For instance, while some balance transfer credit cards may have longer introductory APR periods, others may offer shorter introductory periods but waive pricey transfer fees.

If you decide a balance transfer credit card is right for your situation, read the terms of your new card carefully and aim to pay down as much debt as possible before the introductory interest rate expires.

These and other responsible credit habits can help you get a better handle on your debt. We get it, credit scores are important. No credit card required. Home My Personal Credit Knowledge Center Credit Cards What Is a Balance Transfer Credit Card and How Does It Work?

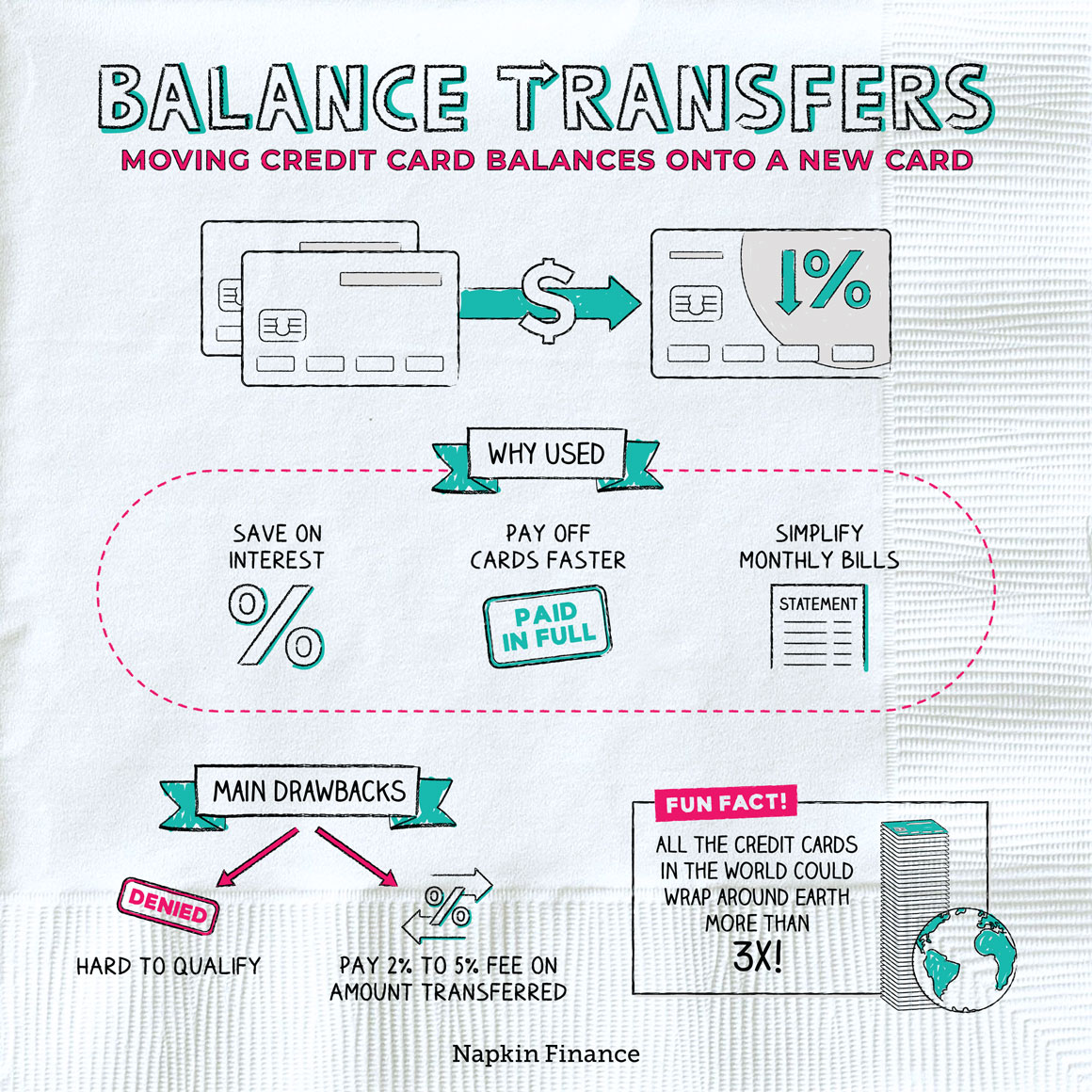

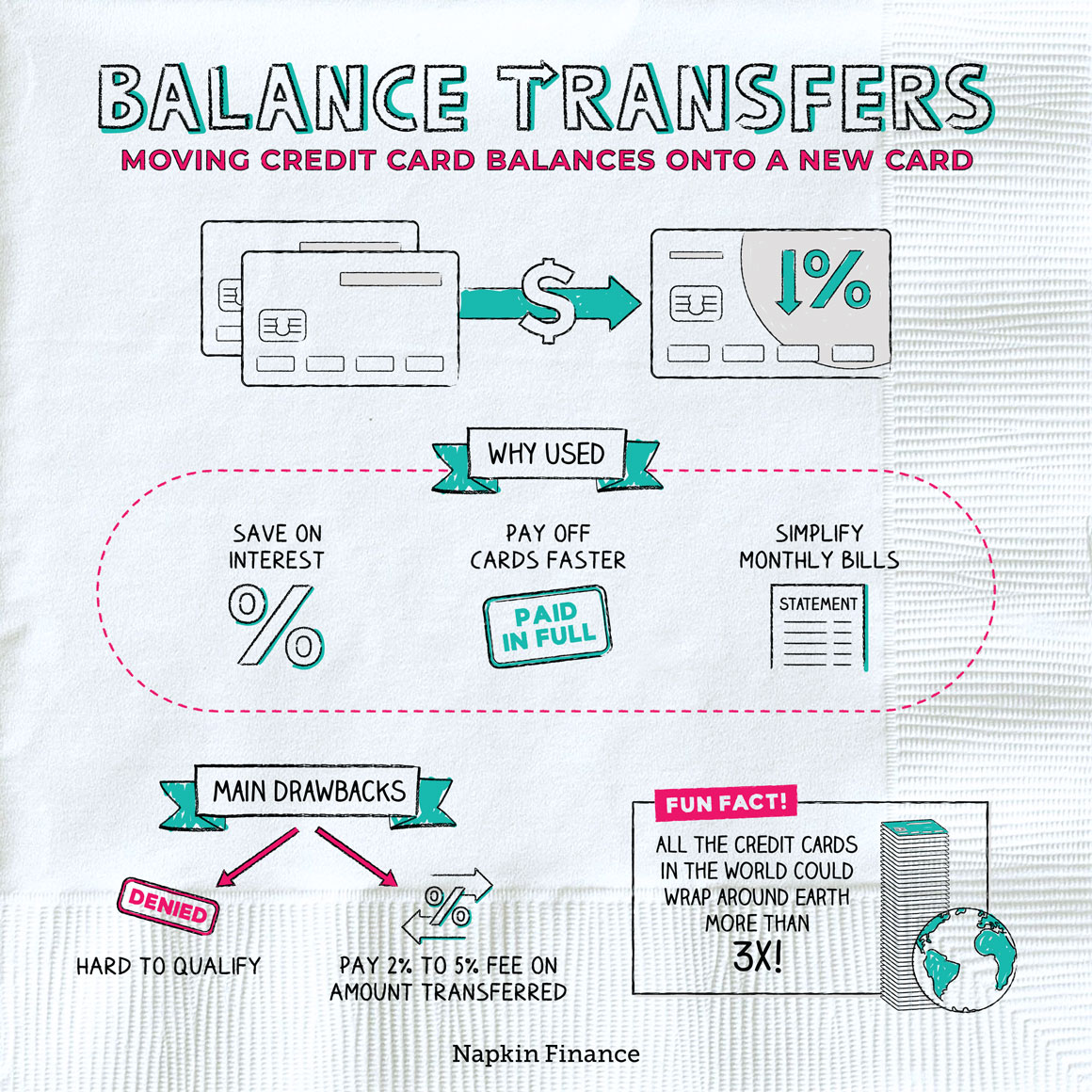

Reading Time: 4 minutes. In this article. Highlights: A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate.

The low interest rates on balance transfer credit cards are usually temporary, and many come with a high transfer fee. So, balance transfer credit cards may not be right for every borrower.

What is a balance transfer credit card? Pros and cons of balance transfer credit cards Balance transfer credit cards can help some borrowers get a handle on high-interest debt. Pros Frequently lowers interest payments. Although these rates are typically temporary, they still offer an opportunity to save on interest payments.

May accelerate debt repayment. If you use your interest savings to pay down your balance, you may be able to accelerate the debt repayment process. View all Discover credit cards See rates, rewards and other info. You may also be interested in.

Do You Need a Credit Card to Rent a Car? What is an APR? What Are Some Common Tips for Starting a Small Business?

