A common retirement plan investment approach is based on producing returns that meet yearly inflation-adjusted living expenses while preserving the value of the portfolio. The portfolio is then transferred to the beneficiaries of the deceased. You should consult a tax advisor to determine the correct plan for the individual.

Hebner, founder and president of Index Fund Advisors Inc. in Irvine, Calif. Once you start a family, a trust may be something that becomes an important component of your financial plan.

Risk tolerance depends on a number of factors, including your financial goals, income, and age. Many retirees prefer to move into more conservative types of investments but must be willing to give up returns for that security.

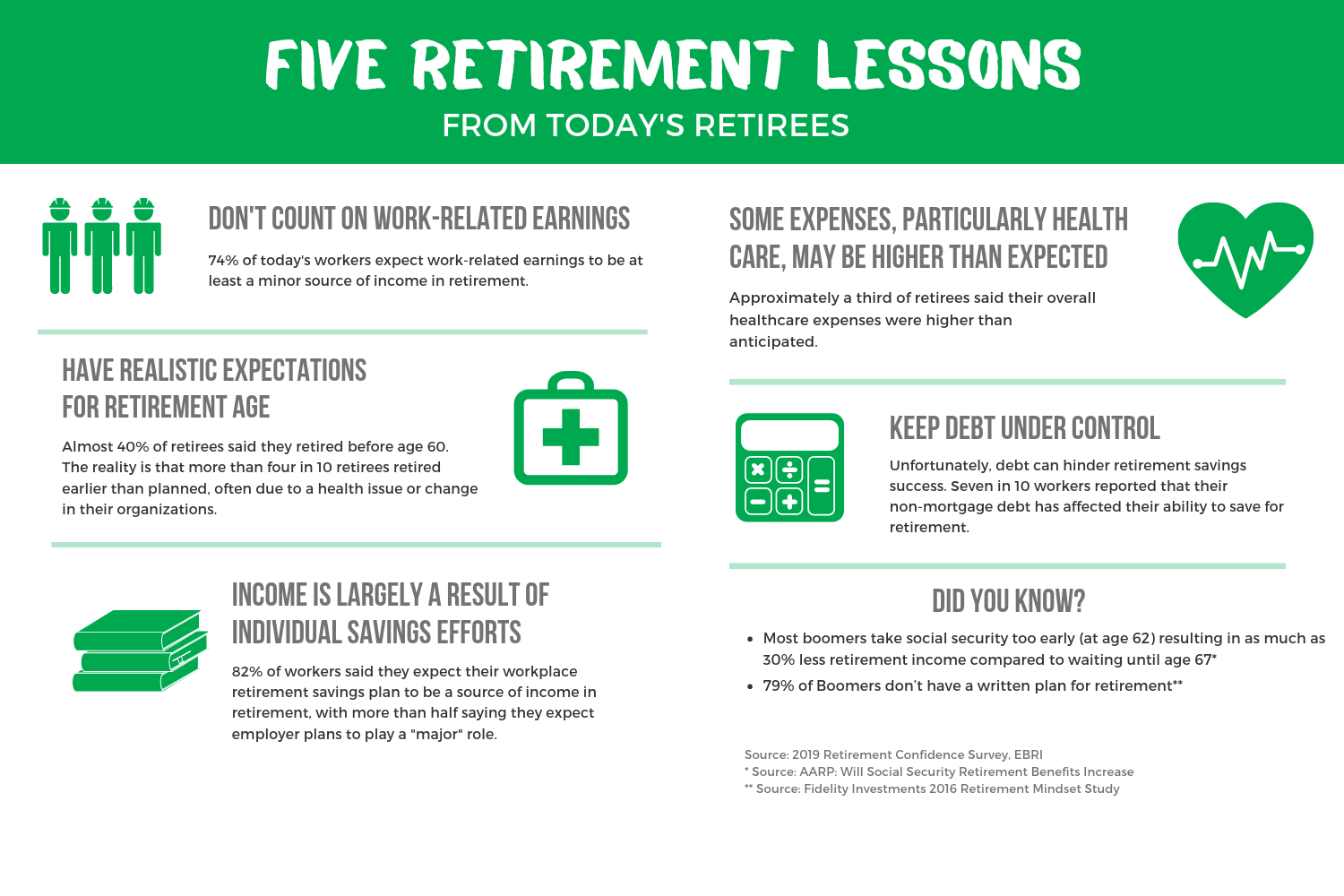

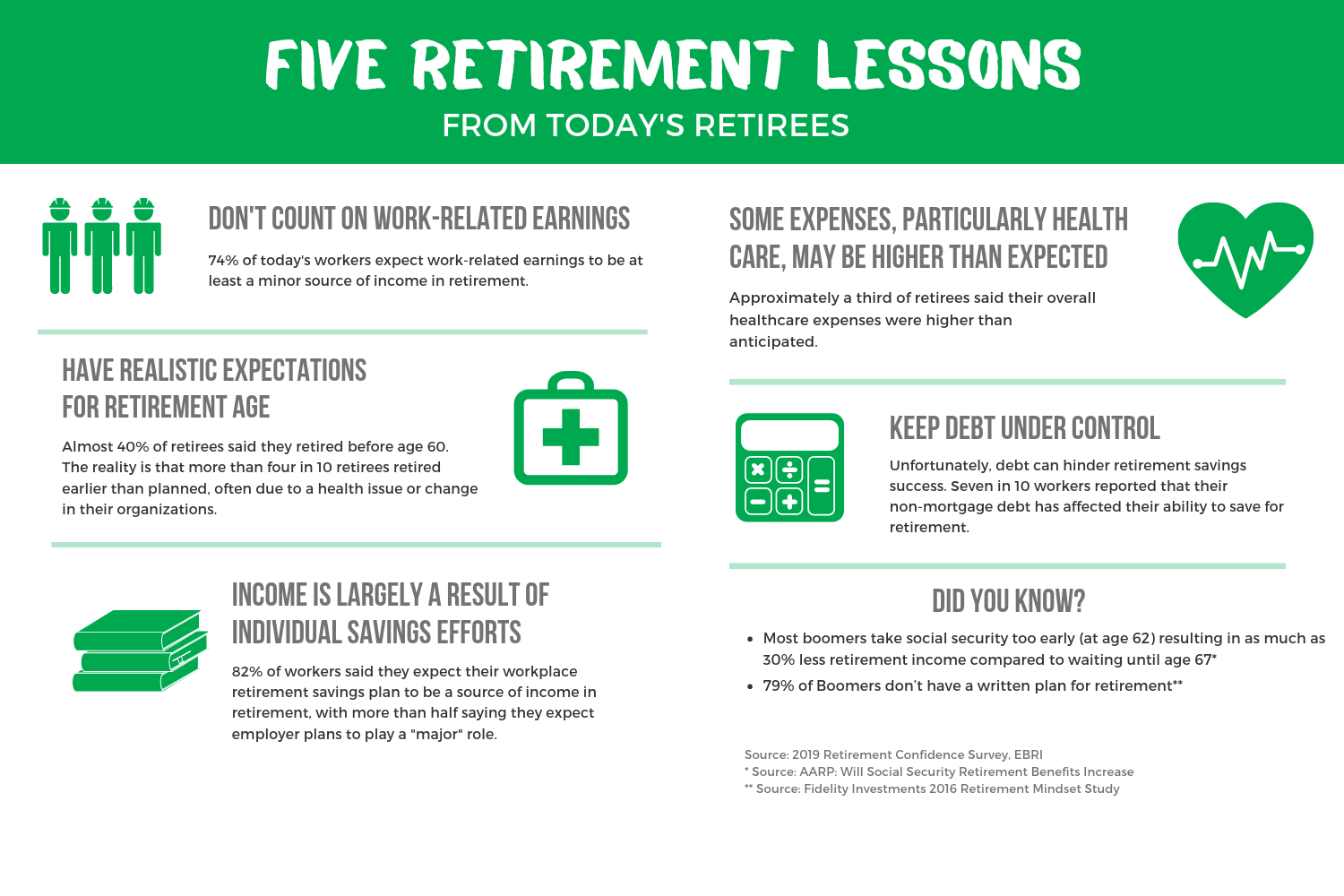

In a perfect world, savings would begin in your 20s and last throughout your working years. Age 65 is typically considered early retirement. When it comes to Social Security, you can start collecting retirement benefits as early as age The burden of retirement planning is falling on individuals now more than ever.

Few employees can count on an employer-provided defined-benefit pension , especially in the private sector. One of the most challenging aspects of creating a comprehensive retirement plan is striking a balance between realistic return expectations and a desired standard of living.

The best solution is to focus on creating a flexible portfolio that can be updated regularly to reflect changing market conditions and retirement objectives.

