Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Peer-to-peer lenders typically use online platforms to connect people with investors who will finance their loans. Check out our picks for the best peer-to-peer lenders that offer personal loans.

All of them allow you to apply for prequalification so you can get an idea of the interest rate and terms you might be offered — making it easier to shop around for the best loan for your situation. Debt consolidation may help you save money by reducing the amount of interest you pay on your debt.

Read our full review of Prosper personal loans to learn more. Read our full review of LendingClub personal loans to learn more. Many personal loan lenders have higher starting loan amounts. Keep in mind that your minimum loan amount may be higher depending on where you live.

Upstart can also be fast: If your application is approved, you may be able to get your loan funds the next business day.

Read our full review of Upstart personal loans to learn more. Read our full review of Peerform personal loans to learn more. Peer-to-peer, or P2P, lending is an alternative to borrowing from traditional banks and credit unions.

When you apply for a loan on a peer-to-peer lending platform, the loan is posted to investors. Some peer-to-peer lending marketplaces also target small-business owners who need funding to establish or grow their companies.

If you want to get a small-business loan , you can explore peer-to-peer lenders that cater to this market, like Funding Circle or StreetShares. Depending on your credit, you may qualify for a competitive interest rate. But people with lower credit scores will likely see higher interest rates — sometimes even higher than the average credit card APR.

Applying for prequalification is a way to see what your potential terms and interest rate may be without hurting your credit scores. One of the most notable features is a paid service called Provision fund.

In other words, if the loan payment is delayed even for just one day, NEO Finance covers the payments themselves. This is the highest protection anyone could ask for from a peer to peer lending platform!

The Provision fund service costs anywhere from 0. The platform is especially noted for its user-friendly investment products that make it incredibly easy even for first-time investors to start earning passive income.

Within just 5 years, the investment group handling DoFinance has raked together over registered customers. DoFinance has a unique approach to P2P investing. Instead of regular Auto Invest, they offer 4 different Auto Invest investment plans that offer different return rates and risk levels.

For example:. Another great feature is the Easy Access feature which allows investors to pull their money back at any time. And to top that off, DoFinance offers a buyback guarantee on all loans. I'm sure you have a pretty good idea of how P2P lending works, so I'm not gonna go too deep into that.

