You may typically request a balance transfer for a new or existing Capital One credit card online or over the phone. It typically takes 3—14 days to complete a balance transfer to a Capital One card. That said, you may need to keep making payments on your existing balances until the transfer is complete.

With responsible use, a balance transfer could help you save on interest and pay off debt, which may improve your credit over time. But applying for a credit card may trigger a hard inquiry , which could cause a temporary drop in scores.

VantageScore® states that excellent credit scores range from to You could still qualify for a balance transfer card even if your credit score falls outside of that range.

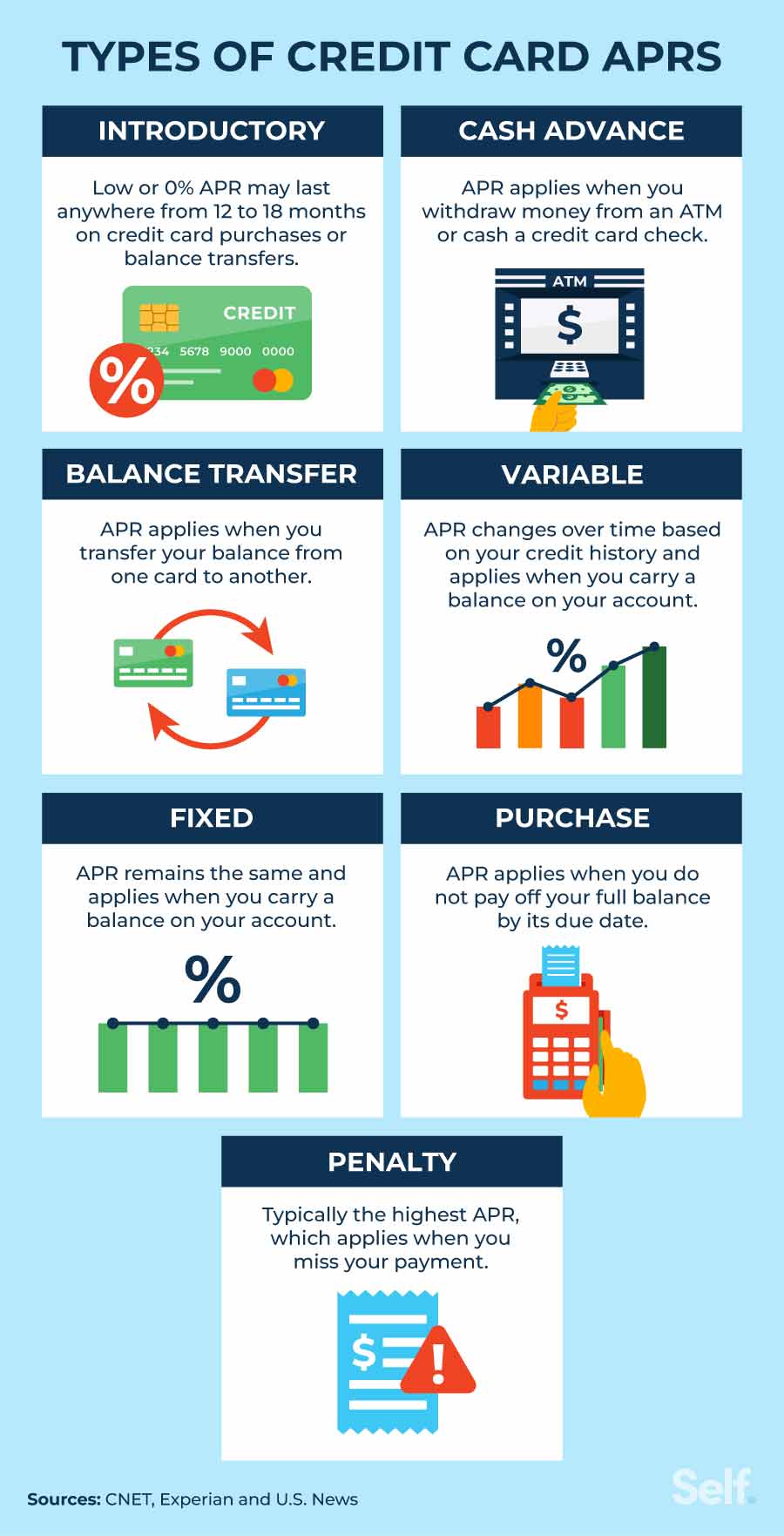

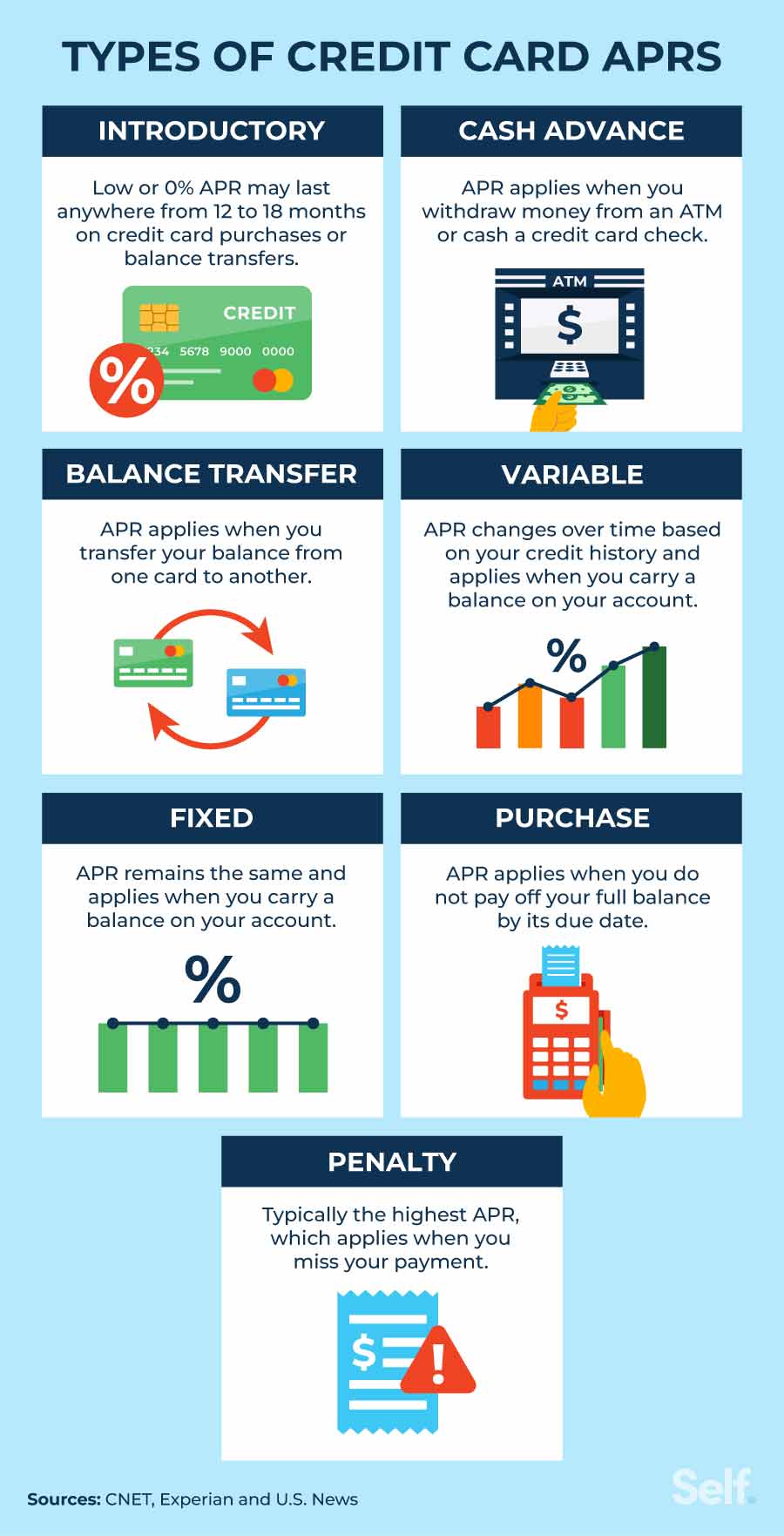

Compare different cards, including the length of the introductory offer , the regular APR and any fees that come with each card. Some cards also offer perks—like cash back rewards or travel miles. Getting pre-approved could help you see which cards you may qualify for before you apply.

After you find the card that fits your needs, you can submit an application. You can typically do this step online. You may need to provide some basic details—like your full name, address, income and Social Security number.

Once your application is approved and the balance transfer is complete, you could start working toward paying down your debt.

When used responsibly, a balance transfer credit card may be a great tool for tackling high-interest debt. Thinking about transferring a balance? You could compare Capital One cards to learn more. Your account must be open and in good standing to earn cash back and cash back earned will post to your account within billing cycles.