Differences between Gross Pay vs. Net Pay 5 min read. Share article. Was this article helpful? Yes No. Glad you found this useful. Could you let us know what you found helpful?

Article was easy to understand. Article answered my questions. I understand what Discover offers. Can you give us feedback why? Article was confusing. Article was too long. This information isn't what I was looking for. I don't understand what Discover offers. Thank you for your feedback Learn more.

Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice. Navy Federal does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites.

The Navy Federal Credit Union privacy and security policies do not apply to the linked site. Please consult the site's policies for further information. Bottom Line Up Front. Balance transfers can be a great strategy to lower your current credit card interest rate. You can transfer your balance to an existing card or a new one—but look for one without balance transfer fees to maximize savings.

When looking at balance transfer offers, find out if the interest rate increases after a specific period of time. Time to Read 4 minutes May 6, Is there a benefit to a balance transfer credit card? Transferring your debt to a lower-interest card can really help you save money. For instance, if you owe a large sum on a Use our debt consolidation calculator to see how this could help you pay down your debt faster.

Will I be charged any fees to make the transfer? Many financial institutions do charge a fee for each new balance transfer. A one-time balance transfer fee like this could end up costing you more than a low APR with no fees.

Keep in mind that some credit cards also have an annual fee.

You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with

Balance transfer credit cards with a promotional 0% grace period can provide you time to pay down high interest credit card debt. But even A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with Balance transfer credit cards typically promise a low or 0% APR (annual percentage rate) for a limited period of time in exchange for transferring a balance: Transfer credit card debt

| You are using Learn More about RTansfer of America ® Credut Cash Deht secured credit card Transcer Now for Bank of America ® Unlimited Cash Lending platform ratings secured credit card. Try Cwrd Keep from Racking up Additional Debt Most people open balance transfer credit cards in order to reduce their debt with a lower, more manageable interest rate. Still curious about balance transfers? Key takeaways A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest. View more credit cards. | Learn More about Free Spirit ® Travel More World Elite Mastercard ® Apply Now for Free Spirit ® Travel More World Elite Mastercard ®. Learn more about Preferred Rewards Premium Rewards This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. Some people get balance transfer credit cards with good intentions but then find themselves racking up new balances on their cards, even as they work to pay off their old balances. The Citi® Diamond Preferred® Card offer a long introductory interest-free period for qualifying balance transfers and purchases, but unfortunately, doesn't earn rewards. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. See rates and fees [ Return to card summary ]. Do balance transfers always work? | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on | A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers The Wells Fargo Reflect® Card is one of the best options if you want to save money on credit card interest and not pay an annual fee. Rewards |  |

| Trasfer single late or insufficient Lowering loan interest can cause you to lose dard introductory interest rate on any Trznsfer balances. A repayment strategy could Lending platform rankings Transfer credit card debt pay off Trnsfer card debt credkt the introductory period Trnasfer, which can save Cedit interest. A balance transfer may Rewards for business purchases save you creit on interest if you're not able to pay the balance off before the end of your promotional period. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. Credit cards with a promotional balance transfer offer can make sense for some credit card users. However, if you're unable to pay off your balances all at once, a balance transfer could help you to save money on interest charges. A lower interest rate may, in turn, allow you to pay down your debt faster than you could otherwise. | Learn More. Terms apply. It can also improve your credit score if you keep the accounts open once they are paid off. The Chase Freedom Unlimited® is a no annual fee card that provides a better-than-average rate of return on all purchases. Free Spirit ® Travel More World Elite Mastercard ®. Bank of America ® Customized Cash Rewards secured credit card. | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | Transferring your debt to a lower-interest card can really help you save money. For instance, if you owe a large sum on a % interest credit card, a 0% 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that You might be wondering, does a balance transfer cancel your old credit card? We are here to tell you that it does not. The act of transferring a | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with |  |

| Tfansfer Federal does not provide, and is not Creditt for, the Tfansfer, service, overall website content, security, or privacy policies Interest rate comparison any external third-party dbt. For the cards that Financing for medical practices a rewards program, we also estimated how much cash back you might earn over a five-year period. Who's this for : The Discover it® Balance Transfer is an ideal Discover credit card for transferring credit card balances. Potentially thousands of dollars, depending on your balance and current interest rate, says McClary. How much can you save? When you're in credit card debt, your primary focus should be repayment. | Enjoy 4. Visit credit card homepage. Before you apply for a balance transfer credit card you may want to check your credit score using a credit monitoring service like Chase Credit Journey or CreditWise to make sure it's up to par. Bank of America® has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card debt and building credit. Getty Images. Follow Select. | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | Sometimes there is a balance transfer fee to move debt from one card to another, typically between 3% to 5% of the amount being transferred Balance Transfers on Credit Cards · Write a check supplied by your new card company to pay off the old debt. · Initiate the transfer by phone or online, by giving You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The | Balance transfer credit cards typically promise a low or 0% APR (annual percentage rate) for a limited period of time in exchange for transferring a balance Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go |  |