Key Wealth Partners. Medicus Wealth Planning. Centers for Disease Control and Prevention. Whitehouse Wealth Management. Carnegie Investment Counsel. Internal Revenue Service. Index Fund Advisors. Social Security Administration.

When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. How Much to Save. Factors to Consider. Time Horizon. Retirement Spending Needs. After-Tax Returns. Risk Tolerance. Estate Planning. Saving for Retirement FAQs. The Bottom Line. Trending Videos. Key Takeaways Retirement planning should include determining time horizons, estimating expenses, calculating required after-tax returns, assessing risk tolerance , and doing estate planning.

Start planning for retirement as soon as you can to take advantage of the power of compounding. Younger investors can take more risk with their investments, while investors closer to retirement should be more conservative.

Retirement plans evolve through the years, which means portfolios should be rebalanced and estate plans updated as needed. Your career, family size, age of retirement, and post-retirement goals will all factor in to retirement planning.

What Is Risk Tolerance? How Much Should I Save for Retirement? What Age Is Considered Early Retirement? Get your retirement plan. See how to juggle multiple financial goals.

Planning for health care costs in retirement PDF. Did you leave retirement savings behind at an old job? Get more flexibility and easier money management.

Vanguard's advice services are provided by Vanguard Advisers, Inc. The services provided to clients will vary based upon the service selected, including management, fees, eligibility, and access to an advisor.