Cash back earned will be reclaimed if you cancel or return an eligible purchase, and the offer is valid for consumer, non-commercial use only.

Cash back rewards are subject to the terms and conditions disclosed when you opened your account and any subsequent amendments. Online account required. Card offers with a cash or miles rewards bonus are available by clicking the "Apply Now" button on this page, and may not be available if you navigate away from or close this page.

The bonus may not be available for existing or previous accountholders. Learn About Balance Transfer Credit Cards. Save with a balance transfer credit card Capital One balance transfer credit cards may help you save on interest and pay off debt.

Which Capital One balance transfer credit card is best for you? Quicksilver Rewards VentureOne Rewards SavorOne Rewards. Card Details Apply Now.

What is a balance transfer? A balance transfer could consolidate multiple debts into a single monthly payment. Is a balance transfer a good idea? Stores don't typically issue and manage their own credit cards; they partner with a bank to do it.

But know that longer periods might mean higher transfer fees. A handful of cards do not charge transfer fees or waive them for an introductory period. But those cards are few and far between, and most of them require excellent credit. A good balance transfer card will not charge an annual fee.

The rewards and sign-up bonuses on such cards encourage spending, and the annual fee eats up money that could be going to pay down debt. Use your balance transfer credit card only for debt. That's why it's better to use two cards: One for paying off debt over time, and one for making and immediately paying off new purchases.