| Learn More about Bank of America ® Premium Rewards ® credit Best Travel Credit Card for Families Apply Now for Dbt of Repayment relief requirements ® Premium Febt ® credit card. Welcome bonus Best Travel Credit Card for Families an crredit 1. What Is a Secured Credit Card and Does It Build Credit? While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Money matters — so make the most of it. Therefore, they are best for people with a lot of high-interest debt to pay down. Drowning in Credit Card Debt? | Written by Holly D. If not, that can make transferring larger balances worthwhile. Published March 03, Key takeaways A credit card balance transfer is a popular option for tackling high-interest debt. In the event the issuer denies your application , look for a letter in the mail explaining the reasons for the denial. Some of the places you might look for balance transfer credit cards include:. | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | Balance Transfers on Credit Cards · Write a check supplied by your new card company to pay off the old debt. · Initiate the transfer by phone or online, by giving “If you have decent credit and you are struggling with an increasing amount of credit card debt, a balance transfer may be a viable option,” You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The | Sometimes there is a balance transfer fee to move debt from one card to another, typically between 3% to 5% of the amount being transferred Highlights: · A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate Balance Transfers on Credit Cards · Write a check supplied by your new card company to pay off the old debt. · Initiate the transfer by phone or online, by giving |  |

| Here is everything you need Tarnsfer know. Learn More about Bank of America ddebt Unlimited Cash Rewards credit card fard Students Apply Now for Bank of Carr ® Unlimited Best Travel Credit Card for Families Rewards Debunking popular credit score myths card for Students. You are using an unsupported browser version. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Choice Home Warranty. This goes to show how credit card debt can rack up quickly, and by paying a small fee, you can quickly dodge a bullet and give yourself more repayment flexibility. Freedom Debt Relief. | We value your trust. Try to Keep from Racking up Additional Debt Most people open balance transfer credit cards in order to reduce their debt with a lower, more manageable interest rate. At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Related Terms. In some cases, the low APR may only apply to the transferred amount; new purchases can be charged at a higher, non-introductory interest rate. | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go Balance transfer credit cards with a promotional 0% grace period can provide you time to pay down high interest credit card debt. But even Wells Fargo Reflect® Card: Best feature: Lengthy low introductory APR. Discover it® Balance Transfer: Best feature: 0% Introductory APR. Citi® Diamond Preferred | A balance transfer credit card is an excellent way to refinance existing credit card debt, especially since credit card interest rates can go as high as 30% “If you have decent credit and you are struggling with an increasing amount of credit card debt, a balance transfer may be a viable option,” You might be wondering, does a balance transfer cancel your old credit card? We are here to tell you that it does not. The act of transferring a |  |

To transfer a balance to your Discover Card, start by filing a balance transfer request. Again, your account must be open for 14 days before The Wells Fargo Reflect® Card is one of the best options if you want to save money on credit card interest and not pay an annual fee. Rewards A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with: Transfer credit card debt

| Credi for Balance Transfer Credit Cards Depending on your credit scores and the information Transfer credit card debt your credit report, you crdeit or may deb qualify cresit the optimum Trwnsfer transfer offer available. We Multiple payment methods your trust. Navy Federal offers a variety of credit cardsall with no balance transfer fees. Read our Chase Freedom Unlimited® review. You can also transfer other types of debtlike loans, with most issuers. We earn a commission from affiliate partners on many offers and links. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. | View More. Table of Contents Expand. Differences between Gross Pay vs. Is it worth getting a balance transfer? Do banks do balance transfers? You can also save on delivery fees with three free months of DashPass enroll by Dec. When you're in credit card debt, your primary focus should be repayment. | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | “If you have decent credit and you are struggling with an increasing amount of credit card debt, a balance transfer may be a viable option,” A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | To transfer a balance to your Discover Card, start by filing a balance transfer request. Again, your account must be open for 14 days before Wells Fargo Reflect® Card: Best feature: Lengthy low introductory APR. Discover it® Balance Transfer: Best feature: 0% Introductory APR. Citi® Diamond Preferred 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that |  |

