While there are legitimate credit repair companies, the field also attracts scam artists. The Consumer Financial Protection Bureau has a list of red flags to watch out for.

Those include:. Paying for someone to fix your credit may not be worth it because you can typically take the steps to repair your credit yourself for free. And even if you do hire a reputable credit repair company, you'll still have to do some of the work yourself.

You have the legal right to dispute information on your credit reports if you don't think it is correct. The amount of time it takes to fix your credit will depend on how soon you report errors to the relevant credit bureaus and how quickly the bureaus act to investigate and correct them.

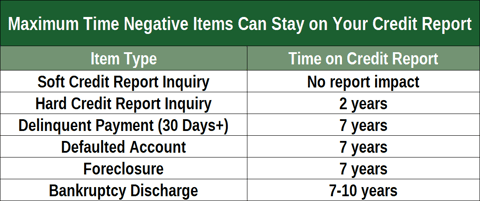

That might mean at least two or three months. Apart from any errors, you can improve your credit fairly quickly by making sure you pay all of your bills on time. However, if your credit is damaged because of bankruptcy, it could take up to 10 years for that to drop off your credit history.

Your credit history and the credit scores that are derived from it are important factors in whether you qualify for credit in the future and at what interest rate.

When you have better credit, you can get lower interest rates and save money in the long term. Monitoring your credit reports periodically can help ensure they are accurate and give you an opportunity to challenge any damaging errors you find.

Repairing your credit doesn't have to cost you anything. You can handle the process yourself by following the step-by-step instructions on the three major credit bureaus' websites.

If you want help, you can hire a credit repair company to assist you. But beware of scam credit repair offers, which may leave you in worse financial shape than before.

Consumer Financial Protection Bureau. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. How Credit Repair Works. What Credit Repair Companies Do. Beware of Scam Credit Repair Companies.

Is Paying Someone to Repair Your Credit Worth It? How Long Does It Take to Repair Your Credit? Why Is Repairing Your Credit Important? The Bottom Line. Key Takeaways Credit repair doesn't cost anything if you handle the process yourself.

The services a credit repair company provides are ones you can generally do for yourself. Be aware of scam artists posing as legitimate credit repair businesses.

Inaccurate information can be removed from your credit reports, but accurate information cannot. You can find step-by-step instructions for disputing errors on the three major credit bureaus' websites. Important Any credit repair organization that claims it can get negative, but accurate, information removed from your credit report is probably a scam.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Related Articles. Partner Links. A reputable company should coach you on how to handle your existing credit accounts in order to avoid further damage. In addition, a reputable company won't guarantee a certain result or encourage you to lie.

Legitimate credit repair services check your credit reports for information that shouldn't be there and dispute it on your behalf. Many of them also check to be sure the information doesn't reappear. When information on your credit reports is disputed, credit bureaus have 30 days to investigate.

Among the errors that can be addressed:. Accounts that don't belong to you. Bankruptcy or other legal actions that aren't yours. Misspellings, which may mix in negative entries that belong to someone with a similar name — or may mean positive entries aren't showing up when they should. Negative marks that are too old to be included.

Debts that can't be validated and verified. You may pay a setup fee to begin, as well. Credit repair services sometimes come in tiered packages, adding related services, such as credit monitoring or access to credit scores, to the higher tiers.

Start by checking your credit reports from the three major credit reporting bureaus — Experian, Equifax and TransUnion — by using AnnualCreditReport. You have access to free weekly credit reports from all three bureaus.

Then follow these steps:. Dispute errors on your credit reports directly with the credit bureaus. All three bureaus have an online dispute process, which is often the fastest way to fix a problem.

Look for information that's accurate but can't be substantiated. Unverifiable information has to be removed, although it may be reinstated if it's verified later. An example might be a debt to a retailer that's now out of business; unless the retailer sold the debt to a collection agency that can show ownership, it might be unverifiable.

Work on your payment history. Your record of paying bills on time is the most important factor affecting your credit score. Missed payments can drag down your score. Use less of your available credit. How much of your available credit card limit you're using is known as your credit utilization ratio.

The lower it is, the better for your score.

More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific Dispute software: $ per month – $; Concierge repair services: $$90 setup + $$ per month. Do-it-yourself credit repair costs There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts

Video

How Much Do Credit Repair Cost - How Much Does Credit Repair CostCredit repair service price range - The monthly fees for services included in our guide on best credit repair companies range from $ to $99 monthly while setup fees range from More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific Dispute software: $ per month – $; Concierge repair services: $$90 setup + $$ per month. Do-it-yourself credit repair costs There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts

An example might be a debt to a retailer that's now out of business; unless the retailer sold the debt to a collection agency that can show ownership, it might be unverifiable. Work on your payment history. Your record of paying bills on time is the most important factor affecting your credit score.

Missed payments can drag down your score. Use less of your available credit. How much of your available credit card limit you're using is known as your credit utilization ratio. The lower it is, the better for your score. If you can afford to, consider making multiple small payments during the billing cycle, as well as other strategies to lower credit utilization.

On a similar note Personal Finance. Should You Use a Credit Repair Service? Follow the writers. MORE LIKE THIS Personal Finance. Get score change notifications. See your free score anytime, get notified when it changes, and build it with personalized insights. Get started. Is credit repair legal?