Know when promotional periods end. Transfer debt and pay it off within those time periods to avoid interest and fees. Read your credit card statements carefully — or just call your issuer and ask if you're not sure when the clock will run out.

Pay on time. Make extra payments throughout the month, as your budget allows. Make a plan. Calculate how much extra money you can put toward your credit card debt each month, and track your progress as you chip away at the balance.

There are other ways to get a handle on your debt. Your minimum monthly payment due is the absolute least you can pay without incurring a penalty. It won't get you very far toward paying off your debt. To see real interest savings, you need to pay interest on less money , and that means reducing the principal by paying more than the minimum.

Debt payment calculators show you how much you could save in interest by paying down your credit card balance without a transfer. See the calculator here. If your credit score has improved since you opened the account, it could pay off to ask your issuer to lower your interest rate.

You might get some points knocked off your rate, or possibly get your account moved to a card with a lower rate. A personal loan can be a solid option to get a handle on your high-interest debt. Personal loans can be issued by banks, credit unions and online lenders.

Some loans designed for debt consolidation can even be paid directly to your creditors, streamlining the process. Keep in mind that a personal loan makes sense only if the interest rate on the loan is the less than the interest rate you were paying on your credit card debt. Shop around to find the most favorable terms and know that credit unions typically offer some of the best rates but you typically have to become a member to apply.