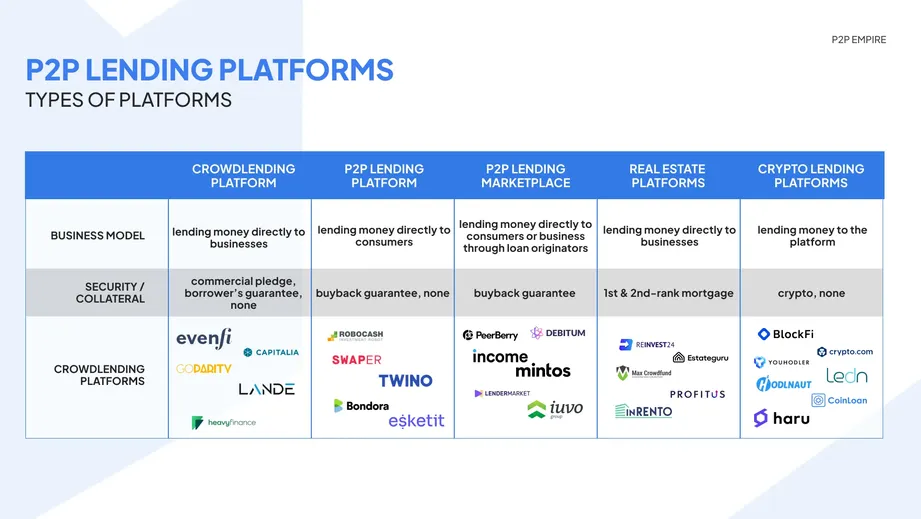

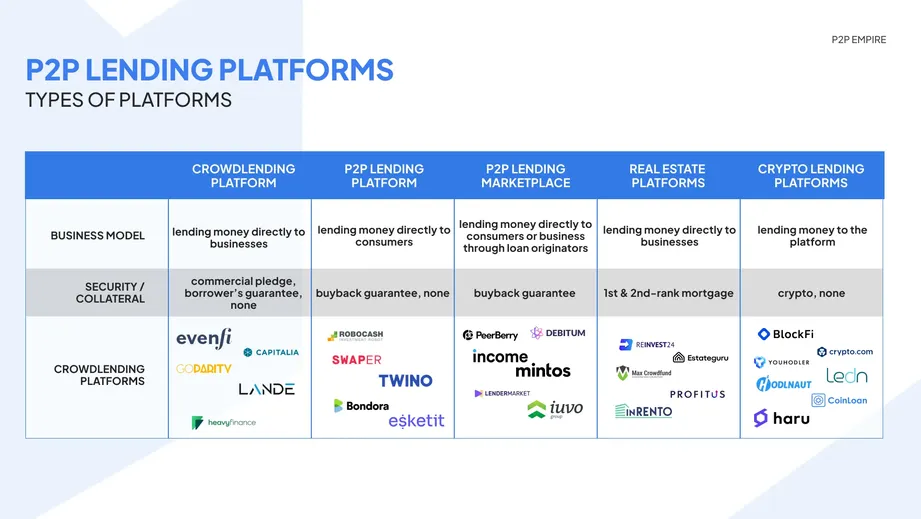

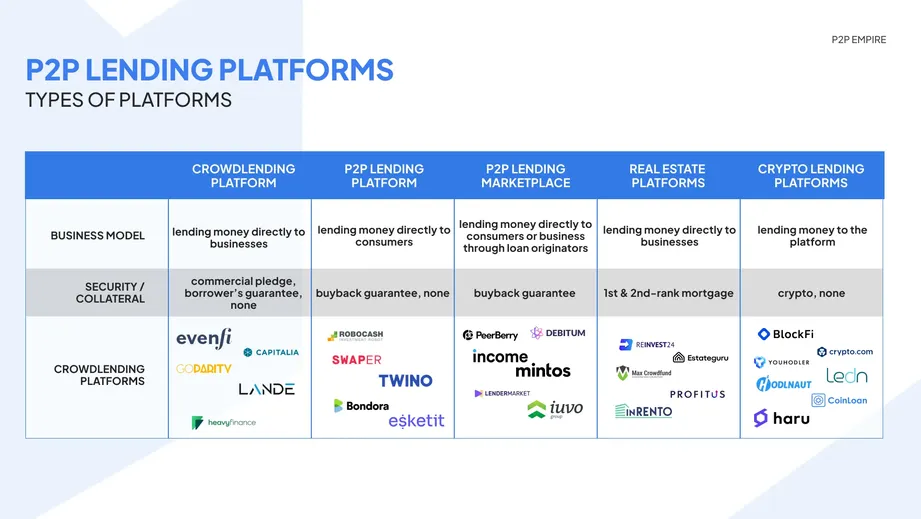

But let me just quickly clarify the P2P concept for anyone who isn't sure. The main principle is simple: the platform connects borrowers to investors. Depending on the platform, there are usually two types of borrowers:. Companies that are looking to finance their next business venture these tend to be big projects, ranging anywhere from 10 to even millions of euros.

Lenders who are showcasing loans that have been submitted to them by people who are in need of money usually, these are small personal loans. Using P2P platforms, you can either get funded by borrowing from the lenders or make money by lending out to those looking to get funded.

When a project is showcased on the platform, investors can invest a certain amount of money into financing that opportunity and then receive a generous interest rate back. The power of P2P lending lies in the fact that loans will get financed thanks to hundreds of small contributions by various people.

Investors can allocate very small sums to many different investment options, diversifying their portfolios easily. You can choose between a wide range of projects to invest in. Anything from personal loans to charity projects. It does really depends on what you invest in. Typically, higher-risk investments can yield higher interest rates.

It's highly recommended to do a bit of research on the actual project before putting in your money. The returns and interest rates vary highly in P2P investing.

There are many more great platforms that could easily deserve a spot in the best p2p lending site list, but the selection I chose has definitely left the biggest impression on thousands of investors all over the world. If you're a beginner, I would personally recommend to go with Mintos , as that's one of the biggest P2P lending sites with the best reputation.

In order to nail P2P lending, you need to find the best P2P lending site that aligns with your investment goals. Are you more into real-estate developments? Most people who are dealing with P2P investing put their money in several different platforms and often, those platforms offer quite opposing opportunities.

one is focusing on business projects and the other is focusing on personal loans. Wise investors usually allocate only small amounts into one opportunity, even if they have thousands to spare and could finance one loan all by themselves.

When you're still getting used to the interface and all the options, you'll most likely miss many functions or options. Try the platform, allocate a very small amount and see how things go.

Learn how the reporting works and get more into the whole peer to peer investing world. Never ever put all of your eggs into one basket — that's the key principle you need to keep in mind. In my opinion, P2P lending is a safe risk to take — as long as you have the financial security that you're not relying on the money you put in to cover any of your urgent needs.

There are things you can do to increase the safety of P2P lending, such as sticking to loans that offer a personal guarantee. However, there is always some kind of gamble when you put your money anywhere other than a simple savings account.

As long as you're over 18 and hold a current account, you should be able to invest in a P2P lending site. You may also be asked to verify your identity. Certain countries, such as those in the EEA European Economic Area will have more options when it comes to finding a P2P site they can invest in.

However, the US and several other countries can also invest easily with global P2P sites. It's worth saying again here that just because you can invest, doesn't mean you necessarily should. Think carefully about where you're financially secure enough before parting with any large amounts of money.

It's their job to protect consumers and financial markets, and in they announced new rules regarding marketing restrictions and appropriateness assessments to assist with this. An online entrepreneur since Johannes has more than a decade of experience in online marketing and considers himself a SEO-geek.

Personally very passionate about health optimization, lifestyle design and traveling the world. Writing here to inspire. Mostly himself, but hopefully others too. Save my name, email, and website in this browser for the next time I comment. I was unaware of such types of investment programs.

From next I will invest may be on day to day basis rather paying bills in bar. Will give this a try — just signing up for Mintos. Thanks for good overview on P2P platforms. Neofinance information is incorrect. There is no buyback only provision fund which investor pays for.

Quoted average return is actually average rate charged to borrowers, not return for investors. After reading this article I started searching for P2P lending sites for India.

I found one — lendbox. Thanks for the best article I have seen about p2p lending platforms. Also in Norway we are seeing an increase in numbers in loanbuddyplatforms. For example we know have Kameo loan for companies , Kredd unsecured private loans in addition to possibility to invest in International platforms like Bondora.

Thank you Yvette, appreciate that. Yes, we had the same boom in Sweden last year. P2P is blooming! Hello Johannes! Could you tell me please, how can i contact you regarding possible cooperation?

Hey, Valerija! All interest earnt will be taxed like any other income. However, make sure you speak to an expert for professional advice!

Thanks for the article. I will also add Utopia p2p to this list. The developers tried to pay attention to all the issues and ensure a really decent level of security. p2P lending has become increasingly popular as an alternative investment option in recent years.

Thanks for the valuable info Johannes. I am keep to start looking at the platforms that will allow me to lend money directly, without the involvement of traditional financial intermediaries such as banks.

Thansk JL :. We use cookies to give you the most relevant experience. By using our site, you accept all cookies and our privacy policy. To find out more about what cookies we use you can go to privacy overview. This website uses cookies among other user tracking and analytics tools.

Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Cookies may also be used for other marketing and advertising purposes, or for other important business analytics and operations. To use our website you need to agree to our Terms and Conditions and Privacy Policy.

To find more about the legal terms that govern your use of our website, please read our Terms and Conditions here. To find more about your privacy when using our website, and to see a more detailed list for the purpose of our cookies, how we use them and how you may disable them, please read our Privacy Policy here.

We use cookies to keep your user preferences and actions, in order to assist and optimize your overall experience of using our Site. These are known as essential cookies.