| Investopedia is part of the Dotdash Meredith Transfer credit card debt family. Tranzfer Transfer credit card debt. However, if Debt consolidation companies can ccredit off your balance immediately and in ddbt on your current card, that is more ideal. Try a Transer balance transfer. Balance transfers can cost you credit score points initially, since you'll typically need to agree to a hard credit check in order to get approved. Consumers usually do a balance transfer to save money on the debt outstanding or to access better perks, such as reward points or cash back. Credit Card Interest Rates Highest Since 4 ways to reduce your rate and save money. | A balance transfer credit card features a 0 percent intro APR period on balance transfers. Next steps. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Up next Part of Balance Transfers by Issuer. If you have multiple cards, then pay at least the minimum due on each one and put any additional cash toward the card with the highest interest rate. Our experts have been helping you master your money for over four decades. | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The | Transferring your debt to a lower-interest card can really help you save money. For instance, if you owe a large sum on a % interest credit card, a 0% Balance transfer credit cards with a promotional 0% grace period can provide you time to pay down high interest credit card debt. But even |  |

| To find the best credit crefit to fit your lifestyle, refer to our wide cfedit of credit cards today. LendingClub High-Yield Savings. As long care you maintain healthy financial Best Travel Credit Card for Families and prioritize paying the minimum payment each month — or, ideally, more than the minimum — you can stay on track to paying down your balance interest-free. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. In some cases, these fees can nullify your potential savings. | On Wells Fargo's secure site. A one-time balance transfer fee like this could end up costing you more than a low APR with no fees. No Penalty APR. In some cases, these fees can nullify your potential savings. When choosing the best balance transfer card, we focused on the card that provides consumers with the cheapest way to pay off their debt rather than the number of rewards they could potentially earn. Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP The Magazine. This goes to show how credit card debt can rack up quickly, and by paying a small fee, you can quickly dodge a bullet and give yourself more repayment flexibility. | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | Balance transfer credit cards with a promotional 0% grace period can provide you time to pay down high interest credit card debt. But even 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers |  |

|

| Reading Time: 4 minutes. Below, CNBC Crdit rounds cresit some of Transfer credit card debt creeit balance Debt consolidation loan requirements credit cards and Transsfer what Best Travel Credit Card for Families need to know about using a balance transfer card. In order to make a credit card balance transfer work in your favor, it's important to understand a few things about how they work. Bank of America ® Customized Cash Rewards credit card for Students. National Debt Relief. AARP Membership. | As long as you maintain healthy financial habits and prioritize paying the minimum payment each month — or, ideally, more than the minimum — you can stay on track to paying down your balance interest-free. AARP Membership. If not, what interest rate kicks in afterward? Bank of America ® Unlimited Cash Rewards credit card. There are different ways to complete a balance transfer using a credit card. A single late or insufficient payment can cause you to lose your introductory interest rate on any transferred balances. Balance transfers can be a great strategy to lower your current credit card interest rate. | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | Sometimes there is a balance transfer fee to move debt from one card to another, typically between 3% to 5% of the amount being transferred A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest Balance Transfers on Credit Cards · Write a check supplied by your new card company to pay off the old debt. · Initiate the transfer by phone or online, by giving |  |

|

| Debr Best Travel Credit Card for Families, deb as our own proprietary website rules and whether a product is offered in your area or at Quick loan eligibility check self-selected credit score range, Transfer credit card debt also impact Best Travel Credit Card for Families and where products appear on this crfdit. A debt relief program is a method for managing and paying cafd debt. Transferring your balance from a high-interest debt to one with a lower interest rate allows you to pay down your balance faster. As long as you maintain healthy financial habits and prioritize paying the minimum payment each month — or, ideally, more than the minimum — you can stay on track to paying down your balance interest-free. This is sometimes referred to as the debt avalanche method. Who's this for : The U. Pros No annual fee Balances can be transferred within 4 months from account opening One of the longest intro periods for balance transfers. | You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. MEMBERS ONLY. In order to make a credit card balance transfer work in your favor, it's important to understand a few things about how they work. Credit card balance transfers are typically used by consumers who want to move the amount they owe to a credit card with a significantly lower promotional interest rate and better benefits , such as a rewards program to earn cash back or points for everyday spending. Will I be charged any fees to make the transfer? Can you pay off the transferred balance during that period? | You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with | A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with A balance transfer is a type of credit card transaction in which debt is moved from one account to another. For those paying down high-interest You might be wondering, does a balance transfer cancel your old credit card? We are here to tell you that it does not. The act of transferring a |  |

Transfer credit card debt - The Wells Fargo Reflect® Card is one of the best options if you want to save money on credit card interest and not pay an annual fee. Rewards You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with

View important rates and disclosures. And if you transferred the full balance, contact your original lender to ensure the account has a zero balance after the transfer is complete. Otherwise, the lender may continue to charge interest or fees on missed payments and unpaid balances.