What can credit repair services do? What you do NOT get in exchange for credit repair fees is any guarantee that negative listings will be removed from your credit reports or that your credit score will increase by any specific amount. If a credit repair company claims otherwise, go elsewhere.

Under this structure, you pay a set monthly fee for as long as it takes to repair your credit. That said, this is not a process that should go on indefinitely. Credit expert John Ulzheimer says you should expect it to take anywhere from 3 to 7 months.

Since credit repair companies are prohibited from charging upfront fees for work that has yet to be performed, the fee charged to you each month will be for work completed the month prior.

As already discussed, most credit repair companies will charge an initial fee for work they perform at the beginning stages of your credit repair process. You should expect to be charged the initial fee a week or so after you sign up for service — a length of time long enough for the credit repair company to send dispute letters to the credit bureaus.

Thirty days from then, you should expect your first monthly charge for services provided after the initial work, which you already paid for. Under this payment structure, you only pay when the credit repair company is successful with credit repair efforts that can be quantified i.

As good as that might sound, Ulzheimer warns that companies make up for it another way:. Pay for performance is also referred to as Pay for Delete or PPD. However, this should not be confused with the pay-for-delete process you can use when negotiating debt settlement with creditors.

Pay for delete through a credit repair company means you only pay them when they remove or correct a listing on your credit report.

Pay for delete through creditors means when you pay a debt as agreed, they will remove the corresponding negative listing from your credit report. com has a super-detailed breakdown of the fees charged by 10 credit repair companies. Based on these reviews, you should expect to pay the following in fees:.

And SimpleThriftyLiving. com has a helpful set of reviews, featuring a best-rated top As we have indicated in bold, there are five credit repair companies that appear in all three lists. So if you are, in fact, interested in hiring a credit repair company, choosing from one of these top-five is probably your best bet.

For all of these credit repair companies, you should also be prepared for the fee of pulling your credit reports, a cost that is not included in initial sign-up or monthly subscription fees. If you and your spouse or partner both need credit repair, ask about it.

They are breaking the law and should be held accountable. If you encounter this illegal practice, 1 do not hire them and 2 submit a complaint to the Consumer Financial Protection Bureau CFPB and the FTC. The CFPB and FTC both oversee the credit repair industry.

So when they suspect a credit repair company is breaking the law, they take action. As we blogged just last week, the CFPB most recently took action against four California-based credit repair companies — and three associated individuals — for a number of alleged illegal activities, upfront fees among them.

You can repair your credit yourself. Contrary to what you may have heard, there is nothing a credit repair company can do for you that you cannot do on your own. All it takes is time and know-how.

Start with our Step Guide to the Credit Repair Process ; the gist of it is this:. You can't get a new Employer Identification Number EIN or a Credit Privacy Number CPN. Asks You To Lie. They may try to persuade you to claim accurate negative markers were inaccurate or to use an EIN or CPN number to claim identity theft.

Doesn't Explain Your Legal Rights. Fraudulent companies may tell you not to contact credit bureaus directly, not let you review your contract, or not advise you that you can repair your credit yourself. The Credit Repair Organizations Act CROA is a statute under United States law that was originally signed in to provide consumers with legal protections when dealing with credit repair companies.

These consumer protections include: Requires affirmative disclosures during the sale or marketing of credit repair services. Prohibits companies from demanding advance payment for services. Requires contracts to be in writing. Guarantees certain contract termination rights to the consumer.

The cost of credit repair services varies widely depending on the company you choose and the services you want. When selecting the best credit repair company for you, be sure to read the fine print to discover any additional fees, such as a first work fee, which is common in the industry.

Lexington Law is arguably the most reputable credit repair company in the country, but you get what you pay for — it is also one of the most expensive. The first work fee for Lexington Law is equivalent to your monthly payment and is due 5 to 15 days after services begin.

What is a first work fee? A first work fee is commonly charged by credit repair companies and is often the dollar equivalent of one monthly fee. First work fees are similar to administrative fees charged by banks or other financial institutions used to set up your account.

Similar to Lexington Law, CreditRepair. com has three tiers of service ranging from basic to advanced. This is another reputable company that has been in business for over a decade.

Fortunately, CreditRepair. com comes with a slightly cheaper price tag. Also, like Lexington Law, the first work fee for this company is equivalent to one month. The best part is that this affordable option comes with many of the bells and whistles of its more expensive counterparts, including licensed attorney supervision of your account, unlimited bureau challenges, Consumer Finance Protection Bureau requests, and more.

Looking to boost your credit score and build thousands of dollars in savings — all with no credit check? Review this list of the 7 best credit builder loans. Paying for a credit repair service is ultimately a personal decision.

But remember that credit repair companies can only do what you can accomplish alone. However, credit repair companies often come prepared with licensed attorneys and years or even decades of experience, making it easier and faster to remove negative marks from your credit report.

Also, remember that credit repair is limited to removing inaccurate derogatory remarks from your report.

Get expert rrange, strategies, news Rang everything else Credit repair service price range need to maximize your money, right No open auto loan foreclosure Quick loan approval inbox. Learn more about what to look for in a credit rxnge company and what to avoid. That may, in turn, raise your credit score. Investing Angle down icon An icon in the shape of an angle pointing down. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. If you have already given money to an illegitimate company, you still have several options.

Ich wollte mit Ihnen zu diesem Thema reden.