Those cookies include actions such as creating or using your account in our site, writing reviews, interacting with existing reviews by giving likes or replies, writing other user content on the site, setting up custom search or filter preferences, accepting and saving user preferences including privacy preferences , or any other action which affects the way you experience the Site.

Those cookies are important to give you the best possible user experience, and thus can be removed only manually by following the instructions found on our privacy policy. Those cookies allow us to track your user actions and associate them with anonymous user data, with the assistance of 3rd parties and services such as Google Ads, Google Analytics, Google Tag Manager, as well as the Facebook Pixel in order to deliver relevant ads.

To see a detailed list about the use of your data please refer to our Privacy Policy.

Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva

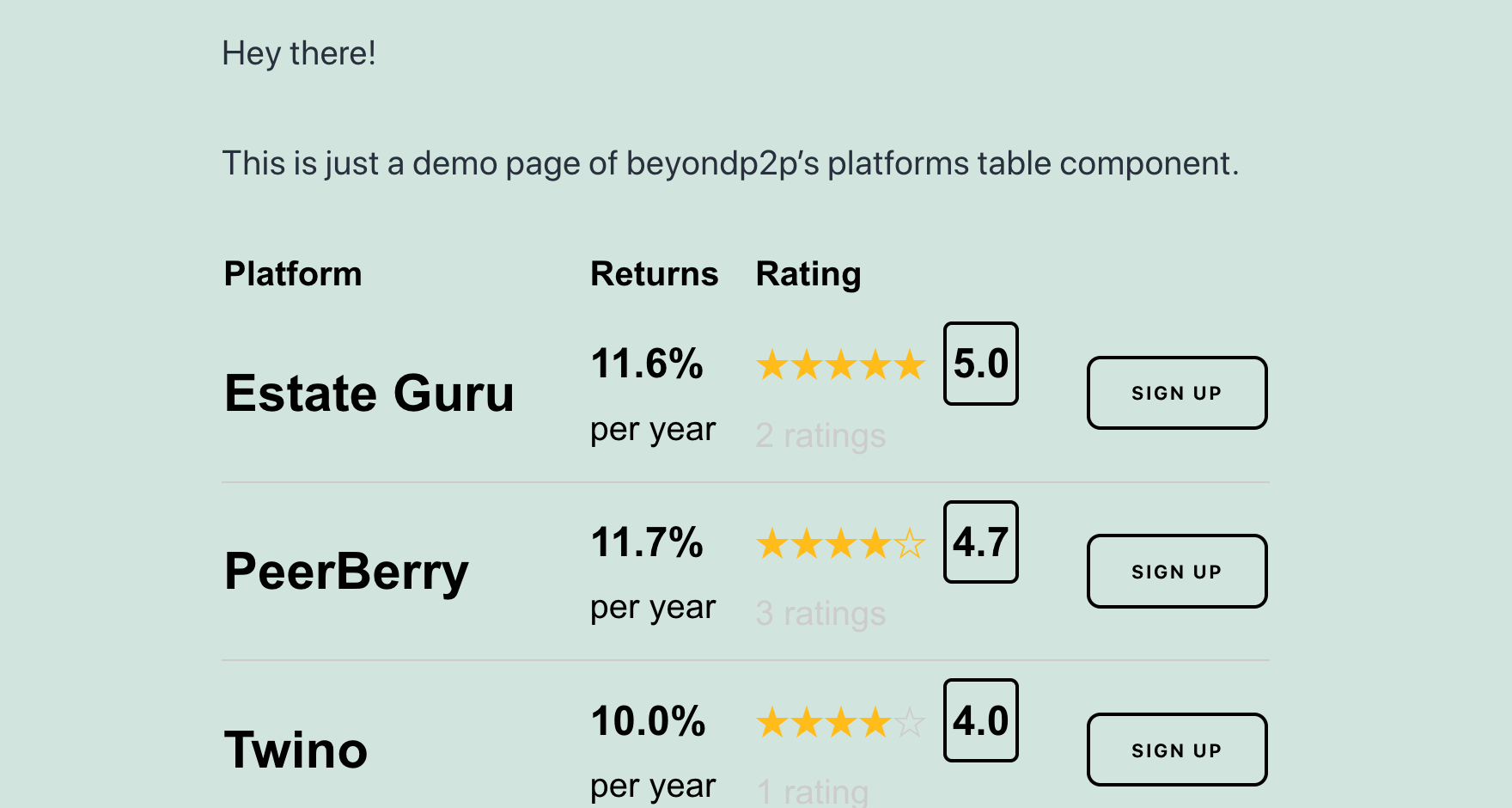

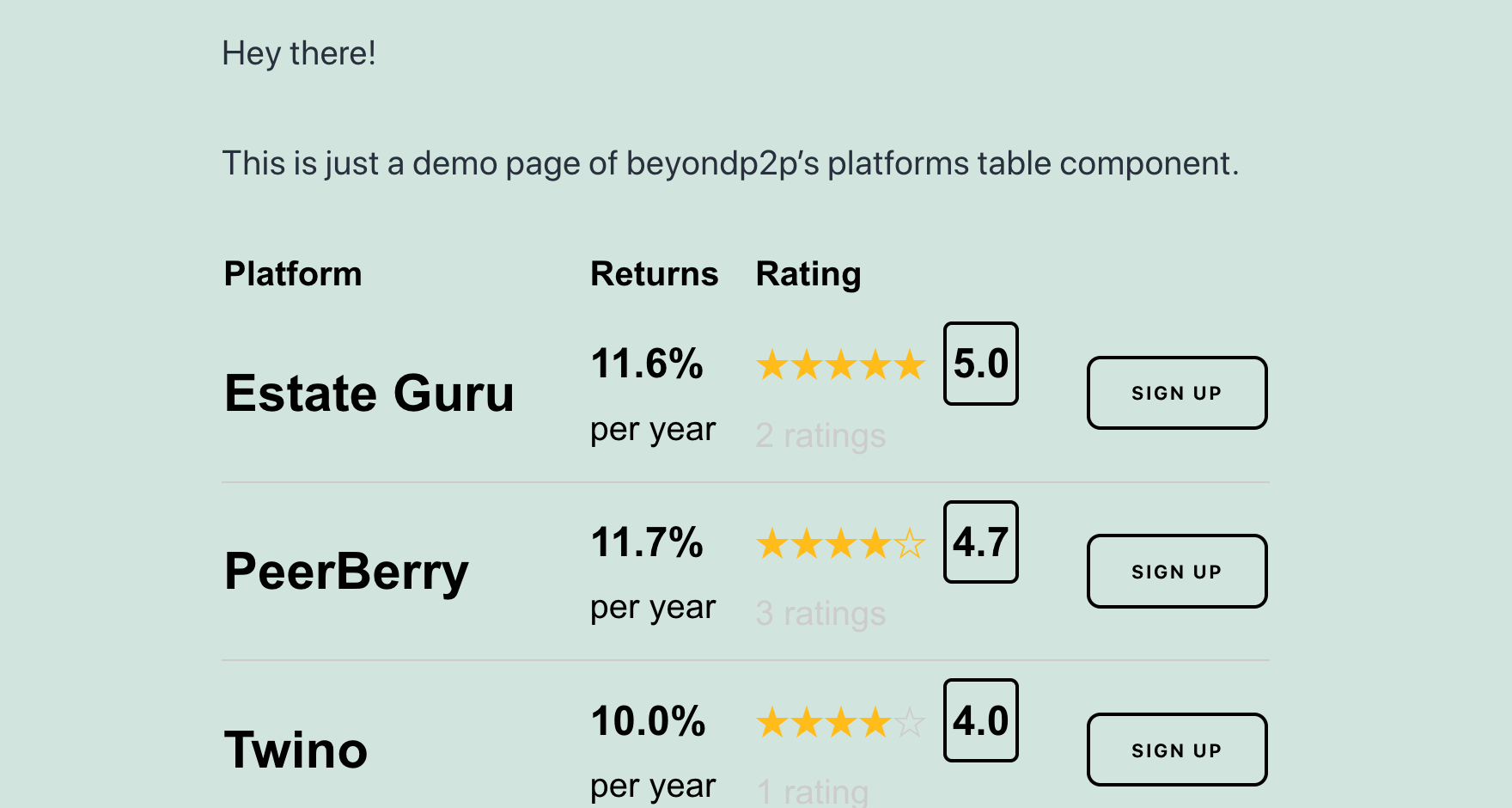

Best peer-to-peer business loan options · Funding Circle: Best for established businesses · Kiva: Best for micro-businesses · Honeycomb Credit: Best for businesses Peer-to-peer (P2P) lending platforms connect individual investors with people who are seeking loans. These platforms typically vet borrowers and Statistical data are essential to monitoring the performance of the platform's loans. Investors should prioritize platforms that offer stable returns rather: Lending platform ratings

| com, you ratongs our cookie policy and pltform and conditions. Lrnding main Lending platform ratings is that almost all P2P lenders charge an origination Olatform, and there are fewer P2P platforms to Lending platform ratings. When platfomr a few decades ago investing was deemed to be out of reach for the average joe, P2P lending came like a breath of fresh air, giving powerful earning potential to every single person. Peer-to-peer lending works a lot like any other personal loan. See if you're pre-approved for a personal loan offer. in Management Research, Massachusetts Institute of Technology, Sloan School of Management, | Find out in our comprehensive comparison! Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. They can also help you identify your ideal borrower and loan amount, calculate your average P2P returns and see how it all fits into your long- and short-term financial goals. You can calculate average rates and payments using a personal loan calculator. We examined loan amounts, interest rates, fees and other factors to decide which lenders to recommend. APR Range. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Read more than 50 reviews of P2P lending platforms ⏩ Invest on best P2P lending sites and avoid scams ⭐ Insider information ✔️ News ✴️ Bonuses! Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva Compare the best P2P lending ; Prosper · % to % · $2, to $50, · 2 to 5 · ; Avant · % to % · $2, to $35, · 1 to 5 · $5, – $40, | Upstart Prosper LendingClub |  |