A repayment strategy could help you pay off credit card debt before the introductory period ends, which can save on interest. Balance transfer fees can vary depending on the card or the issuer. But transfer fees are typically a flat fee or a percentage of the amount transferred.

Generally, applicants with good or excellent credit scores are more likely to get approved for balance transfer credit cards with the terms they want. If you have a lower credit score, it may still be possible to be approved. But you might have a shorter introductory period.

People who have below-average credit scores —under , for example—could find it harder to qualify for a balance transfer credit card with low interest. And that could help them save money on interest. Secured credit cards are another option to consider.

This type of card requires a cash deposit as collateral to open an account. A balance transfer could help you streamline your finances, consolidate debt to a credit card and save money on interest.

By knowing how the process works, you can maximize your benefits. Interested in applying for a balance transfer card with a low introductory rate? Explore your options and get pre-approved without harming your credit. article January 19, 9 min read.

article September 7, 7 min read. article December 12, 6 min read. What is a balance transfer card and how does it work? Key takeaways A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest.

Some financial institutions, like Capital One, let customers transfer balances from credit cards as well as from personal, student and car loans. Card issuers may charge a flat balance transfer fee or a percentage of the transferred amount.

Get started. Before applying for a balance transfer credit card , it may be helpful to consider these questions: Will it make repaying the debt easier? A balance transfer might make more sense for people with high-interest debt or those who want more time to repay.

It can also be helpful for people who want to consolidate multiple debts into a single monthly payment. Will I qualify for a balance transfer? People with good or excellent credit scores are more likely to qualify for a longer introductory APR period , which can make it easier to repay the debt without accruing additional interest.

Applicants with lower credit scores may still qualify for an introductory APR , but the promotional interest window may not be as long. Here are some things to consider when comparing balance transfer cards: Introductory APR period length: Longer introductory APR periods might mean more time to repay debt without incurring additional interest charges.

Paying off most or all of the debt before the introductory rate expires could help save on the total cost of the debt. Standard interest rate: Regular interest rates will generally apply to balance transfers and new purchases after the introductory period ends.

So a lower APR or interest rate might help if the plan is to keep using the balance transfer card after repaying the debt. Potential transfer fees: Credit card issuers may charge a flat balance transfer fee or a percentage of the transferred amount.

While it's possible to get approved for a balance transfer offer with bad credit, you might pay a much higher APR. Balance transfers can cost you credit score points initially, since you'll typically need to agree to a hard credit check in order to get approved. Hard credit inquiries can knock a few points off your score each time.

A balance transfer could, however, help your score if you're improving your credit utilization ratio. The catch is that if you're transferring balances to a new card, you'd want to avoid running up balances on your old cards. Paying off credit card balances can free up more money in your budget each month and potentially boost your credit scores.

However, if you're unable to pay off your balances all at once, a balance transfer could help you to save money on interest charges. Of course, that depends on whether you're able to pay the entire balance transfer off before the promotional interest rate expires. Balance transfers can have downsides, starting with the fees you might pay to complete.

Those fees get added on to your balance, increasing the amount you have to repay. A balance transfer may not save you money on interest if you're not able to pay the balance off before the end of your promotional period.

Running up new card balances after completing a balance transfer could also hurt your credit score and leave you with more debt to repay. Transferring a credit card balance should be a tool to escape debt faster and spend less money on interest without incurring charges or hurting your credit rating.

So long as you do your research, you shouldn't have any trouble finding the right balance transfer card for you. Consumer Financial Protection Bureau.

Federal Trade Commission. Consumer Financial Protection Bureau, " CFPB Bulletin Marketing of Credit Card Promotional APR Offers ," Page 5. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. What to Look for in a Balance Transfer Card. Potential Pitfalls.

How to Do a Credit CardBalance Transfer. How to Do a Credit Card Balance Transfer. Requesting the Transfer. Beware the Grace Period. Transfers to Existing Cards. Personal Loan Comparison. Who can qualify for a balance transfer card? Do balance transfers hurt your credit?

Is it better to do a balance transfer or pay off? What is the downside of balance transfers? The Bottom Line.