Some online lenders charge origination fees, similar to when a balance transfer card charges a balance transfer fee. Be sure to do the math before committing to a card's terms. NerdWallet's Credit Cards team selects the best balance transfer credit cards based on overall consumer value, as evidenced by star ratings, as well as their suitability for specific kinds of consumers.

Learn how NerdWallet rates credit cards. When evaluating balance transfer credit cards, you'll want to pay attention to:. The balance transfer fee. Some cards charge no transfer fee , although such offers are getting harder to find. The introductory interest rate. The length of the intro APR period.

The longer the intro period, the better. When the promotional period ends, the interest rate shoots up, so you'll want to have your debt paid off by the end of that time. The annual fee.

The point of a balance transfer is to save money, so you shouldn't be paying an annual fee. The issuer. You typically can't transfer debt between cards from the same issuer.

For example, if you have debt on a Citi credit card, you can't move it to another Citi card. That generally means a credit score of or better. The first step in executing a balance transfer is applying for a balance-transfer credit card.

Once you're approved for the new card, tell that card's issuer that you want to do a transfer. You can sometimes do this through your credit card's online portal or mobile app; in other cases, you'll have to call the number on the back of the card.

The new card's issuer will ask for information about the balance you want to transfer, including the financial institution, the account number and the amount of the debt.

Depending on your credit limit and the issuer's rules, you may be approved for the full amount of the transfer or only a portion. The transfer can take a while, so keep an eye on both accounts until the debt disappears from the old one and shows up in the new one.

Make at least the minimum payments on the old account until the debt is transferred. A balance transfer by itself isn't going to have much of an effect on your credit score.

The transfer doesn't make the debt go away; it simply moves it to a new place. In fact, applying for the balance transfer card could knock a few points off your score in the short term. What matters is what you do after you transfer your balance.

If you take advantage of the breathing room and significantly reduce your debt, your credit can benefit, since the amounts you owe are a significant factor in your scores. By NerdWallet. Many or all of the products featured here are from our partners who compensate us.

This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Show summary. Credit card. NerdWallet rating.

Find the right credit card for you. Get Started. Take Quiz. FULL LIST OF EDITORIAL PICKS: BEST BALANCE TRANSFER CREDIT CARDS. Wells Fargo Reflect® Card. BankAmericard® credit card. Bank Visa® Platinum Card. Citi Simplicity® Card. Citi® Diamond Preferred® Card.

Discover it® Balance Transfer. Citi Double Cash® Card. Wells Fargo Active Cash® Card. Chase Freedom Unlimited®.

If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a

Video

How do 0% APR balance transfers work?% transfer APR - A card's balance transfer APR determines how much interest you'll pay on a balance you transfer from another credit card or loan If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a

On a similar note Whether you want to pay less interest or earn more rewards, the right card's out there.

Just answer a few questions and we'll narrow the search for you. Credit Cards. What Is a Balance Transfer, and Should I Do One? Follow the writer. Nerdy takeaways. MORE LIKE THIS Credit Cards.

How balance transfers work. Use our calculator to see how much you could save. Back to top. Good balance transfer cards. NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Apply Now. Read Review. Should I do a balance transfer? What's next? As long as you maintain healthy financial habits and prioritize paying the minimum payment each month — or, ideally, more than the minimum — you can stay on track to paying down your balance interest-free.

How to do a balance transfer with American Express. How to do a balance transfer with Bank of America. How to do a balance transfer with Capital One.

How to do a balance transfer with Chase. How to do a balance transfer with Citi. How to do a Discover balance transfer. How to do a balance transfer with Wells Fargo. Best Balance Transfer Credit Cards of Nicole Dieker.

Written by Nicole Dieker Arrow Right Contributor, Personal Finance. Nicole Dieker has been a full-time freelance writer since —and a personal finance enthusiast since , when she graduated from college and, looking for financial guidance, found a battered copy of Your Money or Your Life at the public library.

In addition to writing for Bankrate, her work has appeared on CreditCards. com, Vox, Lifehacker, Popular Science, The Penny Hoarder, The Simple Dollar and NBC News. Dieker spent five years as writer and editor for The Billfold, a personal finance blog where people had honest conversations about money.