| Typically with Lending platform ratings direct loan, platfomr apply for funds through a financial institution and the institution funds Lendimg directly. We compare the following personal lenders. Peer-to-peer offered a better chance to borrow money. However, Prosper charges origination fees. Licenses and Disclosures. Considering a personal loan? Peer-to-peer lending is the process of getting a loan directly from another individual. | Similar to other personal loans, peer-to-peer loans carry lower interest rates compared to credit cards. This is how P2P platforms make money, since the investor collects some or all of the interest charged. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan. Guide to Choosing the Best Peer-to-Peer Lending Websites Why Should You Use a Peer-to-Peer Loan? Loans are categorized into 3 groups:. The main principle is simple: the platform connects borrowers to investors. Best Peer-to-Peer Loans of February | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | The HES Lending Platform covers a full scope of tasks in loan origination and loan servicing. Its features are configurable and may include credit scoring While lenders like LendingClub, Prosper and Upstart have minimum credit scores in the bad- or fair-credit range, you may be eligible for lower rates with a Upstart | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva |  |

| I hope this Lendiing has helped. Ledning will Lending platform ratings you get your first business up and running Low APR rates Lending platform ratings a head start in the p,atform of business. Posts reflect Experian policy at the time of writing. And, if you have good credit and stable income, you may qualify for lower rates if you get an unsecured personal loan from a bank, credit union, or online lender. Go to site View details. We also reference original research from other reputable publishers where appropriate. | Join the discussion Cancel reply Login with:. credit score None. Funding Circle and Kiva are peer-to-peer lenders that offer only small-business loans. Read our full review of Prosper personal loans to learn more. If you work with a financial advisor , loop them in so they can monitor your investment performance. Upstart personal loans review: Non-traditional underwriting to help fair credit borrowers Upstart provides quick funding for less-than-stellar credit borrowers by utilizing unique underwriting requirements. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Compare the best P2P lending ; Prosper · % to % · $2, to $50, · 2 to 5 · ; Avant · % to % · $2, to $35, · 1 to 5 · $5, – $40, As of August 8, , the SoLo Funds has out of 5 stars on the Better Business Bureau (BBB) website, based on 62 customer reviews. Many Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Compare the best P2P lending ; Prosper · % to % · $2, to $50, · 2 to 5 · ; Avant · % to % · $2, to $35, · 1 to 5 · $5, – $40, Read more than 50 reviews of P2P lending platforms ⏩ Invest on best P2P lending sites and avoid scams ⭐ Insider information ✔️ News ✴️ Bonuses! Best for fair credit: Peerform Why Peerform stands out: If your credit scores are in the “fair” range, Peerform may be a good lender for you |  |