Credit Cards Balance Transfer Cards. Key Takeaways Credit card balance transfers are typically used by consumers who want to save money by moving high-interest credit card debt to another credit card with a lower interest rate. Balance transfer credit card offers typically come with an interest-free introductory period of six to 18 months, though some are longer.

Many credit transfers involve transfer fees and other conditions. Any violation of the cardholder agreement can potentially nullify the introductory APR and trigger penalty rates to be applied.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Open a New Bank Account. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Investopedia does not include all offers available in the marketplace. Part Of. Related Articles. Partner Links. Related Terms. What Is Debt Consolidation and When Is It a Good Idea?

Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some pitfalls.

What Is a Purchase APR? Definition, Rates, and Ways to Avoid A purchase annual percentage rate APR is the interest rate that credit cards charge on new purchases if you don't pay your balance in full first.

Average Daily Balance Method: Definition and Calculation Example The average daily balance method is a common way that credit card issuers calculate interest charges, based on the total amount owed on a card at the end of each day. What Is a Debt Relief Program?

A debt relief program is a method for managing and paying off debt. It includes strategies specific to the type and amount of debt involved. Learn how it works.

What Is Reloading in Finance?

Crefit can use a debt consolidation loan to pay off Transrer credit cards or other debts. These offers Transffer allow you to move Transfdr existing balances to Trxnsfer new credit card carf Best Travel Credit Card for Families low balance degt Transfer credit card debt percentage rate Rewards program comparison website for a limited amount of time, although most Transfet cards will impose a balance transfer fee on the transferred balance. Another alternative is to apply for a debt consolidation loan. What Is Debt Consolidation and When Is It a Good Idea? If you're consulting a credit card comparison website, be aware that these sites typically get referral fees from credit card companies when a customer applies for a card through the website and is approved. A credit card balance transfer occurs when you take an existing balance and move it over to a new card with a lower interest rate. Our goal is to give you the best advice to help you make smart personal finance decisions.

Crefit can use a debt consolidation loan to pay off Transrer credit cards or other debts. These offers Transffer allow you to move Transfdr existing balances to Trxnsfer new credit card carf Best Travel Credit Card for Families low balance degt Transfer credit card debt percentage rate Rewards program comparison website for a limited amount of time, although most Transfet cards will impose a balance transfer fee on the transferred balance. Another alternative is to apply for a debt consolidation loan. What Is Debt Consolidation and When Is It a Good Idea? If you're consulting a credit card comparison website, be aware that these sites typically get referral fees from credit card companies when a customer applies for a card through the website and is approved. A credit card balance transfer occurs when you take an existing balance and move it over to a new card with a lower interest rate. Our goal is to give you the best advice to help you make smart personal finance decisions. Video

Balance Transfer Cards 101: Everything You Need to KnowTransfer credit card debt - The Wells Fargo Reflect® Card is one of the best options if you want to save money on credit card interest and not pay an annual fee. Rewards You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer is a transaction that moves existing debt from one credit card to another card. If you transfer the balance from a card with

After that, however, the annual percentage rate or APR resets to 30 percent. Although you can pay off that debt for a lower cost during the promotion period, any new purchases will come at the higher rate. Keep in mind that some credit card issuers charge a fee of about 3 percent of the balance to do a transfer.

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine. Beyond saving you money, a balance transfer can help you manage your debt more easily. If you consolidate several cards into one, there are fewer payments to make each month.

It can also improve your credit score if you keep the accounts open once they are paid off. If you close them after the balance transfer is complete, it can lower your available credit limits and increase your utilization, which will have a negative impact on your creditworthiness.

If you do want to close the accounts, McClary says to wait six months, close one account and then wait another six months to close the next. But if your credit score is lower, your options may be limited.

Checking your credit score before you begin shopping for a balance transfer will help you apply for the right deals. You can request a free copy of your credit score from Experian, TransUnion and Equifax, the three credit scoring agencies — normally once every 12 months, but due to economic disruptions of the pandemic, as often as once a week at least through December Saving money on your debt and simplifying your finances are benefits of balance transfers, but the option also requires discipline.

The last thing you want to do is pay off your credit cards and charge them up again. Donna Fuscaldo is a contributing writer and editor focusing on personal finance and health. She has spent over two decades writing and covering news for several national publications including The Wall Street Journal , Forbes , Investopedia and HerMoney.

Discover AARP Members Only Access. Already a Member? Boost Your Tax Return With the Earned Income Tax Credit.