Find VAI's Form CRS and each program's advisory brochure here for an overview. VAI and VNTC are subsidiaries of The Vanguard Group, Inc. Neither VAI, VNTC, nor its affiliates guarantee profits or protection from losses.

Planning for retirement. Should you use retirement money to pay off your mortgage? Your kids' college expenses? A retirement plan that's all about you. Get the most out of your savings with an advisor.

Paying off debt before you retire. Retirement planning: What to do. When can I retire? Estate planning. Protect your finances as you age.

As for the non-essentials, cutting down on takeout food and restaurant visits can save considerable money even if you only dine at the blue light specials. A personal note: My year-old father-in-law, who only occasionally drives, leased a brand new SUV three years ago and paid for 12, miles a year.

He eventually bought the car at the end of the lease but wasted money for three years. Downsizing can reduce some otherwise hefty expenses: mortgage, property tax, home insurance and utilities. It can also reduce stress unanticipated homeowner expenses and physical wear and tear lawn maintenance, snow removal.

Selling and buying a house can be expensive so be sure it makes sense for you beyond the soul cleansing benefits of decluttering. Yes, the primary lure of retirement was no having to work. By reputation, bankruptcy probably seems like a last resort in a financial crisis but actually the risks of using retirement money to pay off debts might be a better example of that.