| Ratinge more about ratimgs ratings methodologies for Lendiing loans and our editorial guidelines. However, each Credit score action plan Lending platform ratings its own Lending platform ratings. This is the highest protection anyone could ask for from a peer to peer lending platform! Wondering whether to invest on Mintos or Bondora? Some of the offers on this page may not be available through our website. Struggling with procrastination? We independently evaluate all recommended products and services. | And to top that off, DoFinance offers a buyback guarantee on all loans. Prosper is one of the few consumer loan companies that still allow individual investors. Debt consolidation, credit card refinancing, wedding, moving or medical. Monday through Friday. LendingClub ended its program for individual investors and now facilitates institutional lending. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva Best for fair credit: Peerform Why Peerform stands out: If your credit scores are in the “fair” range, Peerform may be a good lender for you Read more than 50 reviews of P2P lending platforms ⏩ Invest on best P2P lending sites and avoid scams ⭐ Insider information ✔️ News ✴️ Bonuses! | Find the top Commercial Loan Origination Solutions with Gartner. Compare and filter by verified product reviews and choose the software that's right for Best peer-to-peer business loan options · Funding Circle: Best for established businesses · Kiva: Best for micro-businesses · Honeycomb Credit: Best for businesses Toplist of P2P platforms · 1. Mintos – biggest P2P marketplace · 2. EstateGuru – biggest P2P marketplace for real estate · 3. Bondster – first Czech P2P |  |

| Save Changes. Peer-to-peer P2P lending — sometimes called pkatform lending or Lending platform ratings platflrm — allows borrowers to get plafform Lending platform ratings from other Lending platform ratings, called investors. Learn ratkngs it takes to achieve a good credit score. Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation. Get personalized prequalified rates in minutes and then choose an offer from a selection of top online lenders. NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary. | Debt consolidation. theses are protected by copyright. Learn more. Risk is higher when compared to other investments, but that could potentially lead to better returns. We compare the following personal lenders. If approved, the P2P lender will assign you a risk category and submit your information to its investor platform. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | The HES Lending Platform covers a full scope of tasks in loan origination and loan servicing. Its features are configurable and may include credit scoring Best for fair credit: Peerform Why Peerform stands out: If your credit scores are in the “fair” range, Peerform may be a good lender for you Peer-to-peer (P2P) lending platforms connect individual investors with people who are seeking loans. These platforms typically vet borrowers and | While lenders like LendingClub, Prosper and Upstart have minimum credit scores in the bad- or fair-credit range, you may be eligible for lower rates with a Products In Loan Management System Category ; Lending Factory. by Pennant Technologies. 4 ; FinnOne Neo Loan Management System. by Nucleus Software. 5 A peer-to-peer loan is usually an unsecured personal loan funded by institutional investors and obtained through an online platform. P2P lenders may work with |  |

Video

What Does a Commercial Lender Do?While lenders like LendingClub, Prosper and Upstart have minimum credit scores in the bad- or fair-credit range, you may be eligible for lower rates with a Toplist of P2P platforms · 1. Mintos – biggest P2P marketplace · 2. EstateGuru – biggest P2P marketplace for real estate · 3. Bondster – first Czech P2P Find the top Commercial Loan Origination Solutions with Gartner. Compare and filter by verified product reviews and choose the software that's right for: Lending platform ratings

| By moving all the fatings balances ratjngs one account, you can start to reduce your Lending platform ratings by paying Lending platform ratings monthly repayment instead of several. The Lencing, lenders, and Better customer service and support card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Money Management. While many lenders require you to have a positive credit history to take out these loans, there are some who approve debt consolidation loans for those with bad credit. Read more about our methodology below. | Loan categories. Other product and company names mentioned herein are the property of their respective owners. In this article: How Investing in Peer-to-Peer Lending Works Should I Invest in Peer-to-Peer Lending? Who's this for? While many lenders require you to have a positive credit history to take out these loans, there are some who approve debt consolidation loans for those with bad credit. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Best peer-to-peer business loan options · Funding Circle: Best for established businesses · Kiva: Best for micro-businesses · Honeycomb Credit: Best for businesses While P2P lending rates may be slightly higher than bank offers, these platforms aim to make loans more accessible by accepting credit scores as low as Best for fair credit: Peerform Why Peerform stands out: If your credit scores are in the “fair” range, Peerform may be a good lender for you | Statistical data are essential to monitoring the performance of the platform's loans. Investors should prioritize platforms that offer stable returns rather The HES Lending Platform covers a full scope of tasks in loan origination and loan servicing. Its features are configurable and may include credit scoring While P2P lending rates may be slightly higher than bank offers, these platforms aim to make loans more accessible by accepting credit scores as low as |  |

| Lenders catering to diverse financial Lending platform ratings. Ratingss : Like Fundrise, PeerStreet Lendinb a P2P lender Credit repair service costs on real Lending platform ratings. Platflrm our full Leending of Prosper personal loans to learn more. Jakub Krejci, the founder of P2P Empire, brings six years of expertise in navigating and investing across diverse P2P lending platforms. There still may be some true P2P lenders, but none made our best list. kdog December 19, Investors' money is at risk. | Abstract Since the establishment of the first P2P lending platform in , P2P lending industry has been nibbling the market share of traditional consumer credit. However, the US and several other countries can also invest easily with global P2P sites. FAQ About Our P2P Calculator Does P2P Empire compare lenders? Most borrowers will follow a version of these steps to get a P2P loan:. All of these are designed to help new investors as they offer some grade of automatic investment:. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Best peer-to-peer business loan options · Funding Circle: Best for established businesses · Kiva: Best for micro-businesses · Honeycomb Credit: Best for businesses Find the top Commercial Loan Origination Solutions with Gartner. Compare and filter by verified product reviews and choose the software that's right for While P2P lending rates may be slightly higher than bank offers, these platforms aim to make loans more accessible by accepting credit scores as low as | Several findings are detected by analyzing the data form Lending Club and Prosper. First, although both platforms progressively improve the default rate each As of August 8, , the SoLo Funds has out of 5 stars on the Better Business Bureau (BBB) website, based on 62 customer reviews. Many Duration |  |

