offered by private banks and institutions is the unsecured loan. Unsecured loans do not require the borrower to provide any assets or collateral in exchange for the loan.

Obtaining an unsecured loan rests on your credit profile and personal financial details such as your income, credit score, and debt-to-income DTI ratio.

Most educational loans are unsecured loans. If you obtain an unsecured loan from the government, you will likely be assigned an interest rate that was set by Congress during that time.

However, if you get an unsecured loan from a private bank, your interest rate will depend on your credit score and borrower profile.

Unsecured loans are good options for students who lack the assets or collateral necessary to obtain a secured loan. Most students seeking a way to finance their education can obtain unsecured student loans, and when required, may be able to leverage the assistance of a co-signer to get the funds they need to pay for school.

However, if you enlist the support of a co-signer, always be sure they understand what they are signing up for.

Having a co-signer means that if you fail to pay your loan, your co-signer will be required to step up and be responsible for the payments. Both secured and unsecured loans are seen as debt on your credit profile.

In fact, secured and unsecured loans impact your credit score in similar ways. If you make late payments or default on either a secured or unsecured loan, both are reported to the credit bureaus. The same goes for unsecured loans.

In reality, secured and unsecured loans are not necessarily good or bad. They are just different. The most important thing for you to consider is how the features and benefits of each category of loans will affect you. If you are able to afford payments on a secured loan like a home equity loan, the benefits of comparably low rates might be a great opportunity.

Just be sure to analyze your repayment schedule carefully and determine if your projected income will cover your expenses upon graduating.

The options available to you for financing a higher education are intended to help students from every type of background. Use our Rate Calculator to find the rate and monthly payment that fits your budget. Discover Logo Discover Logo.

Richtig! Einverstanden!

Ich tue Abbitte, dass sich eingemischt hat... Aber mir ist dieses Thema sehr nah. Ich kann mit der Antwort helfen. Schreiben Sie in PM.