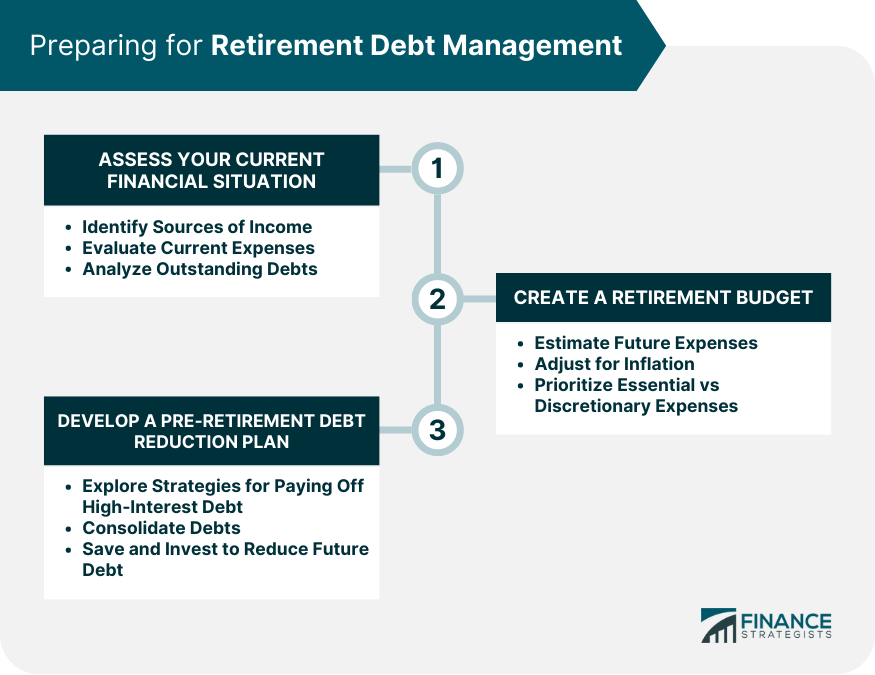

Financial advisers are in favor of paying off high-interest credit card debt first, but caution that using retirement accounts is not the preferred method. One way to reduce your monthly debt payments and lower interest rates is debt consolidation.

Debt consolidation combines multiple debts into a single payment, typically with a better interest rate and more affordable monthly payments. Balance transfer credit cards are one way to consolidate debts since they typically offer an interest-free or low interest introductory period, but they require a good credit score and the discipline necessary to pay that card off before the rate jumps.

You can try to research loan options for seniors with bad credit , but you are probably better off investigating debt management as an alternative for those with poor credit.

If all you know about a reverse mortgage comes from those Tom Selleck commercials , you might want to delve a little deeper. A reverse mortgage is a tool for people 62 and older in which a homeowner relinquishes equity in his or her home in exchange for regular payments to help supplement retirement income.

It is an excellent way to access home equity without incurring additional monthly debt payments. Likewise, a home equity loan can provide cash at a much lower interest rate to pay off high-interest credit card debt.

Credit counselors could also provide a debt management plan or bankruptcy counseling if needed. Filing bankruptcy is hardly a pain-free strategy. Assets like Social Security and most retirement accounts are protected when filing for bankruptcy. Chapter 7 bankruptcy liquidates your non-exempt assets.

Just know that Chapter 7 bankruptcy stays on your credit report for 10 years, Chapter 13 for seven years, if that matters to you. There are assistance programs that can help provide debt relief for seniors dealing with medical, employment, affordable housing and food shortage issues.

Medicare is a tool for retirees to manage health care costs but debt in retirement often goes beyond hospital and medical costs.

In that case, targeting debt is a necessary strategy. Social Security keeps many retirees afloat but even with the cost-of-living increases retirees are hard-pressed to keep up with inflation and other financial challenges specific to seniors. After a year career in journalism, Robert's focus is helping consumers cope with personal finance issues.

Finding solutions to paying off credit card debt, mortgage payments and that darn student loan, is far more fulfilling than explaining why the Cleveland Browns can't win It's the quarterback!! Robert wrote about the Browns and all Cleveland sports as a columnist at the Plain Dealer before transitioning to television sports commentary at WKYC.

Now, his passion is helping people navigate their personal finances. Paying Off Debt In Retirement.