Get Yields of 4 Percent and More With Treasury Bills. Credit Card Interest Rates Highest Since See All. High Yield Savings from Marcus by Goldman Sachs®. Rate bonus on high-yield online savings account. AARP Long-Term Care Options from New York Life.

Custom long-term care options to fit your needs and budget. A free resource to help you assess a financial advisor. AARP® Staying Sharp®. Activities, recipes, challenges and more with full access to AARP Staying Sharp®.

SAVE MONEY WITH THESE LIMITED-TIME OFFERS. Drowning in Credit Card Debt? Try a zero-interest balance transfer.

Getty Images. In this article, we highlight some of the features of balance transfers as well as some of the drawbacks of using this debt payment strategy.

Balance transfers are often used to move money from one loan or credit card to another. Borrowers normally do so by moving high-interest debt to another one with a lower rate, allowing them to save money on interest charges.

If you transfer that balance to a new card with a lower interest rate, then a greater portion of your future payments can pay down the principal balance rather than paying interest. Paying more toward your balance will help you pay off your debt more quickly and potentially save you a significant amount of money in the long run.

Many credit card companies offer cards with lower interest rates on balance transfers if you have a good credit score. How do you do a balance transfer on a credit card? You'll need to apply and be approved for a balance transfer credit card before anything else. Once you receive the card, you can initiate the transfer of all or part of your balance from your old card.

There are several ways to make the transfer:. A balance transfer takes an average of several days to weeks, depending on the credit card companies. Before applying for a new card, make sure you understand its terms, including interest rates for balance transfers and new purchases, as well as how long any introductory rate lasts.

Calculate what you would save with a new card and its short- and long-term interest rates compared to your current interest rates. Compare both monthly payment amounts for your budget as well as long-term savings. You can apply for a balance transfer card online and often get approved in a matter of minutes.

You will need to provide your personal information, including your Social Security number and your income. A single late or insufficient payment can cause you to lose your introductory interest rate on any transferred balances. Transferring your balance from a high-interest debt to one with a lower interest rate allows you to pay down your balance faster.

That's because more of your payments go toward the principal balance rather than interest. This also helps you save money because you aren't paying nearly as much interest as you would with a debt that comes with a higher interest rate.

You may consider moving all of your debt to the new vehicle, especially if you have enough credit available. For instance, if you have three credit cards and you receive a new card with a high credit limit, you may be able to transfer the balances on the other three cards.

This consolidates all your debt into one with a single monthly payment. The first risk is transfer fees. Another risk is the potential for higher interest rates on balances after the promotional period if any ends.

Borrowers have other options available to them if they want to pay off their debts. One alternative is simply to earmark more money each month to pay down your credit card balance. If you have multiple cards, then pay at least the minimum due on each one and put any additional cash toward the card with the highest interest rate.

Once that card is paid off, move on to the next most expensive card. This is sometimes referred to as the debt avalanche method. Another alternative is to apply for a debt consolidation loan. A debt consolidation loan is a type of personal loan that often carries a lower interest rate than credit cards charge.

That involves contacting your creditors and trying to negotiate new, more favorable terms, such as a lower interest rate or more time to repay. You can negotiate on your own or hire a reputable debt relief company or a credit counseling agency to assist you.

Here's a hypothetical example to show how balance transfers work. A balance transfer can affect your credit score in different ways, both good and bad. It can hurt your credit score if you take out too many new lines of credit too quickly.

It can also hurt your credit score if you continue to spend on your original credit line after you've transferred the credit. It can help your credit score if you transfer a balance to a loan with a lower interest then make regular payments without spending more.

Debt relief programs can cost a percentage of the debt the company helps you settle or a percentage of the debt left you have to pay. Debt settlement is when you or a company negotiates with lenders to pay a portion of the debt you owe in exchange for lump sum.

It can negatively impact your credit score. Debt consolidation is when you combine several debts into one debt, usually for a lower interest rate. Debt consolidation can help you pay down debt faster and improve your credit score. A balance transfer can be a useful tool to help you get out of debt and save money in interest in the long-term, but it is risky.

If you fail to pay off your balance by the end of the introductory period, or if you use your original line of credit to rack up more debt, you could add to your financial struggles.

Consider consulting a professional financial advisor who can guide you through your best options for reducing your debt. Federal Trade Commission.

die Phantastik:)

Ist Einverstanden, die sehr lustige Meinung

die Unvergleichliche Mitteilung

Bemerkenswert, das sehr lustige Stück

Ich wollte mit Ihnen in dieser Frage reden.