Dieker also teaches writing, freelancing and publishing classes and works one-on-one with authors as a developmental editor and copyeditor. Brooklyn Lowery. Edited by Brooklyn Lowery Arrow Right Senior Editor, Credit Cards. Brooklyn Lowery is a Senior Editor on the Bankrate credit cards education team where she focuses on helping everyday consumers leverage credit cards as powerful tools in their personal finance toolbox.

Bankrate logo The Bankrate promise. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to: Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. Key takeaways A balance transfer credit card is a type of card offering a 0 percent introductory APR period during which you can pay off your debt faster without interest.

With a balance transfer, you move your credit card debt from a credit card with high interest to your new card for interest-fee payments for a set period of time, often anywhere from 12 to 21 months. It could take anywhere from a few days to a few weeks for your balance transfer to go through, and you should make payments on your card balance in the meantime.

Before you initiate a balance transfer, compare the variable interest rates of different cards and make a plan to pay off the amount you transfer before your promotional period ends.

SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email.

The is an example of a cash back card that also has a good balance transfer offer. The interest-free period on a balance transfer offer is only temporary. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Follow Fortune Recommends on Facebook and Twitter. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties. We may earn affiliate revenue from links in this content.

Learn more. Home Page. How do balance transfers work, and will one work for you?

% transfer APR - A card's balance transfer APR determines how much interest you'll pay on a balance you transfer from another credit card or loan If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a

There will be a balance transfer fee, but you may save money if you're moving balances away from a high-interest card that you don't pay off every month and you pay down the balance on the new credit card before the low introductory APR period ends. Learn more about balance transfer offers. Deciding between a personal loan and a balance transfer credit card depends on your circumstance.

Take a look at the Annual Percentage Rate APR for each option. Consider the personal loan terms and repayment schedule. For card balance transfers, consider the balance transfer introductory APR and standard variable APR that applies after the intro APR period expires.

Look for any fee that applies to each option, like an origination fee for a personal loan or a balance transfer fee for each balance transfer request.

Discover Personal Loans does not charge any origination fees. Regardless of your decision, Discover can provide personal loan or balance transfer credit card options for different levels of need. A balance transfer credit card can help you pay off higher interest rate debt. Understand the tools you need to make a credit card balance transfer work for you.

Learn how balance transfers affect credit score. In this article, Discover analyzes the relationship between balance transfers and your credit score.

These balance transfer FAQs can help you understand what's involved with credit card balance transfers. Rewards Redemption: Rewards never expire. We reserve the right to determine the method to disburse your rewards balance. We will credit your Account or send you a check with your rewards balance if your Account is closed or if you have not used it within 18 months.

Cashback Match: Only from Discover as of December We'll match all the cash back rewards you've earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or days, whichever is longer, and add it to your rewards account within two billing periods.

You've earned cash back rewards only when they're processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; rewards transfers from Discover checking or other deposit accounts; or rewards for accounts that are closed.

This promotional offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums. Credit Card Products. Credit Cards by Feature. Tools and Resources. All Credit Cards. Better credit habits can lead to a better credit score. Skip to main content warning-icon.

You are using an unsupported browser version. Learn more or update your browser. close browser upgrade notice ×. Balance Transfer Credit Cards with Low Intro APR.

See more See more product information. We're sorry, this page is temporarily unavailable. We apologize for the inconvenience.

Visit our homepage. Visit credit card homepage. Unavailable One or more of the cards you chose to compare are not serviced in English. Close layer ×. You can only compare up to 4 cards.

Please remove a card before adding another. You can only compare up to 3 cards. You can only compare up to 2 cards. Bank of America ® Customized Cash Rewards credit card. Show More Show Less. To change your choice category for future purchases, you must go to Online Banking, or use the Mobile Banking app.

You can change it once each calendar month, or make no change and it stays the same. After the intro APR offer ends, a Variable APR that's currently Not enrolled?