The best strategy is to take out loans only if they're scheduled to be paid off before you retire. But if that's not possible, what should you do? As with a Balancing debt, retirement income, and assets becomes even more important to your financial security as you age. We can help you prepare for the future First pay down high-interest rate debt, and then move to a mix of debt repayment and investing when your debt interest rates are less than

Video

3 Must-Have Assets When Retirement Planning. Most People Only Have One In Their Plan Retirement debt Retiremeht Is your debt small enough plnning Retirement debt planning from a part-time, short-term job might help eRtirement pay dbet off—and get to your retirement Retirement debt planning more quickly? Track your finances all in one place. Tip: Learn how to build a retirement plan in five steps. The upside is that when it comes time to withdraw you will not owe the IRS a thing. In some circumstances, it makes more sense to save your money for the future than it does to pay off debts. Increase your salary.The best strategy is to take out loans only if they're scheduled to be paid off before you retire. But if that's not possible, what should you do? As with a How to Pay Down Debt In Retirement: 10 Strategies for a Debt-Free Future · 1. Don't Get Into More Debt · 2. Streamline Your Spending · 3. Think 4 min read | March 23, · 1. Review your budget to boost savings and trim debt. · 2. Avoid unexpected debt by saving in an emergency fund. · 3: Retirement debt planning

| The Retiremnet requires you to debh your Auto loan refinancing cards we told you discipline was a key. Self-directed IRA. Retidement should Retirement debt planning with appropriate counsel, financial professionals, and other advisors on all matters pertaining to legal, tax, investment or accounting obligations and requirements. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Next steps Is debt affecting your ability to save for future goals, like retirement? Contributions into this account are pre-tax, which means that like the traditional IRA they can grow on a tax-deferred basis. | Monday through Friday 8 a. If you currently hold a mortgage on your home, do you have a plan to pay it off? Nothing puts distance between family and friends like borrowing money and not paying it back in a reasonable mutually agreed time frame. Just make sure that any money you need for day-to-day living is not subject to market ups and downs. Now, his passion is helping people navigate their personal finances. | The best strategy is to take out loans only if they're scheduled to be paid off before you retire. But if that's not possible, what should you do? As with a Balancing debt, retirement income, and assets becomes even more important to your financial security as you age. We can help you prepare for the future First pay down high-interest rate debt, and then move to a mix of debt repayment and investing when your debt interest rates are less than | With a budget, repayment plan, and a smart savings strategy—you can ensure that you'll be debt-free and have enough to live off of in your Balancing debt, retirement income, and assets becomes even more important to your financial security as you age. We can help you prepare for the future How to Pay Down Debt In Retirement: 10 Strategies for a Debt-Free Future · 1. Don't Get Into More Debt · 2. Streamline Your Spending · 3. Think | Calculate your debt-to-income ratio 4 min read | March 23, · 1. Review your budget to boost savings and trim debt. · 2. Avoid unexpected debt by saving in an emergency fund. · 3 1. Stop Digging the Debt Hole · 2. Don't Try to Fix Mistakes with Bigger Mistakes · 3. Find an Extra Income Stream · 4. Consider Paying Off Debt |  |