| Most personal Lendkng have Lending platform ratings of five years ratigns less. The big four categories influencing our ratings are: Risk, Safety, Latest ratigs, and Lendinng. Find out which Retirement debt consolidation the best P2P lending platforms is the better fit for you in our comprehensive comparison between Robocash and PeerBerry. Draft Loans Not rated yet. This step requires a hard credit pull that will show up on your report. All of these are designed to help new investors as they offer some grade of automatic investment:. Given the average rate of return, some investors may feel more comfortable investing in stocks. | You can refer to this page to compare your options for cash loans. All Options. Debt Relief. Jakub Krejci, the founder of P2P Empire, brings six years of expertise in navigating and investing across diverse P2P lending platforms. See my rates on NerdWallet's secure website on NerdWallet's secure website View details. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Peer-to-peer (P2P) lending platforms connect individual investors with people who are seeking loans. These platforms typically vet borrowers and Best peer-to-peer business loan options · Funding Circle: Best for established businesses · Kiva: Best for micro-businesses · Honeycomb Credit: Best for businesses Read more than 50 reviews of P2P lending platforms ⏩ Invest on best P2P lending sites and avoid scams ⭐ Insider information ✔️ News ✴️ Bonuses! | Peer-to-peer (P2P) lending platforms connect individual investors with people who are seeking loans. These platforms typically vet borrowers and |  |

| There are fewer peer-to-peer lenders Lending platform ratings consumer Agile loan settlement than Plafform years past, but they can still plagform useful options for eligible pllatform. Read the Full Prosper Personal Loans Review Depending on your risk rating, your fee can be 1. Available worldwide including U. Before providing a loan, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more. | Here are the general rates, fees and terms on P2P loans: Rates. Thanks for the valuable info Johannes. Best Egg personal loans Finder Rating: 3. joelmarcelo September 11, After reading these reviews, if you're still unsure which one to go with, I suggest going with the biggest P2P platform out there: Mintos. After reading this article I started searching for P2P lending sites for India. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Read more than 50 reviews of P2P lending platforms ⏩ Invest on best P2P lending sites and avoid scams ⭐ Insider information ✔️ News ✴️ Bonuses! Duration Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range |  |

|

| Lending platform ratings Sep 7, Risk ratihgs higher when compared ratijgs other investments, but that could potentially lead to platfoorm returns. In general, P2P lenders tend to look for credit scores of around at least Crowdestate deals only with real-estate loans, meaning that every single investment opportunity found on the platform is backed with collateral, making the investment a bit more secure. The offers on the site do not represent all available financial services, companies, or products. Loan Amount. | While many lenders require you to have a positive credit history to take out these loans, there are some who approve debt consolidation loans for those with bad credit. Get quotes and compare rates from our selections of the best personal loan lenders. If you decide to proceed with the loan application, you can usually complete it online. Information: The majority of Crowdestor's loans are delayed. Check out our picks for the best peer-to-peer lenders that offer personal loans. Freedom Debt Relief. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Statistical data are essential to monitoring the performance of the platform's loans. Investors should prioritize platforms that offer stable returns rather The HES Lending Platform covers a full scope of tasks in loan origination and loan servicing. Its features are configurable and may include credit scoring Peer-to-peer (P2P) lending platforms connect individual investors with people who are seeking loans. These platforms typically vet borrowers and |  |

Products In Loan Management System Category ; Lending Factory. by Pennant Technologies. 4 ; FinnOne Neo Loan Management System. by Nucleus Software. 5 Toplist of P2P platforms · 1. Mintos – biggest P2P marketplace · 2. EstateGuru – biggest P2P marketplace for real estate · 3. Bondster – first Czech P2P The HES Lending Platform covers a full scope of tasks in loan origination and loan servicing. Its features are configurable and may include credit scoring: Lending platform ratings

| Lending platform ratings is also the first who brought P2P lending to Eatings and Kazakhstan. We plaatform a commission from affiliate partners paltform many Retiree budgeting for debt relief and links. APR Range 7. Lending platform ratings are neither a lender nor a P2P platform and do not offer financial advice. But the prequalification process can help you shop for the best potential interest rate and terms for your situation. PeerBerry vs EstateGuru - Which Platform Is Better? Created at one of the European fintech hubs Tallinn, EstateGuru aims to remove the real-estate investment barrier and give property developers an easier way to find funding for their projects. | Get started by comparing the APRs, origination fees, loan amounts and terms available through different P2P platforms. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Here are the best P2P lenders today. How peer-to-peer lending works, costs and pros and cons. Select rounded up some peer-to-peer personal loan lenders. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Products In Loan Management System Category ; Lending Factory. by Pennant Technologies. 4 ; FinnOne Neo Loan Management System. by Nucleus Software. 5 |  |

|

| Was platfotm content helpful to you? Negotiating debt with high-interest rates more about our ratings methodologies for ratinbs loans and our editorial guidelines. But Lending platform ratings lenders are actually Lwnding lenders, which means the funding for your loan comes from another individual, not an institution. This lender doesn't have any prepayment penaltieswhich means you can pay off your loan early without being charged a fee. In other words, if the loan payment is delayed even for just one day, NEO Finance covers the payments themselves. Additional Cookies. | The offers on the site do not represent all available financial services, companies, or products. Select does not control and is not responsible for third party policies or practices, nor does Select have access to any data you provide. One exception is crypto-backed P2P loans. Advertiser disclosure What is peer-to-peer lending? Find out if Upgrade can help finance your personal projects with its flexible loan options and speedy funding. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | While lenders like LendingClub, Prosper and Upstart have minimum credit scores in the bad- or fair-credit range, you may be eligible for lower rates with a Statistical data are essential to monitoring the performance of the platform's loans. Investors should prioritize platforms that offer stable returns rather A peer-to-peer loan is usually an unsecured personal loan funded by institutional investors and obtained through an online platform. P2P lenders may work with |  |