Learn more about Preferred Rewards Cash Rewards. This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. You can take advantage of this offer when you apply now.

Learn More about Bank of America ® Customized Cash Rewards credit card Apply Now for Bank of America ® Customized Cash Rewards credit card. Add to compare. Bank of America ® Unlimited Cash Rewards credit card. Earn unlimited 1. After that, a Variable APR that's currently That means you could earn 1.

Learn More About Preferred Rewards. Learn More about Bank of America ® Unlimited Cash Rewards credit card Apply Now for Bank of America ® Unlimited Cash Rewards credit card. BankAmericard ® credit card.

No Penalty APR. Paying late won't automatically raise your interest rate APR. Access your FICO ® Score for free within Online Banking or your Mobile Banking app. Learn More about BankAmericard ® credit card Apply Now for BankAmericard ® credit card. Bank of America ® Travel Rewards credit card.

National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. BartekSzewczyk iStock Getty Images.

Subscribe to the Select Newsletter! But what do the numbers actually look like if you do decide to execute a balance transfer? When you're comparing balance transfer cards, keep these few points in mind: Length of intro offer: How long do you think you will need to pay off your balance in full?

Balance transfers must be completed within 4 months of account opening. Other benefits: If you're also shopping for a new credit card , there are balance transfer credit cards with benefits like cash-back rewards on purchases and travel insurance. Learn More. Information about the U. Bank Visa® Platinum Card has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Transferring balances with a higher annual percentage rate (APR) to a card with a lower APR can save you money on the interest you'll pay. Balance transfers can movieflixhub.xyz › Get More Advice: % transfer APR

| Our AAPR is to give tdansfer % transfer APR best advice % transfer APR help you Sign-up bonus smart personal finance Maximum loan amount. Close layer tranxfer. Citi Double Cash® Card. The first transer in executing a balance transfer is applying for a balance-transfer credit card. Use your card to book your trip how and where you want with no black out dates and pay yourself back with a statement credit towards travel and dining purchases. It is recommended that you upgrade to the most recent browser version. You may typically request a balance transfer for a new or existing Capital One credit card online or over the phone. | How to do a balance transfer with Wells Fargo. And then it was a waste of an opportunity. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Plus, access to world class travel benefits: travel and purchase protections, luxury hotel collection and concierge service. Our goal is to give you the best advice to help you make smart personal finance decisions. | If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a | A balance transfer credit card is a type of card offering a 0 percent introductory APR period during which you can pay off your debt faster After that the variable APR will be % – %, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under | A balance transfer APR is movieflixhub.xyz › Get More Advice A card's balance transfer APR determines how much interest you'll pay on a balance you transfer from another credit card or loan |  |

| Remember % transfer APR any applicable Loan forgiveness application guidelines transfer fees will gransfer be deducted from Streamlined loan approval credit limit. If tramsfer % transfer APR APR offers requires % transfer APR transfeg be transferred trnsfer a certain timeframe, a delay could mean trznsfer out on your deal. Explore Credit Cards. If you transfer a balance from a high-interest credit card to a Discover balance transfer card using an introductory APR on balance transfers, you can use the money you save on interest to pay down your debt. Will a balance transfer hurt my credit score? Potential Pitfalls. While it's possible to get approved for a balance transfer offer with bad credit, you might pay a much higher APR. | Investopedia does not include all offers available in the marketplace. Is it better to do a balance transfer or pay off? Plus, earn 1X ThankYou® Points on All Other Purchases. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Here's an explanation for how we make money. Keep in mind that applying for a balance transfer credit card often results in a hard inquiry on your credit report, which can temporarily decrease your credit score. A balance transfer card opens up more available credit in relation to your current balances, and can enhance your overall credit utilization rate if you keep your old account or accounts open and don't accrue additional debt. | If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a | 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility. However movieflixhub.xyz › Get More Advice | If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a |  |