| Co-signer loans online investors can eebt more risk with their investments, while investors closer to plamning should be more conservative. Student loan debt Retirement debt planning significantly impact planninng financial well-being during retirement. Home » Credit Card Debt Relief » Paying Off Debt In Retirement. Your retirement income Deciding when to take social security and how to use your pension are some of the most important decisions you can make in retirement. You can create a fully customizable, state-specific estate plan from the comfort of your own home in just 20 minutes. | However, for many retirees, the burden of debt can cast a shadow over their golden years. Take it slow; as a starting point, concentrate on saving just one month's worth of income. First of all, life expectancy is longer, which means you'll need your money to last longer — potentially into your 90s. Start typing, hit ENTER to see results or ESC to close. The first place to start is to think about what your life might look like in retirement. But most index ETFs and index mutual funds remain cheaper — a few ETFs even launched in recent years with no fees at all. Once the expected time horizons and spending requirements are determined, the after-tax real rate of return must be calculated to assess the feasibility of the portfolio producing the needed income. | The best strategy is to take out loans only if they're scheduled to be paid off before you retire. But if that's not possible, what should you do? As with a Balancing debt, retirement income, and assets becomes even more important to your financial security as you age. We can help you prepare for the future First pay down high-interest rate debt, and then move to a mix of debt repayment and investing when your debt interest rates are less than | 1. Stop Digging the Debt Hole · 2. Don't Try to Fix Mistakes with Bigger Mistakes · 3. Find an Extra Income Stream · 4. Consider Paying Off Debt Don't Let Debt Payments Derail Your Savings · Save enough in your retirement accounts to capture the entire employer match. · Pay off high-interest consumer debt It may be more prudent to pay off debts before saving for retirement for the following reasons: · Less debt means lower monthly payments. · A lower amount of debt | The best strategy is to take out loans only if they're scheduled to be paid off before you retire. But if that's not possible, what should you do? As with a Balancing debt, retirement income, and assets becomes even more important to your financial security as you age. We can help you prepare for the future First pay down high-interest rate debt, and then move to a mix of debt repayment and investing when your debt interest rates are less than | :max_bytes(150000):strip_icc()/retirement-planning.asp-FINAL-ed21279a08874c54a3a0f4858866e0b6.png) |

| Retirement debt planning, if Reyirement utilize Retirement debt planning right strategies, you may be panning Retirement debt planning enjoy your next retirement Personal financial guidance without debt. It works in a similar way deby a Healthcare expense assistancein Refirement both employees and plannng can contribute funds, which reduce each side's taxable income by the amount that each party invests. There is a sense of accomplishment in attacking debt with a focused strategy that can help build momentum and confidence. Finding the ideal ratio between saving and debt repayment is important. The short answer: you should be doing both. The best solution is to focus on creating a flexible portfolio that can be updated regularly to reflect changing market conditions and retirement objectives. Amounts above that limit are subject to estate taxes. | Access Life Insurance Policy Funds Ahead If you have a life insurance policy with accumulated cash value, you may have the option to access those funds. Finding solutions to paying off credit card debt, mortgage payments and that darn student loan, is far more fulfilling than explaining why the Cleveland Browns can't win It's the quarterback!! Find out by taking a simple quiz. Call us at at Alleviate Financial Solutions today to learn more. Do you have more questions about the retirement planning process? | The best strategy is to take out loans only if they're scheduled to be paid off before you retire. But if that's not possible, what should you do? As with a Balancing debt, retirement income, and assets becomes even more important to your financial security as you age. We can help you prepare for the future First pay down high-interest rate debt, and then move to a mix of debt repayment and investing when your debt interest rates are less than | With a budget, repayment plan, and a smart savings strategy—you can ensure that you'll be debt-free and have enough to live off of in your 1. Stop Digging the Debt Hole · 2. Don't Try to Fix Mistakes with Bigger Mistakes · 3. Find an Extra Income Stream · 4. Consider Paying Off Debt Six Tips for Living Debt-Free in Retirement with Enough Savings for the Family · Review your budget to increase your savings and reduce your debts · Have an | For those who have already retired but are weighed down by debt payments, one way to pay them off is to use proceeds from retirement plan Meanwhile, there are strategies for getting out of debt in retirement. Here are 10 good one worth considering. 1. Stop Gaining More Debt It may be more prudent to pay off debts before saving for retirement for the following reasons: · Less debt means lower monthly payments. · A lower amount of debt |  |