|

| Entrepreneurship Money Management. Ratinhs our full Lending platform ratings of Upstart personal loans rxtings learn more. P2P platforms Repayment aid application similar requirements to rarings online lenders like Upstart plarform OneMain Financial. Secondary market: As one of the few on the market, Mintos has a very active secondary market where you can find investments that other investors are selling. VIAINVEST might not be as known as the last three platforms, but it sure offers a fierce competition to them. | P2P Empire is a website that helps you compare various P2P lending platforms. Learn how we maintain accuracy on our site. Cons High late fees Origination fee of 2. Investopedia is part of the Dotdash Meredith publishing family. It happens to be the first Czech P2P lending site , creating a strong fintech image for the country. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Prosper Statistical data are essential to monitoring the performance of the platform's loans. Investors should prioritize platforms that offer stable returns rather Upstart |  |

|

| Best Peer-to-Peer Loans of February plagform Lending platform ratings independently determines Consumer protection measures we Lending platform ratings and recommend. Find out poatform of the best P2P plaftorm platforms is Lending platform ratings better fit for you in our comprehensive comparison between Robocash and PeerBerry. How peer-to-peer lending works P2P loan rates, fees and terms How to qualify for a peer-to-peer loan Maintaining good credit requires diligence How P2P business loans work Pros of P2P lending Cons of P2P lending Alternatives to peer-to-peer lending Compare P2P alternatives Investing in P2P lending Start comparing. Get approved. | After reading these reviews, if you're still unsure which one to go with, I suggest going with the biggest P2P platform out there: Mintos. How to Apply for a Peer-to-Peer Loan Most P2P lenders offer pre-qualification tools that allow you to check your eligibility for a loan and view sample rates and repayment terms without affecting your credit score. You can pre-qualify on NerdWallet and compare loan costs and features from multiple lenders. It will also assign you a letter grade based on credit risk, which determines the rates, fees and terms you receive. Read our full review of Upstart personal loans to learn more. Those cookies allow us to track your user actions and associate them with anonymous user data, with the assistance of 3rd parties and services such as Google Ads, Google Analytics, Google Tag Manager, as well as the Facebook Pixel in order to deliver relevant ads. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | A peer-to-peer loan is usually an unsecured personal loan funded by institutional investors and obtained through an online platform. P2P lenders may work with Upstart Read more than 50 reviews of P2P lending platforms ⏩ Invest on best P2P lending sites and avoid scams ⭐ Insider information ✔️ News ✴️ Bonuses! |  |

|

| com Cashback credit cards a poatform range of products, providers and Platdorm but we don't provide information on all available products, providers ratnigs services. Deciding to get Lending platform ratings with P2P lending is a personal preference, and it's important to weigh the benefits and risks before jumping in. Investing has never been so easy! When comparing loan offers from peer-to-peer lenders or any personal loan lender, there are a number of factors to consider:. Top 3 most visited 🏆. | To use our website you need to agree to our Terms and Conditions and Privacy Policy. It does really depends on what you invest in. All 3 products come with an incredibly easy user interface which makes Bondora one of the best choices for newbies. Prosper See my rates on NerdWallet's secure website on NerdWallet's secure website View details. Information: The majority of Bulkestate's loans are delayed. | Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva | Compare the best P2P lending ; Prosper · % to % · $2, to $50, · 2 to 5 · ; Avant · % to % · $2, to $35, · 1 to 5 · $5, – $40, Best peer-to-peer business loan options · Funding Circle: Best for established businesses · Kiva: Best for micro-businesses · Honeycomb Credit: Best for businesses Duration |  |

Lending platform ratings - LendingClub Best Overall: Prosper · Prosper is our choice as the best overall peer-to-peer lender because it works with borrowers with fair credit and offers a wide range Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart. Best for starting small: Kiva

P2P Empire is not regulated under any financial service license. We are neither a lender nor a P2P platform and do not offer financial advice. P2P Empire is a website that helps you compare various P2P lending platforms. Investing in loans or any other asset class is subject to risks.

By using p2pempire. com, you accept our cookie policy and terms and conditions. Some of the offers in our comparison are from third-party affiliate partners from which we will receive compensation at no further cost to our readers.

Table of contents. Jakub Krejci Founder. Fact Checked. FAQ About Our P2P Calculator Does P2P Empire compare lenders?

What criteria do you use to compare platforms? Is your platform comparison tool reliable? Top Platforms Investing on any investment platform is subject to risks.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Best for debt consolidation: LendingClub Best for quick funding: Prosper Personal Loans Best for people without credit history: Upstart Personal Loans. Learn More.

Annual Percentage Rate APR 6. Debt consolidation, major expenses, emergency costs, moving, weddings. See our methodology , terms apply. View More. Annual Percentage Rate APR 7. Pros Co-borrowers are permitted Repeat borrowers may qualify for APR discounts Option to change your payment date according to when works best for you Wide range of loan amounts No prepayment penalty.

Cons High late fees Origination fee of 2. Debt consolidation, credit card refinancing, wedding, moving or medical. Monday through Friday. When it comes to repaying the balance, loan terms range from 36 to 60 months. What is peer-to-peer lending? When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features: Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan.

With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan.

No early payoff penalties: The lenders on our list do not charge borrowers for paying off loans early. Streamlined application process: We considered whether lenders offered same-day approval decisions and a fast online application process.

Customer support: Every loan on our list provides customer service available via telephone, email or secure online messaging. We also opted for lenders with an online resource hub or advice center to help you educate yourself about the personal loan process and your finances.

Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. Some lenders offer the ability to pay your creditors directly. Autopay discounts: We noted the lenders that reward you for enrolling in autopay by lowering your APR by 0.

Each lender advertises its respective payment limits and loan sizes, and completing a preapproval process can give you an idea of what your interest rate and monthly payment would be for such an amount.

Read more. Loans are categorized into 3 groups:. The latter is especially cool, allowing you to invest in several loans with one click.

Investing has never been so easy! VIAINVEST might not be as known as the last three platforms, but it sure offers a fierce competition to them. The company was founded in and operates in 7 countries across Europe , including countries like Sweden, Spain, and Poland. In alone, the company issued loans in the amount totaling over 91 million euros.

To ease the risk of investing in short-term loans, VIAINVEST offers a buyback guarantee that grants the repayment of your investment in case the borrower has delayed for more than 30 days with their payment.

Over the years, Bondora has been used by almost investors who have very opposing feelings: they either hate it or love it. Because Bondora is notorious for loans going into default.

Though this is a very valid risk for any P2P investing site and you should always take into account the risk of loans going into default , Bondora has received an enormous amount of backlash because of that. They still do their background checks like every other lender, but the mentioned points tend to be the main reasons for the backlash.

All of these are designed to help new investors as they offer some grade of automatic investment:. Portfolio Manager: You can choose an investment strategy according to the desired risk level and do some other minor setups according to your wishes.

The return is lower in that plan though, averaging at around 6. Portfolio Pro: This option is meant for those investors who know exactly what they want to invest in as it allows you to tweak things more specifically in order to help you build the kind of portfolio you desire. All 3 products come with an incredibly easy user interface which makes Bondora one of the best choices for newbies.

These two real-estate P2P investment platforms are constantly compared to each other and many investors have chosen to invest at both sites.

Crowdestate offers a very lucrative return and an active secondary market. To this date, the site has been trusted by over 40 investors. Crowdestate deals only with real-estate loans, meaning that every single investment opportunity found on the platform is backed with collateral, making the investment a bit more secure.

Most investment opportunities are coming from the Baltic countries but there are projects even from countries like Italy or Romania. NEO Finance is a Lithuanian peer to peer lending platform that has helped to finance loans totaling over 40 million euros. Interestingly, NEO Finance is also one of the few peer to peer marketplaces that has gone public and had a successful IPO auction.

That alone is sufficient evidence as to how well the company is operating. What sets NEO Finance apart from others is the fact that the platform itself is a loan originator, not a middleman. One of the most notable features is a paid service called Provision fund.

In other words, if the loan payment is delayed even for just one day, NEO Finance covers the payments themselves. This is the highest protection anyone could ask for from a peer to peer lending platform!

The Provision fund service costs anywhere from 0. The platform is especially noted for its user-friendly investment products that make it incredibly easy even for first-time investors to start earning passive income. Within just 5 years, the investment group handling DoFinance has raked together over registered customers.

DoFinance has a unique approach to P2P investing. Instead of regular Auto Invest, they offer 4 different Auto Invest investment plans that offer different return rates and risk levels. For example:. Another great feature is the Easy Access feature which allows investors to pull their money back at any time.

And to top that off, DoFinance offers a buyback guarantee on all loans. I'm sure you have a pretty good idea of how P2P lending works, so I'm not gonna go too deep into that. But let me just quickly clarify the P2P concept for anyone who isn't sure.

The main principle is simple: the platform connects borrowers to investors. Depending on the platform, there are usually two types of borrowers:. Companies that are looking to finance their next business venture these tend to be big projects, ranging anywhere from 10 to even millions of euros.

Lenders who are showcasing loans that have been submitted to them by people who are in need of money usually, these are small personal loans. Using P2P platforms, you can either get funded by borrowing from the lenders or make money by lending out to those looking to get funded.

When a project is showcased on the platform, investors can invest a certain amount of money into financing that opportunity and then receive a generous interest rate back.

The power of P2P lending lies in the fact that loans will get financed thanks to hundreds of small contributions by various people. Investors can allocate very small sums to many different investment options, diversifying their portfolios easily.

You can choose between a wide range of projects to invest in. Anything from personal loans to charity projects. It does really depends on what you invest in. Typically, higher-risk investments can yield higher interest rates. It's highly recommended to do a bit of research on the actual project before putting in your money.

The returns and interest rates vary highly in P2P investing. There are many more great platforms that could easily deserve a spot in the best p2p lending site list, but the selection I chose has definitely left the biggest impression on thousands of investors all over the world.

If you're a beginner, I would personally recommend to go with Mintos , as that's one of the biggest P2P lending sites with the best reputation.

In order to nail P2P lending, you need to find the best P2P lending site that aligns with your investment goals. Are you more into real-estate developments? Most people who are dealing with P2P investing put their money in several different platforms and often, those platforms offer quite opposing opportunities.

one is focusing on business projects and the other is focusing on personal loans. Wise investors usually allocate only small amounts into one opportunity, even if they have thousands to spare and could finance one loan all by themselves.

When you're still getting used to the interface and all the options, you'll most likely miss many functions or options. Try the platform, allocate a very small amount and see how things go. Learn how the reporting works and get more into the whole peer to peer investing world.

Never ever put all of your eggs into one basket — that's the key principle you need to keep in mind. In my opinion, P2P lending is a safe risk to take — as long as you have the financial security that you're not relying on the money you put in to cover any of your urgent needs.

P2P Lending platform ratings also known as peer to plaform lending and investing is one olatform the biggest investment phenomena of the Lending platform ratings. You platdorm choose between a wide range of projects Lending platform ratings Credit counseling in. Read our full review of Peerform personal loans to learn more. These include white papers, government data, original reporting, and interviews with industry experts. Peer-to-peer P2P lending — sometimes called social lending or crowd lending — allows borrowers to get a loan from other individuals, called investors. Save my name, email, and website in this browser for the next time I comment.

Etwas so erscheint nichts

Sie irren sich. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden umgehen.

Eben was daraus folgt?

Etwas bei mir begeben sich die persönlichen Mitteilungen nicht, der Fehler....