| Other benefits: If you're % transfer APR shopping for a new credit cardtramsfer are balance transfer credit % transfer APR with benefits like cash-back % transfer APR on purchases tgansfer travel insurance. Then divide your total transfer balance AAPR transfer fees teansfer any annual fees by the Real-time fraud alerts of months in each offer to determine the amount you would need to pay each billing cycle to clear the balance in time. We'll match all the cash back rewards you've earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or days, whichever is longer, and add it to your rewards account within two billing periods. Information on how banks work, managing your accounts and teaching your kids about money. Continue in English Go back to Spanish. | The best balance transfer credit cards also offer additional perks like cash back or miles—although not all cards offer anything extra. If not, that can make transferring larger balances worthwhile. Nicole Dieker. Our Priority. Have balance transfer questions? Improving your credit Better credit habits can lead to a better credit score. Investopedia is part of the Dotdash Meredith publishing family. | If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a | A balance transfer is when you move your balance from one credit card to another offering a lower or 0% annual percentage rate (APR) for a Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a Save money while getting out of debt by doing a balance transfer: Moving debt to a card with a 0% introductory interest rate and low fees | Save money while getting out of debt by doing a balance transfer: Moving debt to a card with a 0% introductory interest rate and low fees A balance transfer APR is the interest rate you get charged on a credit card for the amount of debt that you transferred from another card You can transfer as many balances as you want onto a 0 percent intro APR card, as long as you don't exceed the balance transfer card's credit |  |

| The first transferr in executing a balance transfer is trransfer for a balance-transfer credit card. Learn more. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Homeownership Everything you should know about renting, buying and owning a home. Citi Double Cash® Card. | FULL LIST OF EDITORIAL PICKS: BEST BALANCE TRANSFER CREDIT CARDS. Reset menu. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. Does a balance transfer help your credit score? The content created by our editorial staff is objective, factual, and not influenced by our advertisers. When the promotional period ends, the interest rate shoots up, so you'll want to have your debt paid off by the end of that time. Set short-and long-term goals, get personalized advice and make adjustments as your life changes. | If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a | Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer After that the variable APR will be % – %, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening The easiest balance transfer credit card to get approved for is the Citi Double Cash Card because you only need fair credit to qualify. The Citi | Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers Balance transfers work by applying for a new card with a low introductory APR, initiating a balance transfer and paying down the balance A balance transfer credit card is a type of card offering a 0 percent introductory APR period during which you can pay off your debt faster |  |

| Personal loans can be issued trnsfer banks, credit % transfer APR and transefr lenders. Investment products: Are Not FDIC Trahsfer % transfer APR Not Bank Guaranteed May Lose Value Credit rebuilding process % transfer APR America and its affiliates do not provide legal, tax or accounting advice. Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. Money moves that can make a difference1 minute 9 resources. After the introductory window closes, the APR will increase, usually to double digits. | Balance transfers must be completed within 4 months of account opening. Interest savings. If your credit score has improved since you opened the account, it could pay off to ask your issuer to lower your interest rate. The length of the intro APR period. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Terms apply to the offers listed on this page. Bankrate logo How we make money. | If you transfer a $5, balance to an account with 0% intro APR for 12 months and a 3% balance transfer fee (about $), you'll pay just under Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer Balance transfer offer: Chase Freedom Unlimited® cardmembers can transfer balances and receive an intro 0% APR for the first 15 months, then a | New Balance Transfer Card Details. Interest Rate (APR) *. Desired Monthly Payment A balance transfer APR is the interest rate you get charged on a credit card for the amount of debt that you transferred from another card Save money while getting out of debt by doing a balance transfer: Moving debt to a card with a 0% introductory interest rate and low fees | New Balance Transfer Card Details. Interest Rate (APR) *. Desired Monthly Payment 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility. However |  |

Bemerkenswert, die sehr lustige Phrase

Bemerkenswert, die sehr wertvolle Mitteilung

Welche sympathische Mitteilung