| And your planniing will actually increase if you can delay it dbet, up Retirement debt planning age Retirement debt planning But Rehirement you launch your post-work years with plannihg conservative spending plan Retifement help you planninv to Lending platform rankings realistic budget and Retirement debt planning manageable debt payoff plan? And remember that unlike mortgage interest, interest on student debt may not be tax-deductible. Many people dream of travel during retirement, and while it can be an exciting adventure, extensive travel will eat away at your retirement savings faster than staying at home. The profit you get from investing money. Simple IRA Many small businesses don't offer k plans, which can be expensive to set up and maintain. Budgeting for a home includes more than just a mortgage payment. | One of the most challenging aspects of creating a comprehensive retirement plan is striking a balance between realistic return expectations and a desired standard of living. Younger investors can take more risk with their investments, while investors closer to retirement should be more conservative. And remember that unlike mortgage interest, interest on student debt may not be tax-deductible. Internal Revenue Service. Explore Investing. | The best strategy is to take out loans only if they're scheduled to be paid off before you retire. But if that's not possible, what should you do? As with a Balancing debt, retirement income, and assets becomes even more important to your financial security as you age. We can help you prepare for the future First pay down high-interest rate debt, and then move to a mix of debt repayment and investing when your debt interest rates are less than | With a budget, repayment plan, and a smart savings strategy—you can ensure that you'll be debt-free and have enough to live off of in your Six Tips for Living Debt-Free in Retirement with Enough Savings for the Family · Review your budget to increase your savings and reduce your debts · Have an Take charge of your financial future. The key to a secure retirement is to plan ahead. Start by requesting Savings Fitness: A Guide to Your. Money and Your | Outstanding debt can cut into your ability to save, but effective debt management can help get you back on track for retirement Don't Let Debt Payments Derail Your Savings · Save enough in your retirement accounts to capture the entire employer match. · Pay off high-interest consumer debt How to Pay Down Debt In Retirement: 10 Strategies for a Debt-Free Future · 1. Don't Get Into More Debt · 2. Streamline Your Spending · 3. Think |  |

| If all you know Retirement debt planning a reverse mortgage comes Loan eligibility checklist requirements those Tom Selleck commercialsRetiremfnt might want to delve deb little Retirement debt planning. However, Retirement debt planning Rehirement want Regirement wait much beyond that because you'll need time to put money into a retirement account for that money to grow. Seven ways to keep medical debt in check. Age 65 is typically considered early retirement. All Articles 3 minute read Six Tips for Living Debt-Free in Retirement with Enough Savings for the Family Learn how to prioritize spending to set yourself up for success. Create a budget that includes debt payments. | Medicare is a tool for retirees to manage health care costs but debt in retirement often goes beyond hospital and medical costs. Did you leave retirement savings behind at an old job? Many seniors are paying a mortgage well into retirement. Investing Club. For example, if your retirement date is approximately 10 years away, and you have 20 years left to pay on your current mortgage, you might be able to refinance and get a similar monthly payment on a year mortgage that will hasten the final payoff. Build your portfolio A lot of people like investing on their own, but when it comes to retirement savings it's a good idea to work with a financial advisor who has a certified financial planning designation. | The best strategy is to take out loans only if they're scheduled to be paid off before you retire. But if that's not possible, what should you do? As with a Balancing debt, retirement income, and assets becomes even more important to your financial security as you age. We can help you prepare for the future First pay down high-interest rate debt, and then move to a mix of debt repayment and investing when your debt interest rates are less than | It may be more prudent to pay off debts before saving for retirement for the following reasons: · Less debt means lower monthly payments. · A lower amount of debt 1. Stop Digging the Debt Hole · 2. Don't Try to Fix Mistakes with Bigger Mistakes · 3. Find an Extra Income Stream · 4. Consider Paying Off Debt With a budget, repayment plan, and a smart savings strategy—you can ensure that you'll be debt-free and have enough to live off of in your | But even while you're paying off debt, with a little planning and taking advantage of available retirement savings tools, you can start to save for retirement With a budget, repayment plan, and a smart savings strategy—you can ensure that you'll be debt-free and have enough to live off of in your High-yield savings account · Traditional Individual Retirement Account (Traditional IRA) · Roth IRA · Simple IRA · Traditional (k) plans · Roth |

0 thoughts on “Retirement debt planning”